Professional Documents

Culture Documents

Samnidhy Faq's

Uploaded by

Sourav DharCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Samnidhy Faq's

Uploaded by

Sourav DharCopyright:

Available Formats

FAQ

Understand

SAMNIDHY

better

2014

Still got queries! Write to us at samnidhy@hotmail.com or

message us on www.facebook.com/Samnidhy

SEBI REGISTERED FUND

SAMNIDHY|SMIF

FAQ

samnidhy@hotmail.com

Q1.) What is samnidhy?

Samnidhy is a Student Managed Investment fund whose investors and the fund managers

belong to TAPMI fraternity. The corpus to be invested is raised from the students, faculty

members and alumnus of TAPMI and a team of selected students of TAPMI manage the fund

with an objective of maximizing investors wealth over a period of time.

Q2.) Is it associated with some legal entity?

Samnidhy will have two major registrations which will grant it a legal status as per the Indian

law. Samnidhy will be registered as an Association of Persons (AOP) company under the

Registrar of Companies, Ministry of Corporate Affairs and the guidelines there under.

Also Samnidhy will be registered as an Investment fund under the Securities Exchange Board of

India (SEBI) and the guideline laid there under.

Q3.) How is it different from other Investment funds?

In India, there are currently three organized Student Managed Investment funds that are run

by the different top notch B-schools. But all these funds are privately run by the students of

those institutes on their personal accounts making it more of a trust transactions.

Samnidhy will be the fourth student Investment fund in India but the only fund to run in a legal

structure and be recognized by the regulators of the market.

Q4.) How are Bloomberg and Samnidhy related/different?

Samnidhy is a Student Investment fund where students of TAPMI can invest in the fund with an

objective of earning returns associated with stock investments.

Bloomberg is a financial database which helps our analysts to dig in financial data and work on

their research for samnidhy

Q5.) What is the structure of the core team?

Samnidhy core team is guided by an Advisory Committee which consists of seven members:

1.

2.

3.

4.

5.

6.

Dr. Prabhakar Patil, Joint Director, Securities Exchange Board of India (SEBI)

Mr. Viswanathan Iyer, Director, National Australia Bank

Mr. Dhaval Vakaria, Vice President, Avendus Private Equity Advisors

Mr. Arijit Mukherjee, Vice President, AnandRathi

Prof. Madhu Veeraraghavan, Area Chair, Accounting, Economics and Finance, TAPMI

Prof. Aditya Jadhav, Associate Professor, Accounting Economics and Finance, TAPMI

SAMNIDHY|SMIF

FAQ

samnidhy@hotmail.com

7. Prof. Vishwanathan Iyer, Associate Professor, Accounting Economics and Finance Area

Core Samnidhy team comprises of 43 student members, which has:

14 PGP II analysts and

29 PGP I analysts

Q6.) How and when can we make the investment?

The fund will be launched with a New Fund Offer (NFO) where the interested investors will be

given a time window to invest in the fund. Once the NFO closes any requests for fresh

investments in the fund will be accepted on the 5th of every month.

Q7.) What is the maximum/minimum amount that can be invested?

The minimum amount an individual can invest in samnidhy is INR 1000

The maximum amount an individual can invest in samnidhy is INR 5000

Q8.) Is there a guaranteed return?

No equity fund in the world gives guaranteed returns and neither do we. But we follow the

policy on maximizing wealth and minimizing risks and try to outperform market return at every

level.

Q9.) What are the risks associated with these investments?

Samnidhy is a pure equity fund. Therefore your investments are subject to the risk associated

with investments in Stock market.

Q11.) Is there a provision to withdraw the investment?

Yes, an individual investor is given a choice to withdraw their investment in the month they

graduate from TAPMI which is mostly the month of March every year for the batch graduating

that year. If the individuals want to remain invested in the fund after graduation as an alum,

they are allowed to do so.

Q12.) Samnidhy- SMIF, is there any association with TAPMI?

Samnidhy and TAPMI are two different legal bodies run and managed in silos from each other

and are totally dissociated with each other. No member of the TAPMI management bears any

SAMNIDHY|SMIF

FAQ

samnidhy@hotmail.com

responsibility towards samnidhys obligations and no member of the samnidhy body bear any

responsibility towards TAPMIs obligations financial or otherwise.

Q13.) Who all can invest?

Only the Management staff, administration staff, faculty staff, students and alumnus of T. A. Pai

Management Institute (TAPMI), Manipal are invited to invest in Samnidhy.

Q15.) Can I invest again after the initial investment?

The minimum an individual can invest in one transaction is INR 1000 and the total collective

investments of an individual can go upto INR 5000. Therefore you can invest in the fund multiple

times till your collective investment reach upto INR 5000.

Q16.) What are the reporting standards in samnidhy?

Samnidhy follows the highest standards of transparent reporting to its investors. The following

are the guidelines laid down by us:

Samnidhy bank statements will be made public on every last Saturday of the month to

all the investors

Samnidhy demat account statements will be made public on every last Saturday of the

month to all the investors

A review report on the fund will be shared every 15 days with all the investors

A Performance report on the fund will be shared every quarter with all the investors

An investor meet will be conducted each quarter where all the investors will be invited

to question and discuss the prospects of the fund with the samnidhy team

Any investor can register his/her grievance against the fund with the Chief Peoples

Officer (CPO) of samnidhy and the CPO will personally report to each investor for the

same

You might also like

- Corporate finance group work analysis and WACC calculationsDocument15 pagesCorporate finance group work analysis and WACC calculationscaglar ozyesilNo ratings yet

- Credit Card Types, Benefits & RisksDocument14 pagesCredit Card Types, Benefits & RisksAsef KhademiNo ratings yet

- Insurance Policy Types and ConceptsDocument28 pagesInsurance Policy Types and ConceptsSourav Dhar100% (2)

- Chapter 4 Financing Decisions PDFDocument72 pagesChapter 4 Financing Decisions PDFChandra Bhatta100% (1)

- Chapter 8 Insurance PricingDocument17 pagesChapter 8 Insurance Pricingticen100% (1)

- Cost of CapitalDocument55 pagesCost of CapitalSaritasaruNo ratings yet

- CocDocument47 pagesCocUmesh ChandraNo ratings yet

- Overview of Global Carbon Market: Presented byDocument26 pagesOverview of Global Carbon Market: Presented byvideo2063No ratings yet

- Systematic Unsystematic RiskDocument34 pagesSystematic Unsystematic Riskharsh thakkarNo ratings yet

- 9 - Accounting For Franchise Operations - FranchisorDocument7 pages9 - Accounting For Franchise Operations - FranchisorDarlene Faye Cabral RosalesNo ratings yet

- What Are Financial RatiosDocument6 pagesWhat Are Financial Ratiosmichelle dizon100% (1)

- Effect of Price Change on Substitute GoodsDocument10 pagesEffect of Price Change on Substitute GoodsDrishika Mahajan100% (1)

- Financial Statement Analysis PPT 3427Document25 pagesFinancial Statement Analysis PPT 3427imroz_alamNo ratings yet

- CHP 1 - Introduction To Merchant BankingDocument44 pagesCHP 1 - Introduction To Merchant BankingFalguni MathewsNo ratings yet

- Presentation Insurance PPTDocument11 pagesPresentation Insurance PPTshuchiNo ratings yet

- Security Analysis: Chapter - 1Document47 pagesSecurity Analysis: Chapter - 1Harsh GuptaNo ratings yet

- Characteristic Features of Financial InstrumentsDocument17 pagesCharacteristic Features of Financial Instrumentsmanoranjanpatra93% (15)

- Sapm - Fifth (5) Sem BBIDocument156 pagesSapm - Fifth (5) Sem BBIRasesh ShahNo ratings yet

- Leverage: Presented by Sandesh YadavDocument14 pagesLeverage: Presented by Sandesh YadavSandesh011No ratings yet

- Mutual Funds: By: Dr. Neelam TandonDocument28 pagesMutual Funds: By: Dr. Neelam TandonSuresh RaghavNo ratings yet

- The Correlation Structure of Security Returns: Multiindex Models and Grouping TechniquesDocument26 pagesThe Correlation Structure of Security Returns: Multiindex Models and Grouping TechniquessaminbdNo ratings yet

- Global Capital Market & Their EffectsDocument22 pagesGlobal Capital Market & Their EffectsJay KoliNo ratings yet

- Chapter 7 Portfolio Theory: Prepared By: Wael Shams EL-DinDocument21 pagesChapter 7 Portfolio Theory: Prepared By: Wael Shams EL-DinmaheraldamatiNo ratings yet

- Security Analysis - IntroductionDocument20 pagesSecurity Analysis - IntroductionAnanya Ghosh100% (1)

- Hotel Revenue Centres in Hospitality ManagementDocument4 pagesHotel Revenue Centres in Hospitality ManagementVipin Rawat100% (3)

- Amfi Advisors Module NotesDocument57 pagesAmfi Advisors Module NotesMahekNo ratings yet

- Portfolio Management Through Mutual FundsDocument14 pagesPortfolio Management Through Mutual FundsMedha SinghNo ratings yet

- MF Distributor Certification Revision KitDocument24 pagesMF Distributor Certification Revision KitAmmaji GopaluniNo ratings yet

- Foundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsFrom EverandFoundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsNo ratings yet

- Mutual Funds: Presented By: Saurabh Tamrakar Ravikant Tiwari Prateek DevraDocument25 pagesMutual Funds: Presented By: Saurabh Tamrakar Ravikant Tiwari Prateek DevraChanchal KansalNo ratings yet

- Capital Structure: Theory and PolicyDocument31 pagesCapital Structure: Theory and PolicySuraj ShelarNo ratings yet

- Fundamentals of insurance terminology explainedDocument16 pagesFundamentals of insurance terminology explainedFaye Nandini SalinsNo ratings yet

- CryptocurrencyDocument19 pagesCryptocurrencySonu SainiNo ratings yet

- Security Analysis and Portfolio ManagementDocument31 pagesSecurity Analysis and Portfolio ManagementAnubhav SonyNo ratings yet

- 46370bosfinal p2 cp6 PDFDocument85 pages46370bosfinal p2 cp6 PDFgouri khanduallNo ratings yet

- Revenue (Sales) XXX (-) Variable Costs XXXDocument10 pagesRevenue (Sales) XXX (-) Variable Costs XXXNageshwar SinghNo ratings yet

- Course Outline Advanced Corporate Finance 2019Document8 pagesCourse Outline Advanced Corporate Finance 2019Ali Shaharyar ShigriNo ratings yet

- SYBBIDocument13 pagesSYBBIshekhar landageNo ratings yet

- 01 Tutorial 01 - Introduction To Wealth ManagementDocument4 pages01 Tutorial 01 - Introduction To Wealth ManagementNothingToKnowNo ratings yet

- Security Analysis and Portfolio ManagementDocument21 pagesSecurity Analysis and Portfolio ManagementShiva ShankarNo ratings yet

- How To Write A Ratio AnalysisDocument2 pagesHow To Write A Ratio AnalysisLe TanNo ratings yet

- Portfolio ManagementDocument15 pagesPortfolio ManagementtanviNo ratings yet

- Course of International Financial Management PDFDocument1 pageCourse of International Financial Management PDFTarun SrivastavaNo ratings yet

- CA Inter FM-ECO Chapter 6 Key ConceptsDocument23 pagesCA Inter FM-ECO Chapter 6 Key ConceptsAejaz MohamedNo ratings yet

- Security Market LineDocument5 pagesSecurity Market LineHAFIAZ MUHAMMAD IMTIAZ100% (1)

- Introduction To Accounting and Business: Instructor Le Ngoc Anh KhoaDocument66 pagesIntroduction To Accounting and Business: Instructor Le Ngoc Anh KhoaThien TranNo ratings yet

- 9 Mutual FundsDocument32 pages9 Mutual FundsarmailgmNo ratings yet

- Companies Act 2013 overviewDocument152 pagesCompanies Act 2013 overviewsheharban sulaimanNo ratings yet

- Introduction To Financial ManagemntDocument29 pagesIntroduction To Financial ManagemntibsNo ratings yet

- Techniques For Managing ExposureDocument26 pagesTechniques For Managing Exposureprasanthgeni22100% (1)

- Equity ValuationDocument38 pagesEquity ValuationkedianareshNo ratings yet

- HDFC Balanced Advantage Fund OverviewDocument11 pagesHDFC Balanced Advantage Fund OverviewManasi AjithkumarNo ratings yet

- SAPM Assignment For MBADocument2 pagesSAPM Assignment For MBARahul AroraNo ratings yet

- Evaluation of EDPDocument33 pagesEvaluation of EDPKiran Gujamagadi100% (1)

- Module 21 PDFDocument10 pagesModule 21 PDFAnonymous unF72wA2JNo ratings yet

- NISM MFD Exam Model Test & Study NotesDocument24 pagesNISM MFD Exam Model Test & Study NotesKanikaa B KaliyaNo ratings yet

- World Bank Group ProfileDocument26 pagesWorld Bank Group ProfilevmktptNo ratings yet

- GRP 1 Financial-Market-Intro-TypesDocument34 pagesGRP 1 Financial-Market-Intro-TypesXander C. PasionNo ratings yet

- Long Term Finance Shares Debentures and Term LoansDocument21 pagesLong Term Finance Shares Debentures and Term LoansBhagyashree DevNo ratings yet

- Diploma in Corporate Finance SyllabusDocument18 pagesDiploma in Corporate Finance Syllabuscima2k15No ratings yet

- Decision Areas in Financial ManagementDocument15 pagesDecision Areas in Financial ManagementSana Moid100% (3)

- Wealth Maximization ObjectiveDocument8 pagesWealth Maximization ObjectiveNeha SharmaNo ratings yet

- Bond MarketDocument35 pagesBond MarketBhupendra MoreNo ratings yet

- Bond valuation and yield analysisDocument35 pagesBond valuation and yield analysisTanmay MehtaNo ratings yet

- Types of Mutual FundDocument3 pagesTypes of Mutual FundKhunt DadhichiNo ratings yet

- 15f253 Sourav Dhar BPMTDocument4 pages15f253 Sourav Dhar BPMTSourav DharNo ratings yet

- Payment ReceiptDocument1 pagePayment ReceiptSourav DharNo ratings yet

- TSMT Assignment 2Document3 pagesTSMT Assignment 2Sourav DharNo ratings yet

- Dataset - Port - Opt 1Document195 pagesDataset - Port - Opt 1Sourav DharNo ratings yet

- Quantitative Aptitude Cheat Sheet: Formulae and FundasDocument11 pagesQuantitative Aptitude Cheat Sheet: Formulae and FundasSyed Monsoor AhmedNo ratings yet

- Risk and Return Note 1Document12 pagesRisk and Return Note 1Bikram MaharjanNo ratings yet

- Case Interview FrameworksDocument6 pagesCase Interview Frameworkserika KNo ratings yet

- Calculate WACC for NewCorp using relevered betaDocument4 pagesCalculate WACC for NewCorp using relevered betaSourav DharNo ratings yet

- Top100 Pharma Companies Based On Exports 2005 06Document2 pagesTop100 Pharma Companies Based On Exports 2005 06Suman RachaNo ratings yet

- Con Call 2015 - Round DetailsDocument1 pageCon Call 2015 - Round DetailsSourav DharNo ratings yet

- Beer IndustryDocument20 pagesBeer IndustryLâm HàNo ratings yet

- Industry Analysis Pharmaceutical Industry (2015)Document5 pagesIndustry Analysis Pharmaceutical Industry (2015)Sourav DharNo ratings yet

- LEARNING MODULE-Financial Accounting and ReportingDocument7 pagesLEARNING MODULE-Financial Accounting and ReportingAira AbigailNo ratings yet

- Haramaya UniversityDocument22 pagesHaramaya UniversityAbdulhafiz Abakemal89% (9)

- Management Implementation in Pharma CompaniesDocument28 pagesManagement Implementation in Pharma CompaniesRACHMA EQUATRIN PNo ratings yet

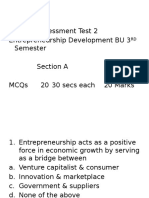

- Internal Assessment Test on Entrepreneurship ConceptsDocument28 pagesInternal Assessment Test on Entrepreneurship ConceptsRam Krishna KrishNo ratings yet

- School Record McqsDocument1 pageSchool Record Mcqscixemey590No ratings yet

- Interview Base - Knowledge & PracticalDocument39 pagesInterview Base - Knowledge & Practicalsonu malikNo ratings yet

- 2023 07 q1-2024 Investor PresentationDocument73 pages2023 07 q1-2024 Investor PresentationtsasidharNo ratings yet

- Pakistan Labor Laws Course WorkDocument9 pagesPakistan Labor Laws Course Workdownloader2010No ratings yet

- Customer Support Trends 2022 ReportDocument28 pagesCustomer Support Trends 2022 ReportageNo ratings yet

- Talent Management at Infosys: Building a Talent Engine to Sustain GrowthDocument5 pagesTalent Management at Infosys: Building a Talent Engine to Sustain GrowthTony JosephNo ratings yet

- Safety Shoes PolicyDocument1 pageSafety Shoes PolicyMarlon BernardoNo ratings yet

- Need, Want, Demand: Understanding Consumer BehaviorDocument5 pagesNeed, Want, Demand: Understanding Consumer Behaviorbim269100% (1)

- Financial Analysis of Coca Cola in PakistanDocument40 pagesFinancial Analysis of Coca Cola in PakistanŘabbîâ KhanNo ratings yet

- Revised Chapter 2Document44 pagesRevised Chapter 2kellydaNo ratings yet

- Marketing Management With Dr. Rizwan Ali: The University of LahoreDocument21 pagesMarketing Management With Dr. Rizwan Ali: The University of LahoreAqib LatifNo ratings yet

- The Strategic Role of Accountants in New Product DevelopmentDocument6 pagesThe Strategic Role of Accountants in New Product DevelopmentandychukseNo ratings yet

- Principles of Management Course OutlineDocument6 pagesPrinciples of Management Course OutlineSADEEQ AKBARNo ratings yet

- LAS w7Document7 pagesLAS w7Pats MinaoNo ratings yet

- HRD and Corporate Social ResponsibilityDocument24 pagesHRD and Corporate Social ResponsibilityCamille HofilenaNo ratings yet

- The Future of Retail in Asia-Pacific: How To Thrive at High SpeedDocument12 pagesThe Future of Retail in Asia-Pacific: How To Thrive at High SpeedPhạm Thanh HuyềnNo ratings yet

- Tax Implications For Intangibles and IP - May 2012Document5 pagesTax Implications For Intangibles and IP - May 2012gasconjmNo ratings yet

- Acct StatementDocument4 pagesAcct StatementRaghav SharmaNo ratings yet

- 9706 s10 QP 41Document8 pages9706 s10 QP 41roukaiya_peerkhanNo ratings yet

- Interim ReportDocument13 pagesInterim ReportDeepanshi RawatNo ratings yet

- Advance Multiple Choice QuizDocument4 pagesAdvance Multiple Choice QuizSamuel DebebeNo ratings yet

- PRICE DISCRIMINATION AND OPPORTUNITY COSTDocument15 pagesPRICE DISCRIMINATION AND OPPORTUNITY COSTjoshua xxxNo ratings yet