Professional Documents

Culture Documents

Accounting Process

Uploaded by

Saugata Shovan HaiderCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Process

Uploaded by

Saugata Shovan HaiderCopyright:

Available Formats

THE ACCOUNTING PROCESS

Accounting is called the language of business because it is so widely used in describing all

types of business activities. Accounting is an information system. Being an information

system it identifies, records, and communicates economic events relevant to a particular

organization. The accounting process consists of these three basic activities of accounting,

i.e., identification recording communication.

Identification

Recording

Communication

Select Economic

Events, i.e.,

Transactions

Record: Journalize

Classify: Ledger

&

Summarize: Trial

Balance

Prepare accounting

reports

Analyze and interpret

for users

IDENTIFICATION

Transactions are the economic events of the enterprises that are recorded. A company may

carry on many activities that do not in themselves represent business transactions. Hiring

employees, answering telephone, talking with customers are examples. Each transaction

must be analyzed in terms of its effect on the components of the basic accounting equation.

The total assets equal the total of liabilities and equity. Assets = Liabilities + Owners Equity.

This is the fundamental accounting equation.

The assets of an entity are the things of value that it owns. The sources of funds used to

acquire assets are liabilities and equity. Liabilities are sources from creditors. Equity consists

of (a) funds obtained from equity investors, who are owners and (b) retained earnings

resulting from the entitys profitable operation.

Accounting systems are set up in such a way that a record is made of two aspects of each

event that affects these records, and in essence these aspects are changes in assets and

changes in liabilities or equities.

The equality of the basic equation must be preserved. Therefore, each transaction must

have a dual effect on the equation.

DEBITS AND CREDITS

The terms debit and credit mean left and right, respectively. They are commonly abbreviated

as Dr. for debit and Cr. for credit.

Each transaction must affect two or more accounts to keep the basic equation in balance. In

other words, for each transaction debits must equal credits in the accounts. The equality of

debits and credits provides the basis for the double entry system of recording transactions.

RULES FOR DEBITS AND CREDITS

The basic accounting equation is

Assets = Liabilities + Owners Equity

Assets :

Increase

Debit

Decrease

Credit

Liabilities:

Decrease

Debit

Increase

Credit

Owners Equity:

Decrease

Debit

Increase

Credit

RECORDING

Recording consists of keeping a chronological dairy of measured events in an orderly and

systematic manner called journal. Economic events are also classified, which known as

ledger and summarizing the classified accounted and communicated to interested users

through accounting reports.

THE JOURNAL

Transactions are initially recorded in chronological order in a journal before being

transferred to the accounts. Thus the journal is referred to as the book of original entry. For

each transaction the journal shows the debit and credit effects on specific accounts.

THE ACCOUNT:

An account is an individual accounting record of increases and decreases in a specific asset,

liability or owners equity item. In its simplest form, an account consists of three parts:

the title of the account

a left or debit side

a right or credit side

The entire group of accounts maintained by a company is called the ledger. A general ledger

contains all the assets, liabilities and owners equity accounts.

THE TRIAL BALANCE

A trial balance is a list of accounts and their balances at a given time. Usually a trial balance

is prepared at the end of an accounting period. The primary purpose of a trial balance is to

prove or check that the debits equal the credits after posting. If the debits and credits do not

agree, the trial balance can be used to uncover errors in journalizing and posting. However, a

trial balance does not guarantee that all recorded transactions are correct.

COMMUNICATION

The identifying and recording activities are of little use unless the information is

communicated to interested users. Financial information is communicated through

accounting reports, which are called financial statements. Usually four financial statements

are prepared from the summarized accounting data: income statement, owners equity

statement, balance sheet and statement of cash flow. A vital element in communicating

economic events is the accountants ability to analyze and interpret the reported

information. Analysis and interpretation involves the use of ratios, percentage, graphs,

trends, relationships, explanation of limitation and meaning of reported data and so on.

______________________________________________________________________________________

References:

01. Anthoney Robert, N - Essentials of Accounting.

02. Weygandt, Kieso, Kell - Accounting Principles.

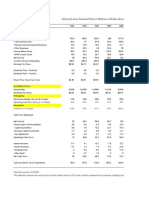

EXERCISE ON ACCOUNTING PROCESS

Problem: 1

Mr. Tareq started a merchandising business on 1st January 2003, by bringing cash Tk.

30,000 and furniture worth Tk. 18,000 as capital. During the month, the following

transactions took place in his business.

Date

Transaction

Tk.

04.01.03

Purchased on cash goods for resale

3,000

10.01.03

Purchased goods for resale from Karim & Brothers on credit

6,000

12.01.03

Purchased furniture for use in the business

2,000

18.01.03

Cash sales

2,500

19.01.03

Paid cash to Karim & Brothers

4,000

24.01.03

Sold goods to Mr. Rahman on credit

9,000

27.01.03

Paid Rent of the current month

1,500

28.01.03

Sold goods for cash

2,500

29.01.03

Collected cash from Mr. Rahman

6,000

30.01.03

Paid for salary of the current month

1,200

Please analyze the events and complete upto trial balance.

You might also like

- Fundamental of Accounting and Taxation NotesDocument20 pagesFundamental of Accounting and Taxation NotesMohit100% (1)

- Principle of AccountingDocument4 pagesPrinciple of AccountingMahabub Alam100% (1)

- Accounting Survival Guide: An Introduction to Accounting for BeginnersFrom EverandAccounting Survival Guide: An Introduction to Accounting for BeginnersNo ratings yet

- Basic Accounting PrinciplesDocument8 pagesBasic Accounting PrinciplesGlenda Ortillano LeeNo ratings yet

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- Accounting NotesDocument66 pagesAccounting NotesSreenivas KuppachiNo ratings yet

- GAURAVDocument12 pagesGAURAVSaurabh MishraNo ratings yet

- Afm Unit 1 Total NotesDocument26 pagesAfm Unit 1 Total NotesanglrNo ratings yet

- Financial Accounting and AnalysisDocument32 pagesFinancial Accounting and AnalysisSafwan HossainNo ratings yet

- Equation Becomes: Assets A Liabilities L + Stockholders' Equity SEDocument2 pagesEquation Becomes: Assets A Liabilities L + Stockholders' Equity SEJorge L CastelarNo ratings yet

- Financial Accounting WORDDocument18 pagesFinancial Accounting WORDramakrishnanNo ratings yet

- Assingment Financial Accounting1Document9 pagesAssingment Financial Accounting1ANURAG SHUKLANo ratings yet

- Accounting Paper SummaryDocument1 pageAccounting Paper SummaryBataricitraNo ratings yet

- What Is 'Accounting': Definition ofDocument4 pagesWhat Is 'Accounting': Definition ofNica Dacatimbang - LeriosNo ratings yet

- ACTBAS 1 Lecture 6 Notes Accounting Cycle of A Service Business Part I: Journalizing, Posting and Trial BalanceDocument22 pagesACTBAS 1 Lecture 6 Notes Accounting Cycle of A Service Business Part I: Journalizing, Posting and Trial BalanceAA Del Rosario AlipioNo ratings yet

- Actbas 1 - Lesson 7 Journalizing, Posting and TBDocument11 pagesActbas 1 - Lesson 7 Journalizing, Posting and TBJustineGomezChan100% (1)

- The Accounting Process Identifies Business Transactions and EventsDocument2 pagesThe Accounting Process Identifies Business Transactions and EventsPutri Sekar ArumNo ratings yet

- LDocument3 pagesLLerroyd LacayNo ratings yet

- Group 6 IbdivDocument6 pagesGroup 6 IbdivRafasya Dan ShakilaNo ratings yet

- Chapter 1: Financialapplications Fundamentals of AccountingDocument60 pagesChapter 1: Financialapplications Fundamentals of AccountingSTEVE WAYNE100% (1)

- Nature and Functions of AccountingDocument19 pagesNature and Functions of Accountingketzzz80No ratings yet

- Unit - 1 (Hotel Accounts)Document19 pagesUnit - 1 (Hotel Accounts)Joseph Kiran ReddyNo ratings yet

- Accountancy T20Document38 pagesAccountancy T20Nischal HathiNo ratings yet

- The Accounting CycleDocument84 pagesThe Accounting Cyclejovani capiz100% (1)

- ContinueDocument3 pagesContinuejuwan decastroNo ratings yet

- AccountingDocument32 pagesAccountingraza2658181No ratings yet

- JournalizationDocument36 pagesJournalizationDavid Guerrero Terrado100% (1)

- The Purpose and Use of The Accounting Records Which Used in MontehodgeDocument15 pagesThe Purpose and Use of The Accounting Records Which Used in MontehodgeNime AhmedNo ratings yet

- Financial Accounting 123Document46 pagesFinancial Accounting 123shekhar87100% (1)

- Afm Unit - 1 TheoryDocument13 pagesAfm Unit - 1 Theoryನಂದನ್ ಎಂ ಗೌಡNo ratings yet

- Tesda Competency Reviewer, Deped Updates, L.E.T CoverageDocument8 pagesTesda Competency Reviewer, Deped Updates, L.E.T CoverageSharon Ann Basul100% (1)

- Accounting: What It IsDocument2 pagesAccounting: What It IsKumarNo ratings yet

- Introduction To Financial Accountin1Document27 pagesIntroduction To Financial Accountin1yug.rokadia100% (1)

- 2.0 The Recording ProcessDocument14 pages2.0 The Recording ProcessSarah Jane Dulnuan NipahoyNo ratings yet

- Fabm1 3rdQtrDocument61 pagesFabm1 3rdQtrEsmeralda ViaNo ratings yet

- Accounting For Managerial Decisions Commerce DuniyaDocument477 pagesAccounting For Managerial Decisions Commerce DuniyaJignesh Togadiya100% (3)

- Basic AccountingDocument14 pagesBasic AccountingShamim Ahmed AshikNo ratings yet

- Notes in AccountingDocument7 pagesNotes in AccountingSolis XIIINo ratings yet

- Introduction To Accounting 1st SemDocument15 pagesIntroduction To Accounting 1st SemANJALI KUMARI100% (2)

- Unit - 1Document32 pagesUnit - 1Afzal AhmadNo ratings yet

- AccountingDocument44 pagesAccountingPrasith baskyNo ratings yet

- Financial Accounting SummaryDocument25 pagesFinancial Accounting SummarySofia EizingaNo ratings yet

- An Introduction AccountingDocument16 pagesAn Introduction AccountingArathy KrishnaNo ratings yet

- Financial AccoountingDocument5 pagesFinancial AccoountingASR07No ratings yet

- POA Book NotesDocument72 pagesPOA Book NotesChelsea MortleyNo ratings yet

- Accounting & Accounting CycleDocument34 pagesAccounting & Accounting CyclechstuNo ratings yet

- Financial Accounting Is The Process of Preparing Financial Statements For A BusinessDocument11 pagesFinancial Accounting Is The Process of Preparing Financial Statements For A Businesshemanth727100% (1)

- Basic Accounting For Non-Accountants - Part 1Document34 pagesBasic Accounting For Non-Accountants - Part 1Brian Baluya95% (113)

- Bookkeeping NC 3 Review GuideDocument6 pagesBookkeeping NC 3 Review GuideCatherine Hidalgo100% (1)

- Acctg BasicsDocument5 pagesAcctg BasicsLmark VerdadNo ratings yet

- Lecture 1-Introduction To Applied Office AccountingDocument15 pagesLecture 1-Introduction To Applied Office AccountingMary De JesusNo ratings yet

- FA 1 NotesDocument15 pagesFA 1 Noteskshitij_94No ratings yet

- Mod3 Part 1 Accounting Cyle For Service BusinessDocument21 pagesMod3 Part 1 Accounting Cyle For Service Businessviaishere4u100% (1)

- Balance Sheet: AccountingDocument5 pagesBalance Sheet: AccountingPrathameshChoudhury100% (1)

- Give Atleast 3 Meaning of Accounting?Document3 pagesGive Atleast 3 Meaning of Accounting?Hazzelle DumaleNo ratings yet

- Financial Accounting NotesDocument31 pagesFinancial Accounting NotesSherisse' Danielle Woodley100% (2)

- MANACC-Accounting Records and Systems (Narrative Form)Document14 pagesMANACC-Accounting Records and Systems (Narrative Form)TinNo ratings yet

- Financial Fraud SchemesDocument9 pagesFinancial Fraud SchemesPrabhu SachuNo ratings yet

- It DaibbDocument5 pagesIt DaibbSaugata Shovan HaiderNo ratings yet

- Math 1Document17 pagesMath 1Saugata Shovan HaiderNo ratings yet

- Basic For MathDocument1 pageBasic For MathSaugata Shovan HaiderNo ratings yet

- Breakeven AnalysisDocument4 pagesBreakeven AnalysisSaugata Shovan HaiderNo ratings yet

- 123123Document100 pages123123Carlo SolanoNo ratings yet

- Ge Six SigmaDocument14 pagesGe Six SigmagauravnanjaniNo ratings yet

- Banglore To Delhi Flight InvoiceDocument2 pagesBanglore To Delhi Flight InvoiceNikhil AgrawalNo ratings yet

- BNI Presentation - 25 12 2018 FinalDocument13 pagesBNI Presentation - 25 12 2018 FinalNavneetNo ratings yet

- McKinsey Over The YearsDocument2 pagesMcKinsey Over The YearsJohn TempletonNo ratings yet

- Management Accounting: Information For Creating Value and Managing ResourcesDocument34 pagesManagement Accounting: Information For Creating Value and Managing ResourcesMuhdTaQiuNo ratings yet

- Ben Graham and The Growth Investor: Presented To Bryant College April 10, 2008Document115 pagesBen Graham and The Growth Investor: Presented To Bryant College April 10, 2008bernhardfNo ratings yet

- 2017 SSUG Attendee ListDocument4 pages2017 SSUG Attendee ListAntares SchachterNo ratings yet

- Final Report On Customer Satisfaction in PIADocument19 pagesFinal Report On Customer Satisfaction in PIAWajid Ali50% (4)

- PDFDocument2 pagesPDFninad charatkarNo ratings yet

- Accounting 2Document1 pageAccounting 2Jomicah SimbilloNo ratings yet

- Christy LeeDocument22 pagesChristy LeeNivedha RajuNo ratings yet

- Introduction To Taxation - Student GuideDocument25 pagesIntroduction To Taxation - Student GuideRevankar B R ShetNo ratings yet

- FA3PDocument4 pagesFA3PdainokaiNo ratings yet

- Joint Cost AllocationDocument20 pagesJoint Cost AllocationMuhammad Haris Fajar RahmatullahNo ratings yet

- Principles of AccountingDocument5 pagesPrinciples of AccountingAminul Haque RusselNo ratings yet

- Cargo Dan LogisticDocument42 pagesCargo Dan Logisticsiti fatkhul milaNo ratings yet

- Yamaha Corporation (13035676)Document13 pagesYamaha Corporation (13035676)NguyenZumNo ratings yet

- PMD3RDocument4 pagesPMD3RAnonymous WtjVcZCgNo ratings yet

- Career Option As A Company Secretary (C. S)Document3 pagesCareer Option As A Company Secretary (C. S)Shivangi JaiswalNo ratings yet

- Foxconn Company Ethical IssueDocument6 pagesFoxconn Company Ethical IssueKarlina DewiNo ratings yet

- InnovationDocument20 pagesInnovationSayed EltaweelNo ratings yet

- Accounting & Financial AnalysisDocument35 pagesAccounting & Financial AnalysisVishal Ranjan100% (2)

- 5 Forces and Diamond ModelDocument23 pages5 Forces and Diamond ModelMohammad Imad Shahid KhanNo ratings yet

- Linear Tech Dividend PolicyDocument25 pagesLinear Tech Dividend PolicyAdarsh Chhajed0% (2)

- Fraternal Order of Leviathan - Leviathan SororitasDocument12 pagesFraternal Order of Leviathan - Leviathan SororitasBetson CajayonNo ratings yet

- Oracle HRMS Setup For SingaporeDocument33 pagesOracle HRMS Setup For SingaporeShmagsi11No ratings yet

- Effects of Globalization On Indian Insurance SectorDocument21 pagesEffects of Globalization On Indian Insurance SectorArindam DeyNo ratings yet

- Pricing ModelsDocument9 pagesPricing ModelshimanshiNo ratings yet

- Poea Requirements ChecklistDocument1 pagePoea Requirements ChecklistChristine Pestano SakaiNo ratings yet

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (15)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingFrom EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingRating: 4.5 out of 5 stars4.5/5 (760)

- Project Control Methods and Best Practices: Achieving Project SuccessFrom EverandProject Control Methods and Best Practices: Achieving Project SuccessNo ratings yet

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCFrom EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCRating: 5 out of 5 stars5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 4.5 out of 5 stars4.5/5 (14)

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookFrom EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookNo ratings yet

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessFrom EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessRating: 4.5 out of 5 stars4.5/5 (28)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetFrom EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetRating: 4.5 out of 5 stars4.5/5 (14)