Professional Documents

Culture Documents

Study and Ranking Effective Consumers Satisfaction Indexes (CSI) As A Pre-Requisite of Consumers Relationship Management (CRM) in Banking System Via AHP Technique

Uploaded by

TI Journals PublishingOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Study and Ranking Effective Consumers Satisfaction Indexes (CSI) As A Pre-Requisite of Consumers Relationship Management (CRM) in Banking System Via AHP Technique

Uploaded by

TI Journals PublishingCopyright:

Available Formats

Int. j. econ. manag. soc. sci., Vol(3), No (12), December, 2014. pp.

16-23

TI Journals

International Journal of Economy, Management and Social Sciences

www.tijournals.com

ISSN:

2306-7276

Copyright 2014. All rights reserved for TI Journals.

Study and Ranking Effective Consumers Satisfaction Indexes (CSI)

as a Pre-requisite of Consumers Relationship Management (CRM) in

Banking System via AHP Technique

Fereshteh Amin*

Assistant professor of Faculty of Management in Tehran University, Tehran, Iran.

Hoda Ghorbani

MSC degree from Tehran university, Iran

Ali Ramzani

Assistant professor of department of faculty of management and account, Islamic azad university,karaj, Iran.

Mahdieh Haghani

MSC degree from Tehran university, Iran.

*Corresponding author: famin@ut.ac.ir

Keywords

Abstract

Customers relations management

Customer satisfaction index

Ranking

Setting priorities

Analytical hierarchical process (AHP)

technique

The goal of the present research is to identify and set priorities of effective factors in customers satisfaction

in the banking system. This research has employed literature review of the subject and interview with

banking elites that led to identifying 40 factors. After using factor analysis technique, all factors were

categorized in four groups, including competitive factors, human factors, environmental factors and

professional factors. In conclusion, the couple comparison technique was employed by receiving advice of

elites to give weights to those factors in relation with others. The results showed that, the competitive factors

and human factors, in order, were more effective than other factors; and in human factor part, were suitable

encounter of staff, method of responding to the clients and the physical neatness of the staff, and in

professional factors category, the indexes of accuracy of banking performance, speed in performing bank

affairs and quality of providing bank services were important. In environmental factors, less crowded

branches, observing the turn of clients and closeness of branches distances, and in competitive factors,

higher interest rate, higher facilities ceiling and less expenses and commission fee had the highest weight

and importance from the viewpoints of customers.

1.

Introduction

Creation of new competitive atmosphere in banking industry of Iran and emergence of private banks, financial and credit institutes and activities

of various interest free funds have made the necessity to pay more attention to the customers demands, needs and expectations as well as

providing compatible services, even beyond their expectations inevitable. In order to achieve their goals, banks need attraction and gaining trust

and satisfaction of their customers and by employing customer- trend approach based on customers demands, they could achieve their goals;

hence, they should focus on their customers satisfaction and by paying attention to the economic, social and cultural changes and their

customers needs, they should perform constant efforts to keep their customers and absorb new clients. CRM means a series of steps that are

taken to establish, develop, maintain, improve and optimize long term and valuable relationship between customers and organizations.

CRM is a business strategy for adopting and managing effective relationships with customer for more profitability. Effective and long

relationship with customers leads to saving customers and winning their loyalty. In another word, customers stay in grasp of organization and the

latter will own the customer. The proprietorship gives emergence to competitive advantages, improvement in customers saving status and

profitability for the organization. CRM is a part of the strategy of an organization for identifying customers, keeping them satisfied and changing

them into permanent customers that in turn, using the relationship of customers and organizations and their needs would lead to a proper study

and analysis. CRM is a business approach for the entire organization that would assist organization in achieving its customer-centered goals.

Studies showed that in all models, the first stage is to identify customers needs and demands and absorbing the CRM in relation with his

satisfaction. In fact, the major goal of all existing models is to reach a high level of customers satisfaction and loyalty. In developing a suitable

model of customer relation in bank; too, in the first step it is of great importance to identify effective CSI and arrange the priorities of those

indexes accordingly.

2.

A Literature Review on Theoretical Aspects of the Research

2.1 Definition of CRM

CRM is a business strategy that goes beyond increase in volume of transaction and its goal is to increase profitability, income and customers

satisfaction. In order to realize those goals, organizations employ some tools, procedures, methods and relationship with their customers. Despite

a general agreement on the concept of CRM, if experts are asked about CRM, they would give different answers. Some believe CRM as the

strategy, some see it as technology, some call it processes and a group would consider it as an information system; therefore, in order to

determine CRM as best as possible, some of the definitions have been listed as follows:

CRM is a series of systemic processes and abilities that supports the long-term strategy of company as well as long-term relationship with key

and special customers. [6]

The view of organization for perceiving and affecting customers behavior through establishing significant relationship with customers to absorb

clients, keep the customer, gaining his loyalty and extracting the customers profitability. [7]

17

Study and Ranking Effective Consumers Satisfaction Indexes (CSI) as a Pre-requisite of Consumers Relationship Management (CRM) in Banking System via A...

International Journal of Economy, Management and Social Sciences Vol(3), No (12), December, 2014.

CRM means managing profitable counter relations from the viewpoint of a product or service seller. [8]

CRM is a dynamic process for managing the organizations relationship with the customer in order to create continuous profitable counter

relations among selected customers and the organization; and subsequently, rejecting non-profitable customers from the firm [9] . CRM is a

business strategy of the institute that is developed for the purpose of maximizing companys income and customers satisfaction through

categorizing and classifying customers. [10]

CRM is a technology or process to change customers information into knowledge on customer in the organization. [11]

By considering the above-mentioned definitions and comparing them with the concept of relationship-oriented marketing, one could see that

both CRM and relationship-oriented marketing concepts have been focused on the personal relations between the buyer and seller where those

relations have a long term nature, being profitable for both parties. In short, from the viewpoint of a company, both CRM and relation-oriented

marketing concepts are special organizational values and culture that put the buyer-seller relationship the focal point of organizational strategy or

operations; however, unlike similarities, it has been discussed that there are major differences between the two concepts:

First, marketing has a more strategic relationship method nature while CRM is used in a more technical way; second, methodological marketing

has more behavioral and sensational mode and makes great focuses on variables such as sympathy, trust, counter behavior and such items and in

turn, CRM is a more managerial item that focuses on the quality of making more coordinated management efforts in absorbing, maintain

customers and reinforcing their relationship; third, relationship-oriented marketing does not only emphasize on the mutual relationship of

provider and customer; but rather, it includes communication with beneficiaries of the organization, such as provider, staff, customers and even

the government; on the other hand, CRM is mostly involved in establishing relationship with key customers.

2.2 Process of CRM

2.2.1 The categories of CRM process from TAM viewpoint

Kayee Tam believes CRM as a process that revolves around changing information and knowledge gained from customers to interaction,

followed by their relations. This process includes few important categories.

Perspective obtained from customer

The value obtained by customer

Market planning

Interaction with customer

Analysis and processing

Learning

Discovery and science

Analysis and Processing

Process of CRM cycle

Market planning

Interaction with customer

Action

Figure 1. Process of CRM from TAM viewpoint

In order to maximize customer satisfaction, income and profitability, the necessary perspective of customers should be obtained through

analyzing customers satisfaction. This learning is a constant process and includes acquiring information on product, distribution paths, markets

and competition as well. [12]

2.2.2 The Tactical integration model of CRM processes

Based on following diagram, the sub-cycle of CRM process as introduced by SWIFT consists of following categories:

Interaction with customer

Discovery of knowledge

Learning

Action

Analysis and process

Planning

Figure 2. Model of tactical integration of CRM processes

Fereshteh Amin *, Hoda Ghorbani, Ali Ramzani, Mahdieh Haghani

18

International Journal of Economy, Management and Social Sciences Vol(3), No (12), December, 2014.

Discovery of knowledge: Analysis of customers characteristics and investment strategies are constituents of this part. This is done

through process of customers identification, classifying customer and predicting organizations customer.

Interaction with customer: This stage means execution and CRM through relevant information on proper time and providing

products by using a range of interactive canals.

Market planning: In this stage, the distribution path and products that are offered to special customers are defined. This stage requires

four different activities named market planning, product provision planning, marketing planning and communication planning.

Analysis and process: This stage includes a process the goal of it is to absorb and analyze customers data through communications the

organizations have obtained through their interaction paths. This part is a type of constant learning process that emphasizes on

information processing, prices amounts and approaches that increase organizations opportunities in interactions with customer. [4]

2.2.3 CRM Lifecycle Model

Kalakota in his model states CRM as being made of the three stages of absorption, promotion and saving and in each stage; it supports the

recognition and understanding the relationship between the organization and its customers. Those stages are:

Absorption of new customer through advertising goods and services leadership

Promotion of profitability of existing customers

Saving profitable customers for own survival through emphasizing on delivering services that the customer rather the market asks.

2.3 Definition of customer satisfaction:

Customer satisfaction is the product of comparisons made by the customer between the reality of the product or service and his own

expectations, demands, goals and social norms in connection with the product [15].Customers satisfaction is the main result of marketers

activities that causes an establishment and maintenance of customer-organization relationship during different stages of consumers purchase

behavior. Customers satisfaction could be seen as an emotional reaction that is manifested by what customer receives for the difference

between what he expects and what he receives [2].Catler says that satisfaction is the feeling of pleasure or hopelessness of the individuals that

he shows by comparing what he expected and the product performance [7]. of these definitions, it could be seen that feeling of pleasure is a type

of perception and view that is under influence of individuals expectations. Those expectations could be resulted from previous expectations

and experiences of the individual or come from suggestions that have been induced by others without his prior experiences of the product or

service. Of course, it should be noted that according to Herzbergs studies, the feeling of satisfaction that has been defined as compatibility

with the individuals expectations is among health and maintenance factor rather than motivating factor; that is, if the product performance is

below expectations, it will lead to dissatisfaction, resulting in emergence of sufficient reasons to give up the organization and seeking other

organizations. On the other hand, if the product perception is equal or higher than expectations from the product, it only raises satisfaction in

the person and he will have no sufficient reason to give up the organization.

A review on customers satisfaction models:

The satisfaction model of the Swedish customer: It was the first model of CRI that was introduced in Sweden in 1992. This model has

following elements:

1. The receivable value: This shows the comparison made by the customer from the quality he received versus the money he paid.

Customer likes to receive a quality suitable to the money he paid; even that quality is not the best quality.

2. Customers expectations: The customers expectation fits the concerned product or service. The expectations are characteristics of the

product or service received by the customer as he had predicted.

3. Customers voice: This expresses the customers situation regarding the value he received and his expectations. If the value received

by the customer agrees with his expectation level, the customers voice would express his loyalty and customer. Levels of complaints

to the organization are a picture of customers voice.

4. Loyalty and satisfaction of customer: Loyalty is the final dependant variable that forms as a result of the equilibrium level of the value

received and the level of expectations and by paying attention to customers voice, one could be informed on the satisfaction or

dissatisfaction of the customer. [16]

2.3.1 American CSI

This model was developed at Michigan University by cooperation of American Quality Association in 1994. In this model, a 15-question

questioner was prepared to extract the 6 parts of the model. The difference of this model and the Swedish model is adding a separate quality

receivable. The quality receivable expresses amount of quality needed by the customer, the quality presented and the quality expected. Other

parts of the model are as the Swedish model. [3]

2.3.2 European CSI

The European CSI model is shown below. This model is like a structural model that consists of few concealed variables and its general

structure is the same as ACSI model. In this model, we see seven concealed variables. Those categories are: [14]

Factors

Product

Price

Distribution canals

Services

Organization picture

Customers expectations

Table 1. Indexes and factors of ECSI model

Indexes

1. Quality 2. Performance 3. Accessibility

1. Price level 2. Discount

3. Payment term

1. Place 2. Accessibility 3. Services 4. Accessibility time (business hours for customers return)

1. Accuracy 2. Trustworthiness 3. Staff eagerness and inclination 4. Guaranty of product 5. Staff skills and its general behavior

1. Fame 2. Business status 3. Credibility and assurance

1. Past experiences 2. Personal need

2.3.3 The Swiss CIS Model

In this model, the customer satisfaction variable could be measured and calculated by three indexes. In the present model, the assumption is

that, satisfied customer, in addition to grow the feeling of belonging and loyalty, will also show more trend to establish a durable and longstanding relationship with the supplier. The customers loyalty variable is measured by three measures as the second consequence of

customers satisfaction in the SWICS. This research has used the highest accuracy monitoring assessment model. The results of initial studies

in SWICS have been analyzed by hierarchical clustering technique and yield valuable findings. [5]

19

Study and Ranking Effective Consumers Satisfaction Indexes (CSI) as a Pre-requisite of Consumers Relationship Management (CRM) in Banking System via A...

International Journal of Economy, Management and Social Sciences Vol(3), No (12), December, 2014.

2.3.4 CSI model in banking industry

This index has been presented by American Bankers Association (ABA). This index has been designed in a way that enables banks to measure

their customers satisfaction in monthly and seasonal intervals and monitor changes in customers. By using this tool in internet, bankers

obtained a great range of information in connection with customers needs and expectations. That information is available to bankers online in

internet. Data collection from customers who do not have access to internet is done through sending questionnaires appended to their accounts

operations statements, direct contact, telephone call, mail or a combination of above-mentioned methods. The device of this index is a

questionnaire titled Write us how to work containing 27 questions; the subjects are scored in two types in a 6-grade scale. Score one is in

connection with the importance of the question from the viewpoint of subjects; that is, how much importance the customer gives to the

question. The second score is in relations with bank function; that is, from the viewpoint of customers, bank is in relations with bank function.

That is, from the viewpoint of customers, what score the bank receives for its performance. Lower scores are for poor function and higher

scores are for better function. Questions are classified under five categories as follows: [14]

Table 2. Factors and indexes of CSI model in bank

Factors

Indexes

Services

1. Staffs politeness 2. Speed of services 3. Immediate mistake correction 4. Time of performing operations

Professional performance (employees work professionally)

1. Easy access to branches 2. Not-crowded branches 3. Feasibility and facilities of automatic pay machines,

4. Cleanness and neatness of branches 5.parking places

Place of providing service

Product (goods/services)

1. Current account services 2. Commission fees and service expenses 3. Saving accounts, credit cards

4. Investment services 5. Loan services 6. Telephone bank 7. Computer services 8. Statements of accounts 9.

Loan interests 10. Saving accounts interests

General satisfaction

1. Do you recommend our bank to your friends? 2. Do you plan to refer to our bank for your next loan?

3. How did you find our bank services compared to other financial companies? 4. Do you plan to refer to

our bank for your next deposit account? 5. Are you going to refer to our bank for your next investment?

Customers information

1. Age 2. Annual income 3. Family 4. Amount of deposit 5. Job 6. gender

2.3.5 Atanasopolos Model

This model was introduced in 1999. The model studies the customer satisfaction indexes in five scopes:

A. Staff competency

1. The staff of bank is fully aware of the bank products.

2. You receive the demanded service from the bank staff with good speed.

3. The bank staff enjoy sufficient knowledge (as needed) to provide you a fast service.

4. The bank staffs do not mind spending more time to give you better services.

5. The bank staffs are aware of your needs and how the bank products would meet your demands.

B. Reliability

1. If there will be a problem, the bank will talk to me about this problem.

2. There is no need to turn to the bank in order to solve a problem.

3. This bank is a bank that is worthy of being trusted.

C.

1.

2.

3.

Product renovation

Bank provides vast and various products.

The bank products have the flexibility that could meet my demands.

This bank provides telephone services as well.

D. Pricing

1. The interest rates of the loans of my bank are higher than other banks.

2. The saving deposit interest rate in my bank is lower than other banks.

3. I feel I am paying a large amount of commission fee.

E.

1.

2.

3.

4.

5.

6.

Physical evidences:

A friendly and warm atmosphere is over this bank.

The bank staff is in their work with neat appearance and clean clothes.

The internal atmosphere and environment of the bank leaves positive effects on you to receive its services.

The internal designs of the preliminary works facilitate transactions performance.

The internal atmosphere and environment of the branch assists staff in presenting better services.

The staff of this bank has a friendly behavior.

1.

2.

3.

Comfort

The bank branch is close to your work place.

The branch of this bank is near other buildings of the bank as well as close to other banks.

The branch of this bank is near a shopping center I usually visit. (Johnson and et al. 2001, P.18)

F.

2.4 Heis Derg studies

Studies showed that it is usually less expensive to keep the existing customers than finding new customer. A satisfied and loyal customer

might cost large amount of money during his years of relationship with the company; especially, if this customer is encouraged to receive

services with the quality as promised by the organization; therefore, keeping interaction with exiting customer is less costly than seeking new

customers.

Fereshteh Amin *, Hoda Ghorbani, Ali Ramzani, Mahdieh Haghani

20

International Journal of Economy, Management and Social Sciences Vol(3), No (12), December, 2014.

2.5 Walters Research

Walter offers 52 methods to have customers satisfaction for every, the most important of them are mood, customer-centered culture,

improving the abilities of staff, measurement of performance, attention to the lifetime value of the customer, giving importance to services to

customer, constant inquiry on customers needsThis study showed that there is an intelligent method to keep customers satisfied in order to

arrange for some reform actions before there will be any problem in the organization since, when customers show reactions, it is usually too

late for any actions .

2.6 Researches of Paklan Vang and Kanchi

These researchers studied both the European and American CSI models and concluded that the relationships specified in measuring customers

satisfaction did not have the required certainty and definition and ultimately, the mentioned researchers developed a model titled Kanchis

Model for Satisfaction Measurement. The model was tested by 450 customers of a bank in Hong Kong. [3]

2.7 A few practical examples of gaining customers satisfaction in bank

First Union Bank invited one of its loyal for the bank anniversary and awarded him to open a free of charge bank account. That customer will

benefit from special services of the bank. The First U.S.A. bank sends invitations to its customers with the topic A plan immediately upon

your request. In the questionnaire, the name and birthday of the close relatives are asked. In addition, your hobbies, favorite journals, cultural

and sports activitiesare asked. The UOB Bank has the motto of Bank is in your finger tips is printed on the checkbooks with the picture of

real individuals on the electronic cards and the logo of legal customers and placing electronic cards for personnel of the bank are used. The

Bank of America uses paperless banking for support and protection of garbage recycling (paper and ) and executes one of the most

important ethical principles for American people and by this approach, it doubled its fame, prestige and customers in the American society.

The Miami Bank uses special rooms with comfortable furniture and entertaining its customers with coffee and fruit. It offers its services in the

customers homes and working places as well. The DBS Bank provides services with the topic of Eight and satisfies its customers,

improving the customers absorption towards the bank. The number 8 shows the bank and consultation company links as the two connecting

ring. Union Bank has established a customer club in the bank and presents the club bank to the special customers of this bank and by that

action, it could find special place in public minds. The Fargo Vels Bank has mounted a board (five minutes or five dollars) meaning that

customers wait more than five minutes in this branch of bank to receive bank services and stay in line, the bank will credit five dollars in their

accounts. [1]

2.8 Research questions

- What are the effective CSI in bank system?

- What are the levels of effective indexes on customers satisfaction?

- What is the priority of effective CSI in banking system?

3.

Research Methodology

In terms of research methodology, the present research could be considered as descriptive-surveying research in terms of data collection; for,

in this research, the researcher made no changes in the variables subject of study and has only studied the existing conditions. In addition, in

terms of the goal of research, the research could be classified as an applied research. In such researches, theories, regulations and techniques

that are developed in fundamental research have been used for improving applied knowledge in a special ground and solving actual problem

solving in that area.

3.1 Society and statistical subjects of the research

The statistical subject of this research includes the entire customers of banking system in the city of Tehran. In this research, the probable

sampling used unlimited society for selecting statistical samples.

3.2 Data collection method

In this research, literature review was used to collect data on the subject, the theoretical fundamentals and research history. In order to extract

general indexes effective on customers satisfaction in bank branches, in addition to theoretical fundamentals of the research, an open

interview was carried out with a number of banking system elites and professionals, branch managers, university professors and a number of

permanent customers of the branch. The results of the interviews were studied by using contents analysis techniques and the relevant indexes

on customers satisfaction were extracted from bank branches. Ultimately, a questionnaire containing 40 questions was developed to measure

the effectiveness of extracted indexes and their ranking. The copies of questionnaire were then distributed among the statistical samples of the

research.

4.

Findings of Research

Question 1: What are the effective CSI in branches of bank system?

As noted above, after interview with the banking elites, 40 items were identified as main categories in the satisfaction of bank branches. The

research questionnaire was developed by using those categories, followed by a factor analysis on the output data. By that procedure, 4 factors

were identified as the most important effective factors on customers satisfaction of bank branches. In sum, the four extracted factors

underwent Varimax rotation and could determine 76/268 percent of total variance on the questionnaire of assessing effective factors in

customers satisfaction. The combination of questions arrangement in the questionnaire on the four extracted factor in the factor analysis was

as follows:

First factor: There are eight questions on this factor and this factor is labeled as human factors.

Second factor: There are eight questions on this factor and this factor is labeled as professional factors.

Third factor: There are thirteen questions on this factor and this factor is labeled as environmental factors

Fourth factor: There are eleven questions on this factor and this factor is labeled as competitive factors.

Question 2: What are the levels of effective indexes on customers satisfaction?

In this study, the single sample average comparison test has been used to test the level of effective factors on customers satisfaction in

banking system. Based on the opinions of statistical sample individuals, the numbers which were obtained were: human factors (t=2.015, P=0,

21

Study and Ranking Effective Consumers Satisfaction Indexes (CSI) as a Pre-requisite of Consumers Relationship Management (CRM) in Banking System via A...

International Journal of Economy, Management and Social Sciences Vol(3), No (12), December, 2014.

M=4.32), professional factors (t=2.84, P=0/, M=3.18), environmental factor (t=2.36, P=0.01, M=3.098) and competitive factors (t=2.23,

P=0.04, M=4.47) the mean average obtained in all items was significantly higher than average.

Question 3: What is the priority of effective CSI in banking system?

In this study, AHP technique was used in order to arrange ranking effective factors on customers satisfaction and the sub-series of each one of

the factors and the views of 15 banking elites were used to complete the couple comparison questions as samples. The results on the

relationship of comparing general factors have been listed in below table. The tables like following sample have been developed for the subsets and the weight of each one of the indexes has been calculated.

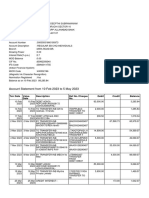

Table 3. Geometrical weight average of each one of the effective factors on the customers satisfaction

CSI Factors

Competitive advantages

Professional factors

Human factors

Environmental factors

Total

Competitive

factors

0.082

0.456

0.307

0.155

1.00

Professional

factors

0.117

0.649

0.117

0.116

1.00

Human

factors

0.036

0.751

0.135

0.078

1.00

Environmental

factors

0.060

0.630

0.197

0.113

1.00

Total

Average

0.295

2.486

0.756

0.462

0.074

0.622

0.189

0.116

1.00

Since almost all calculations on AHP based on the initial judgment of the decision maker takes place in form of couple comparisons matrix,

any errors and inconsistency in comparing and determining the importance between choices and indexes would distort the final results

obtained from calculations. The consistency ratio (CR) as a tool for calculating and showing the consistency degree and how to trust on the

results obtained from priorities have been used for the four general factors as samples and for other indexes; too, the calculation of CR has

been done in the same way. CR is a tool for specifying the consistency of judgments and shows how the priorities resulted from comparisons

could be trusted. The process of CR calculation consists of following steps:

1. Calculation of Weighted Sum Vector: This is obtained by multiplying the couple comparisons matrix on the relative weights vector.

2. Calculation of Consistency Vector: This is the product of dividing weighted sum in relative priority vector.

3. Calculation of max : max is equal to mean average of consistency vector elements

4. Calculation of consistency index (CI):

CI

5.

max n

n 1

(1)

In which, n is the number of choices.

Calculation of consistency ratio (CR): the product of dividing the consistency index on random index I.

CR CI

RI

(2)

Ultimately, if the consistency rate obtained is less than 0.1, the comparisons consistency is acceptable.

Table 4. The consistency rate of couple comparisons of effective factors on customers satisfaction

Weighted Sum Vector

WSV

0.298

2.724

0.778

0.475

Consistency vector

C.V

4.032228482

4.382144709

4.116139882

4.109083843

max

4.159899229

Consistency index

C.I

0.053299743

Consistency rate

CR

0.059221937

As it could be seen in the above table, the consistency rate of general factors is 0.059 and since this number is less than 0.1, it is therefore in

acceptable range and shows consistency among the priorities of couple comparisons. The calculations of consistency rates of each single table

of the sub-set factors is not mentioned to save the time and only results are shown.

The consistency rate of couple comparisons of the indexes of human factors sub-sets that affect customers satisfaction (0.022<0.1) is in an

acceptable range; therefore, there is consistency among couple comparisons.

The consistency rate of couple comparisons of the indexes of professional factors sub-sets that affect customers satisfaction (0.005<0.1) is in

an acceptable range; therefore, there is consistency among couple comparisons.

The consistency rate of couple comparisons of the indexes of environmental factors sub-sets that affect customers satisfaction (0.076<0.1) is

in an acceptable range; therefore, there is consistency among couple comparisons.

The consistency rate of couple comparisons of the indexes of competitive advantages factors sub-sets that affect customers satisfaction

(0.009<0.1) is in an acceptable range; therefore, there is consistency among couple comparisons.

The results of weighing indexes of sub-sets of each one of the factors effective on customers satisfaction are listed in table 5.

As the results show, in human factors part, the most important index affecting customers satisfaction in bank systems are suitable conduct of

staff index, method of responding to customer, neat physical appearance of staff and in professional part, the indexes of accuracy of banking

affairs, speed in bank affairs and quality of banking services, and in the environmental factors, not-crowded branch, observing customers

turns and closeness of the branch, and in competitive factors, higher rate of interests, higher facilities and less expenses and commission fee

had the highest weights and importance from the customers viewpoints.

Fereshteh Amin *, Hoda Ghorbani, Ali Ramzani, Mahdieh Haghani

22

International Journal of Economy, Management and Social Sciences Vol(3), No (12), December, 2014.

Table 5. Weight of indexes of sub-sets of effective factors on customers satisfaction

5.

Human factors

Weight

Environmental

factors

Weight

Professional factors

Weight

Competitive

factors

Weight

Suitable conduct of

staff

23%

not-crowded

branch

12%

accuracy of bank

activities

18%

Internet services

6%

Physical neatness

of staff

13%

air condition

system

9%

feasibility of service

receipt

10%

Telephone bank

4%

Responding way

19%

safety systems of

branch

8%

precision in service

presentation

11%

Higher interest

rate

18%

Confidentially of

staff

10%

closeness of

branch

10%

speed in service

presentation

13%

Ceiling of credits

payable

16%

Staff gender

5%

branch cleanness

7%

accuracy of bank

advertisement

9%

ATM services

6%

Age of staff

3%

observing

customers turn

11%

branch management

11%

Commissions and

fees

14%

Degree of trusting

customer

18%

duration of

staying in line

7%

quality of presenting

bank services

12%

Services needed

by the customer

13%

Number of staff

7%

size of branch

7%

method of informing

customers

7%

Special services

11%

working hours of

bank

6%

method of customers

absorption

9%

Advertisement

gifts

parking lot in

branch

3%

Bank services

entertainment

facilities

4%

Competitive

factors

decoration of

internal space

8%

tools and facilities

in the branch

5%

external space of

the branch

3%

Suggestions and Recommendations

In todays world, earning profit and financial benefits is the most important goal of organizations for their survival in the highly challenged

and competitive environment in the global village. Today, customers as the providers of financial benefits of organizations are the most

important factors of organizations growth and survival and organizations try to maintain a long term relationship with their customers by

absorbing and keeping satisfied and loyal customers. In an increasingly competitive business environment, gaining customers satisfaction has

becoming the main goal of organization. Customers satisfaction is something higher than positive effects on the efforts made in the

organization. This not only forces staff to be active, but also is considered as a profitable source for the organization[12]. Customers

satisfaction creates large amount of advantages for the organization and higher levels of customers satisfaction leads to their loyalty. Keeping

good customers in long terms than constant absorption of new customers to replace those who disconnected with the company is a more useful

approach. Customers that have large satisfaction convey their positive experiences to others and in this way, they become advertisement tools

for the organization, lowering the costs of absorbing new customers, This is particularly very important for those that provide services because

their fame and prestige and advertising their advantages and positive points by others are a great source for gaining public trust. High

satisfaction of customer is a type of insurance against probable mistakes of the organization that becomes inevitable as a result of changes

related to the type of their service production. Permanent customers, in facing such conditions, show more understanding because due to their

good previous experiences, they easily forgive the little mistakes of organization. Therefore, it is not strange that gaining customers

satisfaction has become the most important duty of organizations and institutes. [13]

In today business world, organizations could not afford being indifferent towards customers expectations and needs. They should take their

most efforts to increase customers satisfaction because they are the only source of their capital return. Customers satisfaction brings along

with it advantages such as competitive advantages, lowering the costs of mistakes, encouraging customer to repeat transactions and stay loyal,

reducing the costs of absorbing new customers, increasing the fame and credit and sustained growth and development. In service organizations

such as banks, the effective factors on customers satisfaction could be studied from various aspects and as the results of this research showed,

those factors could be classified in the four human, competitive, environmental and professional groups. Of the four groups, competitive

factors have higher stand than others. The reason is that, the intensity of environmental changes in today world has turned into a factor that

makes organizations stay in constant competition with their competitors in order to survive in the market and in this competition arena,

producing goods or providing services with best quality and observing customer-centered principles have found determining role, creating an

unprecedented duty for heads of organizations. Banking industry in today world is facing a dynamic and complicated environment. The

increasing expansion of financial and credit institutes, establishment and expansion of private banks, increasing move of insurance

organizations towards providing financial and non-financial services, increasing advances of technology in this industry and moving towards

electronic bank have created a special and highly competitive atmosphere for bank sector. Banks of today require more challenges for

23

Study and Ranking Effective Consumers Satisfaction Indexes (CSI) as a Pre-requisite of Consumers Relationship Management (CRM) in Banking System via A...

International Journal of Economy, Management and Social Sciences Vol(3), No (12), December, 2014.

performing any of their routine duties and processes including absorbing deposits, optimized allocation of resources, granting loans and

facilities, absorbing professional and skillful forcesand planning and decision making in this condition demands a deep and serious

perspective and views to the internal and external environment of organizations and the interactions in them.

Bank clients should have access to sufficient information regarding referring to the bank and following up their financial affairs. Accurate

information on services and their performance should be easily accessible to them. Services should be provided with sufficient speed and

customers must be able to perform their bank affairs in the shortest time possible. Those services should be flawless and proper as much as

possible. The neat physical appearance of services, the physical place and organizational environment where the customers refer are among

other demands and needs of customers. The results of this research showed that after competitive factors, the human factors have higher degree

of importance than other factors. The method of handling customers by staff is of great importance. A suitable conduct with customers could

cover the poor technical aspects of services as well. Managers of banks branches could perform various activities to provide desirable services

to customers and creating a suitable relationship with them. They should identify customers expectations and determine clear and distinct

goals for their services; they should be a trustable and faithful advisor to their customers and deal with proper conduct. A successful

organization creates the sense of commitment in providing desirable services among its staff, creates a suitable and simple structure for

providing services, puts special importance to its personnel (internal clients), assesses and measures its customers satisfaction permanently

and investigates their complaints fast. It establishes a friendly and good relationship as well as mutual trust with its clients.

Presently, customers are the determining factors of survival and durability of organizations and all organizations, including banks require

designing systems to identify customers demands and needs and forming the method of their relationships. In academic literature, those

systems are defined as models of managing relationship with customer. Each customer relationship management (CRM) system includes

various elements and parts and the first and most important of those sections that have been noted almost in all models is the issue of

identifying customer and recognizing the factors that affect his satisfaction. The present research discusses CRM models from this aspect and

has studied this part in banking system in detail. The research has identified general effective factors on customers satisfaction and has given

weights to those factors and their sub-series. Researchers in future study could use the results to design a suitable CRM model for bank

branches.

With respect to the results, following suggestions are made:

Since needs, demands and expectations of customers are functions of time; therefore, bank should arrange for regular survey to

assess customers satisfaction in six or twelve- month intervals.

Increase in competitive power of bank branches by employing variable, simple and applicable services to fit customers needs

To develop a software with respect to the mathematical and conceptual pattern of this research and installing it on the bank site to

study the process of customers satisfaction in regular form

To allocate a special place for key customers to decrease or remove turn and waiting time

To plan for lowering tangible or Rials costs for key clients; as an example, discount or exemption from paying commission fee for

them

To use modern facilities in providing services (computers, printers and modern counters)

To re-design forms, bills, statements, checkbooksto look nice and pleasant in the eyes of customers

To use physical facilities 9furniture, counterswith high attraction aspects.

To uniform staff clothes in order to seem neat by customers

To establish a unit for studying and researching new services that should be presented by bank and increase the variety of their

services.

To hold educational courses with focus on customers for staff and to reward staff that show changes in their behaviors and skills in

handling customers after taking those courses.

References

[1]

[2]

[3]

[4]

[5]

[6]

[7]

[8]

[9]

[10]

[11]

[12]

[13]

[14]

[15]

[16]

Ahmadpour,H & Hamedani.A.R ) 2012). Factors affecting commercial bank to retain attract customers, First international conference on marketing of

banking services. 1-15.

Fecikova, I (2004). A index method for measurement of customer satisfaction, TQM magazine, Vol.16,No. 1, 57-66.

Feinberg. R. A, Hokama. L, Kadam, R & Kim, I (2002). Operational determinants of caller satisfaction in the banking/financial services call center,

International Journal of Bank Marketing.Vol. 20, NO.2, 131_141.

Johansson. j & Strom. F. (2002). Customer relationship management case studies of five Swedish companies, MS thesis ,Lule University of Technology

Johnson. M. D, Gustafsson. A, Andreassen. T.W, Lervik. L& Cha.J. (2001). The evolution and future of national customer satisfaction index models', Journal

of economic psychology. Vol.16, NO.2, 1-43.

Kavosi, M& saghai.A. (2008). Methods for measuring customer satisfaction, Sabzan Publishers,Tehran.

Kotler, P& Armstrong. G (2009). Principles of marketing, Ailar Publishers, Tehran.

Manuel. J.V& Pedro .S.C. (2003) The employee-customer satisfaction chain in the ECSI model. European Journal of Marketing, Vol. 37, No.11/12

,1703_1722.

Ngai. E.W.T (2005) Customer relationship management research (1992-2002), Marketing Intelligence & Planning, Vol. 23 ,No. 6, 16-26.

Ngai. E.W.T, Li Xiu & Chau. D.C.K.(2009) .Application of data mining techniques in customer relationship management:A literature review and

classification', journal of Expert Systems with Applications, NO. 36, 25922602.

Richards. K.A & Jones. E (2008). Customer relationship management: Finding value drivers, journal of Industrial Marketing Management,VOL 37,NO. 2,

120_130

Sajadi,A.A (2001). The role of customer satisfaction in business, NO. 22, 15_24

Venus. D & Safarian. M. (2009). Marketing of banking services, Negah danesh Publishers, Tehran.

Vilares, M.J. & Coelho, P.S. (2003). The employee-customer satisfaction chain in the ECSI model. European Journal of marketing, 37(12), 1703-1722.

Villalobos. G (2000). Web-Application for the Customer Satisfaction Measurement Thomas Wettstein, MS Thesis ,Faculty of Economic and Social Sciences

of the University of Fribourg.

Yang. X, Tian. P, Zhang, Z. (2003). A Comparative Study on Several National Customer Satisfaction Indices (CSI)' , Jurnal of Marketing,Vol.56, No.5, 1-5.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Relationship Between Couples Communication Patterns and Marital SatisfactionDocument4 pagesRelationship Between Couples Communication Patterns and Marital SatisfactionTI Journals PublishingNo ratings yet

- Debate Lesson PlanDocument3 pagesDebate Lesson Planapi-280689729No ratings yet

- The Impact of El Nino and La Nina On The United Arab Emirates (UAE) RainfallDocument6 pagesThe Impact of El Nino and La Nina On The United Arab Emirates (UAE) RainfallTI Journals PublishingNo ratings yet

- Do Social Media Marketing Activities Increase Brand Equity?Document4 pagesDo Social Media Marketing Activities Increase Brand Equity?TI Journals PublishingNo ratings yet

- Ce Project 1Document7 pagesCe Project 1emmaNo ratings yet

- Novel Microwave Assisted Synthesis of Anionic Methyl Ester Sulfonate Based On Renewable SourceDocument5 pagesNovel Microwave Assisted Synthesis of Anionic Methyl Ester Sulfonate Based On Renewable SourceTI Journals PublishingNo ratings yet

- Arte PoveraDocument13 pagesArte PoveraSohini MaitiNo ratings yet

- Portland Cement: Standard Specification ForDocument9 pagesPortland Cement: Standard Specification ForHishmat Ezz AlarabNo ratings yet

- Factors Affecting Medication Compliance Behavior Among Hypertension Patients Based On Theory of Planned BehaviorDocument5 pagesFactors Affecting Medication Compliance Behavior Among Hypertension Patients Based On Theory of Planned BehaviorTI Journals PublishingNo ratings yet

- Empirical Analysis of The Relationship Between Economic Growth and Energy Consumption in Nigeria: A Multivariate Cointegration ApproachDocument12 pagesEmpirical Analysis of The Relationship Between Economic Growth and Energy Consumption in Nigeria: A Multivariate Cointegration ApproachTI Journals PublishingNo ratings yet

- Effects of Priming Treatments On Germination and Seedling Growth of Anise (Pimpinella Anisum L.)Document5 pagesEffects of Priming Treatments On Germination and Seedling Growth of Anise (Pimpinella Anisum L.)TI Journals PublishingNo ratings yet

- Allelopathic Effects of Aqueous Extracts of Bermuda Grass (Cynodon Dactylon L.) On Germination Characteristics and Seedling Growth of Corn (Zea Maize L.)Document3 pagesAllelopathic Effects of Aqueous Extracts of Bermuda Grass (Cynodon Dactylon L.) On Germination Characteristics and Seedling Growth of Corn (Zea Maize L.)TI Journals PublishingNo ratings yet

- Simulation of Control System in Environment of Mushroom Growing Rooms Using Fuzzy Logic ControlDocument5 pagesSimulation of Control System in Environment of Mushroom Growing Rooms Using Fuzzy Logic ControlTI Journals PublishingNo ratings yet

- Composites From Rice Straw and High Density Polyethylene - Thermal and Mechanical PropertiesDocument8 pagesComposites From Rice Straw and High Density Polyethylene - Thermal and Mechanical PropertiesTI Journals PublishingNo ratings yet

- A Review of The Effects of Syrian Refugees Crisis On LebanonDocument11 pagesA Review of The Effects of Syrian Refugees Crisis On LebanonTI Journals Publishing100% (1)

- Different Modalities in First Stage Enhancement of LaborDocument4 pagesDifferent Modalities in First Stage Enhancement of LaborTI Journals PublishingNo ratings yet

- The Effects of Praying in Mental Health From Islam PerspectiveDocument7 pagesThe Effects of Praying in Mental Health From Islam PerspectiveTI Journals PublishingNo ratings yet

- Regression Week 2: Multiple Linear Regression Assignment 1: If You Are Using Graphlab CreateDocument1 pageRegression Week 2: Multiple Linear Regression Assignment 1: If You Are Using Graphlab CreateSamNo ratings yet

- DocsDocument4 pagesDocsSwastika SharmaNo ratings yet

- IOM - Rampa Hidráulica - Blue GiantDocument32 pagesIOM - Rampa Hidráulica - Blue GiantPATRICIA HERNANDEZNo ratings yet

- Parts List 38 254 13 95: Helical-Bevel Gear Unit KA47, KH47, KV47, KT47, KA47B, KH47B, KV47BDocument4 pagesParts List 38 254 13 95: Helical-Bevel Gear Unit KA47, KH47, KV47, KT47, KA47B, KH47B, KV47BEdmundo JavierNo ratings yet

- ModelsimDocument47 pagesModelsimKishor KumarNo ratings yet

- Agriculture Vision 2020Document10 pagesAgriculture Vision 20202113713 PRIYANKANo ratings yet

- Introduction To Templates in C++Document16 pagesIntroduction To Templates in C++hammarbytpNo ratings yet

- Week 2 - Sulphur DyesDocument5 pagesWeek 2 - Sulphur DyesRR TNo ratings yet

- Ugtt April May 2019 NewDocument48 pagesUgtt April May 2019 NewSuhas SNo ratings yet

- Feb-May SBI StatementDocument2 pagesFeb-May SBI StatementAshutosh PandeyNo ratings yet

- Denial of LOI & LOP For Ayurveda Colleges Under 13A For AY-2021-22 As On 18.02.2022Document1 pageDenial of LOI & LOP For Ayurveda Colleges Under 13A For AY-2021-22 As On 18.02.2022Gbp GbpNo ratings yet

- The Algorithm Development and Implementation For 3D Printers Based On Adaptive PID ControllerDocument8 pagesThe Algorithm Development and Implementation For 3D Printers Based On Adaptive PID ControllerShahrzad GhasemiNo ratings yet

- What Is Public RelationsDocument52 pagesWhat Is Public RelationsMarwa MoussaNo ratings yet

- Normal Consistency of Hydraulic CementDocument15 pagesNormal Consistency of Hydraulic CementApril Lyn SantosNo ratings yet

- Investigation of The Microstructures, Properties, and Toughening Mechanism of Polypropylene/calcium Carbonate Toughening Masterbatch CompositesDocument16 pagesInvestigation of The Microstructures, Properties, and Toughening Mechanism of Polypropylene/calcium Carbonate Toughening Masterbatch CompositesHatchi KouNo ratings yet

- CV TitchievDocument3 pagesCV TitchievIna FarcosNo ratings yet

- IJISRT23JUL645Document11 pagesIJISRT23JUL645International Journal of Innovative Science and Research TechnologyNo ratings yet

- 3Document76 pages3Uday ShankarNo ratings yet

- Vacon NX, Non-Regenerative Front End FI9 UD01217B PDFDocument48 pagesVacon NX, Non-Regenerative Front End FI9 UD01217B PDFSilvian IonescuNo ratings yet

- EceDocument75 pagesEcevignesh16vlsiNo ratings yet

- Chapter 4 Seepage TheoriesDocument60 pagesChapter 4 Seepage Theoriesmimahmoud100% (1)

- List of Institutions With Ladderized Program Under Eo 358 JULY 2006 - DECEMBER 31, 2007Document216 pagesList of Institutions With Ladderized Program Under Eo 358 JULY 2006 - DECEMBER 31, 2007Jen CalaquiNo ratings yet

- Eea2a - HOLIDAY HOMEWORK XIIDocument12 pagesEea2a - HOLIDAY HOMEWORK XIIDaksh YadavNo ratings yet

- Mericon™ Quant GMO HandbookDocument44 pagesMericon™ Quant GMO HandbookAnisoara HolbanNo ratings yet

- OMN-TRA-SSR-OETC-Course Workbook 2daysDocument55 pagesOMN-TRA-SSR-OETC-Course Workbook 2daysMANIKANDAN NARAYANASAMYNo ratings yet

- L Rexx PDFDocument9 pagesL Rexx PDFborisg3No ratings yet