Professional Documents

Culture Documents

Financial Results & Limited Review For Sept 30, 2013 (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review For Sept 30, 2013 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

PREMIER PIPES LIMITED

Regd. Off :- Som Biz-Ness Xqure, 4th Floor, 1- The Mall, Kanpur- 208001

Unaudited Financial Results for the Quarter and Half Year Ended 30th September, 2013

Part- I

(Rs. In Lacs)

Sl.

No

.

Quarter Ended

Unaudited

Particulars

30.09.2013

30.06.2013

Year Ended

Audited

Half Year Ended

Unaudited

30.09.2012

30.09.2013

30.09.2012

31.03.2013

1 Income from operations

618.11

771.91

711.2

1390.02

1126.97

618.11

771.91

711.2

1390.02

1126.97

2964.28

2 Expenditure

a. Cost of materials consumed

535.55

696.61

544.11

1232.16

836.61

2362.29

b. Purchases of Stock- in-trade

0.00

0.00

0.00

181.19

18.48

(0.66)

52.63

9.87

10.29

11.26

20.16

21.38

e. Depreciation and amortisation expense

11.30

11.30

10.90

22.60

21.8

45.61

f. Other expenses

18.01

24.70

64.26

42.71

94.71

214.87

593.21

742.24

683.16

24.90

29.67

28.04

54.57

48.27

43.49

0.19

5.26

0.03

5.45

0.05

98.44

25.09

34.93

28.07

14.56

25.87

16.75

10.53

9.06

11.32

(a) Net Sales/ Income from Operation (Net of Excise Duty)

(b) Other operating Income

Total Income from operations (Net)

c. Changes in inventories of finished goods

d. Employee benefits expense

h. Total expenses

3 Profit from operations before other income, finance cost and

Exceptional Items (1-2)

4 Other Income

5 Profit from ordinary activities before finance cost and exceptional

items

6 Finance cost

7 Profit from ordinary activities after finance cost but before

exceptional items

8 Exceptional Items

9 Profit (+)/ Loss(-) from Ordinary Activities before tax (7-8)

10 Tax expense

11 Net Profit (+)/ Loss(-) from Ordinary Activities after tax (9-10)

17.82

1335.45

60.02

40.43

104.2

1078.70

48.32

33.83

2964.28

-

74.54

42.29

2920.79

141.93

116.18

19.59

14.49

25.75

(0.82)

26.57

10.53

9.06

11.32

3.25

3.08

3.76

19.59

6.33

14.49

4.81

13.26

9.68

0.00

7.28

5.98

7.56

12 Extraordinary Item(net of tax expense Rs._____)

13 Net Profit (+)/ Loss(-) for the period

7.28

5.98

13.26

355.00

355.00

7.56

355.00

9.68

355.00

26.57

355.00

587.58

587.58

(11-12)

14 Paid-up equity share capital (Face Value Rs. 10/- each)

15 Reserve excluding Revaluation Reserves as per balance sheet of

previous accounting year

16 Earnings Per Share (before and after extraordinary items) (of Rs.

10/- each) (not annualised)

587.58

587.58

355.00

587.58

26.57

0.21

0.17

0.21

0.37

0.27

0.75

3142706

3142706

3142706

3142706

3142706

3142706

88.53%

88.53%

88.53%

88.53%

88.53%

88.53%

-No. of Shares

-Percentage of shares (as a % of the total shareholding of

promoter and promoter group)

-Percentage of shares (as a % of the total share capital of the

company)

b) Non-encumbered

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

-No. of Shares

-Percentage of shares (as a % of the total shareholding of

promoter and promoter group)

-Percentage of shares (as a % of the total share capital of the

company)

407294

407294

407294

407294

407294

407294

100.00%

100.00%

100.00%

100.00%

100.00%

100.00%

11.47%

11.47%

11.47%

11.47%

11.47%

11.47%

Part-II

PARTICULARS OF SHAREHOLDING

17 Public Shareholding

No. of Shares (Face Value of Rs. 10/- each)

Percentage of shareholding

18 Promoters and promoter group shareholding

a) Pledged/Encumbered

Particulars

Particulars

Quarter ended 30.09.2013

INVESTOR COMPLAINTS

Pending at the beginning of the quarter

Received during the quarter

Disposed of during the quarter

Remaining Unresolved at the end of the quarter

NIL

NIL

NIL

NIL

Notes:1) The above financial results have been reviewed by the Audit Committee and thereafter were approved by the Board of Directors in their meeting

held on 14th November, 2013.

2) As the company operates only in one segment i.e. manufacturing of steel pipes and tubes therefore Segment Reporting is not required.

3) Figures have been regrouped or re-arranged, wherever necessary.

For PREMIER PIPES LIMITED

Sd/Place:-

Kanpur

Date:- 14th November 2013

(Ajay Kumar Jain)

Managing Director

5)

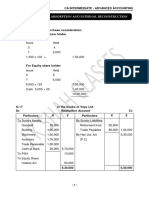

STATEMENT OF ASSETS AND LIABILITIES

(Rs. In Lacs)

As at 31.03.2013

As at 30.09.2013

PARTICULARS

UNAUDITED

Equity and Liabilities

Shareholder's Funds

Share Capital

Reserves and Surplus

AUDITED

Sub Total Shareholder's Funds

355.00

693.07

1,048.07

355.00

679.81

1,034.81

Sub-Total Non-Current Liabilities

515.21

7.98

43.52

566.71

515.21

7.98

44.66

567.85

Sub-Total Current Liabilities

TOTAL LIABILITIES

456.32

242.44

30.19

728.95

2,343.73

484.44

240.18

31.84

756.46

2359.12

Sub-Total Non-Current Assets

456.36

0

0

172.14

1.04

195.37

824.91

478.97

0

0

171.7

1.04

191.26

842.97

Sub-Total Current Assets

TOTAL ASSETS

0

200.94

622.84

36.69

653.22

5.13

1518.82

2343.73

227.35

559.94

75.27

646.99

6.6

1516.15

2359.12

Non - Current Liabilities

Long -Term Borrowings

Deffered Tax Liabilities (NET)

Other Long- Term Liabilities

Current Liabilities

Short-Term Borrowings

Trade Payables

Short-Term Provisions

ASSETS

Non- Current Assets

Fixed Assets

Tangible Assets

Intangible Assets

Capital Work in Progress

Long Term loans and advances

Non- Current Investments

Other Non Current Assets

Current Assets

Current Investments

Inventories

Trade Receivables

Cash and Bank balances

Short-term loans and advances

Other Current Assets

For PREMIER PIPES LIMITED

Sd/Place: Kanpur

(Ajay Kumar Jain)

Date: 14th November 2013

Managing Director

Limited Review Report

We have reviewed the accompanying statement of Unaudited Financial Results of M/s Premier

Pipes Limited, Som Biz- Ness Xqure, 4th Floor, 1, The Mall, Kanpur for the quarter ended

30th September, 2013 except for the disclosures regarding Public Shareholding and Promoter

and Promoter Group Shareholding which have been traced from disclosures made by the

management and have not been audited by us. This statement is the responsibility of the

Company's Management and has been approved by the Board of Directors / Committee of Board

of Directors. Our responsibility is to issue a report on these financial statements based on our

review.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2400,

engagements to Review Financial Statements issued by the Institute of Chartered Accountants of

India. This standard requires that we plan and perform the review to obtain moderate assurance

as to whether the financial statements are free of material misstatements. A review is limited

primarily to inquiries of company personnel and analytical procedures applied to financial data

and thus provide less assurance than as audit. We have not performed an audit and accordingly,

we do not express an audit opinion.

Based on our review conducted as above, nothing has come to our notice that causes us to

believe that the accompanying statement of unaudited financial results prepared in accordance

with the applicable Accounting Standards and other recognized accounting practices and policies

has not disclosed the information required to be disclosed in term of Clause 41 of the Listing

Agreement including the manner in which it is to be disclosed, or that it contains any material

misstatement.

Place:- Kanpur

Date:- 14th November, 2013

You might also like

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Perbandingan Akuntansi Akrual Di Swedia Dan FinalndiaDocument30 pagesPerbandingan Akuntansi Akrual Di Swedia Dan FinalndiaAbdul RohmanNo ratings yet

- Lesson 4 Investment ClubDocument26 pagesLesson 4 Investment ClubVictor VandekerckhoveNo ratings yet

- Ar 2019 # Samindo-4 PDFDocument271 pagesAr 2019 # Samindo-4 PDFpradityo88100% (1)

- GL Local - Ledger - Detail - Level 1Document23 pagesGL Local - Ledger - Detail - Level 1Eyra KeyranaNo ratings yet

- IBM Final PDFDocument4 pagesIBM Final PDFpohweijunNo ratings yet

- Trader's Journal Cover - Brandon Wendell August 2010Document6 pagesTrader's Journal Cover - Brandon Wendell August 2010mleefxNo ratings yet

- Quant Interview PrepDocument25 pagesQuant Interview PrepShivgan Joshi67% (3)

- What Is A Financial Intermediary (Final)Document6 pagesWhat Is A Financial Intermediary (Final)Mark PlancaNo ratings yet

- ESPSDocument2 pagesESPSNitin DevNo ratings yet

- Basics of Engineering Economy, 1e: CHAPTER 12 Solutions ManualDocument15 pagesBasics of Engineering Economy, 1e: CHAPTER 12 Solutions Manualttufan1No ratings yet

- CRSP Stock Indices Data DescriptionsDocument148 pagesCRSP Stock Indices Data DescriptionsnejisouNo ratings yet

- Project On Indian Financial MarketDocument44 pagesProject On Indian Financial MarketParag More85% (13)

- Common Charter of DemandsDocument3 pagesCommon Charter of DemandsshikumamaNo ratings yet

- DO - 163 - S2015 - DupaDocument12 pagesDO - 163 - S2015 - DupaRay Ramilo100% (1)

- Atty. Dionisio Calibo, vs. CA (Cred Trans)Document2 pagesAtty. Dionisio Calibo, vs. CA (Cred Trans)JM CaupayanNo ratings yet

- Page 1 of 8Document8 pagesPage 1 of 8Calvince OumaNo ratings yet

- Fixed DepositDocument16 pagesFixed DepositPrashant MathurNo ratings yet

- Loan Policy CFLDocument3 pagesLoan Policy CFLsumit rathoreNo ratings yet

- Hatch Final ReportDocument47 pagesHatch Final ReportJennifer UrsuaNo ratings yet

- Chapter 1 ACCOUNTING IN ACTIONDocument61 pagesChapter 1 ACCOUNTING IN ACTIONWendy Priscilia Manayang100% (1)

- Audit of SheDocument3 pagesAudit of ShePrince PierreNo ratings yet

- 2017 WOCCU International Operating PrinciplesDocument2 pages2017 WOCCU International Operating PrinciplesEllalaNo ratings yet

- Sample Quiz KEY1Document6 pagesSample Quiz KEY1ElaineJrV-IgotNo ratings yet

- CH 01Document20 pagesCH 01Engr Moinul AhsanNo ratings yet

- Steps of Loan ProcessDocument16 pagesSteps of Loan ProcessShraddha TiwariNo ratings yet

- The Finance ResourceDocument10 pagesThe Finance Resourceadedoyin123No ratings yet

- Terminology in Product Cost Controlling (SAP Library - Cost Object Controlling (CO-PC-OBJ) ) PDFDocument2 pagesTerminology in Product Cost Controlling (SAP Library - Cost Object Controlling (CO-PC-OBJ) ) PDFkkka TtNo ratings yet

- 5 Amalgamation, Absorption and External Reconstruction - HomeworkDocument21 pages5 Amalgamation, Absorption and External Reconstruction - HomeworkYash ShewaleNo ratings yet

- Nism PGPSM Placements Batch 2012 13Document24 pagesNism PGPSM Placements Batch 2012 13P.A. Vinay KumarNo ratings yet

- Szymoniak False Claims Act Complaint - SCDocument74 pagesSzymoniak False Claims Act Complaint - SCMartin Andelman100% (2)