Professional Documents

Culture Documents

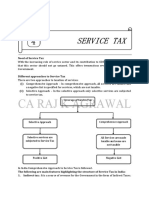

Service Tax Act - Section 66, 66A, 66BA, 66B, 66C, 66D, 66E and 66F

Uploaded by

Parth UpadhyayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Service Tax Act - Section 66, 66A, 66BA, 66B, 66C, 66D, 66E and 66F

Uploaded by

Parth UpadhyayCopyright:

Available Formats

9/10/2014

Service Tax Act : Section 66, 66A, 66BA, 66B, 66C, 66D, 66E and 66F

Hide Menu

Top

Service Tax Act

Section 66, 66A, 66BA, 66B, 66C, 66D, 66E and 66F

As on 24.10.2013

1[66. Charge of service tax

There shall be levied a tax (hereinafter referred to as the service tax) at the rate of twelve per cent. of the

value of taxable services referred to in sub-clauses (a), (d), (e), (f), (g,) (h), (i), (j),(k), (l), (m), (n), (o), (p),

(q), (r), (s), (t), (u), (v), (w), (x), (y), (z), (za), (zb), (zc), (zh), (zi), (zj), (zk),(zl), (zm), (zn), (zo), (zq), (zr),

(zs), (zt), (zu), (zv), (zw), (zx), (zy), (zz), (zza), (zzb), (zzc), (zzd), (zze), (zzf), (zzg), (zzh), (zzi), (zzk),

(zzl), (zzm), (zzn), (zzo), (zzp), (zzq), (zzr), (zzs), (zzt), (zzu), (zzv), (zzw), (zzx), (zzy), (zzz), (zzza),

(zzzb), (zzzc), (zzzd), (zzze), (zzzf), (zzzg,) (zzzh), (zzzi), (zzzj), (zzzk), (zzzl), (zzzm), (zzzn), (zzzo),

(zzzp), (zzzq), (zzzr), (zzzs), (zzzt), (zzzu), (zzzv), (zzzw), (zzzx), (zzzy), (zzzz), (zzzza), (zzzzb),

(zzzzc), 2[(zzzzd), (zzzze), (zzzzf), (zzzzg), (zzzzh), (zzzzi), 3[(zzzzj), (zzzzk), (zzzzl), 4[(zzzzm),

(zzzzn), (zzzzo), (zzzzp),(zzzzq) (zzzzr) (zzzzs) (zzzzt) 5[ , (zzzzu), (zzzzv) (zzzzv) and (zzzzw)] of

clause (105) of section 65 and collected in such manner as may be prescribed.] 6

1 Substituted (w.e.f. 01.06.2007) by s. 135 of the Finance Act, 2007 (22 of 2007).

2 Substituted (w.e.f. 16.05.2008) by s. 90 of the Finance Act, 2008 (18 of 2008)

3 Substituted (w.e.f. 01.09.2009) by s.113 of the Finance (No 2) Act, 2009 (33 of 2009).

4 Substituted (w.e.f. 01.07.2010) by s. 76 of the Finance Act, 2010 (14 of 2010).

5 Substituted (w.e.f. 01.05.2011) by s. 74 of the Finance Act, 2011 (8 of 2011).

6 Section 66 not applicable from 1-7-2012 vide Notification No 22/2012-ST dated 5-6-2012

[766A. Charge of service tax on services received from outside India, 8

7 Inserted (w.e.f.1.6.2012) by s.143 of the Finance Act, 2012 (23 of 2012).

8 Section 66 A not applicable w.e.f. 1-7-2012 vide Notification No 23/2012-ST dated 5-6-2012

(1) Where any service specified in clause (105) of section 65 is, - is, (a) provided or to be provided by a person who has established a business or has a fixed establishment

from which the service is provided or to be provided or has his permanent address or usual place of

residence, in a country other than India, and

(b) received by a person (hereinafter referred to as the recipient) who has his place of business, fixed

establishment, permanent address or usual place of residence, in India, such service shall, for the

purposes of this section, be taxable service, and such taxable service shall be treated as if the recipient

had himself provided the service in India, and accordingly all the provisions of this Chapter shall apply:

Provided that where the recipient of the service is an individual and such service received by him is

otherwise than for the purpose of use in any business or commerce, the provisions of this sub-section

shall not apply:

Provided further that where the provider of the service has his business establishment both in that

country and elsewhere, the country, where the establishment of the provider of service directly

concerned with the provision of service is located, shall be treated as the country from which the service

is provided or to be provided.

(2) Where a person is carrying on a business through a permanent establishment in India and through

http://finotax.com/other-tax/stax-act10#s66d

1/5

9/10/2014

Service Tax Act : Section 66, 66A, 66BA, 66B, 66C, 66D, 66E and 66F

another permanent establishment in a country other than India, such permanent establishments shall be

treated as separate persons for the purposes of this section.

Explanation 1. - A person carrying on a business through a branch or agency in any country shall be

treated as having a business establishment in that country.

Explanation 2. - Usual place of residence, in relation to a body corporate, means the place where it is

incorporated or otherwise legally constituted.]

[1 66B. Charge of Service Tax on services received from outside India.**** ]

1 Inserted (w.e.f 1.7.2012) by,w.e.f.1-7-2012 vide Notification No 19/2012-ST, dated 5-6-2012).

There shall be levied a tax (hereinafter referred to as the service tax) at the rate of twelve per cent. on the

value of all services, other than those services specified in the negative list, provided or agreed to be

provided in the taxable territory by one person to another and collected in such manner as may be

prescribed. 2[***]

2 Explanation to Section 66 B omitted by the Finance Act 2013 w.e.f 10.05.2013.

3[ 66BA. Reference to section 66 to be construed as reference to Section 66B , 3 Inserted by the Finance Act ,2013.

(1) For the purpose of levy and collection of service tax, any reference to section 66 in the Finance Act,

1994 or any other Act for the time being in force, shall be construed as reference to section 66B thereof.

(2) The provisions of this section shall be deemed to have come into force on the 1st day of July, 2012."]

66C. Determination of place of provision of service(1) The Central Government may, having regard to the nature and description of various services, by rules 4

made in this regard, determine the place where such services are provided or deemed to have been

provided or agreed to be provided or deemed to have been agreed to be provided.

4 See place of provision of services Rule s2012 vide Notification No 28/2012-ST dated 20-06-2012 w.e.f 01.07.2012.

(2) Any rule made under sub-section (1) shall not be invalid merely on the ground that either the service

provider or the service receiver or both are located at a place being outside the taxable territory.

66D. Negative list of services:

The negative list shall comprise of the following services, namely:-(a) services by Government or a local authority excluding the following services to the extent they are

not covered elsewhere (i) services by the Department of Posts by way of speed post, express parcel post, life insurance

and agency services provided to a person other than Government;

(ii) services in relation to an aircraft or a vessel, inside or outside the precincts of a port or an airport;

(iii) 5transport of goods or passengers; or

5 . exempted for railways w.e.f.02.07.2012 to 30.09-2012 vide Notification No 43/2012-ST dated 02.07.2012

http://finotax.com/other-tax/stax-act10#s66d

2/5

9/10/2014

Service Tax Act : Section 66, 66A, 66BA, 66B, 66C, 66D, 66E and 66F

(iv) support services, other than services covered under clauses (i) to (iii) above, provided to

business entities;

(b) services by the Reserve Bank of India;

(c) services by a foreign diplomatic mission located in India;

(d) services relating to agriculture by way of (i) agricultural operations directly related to production of any agricultural produce including

cultivation, harvesting, threshing, plant protection or 6[***)testing;

6 seed omitted by Finance Act ,2013 w.e.f 10.5.2013

(ii) supply of farm labour;

(iii) processes carried out at an agricultural farm including tending, pruning, cutting, harvesting,

drying, cleaning, trimming, sun drying, fumigating, curing, sorting, grading, cooling or bulk packaging

and such like operations which do not alter the essential characteristics of agricultural produce but

make it only MARKETABLE for the primary market;

(iv) renting or leasing of agro machinery or vacant land with or without a structure incidental to its

use;

(v) loading, unloading, packing, storage or warehousing of agricultural produce;

(vi) agricultural extension services;

(vii) services by any Agricultural Produce MARKETING Committee or Board or services provided

by a commission agent for sale or purchase of agricultural produce;

(e) TRADING of goods;

((f) any process amounting to manufacture or production of goods;

(g) selling of space or time slots for advertisements other than advertisements broadcast by radio or

television;

(h) service by way of access to a road or a bridge on payment of toll charges;

(i) betting, gambling or lottery;

(j) admission to entertainment events or access to amusement facilities;

(k) transmission or distribution of electricity by an electricity transmission or distribution utility;

(l) services by way of (i) pre-school education and education up to higher secondary school or equivalent;

(ii) education as a part of a curriculum for obtaining a qualification recognised by any law for the time

being in force;

(iii) education as a part of an approved vocational education course;

(m) services by way of renting of residential dwelling for use as residence;

(n) services by way of (i) extending deposits, loans or advances in so far as the consideration is represented by way of

interest or discount;

(ii) inter se sale or purchase of foreign CURRENCY amongst banks or authorised dealers of

foreign exchange or amongst banks and such dealers;

(o) service of transportation of passengers, with or without accompanied belongings, by (i) a stage carriage;

(ii) 1 railways in a class other than 1. Exempted w.e.f.02-07-2012 to 30-09-2012 vide Notification No43/2012-ST ,dated 02-07-2012

(A) first class; or

(B) an air-conditioned coach;

(iii) metro, monorail or tramway;

http://finotax.com/other-tax/stax-act10#s66d

3/5

9/10/2014

Service Tax Act : Section 66, 66A, 66BA, 66B, 66C, 66D, 66E and 66F

(iv) inland waterways;

(v) public transport, other than predominantly for tourism purpose, in a vessel of less than fifteen

tonne net; and

(vi) metered cabs, radio taxis or auto rickshaws;

(p) services by way of transportation of goods (i) by road except the services of (A) a goods transportation agency; or

(B) a courier agency;

(ii) by an aircraft or a vessel from a place outside India to the first customs station of landing in India;

or

(iii) by inland waterways;

(q) funeral, burial, crematorium or mortuary services including transportation of the deceased.

66E. Declared Services.

The following shall constitute declared services, namely:-(a) renting of immovable property;

(b) construction of a complex, building, civil structure or a part thereof, including a complex or building

intended for sale to a buyer, wholly or partly, except where the entire consideration is received after

issuance of completion-certificate by the competent authority.

Explanation. - For the purposes of this clause, (I) the expression "competent authority" means the Government or any authority authorized to issue

completion certificate under any law for the time being in force and in case of non-requirement of

such certificate from such authority, from any of the following, namely:-(A) architect REGISTERED with the Council of Architecture constituted under the Architects

Act, 1972; or

(B) chartered engineer registered with the Institution of Engineers (India); or

(C) licensed surveyor of the respective local body of the city or town or village or development or

planning authority;

(II) the expression "construction" includes additions, alterations, replacements or remodeling of any

existing civil structure;

(c) temporary transfer or permitting the use or enjoyment of any intellectual property right;

(d) development, design, programming, customisation, adaptation, upgradation, enhancement,

implementation of information technology software;

(e) agreeing to the obligation to refrain from an act, or to tolerate an act or a situation, or to do an act;

(f) transfer of goods by way of hiring, leasing, licensing or in any such manner without transfer of right to

use such goods;

(g) activities in relation to delivery of goods on hire purchase or any system of payment by instalments;

(h) service portion in the execution of a works contract;

(i) service portion in an activity wherein goods, being food or any other article of human consumption or

any drink (whether or not intoxicating) is supplied in any manner as a part of the activity.

66F. Principals of interpretation of specified descriptions of services or bundled

services.

http://finotax.com/other-tax/stax-act10#s66d

4/5

9/10/2014

Service Tax Act : Section 66, 66A, 66BA, 66B, 66C, 66D, 66E and 66F

(1) Unless otherwise specified, reference to a service (herein referred to as main service) shall not include

reference to a service which is used for providing main service.

(2) Where a service is capable of differential treatment for any purpose based on its description, the most

specific description shall be preferred over a more general description.

(3) Subject to the provisions of sub-section (2), the taxability of a bundled service shall be determined in the

following manner, namely:-(a) if various elements of such service are naturally bundled in the ordinary course of business, it shall

be treated as provision of the single service which gives such bundle its essential character;

(b) if various elements of such service are not naturally bundled in the ordinary course of business, it

shall be treated as provision of the single service which results in highest liability of service tax.

Explanation. - For the purposes of sub-section (3), the expression "bundled service" means a bundle of

provision of various services wherein an element of provision of one service is combined with an element

or elements of provision of any other service or services.;

Disclaimer

Due care has been in compiling this page. But, this site does not make any claim that the information available on its pages is

correct and up-to-date. The contents of this site cannot be treated or interpreted as a statement of law. In case, any loss or

damage is caused to any person due to his/her treating or interpreting the contents of this site or any part thereof as correct,

complete and up-to-date statement of law out of ignorance or otherwise, this site will not be liable in any manner whatsoever for

such loss or damage.

http://finotax.com/other-tax/stax-act10#s66d

5/5

You might also like

- Maritime LienDocument33 pagesMaritime Lienbhaswath2000100% (1)

- Entity Formation Checklist GuideDocument15 pagesEntity Formation Checklist GuideKevinNo ratings yet

- Texas Real Estate: Ch. 1 - Ethics and Professional ConductDocument3 pagesTexas Real Estate: Ch. 1 - Ethics and Professional ConductTonya LewisNo ratings yet

- Learn Why Bankers Have Forgiven Loans BankFreedomDocument2 pagesLearn Why Bankers Have Forgiven Loans BankFreedomdbush2778No ratings yet

- Deed of Release of RemDocument3 pagesDeed of Release of RemLen Sor LuNo ratings yet

- Shareholder's Agreement SAMPLEDocument7 pagesShareholder's Agreement SAMPLEIsmael Nogoy100% (3)

- Ethics and Governance Lecture Notes Lecture 1 12Document43 pagesEthics and Governance Lecture Notes Lecture 1 12Faig KarimliNo ratings yet

- The Monthly Budget WorksheetDocument3 pagesThe Monthly Budget WorksheetJessi Fearon0% (1)

- History of Philippine BankingDocument13 pagesHistory of Philippine BankingBryan Santos ChaNo ratings yet

- Superior Court of The State of California County of SacramentoDocument19 pagesSuperior Court of The State of California County of Sacramentomlkral100% (1)

- Credit Risk Estimation TechniquesDocument31 pagesCredit Risk Estimation TechniquesHanumantha Rao Turlapati0% (1)

- Court Rules Legal Interest Rate Applies to Unpaid LoanDocument1 pageCourt Rules Legal Interest Rate Applies to Unpaid LoanCharles Roger Raya100% (1)

- Bhairava Homam Sanskrit PDFDocument36 pagesBhairava Homam Sanskrit PDFshalumutha3No ratings yet

- Grepalife V CADocument3 pagesGrepalife V CAMykee NavalNo ratings yet

- Bimal Jain BGM Service Tax 051014Document67 pagesBimal Jain BGM Service Tax 051014Aayushi AroraNo ratings yet

- Service Tax Export of ServicesDocument1 pageService Tax Export of Servicesbh_mehta_06No ratings yet

- 22229paper4st cp1Document9 pages22229paper4st cp1TejTejuNo ratings yet

- Service Tax - Negative ListDocument46 pagesService Tax - Negative ListShabaaz ShaikhNo ratings yet

- Service Tax: Chapter V of The Finance Act, 1994Document66 pagesService Tax: Chapter V of The Finance Act, 1994Niyati VaidyaNo ratings yet

- Export of Service Rules, 2005Document2 pagesExport of Service Rules, 2005mads70No ratings yet

- Presentation On Service Tax AmendmentsDocument19 pagesPresentation On Service Tax AmendmentsSmriti KhannaNo ratings yet

- Service Tax: Chapter V of The Finance Act, 1994Document68 pagesService Tax: Chapter V of The Finance Act, 1994Nitin GuptaNo ratings yet

- The Minimum Wages and Conditions of Employment Act - Statutory Instrument No 47Document5 pagesThe Minimum Wages and Conditions of Employment Act - Statutory Instrument No 47PMRCZAMBIANo ratings yet

- Budget 2012bookDocument112 pagesBudget 2012bookSatish J. MakwanaNo ratings yet

- Sindh Sales Tax Special Procedure (Withholding) Rules, 2014: Notification No. SRB-3-4/14/2014, Dated 1st July, 2014.Document24 pagesSindh Sales Tax Special Procedure (Withholding) Rules, 2014: Notification No. SRB-3-4/14/2014, Dated 1st July, 2014.Mehak RaniNo ratings yet

- Export & Import of Services, Rules in IndiaDocument26 pagesExport & Import of Services, Rules in IndiafocusindiagroupNo ratings yet

- Quipo ReportDocument24 pagesQuipo ReportNaiju MathewNo ratings yet

- Site Info ClearanceDocument9 pagesSite Info ClearanceAnuppur Amlai RangeNo ratings yet

- IDT SupplemantaryDocument77 pagesIDT SupplemantarykanchanthebestNo ratings yet

- Brief Facts of The Case: 2.1Document11 pagesBrief Facts of The Case: 2.1Gaurav SinghNo ratings yet

- Notes RCM 66F Reimbursement 29-5-15Document22 pagesNotes RCM 66F Reimbursement 29-5-15Prabhat BhatNo ratings yet

- TRAVEL TAX TITLEDocument9 pagesTRAVEL TAX TITLEAPI SupportNo ratings yet

- Notification No 15/2012Document2 pagesNotification No 15/2012Ankit GuptaNo ratings yet

- (A) Date of Introduction: (B) Definition and Scope of ServiceDocument6 pages(A) Date of Introduction: (B) Definition and Scope of ServicePradeep JainNo ratings yet

- Stock Exchange Service (A) Date of IntroductionDocument7 pagesStock Exchange Service (A) Date of Introductionarshad89057No ratings yet

- Central VatDocument6 pagesCentral Vatchethan sogiNo ratings yet

- Service Tax - Pop RulesDocument5 pagesService Tax - Pop RulesSuman ParialNo ratings yet

- Amendments in Service TaxDocument15 pagesAmendments in Service TaxShankar NarayananNo ratings yet

- Export of Services Rules 2005Document2 pagesExport of Services Rules 2005Venkata ChalapathyNo ratings yet

- Indian Indirect Tax Laws-A Brief Guide: Shammi Kapoor Vishal Kumar Purva JunejaDocument33 pagesIndian Indirect Tax Laws-A Brief Guide: Shammi Kapoor Vishal Kumar Purva Junejavijay9514No ratings yet

- Taxation of Financial Services Sybbi FinalDocument24 pagesTaxation of Financial Services Sybbi Finalsheenu152005No ratings yet

- Budget 2011 - Service TaxDocument17 pagesBudget 2011 - Service TaxMukesh SoniNo ratings yet

- Service Tax Qick RevisionDocument91 pagesService Tax Qick RevisiongouthamNo ratings yet

- Export of Service Rules, 2005Document4 pagesExport of Service Rules, 2005Nalini BhorNo ratings yet

- Amendments Applicable For Nov 2018 Exam: Income TaxDocument4 pagesAmendments Applicable For Nov 2018 Exam: Income TaxKrishna DasNo ratings yet

- Tax Laws Updates For June 2013 ExamsDocument68 pagesTax Laws Updates For June 2013 Examsnisarg_No ratings yet

- ELP Budget 2011Document81 pagesELP Budget 2011AurnsNo ratings yet

- Financial Services (Distributed Ledger TechnologyDocument8 pagesFinancial Services (Distributed Ledger TechnologyJack DanielsNo ratings yet

- India's Software, Services Exports Forecast at $40BDocument3 pagesIndia's Software, Services Exports Forecast at $40BgauravsavaleNo ratings yet

- Variant 3 REVISED Jan13 LDocument96 pagesVariant 3 REVISED Jan13 LGopakumar PNo ratings yet

- Commercial Tax LawDocument39 pagesCommercial Tax LawAnonymous I5hdhuCxNo ratings yet

- Input Tax Credit-1Document74 pagesInput Tax Credit-1Shaikh HumeraNo ratings yet

- CA Final IDT A MTP 1 May 2024 Castudynotes ComDocument13 pagesCA Final IDT A MTP 1 May 2024 Castudynotes Comamanjain254No ratings yet

- TPT RoadDocument13 pagesTPT RoadLakhan PatidarNo ratings yet

- Circular 973Document1 pageCircular 973patelpratik1972No ratings yet

- Input TAX Credit: Learning OutcomesDocument73 pagesInput TAX Credit: Learning OutcomesRavi kanthNo ratings yet

- InterimBudget2024 2025Document15 pagesInterimBudget2024 2025mailhrchandranNo ratings yet

- Delhi Chit Fund Association v. Union of India: Service Tax Not Applicable to Chit Fund BusinessDocument10 pagesDelhi Chit Fund Association v. Union of India: Service Tax Not Applicable to Chit Fund BusinessDipesh Chandra BaruaNo ratings yet

- Union of India UOI and Ors Vs Intercontinental ConSC20181403181634531COM722172Document26 pagesUnion of India UOI and Ors Vs Intercontinental ConSC20181403181634531COM722172vishuNo ratings yet

- Chit Funds Exempted From Service TaxDocument19 pagesChit Funds Exempted From Service TaxranjithxavierNo ratings yet

- Service Tax on Air TravelDocument15 pagesService Tax on Air TravelvijaykoratNo ratings yet

- Note On Import and Export of Services A.R. Krishnan 1. Situs of Taxation Territorial JurisdictionDocument15 pagesNote On Import and Export of Services A.R. Krishnan 1. Situs of Taxation Territorial JurisdictionAbhishek SiroyaNo ratings yet

- Special Economic ZoneDocument34 pagesSpecial Economic ZonevrathiaNo ratings yet

- Capital Gains Tax GuideDocument55 pagesCapital Gains Tax Guidesoumitra2377No ratings yet

- Export of ServicesDocument9 pagesExport of ServicesshantX100% (1)

- Service tax basicsDocument29 pagesService tax basicsporzvtzoNo ratings yet

- Negative List of ServicesDocument104 pagesNegative List of ServicesGautam SinghNo ratings yet

- Govt Circular For Ser - TaxDocument18 pagesGovt Circular For Ser - Taxcasanjaydodiya5No ratings yet

- Amendment CustomsDocument50 pagesAmendment Customsamithamp20No ratings yet

- NTPC Tax CircularDocument20 pagesNTPC Tax CircularKundan RathodNo ratings yet

- 2 of 2008 8 % To 10 % Duty ChangeDocument3 pages2 of 2008 8 % To 10 % Duty Changephani raja kumarNo ratings yet

- Short Title, Extent and Commencement. - : (28/2012-Service Tax Dated 20.06.2012)Document4 pagesShort Title, Extent and Commencement. - : (28/2012-Service Tax Dated 20.06.2012)Kanishk YadavNo ratings yet

- 33515mtpfinal Sr2ans p8Document11 pages33515mtpfinal Sr2ans p8ChandanMatoliaNo ratings yet

- Form 11 Revised FormatDocument3 pagesForm 11 Revised FormatParth UpadhyayNo ratings yet

- NewjobDocument35 pagesNewjobParth UpadhyayNo ratings yet

- Form 11 Revised FormatDocument3 pagesForm 11 Revised FormatParth UpadhyayNo ratings yet

- Tarpana SanskritDocument9 pagesTarpana SanskritnavinnaithaniNo ratings yet

- Chapter 5 Depreciation Accounting PDFDocument42 pagesChapter 5 Depreciation Accounting PDFravibhartia197888% (8)

- Rina Mocha Kam NG Alas To TramDocument2 pagesRina Mocha Kam NG Alas To TramParth UpadhyayNo ratings yet

- 12thFYP ObjectivesDocument3 pages12thFYP ObjectivesParth UpadhyayNo ratings yet

- Current Affairs Pocket PDF - December 2015 by AffairsCloudDocument22 pagesCurrent Affairs Pocket PDF - December 2015 by AffairsCloudRakesh RanjanNo ratings yet

- Week 10 Current Affairs 2016 PDFDocument16 pagesWeek 10 Current Affairs 2016 PDFParth UpadhyayNo ratings yet

- Current Affairs Pocket PDF - January 2016 by AffairsCloud - FinalDocument25 pagesCurrent Affairs Pocket PDF - January 2016 by AffairsCloud - FinalRAGHUBALAN DURAIRAJUNo ratings yet

- Basic Uses of The English Tenses PDFDocument4 pagesBasic Uses of The English Tenses PDFSreeNo ratings yet

- Current Affairs of Feb16Document12 pagesCurrent Affairs of Feb16Parth UpadhyayNo ratings yet

- 2016 Books AuthorsDocument2 pages2016 Books AuthorsParth UpadhyayNo ratings yet

- RBI designates SBI, ICICI Bank as D-SIBsDocument10 pagesRBI designates SBI, ICICI Bank as D-SIBsParth UpadhyayNo ratings yet

- Appointments 2016Document4 pagesAppointments 2016Parth UpadhyayNo ratings yet

- Current Affairs FebruaryDocument29 pagesCurrent Affairs FebruaryParth UpadhyayNo ratings yet

- Week 41 - 4 Oct-10 OctDocument15 pagesWeek 41 - 4 Oct-10 OctParth UpadhyayNo ratings yet

- Week 41 - 4 Oct-10 OctDocument15 pagesWeek 41 - 4 Oct-10 OctParth UpadhyayNo ratings yet

- Fab Current Affair 2016Document25 pagesFab Current Affair 2016Parth UpadhyayNo ratings yet

- Nov GKDocument16 pagesNov GKParth UpadhyayNo ratings yet

- Current Affairs - Week 35 Banking: Bandhan BankDocument12 pagesCurrent Affairs - Week 35 Banking: Bandhan BankParth UpadhyayNo ratings yet

- Fiscal Policy 2015Document11 pagesFiscal Policy 2015Parth UpadhyayNo ratings yet

- Current Affairs - 5 WeekDocument16 pagesCurrent Affairs - 5 WeekParth UpadhyayNo ratings yet

- Week SeptDocument16 pagesWeek SeptParth UpadhyayNo ratings yet

- Week 40 - 27 Sep - 3 OctDocument12 pagesWeek 40 - 27 Sep - 3 OctParth UpadhyayNo ratings yet

- Current Affairs - Week 51Document22 pagesCurrent Affairs - Week 51Parth UpadhyayNo ratings yet

- Week 43-11 Oct - 25 Oct Weekly PDFDocument46 pagesWeek 43-11 Oct - 25 Oct Weekly PDFParth UpadhyayNo ratings yet

- Week 4 GKDocument9 pagesWeek 4 GKParth UpadhyayNo ratings yet

- Questa Education Foundation Loan Terms and Conditions and Payment NoteDocument6 pagesQuesta Education Foundation Loan Terms and Conditions and Payment NoteInstitute for Higher Education PolicyNo ratings yet

- Summary (NEW Lease)Document3 pagesSummary (NEW Lease)Anonymous AGI7npNo ratings yet

- Allandale Sportsline v. Good Development Corp, G.R. No. 164521, December 18, 2008Document15 pagesAllandale Sportsline v. Good Development Corp, G.R. No. 164521, December 18, 2008Alan Vincent FontanosaNo ratings yet

- Income Tax Proof Submission FAQs (FY 2014-15)Document15 pagesIncome Tax Proof Submission FAQs (FY 2014-15)Seetha ChimakurthiNo ratings yet

- Provisional Remedies Cases Rule 57 58Document128 pagesProvisional Remedies Cases Rule 57 58SuNo ratings yet

- The Need For A System of Credit: People Buy Things That They Cannot Afford To Pay For at The Moment, But Probably Can Pay For in The Long RunDocument63 pagesThe Need For A System of Credit: People Buy Things That They Cannot Afford To Pay For at The Moment, But Probably Can Pay For in The Long RunjaneNo ratings yet

- The Kenya Banking ActDocument63 pagesThe Kenya Banking ActAlice WairimuNo ratings yet

- Provisions of Sections 269SS and 269T under Income Tax ActDocument4 pagesProvisions of Sections 269SS and 269T under Income Tax ActJaikumar SinghNo ratings yet

- Complaint - SyticoDocument5 pagesComplaint - SyticoMikhael O. SantosNo ratings yet

- Project FinanceDocument9 pagesProject FinancebrierNo ratings yet

- ENGECODocument3 pagesENGECOmgoldiieeee20% (5)

- LMDCDocument2 pagesLMDCPj TignimanNo ratings yet

- Lra Fee Schedule 1Document4 pagesLra Fee Schedule 1Alvin SantosNo ratings yet

- Government of India Small Savings SchemesDocument16 pagesGovernment of India Small Savings SchemesPranav BhattadNo ratings yet

- Sangrador V Valderama - GR 79552Document9 pagesSangrador V Valderama - GR 79552Jeremiah ReynaldoNo ratings yet

- Vasu P. Shetty vs. M - SDocument8 pagesVasu P. Shetty vs. M - SSaksham KaushikNo ratings yet

- Statement of Financial PositionDocument7 pagesStatement of Financial PositionJay KwonNo ratings yet

- 2017 CFPB Ocwen-ComplaintDocument93 pages2017 CFPB Ocwen-ComplaintkmccoynycNo ratings yet