Professional Documents

Culture Documents

Accounting For Income Taxes

Uploaded by

Henry ListerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting For Income Taxes

Uploaded by

Henry ListerCopyright:

Available Formats

Accounting for Income Taxes

LO: Identify the major differences between tax and

accounting treatments

Taxable income usually differs from accounting profit before

tax.

- Assessable income is similar (but not identical) to

accounting income

- Allowable deductions are similar (but not identical) to

accounting expenses

Many expenses payable:

- Accounting treatment: recognised as an expense when

accrued

- Tax treatment: recognised as a tax deduction when paid

For some revenue received in advance:

- Accounting treatment: recognised as revenue when

earned

- Tax treatment: typically assessed for tax when received

Property, plant and equipment:

- Accounting treatment: depreciation is allocated over the

estimated economic life of the asset

- Tax treatment: depreciation recognised as a tax

deduction in the schedule of depreciation rates issued

by the ATO

Doubtful debts:

- Accounting treatment: recognised as an expense when

identified as doubtful

- Tax treatment: treated as a tax deduction when the

receivables are written off as bad

Refer Table 9.1 textbook page 235

LO: Identify and explain alternative ways of accounting for

company income tax

Income tax payable is:

- The amount that must be paid to the government

- Calculated by applying the company income tax rate to

taxable income

Income tax expense is:

- The amount of income tax shown as an expense on the

statement of comprehensive income

- Not necessarily the same as income tax payable

Tax payable method

Assumes tax expense in a period is the tax payable to the

government

In Example 9.1 (textbook page 235) :

Year 1 journal entry:

Income tax expense

Dr $18,000

Income tax payable

Cr $18,000

Advantages

Simple to apply

Reasonable to assume that tax expense for a period is

the tax that must be paid for the period

LO: Understand the perceived problems with the taxpayable method

Criticisms:

- It was believed it resulted in misleading financial

statements

- Changes in profit after tax may not be caused by

changes in performance but by vagaries of the income

tax legislation

Counter argument:

- Tax payable method reflects reality

LO: Apply the statement of financial position approach

to tax allocation

Introduces the idea of a tax base of an asset or liability

- The amount at which an asset or liability would be

shown in a statement of financial position derived from

accounts prepared for tax purposes

In Example 9.1, Captain Ltd had a depreciable asset costing

$100,000 with a zero residual value:

- For accounting purposes:

- The asset was depreciated over four years on a

straight-line basis

- For taxation purposes:

- The asset was depreciated over four years on a

reducing-balance basis

Temporary differences:

In year 1, the depreciation expense recognised for accounting

purposes is $15,000 less than the amount claimed for tax

($25,000 vs $40,000).

As a result, the CA of asset > TB by $15,000 ($75,000$60,000).

This difference between the carrying amount and tax base of

the asset is defined as temporary difference.

The difference is temporary because it will reverse in future

periods. E.g. see the differences between Income tax

expense and Income tax payable over the 4 year periods in

Example 9.1.

The use of reducing-balance depreciation for tax purposes

means that less tax is paid now but more will be paid later.

Deferred tax liabilities (DTLs) and deferred tax assets (DTAs):

- Arise because of temporary differences between the

carrying amount and tax base of an asset or liability

- They are reversed from the accounts as the temporary

differences reverse

Assets:

- DTL = Carrying amount > Tax base

- DTA = Tax base > Carrying amount

Liabilities:

- DTA = Carrying amount > Tax base

- DTL = Tax base > Carrying amount

General journal entries to record DTA/DTL:

Dr Deferred Tax Asset

Cr Deferred Income Tax Expense

Dr Deferred Income Tax Expense

Cr Deferred Tax Liability

The income tax expense reported in the statement of

comprehensive income has two components:

- The amount of income tax payable (current income tax

expense paid to ATO); plus

- The amount necessary to restate the deferred tax

liability or asset to its current amount (deferred income

tax expense)

General journal entries for Year 1 (Example 9.1):

Current income tax expense Dr $18,000*

Income tax payable

Cr

$18,000

(*18,000 = taxable income 60,000 x 30%)

Deferred income tax expense Dr $4,500

Deferred tax liability

Cr

$4,500**

(** 4,500 = taxable temporary difference 15,000 x 30%)

The income tax expense of Year 1 reported in the statement of

comprehensive income is:

Current income tax expense:

$18,000

Deferred income tax expense: $ 4,500

----------Income tax expense:

$22,500

Permanent differences:

- In addition to the temporary differences, there are also

permanent differences, which are assets or liabilities

that are recognised in either an accounting statement of

financial position or a tax statement of financial position

but are never recognised in the other

- Examples

- Tax exempt income

- Expenses payable with a zero tax base

- Allowable tax deductions that are not recognised

for accounting purposes

- They do not result in DTAs or DTLs

LO: Understand and apply the requirements of AASB

112

The tax base of an asset is

either:

- The amount that will be deductible for tax

purposes against any taxable economic benefits

that will flow to an entity when it recovers the

carrying amount of the asset; or

- The carrying amount where the economic benefits

will not be taxable.

(AASB 112: 7)

Example:

- A non-current asset cost $100,000 and accumulated

depreciation for accounting purposes is $40,000:

- The carrying amount = $60,000

- An amount of $55,000 has been claimed as a

depreciation deduction for tax purposes:

- The tax base = $45,000 (100,000-55,000)

- Temporary difference: Carrying amount - Tax base

= $60,000- $45,000

= 15,000

If the tax rate is 30%: DTL is $15,000 X 30% = $4,500

The general journal entry

(assuming a $3,000 carried-forward DTL balance):

Deferred income tax expense Dr $1,500

Deferred tax liability

Cr

$1,500

Again, starting from the DTL calculation of $4,500 (see

slide number 27)

- General journal entry

(assuming a $5,500 carried-forward DTL balance):

Deferred tax liability

Dr

$1,000

Deferred income tax expense Cr

$1,000

With your neighbour, do a T account to show how this

works

-

The tax base of a liability:

- Is the carrying amount less any amount that will be

deductible for tax purposes in respect of that liability

- In the case of revenue received in advance, its tax base

is its carrying amount less any amount of the revenue

that will not be taxable in future periods

(AASB 112: 8)

Example:

Provision for long-service leave of $100,000

Carrying Amount = $100,000

Tax Base = $nil

Temporary difference = $100,000

DTA = $100,000 X 0.30 = $30,000

Step 1: Calculate taxable income to determine income tax payable

and current income tax expense

Income Tax Payable = Taxable income x Tax Rate*

*Using the tax rates enacted or substantively enacted by the end of

the reporting period (AASB112:46)

Step 2: Identify temporary differences resulting in deferred tax

assets (DTA) and deferred tax liabilities (DTL) to determine the

changes in the DTA and DTL

Step 3: Record the journal entries for income tax payable and

current income tax expense and changes in DTA, DTL and deferred

income tax expense accounts.

Dr Current Income Tax Expense

Cr Income Tax Payable

Dr Deferred Income Tax Expense

Cr Deferred Tax Liability*

(*increase in taxable temporary differences x tax rate)

Dr Deferred Tax Asset**

Cr Deferred Income Tax Expense

(**increase in deductible temporary differences x tax rate)

Revalued assets

Revaluation of property, plant and equipment gives rise to a

taxable/deductible temporary difference

Example:

- A depreciable asset was acquired for $100,000 with a

useful life of 10 years

- The asset was depreciated straight-line over the same

useful life for accounting and tax purposes

- After 5 years the asset is revalued to $75,000

Before revaluation:

- Carrying amount $_____

- Tax Base $_____

- Temporary difference $________

- Journal entries for the revaluation:

After revaluation:

- Carrying amount $______

- Tax Base $_______

- Temporary difference $________

- DTA or DTL $________

- Journal entry to record DTA or DTL:

In this case, current tax and deferred tax must be charged or

credited directly to equity (AASB 112.61A, note in particular 61A(a)

and (b)

Refer Example 9.5 (textbook page 257)

After criticism of the tax payable method of accounting for

income tax, a new and more complicated method emerged

that sought to smooth reported profits.

With the emergence of the conceptual framework, which pays

more attention to balance sheet items, this method was

adjusted to what we see today.

The method is controversial and requires thought:

- Questions arise whether a deferred tax liability really is

a liability as defined by the framework, and whether a

deferred tax asset really is an asset as defined by the

framework.

- Questions also arise about the meaning of the amount

reported in the income statement as income tax

expense.

You might also like

- CHAPTER 42 - Accounting For Income TaxDocument18 pagesCHAPTER 42 - Accounting For Income TaxJoshua Wacangan100% (1)

- Notes in Preferential TaxationDocument57 pagesNotes in Preferential TaxationJeremae Ann Ceriaco100% (1)

- 2010 Illustrative Fs Sme Final Clean New - UnlockedDocument74 pages2010 Illustrative Fs Sme Final Clean New - UnlockedKendall JennerNo ratings yet

- Tax Practice Set ReviewerDocument9 pagesTax Practice Set Reviewerjjay_santosNo ratings yet

- HO1 - Accounting For Income TaxDocument5 pagesHO1 - Accounting For Income TaxCharlesNo ratings yet

- Module 02 - Bases Conversion and Development ActDocument22 pagesModule 02 - Bases Conversion and Development ActKyla Shmily GonzagaNo ratings yet

- Accounting For Income TaxesDocument25 pagesAccounting For Income TaxesKulet AkoNo ratings yet

- Module 1 PPT Introduction To TaxDocument24 pagesModule 1 PPT Introduction To TaxAhmad Farhad TaneenNo ratings yet

- Accounting Cash Definition ReconciliationDocument10 pagesAccounting Cash Definition ReconciliationjoannaberroNo ratings yet

- Auditing Special Purpose Financial StatementsDocument18 pagesAuditing Special Purpose Financial StatementscolleenyuNo ratings yet

- Notes To FsDocument10 pagesNotes To FsCynthia PenoliarNo ratings yet

- Lecture On Share Based Payments Share Appreciation RightsDocument8 pagesLecture On Share Based Payments Share Appreciation RightsChristine AltamarinoNo ratings yet

- INTACC 3.1LN Presentation of Financial StatementsDocument9 pagesINTACC 3.1LN Presentation of Financial StatementsAlvin BaternaNo ratings yet

- Quizz Chapter 21Document9 pagesQuizz Chapter 21Rachel EnokouNo ratings yet

- Government Accounting'Document22 pagesGovernment Accounting'Jayvee FelipeNo ratings yet

- Accounting for Payroll ProceduresDocument15 pagesAccounting for Payroll ProceduresDenise Aubrey GallardoNo ratings yet

- Toa Interim ReportingDocument17 pagesToa Interim ReportingEmmanuel SarmientoNo ratings yet

- Ifrs 9Document80 pagesIfrs 9Veer Pratab SinghNo ratings yet

- Topic 5a - Audit of Property - Plant and EquipmentDocument20 pagesTopic 5a - Audit of Property - Plant and EquipmentLANGITBIRUNo ratings yet

- Compound Financial InstrumentsDocument3 pagesCompound Financial Instrumentskevior2No ratings yet

- Ais Conversion CycleDocument51 pagesAis Conversion CycleAms Penaflor100% (6)

- At-5909 Risk AssessmentDocument8 pagesAt-5909 Risk AssessmentVeron BrionesNo ratings yet

- Taxn 3100 Instructional Module 1 PDFDocument5 pagesTaxn 3100 Instructional Module 1 PDFSandyNo ratings yet

- Framework of Philippine Standards On AuditingDocument2 pagesFramework of Philippine Standards On AuditingKaye SyNo ratings yet

- KY-385 KUCHEF Multi-Cooker IM-V1.2Document40 pagesKY-385 KUCHEF Multi-Cooker IM-V1.2al83rt777750% (2)

- Income Taxation Finals Quiz 2Document7 pagesIncome Taxation Finals Quiz 2Jericho DupayaNo ratings yet

- Pas 12 Income TaxesDocument4 pagesPas 12 Income TaxesFabrienne Kate Eugenio LiberatoNo ratings yet

- Johnstone - 9e - Auditing - Chapter 10 - PPT FINALDocument93 pagesJohnstone - 9e - Auditing - Chapter 10 - PPT FINALNurlinaEzzati0% (1)

- Audit - Sales and ReceivablesDocument6 pagesAudit - Sales and ReceivablesValentina Tan DuNo ratings yet

- Investment in AssociateDocument11 pagesInvestment in AssociateElla MontefalcoNo ratings yet

- Auditor's Responses To Assessed RisksDocument41 pagesAuditor's Responses To Assessed RisksPatrick GoNo ratings yet

- Quiz Discontinued OperationDocument2 pagesQuiz Discontinued OperationRose0% (1)

- Chapter 18 Policies Estimates and ErrorsDocument28 pagesChapter 18 Policies Estimates and ErrorsHammad Ahmad100% (1)

- Accounting Students Exam GAAP and Financial ReportingDocument7 pagesAccounting Students Exam GAAP and Financial ReportingJohnAllenMarillaNo ratings yet

- 3 Module 3 - Notes To Financial Statements AE 17 Intermediate Accounting 3Document14 pages3 Module 3 - Notes To Financial Statements AE 17 Intermediate Accounting 3CJ Granada100% (1)

- 13Document63 pages13amysilverbergNo ratings yet

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityFrom EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityNo ratings yet

- Chapter 6-Audit ReportDocument14 pagesChapter 6-Audit ReportDawit WorkuNo ratings yet

- IAS 16 Property Plant Equipment AccountingDocument6 pagesIAS 16 Property Plant Equipment AccountinghemantbaidNo ratings yet

- IAS 1 Presentation of Financial Statements PDFDocument4 pagesIAS 1 Presentation of Financial Statements PDFTEE YAN YING UnknownNo ratings yet

- Adjusting EntriesDocument43 pagesAdjusting EntriesCH Umair MerryNo ratings yet

- PAS 27 Consolidated and Separate FS ReviewedDocument14 pagesPAS 27 Consolidated and Separate FS ReviewedRonalynPuatuNo ratings yet

- Acc Business Combination NotesDocument118 pagesAcc Business Combination NotesTheresaNo ratings yet

- Agreed Upon Procedures vs. Consulting EngagementsDocument49 pagesAgreed Upon Procedures vs. Consulting EngagementsCharles B. Hall100% (1)

- Financial Asset MILLANDocument6 pagesFinancial Asset MILLANAlelie Joy dela CruzNo ratings yet

- PFRS 8 - Operating SegmentsDocument13 pagesPFRS 8 - Operating SegmentsYassi CurtisNo ratings yet

- Tax PlanningDocument21 pagesTax Planningpriyani0% (1)

- Income Tax Schemes, Accounting Periods, Accounting Methods and Reporting C4Document73 pagesIncome Tax Schemes, Accounting Periods, Accounting Methods and Reporting C4Diane CassionNo ratings yet

- StrataxDocument40 pagesStrataxAsh PadillaNo ratings yet

- TOPIC 3e - Risk and MaterialityDocument33 pagesTOPIC 3e - Risk and MaterialityLANGITBIRUNo ratings yet

- Accounting For Income TaxesDocument16 pagesAccounting For Income TaxesMUNAWAR ALI100% (5)

- Module 13 Regular Deductions 3Document16 pagesModule 13 Regular Deductions 3Donna Mae FernandezNo ratings yet

- The Petty Cash FundDocument10 pagesThe Petty Cash FundLilian TaiNo ratings yet

- Audit of General Insurance CompaniesDocument16 pagesAudit of General Insurance CompaniesTACS & CO.No ratings yet

- 015 - Quick-Notes - Financial Liabilities From Borrowings Part 2Document3 pages015 - Quick-Notes - Financial Liabilities From Borrowings Part 2Zatsumono YamamotoNo ratings yet

- Module 9 SHAREHOLDERS' EQUITYDocument3 pagesModule 9 SHAREHOLDERS' EQUITYNiño Mendoza MabatoNo ratings yet

- CH04 Revenue Cycle PDFDocument73 pagesCH04 Revenue Cycle PDFZion Ilagan0% (1)

- Ias 12Document45 pagesIas 12Reever RiverNo ratings yet

- Company Accounting - Powerpoint PresentationDocument29 pagesCompany Accounting - Powerpoint Presentationtammy_yau3199100% (1)

- Tax Effect Accounting (AASB 1020)Document40 pagesTax Effect Accounting (AASB 1020)Queenlizzie LamSamNo ratings yet

- Revenue and Construction ContractsDocument7 pagesRevenue and Construction ContractsHenry ListerNo ratings yet

- EquityDocument7 pagesEquityHenry ListerNo ratings yet

- Accounting For Financial InstrumentsDocument13 pagesAccounting For Financial InstrumentsHenry ListerNo ratings yet

- Financial Accounting StudyDocument9 pagesFinancial Accounting StudyHenry ListerNo ratings yet

- Extractive IndustriesDocument5 pagesExtractive IndustriesHenry ListerNo ratings yet

- Accounting For Provisions and Contingent LiabilitiesDocument8 pagesAccounting For Provisions and Contingent LiabilitiesHenry Lister100% (1)

- Guzman Cruz Cpas and Co.: Guideline For BIR Tax Deadlines During Enhanced Community Quarantine (ECQ) PeriodDocument2 pagesGuzman Cruz Cpas and Co.: Guideline For BIR Tax Deadlines During Enhanced Community Quarantine (ECQ) PeriodGerald SantosNo ratings yet

- Condition TypeDocument18 pagesCondition TypeDeepak SangramsinghNo ratings yet

- Income Taxation (TAX 101) TH Quiz No.3 ScoreDocument3 pagesIncome Taxation (TAX 101) TH Quiz No.3 ScoreMaricel MielNo ratings yet

- Invoice For Portable Toilets - Nuggets ParadeDocument1 pageInvoice For Portable Toilets - Nuggets Parade9newsNo ratings yet

- Law of Taxation Law-I Course SyllabusDocument2 pagesLaw of Taxation Law-I Course SyllabusAmanNo ratings yet

- Generator Registration Fees (El - Tax) Generator Registration Fees (El - Tax) Generator Registration Fees (El - Tax)Document1 pageGenerator Registration Fees (El - Tax) Generator Registration Fees (El - Tax) Generator Registration Fees (El - Tax)aaanathanNo ratings yet

- Assignment No. 4Document3 pagesAssignment No. 4Paula VillarubiaNo ratings yet

- Assessing public financial management frameworksDocument24 pagesAssessing public financial management frameworksSamer_AbdelMaksoudNo ratings yet

- Corruption PDFDocument19 pagesCorruption PDFJuan ValerNo ratings yet

- GST NotesDocument156 pagesGST NotesNishthaNo ratings yet

- F6ZWE 2015 Jun ADocument8 pagesF6ZWE 2015 Jun APhebieon MukwenhaNo ratings yet

- Tax.103 2 Corporate Income Taxation StudentsDocument23 pagesTax.103 2 Corporate Income Taxation StudentsJames R JunioNo ratings yet

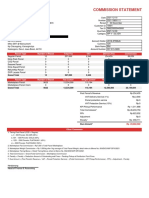

- Commission Statement: Mitra InformationDocument3 pagesCommission Statement: Mitra InformationZia Chusnul LabibNo ratings yet

- Answer KeyDocument13 pagesAnswer KeyRoronoa Zoro100% (1)

- Tax Q and A 1Document2 pagesTax Q and A 1Marivie UyNo ratings yet

- Tax AmnestyDocument3 pagesTax Amnestyapi-236234542No ratings yet

- .Apr 2022Document10 pages.Apr 2022SWAPNIL JADHAVNo ratings yet

- Starter Checklist v1.0Document2 pagesStarter Checklist v1.0Akalisue Hatebreeder TheopoisondigipackNo ratings yet

- Tax Invoice: 36AADCM3491M1Z2 30AAACC6253G1Z6Document1 pageTax Invoice: 36AADCM3491M1Z2 30AAACC6253G1Z6VIDHI JAINENDRASINH RANANo ratings yet

- Payroll TanodDocument2 pagesPayroll TanodRosalie Sareno Alvior100% (2)

- Payslip Summary for Rahul DasDocument3 pagesPayslip Summary for Rahul DasasdNo ratings yet

- Reconciling Bank Deposits and Interest Items for 7 YearsDocument4 pagesReconciling Bank Deposits and Interest Items for 7 YearsJerwin Cases TiamsonNo ratings yet

- Cpa Review School of The Philippines ManilaDocument5 pagesCpa Review School of The Philippines ManilaSamuel Cedrick AbalosNo ratings yet

- CIR v. Algue, Inc., G.R. No. L-28896Document1 pageCIR v. Algue, Inc., G.R. No. L-28896fay garneth buscato100% (2)

- Phil. Health ContributionsDocument5 pagesPhil. Health Contributionshae123467% (9)

- ABC Co. Started Its OperationsDocument1 pageABC Co. Started Its OperationsQueen ValleNo ratings yet

- Country Responses To The Financial Crisis KosovoDocument39 pagesCountry Responses To The Financial Crisis KosovoInternational Consortium on Governmental Financial Management50% (2)

- Lifeblood DoctrineDocument1 pageLifeblood DoctrineEric Roy Malik0% (1)

- Exercises 5-1 Taxation SolutionsDocument56 pagesExercises 5-1 Taxation SolutionsDevonNo ratings yet

- 1.MFRS 112Document46 pages1.MFRS 112Yau Xiang Ying100% (1)