Professional Documents

Culture Documents

FINS2624 Week7 Tutorial

Uploaded by

Kai LinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FINS2624 Week7 Tutorial

Uploaded by

Kai LinCopyright:

Available Formats

Fins2624(Portfolio Management)

Kai Lin(z3411977)

Question1

a).Total Market Volume: 58*1000+60*1200+140*500=$200000

Weighting for each stock:

A: 58*1000/200000=29%

B: 60*1200/200000=36%

C: 140*500/200000=35%

Hence, R M =0.29 R A +0.36 R B +0.35 RC

2M =Var ( 0.29 R A +0.36 R B +0.35 RC ) =0.292 2A +0.362 2B +0.352 2C +20.290.36Cov ( A , B )+ 20.29

Cov ( R A , R M )=Cov ( R A , 0.29 R A +0.36 R B+ 0.35 R C )

0.29 Var ( R A ) +0.36 Cov ( A , B ) +0.35 Cov ( A ,C )=0.290.1225+ 0.360.098+ 0.350.042=0.085505

Hence BetaA=0.085505/0.07500665=1.140

Cov ( R B , R M )=Cov ( RB , 0.29 R A +0.36 R B +0.35 RC )

0.29 Cov ( A , B ) +0.36 Var ( B )+ 0.35 Cov ( B , C )=0.290.098+0.360.16+0.350.04=0.10002

Hence BetaB=0.10002/0.07500665=1.333

Cov ( RC , RM ) =Cov ( RC , 0.29 R A +0.36 R B +0.35 RC )

0.29 Cov ( A ,C ) +0.36 Cov ( B ,C ) +0.35 Var (C )=0.04058

Hence BetaC=0.04058/0.07500665=0.541

Let the weight be w in A, 0.9-w in C0.1in rf

1.14w+(0.9-w)*0.541=0.6 w=18.89%

Rp=0.1Rf+0.1889RA+0.8111RC.

For beta P=0.9 zero risk free asset.

1.14w+(1-w)0.541=0.9

Rp=0.5993RA+0.4007RC

w=59.93%

1-w=40.07%

E ( RB )=r f + B ( E ( r M )r f ) =14.67 =4 +1.333 ( E ( r M ) 4 )

E ( r M )=12

E ( r A ) =r f + A ( E ( r M )r f ) =4 +1.14 ( 12 4 ) =13.12

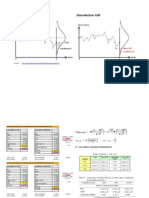

Question2

A). r p=0.5r X +0.5 r Y

Var ( r P ) =Cov ( 0.5 r X +0.5 r Y , 0.5 r X + 0.5 r Y ) =0.25 Cov ( r X ,r X ) +0.25 Cov ( r Y , r Y ) + 0.5Cov ( r X , r Y )=0.25 (

N

B).

1

2

2 i

N i

N

C). As N->infinity

1

1

2 = 2i 0, unsystematic risks are diversified .

2 i

N

N i

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Intra-Horizon VaR and Expected Shortfall Spreadsheet With VBADocument7 pagesIntra-Horizon VaR and Expected Shortfall Spreadsheet With VBAPeter Urbani0% (1)

- IM-Chapter 7 Portfolio TheoryDocument32 pagesIM-Chapter 7 Portfolio TheoryVirali Jadeja100% (1)

- CFA Chapter 10 PROBLEMSDocument3 pagesCFA Chapter 10 PROBLEMSFagbola Oluwatobi OmolajaNo ratings yet

- FINS2624 Week5 TutorialDocument2 pagesFINS2624 Week5 TutorialKai Lin0% (1)

- FINS2624 Week4 TutorialDocument3 pagesFINS2624 Week4 TutorialKai LinNo ratings yet

- FINS2624 Week 3 TutorialDocument3 pagesFINS2624 Week 3 TutorialKai LinNo ratings yet

- FINS2624 Week8 TutorialDocument1 pageFINS2624 Week8 TutorialKai LinNo ratings yet

- 2799-Article Text-13347-1-10-20220701Document13 pages2799-Article Text-13347-1-10-20220701Firas Taqiyyah Al FakhirahNo ratings yet

- BCG Matrix of Gourment Bakers and SweetsDocument5 pagesBCG Matrix of Gourment Bakers and Sweetsmaria tabassumNo ratings yet

- Efficient Frontier SamvegDocument4 pagesEfficient Frontier Samvegaashutosh sawantNo ratings yet

- ALM AssignmentDocument8 pagesALM AssignmentAbdul RaheemNo ratings yet

- Chapter 7 Portfolio Theory: 1 Introduction and OverviewDocument38 pagesChapter 7 Portfolio Theory: 1 Introduction and OverviewEbenezerMebrateNo ratings yet

- AssignmentDocument5 pagesAssignmentHabiba KausarNo ratings yet

- Momentum - 1927 - 2014 Partial View of Data in SpreadsheetDocument1 pageMomentum - 1927 - 2014 Partial View of Data in SpreadsheetpedroNo ratings yet

- Latifatuzzarah Mashitoh FebDocument187 pagesLatifatuzzarah Mashitoh FebsalmaNo ratings yet

- Introduction to Portfolio Optimization in PythonDocument37 pagesIntroduction to Portfolio Optimization in PythonLuca FarinaNo ratings yet

- 05 CAPM - ADocument73 pages05 CAPM - AHaoyang Pazzini YeNo ratings yet

- PS 2 Fall2022Document4 pagesPS 2 Fall20221227352812No ratings yet

- Homework #7Document2 pagesHomework #7Ryan Ben SlimaneNo ratings yet

- Calculate Portfolio Sharpe RatioDocument7 pagesCalculate Portfolio Sharpe RatioazamopulentNo ratings yet

- Backtest - Garufi (Recuperado Automaticamente)Document44 pagesBacktest - Garufi (Recuperado Automaticamente)Ederson EdyNo ratings yet

- Chapter 8Document40 pagesChapter 8ebrahimnejad64No ratings yet

- Determination of Optimal Portfolio by Using Tangency Portfolio and Sharpe RatioDocument7 pagesDetermination of Optimal Portfolio by Using Tangency Portfolio and Sharpe RatiowoelfertNo ratings yet

- Portofolio Efficient Frontier - Kaunang, MarioDocument3 pagesPortofolio Efficient Frontier - Kaunang, Mariomario kaunangNo ratings yet

- 5 Portfolio TheoryDocument15 pages5 Portfolio TheoryUtkarsh BhalodeNo ratings yet

- Mabel Reviews Investment Project RisksDocument7 pagesMabel Reviews Investment Project RisksDarwinQuevedoNo ratings yet

- Portfolio Theory CAPMDocument7 pagesPortfolio Theory CAPMrohit vincentNo ratings yet

- Portfolio Optimization: BSRM Brac Beximco GP RAKDocument27 pagesPortfolio Optimization: BSRM Brac Beximco GP RAKFarsia Binte AlamNo ratings yet

- Analyzing Value at Risk in Forming an Optimal PortfolioDocument13 pagesAnalyzing Value at Risk in Forming an Optimal PortfoliorifkaindiNo ratings yet

- Nama: Redi Perdiansyah NIM: 55120110139 Quiz Ke: 9: Stock X Stock y Stock ZDocument5 pagesNama: Redi Perdiansyah NIM: 55120110139 Quiz Ke: 9: Stock X Stock y Stock ZFikky Chandra SilabanNo ratings yet

- Meucci ReDefining and Managing Diversification PDFDocument44 pagesMeucci ReDefining and Managing Diversification PDFcastjamNo ratings yet

- Introduction To Computational Finance and Financial EconometricsDocument54 pagesIntroduction To Computational Finance and Financial EconometricsMR 2No ratings yet

- MIT18 S096F13 Lecnote14Document34 pagesMIT18 S096F13 Lecnote14eni100% (1)

- BCG Matrix of Gourmet Bakers & Sweets: Group Members Nauman Bilal 4714 Umair Majeed 4739Document5 pagesBCG Matrix of Gourmet Bakers & Sweets: Group Members Nauman Bilal 4714 Umair Majeed 4739maria tabassumNo ratings yet