Professional Documents

Culture Documents

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

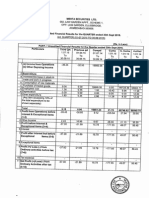

MEHTA SECURITIES LIMITED

OO2,

LAW GARDEN APPT., SCHEME-I,

LAW GARDEN, ELLISBRIDGE,

AHMEDABAD-380006.

OPP.

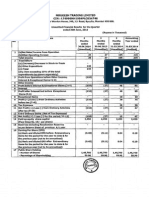

Unadited Financial Results for the Quarter ended 30th Sept 2014.

3rd QUARTER (01-07-2014 TO 30-09-2014)

iri Lacs

Particulars

(a)Net Sales/Income from

Operations (b) Other Operating

Third Qrt Previous Qrt

Corspd

Cumu

C. Cumu

Audited

01.07.14

01.04. r 4

01.07.13

01.01.14

01.01.13

1.1.13

To

To

To

To

To

To

30.09.14

30.06.14

30.09. r 3

30.09.14

30.09. r3

31.12.13

19860.36

27t31.02

7753.22 66774.56

49006.02

58831.07

19846.3s

490s7.s0

58844.71

Income

2 Expenditure

a Increase/decrease in stock in

trade and work in progress

b Consumption of raw materials

c Purchase of traded goods

27067.39

7744.48

66728.3(,

d Employees cost

a Depreciation

1.92

0.79

0.92

9.96

9.03

10.s9

0.00

0.0c

0.00

f Other expenditure

0.00

0.00

6.17

2.96

3.6C

1.01

8.30

12.76

29.03

19851.2A

27071.71

7746.41

66746-62

49079.29

58890.s0

3 Profit from Operations before

Interest & Exceptional Items (1

2)

9.12

59.24

6.81

27.94

-73.27

-59.43

4 Other Income

6.67

3.6s

3.1C

21.13

9.08

53.35

15.78

62.89

9.91

49.07

-64.19

-6.08

15.78

62.89

9.91

49.07

-64.19

-6.08

15.78

62.89

9.91

49.07

-64.19

-6.08

15.78

62.89

9.91

49.07

-64.19

-6.08

15.78

62.89

9.91

49.07

-64.19

-6.08

g Total

(Any item exceeding l0% of the

total expenditure to be shown

separately)

5 Profit before Interest

&

Exceptional ltems (3+4)

6 lnterest

7 Profit after Interest but before

Exceptional Items (5-6)

8 Exceptional Items

I Profit (+)/ Loss O from Ordinary

Activities before tax (7+8)

10 Iax expense

11

Net Profit (+)/Loss(-) from

Ordinary Activities after tax (9-

12 Extraordinary Item (net

expense

oftax

Rs.......)

13 Net Profit (_).Loss(-) for the

period (13-14)

&

F(

ffi$

--*..,*@rr

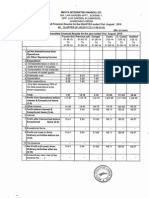

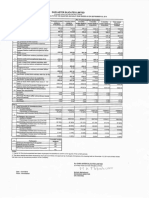

3rd OUARTER (01-07-2014 TO 30-09-2014)

in Lacs

Particulars

14 Paid-up equity share capital

(Face Yalue of the Share shall be

indicated)

Third Qrt Previous Qrt

Corspd

Cumu

01.07.14

01.04.14

01.07.13

To

To

To

30.09.r4

30.06.14

308.94

Rs.10/-

1320101

42.73%

Audited

01.01.14

C. Cumu

01.01.13

To

To

To

30.09.'13

30.09.14

30.09.13

31.12.13

308.94

308.94

308.94

308.94

Rs.l0/-

Rs.l0/-

Rs.l0/-

Rs.l0/-

t320t0l

l320l0l

1320t0t

l320l0r

l320l0t

42.73%

42.73%

42.73%

nlZYo

42.73%

NIL

NIL

NIL

NIL

NIL

NIL

1769299

1769299

1769299

1769299

1769299

1769299

57.27o/o

57.27o/o

57.27o/o

57.27o/o

57.270/o

57.27o/o

l.l.l3

308.94

Rs.10/-

15 Reserve excluding Revaluation

Reserves as per balance sheet of

previous accounting year

16 Eamings Per Share (EPS) (a)

Basic and diluted EPS before

Extraordinary items for the

period, for the year to date and for

the previous year (not to be

annualized) (b) Basic and diluted

EPS after Extraordinary items for

the period, for the year to date

and forthe previous year (not to

17 Public shareholding - Number

shares - Percentage of

of

shareholding

18 Promoters and promoter group

Shareholding *+

a) Pledged / Encumbered Number of shares - Percentage

of

shares (as ao/o of the total

shareholding of promoter and

promoter group) - Percentage of

shares (as ao/o ofthe total share

b) Non-encumbered - Number of

Shares - Percentage of shares

(as a% of the total shareholding

of promoter and promoter group) Percentage of shares (as a % of

the total share capital of the

company)

1 The Board of Directors took on record the above

2 The company has received nil compliant from the investors during the euarter and no complaint is lying

unresolved as on 30th Sept 2014

Date:3111012014

Place :,Ahmedabad

-orised

Signatory

:{

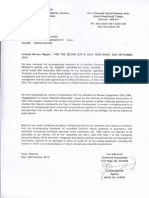

Limited Review Report to Board of Directors

Mehta Securities Ltd

We have reviewed the accompanying statement of unaudited financial results of August

Mehta Securities Ltd for the period ended Sept 2014 except for the disclosures regarding

'Public Shareholding' and 'Promoter and Promoter Group Shareholding' which have been

traced from disclosures made by the managemont and have not been audited by us. This

statement is the responsibility of the Company's Management and has been approved by the

Board of Directors/ committee of Board of Directors. Our responsibility is to issue a report

on these financial statements based on our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE)

2400, Engagements to Review Financial Statements issued by the Institute of Chartered

Accountants of India. This standard requires that we plan and perform the review to obtain

moderate assurance as to whether the financial statements are free of material misstatement.

A review is limited primarily to inquiries of company personnel and analytical procedures

applied to financial data and thus provides less assurance than an audit. We have not

performed an audit and accordingly, we do not express an audit opinion.

Based on our review conducted as above, nothing has come to our attention that causes us to

believe that the accompanying statement of unaudited financial results prepared in

accordance with applicable accounting standards and other recognized accounting practices

and policies has not disclosed the information required to be disclosed in terms of Clause 4l

of the Listing Agreement including the manner in which it is to be disclosed, or that it

contains any material

misstatement.,r";r;;ffiro

Place :Ahmedabad

Date: 31.102014

t

For, Dinesh K. Shah & Co.,

Chartered Accountants

(Dinesh K Shah-Partner)

(M.No.10477)

:t

You might also like

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Aug 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Aug 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2013 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Aug 31, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Aug 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Document5 pagesAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Document3 pagesFinancial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Nov 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Nov 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Jaihind Synthetics Limited: S BusDocument4 pagesJaihind Synthetics Limited: S BusShyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Result)Document4 pagesFinancial Results & Limited Review For June 30, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- GVK Annual2014Document149 pagesGVK Annual2014SUKHSAGAR1969No ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- CMBL 2019Document90 pagesCMBL 2019Gaurav GhareNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- CPA Review Notes 2019 - Audit (AUD)From EverandCPA Review Notes 2019 - Audit (AUD)Rating: 3.5 out of 5 stars3.5/5 (10)

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Corporate Governance StatementDocument15 pagesCorporate Governance StatementRahul PagariaNo ratings yet

- Table of Content: Part 1 Socialism and CapitalismDocument5 pagesTable of Content: Part 1 Socialism and CapitalismAnshul SinghNo ratings yet

- ISTD Paper1 Business Strategy and HRDDocument4 pagesISTD Paper1 Business Strategy and HRDcharuNo ratings yet

- Bank Exam Question Papers - Bank of IndiaDocument34 pagesBank Exam Question Papers - Bank of IndiaGomathi NayagamNo ratings yet

- Cash Flow ProjectDocument85 pagesCash Flow ProjectUsman MohammedNo ratings yet

- IMPACT OF AI (Artificial Intelligence) ON EMPLOYMENT: Nagarjuna V 1NH19MCA40 DR R.SrikanthDocument24 pagesIMPACT OF AI (Artificial Intelligence) ON EMPLOYMENT: Nagarjuna V 1NH19MCA40 DR R.SrikanthNagarjuna VNo ratings yet

- Ghana SME LandscapeDocument11 pagesGhana SME LandscapeWasili MfungweNo ratings yet

- MGT-314 Essential of Management MID TERM PAPERDocument2 pagesMGT-314 Essential of Management MID TERM PAPERAli KazmiNo ratings yet

- Scarcity, Opportunity Costs, and Production Possibilities CurvesDocument14 pagesScarcity, Opportunity Costs, and Production Possibilities CurvesAhmad Mahmuz ArroziNo ratings yet

- Goldaman Facebook Deal - WhartonDocument4 pagesGoldaman Facebook Deal - WhartonRafael CarlosNo ratings yet

- Personal Financial Statement: Section 1-Individual InformationDocument3 pagesPersonal Financial Statement: Section 1-Individual InformationAndrea MoralesNo ratings yet

- Resume For MSP - Thomas PintacsiDocument2 pagesResume For MSP - Thomas PintacsiTom PintacsiNo ratings yet

- Toyota MisDocument18 pagesToyota MisAdejumohNo ratings yet

- IFI Banking TranscriptDocument21 pagesIFI Banking TranscriptAnonymous NeRBrZyAUbNo ratings yet

- DailySocial Fintech Report 2019Document51 pagesDailySocial Fintech Report 2019Clara Lila100% (3)

- Mba-1 SemDocument14 pagesMba-1 SemAnantha BhatNo ratings yet

- CemDocument6 pagesCemSamaresh ChhotrayNo ratings yet

- Cashinfinity EuroDocument2 pagesCashinfinity EuroAna CarvalhoNo ratings yet

- Rich Dad Poor DadDocument16 pagesRich Dad Poor DadPrateek Singla100% (3)

- Sample Business Article CritiqueDocument5 pagesSample Business Article CritiqueGlaize FulgencioNo ratings yet

- WG O1 Culinarian Cookware Case SubmissionDocument7 pagesWG O1 Culinarian Cookware Case SubmissionAnand JanardhananNo ratings yet

- ACT450 - Fa20 - Project Deliverable PDFDocument10 pagesACT450 - Fa20 - Project Deliverable PDFHassan SheikhNo ratings yet

- Ent 12 Holiday HWDocument4 pagesEnt 12 Holiday HWsamNo ratings yet

- BSBSUS211 - Assessment Task 1Document7 pagesBSBSUS211 - Assessment Task 1Anzel Anzel100% (1)

- Chap 13Document18 pagesChap 13N.S.RavikumarNo ratings yet

- An Introduction To The Supply Chain Council's SCOR MethodologyDocument17 pagesAn Introduction To The Supply Chain Council's SCOR MethodologyLuis Andres Clavel Diaz100% (1)

- Financial Accounting Theory: Sixth William R. ScottDocument32 pagesFinancial Accounting Theory: Sixth William R. Scottanon_757820301No ratings yet

- HL Business Management Course Outline - FinalDocument14 pagesHL Business Management Course Outline - FinalAnthony QuanNo ratings yet

- Capital Adequacy (Test)Document25 pagesCapital Adequacy (Test)Kshitij Prasad100% (1)

- Administrative Theory by Henry FayolDocument6 pagesAdministrative Theory by Henry FayolKaycee GaranNo ratings yet