Professional Documents

Culture Documents

Ranges (Up Till 11.50am HKT) : Currency Currency

Uploaded by

api-290371470Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ranges (Up Till 11.50am HKT) : Currency Currency

Uploaded by

api-290371470Copyright:

Available Formats

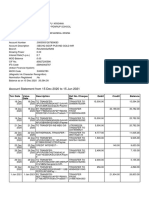

Ranges (Up till 11.

50am HKT)

Currency

0.7280. AudUsd backed off as Chinese equity indices

turn negative.

Currency

EURUSD

1.13285-595

EURJPY

136.63-137.05

USDJPY

120.39-85

EURGBP

0.7340-55

GBPUSD

1.5427-60

USDSGD

1.4075-1.4130

USDCHF

AUDUSD

0.9679-0.9703

0.7078-0.7136

USDTHB

USDKRW

36.00-07

1177.4-1182.5

NZDUSD

0.6279-0.6345

USDTWD

32.434-710

USDCAD

1.3226-57

USDCNH

6.4005-6.4140

AUDNZD

1.1210-52

XAU

1105.3-1109.7

Key Headlines

Quiet session ahead of FOMC and BOJ. There is

someone bidding decent amount of Euros at 1.1340. No

idea who but traders suspect Asian behind.

Japan Nikkei225 opened up positive but turned

negative weighed down by PM Abe, I meant cell phone

carriers.

Bipan Rais piece published today our economics

group sees a rate hike despite the protestations of

notable economists that the Fed should forgo raising

rates in the near-term. Bipan highlighted 5 important

signals - #1 the longer-run rate; #2 median dot

projections; #3 outlook on growth and inflation; #4

dissenters within statement; #5 how concerned is Fed

with international developments.

FX Flows

Overall market has been calm ahead of key events this

week BOJ and FOMC. Only interesting thing is EurUsd.

The pair kicked off 1.1338 and got up to 1.13595. On the

way back, our traders noticed very decent bids placed in

platforms at 1.1340. We suspect these bids are planted

after 6.30am HK this morning and mostly likely an

Asian behind. I heard bids also lined up 1.1310-20 and

sellers are mostly atop 1.1400.

As the AudUsd firmed up, UsdCad drifted lower. Most of

the offers are lined up above 1.3310 and we have little to

share on the downside, unless we get to mid-1.31s. My

colleague Sam mirrored the same thought on Cad

looking at bonds, he thinks Cad is cheap compared to the

Usd. Yield differentials between 2-year CAD bonds and

2-year UST, tells us UsdCad could see 1.3125.

From Bipan Rais piece published today our economics

group sees a rate hike despite the protestations of

notable economists that the Fed should forgo raising

rates in the near-term. Bipan highlighted 5 important

signals - #1 the longer-run rate; #2 median dot

projections; #3 outlook on growth and inflation; #4

dissenters within statement; #5 how concerned is Fed

with international developments.

Im not an expert for British politics but reading from the

press, Jeremy Corbyn winning the Labour Party

leadership should have some impact. The UK Telegraph

has a story that UKs biggest trade unions hailed

Corbyns election as Labour leader and threatened to

topple the Government using coordinated strikes and

demonstrations. Roger Bootle also put out a piece Corbyn said that a Labour government would introduce

peoples QE, that is to say, increased government

spending, perhaps on infrastructure, financed with

printed money. Some of PM Camerons key allies are

warning that Mr Corbyn and the movement he appears

to have inspired are an unknown quantity and must not

be underestimated.

Asians

In general, Greenback started weak versus the Asians but

regained in the late morning on profit taking.

Japan Nikkei225 opened up positive but turned negative

weighed down by cell phone carriers. According to a

story in Bloomberg, Japanese Prime Minister Shinzo Abe

told a meeting of the countrys Council on Economic and

Fiscal Policy that reducing the burden on households

from cell phone fees was an important issue to tackle.

As soon as traders settled down, UsdSgd sold off as

market reacted to the Singapore elections. US dollar

printed 1.4075 and buyers surfaced to take the UsdSgd

back to 1.41-handle. The focus is back on the MAS Semiannual Monetary Policy Statement in Oct. Global

Positioning Index shows that market is only small

fraction short Sgd.

Like the Nikkei, UsdJpy rose on the Tokyo open to

120.85 but fell back to 120.60s as the equity index

clawed back.

CNY fixed at 6.3709, in line with what market had

predicted. Weak Chinese data released over the weekend

puts pressure on the Shanghai Composite Index.

AudUsd seemed firm this morning despite the weekends

China data. General chatter of short covering in AudJpy

this morning. According to our trader Sam, interest rates

is telling us that the Aud looks cheap versus the Usd. If

the rates space is correct, we can see a bounce up to

Who said what

Reuters News: Shares of Softbank and other Japanese

telecom companies fell more than 5% after PM Abe

demands cell phone rates be lowered

These information have been obtained or derived from sources believed to be reliable, but I make no representation or warranty as to their accuracy or completeness.

Copyright 2013 The Poon Report by Vincent Poon. All rights reserved.

South Korea Choi: South Korean exports in very

difficult situation

Japan PM Abe: Determined to pass defence bills this

session

News

WSJ: Chinas Battered Economy Could Surprise

Investors

An economy that isnt in full blown panic mode,

however, at least gives Beijing a fighting chance to effect

a change. The most recent interest-rate cuts, among

other actions, have yet to fully trickle through the

economy. It is possible Chinas growth model is just too

broken and the economy too debt laden to respond to

pump priming. But given how negative sentiment is on

China, even a modest recovery would be a surprise to

many.

http://www.wsj.com/articles/chinas-battered-economycould-surprise-investors-1442199517?

mod=wsj_nview_latest

WSJ: China Unveils Overhaul of Bloated State

Sector

Chinese President Xi Jinping set in motion the overhaul

of the countrys bloated state companies just ahead of his

U.S. visit, in a bid to show Beijing is committed to

change even as the economy slows. A plan released

Sunday, however, represents a modest fix to Chinas

brand of state capitalism. It attempts to enhance state

companies returns by letting them add private investors.

It also tries to improve state companies competitiveness

overseas by making them bigger, though that risks

creating more inefficiency and further stymieing private

enterprise.

http://www.wsj.com/articles/china-to-allow-stateowned-enterprises-to-sell-shares-to-public-1442138335

Telegraph: China economy: growth target in

doubt as investment and factory output stutters

Chinese investment grew at the slowest pace in 15 years

in the first eight months of 2015 as factory output

disappointed, raising fears that third quarter growth

would drop below 7pc for the first time since the

financial crisis. Fixed-asset investment, which covers

expenditure on a wide range of assets from plant and

machinery to infrastructure, expanded by 10.9pc in the

year to August.

http://www.telegraph.co.uk/finance/chinabusiness/11861747/China-economy-growth-target-indoubt-as-investment-and-factory-output-stutters.html

SCMP: Doubts over strategy of Chinas margin

lender in propping up stock values

The top stock picks of China Securities Finance

Corporation (CSFC) raise some doubts about whether it

put much thought into its investment strategy before

stepping in to shore up market values. The official

securities margin lender scrambled to buy stocks during

the market rout, including unpopular small-to-mid-caps

with poor fundamentals and high valuations. Some of

these companies had been selling assets for years to

avoid a delisting, while others have price-to-earnings

(P/E) ratios that top 1,000 when an ideal P/E is around

15 to 20.

http://www.scmp.com/business/markets/article/18579

25/doubts-over-strategy-chinas-margin-lenderpropping-stock-values

FT: Franklin Templeton suffers record outflows

Analysts are slicing their earnings forecasts for Franklin

Templeton, as the US asset management group wrestles

with some of the worst outflows from its mutual funds in

its history. Investors pulled more money from the

Templeton Global Bond fund, run by emerging markets

trader Michael Hasenstab, in August than in any

previous month, while Franklins global equities

business has now suffered 16 consecutive months of

outflows.

http://www.ft.com/intl/cms/s/0/942eaea4-58af-11e5a28b-50226830d644.html#axzz3lfQvBdbD

FT: Brazils terrible fall from economic grace

If Brazil was a hospital patient, emergency room doctors

would diagnose it as being in terminal decline. The

kidneys have packed up; the heart will go soon. That, at

any rate, is the damming opinion of a senator from the

Workers party, which has governed Brazil for 13 years,

overseeing both its rise on the global stage and now its

terrible fall.

http://www.ft.com/intl/cms/s/0/fa56a932-5875-11e5a28b-50226830d644.html#axzz3lfQvBdbD

Telegraph: Union bosses threaten to use Jeremy

Corbyn's victory to cripple UK

Union bosses yesterday threatened to use Jeremy

Corbyns victory to cripple Britain by holding a wave of

strikes and instigating civil unrest. The chiefs of the UKs

biggest trade unions hailed Mr Corbyns election as

Labour leader and threatened to topple the

Government

using

coordinated

strikes

and

demonstrations.

http://www.telegraph.co.uk/news/politics/Jeremy_Cor

byn/11862413/Union-bosses-threaten-to-use-JeremyCorbyns-victory-to-cripple-UK.html

Ambrose Evans-Pritchard in Telegraph: BIS

fears emerging market maelstrom as Fed

tightens

Debt ratios have reached extreme levels across all major

regions of the global economy, leaving the financial

system acutely vulnerable to monetary tightening by the

These information have been obtained or derived from sources believed to be reliable, but I make no representation or warranty as to their accuracy or completeness.

Copyright 2013 The Poon Report by Vincent Poon. All rights reserved.

US Federal Reserve, the world's top financial watchdog

has warned. The Bank for International Settlements said

the wild market ructions of recent weeks and capital

outflows from China are warning signs that the massive

build-up in credit is coming back to haunt, compounded

by worries that policymakers may be struggling to

control events. "We are not seeing isolated tremors, but

the release of pressure that has gradually accumulated

over the years along major fault lines," said Claudio

Borio, the bank's chief economist.

http://www.telegraph.co.uk/finance/economics/118589

52/BIS-fears-emerging-market-maelstrom-as-Fedtightens.html

These information have been obtained or derived from sources believed to be reliable, but I make no representation or warranty as to their accuracy or completeness.

Copyright 2013 The Poon Report by Vincent Poon. All rights reserved.

You might also like

- News SummaryDocument21 pagesNews Summaryapi-290371470No ratings yet

- Ranges (Up Till 12.15pm HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 12.15pm HKT) : Currency Currencyapi-290371470No ratings yet

- UntitledDocument17 pagesUntitledapi-290371470No ratings yet

- News SummaryDocument19 pagesNews Summaryapi-290371470No ratings yet

- Ranges (Up Till 11.28am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.28am HKT) : Currency Currencyapi-290371470No ratings yet

- News SummaryDocument17 pagesNews Summaryapi-290371470No ratings yet

- News SummaryDocument14 pagesNews Summaryapi-290371470No ratings yet

- News Summary: Ar04 - 16 PDFDocument10 pagesNews Summary: Ar04 - 16 PDFapi-290371470No ratings yet

- News SummaryDocument15 pagesNews Summaryapi-290371470No ratings yet

- News SummaryDocument14 pagesNews Summaryapi-290371470No ratings yet

- Ranges (Up Till 12.30pm HKT) : Currency CurrencyDocument2 pagesRanges (Up Till 12.30pm HKT) : Currency Currencyapi-290371470No ratings yet

- UntitledDocument18 pagesUntitledapi-290371470No ratings yet

- UntitledDocument11 pagesUntitledapi-290371470No ratings yet

- News Summary: n15 - 16 PDFDocument11 pagesNews Summary: n15 - 16 PDFapi-290371470No ratings yet

- News SummaryDocument12 pagesNews Summaryapi-290371470No ratings yet

- Ranges (Up Till 11.50am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.50am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.05am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.05am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470No ratings yet

- UntitledDocument14 pagesUntitledapi-290371470No ratings yet

- Ranges (Up Till 11.59am HKT) : Currency CurrencyDocument2 pagesRanges (Up Till 11.59am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 12.20pm HKT) : Currency CurrencyDocument2 pagesRanges (Up Till 12.20pm HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.30am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.30am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.55am HKT) : Currency CurrencyDocument2 pagesRanges (Up Till 11.55am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 12.15pm HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 12.15pm HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.55am HKT) : Currency CurrencyDocument2 pagesRanges (Up Till 11.55am HKT) : Currency Currencyapi-290371470No ratings yet

- UntitledDocument17 pagesUntitledapi-290371470No ratings yet

- Ranges (Up Till 11.35am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.35am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.35am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.35am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Reviewer - ParCorDocument13 pagesReviewer - ParCoramiNo ratings yet

- 10 Balance of PaymentDocument9 pages10 Balance of PaymentP Janaki Raman100% (1)

- Practical Investment Management by Robert.A.Strong Slides ch08Document28 pagesPractical Investment Management by Robert.A.Strong Slides ch08mzqaceNo ratings yet

- Sharekhan: Your Guide To Financial JungleDocument19 pagesSharekhan: Your Guide To Financial JungleAnil VishwakarmaNo ratings yet

- PMP Formulas - Cheat Sheet v0.6Document2 pagesPMP Formulas - Cheat Sheet v0.6Mohamed LabbeneNo ratings yet

- TitleDocument61 pagesTitleNikhil Vaishnav100% (1)

- Global Macro Investment IdeasDocument13 pagesGlobal Macro Investment IdeasJan KaskaNo ratings yet

- Project Report On Mutual Fund Schemes of SBIDocument43 pagesProject Report On Mutual Fund Schemes of SBIRonak Jain100% (2)

- Unit 3 - Foreign Exchange TradingDocument3 pagesUnit 3 - Foreign Exchange TradingPhan Thị Minh ThúyNo ratings yet

- Overview On InvITsDocument4 pagesOverview On InvITssayliNo ratings yet

- Free Cash FlowDocument6 pagesFree Cash FlowAnh KietNo ratings yet

- Corporate Finance 11Th Edition Ross Solutions Manual Full Chapter PDFDocument35 pagesCorporate Finance 11Th Edition Ross Solutions Manual Full Chapter PDFvernon.amundson153100% (10)

- Financial Market and Services Bba 2 Notes 1Document18 pagesFinancial Market and Services Bba 2 Notes 1Sneha AroraNo ratings yet

- Key Square January 2024 LetterDocument18 pagesKey Square January 2024 LetterBreitbart News100% (1)

- FINA2010 Financial Management: Lecture 2: Financial Statement AnalysisDocument68 pagesFINA2010 Financial Management: Lecture 2: Financial Statement AnalysismoonNo ratings yet

- ManagmentDocument91 pagesManagmentHaile GetachewNo ratings yet

- BPO Frequently Asked Questions Corporates May2018 FinalDocument10 pagesBPO Frequently Asked Questions Corporates May2018 FinalMuthu SelvanNo ratings yet

- Coffee Table Booklet 19012024Document244 pagesCoffee Table Booklet 19012024Antony ANo ratings yet

- Name of Work:-Providing Caretaking, Watch & Ward Services and Up Keeping of Holiday Home at Udaipur During 2021-22Document53 pagesName of Work:-Providing Caretaking, Watch & Ward Services and Up Keeping of Holiday Home at Udaipur During 2021-22ruchita vishnoiNo ratings yet

- 2 Minimum Alternative Tax MatDocument9 pages2 Minimum Alternative Tax MatGagan GumraNo ratings yet

- Goldman Sachs Abacus 2007 Ac1 An Outline of The Financial CrisisDocument14 pagesGoldman Sachs Abacus 2007 Ac1 An Outline of The Financial CrisisAkanksha BehlNo ratings yet

- Account statement for Mr. SAVARAPU KRISHNA from Dec 2020 to Jun 2021Document9 pagesAccount statement for Mr. SAVARAPU KRISHNA from Dec 2020 to Jun 2021SRINIVASARAO JONNALANo ratings yet

- Debt Invetment: Summary: InvestmentDocument3 pagesDebt Invetment: Summary: InvestmentEphine PutriNo ratings yet

- Cambridge IGCSE: Accounting 0452/21Document24 pagesCambridge IGCSE: Accounting 0452/21Khaled AhmedNo ratings yet

- MCQs On Taxation LawDocument18 pagesMCQs On Taxation LawAli Asghar RindNo ratings yet

- Fixed Income Fundamentals: Interest Rate CalculationsDocument167 pagesFixed Income Fundamentals: Interest Rate CalculationsRavi KumarNo ratings yet

- Macro Lecture08Document64 pagesMacro Lecture08Lê Văn KhánhNo ratings yet

- Stress Testing of Agrani Bank LtdDocument2 pagesStress Testing of Agrani Bank Ltdrm1912No ratings yet

- Management AccountingDocument42 pagesManagement AccountingaamritaaNo ratings yet

- AsdDocument41 pagesAsdcpvinculadoNo ratings yet