Professional Documents

Culture Documents

Notice: Agency Information Collection Activities Proposals, Submissions, and Approvals

Uploaded by

Justia.comOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notice: Agency Information Collection Activities Proposals, Submissions, and Approvals

Uploaded by

Justia.comCopyright:

Available Formats

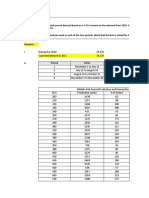

35988 Federal Register / Vol. 71, No.

120 / Thursday, June 22, 2006 / Notices

Issued this 16th day of June, 2006, at an income tax credit of 35% of the first persons need assistance having their

Washington DC. $10,000 of first-year wages and 50% of returns prepared so they can fully

Tyler Duvall, the first $10,000 of second-year wages comply with the law. The form can also

Assistant Secretary for Policy, U.S. paid to long-term family assistance be used to assist the taxpayer after their

Department of Transportation. recipients. The credit is part of the appointment.

[FR Doc. E6–9861 Filed 6–21–06; 8:45 am] general business credit. Respondents: Individuals or

BILLING CODE 4910–9X–P Respondents: Individuals or households; Business or other for-profit;

households; Business or other for-profit. Not-for-profit institutions; Federal

Estimated Total Burden Hours: 1,769 Government; State, Local or Tribal

DEPARTMENT OF THE TREASURY hours. Government.

OMB Number: 1545–1983. Estimated Total Burden Hours:

Submission for OMB Review; Type of Review: Extension. 105,605 hours.

Comment Request Title: Qualified Railroad Track OMB Number: 1545–1998.

Maintenance Credit. Type of Review: Extension.

June 15, 2006. Form: Form 8900.

The Department of Treasury has Title: Alternative Motor Vehicle

Description: Form 8900, Qualified Credit.

submitted the following public Railroad Track Maintenance Credit, was

information collection requirement(s) to Form: Form 8910.

developed to carry out the provisions of

OMB for review and clearance under the Description: Taxpayers will file Form

new Code section 45G. This new section

Paperwork Reduction Act of 1995, 8910 to claim the credit for certain

was added by section 245 of the

Public Law 104–13. Copies of the alternative motor vehicles placed in

American Jobs Creation Act of 2004

submission(s) may be obtained by service after 2005.

(Pub. L. 108–357). The new form

calling the Treasury Bureau Clearance Respondents: Individuals or

provides a means for the eligible

Officer listed. Comments regarding this households; Business or other for-profit;

taxpayers to compute the amount of

information collection should be Not-for-profit institutions; Farms;

credit.

addressed to the OMB reviewer listed Respondents: Business or other for- Federal Government; State, Local or

and to the Treasury Department profit; Tribal Government.

Clearance Officer, Department of the Estimated Total Burden Hours: 2,684 Estimated Total Burden Hours: 65,861

Treasury, Room 11000, 1750 hours. hours.

Pennsylvania Avenue, NW., OMB Number: 1545–1825. OMB Number: 1545–1060.

Washington, DC 20220. Type of Review: Extension. Type of Review: Revision.

DATES: Written comments should be Title: Improving the Accuracy of EITC Title: Application for Withholding for

received on or before July 24, 2006 to be Prepared Returns. Dispositions by Foreign Persons of U.S.

assured of consideration. Form: Form 13388. Real Property Interests.

Description: This postcard will be Form: Form 8288–B.

Internal Revenue Service (IRS)

sent to tax preparers that submitted a Description: Form 8288–B is used to

OMB Number: 1545–0162. mixture of paper and electronic returns apply for a withholding certificate from

Type of Review: Revision. for their clients. The postcard provides IRS to reduce or eliminate the

Title: Credit for Federal Tax Paid on these professionals an opportunity to withholding required by section 1445.

Fuels. acquire additional information about the Respondents: Businesses or other for-

Form: Form 4136. EITC. It is part of a brochure to profit institutions, Individuals or

Description: Internal Revenue Code encourage 100% filing of EITC returns. households.

section 34 allows a credit for Federal Respondents: Business or other for- Estimated Total Burden Hours: 29,256

excise tax for certain fuel uses. This profit; Farms. hours.

form is used to figure the amount of the Estimated Total Burden Hours: 150 Clearance Officer: Glenn P. Kirkland,

income tax credit. The data is used to hours. Internal Revenue Service, Room 6516,

verify the validity of the claim for the OMB Number: 1545–1999. 1111 Constitution Avenue, NW.,

type of nontaxable or exempt use. Type of Review: Extension. Washington, DC 20224. (202) 622–3428.

Respondents: Individuals or Title: Volunteer Return Preparation OMB Reviewer: Alexander T. Hunt,

households; Business or other for-profit. Program Hurricane Katrina Interview Office of Management and Budget,

Estimated Total Burden Hours: and Intake Sheet. Room 10235, New Executive Office

9,822,578 hours. Form: Form 13614K. Building, Washington, DC 20503. (202)

OMB Number: 1545–1569. Description: The complete form is 395–7316.

Type of Review: Revision. used by screeners, preparers, or others

Title: Welfare-to-Work Credit. involved in the return preparation Robert Dahl,

Form: Form 8861. process to more accurately complete tax Treasury PRA Clearance Officer.

Description: Section 51A of the returns of Katrina impacted taxpayers [FR Doc. E6–9855 Filed 6–21–06; 8:45 am]

Internal Revenue code allows employers having low to moderate incomes. The BILLING CODE 4830–01–P

wwhite on PROD1PC61 with NOTICES

VerDate Aug<31>2005 19:08 Jun 21, 2006 Jkt 208001 PO 00000 Frm 00129 Fmt 4703 Sfmt 4703 E:\FR\FM\22JNN1.SGM 22JNN1

You might also like

- Instructions For Form 990: Internal Revenue ServiceDocument24 pagesInstructions For Form 990: Internal Revenue ServiceIRSNo ratings yet

- Consti Coa and LguDocument26 pagesConsti Coa and LguWes ChanNo ratings yet

- Common Questions TaxationDocument5 pagesCommon Questions TaxationChris TineNo ratings yet

- CIR v. COMASERCO - DigestDocument2 pagesCIR v. COMASERCO - DigestMark Genesis RojasNo ratings yet

- US Internal Revenue Service: I1120pc - 1996Document14 pagesUS Internal Revenue Service: I1120pc - 1996IRSNo ratings yet

- US Internal Revenue Service: I1120ric - 1994Document12 pagesUS Internal Revenue Service: I1120ric - 1994IRSNo ratings yet

- G.R. No. 88291 June 8, 1993Document4 pagesG.R. No. 88291 June 8, 1993Angelo FabianNo ratings yet

- Kentucky Tax Registration Application and Instructions: WWW - Revenue.ky - GovDocument28 pagesKentucky Tax Registration Application and Instructions: WWW - Revenue.ky - GovCharles Lamont BrewerNo ratings yet

- Case TaxDocument13 pagesCase TaxGood FaithNo ratings yet

- Tax Bar Qs On General Principles 1987 2019 1Document8 pagesTax Bar Qs On General Principles 1987 2019 1AbseniNalangKhoUyNo ratings yet

- US Internal Revenue Service: I1120ric - 1996Document12 pagesUS Internal Revenue Service: I1120ric - 1996IRSNo ratings yet

- US Internal Revenue Service: I1120rei - 1996Document12 pagesUS Internal Revenue Service: I1120rei - 1996IRSNo ratings yet

- Ruary: - R 4 N F ! R - R .)Document2 pagesRuary: - R 4 N F ! R - R .)SUDHANSHU SINGHNo ratings yet

- Digest NicaDocument8 pagesDigest NicaDanica Irish RevillaNo ratings yet

- Taxation Law Quamto 2017Document32 pagesTaxation Law Quamto 2017Jimcris Posadas HermosadoNo ratings yet

- CIR Vs General FoodsDocument4 pagesCIR Vs General FoodsMonaVargasNo ratings yet

- (CASE DIGEST) CIR v. CA and COMASERCO (G.R. No. 125355) : March 30, 2000Document3 pages(CASE DIGEST) CIR v. CA and COMASERCO (G.R. No. 125355) : March 30, 2000j guevarraNo ratings yet

- Caltex Case StudyDocument4 pagesCaltex Case StudyJoy YuNo ratings yet

- Instructions For Form 1120-L: U.S. Life Insurance Company Income Tax ReturnDocument20 pagesInstructions For Form 1120-L: U.S. Life Insurance Company Income Tax ReturnIRSNo ratings yet

- Alternative Center V ZamoraDocument14 pagesAlternative Center V ZamoraTheodore BallesterosNo ratings yet

- Chapter 10 - Deductions From The Gross Income PDFDocument68 pagesChapter 10 - Deductions From The Gross Income PDFMary CuisonNo ratings yet

- Maceda v. Macaraig (1991) DigestDocument3 pagesMaceda v. Macaraig (1991) DigestEunice IgnacioNo ratings yet

- US Internal Revenue Service: I990sa - 1998Document8 pagesUS Internal Revenue Service: I990sa - 1998IRSNo ratings yet

- Cir vs. Algue DigestDocument1 pageCir vs. Algue DigestTinyssa Paguio50% (2)

- Federal Register-02-28062Document2 pagesFederal Register-02-28062POTUSNo ratings yet

- Adobe Scan Mar 11, 2021Document14 pagesAdobe Scan Mar 11, 2021Jul A.No ratings yet

- WPPF and WWF (As Per Labour Law and Rules Amended Upto Sept 2015) Accountants PerspectiveDocument29 pagesWPPF and WWF (As Per Labour Law and Rules Amended Upto Sept 2015) Accountants PerspectiveFahim Khan0% (1)

- Ra 10963 RRDDocument61 pagesRa 10963 RRDKate EvangelistaNo ratings yet

- Comparative Analysis 8424 and 10963Document31 pagesComparative Analysis 8424 and 10963Rizza Angela Mangalleno100% (2)

- Tax Updates by Atty. Riza LumberaDocument75 pagesTax Updates by Atty. Riza Lumberadmad_shayne50% (2)

- Cta 00 CV 05209 D 1997dec22 Ref-1Document12 pagesCta 00 CV 05209 D 1997dec22 Ref-1Anna Dominique VillanuevaNo ratings yet

- Compendium of Articles of Finance & AccountsDocument11 pagesCompendium of Articles of Finance & AccountsHiraBallabh100% (1)

- Taxation Case DigestDocument15 pagesTaxation Case DigestmimisabaytonNo ratings yet

- Paseo V CIRDocument16 pagesPaseo V CIRzacNo ratings yet

- Instructions For Form 990-T: Internal Revenue ServiceDocument16 pagesInstructions For Form 990-T: Internal Revenue ServiceIRSNo ratings yet

- DISBURSEMENTDocument31 pagesDISBURSEMENTKorinth BalaoNo ratings yet

- US Internal Revenue Service: f8830 - 1995Document2 pagesUS Internal Revenue Service: f8830 - 1995IRSNo ratings yet

- Bir Ruling (Da-560-99) : LexlibDocument3 pagesBir Ruling (Da-560-99) : LexlibRichardNo ratings yet

- Cases Reported: - Third DivisionDocument51 pagesCases Reported: - Third DivisionMohammad BinSiradj AbantasNo ratings yet

- Allowable DeductionsDocument18 pagesAllowable DeductionsZek AngelesNo ratings yet

- Instructions For Form 990-C: Farmers' Cooperative Association Income Tax ReturnDocument16 pagesInstructions For Form 990-C: Farmers' Cooperative Association Income Tax ReturnIRSNo ratings yet

- VAT 5 - CIR vs. Commonwealth MGTDocument1 pageVAT 5 - CIR vs. Commonwealth MGTFrances CruzNo ratings yet

- CIR Vs Commonwealth ManagementDocument3 pagesCIR Vs Commonwealth ManagementGoody100% (1)

- Cir vs. Isabela Cultural Corporation (Icc) : Issue/SDocument5 pagesCir vs. Isabela Cultural Corporation (Icc) : Issue/SMary AnneNo ratings yet

- US Internal Revenue Service: I1041 - 1990Document18 pagesUS Internal Revenue Service: I1041 - 1990IRSNo ratings yet

- Instructions For Form 990-T: Paperwork Reduction Act NoticeDocument12 pagesInstructions For Form 990-T: Paperwork Reduction Act NoticeIRSNo ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon CityDocument19 pagesRepublic of The Philippines Court of Tax Appeals Quezon CityMarcy BaklushNo ratings yet

- Description: Tags: 060600eDocument2 pagesDescription: Tags: 060600eanon-237556No ratings yet

- US Internal Revenue Service: I8656 - 1991Document6 pagesUS Internal Revenue Service: I8656 - 1991IRSNo ratings yet

- RMO No.48-2018Document2 pagesRMO No.48-2018PAMELA KALAWNo ratings yet

- US Internal Revenue Service: I990-Ez - 1996Document32 pagesUS Internal Revenue Service: I990-Ez - 1996IRSNo ratings yet

- CIR vs. Isabela Cultural CorporationDocument32 pagesCIR vs. Isabela Cultural CorporationJuan AntonioNo ratings yet

- Topic 1 Basis of Malaysian TaxationDocument15 pagesTopic 1 Basis of Malaysian TaxationHANIS IZYAN MAT ISANo ratings yet

- Taxation Cases DigestDocument11 pagesTaxation Cases Digestenzoaleno100% (2)

- US Internal Revenue Service: f8830 - 1994Document2 pagesUS Internal Revenue Service: f8830 - 1994IRSNo ratings yet

- Taxation Security Against Oppressive Taxation - The Power To Impose Taxes Is One SoDocument6 pagesTaxation Security Against Oppressive Taxation - The Power To Impose Taxes Is One SoAyana Dela CruzNo ratings yet

- Up Law ComplexDocument10 pagesUp Law ComplexwangruilunNo ratings yet

- USPTO Rejection of Casey Anthony Trademark ApplicationDocument29 pagesUSPTO Rejection of Casey Anthony Trademark ApplicationJustia.comNo ratings yet

- U.S. v. Rajat K. GuptaDocument22 pagesU.S. v. Rajat K. GuptaDealBook100% (1)

- Divorced Husband's $48,000 Lawsuit Over Wedding Pics, VideoDocument12 pagesDivorced Husband's $48,000 Lawsuit Over Wedding Pics, VideoJustia.comNo ratings yet

- Arbabsiar ComplaintDocument21 pagesArbabsiar ComplaintUSA TODAYNo ratings yet

- Signed Order On State's Motion For Investigative CostsDocument8 pagesSigned Order On State's Motion For Investigative CostsKevin ConnollyNo ratings yet

- Stipulation: SAP Subsidiary TomorrowNow Pleading Guilty To 12 Criminal Counts Re: Theft of Oracle SoftwareDocument7 pagesStipulation: SAP Subsidiary TomorrowNow Pleading Guilty To 12 Criminal Counts Re: Theft of Oracle SoftwareJustia.comNo ratings yet

- Amended Poker Civil ComplaintDocument103 pagesAmended Poker Civil ComplaintpokernewsNo ratings yet

- Deutsche Bank and MortgageIT Unit Sued For Mortgage FraudDocument48 pagesDeutsche Bank and MortgageIT Unit Sued For Mortgage FraudJustia.com100% (1)

- Wisconsin Union Busting LawsuitDocument48 pagesWisconsin Union Busting LawsuitJustia.comNo ratings yet

- Emmanuel Ekhator - Nigerian Law Firm Scam IndictmentDocument22 pagesEmmanuel Ekhator - Nigerian Law Firm Scam IndictmentJustia.comNo ratings yet

- Guilty Verdict: Rabbi Convicted of Sexual AssaultDocument1 pageGuilty Verdict: Rabbi Convicted of Sexual AssaultJustia.comNo ratings yet

- Clergy Abuse Lawsuit Claims Philadelphia Archdiocese Knew About, Covered Up Sex CrimesDocument22 pagesClergy Abuse Lawsuit Claims Philadelphia Archdiocese Knew About, Covered Up Sex CrimesJustia.comNo ratings yet

- U.S. v. TomorrowNow, Inc. - Criminal Copyright Charges Against SAP Subsidiary Over Oracle Software TheftDocument5 pagesU.S. v. TomorrowNow, Inc. - Criminal Copyright Charges Against SAP Subsidiary Over Oracle Software TheftJustia.comNo ratings yet

- Rabbi Gavriel Bidany's Federal Criminal Misdemeanor Sexual Assault ChargesDocument3 pagesRabbi Gavriel Bidany's Federal Criminal Misdemeanor Sexual Assault ChargesJustia.comNo ratings yet

- Rabbi Gavriel Bidany's Sexual Assault and Groping ChargesDocument4 pagesRabbi Gavriel Bidany's Sexual Assault and Groping ChargesJustia.comNo ratings yet

- Bank Robbery Suspects Allegedly Bragged On FacebookDocument16 pagesBank Robbery Suspects Allegedly Bragged On FacebookJustia.comNo ratings yet

- Brandon Marshall Stabbing by Wife: Domestic Violence Arrest ReportDocument1 pageBrandon Marshall Stabbing by Wife: Domestic Violence Arrest ReportJustia.comNo ratings yet

- FBI Records: Col. Sanders (KFC - Kentucky Fried Chicken Founder) 1974 Death ThreatDocument15 pagesFBI Records: Col. Sanders (KFC - Kentucky Fried Chicken Founder) 1974 Death ThreatJustia.comNo ratings yet

- Van Hollen Complaint For FilingDocument14 pagesVan Hollen Complaint For FilingHouseBudgetDemsNo ratings yet

- Defamation Lawsuit Against Jerry Seinfeld Dismissed by N.Y. Judge - Court OpinionDocument25 pagesDefamation Lawsuit Against Jerry Seinfeld Dismissed by N.Y. Judge - Court OpinionJustia.comNo ratings yet

- Supreme Court Order Staying TX Death Row Inmate Cleve Foster's ExecutionDocument1 pageSupreme Court Order Staying TX Death Row Inmate Cleve Foster's ExecutionJustia.comNo ratings yet

- Online Poker Indictment - Largest U.S. Internet Poker Cite Operators ChargedDocument52 pagesOnline Poker Indictment - Largest U.S. Internet Poker Cite Operators ChargedJustia.comNo ratings yet

- Court's TRO Preventing Wisconsin From Enforcing Union Busting LawDocument1 pageCourt's TRO Preventing Wisconsin From Enforcing Union Busting LawJustia.comNo ratings yet

- 60 Gadgets in 60 Seconds SLA 2008 June16Document69 pages60 Gadgets in 60 Seconds SLA 2008 June16Justia.com100% (10)

- Lee v. Holinka Et Al - Document No. 4Document2 pagesLee v. Holinka Et Al - Document No. 4Justia.com100% (4)

- Federal Charges Against Ariz. Shooting Suspect Jared Lee LoughnerDocument6 pagesFederal Charges Against Ariz. Shooting Suspect Jared Lee LoughnerWBURNo ratings yet

- Sweden V Assange JudgmentDocument28 pagesSweden V Assange Judgmentpadraig2389No ratings yet

- NY Judge: Tricycle Riding 4 Year-Old Can Be Sued For Allegedly Hitting, Killing 87 Year-OldDocument6 pagesNY Judge: Tricycle Riding 4 Year-Old Can Be Sued For Allegedly Hitting, Killing 87 Year-OldJustia.comNo ratings yet

- OJ Simpson - Nevada Supreme Court Affirms His ConvictionDocument24 pagesOJ Simpson - Nevada Supreme Court Affirms His ConvictionJustia.comNo ratings yet

- City of Seattle v. Professional Basketball Club LLC - Document No. 36Document2 pagesCity of Seattle v. Professional Basketball Club LLC - Document No. 36Justia.comNo ratings yet

- Securingrights Executive SummaryDocument16 pagesSecuringrights Executive Summaryvictor galeanoNo ratings yet

- SMTP/POP3/IMAP Email Engine Library For C/C++ Programmer's ManualDocument40 pagesSMTP/POP3/IMAP Email Engine Library For C/C++ Programmer's Manualadem ademNo ratings yet

- Power & Leadership PWDocument26 pagesPower & Leadership PWdidato.junjun.rtc10No ratings yet

- S1-TITAN Overview BrochureDocument8 pagesS1-TITAN Overview BrochureصصNo ratings yet

- Spoken Word (Forever Song)Document2 pagesSpoken Word (Forever Song)regNo ratings yet

- Catibog Approval Sheet EditedDocument10 pagesCatibog Approval Sheet EditedCarla ZanteNo ratings yet

- Petition For Bail Nonbailable LampaDocument3 pagesPetition For Bail Nonbailable LampaNikki MendozaNo ratings yet

- National Service Training Program 1Document13 pagesNational Service Training Program 1Charlene NaungayanNo ratings yet

- Chapter 8: Organizational LeadershipDocument21 pagesChapter 8: Organizational LeadershipSaludez Rosiellie100% (6)

- PHP Listado de EjemplosDocument137 pagesPHP Listado de Ejemploslee9120No ratings yet

- Timothy L. Mccandless, Esq. (SBN 147715) : Pre-Trial Documents - Jury InstructionsDocument3 pagesTimothy L. Mccandless, Esq. (SBN 147715) : Pre-Trial Documents - Jury Instructionstmccand100% (1)

- Coca-Cola Femsa Philippines, Tacloban PlantDocument29 pagesCoca-Cola Femsa Philippines, Tacloban PlantJuocel Tampil Ocayo0% (1)

- Hybrid and Derivative Securities: Learning GoalsDocument2 pagesHybrid and Derivative Securities: Learning GoalsKristel SumabatNo ratings yet

- Athletic KnitDocument31 pagesAthletic KnitNish A0% (1)

- Chelsea Bellomy ResumeDocument1 pageChelsea Bellomy Resumeapi-301977181No ratings yet

- INA28x High-Accuracy, Wide Common-Mode Range, Bidirectional Current Shunt Monitors, Zero-Drift SeriesDocument37 pagesINA28x High-Accuracy, Wide Common-Mode Range, Bidirectional Current Shunt Monitors, Zero-Drift SeriesrahulNo ratings yet

- Robbins FOM10ge C05Document35 pagesRobbins FOM10ge C05Ahmed Mostafa ElmowafyNo ratings yet

- Strama-Ayala Land, Inc.Document5 pagesStrama-Ayala Land, Inc.Akako MatsumotoNo ratings yet

- Abb PB - Power-En - e PDFDocument16 pagesAbb PB - Power-En - e PDFsontungNo ratings yet

- Class XI Economics 2011Document159 pagesClass XI Economics 2011Ramita Udayashankar0% (1)

- Multigrade Lesson Plan MathDocument7 pagesMultigrade Lesson Plan MathArmie Yanga HernandezNo ratings yet

- 12c. Theophile - de Divers ArtibusDocument427 pages12c. Theophile - de Divers Artibuserik7621No ratings yet

- M. J. T. Lewis - Surveying Instruments of Greece and Rome (2001)Document410 pagesM. J. T. Lewis - Surveying Instruments of Greece and Rome (2001)Jefferson EscobidoNo ratings yet

- Yamaha TW 125 Service Manual - 1999Document275 pagesYamaha TW 125 Service Manual - 1999slawkomax100% (11)

- Clasificacion SpicerDocument2 pagesClasificacion SpicerJoseCorreaNo ratings yet

- UBFHA V S BF HomesDocument11 pagesUBFHA V S BF HomesMonique LhuillierNo ratings yet

- Tradingfxhub Com Blog How To Trade Supply and Demand Using CciDocument12 pagesTradingfxhub Com Blog How To Trade Supply and Demand Using CciKrunal ParabNo ratings yet

- Spelling Power Workbook PDFDocument98 pagesSpelling Power Workbook PDFTinajazz100% (1)

- MYPNA SE G11 U1 WebDocument136 pagesMYPNA SE G11 U1 WebKokiesuga12 TaeNo ratings yet

- SurrealismDocument121 pagesSurrealismLaurence SamonteNo ratings yet