Professional Documents

Culture Documents

Aggregate Demand Aggregate Supply

Uploaded by

Sandesh LokhandeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aggregate Demand Aggregate Supply

Uploaded by

Sandesh LokhandeCopyright:

Available Formats

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

Chapter 13. Aggregate Demand and Aggregate

Supply Analysis

Instructor: JINKOOK LEE

Department of Economics / Texas A&M University

ECON 203 502

Principles of Macroeconomics

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

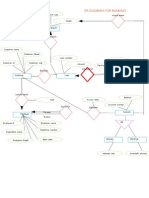

Aggregate Demand and Aggregate Supply

Aggregate demand and aggregate supply model: A model that explains

short-run fluctuations in real GDP and the price level.

In the short run, real GDP and the price level are determined by the

intersection of the aggregate demand curve and the short-run

aggregate supply curve.

The equilibrium real GDP is $14.0 trillion, and the equilibrium price

level is 100.

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

Aggregate Demand and Aggregate Supply

Aggregate demand (AD) curve: A curve that shows the relationship

between the price level and the quantity of real GDP demanded by

households, firms, and the government.

Short-run aggregate supply (SRAS) curve: A curve that shows the

relationship in the short run between the price level and the quantity of real

GDP supplied by firms.

Because we are dealing with the economy as a whole, we need

macroeconomic explanations of...

why the aggregate demand curve is downward sloping,

why the short-run aggregate supply curve is upward sloping,

and why the curves shift.

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

Why Is the Aggregate Demand Curve Downward Sloping?

If we let Y stand for GDP, we have the following relationship:

Y = C + I + G + NX

The aggregate demand curve is downward sloping because a fall in the price

level increases the quantity of real GDP demanded.

To see why, we next look at how changes in the price level affect each

component of aggregate demand, assuming government purchases are not

affected, assuming government purchases are not affected.

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

The Wealth Effect

The Wealth Effect: How a change in the price level affects consumption.

Some of a households wealth, the difference between the value of its

assets and the value of its debts, is held in cash or other nominal assets.

The wealth loses value as the price level rises and gain value as the

price level falls.

When the price level falls, the real value of household wealth rises, and so

will consumption and the demand for goods and services.

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

The Interest-Rate Effect

The Interest-Rate Effect: How a change in the price level affects

investment.

A higher price level increases the interest rate and reduces investment

spending, thereby reducing the quantity of goods and services

demanded.

A lower price level will decrease the interest rate and increase

investment spending, thereby increasing the quantity of goods and

services demanded,

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

The International-Trade Effect

The International-Trade Effect: How a Change in the Price Level Affects

Net Exports.

A higher price level in the United States relative to other countries

causes net exports to fall, reducing the quantity of goods and services

demanded.

A lower price level in the United States relative to other countries

causes net exports to rise, increasing the quantity of goods and services

demanded through the international-trade effect.

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

Shifts of the Aggregate Demand Curve versus Movements along It

The aggregate demand curve tells us the relationship between the price level

and the quantity of real GDP demanded, holding everything else constant.

If the price level changes but other variables that affect the willingness of

households, firms, and the government to spend are unchanged, the

economy will move up or down a stationary aggregate demand curve.

If any variable other than the price level changes, the aggregate demand

curve will shift.

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

The Variables That Shift the Aggregate Demand Curve

Changes in Government Policies

Monetary policy: The actions the Federal Reserve takes to manage

the money supply and interest rates to pursue macroeconomic policy

objectives.

Lower interest rates shift the aggregate demand curve to the right as

consumption and investment spending increase.

higher interest rates shift the aggregate demand curve to the left as

consumption and investment spending decrease.

Fiscal policy: Changes in federal taxes and purchases that are

intended to achieve macroeconomic policy objectives.

An increase in government purchases or a decrease in taxes shifts the

aggregate demand curve to the right

a decrease in government purchases or an increase in taxes shifts the

aggregate demand curve to the left.

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

The Variables That Shift the Aggregate Demand Curve

2

Changes in the Expectations of Households and Firms

If households become more optimistic about their future incomes and

firms become more optimistic about the future profitability of

investment spending, the aggregate demand curve will shift to the right.

Changes in Foreign Variables

If firms and households in other countries buy fewer U.S. goods or if

firms and households in the United States buy more foreign goods, net

exports will fall, and the aggregate demand curve will shift to the left.

If real GDP in the United States increases faster than real GDP in other

countries, net exports will fall.

Net exports will increase if the value of the dollar falls against other

currencies.

An increase in net exports at every price level will shift the aggregate

demand curve to the right.

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

The Variables That Shift the Aggregate Demand Curve

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

The Variables That Shift the Aggregate Demand Curve

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

The Variables That Shift the Aggregate Demand Curve

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

The Long-Run Aggregate Supply Curve

Long-run aggregate supply (LRAS) curve: A curve that shows the

relationship in the long run between the price level and the quantity of real

GDP supplied.

In the long run, the level of real GDP is determined by the number of

workers, the capital stock, and the available technology, none of which

are affected by changes in the price level.

So, in the long run, changes in the price level do not affect the level of

real GDP.

Remember that the level of real GDP in the long run is called potential

GDP, or full-employment GDP.

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

The Long-Run Aggregate Supply Curve

The long-run aggregate supply (LRAS) curve is a vertical line at the

potential level of real GDP.

As the number of workers in the economy increases, more machinery

and equipment are accumulated, and technological change occurs, the

long-run aggregate supply curve shifts to the right.

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

The Short-Run Aggregate Supply Curve

As prices of final goods and services rise, prices of inputs - such as the

wages of workers or the price of natural resources - rise more slowly.

The reason for this is that some firms and workers fail to accurately predict

changes in the price level.

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

The Short-Run Aggregate Supply Curve

There are three common explanations for an upward-sloping SRAS curve

when workers and firms fail to accurately predict the price level:

1

Contracts Make Some Wages and Prices Sticky

Prices or wages are said to be sticky when they do not respond

quickly to changes in demand or supply.

Firms Are Often Slow to Adjust Wages

If firms are slow to adjust wages, a rise in the price level will increase

the profitability of hiring more workers and producing more output

Firms are often slower to cut wages than to increase them.

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

The Short-Run Aggregate Supply Curve

Menu Costs Make Some Prices Sticky

Firms base their prices today partly on what they expect future prices to

be, and changing those prices to account for an unexpected increase in

the price level can be costly.

Menu costs: The costs to firms of changing prices.

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

Shifts of the Short-Run Aggregate Supply Curve versus Movements along It

The short-run aggregate supply curve tells us the short-run relationship

between the price level and the quantity of goods and services firms are

willing to supply, holding constant all other variables.

If the price level changes but other variables are unchanged, the economy

will move up or down a stationary aggregate supply curve;

if any variable other than the price level changes, the aggregate supply

curve will shift.

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

Variables That Shift the Short-Run Aggregate Supply Curve

Increases in the Labor Force and in the Capital Stock

As the labor force and the capital stock grow, firms will supply more

output at every price level, and the short-run aggregate supply curve

will shift to the right.

Technological Change

As positive technological change takes place, the productivity of workers

and machinery increases, which reduces firms costs of production.

It allows them to produce more output at every price level, shifting the

short-run aggregate supply curve to the right.

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

Variables That Shift the Short-Run Aggregate Supply Curve

3

Expected Changes in the Future Price Level

If workers and firms expect the price level to increase by a certain

percentage, the SRAS curve will shift by an equivalent amount, holding

constant all other variables.

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

Variables That Shift the Short-Run Aggregate Supply Curve

Adjustments of Workers and Firms to Errors in Past Expectations

about the Price Level

If workers and firms across the economy are adjusting to the price level

being higher than expected, the SRAS curve will shift to the left.

Unexpected Changes in the Price of an Important Natural Resource

Supply shock An unexpected event that causes the short-run aggregate

supply curve to shift.

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

Variables That Shift the Short-Run Aggregate Supply Curve

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

Variables That Shift the Short-Run Aggregate Supply Curve

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

Long-Run Macroeconomic Equilibrium

In long-run macroeconomic equilibrium, the AD and SRAS curves

intersect at a point on the LRAS curve.

In this case, equilibrium occurs at real GDP of $14.0 trillion and a price

level of 100.

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

Recessions, Expansions, and Supply Shocks

Because the full analysis of the aggregate demand and aggregate supply

model can be complicated, we begin with a simplified case, using two

assumptions:

1

The economy has not been experiencing any inflation.

The price level is currently 100, and workers and firms expect it to

remain at 100 in the future.

The economy is not experiencing any long-run growth.

Potential real GDP is $14.0 trillion and will remain at that level in the

future.

Aggregate Demand

Aggregate Supply

Recession

Macro. Eq. in the Long & the Short Run

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

Recession

In the short run,

A decrease in aggregate demand causes a recession.

In the long run,

It causes only a decrease in the price level.

Economists refer to the process of adjustment back to potential GDP as an

automatic mechanism because it occurs without any actions by the

government.

Aggregate Demand

Aggregate Supply

Expansion

Macro. Eq. in the Long & the Short Run

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

Expansion

In the short run,

an increase in aggregate demand causes an increase in real GDP.

In the long run,

it causes only an increase in the price level.

Stagflation: A combination of inflation and recession, usually resulting

from a supply shock.

Aggregate Demand

Aggregate Supply

Supply Shock

Macro. Eq. in the Long & the Short Run

Aggregate Demand

Aggregate Supply

Macro. Eq. in the Long & the Short Run

Supply Shock

In Panel (a),

A supply shock, such as a large increase in oil prices, will cause a

recession and a higher price level in the short run.

The recession caused by the supply shock increases unemployment and

reduces output.

In panel (b),

Rising unemployment and falling output result in workers being willing

to accept lower wages and firms being willing to accept lower prices.

The short-run aggregate supply curve shifts from SRAS2 to SRAS1 .

Equilibrium moves from point B back to potential GDP and the original

price level at point A.

You might also like

- Public Finance - SyllabusDocument6 pagesPublic Finance - SyllabusJosh RamuNo ratings yet

- Advanced Microeconomics I SyllabusFall2016Sep1SRDocument25 pagesAdvanced Microeconomics I SyllabusFall2016Sep1SRgeekorbit50% (2)

- MB0042-MBA-1st Sem 2011 Assignment Managerial EconomicsDocument11 pagesMB0042-MBA-1st Sem 2011 Assignment Managerial EconomicsAli Asharaf Khan100% (3)

- Principles and Practice of ManagementDocument22 pagesPrinciples and Practice of ManagementShilpa N. Lende100% (4)

- Rostow's TheoryDocument3 pagesRostow's TheoryNazish SohailNo ratings yet

- Module in MicroeconomicsDocument5 pagesModule in Microeconomicshannah mariNo ratings yet

- 10 Principles of EconomicsDocument3 pages10 Principles of EconomicsArlette MovsesyanNo ratings yet

- Ten Principles of Economics: IcroeonomicsDocument24 pagesTen Principles of Economics: IcroeonomicsDuaa TahirNo ratings yet

- Microeconomics AssignmentDocument16 pagesMicroeconomics Assignmentjamila mufazzalNo ratings yet

- External Environment Affecting Business in NigeriaDocument9 pagesExternal Environment Affecting Business in NigeriaKAYODE OLADIPUPONo ratings yet

- Partial and General EquilibriumDocument14 pagesPartial and General EquilibriumkentbnxNo ratings yet

- Monetary Policy of Last 5 YearsDocument28 pagesMonetary Policy of Last 5 YearsPiyush ChitlangiaNo ratings yet

- Awesome Economics Research Paper Topics 2020Document6 pagesAwesome Economics Research Paper Topics 2020Samuel Liël OdiaNo ratings yet

- Evolution of MoneyDocument21 pagesEvolution of MoneyKunal100% (1)

- Information Sheet, Class-8 Economics: Chapter 5: Microeconomics and MacroeconomicsDocument2 pagesInformation Sheet, Class-8 Economics: Chapter 5: Microeconomics and MacroeconomicsSami Sumon100% (1)

- 1 Defining Marketing For The 21st CenturyDocument13 pages1 Defining Marketing For The 21st CenturySomera Abdul Qadir100% (1)

- Principle of Economics LU3: ElasticityDocument47 pagesPrinciple of Economics LU3: ElasticitySHOBANA96No ratings yet

- Risk in Business EnvironmentDocument37 pagesRisk in Business EnvironmentIshita SinglaNo ratings yet

- Profit Maximization and Competitive SupplyDocument4 pagesProfit Maximization and Competitive SupplyRodney Meg Fitz Balagtas100% (1)

- Week5-6: Circular Flow & Quantitative ElementsDocument4 pagesWeek5-6: Circular Flow & Quantitative ElementsMmapontsho TshabalalaNo ratings yet

- Industrial RelationsDocument13 pagesIndustrial Relationsmashion87No ratings yet

- Fiscal PolicyDocument16 pagesFiscal PolicyMar DacNo ratings yet

- International Portfolio InvestmentDocument71 pagesInternational Portfolio InvestmentMomina AyazNo ratings yet

- The IS-LM Model: Equilibrium: Goods and Money Markets Understanding Public PolicyDocument37 pagesThe IS-LM Model: Equilibrium: Goods and Money Markets Understanding Public PolicyShashank Shekhar SinghNo ratings yet

- Demand Analysis PPT MbaDocument24 pagesDemand Analysis PPT MbaBabasab Patil (Karrisatte)0% (1)

- Introduction To Consumer BehaviourDocument28 pagesIntroduction To Consumer BehaviourShafqat MalikNo ratings yet

- Mba Project - ProposalDocument6 pagesMba Project - ProposalJijulal NairNo ratings yet

- PESTLE AnalysisDocument4 pagesPESTLE AnalysisFarhana RomanaNo ratings yet

- Macro Factors Affecting Business EnvironmentDocument15 pagesMacro Factors Affecting Business EnvironmentMonir HossainNo ratings yet

- Consumption, Savings and InvestmentDocument2 pagesConsumption, Savings and InvestmentRIZZA MAE OLANONo ratings yet

- Managerial Economics - Assignment 1Document14 pagesManagerial Economics - Assignment 1api-342063173No ratings yet

- International Marketing AssignmentDocument5 pagesInternational Marketing AssignmentJM GinoNo ratings yet

- Strategic Management & Competitiveness - 1Document49 pagesStrategic Management & Competitiveness - 1kashifNo ratings yet

- Case Study Ratio AnalysisDocument6 pagesCase Study Ratio Analysisash867240% (1)

- Factors That Shape The Company's Strategy: (I) Internal Environment FactorsDocument6 pagesFactors That Shape The Company's Strategy: (I) Internal Environment Factorsmba departmentNo ratings yet

- Three Basic Economic ProblemsDocument2 pagesThree Basic Economic ProblemsrudraarjunNo ratings yet

- Managerial Economics Assignment #1Document3 pagesManagerial Economics Assignment #1Billie MatchocaNo ratings yet

- Concept of Cost in Long Run and EnvelopeDocument21 pagesConcept of Cost in Long Run and Envelopeneha pu100% (1)

- PESTEL AnalysisDocument27 pagesPESTEL AnalysisDeidre Rebello100% (1)

- Fiscal Policy Monetary Policy Lesson PlanDocument24 pagesFiscal Policy Monetary Policy Lesson PlanZemona Sumallo0% (1)

- 3.term PaperDocument14 pages3.term Paperrohitpatil999100% (4)

- Some Points About Research PresentationDocument8 pagesSome Points About Research PresentationHoma Milani100% (4)

- Dfi 306 Public FinanceDocument134 pagesDfi 306 Public FinanceElizabeth MulukiNo ratings yet

- Macro Economics NotesDocument7 pagesMacro Economics NoteskulsoomalamNo ratings yet

- Market StructuresDocument13 pagesMarket Structurespranjalipolekar100% (1)

- Nature and Scope of Managerial Economics MBS First YearDocument15 pagesNature and Scope of Managerial Economics MBS First YearStore Sansar83% (18)

- Entrepreneurial Marketing (Aes 51003) : Prepared For: Prof Madya Noor Hasmini Binti Abd GhaniDocument8 pagesEntrepreneurial Marketing (Aes 51003) : Prepared For: Prof Madya Noor Hasmini Binti Abd GhaniMuhammad Qasim A20D047FNo ratings yet

- Instruments of Monetary Policy and Its ObjectivesDocument4 pagesInstruments of Monetary Policy and Its ObjectivesfarisktsNo ratings yet

- Review Questions & Answers Macro All ChaptersDocument84 pagesReview Questions & Answers Macro All ChaptersHarjinder Pal Singh67% (3)

- ECP5702 MBA ManagerialEconomics ROMANO SPR 16Document4 pagesECP5702 MBA ManagerialEconomics ROMANO SPR 16OmerNo ratings yet

- Inflation LitDocument8 pagesInflation LitAyman FergeionNo ratings yet

- Acc 313Document231 pagesAcc 313Bankole MatthewNo ratings yet

- Aggregate Demand & SupplyDocument11 pagesAggregate Demand & SupplyHeoHamHốNo ratings yet

- Nature of Managerial EconomicsDocument5 pagesNature of Managerial EconomicsgarimaNo ratings yet

- Conduct of Monetary Policy Goal and TargetsDocument12 pagesConduct of Monetary Policy Goal and TargetsSumra KhanNo ratings yet

- Assignment On Strategic Evaluation & ControlDocument13 pagesAssignment On Strategic Evaluation & ControlShubhamNo ratings yet

- Managerial EconomicsDocument16 pagesManagerial EconomicsHarshitPalNo ratings yet

- Policy Stability and Economic Growth: Lessons from the Great RecessionFrom EverandPolicy Stability and Economic Growth: Lessons from the Great RecessionNo ratings yet

- Methodology for Impact Assessment of Free Trade AgreementsFrom EverandMethodology for Impact Assessment of Free Trade AgreementsNo ratings yet

- Agriculture - SandeshDocument12 pagesAgriculture - SandeshSandesh LokhandeNo ratings yet

- Land Reforms - SandeshDocument8 pagesLand Reforms - SandeshSandesh LokhandeNo ratings yet

- Competency Dictionary For The Civil ServicesDocument37 pagesCompetency Dictionary For The Civil ServicesAbhishekTiwariNo ratings yet

- Void of IdeaDocument2 pagesVoid of IdeaSandesh LokhandeNo ratings yet

- CH 13Document46 pagesCH 13SumitAggarwalNo ratings yet

- Vietnam at A Glance 4 Jan 2023Document8 pagesVietnam at A Glance 4 Jan 2023Nguyen Hoang ThoNo ratings yet

- CFA InstituteDocument4 pagesCFA InstituteJaya MuruganNo ratings yet

- Michael Burry Write Ups From 2000Document27 pagesMichael Burry Write Ups From 2000Patrick LangstromNo ratings yet

- Chevron FCFF 4.4.23Document3 pagesChevron FCFF 4.4.23William RomeroNo ratings yet

- Answer Scheme TUTORIAL CHAPTER 4Document13 pagesAnswer Scheme TUTORIAL CHAPTER 4niklynNo ratings yet

- 13 ChartsDocument5 pages13 ChartsLC100% (1)

- A DokumentDocument2 pagesA Dokumentamberjain41No ratings yet

- Opening of A Loan AccountDocument13 pagesOpening of A Loan Accountanilvaddi100% (2)

- Developing The Asian Markets For Non-Performing Assets - India's ExperienceDocument32 pagesDeveloping The Asian Markets For Non-Performing Assets - India's ExperienceRAJESH MAHTO 2058No ratings yet

- Leasing (Compatibility Mode)Document19 pagesLeasing (Compatibility Mode)Sameer ThakurNo ratings yet

- Commerce - Bcom Banking and Insurance - Semester 5 - 2023 - April - Financial Reporting Analysis CbcgsDocument6 pagesCommerce - Bcom Banking and Insurance - Semester 5 - 2023 - April - Financial Reporting Analysis CbcgsVishakha VishwakarmaNo ratings yet

- Zeus MillanDocument7 pagesZeus MillanannyeongNo ratings yet

- Tengse Medical & Agency: Opening BalanceDocument1 pageTengse Medical & Agency: Opening BalanceMahadev TengseNo ratings yet

- Er Diagram For Banking EnterpriseDocument1 pageEr Diagram For Banking EnterpriseShion K Babu50% (2)

- TO Baby Factory: 27 JANUARY, 2019Document3 pagesTO Baby Factory: 27 JANUARY, 2019Aitesam UllahNo ratings yet

- Disbursement Voucher: Appendix 32Document9 pagesDisbursement Voucher: Appendix 32Kieron Ivan Mendoza GutierrezNo ratings yet

- Summer Internship ReportDocument72 pagesSummer Internship Reportyogya sri patibandaNo ratings yet

- Concepts & Conventions in AccountingDocument5 pagesConcepts & Conventions in Accountingpratz dhakateNo ratings yet

- Asset-Liability Management in BanksDocument42 pagesAsset-Liability Management in Banksnike_4008a100% (1)

- Prachi Navghare, 29 ValuationDocument14 pagesPrachi Navghare, 29 ValuationPrachi NavghareNo ratings yet

- Abacus Securities Corp. v. AmpilDocument13 pagesAbacus Securities Corp. v. AmpilHershey Delos SantosNo ratings yet

- Fincfriends PVT LTD: Sub: in Principle Sanction LetterDocument2 pagesFincfriends PVT LTD: Sub: in Principle Sanction LetterDílìp ÎñdúrkãrNo ratings yet

- 1.1 Nature and Purpose of AccountsDocument12 pages1.1 Nature and Purpose of AccountsJustin MarshallNo ratings yet

- Bond ShroutDocument7 pagesBond ShroutScott Ww100% (2)

- The Institution of Engineers (India) : (For Member Technologist Applicants)Document8 pagesThe Institution of Engineers (India) : (For Member Technologist Applicants)dipinnediyaparambathNo ratings yet

- Lesson Plan - Start - Start 3Document12 pagesLesson Plan - Start - Start 3api-455194813No ratings yet

- Naira Redenomination The Nigerians Perspective 2375 4389 1000297Document10 pagesNaira Redenomination The Nigerians Perspective 2375 4389 1000297Kingsley IdogenNo ratings yet

- Arnold Van Den Berg Power Point Jan 29 2020Document60 pagesArnold Van Den Berg Power Point Jan 29 2020Gonzalo Vera MirandaNo ratings yet

- Solutions Paper - TVMDocument4 pagesSolutions Paper - TVMsanchita mukherjeeNo ratings yet

- 67-1-1Document22 pages67-1-1bhaiyarakeshNo ratings yet