Professional Documents

Culture Documents

Fifth Circuit Affirms District Court On Litigation Stay

Uploaded by

Michael LindenbergerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fifth Circuit Affirms District Court On Litigation Stay

Uploaded by

Michael LindenbergerCopyright:

Available Formats

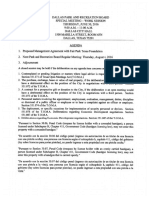

Case: 14-11118

Document: 00513194932

Page: 1

Date Filed: 09/16/2015

IN THE UNITED STATES COURT OF APPEALS

United States Court of Appeals

FOR THE FIFTH CIRCUIT

Fifth Circuit

FILED

No. 14-11118

September 16, 2015

Lyle W. Cayce

Clerk

MIGUEL RISHMAGUE, Individually and on behalf of UCB Properties Trust

and Inversiones Misanisa Trust; ODDE JALIL RISHMAGUE, Individually

and on behalf of UCB Properties Trust and Inversiones Misanisa Trust,

v.

Plaintiffs - Appellants

PAUL D. WINTER, Dependent Executor of the Estate of Robert S. Winter,

substituted in place and stead of ROBERT S. WINTER, deceased; BOWEN,

MICLETTE & BRITT, INCORPORATED; WILLIS OF TEXAS,

INCORPORATED; WILLIS OF COLORADO, INCORPORATED; JAIME

ALEMAN; ALEMAN, GALINDO, CORDERO & LEE; ALEMAN, GALINDO,

CORDERO & LEE TRUST (BVI) LIMITED; AMY S. BARANOUCKY,

Defendants - Appellees

__________________________

Cons w/ 14-11119

BARRY RUPERT; CAROL RUPERT; DAVID QUINTOS; DIANA

DIMITROVA STOILOVA; ELIZABETH RUNKLE, et al

v.

Plaintiffs - Appellants

PAUL D. WINTER, Dependent Executor of the Estate of Robert S. Winter,

substituted in place and stead of ROBERT S. WINTER, deceased ; BOWEN,

MICLETTE & BRITT, INCORPORATED, also known as Bowen Miclette

Descant & Britt, Incorporated; AMY S. BARANOUCKY; WILLIS GROUP

HOLDINGS LIMITED; WILLIS OF COLORADO, INCORPORATED,

Defendants Appellees

Case: 14-11118

Document: 00513194932

Page: 2

Date Filed: 09/16/2015

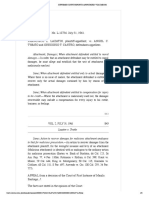

Nos. 14-11118 & 14-11119

Appeals from the United States District Court

for the Northern District of Texas

USDC No. 3:11-CV-2024

USDC No. 3:10-CV-799

Before BENAVIDES, CLEMENT, and HIGGINSON, Circuit Judges.

STEPHEN A. HIGGINSON, Circuit Judge:*

This case is about the district courts continued oversight of the nearly

one hundred actions that are pending in the Northern District of Texas, arising

out of the alleged multi-billion-dollar Ponzi scheme perpetrated by R. Allen

Stanford, over one dozen of which are set for trial in the next year-and-a-half. 1

Shortly after the United States Securities and Exchange Commission (SEC)

filed a civil lawsuit against Stanford and several

Stanford-related

corporations, the district court placed all of the defendants assets in a

receivership. The district court appointed a Receiver, Ralph S. Janvey, to

marshal, conserve, hold, manage and preserve the value of the receivership

estate. 2 SEC v. Stanford Intl Bank Ltd., 424 F. Appx 338, 340 (5th Cir. 2011).

The district court also enjoined [c]reditors and all other persons from [t]he

commencement or continuation, including the issuance or employment of

process, of any judicial, administrative, or other proceeding against the

Receiver, any of the defendants, the Receivership Estate, or any agent, officer,

Pursuant to 5TH CIR. R. 47.5, the court has determined that this opinion should not

be published and is not precedent except under the limited circumstances set forth in 5TH

CIR. R. 47.5.4.

1 See MDL Statistics ReportDistribution of Pending MDL Dockets by District United

States, Judicial Panel on Multidistrict Litigation, (July 15, 2015), www.jpml.uscourts.gov/

sites/jpml/files/Pending_MDL_Dockets_By_District-July-15-2015.pdf.

2 The district court first appointed a receiver on February 17, 2009 and entered an

Amended Order Appointing Receiver on March 12, 2009. On July 19, 2010, the district court

entered a Second Amended Order Appointing Receiver, which is almost identical to the first.

*

Case: 14-11118

Document: 00513194932

Page: 3

Date Filed: 09/16/2015

Nos. 14-11118 & 14-11119

or employee related to the Receivership Estate, arising from the subject matter

of this civil action. The district court also enjoined all persons from [a]ny act

to obtain possession of the Receivership Estate assets as well as [a]ny act to

collect, assess, or recover a claim against the Receiver or that would attach to

or encumber the Receivership Estate.

Before remanding the Plaintiffs-

Appellants lawsuits to state court, the district court explicitly provided that

their lawsuits remain subject to the litigation stay. Plaintiffs-Appellants now

appeal the district courts refusal to lift that litigation stay and to allow their

lawsuits to proceed in state court.

[S]everal courts have recognized the importance of preserving a

receivership courts ability to issue orders preventing interference with its

administration of the receivership property. Schauss v. Metals Depository

Corp., 757 F.2d 649, 654 (5th Cir. 1985); see SEC v. Safety Fin. Serv., Inc., 674

F.2d 368, 372-73 (5th Cir. 1982) ([T]he district court has broad powers and

wide discretion to determine the appropriate relief in an equity receivership.

(citation and internal quotation marks omitted)); see also SEC v. Hardy, 803

F.2d 1034, 1038 (9th Cir. 1986) (A district judge simply cannot effectively and

successfully supervise a receivership and protect the interests of its

beneficiaries absent broad discretionary power.). Emphasizing the district

courts broad authority to issue blanket stays of litigation to preserve the

property placed in receivership pursuant to SEC actions, this court previously

upheld this same litigation stay against similar challenges. Stanford Intl

Bank, 424 F. Appx at 340, 340-42. We are mindful that four years have passed

since that decision. See SEC v. Wencke, 622 F.2d 1363, 1373 (9th Cir. 1980)

(The time at which the motion for relief from the stay is made also bears on

the exercise of the district courts discretion.); SEC v. Wencke, 742 F.2d 1230,

1231 (9th Cir. 1984) (explaining that the relevant issue is one of timing, that

is, when during the course of a receivership a stay should be lifted and claims

3

Case: 14-11118

Document: 00513194932

Page: 4

Date Filed: 09/16/2015

Nos. 14-11118 & 14-11119

allowed to proceed, not whether the stay should be lifted at all). At this time,

however, as the district court continues to receive itself as well as coordinate

and oversee extensive litigation, relating to asset recovery, we cannot say that

the district court abused its discretion in declining to lift the litigation stay.

See Stanford Intl Bank, 424 F. Appx at 340-42; see also SEC v. Kaleta, 530 F.

Appx 360, 361-62, & n.2 (5th Cir. 2013) (emphasizing the necessity of the

litigation stay to protect assets of would-be defendants, parties closely

affiliated with the Receivership Entities, who had personal guarantees to pay

the Receivership Estate); Hardy, 803 F.2d at 1038 (We would be remiss were

we to interfere with a district courts supervision of an equity receivership

absent a clear abuse of discretion.).

The district courts decision is AFFIRMED.

You might also like

- Allen Tate Commencement Address at Univ Minnesota 1967Document9 pagesAllen Tate Commencement Address at Univ Minnesota 1967Michael LindenbergerNo ratings yet

- 2018 Hate Crime Reports Up 12.5 in America's Biggest Metro AreasDocument51 pages2018 Hate Crime Reports Up 12.5 in America's Biggest Metro AreasMichael LindenbergerNo ratings yet

- Bike and Scooter OrdinanceDocument14 pagesBike and Scooter OrdinanceMichael LindenbergerNo ratings yet

- Manafort IndictmentDocument31 pagesManafort IndictmentKatie Pavlich100% (5)

- 9th Circuit Opinion Upholding Travel Order Injunction - June 12 2017Document86 pages9th Circuit Opinion Upholding Travel Order Injunction - June 12 2017Legal InsurrectionNo ratings yet

- Dallas Morning News March 4 1910Document1 pageDallas Morning News March 4 1910Michael LindenbergerNo ratings yet

- In The United States District Court For The Southern District of Texas Houston DivisionDocument17 pagesIn The United States District Court For The Southern District of Texas Houston DivisionMichael LindenbergerNo ratings yet

- Manson Muddle Editorial Page 1970Document1 pageManson Muddle Editorial Page 1970Michael LindenbergerNo ratings yet

- For Release July 10, 2017: Carroll Doherty, Jocelyn Kiley, Bridget JohnsonDocument18 pagesFor Release July 10, 2017: Carroll Doherty, Jocelyn Kiley, Bridget JohnsonWorld Religion NewsNo ratings yet

- Cornyn Writes To Emphasis Importance of NAFTADocument2 pagesCornyn Writes To Emphasis Importance of NAFTAMichael LindenbergerNo ratings yet

- DOJ Sues To Stop AT&T, Time Warner MergerDocument23 pagesDOJ Sues To Stop AT&T, Time Warner MergerCNBC.comNo ratings yet

- Manafort IndictmentDocument31 pagesManafort IndictmentKatie Pavlich100% (5)

- Edwards Brief in Opposition To Stay of Execution RequestDocument30 pagesEdwards Brief in Opposition To Stay of Execution RequestMichael LindenbergerNo ratings yet

- 2017-04-10 Order On Discriminatory IntentDocument10 pages2017-04-10 Order On Discriminatory IntentEddie RodriguezNo ratings yet

- Lindenberger On Sierra LeoneDocument1 pageLindenberger On Sierra LeoneMichael LindenbergerNo ratings yet

- DOJ Report On BPD PDFDocument164 pagesDOJ Report On BPD PDFMichael LindenbergerNo ratings yet

- White House Comey LettersDocument6 pagesWhite House Comey LettersMichael LindenbergerNo ratings yet

- Fate of Supreme Court Nominees Submitted To Senate PDFDocument10 pagesFate of Supreme Court Nominees Submitted To Senate PDFMichael LindenbergerNo ratings yet

- 2016 Tri-Agency ReportDocument27 pages2016 Tri-Agency ReportMichael LindenbergerNo ratings yet

- CBO Analysis and Score On Price-Ryan Healthcare ProposalDocument37 pagesCBO Analysis and Score On Price-Ryan Healthcare ProposalThe Conservative TreehouseNo ratings yet

- Terry Edwards Motion For A Stay of Execution Before The Supreme CourtDocument26 pagesTerry Edwards Motion For A Stay of Execution Before The Supreme CourtMichael LindenbergerNo ratings yet

- Fate of Supreme Court Nominees Submitted To Senate PDFDocument10 pagesFate of Supreme Court Nominees Submitted To Senate PDFMichael LindenbergerNo ratings yet

- TMA THA Comment Regarding Special Waste Disposition RulesDocument3 pagesTMA THA Comment Regarding Special Waste Disposition RulesMichael LindenbergerNo ratings yet

- Foundation Prelim Budget 2017-2019 Detailed - UpdatedDocument5 pagesFoundation Prelim Budget 2017-2019 Detailed - UpdatedMichael LindenbergerNo ratings yet

- Fundraising Letter From Gov. Greg Abbott Promising War On "Soulless Abortion Industry"Document1 pageFundraising Letter From Gov. Greg Abbott Promising War On "Soulless Abortion Industry"Michael LindenbergerNo ratings yet

- Dallas Invitation To Clinton, Trump Re: SolutionsDocument1 pageDallas Invitation To Clinton, Trump Re: SolutionsMichael LindenbergerNo ratings yet

- SHEG Evaluating Information OnlineDocument29 pagesSHEG Evaluating Information OnlineMichael KaplanNo ratings yet

- Parks Board Special Meeting June 30Document1 pageParks Board Special Meeting June 30Michael LindenbergerNo ratings yet

- Voter ID RulingDocument203 pagesVoter ID Rulingdmnpolitics100% (10)

- Fifth Circuit Decision in Fair Park CaseDocument21 pagesFifth Circuit Decision in Fair Park CaseMichael LindenbergerNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Batangas City Ordinance Nullified for Contravening Water CodeDocument1 pageBatangas City Ordinance Nullified for Contravening Water CodePaul Barazon0% (1)

- Mejoff Vs Director of Prisons: FactsDocument10 pagesMejoff Vs Director of Prisons: FactsWindy Awe MalapitNo ratings yet

- Penera Vs Comelec Nov 25Document2 pagesPenera Vs Comelec Nov 25Naldy John Delos SantosNo ratings yet

- Family LawDocument11 pagesFamily LawAadeshRamtekeNo ratings yet

- Search Warrant Instructions)Document4 pagesSearch Warrant Instructions)Shawn Freeman100% (1)

- Transfer Estate TIN Special Power of AttorneyDocument1 pageTransfer Estate TIN Special Power of AttorneyHanan KahalanNo ratings yet

- 2 Diamond Farms, Inc. vs. Southern Philippines Federation of Labor (SPFL) Workers Solidarity of DARBMUPCODocument29 pages2 Diamond Farms, Inc. vs. Southern Philippines Federation of Labor (SPFL) Workers Solidarity of DARBMUPCOacolumnofsmokeNo ratings yet

- Pharmacia and Upjohn Et - Al. vs. AlbaydaDocument13 pagesPharmacia and Upjohn Et - Al. vs. AlbaydaInes Hasta JabinesNo ratings yet

- 80 - Orbeta vs. Sendiong 463 SCRA 200Document8 pages80 - Orbeta vs. Sendiong 463 SCRA 200Mae ThiamNo ratings yet

- Democracy From City States To A Cosmopolitan OrderDocument28 pagesDemocracy From City States To A Cosmopolitan OrderMohmad YousufNo ratings yet

- W 02 (NCC) (W) 561 04 2015Document18 pagesW 02 (NCC) (W) 561 04 2015zamribakar1967_52536No ratings yet

- Amanquiton V People Digest UpdatedDocument2 pagesAmanquiton V People Digest Updatedjustine bayosNo ratings yet

- 36 Rep VsramonaruizDocument2 pages36 Rep VsramonaruizmerleNo ratings yet

- Suspended Sentence for Minors Under Juvenile Justice ActDocument2 pagesSuspended Sentence for Minors Under Juvenile Justice ActNico NuñezNo ratings yet

- Carolina (Carlina) Vda. de Figuracion, Et Al. vs. Emilia Figuracion-GerillaDocument3 pagesCarolina (Carlina) Vda. de Figuracion, Et Al. vs. Emilia Figuracion-GerillaMichelle Montenegro - AraujoNo ratings yet

- Bernadette Hodge, Appellant, v. Department of Homeland Security, Agency. September 15, 2010Document13 pagesBernadette Hodge, Appellant, v. Department of Homeland Security, Agency. September 15, 2010cgreportNo ratings yet

- Vermont Act 91Document42 pagesVermont Act 91AprilMartelNo ratings yet

- WHYMS v. HSBC BANK USA, NATIONAL ASSOCIATION FOR THE BENEFIT OF ACE SECURITIES CORP. DocketDocument2 pagesWHYMS v. HSBC BANK USA, NATIONAL ASSOCIATION FOR THE BENEFIT OF ACE SECURITIES CORP. DocketACELitigationWatchNo ratings yet

- Cassa AppealDocument3 pagesCassa Appealfaith_klepper6777No ratings yet

- ECC vs. CA G.R. No. 115858Document2 pagesECC vs. CA G.R. No. 115858Marianne AndresNo ratings yet

- United States Court of Appeals Fourth CircuitDocument2 pagesUnited States Court of Appeals Fourth CircuitScribd Government DocsNo ratings yet

- Domestic TribunalsDocument4 pagesDomestic TribunalsSacha AliNo ratings yet

- Test 10 MDocument9 pagesTest 10 MritikaNo ratings yet

- Arbaminch University: School of LawDocument36 pagesArbaminch University: School of LawlibenNo ratings yet

- 1896 Anderson How To WinDocument383 pages1896 Anderson How To Winsiva anandNo ratings yet

- Lazatin v. TwañoDocument8 pagesLazatin v. TwañoaitoomuchtvNo ratings yet

- (B29) LAW 104 - Amedo v. Rio (No. L-6870)Document3 pages(B29) LAW 104 - Amedo v. Rio (No. L-6870)m100% (1)

- Web Results: Plea of Guilty To A Lesser Offense - Batas NatinDocument3 pagesWeb Results: Plea of Guilty To A Lesser Offense - Batas NatinGenelle Mae MadrigalNo ratings yet

- KIIT RespondentDocument28 pagesKIIT Respondentkarti_amNo ratings yet

- PD 612Document3 pagesPD 612Abdul Nassif FaisalNo ratings yet