Professional Documents

Culture Documents

Notice: Agency Information Collection Activities Proposals, Submissions, and Approvals

Uploaded by

Justia.comOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notice: Agency Information Collection Activities Proposals, Submissions, and Approvals

Uploaded by

Justia.comCopyright:

Available Formats

20164 Federal Register / Vol. 71, No.

75 / Wednesday, April 19, 2006 / Notices

be used to refer ideas for reducing DEPARTMENT OF THE TREASURY The following paragraph applies to all

taxpayer burden to the TBR for of the collections of information covered

consideration and implementation. Internal Revenue Service by this notice:

An agency may not conduct or

Current Actions: There are no changes Proposed Collection; Comment sponsor, and a person is not required to

being made to the form at this time. Request for Form 8905 respond to, a collection of information

Type of Review: Extension of a unless the collection of information

AGENCY: Internal Revenue Service (IRS),

currently approved collection. displays a valid OMB control number.

Treasury.

Affected Public: Individuals or Books or records relating to a collection

ACTION: Notice and request for

households, Business or other for-profit of information must be retained as long

comments. as their contents may become material

organizations, non-profit institutions,

farms, Federal Government, State, local SUMMARY: The Department of the in the administration of any internal

or tribal governments. Treasury, as part of its continuing effort revenue law. Generally, tax returns and

to reduce paperwork and respondent tax return information are confidential,

Estimated Number of Respondents: as required by 26 U.S.C. 6103.

250. burden, invites the general public and

other Federal agencies to take this Request for Comments

Estimated Number of Respondents: 25 opportunity to comment on proposed

minutes. Comments submitted in response to

and/or continuing information

this notice will be summarized and/or

Estimated Total Annual Burden collections, as required by the

included in the request for OMB

Hours: 62. Paperwork Reduction Act of 1995,

approval. All comments will become a

The following paragraph applies to all Public Law 104–13 (44 U.S.C.

matter of public record. Comments are

of the collections of information covered 3506(c)(2)(A)). Currently, the IRS is

invited on: (a) Whether the collection of

by this notice: soliciting comments concerning Form

information is necessary for the proper

8905, Certification of Intent To Adopt a

An agency may not conduct or performance of the functions of the

Pre-approved Plan.

sponsor, and a person is not required to agency, including whether the

DATES: Written comments should be information shall have practical utility;

respond to, a collection of information received on or before June 19, 2006, to

unless the collection of information (b) the accuracy of the agency’s estimate

be assured of consideration. of the burden of the collection of

displays a valid OMB control number.

ADDRESSES: Direct all written comments information; (c) ways to enhance the

Books or records relating to a collection

to Glenn P. Kirkland, Internal Revenue quality, utility, and clarity of the

of information must be retained as long

Service, room 6516, 1111 Constitution information to be collected; (d) ways to

as their contents may become material Avenue, NW., Washington, DC 20224.

in the administration of any internal minimize the burden of the collection of

FOR FURTHER INFORMATION CONTACT: information on respondents, including

revenue law. Generally, tax returns and

Requests for additional information or through the use of automated collection

tax return information are confidential,

copies of the form and instructions techniques or other forms of information

as required by 26 U.S.C. 6103.

should be directed to R. Joseph Durbala, technology; and (e) estimates of capital

Request for Comments (202) 622–3634, at Internal Revenue or start-up costs and costs of operation,

Service, room 6516, 1111 Constitution maintenance, and purchase of services

Comments submitted in response to Avenue, NW., Washington, DC 20224, to provide information.

this notice will be summarized and/or or through the Internet at Approved: April 10, 2006.

included in the request for OMB RJoseph.Durbala@irs.gov. R. Joseph Durbala,

approval. All comments will become a

SUPPLEMENTARY INFORMATION: IRS Reports Clearance Officer.

matter of public record. Comments are

Title: Certification of Intent To Adopt [FR Doc. E6–5809 Filed 4–18–06; 8:45 am]

invited on: (a) Whether the collection of

a Pre-approved Plan. BILLING CODE 4830–01–P

information is necessary for the proper OMB Number: 1545–2011.

performance of the functions of the Form Number: Form 8905.

agency, including whether the Abstract: Use Form 8905 to treat an DEPARTMENT OF THE TREASURY

information shall have practical utility; employer’s plan as a pre-approved plan

(b) the accuracy of the agency’s estimate and therefore eligible for the six-year Internal Revenue Service

of the burden of the collection of remedial amendment cycle of Part IV of

information; (c) ways to enhance the Revenue Procedure 2005–66, 2005–37 Open Meeting of the Wage &

quality, utility, and clarity of the I.R.B. 509. This form is filed with other Investment Reducing Taxpayer Burden

information to be collected; (d) ways to document(s). (Notices) Issue Committee of the

minimize the burden of the collection of Current Actions: There is no change Taxpayer Advocacy panel

information on respondents, including in the paperwork burden previously AGENCY: Internal Revenue Service (IRS)

through the use of automated collection approved by OMB. This form is being Treasury.

techniques or other forms of information submitted for renewal purposes only. ACTION: Notice.

technology; and (e) estimates of capital Type of Review: Extension of a

or start-up costs and costs of operation, currently approved collection. SUMMARY: An open meeting of the Wage

maintenance, and purchase of services Affected Public: Businesses and other & Investment Reducing Taxpayer

to provide information. for-profit organizations, Farms. Burden (Notices) Issue Committee of the

Estimated Number of Respondents: Taxpayer Advocacy Panel will be

cchase on PROD1PC60 with NOTICES

Approved: April 10, 2006.

29,000. conducted in Detroit MI. The Taxpayer

Glenn P. Kirkland,

Estimated Time Per Respondent: 3 Advocacy Panel is soliciting public

IRS Reports Clearance Officer. hours 49 minutes. comments, ideas and suggestions on

[FR Doc. E6–5808 Filed 4–18–06; 8:45 am] Estimated Total Annual Burden improving customer service at the

BILLING CODE 4830–01–P Hours: 110,490. Internal Revenue Service.

VerDate Aug<31>2005 17:09 Apr 18, 2006 Jkt 208001 PO 00000 Frm 00098 Fmt 4703 Sfmt 4703 E:\FR\FM\19APN1.SGM 19APN1

You might also like

- Federal Register-02-28262Document2 pagesFederal Register-02-28262POTUSNo ratings yet

- Federal Register-02-28261Document1 pageFederal Register-02-28261POTUSNo ratings yet

- Description: Tags: 060600eDocument2 pagesDescription: Tags: 060600eanon-237556No ratings yet

- US Internal Revenue Service: Irb01-30Document27 pagesUS Internal Revenue Service: Irb01-30IRSNo ratings yet

- Federal Register-02-28062Document2 pagesFederal Register-02-28062POTUSNo ratings yet

- Description: Tags: 090204aDocument2 pagesDescription: Tags: 090204aanon-670054No ratings yet

- Federal Register-02-28273Document1 pageFederal Register-02-28273POTUSNo ratings yet

- US Internal Revenue Service: 10274002Document7 pagesUS Internal Revenue Service: 10274002IRSNo ratings yet

- US Internal Revenue Service: Irb06-42Document76 pagesUS Internal Revenue Service: Irb06-42IRSNo ratings yet

- Treasury RFI SOFR FRN3Document3 pagesTreasury RFI SOFR FRN3LaLa BanksNo ratings yet

- US Internal Revenue Service: Irb07-20Document44 pagesUS Internal Revenue Service: Irb07-20IRSNo ratings yet

- IPSAS Vs IFRS PDFDocument6 pagesIPSAS Vs IFRS PDFIrwan WicaksonoNo ratings yet

- IPSAS Vs PDFDocument6 pagesIPSAS Vs PDFIrwan Wicaksono100% (1)

- Description: Tags: 100297aDocument1 pageDescription: Tags: 100297aanon-55798No ratings yet

- 2020-09801 2 PDFDocument6 pages2020-09801 2 PDFchristianNo ratings yet

- Description: Tags: 120302eDocument2 pagesDescription: Tags: 120302eanon-247808No ratings yet

- Accounting Gov ReviewerDocument20 pagesAccounting Gov ReviewerShane TorrieNo ratings yet

- Public Transportation and COVID 19Document11 pagesPublic Transportation and COVID 19DImiskoNo ratings yet

- US Internal Revenue Service: Irb04-49Document74 pagesUS Internal Revenue Service: Irb04-49IRSNo ratings yet

- US Internal Revenue Service: Irb07-17Document60 pagesUS Internal Revenue Service: Irb07-17IRS100% (1)

- US Internal Revenue Service: Irb99-21Document40 pagesUS Internal Revenue Service: Irb99-21IRSNo ratings yet

- Description: Tags: 100207aDocument2 pagesDescription: Tags: 100207aanon-574923No ratings yet

- Frame Work For SSEDocument4 pagesFrame Work For SSEchetdinNo ratings yet

- US Internal Revenue Service: 12256402Document6 pagesUS Internal Revenue Service: 12256402IRSNo ratings yet

- Federal Register / Vol. 87, No. 219 / Tuesday, November 15, 2022 / NoticesDocument4 pagesFederal Register / Vol. 87, No. 219 / Tuesday, November 15, 2022 / NoticesScott FryeNo ratings yet

- US Internal Revenue Service: Irb04-43Document27 pagesUS Internal Revenue Service: Irb04-43IRSNo ratings yet

- LANDCASTERDocument36 pagesLANDCASTERKathleneGabrielAzasHaoNo ratings yet

- Accelerated Depreciation and The Allocation of Income TaxesDocument9 pagesAccelerated Depreciation and The Allocation of Income Taxesyasmine moumene.No ratings yet

- US Internal Revenue Service: Irb07-39Document72 pagesUS Internal Revenue Service: Irb07-39IRSNo ratings yet

- Federal Register-02-28382Document1 pageFederal Register-02-28382POTUSNo ratings yet

- Description: Tags: 100499aDocument1 pageDescription: Tags: 100499aanon-952417No ratings yet

- Description: Tags: 091506aDocument1 pageDescription: Tags: 091506aanon-549919No ratings yet

- US Internal Revenue Service: Irb06-26Document56 pagesUS Internal Revenue Service: Irb06-26IRSNo ratings yet

- Assessment of Charitable Trust and InstitutionDocument52 pagesAssessment of Charitable Trust and InstitutionMayank TripathiNo ratings yet

- US Internal Revenue Service: td8823Document106 pagesUS Internal Revenue Service: td8823IRSNo ratings yet

- NRRI 94-07: Go To Table of ContentsDocument172 pagesNRRI 94-07: Go To Table of Contentspham ngocNo ratings yet

- US Internal Revenue Service: Irb07-19Document128 pagesUS Internal Revenue Service: Irb07-19IRSNo ratings yet

- US Internal Revenue Service: Irb03-47Document78 pagesUS Internal Revenue Service: Irb03-47IRSNo ratings yet

- Accounting-Gov-Reviewer Accounting-Gov-ReviewerDocument20 pagesAccounting-Gov-Reviewer Accounting-Gov-ReviewerReggie AlisNo ratings yet

- The Framework For Assessing Tax Incentives: A Cost-Benefit Analysis ApproachDocument36 pagesThe Framework For Assessing Tax Incentives: A Cost-Benefit Analysis ApproachMCINo ratings yet

- Psds 13 CH 6Document14 pagesPsds 13 CH 6Guido Delos SantosNo ratings yet

- US Internal Revenue Service: Irb03-52Document41 pagesUS Internal Revenue Service: Irb03-52IRSNo ratings yet

- 1 Prof Chauvins Instructions For Bingham CH 4Document35 pages1 Prof Chauvins Instructions For Bingham CH 4Danielle Baldwin100% (2)

- Description: Tags: 120806cDocument2 pagesDescription: Tags: 120806canon-345069No ratings yet

- Description: Tags: 120806bDocument1 pageDescription: Tags: 120806banon-327345No ratings yet

- UACS NotesDocument5 pagesUACS NotesJamila Zarsuelo100% (1)

- Federal Register-02-28263Document1 pageFederal Register-02-28263POTUSNo ratings yet

- FATCA Take 2 - NavigantDocument20 pagesFATCA Take 2 - Navigantivan_mitev9979No ratings yet

- Federal Register-02-28266Document1 pageFederal Register-02-28266POTUSNo ratings yet

- BILLS 116hr8978ih PDFDocument23 pagesBILLS 116hr8978ih PDFMichael ThomasNo ratings yet

- US Internal Revenue Service: Irb06-21Document31 pagesUS Internal Revenue Service: Irb06-21IRSNo ratings yet

- Federal Register-02-28469Document3 pagesFederal Register-02-28469POTUSNo ratings yet

- Solution Manual For Essentials of Accounting For Governmental and Not For Profit Organizations 14th Edition Paul CopleyDocument36 pagesSolution Manual For Essentials of Accounting For Governmental and Not For Profit Organizations 14th Edition Paul Copleyburlaptriad2lyxni100% (47)

- Solution Manual For Essentials of Accounting For Governmental and Not-for-Profit Organizations, 14th Edition, Paul CopleyDocument36 pagesSolution Manual For Essentials of Accounting For Governmental and Not-for-Profit Organizations, 14th Edition, Paul Copleylantautonomyurbeiu100% (18)

- Instructions For Form 990: Internal Revenue ServiceDocument24 pagesInstructions For Form 990: Internal Revenue ServiceIRSNo ratings yet

- BEPS 2.0 - Global Minimum Tax - KPMG CanadaDocument5 pagesBEPS 2.0 - Global Minimum Tax - KPMG CanadaZaid KamalNo ratings yet

- Federal Register 02 28471Document1 pageFederal Register 02 28471POTUSNo ratings yet

- Federal Register-02-28540Document2 pagesFederal Register-02-28540POTUSNo ratings yet

- FA Chapter 1 Branches of Accounting NotesDocument2 pagesFA Chapter 1 Branches of Accounting NotesDarshan S VNo ratings yet

- Accounting Gov ReviewerDocument19 pagesAccounting Gov ReviewerAira Jaimee GonzalesNo ratings yet

- U.S. v. Rajat K. GuptaDocument22 pagesU.S. v. Rajat K. GuptaDealBook100% (1)

- Amended Poker Civil ComplaintDocument103 pagesAmended Poker Civil ComplaintpokernewsNo ratings yet

- Arbabsiar ComplaintDocument21 pagesArbabsiar ComplaintUSA TODAYNo ratings yet

- Divorced Husband's $48,000 Lawsuit Over Wedding Pics, VideoDocument12 pagesDivorced Husband's $48,000 Lawsuit Over Wedding Pics, VideoJustia.comNo ratings yet

- USPTO Rejection of Casey Anthony Trademark ApplicationDocument29 pagesUSPTO Rejection of Casey Anthony Trademark ApplicationJustia.comNo ratings yet

- Emmanuel Ekhator - Nigerian Law Firm Scam IndictmentDocument22 pagesEmmanuel Ekhator - Nigerian Law Firm Scam IndictmentJustia.comNo ratings yet

- U.S. v. TomorrowNow, Inc. - Criminal Copyright Charges Against SAP Subsidiary Over Oracle Software TheftDocument5 pagesU.S. v. TomorrowNow, Inc. - Criminal Copyright Charges Against SAP Subsidiary Over Oracle Software TheftJustia.comNo ratings yet

- Van Hollen Complaint For FilingDocument14 pagesVan Hollen Complaint For FilingHouseBudgetDemsNo ratings yet

- Signed Order On State's Motion For Investigative CostsDocument8 pagesSigned Order On State's Motion For Investigative CostsKevin ConnollyNo ratings yet

- Clergy Abuse Lawsuit Claims Philadelphia Archdiocese Knew About, Covered Up Sex CrimesDocument22 pagesClergy Abuse Lawsuit Claims Philadelphia Archdiocese Knew About, Covered Up Sex CrimesJustia.comNo ratings yet

- Guilty Verdict: Rabbi Convicted of Sexual AssaultDocument1 pageGuilty Verdict: Rabbi Convicted of Sexual AssaultJustia.comNo ratings yet

- Rabbi Gavriel Bidany's Sexual Assault and Groping ChargesDocument4 pagesRabbi Gavriel Bidany's Sexual Assault and Groping ChargesJustia.comNo ratings yet

- Deutsche Bank and MortgageIT Unit Sued For Mortgage FraudDocument48 pagesDeutsche Bank and MortgageIT Unit Sued For Mortgage FraudJustia.com100% (1)

- Brandon Marshall Stabbing by Wife: Domestic Violence Arrest ReportDocument1 pageBrandon Marshall Stabbing by Wife: Domestic Violence Arrest ReportJustia.comNo ratings yet

- Online Poker Indictment - Largest U.S. Internet Poker Cite Operators ChargedDocument52 pagesOnline Poker Indictment - Largest U.S. Internet Poker Cite Operators ChargedJustia.comNo ratings yet

- Defamation Lawsuit Against Jerry Seinfeld Dismissed by N.Y. Judge - Court OpinionDocument25 pagesDefamation Lawsuit Against Jerry Seinfeld Dismissed by N.Y. Judge - Court OpinionJustia.comNo ratings yet

- FBI Records: Col. Sanders (KFC - Kentucky Fried Chicken Founder) 1974 Death ThreatDocument15 pagesFBI Records: Col. Sanders (KFC - Kentucky Fried Chicken Founder) 1974 Death ThreatJustia.comNo ratings yet

- Federal Charges Against Ariz. Shooting Suspect Jared Lee LoughnerDocument6 pagesFederal Charges Against Ariz. Shooting Suspect Jared Lee LoughnerWBURNo ratings yet

- OJ Simpson - Nevada Supreme Court Affirms His ConvictionDocument24 pagesOJ Simpson - Nevada Supreme Court Affirms His ConvictionJustia.comNo ratings yet

- Sweden V Assange JudgmentDocument28 pagesSweden V Assange Judgmentpadraig2389No ratings yet

- City of Seattle v. Professional Basketball Club LLC - Document No. 36Document2 pagesCity of Seattle v. Professional Basketball Club LLC - Document No. 36Justia.comNo ratings yet

- Function Media, L.L.C. v. Google, Inc. Et Al - Document No. 56Document4 pagesFunction Media, L.L.C. v. Google, Inc. Et Al - Document No. 56Justia.com100% (4)

- City of Seattle v. Professional Basketball Club LLC - Document No. 36Document2 pagesCity of Seattle v. Professional Basketball Club LLC - Document No. 36Justia.comNo ratings yet

- NY Judge: Tricycle Riding 4 Year-Old Can Be Sued For Allegedly Hitting, Killing 87 Year-OldDocument6 pagesNY Judge: Tricycle Riding 4 Year-Old Can Be Sued For Allegedly Hitting, Killing 87 Year-OldJustia.comNo ratings yet

- 4 P'sDocument49 pages4 P'sankitpnani50% (2)

- RBS Internship ReportDocument61 pagesRBS Internship ReportWaqas javed100% (3)

- Bahasa Inggris IIDocument15 pagesBahasa Inggris IIMuhammad Hasby AsshiddiqyNo ratings yet

- Independent Power Producer (IPP) Debacle in Indonesia and The PhilippinesDocument19 pagesIndependent Power Producer (IPP) Debacle in Indonesia and The Philippinesmidon64No ratings yet

- Manual Goldfinger EA MT4Document6 pagesManual Goldfinger EA MT4Mr. ZaiNo ratings yet

- Metropolitan Transport Corporation Guindy Estate JJ Nagar WestDocument5 pagesMetropolitan Transport Corporation Guindy Estate JJ Nagar WestbiindduuNo ratings yet

- EOQ HomeworkDocument4 pagesEOQ HomeworkCésar Vázquez ArzateNo ratings yet

- Fatigue Crack Growth Behavior of JIS SCM440 Steel N 2017 International JournDocument13 pagesFatigue Crack Growth Behavior of JIS SCM440 Steel N 2017 International JournSunny SinghNo ratings yet

- VENDOR TBE RESPONSE OF HELIMESH FROM HELITECNICA (Update 11-2)Document1 pageVENDOR TBE RESPONSE OF HELIMESH FROM HELITECNICA (Update 11-2)Riandi HartartoNo ratings yet

- Belt and Road InitiativeDocument17 pagesBelt and Road Initiativetahi69100% (2)

- HPAS Prelims 2019 Test Series Free Mock Test PDFDocument39 pagesHPAS Prelims 2019 Test Series Free Mock Test PDFAditya ThakurNo ratings yet

- Indian Contract ActDocument8 pagesIndian Contract ActManish SinghNo ratings yet

- Involvement of Major StakeholdersDocument4 pagesInvolvement of Major StakeholdersDe Luna BlesNo ratings yet

- 386 - 33 - Powerpoint - Slides - Lipsey - PPT - ch07 (Autosaved)Document46 pages386 - 33 - Powerpoint - Slides - Lipsey - PPT - ch07 (Autosaved)Ayush KumarNo ratings yet

- Mechanizing Philippine Agriculture For Food SufficiencyDocument21 pagesMechanizing Philippine Agriculture For Food SufficiencyViverly Joy De GuzmanNo ratings yet

- Accounting CycleDocument6 pagesAccounting CycleElla Acosta0% (1)

- Traffic Problem in Chittagong Metropolitan CityDocument2 pagesTraffic Problem in Chittagong Metropolitan CityRahmanNo ratings yet

- Democracy Perception Index 2021 - Topline ResultsDocument62 pagesDemocracy Perception Index 2021 - Topline ResultsMatias CarpignanoNo ratings yet

- TCW Act #4 EdoraDocument5 pagesTCW Act #4 EdoraMon RamNo ratings yet

- E Money PDFDocument41 pagesE Money PDFCPMMNo ratings yet

- Project On SurveyorsDocument40 pagesProject On SurveyorsamitNo ratings yet

- Nike Pestle AnalysisDocument10 pagesNike Pestle AnalysisAchal GoyalNo ratings yet

- PT Berau Coal: Head O CeDocument4 pagesPT Berau Coal: Head O CekresnakresnotNo ratings yet

- MHO ProposalDocument4 pagesMHO ProposalLGU PadadaNo ratings yet

- Proposal Tanaman MelonDocument3 pagesProposal Tanaman Melondr walferNo ratings yet

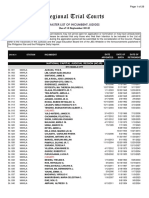

- Regional Trial Courts: Master List of Incumbent JudgesDocument26 pagesRegional Trial Courts: Master List of Incumbent JudgesFrance De LunaNo ratings yet

- Trade Confirmation: Pt. Danareksa SekuritasDocument1 pageTrade Confirmation: Pt. Danareksa SekuritashendricNo ratings yet

- BIR Form 1707Document3 pagesBIR Form 1707catherine joy sangilNo ratings yet

- Module 2Document7 pagesModule 2Joris YapNo ratings yet

- The Global Interstate System Pt. 3Document4 pagesThe Global Interstate System Pt. 3Mia AstilloNo ratings yet

- A Student's Guide to Law School: What Counts, What Helps, and What MattersFrom EverandA Student's Guide to Law School: What Counts, What Helps, and What MattersRating: 5 out of 5 stars5/5 (4)

- Essential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsFrom EverandEssential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsRating: 3 out of 5 stars3/5 (2)

- Legal Writing in Plain English: A Text with ExercisesFrom EverandLegal Writing in Plain English: A Text with ExercisesRating: 3 out of 5 stars3/5 (2)

- The Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyFrom EverandThe Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyRating: 5 out of 5 stars5/5 (2)

- Legal Forms for Starting & Running a Small Business: 65 Essential Agreements, Contracts, Leases & LettersFrom EverandLegal Forms for Starting & Running a Small Business: 65 Essential Agreements, Contracts, Leases & LettersNo ratings yet

- Form Your Own Limited Liability Company: Create An LLC in Any StateFrom EverandForm Your Own Limited Liability Company: Create An LLC in Any StateNo ratings yet

- Commentaries on the Laws of England, Volume 1: A Facsimile of the First Edition of 1765-1769From EverandCommentaries on the Laws of England, Volume 1: A Facsimile of the First Edition of 1765-1769Rating: 4 out of 5 stars4/5 (6)

- Dictionary of Legal Terms: Definitions and Explanations for Non-LawyersFrom EverandDictionary of Legal Terms: Definitions and Explanations for Non-LawyersRating: 5 out of 5 stars5/5 (2)

- Solve Your Money Troubles: Strategies to Get Out of Debt and Stay That WayFrom EverandSolve Your Money Troubles: Strategies to Get Out of Debt and Stay That WayRating: 4 out of 5 stars4/5 (8)

- Legal Forms for Everyone: Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much MoreFrom EverandLegal Forms for Everyone: Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much MoreRating: 3.5 out of 5 stars3.5/5 (2)

- Legal Guide for Starting & Running a Small BusinessFrom EverandLegal Guide for Starting & Running a Small BusinessRating: 4.5 out of 5 stars4.5/5 (9)

- Torts: QuickStudy Laminated Reference GuideFrom EverandTorts: QuickStudy Laminated Reference GuideRating: 5 out of 5 stars5/5 (1)

- LLC or Corporation?: Choose the Right Form for Your BusinessFrom EverandLLC or Corporation?: Choose the Right Form for Your BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Employment Law: a Quickstudy Digital Law ReferenceFrom EverandEmployment Law: a Quickstudy Digital Law ReferenceRating: 1 out of 5 stars1/5 (1)

- Nolo's Deposition Handbook: The Essential Guide for Anyone Facing or Conducting a DepositionFrom EverandNolo's Deposition Handbook: The Essential Guide for Anyone Facing or Conducting a DepositionRating: 5 out of 5 stars5/5 (1)

- So You Want to be a Lawyer: The Ultimate Guide to Getting into and Succeeding in Law SchoolFrom EverandSo You Want to be a Lawyer: The Ultimate Guide to Getting into and Succeeding in Law SchoolNo ratings yet

- Legal Writing in Plain English, Third Edition: A Text with ExercisesFrom EverandLegal Writing in Plain English, Third Edition: A Text with ExercisesNo ratings yet

- How to Make Patent Drawings: Save Thousands of Dollars and Do It With a Camera and Computer!From EverandHow to Make Patent Drawings: Save Thousands of Dollars and Do It With a Camera and Computer!Rating: 5 out of 5 stars5/5 (1)