Professional Documents

Culture Documents

The Philippines Market for Imported Meat and Poultry: A Guide for Canadian Exporters

Uploaded by

kazimirkiraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Philippines Market for Imported Meat and Poultry: A Guide for Canadian Exporters

Uploaded by

kazimirkiraCopyright:

Available Formats

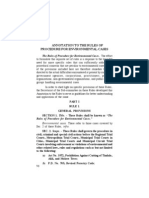

CompetitiveIndustryReporton

thePhilippinesMarketfor

ImportedMeatandPoultry

AGuideforCanadianExporters

*Abbreviated

Preparedfor:

TheEmbassyofCanadainThePhilippines

&

OfficeofSoutheastAsiaRegionalAgriFoodTradeCommissioner

AgricultureandAgriFoodCanada

Preparedby:

Stanton,Emms&Sia

80RafflesPlace,Level3601

UOBPlaza1,

Singapore048624

Tel:+6563347030

Fax:+6562232010

Email:emmsia@pacific.net.sg

Website:http://stantonemmsandsia.foodandbeverage.biz

March2010

ThisreportcontainsmarketinformationcollectedbyStanton,Emms&Sia.

TheGovernmentofCanadaassumesnoliabilityfortheaccuracyandreliabilityofthemarketinformationand

intelligenceprovidedherein.

*Forthecompletereport,CanadiansareinvitedtocontactMs.YvetteBuendiaattheEmbassyofCanadainthe

Philippines:yvette.buendia@international.gc.ca

ThePhilippinesMarketforImportedMeatandPoultry

1.

Introduction

This guide for Canadian exporters is prepared by Stanton, Emms & Sia for the Embassy of

CanadainthePhilippinesandtheASEANAgriFoodTradeCommissioner,AgricultureandAgri

FoodCanada.ItcoversthePhilippinemarketsfor:

fresh/chilledbeef;

frozenbeef;

freshchilledpork;

frozenpork;

frozenpigsoffal;and,

frozenchickenparts.

ItwasresearchedinFebruaryandMarch2010.ThereportwaspreparedtoprovideCanadas

ASEAN based Agrifood Team of Trade Commissioners and Canadian producers and exporters

withanuptodateunderstandingofthetargetmarketandopportunitiesinthePhilippinesfor

selectedCanadianmeatandpoultryproducts.

The main focus of the study is on the size and development trends of the markets for the

selected products mentioned above, the basis of demand, the competitors and the basis of

competition,andfutureprospectsandopportunitiesforCanadianexporters.

Itshouldbenotedthatatthetimeoftheresearch(March2010),therewasnoPhilippinedata

availableonmeatandpoultryimportsforthewholeof2009.

2.

Marketsize,natureofsupplyanddevelopmenttrends

2.1 Overviewofdomesticsupplies

There are currently two datasets available on livestock production in the Philippines. One

shows the industry producing around 3.6 million tonnes of meat and poultry and being

relatively stagnant. The other, that production is around 2.7 million tonnes and has been

growingataround2.7%perannumoverthepast5years(seeChartbelow).

1

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

ProductionofMeatandPoultryinthePhilippines2003to2008

Source:GovernmentofthePhilippines

Thebulkofmeatandpoultryproductioninvolvesporkandchicken(seeChartbelow).

MeatandPoultryProductioninthePhilippinesbyProductTypein2008

Source:GovernmentofthePhilippines

LocallyproducedmeatandpoultryisanimportantpartofthePhilippineseconomy,bothatthe

levelofruralSMEproducersandbigbusinesses,whichhaveaverystrongcompetitiveposition

inthemarket.Thereareindustryreportsofaslumpinmeatandpoultryproductionin2008,

althoughthisisnotreflectedinthedatasetsthatareavailable.

2

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

TradesourcescommentthatthereisnowgrowthindemandforhalalmeatsinthePhilippines

becausetheMuslimpopulation,whichaccountsfor5%oftotalpopulation,isgrowinginsize

andalsoexperiencinghigherincomes.

One of the countrys largest meat processors, Swift Foods (RFM Foods Corporation), has

recently converted all of its sausage manufacturing to halal certified status. The rationale

behindthisconversionalsoincludestheASEANFreeTradeArea(AFTA)andhalalmeatexport

marketsinMalaysia,Singapore,BruneiDarussalamandIndonesiaskeycities.TheMiddleEast

is also regarded as a very important target market, and Swift Foods has already launched its

productsinsomecountriesinthisregion.

According to the government, local meat andpoultry products comprise around 94% of total

consumption.Tradesourcescommentthat2009wasamorepositiveyearforlocalproducers

because the price of inputs, e.g. animal feed, was lower due to the collapse of global

commodityprices.

2.2 Overviewofimportedsuppliesofmeatandpoultry

ThePhilippineshasalargemarketforimportedmeatandpoultryproducts.In2008,itimported

about294,000tonnesofmeatandpoultryproductsvaluedatC$354million,upfrom213,000

tonnesvaluedatC$229millionin2004(seeChartbelow).

TrendsinthePhilippinesImportsofMeatandPoultry2004to2008(AllProducts)

Source:PhilippinesExternalTradeStatisticsforImports

3

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

Overtheperiodbetween2004and2008,importvolumesgrewatanaverageofabout7.5%per

annum,drivenbybuoyanteconomicconditions,strongerendconsumerdemandformeatand

poultry,shortfallsinlocalsuppliesofsomeproductsduetodiseaseoutbreaks,andimproved

marketaccessarisingfromtradeliberalisationbythegovernment.

These trends have taken place against a background where local meat and poultry products,

especially those of the larger businesses and localised SME suppliers, are competitive within

localmarketscenarios.

The state of local competition is reflected in the profile of imports, because imports are

generallyhigherinsegmentswherelocalproducersarechallengedtomeetlocaldemand,e.g.

lowercostbeefandoffal(seeChartbelow)

PhilippineImportsofMeatandPoultryProductsin2008293,734Tonnes

Source:PhilippinesExternalTradeStatisticsforImports

ThePhilippinesisimportingmeatandpoultryproductsfromaround30differentcountriesand

territories(seeChartbelow).

4

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

MainOriginsofthePhilippinesImportsofMeatandPoultryin2008293,734Tonnes

Source:PhilippinesExternalTradeStatisticsforImports

OriginsvaryfromDevelopingWorldcountries,e.g.India,BrazilandChina,tovariousDeveloped

Worldcountries,withCanadaasthemainplayeramongstthemin2008.

2.3 Reviewofmarketsforthespecificproductscoveredbythestudy

2.3.1 Overviewofimports

ThePhilippinesimportsofthespecificproductscoveredbythisstudywerevaluedatatotalof

C$312millionin2008,upfromaboutC$197millionin2004(seeTablebelow).

OverviewofTrendsintheValueofImportsoftheProductsCoveredbythisStudy

Product

2004

2005

2006

2007

2008

C$000

C$000

C$000

C$000

C$000

Fresh/chilledbeef

226

434

402

99

59

Frozenbeef

155,151

142,616

134,679

148,348

219,798

Fresh/chilledpork

10

15

59

Frozenpork

10,506

8,241

4,052

8,863

28,784

Pigsoffal

15,172

15,398

18,064

23,365

33,168

Frozenchickenparts

15,621

20,277

23,456

25,166

29,744

Total

196,686

186,966

180,668

205,900

311,553

Source:Philippineexternaltradestatistics(Officialclassifications)

5

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

Four of the markets covered by this study are large, one very large and all, except the

fresh/chilledmarkets,havebeengrowingoverthepast5years.

Themarketsforfresh/chilledmeatsareverydifficulttodevelopbecauseof:

general price sensitivity in the meat and poultry markets and, for imports, related

weaknessesinthePeso,thelocalcurrency;

strongcompetitionfrommajorbusinessesthatcontrolthemarketforfresh/chilledmeats;

and,

regulatorybarriersandconstraints,especiallyforproductswithTariffRateQuotasinplace.

2.3.2 Fresh/chilledbeef

The Philippines has a very small market for imported fresh/chilled beef. Imports of such

productsamountedtojust29tonnesvaluedatC$59,000in2008,downsubstantiallyfrom206

tonnesvaluedataboutC$226,000in2004(seeTablebelow).

Total

%change

PhilippineImportsofFresh/ChilledBeef2004to2008

2004

2005

2006

2007

Tonnes

Tonnes

Tonnes

Tonnes

206

307

250

31

49.0%

(18.6%)

(87.6%)

2008

Tonnes

29

(6.5%)

Source:Philippinesexternaltradestatistics

Imports of fresh/chilled beef have a minuscule share of the Philippines beef market, which

involved consumption of around 292,000 tonnes in 2008. Trade sources comment that this

demandscenarioishighlyunlikelytochangeintheforeseeablefuture.Thekeyreasonsbeing:

the structure of the Tariff Rate Quota for beef and its operational aspects, which make it

more viable for an importer to bring in frozen beef. More information on the TRQ is

providedinafollowingchapterofthisbriefing;and,

pricesensitivity,sohigherpricedimportedfresh/chilledbeefonlyhaslimitedopportunities.

6

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

Challenges also exist because the Philippines cool chain distribution system has weaknesses,

includinginMetroManila,whichstillmakeimportsoffresh/chilledmeatquiterisky.

TherealityoftheimportedbeefmarkettodayisthatthePhilippinesisprincipallyamarketfor

frozenbeef.

Itshouldbenotedthatimportedbeefisbeingretailedaschilledbeef,alongsidelocalbeefin

thehigherendretailersinMetroManila.Itisnotknownwhetherthisisimportedfresh/chilled

beefordefrostedfrozenbeef.TheTablebelowprovidesasampleofsomeindicativepricesof

someofthebeefcutsavailableinFebruary2010.

IndicativeRetailPricesofChilledBeefinFebruary2010

Product

CountryofOriginand

PesoPerKilogram

C$PerKilogram

Brand

Tenderloin

Local(FarmFresh)

775

17.37

Porterhouse

Local(FarmFresh)

500

11.20

TBone

Local(FarmFresh)

450

10.08

Ribeye

Local(FarmFresh)

435

9.75

Sirloin

Local(Nobrand)

290

6.50

Sirloin

Australia*

378

8.47

Brisket

Local(Nobrand)

212

4.75

Brisket

Australia*

254

5.69

Shank

Local(Nobrand)

200

4.48

Shank

Australia*

264

5.92

Leanbeefcubes

Local(Nobrand)

218

4.88

Leanbeefcubes

Australia*

265

5.94

Mincedbeef**

Local(Nobrand)

169or187

3.79or4.19

Mincedbeef**

Australia*

189or205

4.23or4.59

Striploin,boneless

Australia*

675

15.12

Striploin,boneless

Local(Nobrand)

405

9.07

Shin,bonein

Australia*

340

7.62

Yakinikubeef

USA

229

5.13

*:TheseproductsarenotbeingmarketedusinganAustralianbrandaswouldbethecaseinotherASEANmarkets,

e.g.Singapore(Australiancorporatebrands)orMalaysia(theAussieBeefbrand).

**:Thehigherpriceisforleanmincedbeef.

Source:SupermarketsandhypermarketsinMetroManila

As can be seen from the above, imported beef generally retails at a premium to the price of

local beef, unless the local product is subjected to strong local branding. Trade sources

comment that this situation is possible because there is a perception amongst Filipinos that

foreignbeefisofbetterqualitythanlocalbeef.

7

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

2.3.3 Frozenbeef

Frozenbeefhasthehighestdemandamongstimportsofmeatandpoultry.Thissituationexists

becausetherearemajorconstraintsovertheproductionofbeefinthePhilippines,inamarket

environmentwherethereisalsohighleveldemandfortheproduct.

ThePhilippinesimportsoffrozenbeefamountedto112,066tonnesvaluedatC$219.8million

in 2008, down slightly in an erratic manner from 113,730 tonnes valued at about C$ 155.2

millionin2004(seeTablebelow).

Boneless

Bonein

Carcass or half

carcass

Total

%change

PhilippineImportsofFrozenBeef2004to2008

2004

2005

2006

2007

Tonnes

Tonnes

Tonnes

Tonnes

113,123

95,975

94,075

106,197

588

770

625

1,329

19

113,730

144

96,745

94,844

(14.9)

(2.0)

348

107,874

13.7

2008

Tonnes

109,281

2,468

317

112,066

3.9

Source:Philippinesexternaltradestatistics

Bonelessbeefaccountsforcloseto100%ofimportsinmostyears.

ThePhilippinesisimportingfrozenbeeffromupto18countries,althoughthebulkofimports

come from 6 countries. India is the market leader (see Tables below for market shares and

importtrends).

8

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

ImportsofFrozenBeefbyKeySupplyCountryin2008

112,066Tonnes

Source:PhilippinesExternalTradeStatistics(Allcuts)

TrendsinImportsofFrozenBonelessBeeffromKeySupplyCountries

2004to2008InTonnes

Source:PhilippinesExternalTradeStatistics

Indiahaslongledthemarketbecauseitisthelowestcostsupplierofbeefthatisacceptableto

usersinthePhilippinemeatprocessingindustry,whichhasveryhighvolumedemandforfrozen

beef.

9

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

Trade sources comment that Indian beef (Carabeef) supply fell into shortfalls in 2008, mainly

becauseofboomingdemandfromtheIslamicWorld.Thistippedtheequilibriuminitsmarket

andledtohigherpricesforIndianbeef(seeTablebelow).

India

Australia

Brazil

Canada

NewZealand

USA

Allimports

Tonnes

PhilippineImportsofFrozenBonelessBeef:

ReviewofLandedCostPerTonneandMarketShare2006to2008

2006

2007

2008

C$Per

%Market

C$Per

%Market

C$Per %Market

Tonne

Share

Tonne

Share

Tonne

Share

1,368

65.4

1,365

59.6

2,182

59.0

1,974

2.7

1,952

3.0

1,790

12.3

1,486

28.8

1,327

33.9

1,617

12.0

1,731

0.1

1,127

0.3

1,647

7.4

1,137

1.6

1,071

1.7

1,382

6.2

1,595

0.8

2,118

1.0

2,013

2.5

1,418

100.0

1,370

100.0

1,970

100.0

94,844

107,874

112,066

Source:DerivedfromthePhilippinesExternalTradeStatistics

The market has been growing despite the fact that landed costs of frozen beef from most

countries,includingthemarketleader,India,increasedin2008.Thisgrowthisunderpinnedby

continuedhighdemandfromthemeatprocessorsformanufacturingbeefforuseinlowercost

processedmeatproducts,e.g.cornedbeef,sausagesandburgerpatties.

The demand for Indian beef remained strong because of supply chain inertia and strong

relationships. This prevented a major switch away from Indian beef to other products. The

higherpriceofBrazilianbeefandfreightcostsalsotendedtosupportdemandforIndianbeefin

2008.

ThemainstreamretailchannelsinthePhilippinesurbanareasarenotmajorchannelsforfrozen

beef. The main focus of the meat retailers in these channels is on marketing higher margin

chilledbeef,whichmayincludedefrostedimportedfrozenbeef.

10

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

2.3.4 Fresh/chilledpork

ThePhilippinesmarketforimportedfresh/chilledporkisminusculeandisinherentlyunstable

in its development trends. The countrys official import data indicates that no fresh/chilled

porkwasimportedin2008(seeTablebelow).

Total

PhilippineImportsofFresh/ChilledPork2004to2008

2004

2005

2006

2007

Tonnes

Tonnes

Tonnes

Tonnes

21

11

77

2008

Tonnes

Source:Philippinesexternaltradestatistics

Thismarketishighlyundevelopedbecauseofthewayinwhichporkimportsare:

managed by the government under the Philippines WTO commitments, which include a

TariffRateQuota(TRQ)andMinimumAccessVolumes(MAV);and,

strategisedforbyimportersofmeatimportsundertheTRQsandMAVs.

MoreinformationontheTRQsandMAVsareprovidedinafollowingchapterofthisbriefing.

The other issue that severely undermines the market for imported fresh/chilled pork is the

strength of the local pork producers in their local market and supply chain. As highlighted

earlier,thePhilippinepigindustryproducesinexcessof1.6milliontonnesofporkperannum.

FreshlocalporkisverywidelyavailableinthePhilippinesandthereisabroadbasedperception

ingovernmentandtheindustrythatimportedporkisnotneeded,unlessthereareshortfallsin

supplywhichneedtobefilledtomeetdemand.

Such demand is only filled by frozen pork and offal. Trade sources comment that imported

fresh/chilled pork is not attractive because of its high price (pork is a basic staplemeat), and

complicationsindistributingitundertheconditionsthatprevailinthePhilippinechannels.

TheTablebelowprovidessomeindicativepricesforlocalfreshpork,asretailedinmainstream

supermarketsinFebruary2010.

11

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

RetailPriceofFresh/ChilledPorkinFebruary2010

Product

PesoPerKilogram

C$PerKilogram

Belly

175

3.92

Steak

189to200

4.23to4.48

Chop

168to180

3.76to4.03

Mincedpork

160to175

3.59to3.92

Frontleg(Hock)

147

3.29

Ribs

199to225

4.46to5.04

Source:LeadingsupermarketsinMetroManila

2.3.5 Frozenpork

Philippineimportsoffrozenporkamountedto29,817tonnesvaluedatC$28.8millionin2008,

upinanerraticmannerfrom11,092tonnesvaluedataboutC$10.5millionin2004(seeTable

below).

Boneless

Bonein

Carcassorhalf

carcass

Total

%change

PhilippineImportsofFrozenPork2004to2008

2004

2005

2006

2007

Tonnes

Tonnes

Tonnes

Tonnes

6,912

5,348

3,797

8,419

4,106

1,349

365

1,093

74

11,092

189

6,886

4,162

(37.9%)

(39.6)

55

9,567

129.9

2008

Tonnes

22,980

6,588

249

29,817

211.7

N:negligible.

Source:Philippinesexternaltradestatistics

Trade sources comment that the surge in frozen pork imports since the low point of 2006

resultedfromadiseaseoutbreak,e.g.PRRS.Diseaseisakeydriverinthefrozenporkmarket.

Government officials comment that disease has created a situation where local pork supply

remainedconstrainedin2009andwilllikelybetightinto2011.Whilethisisthecase,imports

willbeindeclinebecausepiginventorieswerealreadyincreasingin2009.

12

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

As can be seen from the data in the Table above, the Philippines demand for frozen pork is

mainly oriented around cuts other than hams, shoulders and other bonein cuts or and

carcassesorhalfcarcasses.Thebulkofdemandisforbonelesscuts,andmainlyvarietymeats.

ThePhilippinesisimportingfrozenporkfromupto18countries,althoughthebulkofimports

come4countries(seeTablesbelowformarketsharesandimporttrends).

ImportsofFrozenPorkbyKeySupplyCountryin2008

29,817Tonnes

Source:PhilippinesExternalTradeStatistics(Allcuts,excludespigsoffal)

TrendsinImportsofFrozenBonelessPorkfromKeySupplyCountries

2004to2008InTonnes

Source:PhilippinesExternalTradeStatistics(excludespigsoffal)

13

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

As can be seen in the Chart above, the 20072008 period saw a surge in imports of frozen

bonelessporkfrom4supplycountries,namelytheUSA,Canada,FranceandGermany.

USA

Canada

France

Germany

Belgium

Spain

Denmark

Netherlands

Allimports

PhilippineImportsofFrozenBonelessPork:

ReviewofLandedCostPerTonneandMarketShare2006to2008

2006

2007

2008

C$Per

%Market

C$Per

%Market

C$Per %Market

Tonne

Share

Tonne

Share

Tonne

Share

1,094

11.1

917

11.9

981

44.8

560

18.0

1,013

21.8

956

20.7

1,655

21.8

1,017

30.7

962

16.7

705

22.3

732

24.7

910

10.0

541

3.8

533

1.3

888

2.0

640

3.2

1,071

1.1

787

2.0

1,346

4.3

1,096

4.2

767

8.1

426

8.0

649

2.6

692

0.8

984

100.0

932

100.0

966

100.0

3,797

8,419

22,980

Source:DerivedfromthePhilippinesExternalTradeStatistics(Excludespigsoffal)

Trade sources comment that North America was able to deal with the boom in demand for

productsin2008becauseofitslargesupplybase,inparticulartheavailabilityofvarietymeats.

ItalsobenefitedfromitsclosetradinglinkswiththePhilippines.TheUSAdominatedthetrade

becauseofitsavailabilityofsupplyandalsoresponsetomeetingdemand.

The market for imported frozen bonein pork saw a similar surge in the 20072008 period,

althoughonlyinvolvingproductsfromtheUSAandCanada(seeChartbelow).

14

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

TrendsinImportsofFrozenBoneinPorkfromKeySupplyCountries

2004to2008(InTonnes)

Source:PhilippinesExternalTradeStatistics(excludespigsoffal)

Thepointsmadeaboveaboutfrozenbonelessporkarealsorelevanttoboneinpork,e.g.pork

ribimports.TheyarethereasonwhyNorthAmericawasabletomaximiseonitsopportunities.

USA

Canada

France

SouthKorea

China

Germany

Denmark

Allimports

PhilippineImportsofFrozenBoneinPork:

ReviewofLandedCostPerTonneandMarketShare2006to2008

2006

2007

2008

C$Per

%Market

C$Per

%Market

C$Per %Market

Tonne

Share

Tonne

Share

Tonne

Share

$920

42.1

866

13.8

968

68.0

$528

13.7

887

79.6

946

27.8

740

2.4

906

1.1

N

1,096

1.1

1,061

0.4

$416

10.4

451

1.5

$1,169

22.6

$860

100.0

871

100.0

966

100.0

N:Negligible.

Source:DerivedfromthePhilippinesExternalTradeStatistics(Excludespigsoffal)

The reality of the market situation in the Philippines is that frozen pork, in particular variety

meats,operateinamarketwherelocalporkdominatesandimportsonlycomeintodealwith

shortages.

15

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

TherewasnofrozenimportedporkcarriedinPhilippinesupermarketsorhypermarketsatthe

timeofmarketobservationsinFebruary2010.

2.3.6 Pigsoffal,frozen

Philippineimportsoffrozenpigsoffalamountedto56,388tonnesvaluedatC$33.2millionin

2008,upfrom24,709tonnesvaluedataboutC$15.2millionin2004(seeTablebelow).

Pigsoffal,not

liver

Pigsliver

Total

%change

PhilippineImportsofPigsOffal2004to2008

2004

2005

2006

Tonnes

Tonnes

Tonnes

19,805

20,657

27,364

4,904

5,160

5,444

24,709

25,817

32,808

4.5

27.1

2007

Tonnes

38,589

6,124

44,713

36.3

2008

Tonnes

49,978

6,410

56,388

26.1

Source:Philippinesexternaltradestatistics

Pigs offal, whether local or imported, is in big demand from households, the food service

industryandthemeatprocessingindustry.

Themarketforimportedfrozenoffalexistsbecausecompetitionforlocalpigsoffalfromthe

abovementioned demand bases causes shortages in supply to exist on a permanent basis.

Importshavegrownbecauseoflargershortagescausedbydiseaseoutbreaksandaconsequent

reductioninthepiginventory.

Frozenpigsoffalisimportedfromalargenumberofsupplycountrieseachyear.Thissituation

existsbecausebuyersinthePhilippinessearchtheworldforthelowestcostproducts.

16

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

ImportsofFrozenPigsOffalbyKeySupplyCountryin2008

56,388Tonnes

Source:PhilippinesExternalTradeStatistics(Alltypesofoffal)

TrendsinImportsofFrozenPigsOffalandVarietyMeats,NotLiver

fromKeySupplyCountries2004to2008(InTonnes)

Source:PhilippinesExternalTradeStatistics

17

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

TrendsinImportsofFrozenPigsLiverfromKeySupplyCountries

2004to2008(InTonnes)

Source:PhilippinesExternalTradeStatistics

Demand has been resilient to increased prices. Imports have grown because pigs offal is a

necessitytokeepthePhilippinesmeatprocessingindustryoperatingathighcapacity.

Canada

USA

France

Germany

Belgium

SouthKorea

Spain

Denmark

Netherlands

Australia

Ireland

Allimports

PhilippineImportsofFrozenPigsOffalandVarietyMeats,NotLiver

ReviewofLandedCostPerTonneandMarketShare2006to2008

2006

2007

2008

C$Per

%Market

C$Per

%Market

C$Per %Market

Tonne

Share

Tonne

Share

Tonne

Share

537

25.6

530

22.0

620

23.4

574

12.8

509

16.0

572

19.8

547

9.9

531

12.0

585

10.1

587

10.7

530

9.7

547

8.8

506

11.6

473

12.6

487

8.8

529

13.5

485

9.1

518

8.3

518

5.4

517

6.8

571

5.9

667

2.5

527

3.9

610

5.8

460

2.6

528

3.1

675

4.6

518

2.6

531

2.0

671

2.0

535

1.0

532

1.3

584

1.5

543

100.0

513

100.0

582

100.0

Source:DerivedfromthePhilippinesExternalTradeStatistics

18

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

Canada

USA

SouthKorea

Australia

Spain

Allimports

PhilippineImportsofFrozenPigsLiver:

ReviewofLandedCostPerTonneandMarketShare2006to2008

2006

2007

2008

C$Per

%Market

C$Per

%Market

C$Per %Market

Tonne

Share

Tonne

Share

Tonne

Share

571

47.4

547

52.5

603

46.2

641

19.3

692

17.3

768

27.2

580

21.7

590

18.4

573

17.0

604

9.7

551

10.7

548

5.5

509

2.5

590

100.0

580

100.0

639

100.0

Source:DerivedfromthePhilippinesExternalTradeStatistics

ThereisnoimportedpigsoffalcarriedinanyPhilippinesupermarkettoday.Localfresh/chilled

pigsliverisretailedataroundPeso115(C$2.58)perkilogram.

2.3.7 Frozenchickenpartsandoffal

ThePhilippinesimportsoffrozenchickenpartsandoffalamountedto44,617tonnesvaluedat

C$29.7millionin2008,upinaconsistentmannerfrom21,206tonnesvaluedataboutC$15.6

millionin2004(seeTablebelow).

Total

%change

PhilippineImportsofFrozenChickenPartsandOffal2004to2008

2004

2005

2006

2007

Tonnes

Tonnes

Tonnes

Tonnes

21,206

25,903

34,262

39,296

22.1

32.2

14.7

2008

Tonnes

44,617

13.5

Source:Philippinesexternaltradestatistics

19

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

Importsoffrozenchickenpartsandoffalcomefromasizeablenumberofcountries,although

only4countriesarethedominantsuppliers(seeChartsbelow).

ImportsofFrozenChickenPartsandOffalbyKeySupplyCountryin2008

44,617Tonnes

Source:PhilippinesExternalTradeStatistics

TrendsinImportsofChickenPartsandOffalfromKeySupplyCountries

2004to2008(InTonnes)

Source:PhilippinesExternalTradeStatistics

20

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

Themarketforfrozenchickenpartsandoffalisunderpinnedbyahighlevelofpricesensitivity.

Theproductsbeingimportedaredeemed:

lowcoststaples(chickenwings),orvalueformoneymeatitems(chickenlegsandthighs);

or,

lowcostfillerstoprocessedmeats(manufacturingchickenmeatandchickenoffal)targeted

atthePhilippinemassmarket,whicharemainlylowerincomegroupconsumers.

Canada

USA

Brazil

Australia

France

Ireland

Denmark

Allimports

PhilippineImportsFrozenChickenPartsandOffal:

ReviewofLandedCostPerTonneandMarketShare2006to2008

2006

2007

2008

C$Per

%Market

C$Per

%Market

C$Per %Market

Tonne

Share

Tonne

Share

Tonne

Share

662

26.2

623

27.0

647

32.7

753

54.1

747

44.9

710

30.0

553

7.9

506

13.1

700

19.6

510

9.5

447

13.0

546

13.1

443

0.1

701

1.8

817

1.4

518

0.3

553

0.6

573

0.3

685

100.0

597

100.0

667

100.0

Source:DerivedfromthePhilippinesExternalTradeStatistics

TherearenoimportedfrozenchickenpartsbeingretailedinthePhilippinesretailchannels.All

chicken sold in supermarkets and hypermarkets are local fresh/chilled products or local fresh

productsthathavebeenfrozenbytheretailer.

The only imported poultry available in supermarkets in Metro Manila are frozen turkey (U.S.

origin)andfrozenduck(U.S.origin).

AsampleofthepricesoflocalfreshchickenpartsandoffalareprovidedintheTablebelow.

21

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

RetailPricesofFresh/ChilledChickeninFebruary2010

Product

PesoPerKilogram C$PerKilogram

Chickendrumstick,fresh/chilled

125to146

2.80to3.27

Chickenthigh,fresh/chilled

120to140

2.69to3.14

Chickenwings,fresh/chilled

146

3.27

Chickenbreast,fresh/chilled

138

3.09

Chickenlivers

128

2.87

Source:SampleofsupermarketsinMetroManila

3.

ThePhilippinesmeatandpoultrydistributionchannels

3.1 Theretailchannels

ThePhilippineshashighlyfragmentedchannelsformeatandpoultry,whichinclude:

thetraditionalchannel,i.e.localisedmeatmarkets;and,

the modern trade, which includes supermarkets, hypermarkets and some cash and carry

stores,e.g.Rustans,SMMart,Robinsons,Landmark,andsomesmalleroperators.

Imported meat and poultry does not pass through the traditional channel. Such products are

niche products in supermarkets, with the key identifiable product being beef. There was no

evidenceofanyimportedfresh/chilledpork,chickenpartsoroffalintheretailmarketatthe

timeofthestudy,i.e.February2010.

Itshouldbenotedthat:

market observations conducted in February 2010 found no evidence of any type of

importedporkorchickeninthemoderntradechannels,incontrasttobeef;

the meat channels in the modern trade are generally oligopolistic in nature. Some key

pointstonoteareasfollows:

o thereiscontroloverthemeattradeinmostofthePhilippinesmodernretailchannels.

This control includes access to shoppers. This is underpinned by the activities of the

localmeatindustryassociation;

22

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

o theretailchannelsaresharedamongstthemainmeatandpoultrycompaniesbecause

ofacooperationagreementbetweenthemasassociationmembers;

o theassociationmembersdonotreallycompeteagainsteachother.Infact,theytryto

avoidcompetingonaheadtoheadbasiswitheachother;

o thissituationkeepsthecurrentretailersoutofthemeattrade.Thebulkoffreshmeat

and poultry (including fresh processed meat) sales are made through Philippine

corporatebrandspecificdelistylepointsofsale,whicharecontrolledbythekeymeat

andpoultrycompanies;

o the association is also a very strong lobby with the government over meat market,

industry,supplychainpolicyandimports;and,

o some of the companies that run meat points of sale in the supermarkets do sell

AustralianandU.Sbeefundertheirownbrandname,ratherthanusingaforeignbrand

nametomarkettheproducts.

Thissituationmakesitverydifficultforforeignbrandstobreakintotheretailmarket,orto

run effective country specific marketing activities in retail channels. The situation in the

PhilippinesisthereforeverydifferenttothatexistinginmostoftheotherASEANmarkets.

Incontrasttothesituationinthefreshmeatchannels,theretaildisplaysoffrozenprocessed

meatsaregenerallymoregenericinvolvinganumberofdifferentPhilippinebrands.

3.2 Thefoodserviceindustry

Thefoodserviceindustryhasverystrongdemandatmassurbanmarketlevel.Thekeychannels

at this level in the market are the fast food and casual dining restaurants, most of which

operateinchains.

Thekeyfastfoodchainsoperateonanationwidebasisandinclude:

JollibeeFoodsCorp,withover600outlets(Annualsales:C$505millionin2008);

McDonalds,whichistheMcDonaldsgroupslargestchaininASEANwithabout300outlets

(Annualsales:C$187million);

KFC,with166outlets;and,

23

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

Somesmallerfastfoodchains,includingWendys(around40outlets)andBurgerKingbrand

(22outlets).

Theseoutletsusearangeofmeatandpoultryitemsontheirmenus.Tradesourcescomment

thattheyareakeydemandbaseforimportedbeefandchickenparts.

The other restaurants that use imported meat and poultry are based in hotels, operate as

chains of outlets, or are single site specialty restaurants, e.g. European, North and South

AmericanandMexicanoutlets.Somekeypointstonoteareasfollows:

accordingtoDepartmentofTourism,thePhilippineshas21DeluxeClass(5star)hotelsand

15FirstClass(4Star)hotels.Allofthesehavesomeformofdemandforimportedmeatand

chicken, especially steaks, including those sourced from the USA, Canada, Australia and

NewZealand.ThesehotelsareusedbytheUSAandAustraliaforpromotionalactivitiesthat

docovermeats,especiallybeef;and

thecasualdiningchainsthatoperateinthePhilippinesincludePancakeHouse(68outlets),

KennyRodgersRoasters(35outlets)andDelifranceBistro(26outlets).Thereareasizeable

number of Americanstyle outlets, e.g. Tony Romas and Racks, that have demand for

steaks,ribsandchicken.

Someotherkeypointstonoteareasfollows:

fresh/chilled beef has its market in high end restaurants, including 4 and 5 star hotels,

foreignbrandedrestaurantchainsandsinglesitehighendrestaurants,e.g.Europeanand

Japanesefoodoutlets.ThisisthemarketthatisbeingtargetedbytheUSA;

there is currently no evidence of fresh/chilled pork or frozen pork in the food service

market.TradesourcesadvisethatU.S.porkhasbeenpromotedinsomeofthehigherend

restaurants,includinghotels,inthepast;

food service buyers are generally price sensitive because of the state of the consumer

market, which is highly price sensitive. Trade sources comment that buyers in the food

serviceindustrywillshiftfromonesourcetoanotheriftheycan,whenpricingchangesand

impactsnegativelyontheprofitabilityoftheirmenu;

24

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

food service companies do not wish to tie themselves to country of origin because this

makes their buyers very inflexible when attempting to buy the lowest priced acceptable

meatorpoultryforuseintheirmenuitems;and,

fastfoodcompanieshavebigdemandforchickendrumsticksofconsistentquality,which

cannotbesatisfiedinsufficientquantitiesbylocalproducers.

3.3 Themeatandmeatprocessingindustry

3.3.1 Thecattle,pigandpoultryindustry

ThePhilippinescattle,pigandpoultryindustryhastwobroadsectorswithinit:

thecommercialsector,whichisrelativelyconcentratedaroundmediumtolargecompanies

withanationalorregional(islandspecific)orientation.

Many of the businesses in this segment are integrated operators and have significant

industrialpowerbasesinthePhilippines,e.g.thegiantSanMiguelCorporation,andsohave

verystrongbargainingpowerinthelocalmarketanddistributionchannels;and,

the backyard sector, which is highly fragmented and localised, and revolves around small

andmicrosizedfamilyownedbusinesses.

The backyard sector rarely interacts with imported meat and poultry because its products

mainlyoperateinthetraditionalmeatmarkets,andnotsupermarketsorhypermarkets.

3.3.2 Themeatandpoultryprocessingindustry

Keyplayersinthemeatandpoultryproductionindustryareintegratedalongthesupplychain

fromfarmstoretailing.

Tradesourcescommentthatthemostimportantdemandbaseforimportedmeatandpoultry

isthePhilippinesprocessedmeatindustry.Somekeypointstonoteareasfollows:

theindustryproduces:

o cannedmeatsandpoultry:cornedbeef,sausages(Viennatype),meatloaf,localready

mealsincans,luncheonmeatandliverspread(apattypeproduct);

25

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

o frozen processed meat and poultry: sausages, chicken nuggets, burger patties and

bacon;and

o fresh/chilledprocessedmeats:sausages,bacon,hamandcornedbeef;

thesausageindustryisusingmixedmeatsinitsproducts,e.g.porkandchicken;

porkskinisusedbysnackproducers,e.g.porkcrackling(friedrind)snacks.Thisindustryis

highlypricesensitivebecauseofitstargetmarket,themassmarketonanationwidebasis;

Bovine variety meats and offal are in big demand due to large shortfalls in local supply.

There is also sizeable demand for pork variety meats and offal, and chicken offal. This

demandcoversawiderangeofmeats,offcuts,byproducts(fats)andoffalsthatarenotin

highvolumedemandinCanada;

corned beef is a massive user of imported beef, offal and fat. It is a captive market for

foreignbovineinputsbecauseitsdemandfaroutstripslocalsupply,andwillcontinuetodo

soinfuture.Liverspreadisabiguserofbeefandporkliverandothervarietymeats.

Traditionally,thereisveryhighdemandforIndianbuffalomeat,butduetohigherpricesof

thisproduct,cornedbeefmanufacturersareusingmorevarietymeatsintheircornedbeef,

e.g.frozencattlehearts.ThisshiftininputshasbeenfacilitatedbyUSMEFanditsmarketing

programs;

chickenoffal(hearts,liversandgizzard)andMDMchickenisindemandaslowpricedinputs

bythemeatprocessingindustry.Latentdemandfortheseproductsisreportedtobevery

big,ifthepriceisright;

asidefrompigskin,mentionedabove,thePhilippinesmeatprocessingindustryhasdemand

formeatfrompigheadsandfeet,pigtails,fat,andthefullrangeofedibleoffals;and

asmentionedearlier,onesausagemanufacturerhasrecentlyalteredstrategysothatitwill

only produce Halal sausages. This is not a new strategy because most, if not all, canned

cornedbeefmadeinthePhilippinesishalalcertified.

SometradesourcesbelievethathalalwillbecomeevenmoreimportantasthePhilippines

meat companies start to interact more with the ASEAN Free Trade Area opportunities.

ExportsofPhilippinecannedprocessedmeatsarealreadyaccessingMalaysiansupermarket

channels.

26

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

4.

ThePhilippinesregulatoryenvironmentforimportedmeatandpoultryinoverview

ThePhilippineshasacomplexandprotectionistregulatoryenvironmentformeatandpoultry.

ThiswasestablishedbyitsGATTUruguayRoundcommitments,whichestablishedtodaysWTO

compliant Tariff Rate Quotas and related tariff structures, Minimum Access Volumes and

SpecialSafeguardsonarangeofsensitiveproducts,includingmeatandpoultry.

TheTablebelowprovidesanoverviewofthePhilippinesMFNtariffsandtheimportdutiesthat

will apply under the recently ratified ASEANAustraliaNew Zealand Free Trade Agreement

(AANZFTA).

HSCode

Description

020110

Carcassesorhalf

carcassesofbovine

animals,freshorchilled

Freshorchilledbovine

cuts,withbonein(excl.

carcassesand1/2

carcasses)

Freshorchilledbovine

meat,boneless

Frozenbovinecarcasses

andhalfcarcasses

Frozenbovinecuts,with

bonein(excl.carcasses

andhalfcarcasses)

Frozen,bonelessmeatof

bovineanimals

Freshorchilledcarcasses

andhalfcarcassesof

swine

Freshorchilledhams,

shouldersandcuts

thereofofswine,with

bonein

Freshorchilledmeatof

swine(excl.carcasses

andhalfcarcasses,and

hams,shouldersandcuts

thereof,withbonein)

020120

020130

020210

020220

020230

020311

020312

020319

TariffRate

Applied

%

10

Active

Quota

TariffRate

OutofQuota

%

ASEANAustralia

NewZealandFTA

%

0%(2012)

10

0%(2012)

10

0%(2012)

10

0%(2012)

10

0%(2012)

10

0%(2012)

30or35

Yes

40

30or35

Yes

40

20%in2012,

phasingdownto

0%in2020.

20%in2012,

phasingdownto

0%in2020.

30or35

Yes

40

Forinquota30%

until2019,then

24%from2020.

Foroutofquota,

40%until2019,

then32%from

2020.

27

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

HSCode

Description

TariffRate

Applied

30or35

Active

Quota

Yes

TariffRate

OutofQuota

40

020321

Frozencarcassesand

halfcarcassesofswine

020322

Frozenhams,shoulders

andcutsthereofof

swine,boneless

30or35

Yes

40

020329

Frozenmeatofswine

(excl.carcassesandhalf

carcasses,andhams,

shouldersandcuts

thereof,boneless)

30or35

Yes

40

020641

Frozenedibleliversof

swine

5or7

020649

Edibleoffalofswine,

frozen(excl.livers)

Frozencutsandedible

offaloffowlsofthe

speciesGallus

domesticus

10

40or5

Yes

40

020714

ASEANAustralia

NewZealandFTA

Forinquota30%

until2019,then

24%from2020.

Foroutofquota,

40%until2019,

then32%from

2020.

Forinquota30%

until2019,then

24%from2020.

Foroutofquota,

40%until2019,

then32%from

2020.

Forinquota30%

until2019,then

24%from2020.

Foroutofquota,

40%until2019,

then32%from

2020.

5%until2014,

then4%into

perpetuity.

0%from2012

ForChickenLivers:

10%in2010,

phasingdownto

0%in2015.

ForWings,Thighs

andOtherOffal:

40%until2019,

then32%from

2020.

Source:PhilippineGovernmentcommitmentstotheWTOandAANZFTA.

Itshouldbenotedthat:

theASEANFreeTradeAreaisnowinfullforce.In2011,themarketwillbefullyopen,i.e.

0% import duty and no nontariff restrictions, to ASEANcontent meat, poultry and

processedmeatsfromalloftheASEANmemberstates.

28

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

There are two different viewpoints about the ASEAN Free Trade Area (AFTA) within the

meatandpoultryindustry:

o onenegative,whichissupportedbyahighdegreeofangeratsuccessivegovernments

foropeningupthemeatandpoultrymarketstoanyformofcompetition;and,

o theotherpositive,withmeatproducersforeseeingnewopportunitiesfortheirproducts

intheotherASEANmemberstates.

Whilethisisthecase,mostPhilippinemeatandpoultryproducershavenotyetstartedto

considertheimplicationsofAFTAontheirindustryortheircompany.Thecompaniesthat

do have AFTA in their strategies are San Miguel Corporation and RFM Corporation/Swift

Foods.

TheTablebelowprovidesanoverviewofthecurrentMinimumAccessVolumesthatstillapply

totheproductsthataredeemedsensitivebythePhilippinegovernment.

MinimumAccessVolumes(MAV)forBeef,PorkandPoultryinthePhilippines

HSGroup

MetricTonnes

0201

Meatofbovineanimals,freshorchilled

5,570

0202

Meatofbovineanimals,frozen

158,502

0203

Meatofswine,fresh,chilledorfrozen

54,210

0207

Meatandedibleoffalofthepoultryof

23,490

headingNo.01.05,fresh,chilledorfrozen

Note:MAVsalsoexistforgoatmeat(notwithinthescopeofthisstudy).

Source:DepartmentofAgriculture,Philippines(February2010)

It should be noted that the Special Safeguards (SSGs) are well entrenched in Philippine

governmentpolicy.TheSSGswouldalmostcertainlybeimplementedifimportsweredeemed

tohaveanegativeimpactofthePhilippinemeatandlivestockindustry.

TradesourcescommentthattheabovereferencedTRQandMAVsmakethemeatandpoultry

marketsthatareaffectedbythemirrationalintermsofthenormalinteractionbetweensupply

anddemandforces.TheMAVallocations,whichenjoythereducedtariffrates,areallocatedto

Philippinecompaniesonanannualbasis.

29

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

Accordingtosometradesources,theallocationsarestillnotwhollytransparentandthereare

occasionswhereitisdifficulttoknowexactlyhowmuchoftheMAVhasbeenused.

It should be noted that the Philippines government has just started a process of a detailed

review of its tariff regime in consultation with its local industries. This exercise, started in

February 2010, and is expected to continue for the next 12 to 18 months, depending on the

levelofdebatewithplayersinthemoresensitiveindustries,e.g.meatandpoultry.

AscanbeseenfromtheaboveTableoftariffs,therearedifferenttariffsarisingfromtheTRQ,

whichalsoapplyundertheAANZFTA.TheAANZFTAdoes,however,providearangeofbenefits

toAustraliaandNewZealand,versusthesituationforCanada.Forexample,by2012,beeffrom

thesetwocountrieswillenjoy0%marketaccess,whencomparedtotheMFNof10%thatwill

applytoCanadianbeef.

Theotherregulatoryprovisionsformeatandpoultryimportedfromcountries,suchasCanada,

arereportedtobequitestraightforward:

the Department of Agricultures Bureau of Animal Industry (BAI) is responsible for

regulatingtheflowofdomesticandimportedanimalsandanimalproductsinthecountry;

anotherDepartmentofAgricultureagency,knownastheNationalMeatInspectionService

(NMIS),isrequiredtoensurethatimportedmeatandmeatproductsareproducedunder

acceptable conditions and systems. This agency liaises with overseas agencies on

permissionsfortheircountrysabattoirs/exporterstotradeinmeat,poultryandoffalwith

thePhilippines;

onlyPhilippineregisteredcompaniesthatareaccreditedbytheDepartmentofAgriculture

as meat importers are permitted to import meat and poultry into the Philippines. These

companieshavetooperatewithintheconfinesoftherelevantTRQandMAVs;and,

an import license is required for all imports of meat, poultry and offal to the Philippines.

ThislicenseispartofthePhilippinesfoodhealthandsafetyproceduresforsuchproducts,

which come into effective operation in the case of animal disease outbreaks in foreign

countries,e.g.atthetimeoftheBSEoutbreakinNorthAmerica.

The accredited importer is required to obtain a Veterinary Quarantine Clearance (VQC)

certificate prior to the importation of meat and meat products into the Philippines. This

clearanceisreportedtoactastheimportlicense.

30

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

5.

Keysuppliersandtheirmarketshares

5.1 Thescenariointhemeatandpoultrymarketanditsimpactoncountryoforigin

Throughoutthisreport,ithasbeenmentionedthatPhilippinebuyerstendtosearchtheworld

forthelowestcostandbestproductfortheirrequirements.Priceisveryimportantbecausethe

Philippinesonlyhasasmallmiddleandupperincomesegmentwithinits86millionpersons,i.e.

around10millionpersons.

Today,demandformeatandpoultryishighlysegmentedandincorporatesarangeofdifferent

productsfromdifferentcountriesoforigin.Thissituationprovidesopportunitiesfor:

premium and better quality, higher priced meats and poultry from the Developed World;

and

lower costalternativemeats andpoultry from the Developing World, e.g. India, and, to a

lesserextent,BrazilandChina.Indiaisthelargestsupplieroftheproductscoveredbythis

studybecauseofthelargervolumesofbeefthatitisexportingtothePhilippines.

5.2 OverviewoftheinvolvementofCanadaanditsmaincompetitors

AscanbeseenfromtheinformationintheTablebelow,Canadaisdoingwellasasupplierof

the meat and poultry products covered by this study. As highlighted earlier in this report,

Canadasupplied20%ofallimportedmeatandpoultryproductsin2008.

ReviewoftheCompetitivePositionofCanadasDirectCompetitorsin2008

Product

Imports

Developing Developed

Top3DevelopedWorldSupplyCountries

World

World*

andTheirMarketShares**

Tonnes

%Share

%Share

Leader***

No2

No3

Beef,fresh

29

The market for fresh/chilled beef is serviced by local suppliers, which

chilled

includesomeverypowerfulandlargelocallyownedmeatcompanies.

70%

30%

Australia

Canada(7%) NewZealand

Beef,frozen

112,066

(13%)

(7%)

31

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

Pork,

fresh/chilled

Pork,frozen

Nil

Themarketforfresh/chilledporkisservicedbylocalsuppliers,which

includesomeverypowerfulandlargelocallyownedmeatcompanies.

29,817

0.4%

99.6%

USA(50%)

Pigsoffal,

56,388

frozen

Chicken

44,617

partsand

offal,frozen

0.5%

99.5%

20%

80%

Canada

(26%)

Canada

(33%)

Canada

(22%)

USA(21%)

France(13%)

USA(30%)

Australia

(13%)

France(9%)

*:OECDcountries.

**:Shareoftotalimports.

***:AmongsttheDevelopedWorldcountries.

Source:PhilippinesExternalTradeStatistics

Itshouldbenotedthatthemainalternative(DevelopingCountry)suppliersarebasedin:

India,forfrozenbeef;and,

Indian beef is supported by its lower price, functionality as a valueformoney meat

manufacturing input, and relationships between exporters and importers, which are

longstanding.Theotherfactorthatisimportantisthehalalstatusofitsmeat,whichisnow

requiredforcornedbeefmanufacturebecauseallcannedcornedbeefproductsmadeinthe

Philippinesarehalalcertified;and,

Brazilforfrozenchickenpartsandoffal.

Thesetwocountries,andChina(stillaminorplayertoday),haveadisruptiveinfluenceinthe

market. Trade sources comment that their products are viewed as OK, although there are

someconcernsaboutthem,whicharenotgenerallyspokenabout.Thekeysellingpointisprice

andacceptablequality.

32

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

6.

ConclusionforCanadaanditsexporters

6.1 Growthforecastsandscenariosforimportedmeatandpoultry

Producersofmeatandpoultryaregenerallypositiveaboutthedemandfortheirproductsover

thenext3to5years.Atpresent,therearesomeshortertermconcernsabout:

therealimpactoftheglobaleconomiccrisisonthePhilippinesintothelongerterm.

Tradesourcescommentthatthishasnotbeenrevealedyet,especiallytheimpactofChinas

economicpositionandpoweronthePhilippinesindustry,jobs,exportearningsandinward

investments;and,

theoutcomeofthe2010Philippinepresidentialelectiononfuturegovernmentpoliciesand

developmentoftheeconomy.

There are some mixed opinions on this issue, although the main concern is that change

could undermine the positive changes that have been seen in the broader economy over

thepast5years.ThishasbeenaperiodwhenthePhilippinesexperiencedthefastestrates

ofeconomicgrowthinitsrecenthistory.

Themeatandpoultryprocessors,foodserviceandretailersgenerallybelievethatthenext3to

5 years will be positive for their businesses, albeit under conditions of continuing high price

sensitivity.

Themaingrowthdriversarecitedas:

naturalpopulationgrowth,whichwillbeveryimportantforlowerpricedcutsandproducts;

and

economicgrowthbasedoncurrentforecasts,whichsuggestthatthePhilippineswillgrowat

ratesofbetween3%and5%perannumoverthenext3years,subjecttotheoutcomeof

the Presidential election and situation regarding periodic major natural disasters, e.g.

typhoons,earthquakes,etc.

33

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

Meatimportersbelievethattherewillcontinuetobeshortfallsinlocalsupplyofbeef(major

shortfall),porkvarietymeatsandpigsoffal,andchickenpartsandoffal.This,combinedwith

theabovedrivers,andthenewFTAs,willprovidesolidsupportforhighervolumesofimports.

Whilethegovernmentispromotingtheproductionofmoremeatandpoultry,andinvestments

are going into new inventories, demand will outstrip supply, especially for inputs to the

processed meats that are consumed by the mass market, i.e. the C and D socio economic

groups(asreferencedearlierinthisreport).

WhiletheASEANFreeTradeAreaanditsnextstagedevelopment,namelytheASEANEconomic

Community, could start to alter competitive scenarios in some segments of the Philippines

foodindustry,itisunknownwhethertheseFTAswillhavemajorshortormediumtermimpacts

onthePhilippinesmeatandpoultryindustry,i.e.asademandbaseforimportedmanufacturing

meats.

Changemaycomefaster,iftheretailindustryisliberalisedandnewforeigninvestmententers

it. Foreign retailers would almost certainly seek new sourcing opportunities arising from the

FTAs.

Theexistingindustryappearstohavesufficientpowertodefenditselfagainstlargeimportsof

meat and poultry from the other ASEAN countries. Additionally, there are weaknesses in the

ASEAN pig and cattle industries that undermine a major reorientation towards exports on an

ASEANregionalbasis.

Having stated this, it is, however, possible that some AFTA threats might develop for the

Philippineschickenindustryfromthestrong,wellorganisedandindustrialisedpoultryindustry

inThailand,althoughatthepresenttimethisindustryisstillfocusedelsewhere.

DemandformeatandpoultryinthebroaderPhilippinesmarketisforecastbytradesourcesto

growatbetween3%and7%perannumoverthenext3to5years,dependingonthestateof

economicgrowthoverthisperiod.

The TRQ and MAV is likely to continue in place for nonASEAN content meat, e.g. Canadian

products,overthenext3to5years,unlessthenewPresidentdecidestochangetoplinepolicy.

This will still impact negatively on the ability of Canadian exporters to initiate supply push

marketingactivitiesinthePhilippines.

Whilethisisthecase,demandwillstillexistfromimporterswhorequireproductsfor:

34

Stanton,Emms&Sia(March2010)

ThePhilippinesMarketforImportedMeatandPoultry

inputstotheirprocessingplants;and,

itemsforthefoodserviceindustry.

Canadianproducerswithotherproductsrelatedtoopportunitiesinthemarketsprofiledinthis

report,andwho would like moremarket information or contacts, maycontact the AgriFood

Trade Commissioner at the Embassy of Canada in the Philippines at: infocentre

manila@international.gc.ca.

35

Stanton,Emms&Sia(March2010)

You might also like

- Tuesday, July 27, 2010: Featured Articles Philippines - Hog Industry UpdatesDocument2 pagesTuesday, July 27, 2010: Featured Articles Philippines - Hog Industry UpdateskheymiNo ratings yet

- Philippines' Rice Trade Policy and Tariffication LawDocument5 pagesPhilippines' Rice Trade Policy and Tariffication LawJan Marinel A. SerinoNo ratings yet

- GAIN Report: United Arab Emirates Poultry and Products Annual Poultry Meat Report 2003Document11 pagesGAIN Report: United Arab Emirates Poultry and Products Annual Poultry Meat Report 2003Aziz MalikNo ratings yet

- By 2 Min Read: Philippines Cuts Pork Tariffs To Address Supply ShortageDocument30 pagesBy 2 Min Read: Philippines Cuts Pork Tariffs To Address Supply ShortageAlvin Jae MartinNo ratings yet

- Thailand's Diverse Snack Foods Market Offers Opportunities for US ExportersDocument36 pagesThailand's Diverse Snack Foods Market Offers Opportunities for US ExportersJiral Patel100% (1)

- Outline PoultryDocument35 pagesOutline PoultrypriilangoNo ratings yet

- Rice Smuggling and Its Effects To The Economic Growth in The PhilippinesDocument16 pagesRice Smuggling and Its Effects To The Economic Growth in The PhilippinesRegine May Urbina TadlasNo ratings yet

- The Fresh Fruit and Vegetable Market in The PhilippinesDocument20 pagesThe Fresh Fruit and Vegetable Market in The PhilippinesJanelle Dela CruzNo ratings yet

- Cabrera, Jo Aliage G. BSA 2-1 Lab Exercise 1Document6 pagesCabrera, Jo Aliage G. BSA 2-1 Lab Exercise 1Jo AliageNo ratings yet

- Fanijo Poultry-Fesibility Study and Posible OutcomeDocument51 pagesFanijo Poultry-Fesibility Study and Posible OutcomeSamuel Fanijo100% (2)

- Export Fruit N VegDocument10 pagesExport Fruit N VegMisbahMoidNo ratings yet

- GAIN Report: Saudi Arabia Poultry and Products Annual 2004Document9 pagesGAIN Report: Saudi Arabia Poultry and Products Annual 2004Aziz MalikNo ratings yet

- Food and Agricultural Import Regulations and Standards Country Report - Addis Ababa - Ethiopia - 12-31-2019Document20 pagesFood and Agricultural Import Regulations and Standards Country Report - Addis Ababa - Ethiopia - 12-31-2019Tesfaye NokoNo ratings yet

- Philippine Corn Industry Supply AnalysisDocument4 pagesPhilippine Corn Industry Supply Analysishgciso50% (2)

- Jornal International BHPDocument4 pagesJornal International BHPAwan UyungNo ratings yet

- FEC Approves N348Document30 pagesFEC Approves N348Hussein Ibrahim GebiNo ratings yet

- 21DM225 Niharika Chandan GbeDocument16 pages21DM225 Niharika Chandan GbeAlisha VermaNo ratings yet

- PALOMPO - Political Economy of Quantitative Restriction On Rice Importation and Its Implication To Phiippine Rice SectorDocument15 pagesPALOMPO - Political Economy of Quantitative Restriction On Rice Importation and Its Implication To Phiippine Rice SectorMariella PalompoNo ratings yet

- Poultry Industry - Meeting TheDocument4 pagesPoultry Industry - Meeting TheOriginalo VersionaNo ratings yet

- Commodities - COMMODITY AND TRADE ISSUESDocument4 pagesCommodities - COMMODITY AND TRADE ISSUESMilling and Grain magazineNo ratings yet

- Poultry Production Group 1 ZariaDocument27 pagesPoultry Production Group 1 ZariaSagir Musa SaniNo ratings yet

- PA 105 - Final PresentationDocument39 pagesPA 105 - Final PresentationRafael Antonio LopezNo ratings yet

- India's Agriculture Export Policy FrameworkDocument31 pagesIndia's Agriculture Export Policy FrameworkRushiNo ratings yet

- DebateDocument8 pagesDebatejohnNo ratings yet

- Activity 2 - Industry StationerDocument7 pagesActivity 2 - Industry StationerKrizza Camelle CalipusanNo ratings yet

- Why Is Africa Food ImporterDocument89 pagesWhy Is Africa Food Importerpurple0123No ratings yet

- Fisheries Profile 2005Document67 pagesFisheries Profile 2005MariaCruzNo ratings yet

- Agmgt 2105 Lab Exer 2Document2 pagesAgmgt 2105 Lab Exer 2joshuaNo ratings yet

- Industry Overview: Section B: Food Processing IndustryDocument6 pagesIndustry Overview: Section B: Food Processing IndustryProf C.S.PurushothamanNo ratings yet

- GAIN Report: Indonesia Grain and Feed Feed Situation 2007Document8 pagesGAIN Report: Indonesia Grain and Feed Feed Situation 2007Aji GunawanNo ratings yet

- Tilapia Market Trend and ProspectsDocument10 pagesTilapia Market Trend and Prospectsganahira992No ratings yet

- Tonga Agriculture Sector Plan SummaryDocument16 pagesTonga Agriculture Sector Plan SummaryAbu SaleahNo ratings yet

- IV. Trade Policies by Sector (1) O: WT/TPR/S/144 Trade Policy ReviewDocument30 pagesIV. Trade Policies by Sector (1) O: WT/TPR/S/144 Trade Policy ReviewJIGNESH125No ratings yet

- The Impact of Economic Crisis On Livestock Industry in IndonesiaDocument34 pagesThe Impact of Economic Crisis On Livestock Industry in IndonesiaoeamaoesahaNo ratings yet

- Livestock Sector ProfileDocument7 pagesLivestock Sector ProfileKalpesh RathodNo ratings yet

- Business Studies MaterialDocument20 pagesBusiness Studies MaterialmwalepersuesNo ratings yet

- Meat Processing ManualDocument93 pagesMeat Processing ManualRenalyn ElmidoNo ratings yet

- Chinese As Low As: Color SorterDocument7 pagesChinese As Low As: Color SorterMujahid AliNo ratings yet

- Agro Sector Rough 1Document4 pagesAgro Sector Rough 1Tonmoy Dash100% (1)

- Yeasrib Hassan BUS 685 Term Paper PDFDocument13 pagesYeasrib Hassan BUS 685 Term Paper PDFYeasrib hassanNo ratings yet

- Indian Poultry ScenarioDocument54 pagesIndian Poultry ScenarioSagar J. ChavanNo ratings yet

- Scientia MARDI - Vol 004 - February 2015Document12 pagesScientia MARDI - Vol 004 - February 2015MARDI Scribd75% (4)

- Philippines international trade policies for food and plant productsDocument3 pagesPhilippines international trade policies for food and plant productslove meNo ratings yet

- Duck Production 2021Document18 pagesDuck Production 2021J-Maris BillonesNo ratings yet

- Poultry Farming Innovations in BamendaDocument27 pagesPoultry Farming Innovations in BamendaPatience Nji MugahNo ratings yet

- Aquaculture PhilippinesDocument29 pagesAquaculture PhilippinesJesi ViloriaNo ratings yet

- Unit 10Document2 pagesUnit 10ndln.nhiNo ratings yet

- Philippine Market Research Report - MDADocument16 pagesPhilippine Market Research Report - MDAVanessa Quizana100% (1)

- Case Study 1 BULATINDocument3 pagesCase Study 1 BULATINHairu VincentNo ratings yet

- TOP Contents - Tailored For YOU: Latest News HeadlinesDocument7 pagesTOP Contents - Tailored For YOU: Latest News HeadlinesMujahid AliNo ratings yet

- Aggie Trends July 2009Document12 pagesAggie Trends July 2009Department of Agriculture PublicationNo ratings yet

- Analysis of The Philippine Chicken Industry: Commercial Versus Backyard SectorsDocument16 pagesAnalysis of The Philippine Chicken Industry: Commercial Versus Backyard Sectorsemeneses3100% (1)

- Pork Industry in Daet Camarines NorteDocument17 pagesPork Industry in Daet Camarines NortePhoto1 Graphy1No ratings yet

- CW PaperDocument2 pagesCW PaperPAZA, LUKE ROGEL C.No ratings yet

- Market Integration of Milkfish IndustryDocument5 pagesMarket Integration of Milkfish Industrykristal021503No ratings yet

- Poultry Plan EditDocument24 pagesPoultry Plan EditOnyinyechi Emereole OnonibaNo ratings yet

- Food Outlook: Biannual Report on Global Food Markets July 2018From EverandFood Outlook: Biannual Report on Global Food Markets July 2018No ratings yet

- Promoting Investment in Agriculture for Increased Production and ProductivityFrom EverandPromoting Investment in Agriculture for Increased Production and ProductivityNo ratings yet

- Food Outlook: Biannual Report on Global Food Markets May 2019From EverandFood Outlook: Biannual Report on Global Food Markets May 2019No ratings yet

- Environmental AnnotationDocument63 pagesEnvironmental AnnotationIvan Angelo ApostolNo ratings yet

- Water Permit Flow Chart v2 PDFDocument1 pageWater Permit Flow Chart v2 PDFkazimirkiraNo ratings yet

- CR V 2014 BrochureDocument18 pagesCR V 2014 BrochureAbraham JunioNo ratings yet

- Rmo 20-2013Document7 pagesRmo 20-2013Carlos105No ratings yet

- SC Administrative Circular No. 41-2020 (May 29, 2020)Document3 pagesSC Administrative Circular No. 41-2020 (May 29, 2020)Eliseo C. Alibania, Jr.No ratings yet

- A Study On The Impact of Election Spending On The Philippine EconomyDocument16 pagesA Study On The Impact of Election Spending On The Philippine EconomyJimmy Dagupan100% (1)

- IRR of EO 146Document7 pagesIRR of EO 146BernNo ratings yet

- DTI and DOLE InterimGuidelinesonWorkplacePreventionandControlofCOVID19 3Document8 pagesDTI and DOLE InterimGuidelinesonWorkplacePreventionandControlofCOVID19 3delacroix314No ratings yet

- SET Decision - SummaryDocument5 pagesSET Decision - SummarykazimirkiraNo ratings yet

- SEC Memorandum Circular No. 5-001Document2 pagesSEC Memorandum Circular No. 5-001kazimirkiraNo ratings yet

- Philippines Country Profile-2Document12 pagesPhilippines Country Profile-2kazimirkiraNo ratings yet

- 2013 Objections - Trial TechniquesDocument4 pages2013 Objections - Trial TechniquesJayson Jay Parra Ison100% (6)

- Nielsen ASEAN2015 PDFDocument18 pagesNielsen ASEAN2015 PDFAnh NguyễnNo ratings yet

- Final 2014 Annual Report SMPFCDocument134 pagesFinal 2014 Annual Report SMPFCkazimirkiraNo ratings yet

- PEMC Financial Penalty ManualDocument12 pagesPEMC Financial Penalty ManualkazimirkiraNo ratings yet

- PreliminaryProspectus - CenturyDocument650 pagesPreliminaryProspectus - CenturykazimirkiraNo ratings yet

- Do 40-03Document38 pagesDo 40-03Sonny Morillo100% (1)

- Citylights Condominium ArticlesDocument8 pagesCitylights Condominium ArticleskazimirkiraNo ratings yet

- Mat 1 - Maternity NotificationDocument2 pagesMat 1 - Maternity NotificationEvelyn Isturis100% (1)

- US v. MylettDocument7 pagesUS v. MylettkazimirkiraNo ratings yet

- BLGF Opinion Dated 25april2000 (Tax On Quarry)Document3 pagesBLGF Opinion Dated 25april2000 (Tax On Quarry)kazimirkiraNo ratings yet

- Sapa Rules (Denr Dao 2007-17)Document11 pagesSapa Rules (Denr Dao 2007-17)kazimirkira100% (2)

- Irr P.D. 1586Document14 pagesIrr P.D. 1586Hannah Tolentino-Domantay0% (1)

- EMB 2012 Water Quality Status Report FinalDocument32 pagesEMB 2012 Water Quality Status Report Finalkazimirkira100% (1)

- Case Study - IDocument3 pagesCase Study - IMamta Singh RajpalNo ratings yet

- Final Individual Proposal - GelatissimoDocument12 pagesFinal Individual Proposal - Gelatissimoapi-521941371No ratings yet

- Taxation Reviewer - SAN BEDADocument128 pagesTaxation Reviewer - SAN BEDAMark Lawrence Guzman93% (28)

- MCQ Corporate FinanceDocument13 pagesMCQ Corporate FinancesubyraoNo ratings yet

- Ayala Corporation Statement of Financial Position 2019 2018 in Millions Audited Audited AsssetsDocument11 pagesAyala Corporation Statement of Financial Position 2019 2018 in Millions Audited Audited AsssetsAlgen SabaytonNo ratings yet

- Comparative Study On Consumer Preference of Domestic Companys and MNCs Selected FMCG GoodsDocument9 pagesComparative Study On Consumer Preference of Domestic Companys and MNCs Selected FMCG GoodsarcherselevatorsNo ratings yet

- AutoDocument11 pagesAutorocky700inrNo ratings yet

- Chapter (1) The Accounting EquationDocument46 pagesChapter (1) The Accounting Equationtunlinoo.067433100% (3)

- SBR Open TuitionDocument162 pagesSBR Open TuitionpatrikosNo ratings yet

- BOI - New LetterDocument5 pagesBOI - New Lettersandip_banerjeeNo ratings yet

- Greeting Card Business PlanDocument52 pagesGreeting Card Business PlanChuck Achberger50% (2)

- Citi Bank in BangladeshDocument2 pagesCiti Bank in BangladeshSSN073068No ratings yet

- Adjudication Order in Respect of Brooks Laboratories Ltd. and Others in The Matter of IPO of Brooks Laboratories LTDDocument40 pagesAdjudication Order in Respect of Brooks Laboratories Ltd. and Others in The Matter of IPO of Brooks Laboratories LTDShyam SunderNo ratings yet

- DWSD Lifeline Plan - June 2022Document12 pagesDWSD Lifeline Plan - June 2022Malachi BarrettNo ratings yet

- Bulats Bec Mock 1 2020-11Document7 pagesBulats Bec Mock 1 2020-11api-356827706100% (1)

- Kalamba Games - 51% Majority Stake Investment Opportunity - July23Document17 pagesKalamba Games - 51% Majority Stake Investment Opportunity - July23Calvin LimNo ratings yet

- Karen Esther Sarmiento Rodriguez: Manager SalesDocument3 pagesKaren Esther Sarmiento Rodriguez: Manager SalesanuarNo ratings yet

- Eo 398-2005 PDFDocument2 pagesEo 398-2005 PDFDalton ChiongNo ratings yet

- Request Ltr2Bank For OIDsDocument2 pagesRequest Ltr2Bank For OIDsricetech96% (48)

- A Transaction Cost DOuglas NorthDocument9 pagesA Transaction Cost DOuglas NorthSala AlfredNo ratings yet

- The Nature of Staffing: Chapter One Staffing Models and StrategyDocument32 pagesThe Nature of Staffing: Chapter One Staffing Models and StrategyHasib AhsanNo ratings yet

- Wakalah Bi Al Istithmar A Case Study of Wafiyah Investment Account Bank Islam Malaysia Berhad BimbDocument25 pagesWakalah Bi Al Istithmar A Case Study of Wafiyah Investment Account Bank Islam Malaysia Berhad BimbMuhammed UsmanNo ratings yet

- Initiating Coverage Report PB FintechDocument30 pagesInitiating Coverage Report PB FintechSantosh RoutNo ratings yet

- Swifttrip Analysis - Investor'S MouDocument3 pagesSwifttrip Analysis - Investor'S Mounnaemeka ObowuNo ratings yet

- Bài Tập Và Đáp Án Chương 1Document9 pagesBài Tập Và Đáp Án Chương 1nguyenductaiNo ratings yet

- Indian Economy 1950-1990 - Question BankDocument5 pagesIndian Economy 1950-1990 - Question BankHari prakarsh NimiNo ratings yet

- Case Study On Citizens' Band RadioDocument7 pagesCase Study On Citizens' Band RadioরাসেলআহমেদNo ratings yet

- Report On Non Performing Assets of BankDocument53 pagesReport On Non Performing Assets of Bankhemali chovatiya75% (4)

- Bio Pharma Case StudyDocument2 pagesBio Pharma Case StudyAshish Shadija100% (2)

- Detailed Project Report On Establishment of Rural Home-Stay Tourism For A Tourism Cooperative SocietyDocument20 pagesDetailed Project Report On Establishment of Rural Home-Stay Tourism For A Tourism Cooperative SocietysauravNo ratings yet