Professional Documents

Culture Documents

YTB 062015 Notes

Uploaded by

nickong53Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

YTB 062015 Notes

Uploaded by

nickong53Copyright:

Available Formats

YONG TAI BERHAD (311186-T)

SELECTED EXPLANATORY NOTES

FOR THE FORTH QUARTER ENDED 30 JUNE 2015

PART A EXPLANATION NOTES TO MFRS 134

A1.

Basis of Preparation

The interim financial statements are unaudited and have been prepared in accordance

with the requirements of Malaysian Financial Reporting Standard ("MFRS") 134,

"Interim Financial Reporting" issued by the Malaysian Accounting Standards Board

("MASB") and paragraph 9.22 of the Bursa Malaysia Securities Berhads Main Market

Listing Requirements.

The unaudited interim financial statements should be read in conjunction with the

Group's annual audited financial statements for the year ended 30 June 2014.

A2.

Accounting Policies

The accounting policies and methods of computation used in the preparation of the

financial statements are consistent with those adopted in the audited financial statements

for the year ended 30 June 2014.

The Group has not early adopted new and revised standards and amendments to standards

that have been issued but not yet effective for the Group's accounting period beginning

1 July 2014 except as mentioned below:

MFRS 15, Revenue from Contracts with Customers

The initial application of the accounting standards, amendments and interpretations are not

expected to have any material financial impacts to the current and prior period financial

statements of the Group and the Company.

A3.

Comparative

On 30 June 2015, the Company had entered into two share Sale and Purchase Agreement

with Extreme Riches (ER) for the disposal of the 100% entire equity interest in :

i.

Golden Vertex Sdn Bhd (GVSB) for cash consideration of RM1.00; and

ii.

The Image Outlet Sdn Bhd (TIOSB) for cash consideration of RM1.00.

In accordance with MFRS 5, Non-current Assets Held For Sale and Discontinued

Operation, GVSB and TIOSB are classified as Disposal group held for sale /

discontinued operation. The comparative of the Discontinued operation in the preceding

year corresponding quarter and year to date have been reclassified and restated as

follow:-

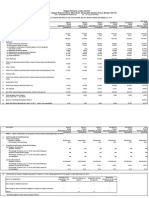

A3.

A4.

Condensed consolidated statement of comprehensive income (Contd)

Revenue

Cost of sales

Gross profit

Other income

Other expenses

Finance costs

(Loss) before tax

Taxation

(Loss) for the period from continuing operations

(Loss)/profit for the period from discontinued operation

Preceding quarter 30.06.2014

As

Disposal

As

previously

Group

Restated

stated

MFRS 5

RM'000

RM'000

RM'000

16,301

5,472

10,829

(14,192)

(5,212)

(8,980)

2,109

260

1,849

9

98

(89)

(7,127)

(3,159)

(3,968)

(616)

(200)

(416)

(5,625)

(3,001)

(2,624)

263

263

(5,362)

(3,001)

(2,361)

3,001

(3,001)

Revenue

Cost of sales

Gross profit

Other income

Other expenses

Finance costs

(Loss) before tax

Taxation

(Loss) for the period from continuing operations

(Loss)/profit for the period from discontinued operation

Preceding year to date 30.06.2014

As

Disposal

As

previously

Group

Restated

stated

MFRS 5

RM'000

RM'000

RM'000

63,807

15,346

48,461

(47,095)

(14,988)

(32,107)

16,712

358

16,354

593

86

507

(22,466)

(4,463)

(18,003)

(2,086)

(315)

(1,771)

(7,247)

(4,334)

(2,913)

(28)

(28)

(7,275)

(4,334)

(2,941)

4,334

(4,334)

Audit Report

The auditors report for the annual financial statements of the Group for the financial year

ended 30th June 2014 was not subject to any qualification.

A5.

Seasonal or Cyclical Factors

The Groups garments and related accessories retail business operations are subject to

seasonal and festive celebrations in Malaysia.

A6.

Unusual Items

During the current quarter under review, there were no items or events that arose, which

affected the assets, liabilities, equity, net income or cash flows during the financial period.

A7.

Changes in Estimates

There were no changes in estimates of amount reported that have material effect on the

results for the current quarter under review.

A8.

Debt And Equity Securities

There were no issuances, cancellations, repurchases, resale and repayments of either debt

or equity securities during the current quarter and financial year to date except par value

reduction of the existing issued and paid-up share capital, rights issue with detachable free

warrants and special share issue. The proceeds from the right issue with Warrants and

Special Issue are expected to be fully utilized for business operation and settlement of

bank borrowing.

A9.

Dividends Paid

There were no dividends paid for the current financial period to date.

A10. Valuation of Property, Plant and Equipment

There has been no valuation taken for the Group's property, plant and equipment for the

current quarter under review.

A11. Changes in Composition of the Group

There were no changes in the composition of the Group during the financial period under

review except the following:Discontinued operation and disposal of subsidiaries

On 30 June 2015, the Company had entered into two shares Sale and Purchase Agreement

with with Extreme Riches (ER) for the disposal of the 100% equity interest in Golden

Vertex Sdn Bhd (GVSB) and The Image Outlet Sdn Bhd (TIOSB) for cash consideration

of RM1.00 each.

The disposal was completed on 30 June 2015 and the disposal proceed has been received

on the same day by the company. The gain on disposal amounted to RM7.050 million.

A12. Changes of Contingent Liabilities or Contingent Assets

There were no changes in contingent liability and contingent asset of the Group since the

end of the previous financial year 30th June 2014.

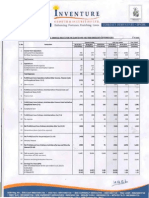

A13. Segment Information

Trading ,

retailing

and

Dyeing

RM'000

Property

development

RM'000

Investment

holding

and

Others

RM'000

Elimination

Total

continuing

operations

Total

discontinued

operations

Total

group

RM'000

RM'000

RM'000

RM'000

12 months ended 30.06.2015

External sales

Inter-segment sales

Total

Results:Segmental result

Unallocated corporate income

Operating profit

Finance costs

Profit before taxation

Taxation

Profit after taxation

41,563

326

41,889

(882)

55,451

55,451

120

120

4,376

(542)

(446)

(446)

-

Non-controlling interest

Profit/ (loss) for the period

Other information

Segment assets

50,266

Unallocated corporate assets

Total consolidated corporate assets

Segment liabilities

31,868

Unallocated corporate liabilities

Total consolidated corporate liabilities

12 months ended 30.06.2014

Revenue

External sales

Inter-segment sales

Total

Results:Segmental result

Unallocated corporate income

Operating loss

Finance costs

Loss before taxation

Taxation

Loss after taxation

Non-controlling interest

Loss for the period

48,461

256

48,717

Other information

Segment assets

49,601

Unallocated corporate assets

Total consolidated corporate assets

Segment liabilities

47,825

Unallocated corporate liabilities

Total consolidated corporate liabilities

97,014

97,014

22,499

22,499

119,513

119,513

2,952

7,340

10,292

(2,202)

8,090

(1,324)

6,766

1,211

1,211

(225)

986

986

4,163

7,340

11,503

(2,427)

9,076

(1,324)

7,752

6,766

986

7,752

40,574

28,365

119,205

3,660

489

36,017

36,017

36,017

120

120

48,461

48,461

15,346

15,346

63,807

63,807

(1,142)

(1,142)

(1,771)

(2,913)

(28)

(2,941)

2

(2,939)

(4,019)

(4,019)

(315)

(4,334)

(4,334)

(4,334)

(5,161)

(5,161)

(2,086)

(7,247)

(28)

(7,275)

2

(7,273)

(376)

(376)

(102)

119,103

1,123

120,226

245

13,701

63,547

6,611

70,158

1,009

71,167

921

113

48,859

6,560

55,419

55,419

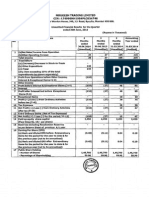

A14. Discontinued Operation/ Disposal of subsidiary

As mention in Note 3 to the Interim Financial Report above, GVSB and TIOSB are

classified as Disposal group held for sale / discontinued operation.

The Group sold GVSB and TIOSB, the loss making subsidiaries in the textile and

garment business segment due to the Groups strategic decision will place greater

focus and concentrate its efforts and resources in properties development business

segment in future.

In accordance with MFRS 5: Non-Current Assets Held for Sale and Discontinued

operation, the results and cash flow of the disposal group were classified as

Discontinued operation in the Statement of Comprehensive Income.

The revenue and results of the Discontinued operation are as follow:

Revenue

Cost of sales

Gross profit

Other income

Other expenses

Finance costs

Profit / (loss) before tax

Taxation

Profit / (loss) for the period

Current

Proceeding

Current

Proceeding

Quarter

Year

Year To Date Year To Date

from

Quarter

From

30.06.2015 30.06.2014

30.06.2015

30.06.2014

RM'000

RM'000

RM'000

RM'000

11,929

5,472

22,499

15,346

(10,872)

(5,212)

(19,405)

(14,988)

1,057

260

3,094

358

(53)

98

(14)

86

(419)

(3,159)

(1,869)

(4,463)

(41)

(200)

(225)

(315)

544

(3,001)

986

(4,334)

544

(3,001)

986

(4,334)

The effect of the disposal , GVSB and TIOSB on the financial position of the Group are

as follow :

GVSB

TIOSB

RM'000

RM'000

Property, plant and equipment

440

106

Inventories

5,062

2,872

Trade and other receivables

2,325

623

Cash and bank balances

90

26

Defer assets

52

Trade and other payables

(11,275)

(4,323)

Term loan

(2,303)

(793)

Tax Payable

50

Share of net assets disposed

(5,661)

(1,387)

Gain on disposal of subsidiary companies

5,662

1,388

sales consideration

1

1

Less : Cash and cash equivalents in subsidiary disposed

(90)

(26)

Net of cash and cash equivalents on disposal of subsidiary

(89)

(25)

A15. Significant Related Party Transaction

There were no significant related party transactions in the current quarter.

5

TOTAL

RM'000

546

7,934

2,948

116

52

(15,599)

(3,096)

50

(7,049)

7,050

2

(116)

(114)

A16. Material Contract

The material contract has been provided for the financial statements as at 30 June

2015 are as follow:On 4 December 2014, YTB Apple Sdn Bhd, a wholly-owned subsidiary of

YONGTAI, and Apple 99 Development Sdn Bhd (A99DSB) had entered into the

joint operation agreement to regulate their rights in relation to their joint participation

and operations in the construction and development of The Apple project

development project (Joint Operation Agreement). Pursuant to the terms of the

Joint Operation Agreement, the Company is required to pay to A99DSB the amount

of RM35.0 million, in consideration of A99DSB agreeing to share its net profit

before income tax to be derived from The Apple property development project (on a

quarterly basis) (YTB Apples Participating Contribution).

The YTB Apples Participating Contribution shall be paid in full to A99DSB within

three (3) months from three (3) business days after YONGTAI obtaining its

shareholders approval on 19 March 2015 (Payment Date). As such, YONGTAI is

required to pay to A99DSB for YTB Apple Participating Contribution by 22 June

2015.

PART B -ADDITIONAL INFORMATION REQUIRED BY THE BURSA

MALAYSIA SECURITIES BERHAD

B1.

Review of Performance

The Groups recorded revenue of RM97.015 million during financial period ended 30

June 2015 as compared to RM48.461 million in the preceding years corresponding

period. The increase in turnover was mainly attributable to revenue recognition from

on-going project in the Property Development business segment.

The Groups profit before taxation was RM8.090 million for the financial year

compared to loss before taxation RM2.913 million in the preceding years

corresponding period. The increase in profit before tax is mainly arising from the

contribution through a joint operation in the property development business and gain

of disposal of subsidiaries amounted RM7.050 million.

The Groups performance was contributed by the following segment:a) Trading, retailing and dyeing segment

Retail business and dyeing segment registered revenue of RM41.563 million for the

financial year ended 30 June 2015 compared to RM48.461 million in the previous

year corresponding period. The decrease in turnover was mainly due to decrease in

consumer demand in trading, retailing and dyeing segment.

b) Property development segment

The Companys wholly-owned subsidiary, YTB Land Sdn Bhd had on 29 April 2014

entered into a Project Collaboration Agreement with PTS Properties Sdn Bhd. The

Collaboration resulted in the diversification of the business of YONGTAI into

property development business segment (Diversification). The Company had

diversified into property development business segment after obtaining shareholders

approval on 24 July 2014.

The Companys property development division operated by YTB Land Sdn Bhd, has

recorded a revenue level of RM55.451 million, representing 57.16% of the Groups

total revenue of RM97.015 million. The Group has recognised the revenue of

RM55.451 million based on the construction progress for its property development

project in Melaka, namely 99 Residences.

B2.

Material Changes in the Quarterly Results as Compared with the Preceding

Quartered

For the current quarter, the Groups revenue was RM21.850 million compared to

RM32.750 million in the immediate preceding quarter. The decrease in the Groups

revenue for the current quarter was mainly due to trading, retailing and dyeing

segment has recorded lower revenue for the current quarter due to cyclical result of

the retail segment.

B2.

Material Changes in the Quarterly Results as Compared with the Preceding

Quartered (Contd)

The Profit before taxation in the current quarter was RM6.470 million compared to

profit before taxation RM0.6870 million in the immediate preceding quarter. It was

mainly contributed by the gain on disposal of subsidiaries amounted RM7.050

million.

B3.

Current Financial Year Prospect

The Board of Directors is of the opinion that the Groups venture into property

development segment will continue its growth and contribute positively to the

Groups performance.

As at end-June 2015, the Groups first maiden project has been successfully

completed and obtained the Certificate of Compliance and Completion (CCC) from

the relevant authority. This project has contributed significantly to the Groups

performance for financial year ended 30 June 2015.

Furthermore, the Company has entered into the joint operation agreement with Apple

99 Development Sdn Bhd, a wholly-owned subsidiary of PTS Properties Sdn Bhd, to

undertake the development of The Apple (Joint Venture). The Apple is a

development project comprising of inter-alia a sixteen (16)-storey four (4)-star hotel

known as Courtyard by Marriott, a thirty-two (32)-storey block of service

apartments and the Podium. With The Apples strategic and prime location, our

Board believes that the Joint Venture provides the Company with an opportunity to

participate in the development of a prime development land into a lucrative property

development project. Once completed, The Apple is poised to become one of the

iconic high-rise buildings as Malacca citys premier tourism and luxury destination,

and will cater to the growing demand for four (4)-star quality hotels in Malacca from

visiting tourists. In addition, The Apple shall have direct access to the Sungai Melaka

Riverfront and shall have a spectacular view of the iconic Kampung Morten, in

addition to its location next to Malaccas latest prestigious development projects such

as The Shore @ Sungai Malacca, 99 Residences and Jaya 99.

Moving forward, the Company expects to further turnaround its financial

performances in the immediate term by further growing our property development

business segment by continuously seeking for opportunities to acquire more lands

with good prospects for its future property development activities. In addition, the

Group also will continuously seek joint venture opportunities with other established

property developers in Malaysia to develop the Groups credential as a property

developer.

B4.

Profit Forecast and Profit Guarantee

The Group has not provided any profit forecast or profit guarantee in a public

document.

B5.

Quoted Securities

(a) There was no purchase or disposal of quoted securities for the current quarter

and financial period to date.

(b) There is no investment in quoted securities as at the end of the quarter under

review.

B6.

Corporate Proposals

The Rights Issue with Warrants and Special Issue was completed on 30 June 2015

pursuant to the listing of and quotation for the following securities on the Main

Market of Bursa Securities :

(i) 80,230,000 Rights Shares issued pursuant to the Rights Issue with Warrants;

(ii) 40,115,000 Warrants issued pursuant to the Rights Issue with Warrants; and

(iii) 40,000,000 Special Issue Shares issued pursuant to the Special Issue.

On 3 August 2015, on behalf of the Board of the Company, AmInvestment Bank

Berhad announced that the Company had on even date, entered into five (5) separate

memorandums of understanding (MOUs) with the following parties:

(i) PTS Properties Sdn Bhd, Boo Kuang Loon and Apple Impression Sdn Bhd in

respect of the proposed acquisition by the Company of the entire equity interest in

PTS Impression Sdn Bhd, a company holding the rights to produce and stage a

tourism stage performance known as Impression Melaka (Proposed Acquisition

of PTS Impression);

(ii) Admiral City Sdn Bhd for the following:

the proposed acquisition of approximately 17 acres of seafront land

(Impression Land) located in Kawasan Bandar VI, District of Melaka

Tengah, Melaka (Proposed Acquisition of Impression Land); and

proposed establishment of a joint development arrangement to jointly develop

approximately 100 acres of leasehold land located adjacent to the Impression

Land, all of which are located in Kawasan Bandar VI, District of Melaka

Tengah, Melaka (Proposed Melaka JV)

(iii) Pang Kwee Yin and Wong See Ming in respect of the proposed acquisition of

Terrawest Resources Sdn Bhd, a company which owns two (2) parcels of freehold

and contiguous land located in Puchong, Selangor for a potential property

development project (Proposed Acquisition of Terrawest);

(iv) Sia Chien Vui, Dato Sri Lee Ee Hoe and PTS Properties Sdn Bhd in respect of

the proposed acquisition by YTB of the entire equity interest in Yuten Development

Sdn Bhd, a company which has a joint venture arrangement with Fahad Holdings Sdn

Bhd to jointly develop two (2) adjoining parcels of land along Jalan U-Thant, Kuala

B6.

Corporate Proposals (Contd)

Lumpur (Proposed Acquisition of Yuten); and

(v) Lim Hooi Yen and Beeh Boon Siang in respect of the proposed acquisition of

Land & Build Sdn Bhd, a company which holds the development rights to develop

two (2) parcels of freehold land located in Johor Bahru (Proposed Acquisition of

L&B).

Pursuant to the MOUs, the parties have agreed to negotiate exclusively in good faith

the detailed terms and conditions for each of the proposals above with the intention of

entering into definitive agreements.

The MOUs take effect from the date of the MOUs and shall remain in force until the

expiry of three (3) months (except for the MOU entered into with Admiral City Sdn

Bhd that shall remain in force until the expiry of two (2) months) from the date of the

MOUs or any other date to be mutually agreed in writing by the parties.

There has been no major development of the MOUs and/or the above proposals since

the last announcement.

Further details of the Corporate Proposals can be obtained from the website of Bursa

Malaysia Securities Berhad.

B7.

Sales of Unquoted Investments and/or Investment Properties

There were no sales of unquoted investments and properties during the financial

quarter under review.

B8.

Derivative Financial Instruments

The group did not have any derivative financial instruments as at the end of the

reporting period.

B9.

Changes in Material Litigation

There was no pending material litigation as at the end of the financial year up to the

date of this announcement.

B10. Dividends

The Directors has not recommended any payment of dividends in respect of the

financial period ended June 2015.

10

B11.

Taxation

Quarter Ended

30.06.2015

30.06.2014

RM'000

RM'000

Year To date Ended

30.6.2015

30.06.2014

RM'000

RM'000

Tax comprises:-Malaysia Income Tax

- Deferred Tax

332

-

(263)

-

1324

-

Tax expenses for the period

332

(263)

1,324

28

28

The effective tax rate for the current quarter and financial year-to-date was higher

than the effective statutory tax rate as there is no groups tax relief and certain

expenses are not deductible for tax purposes.

B12.

Group Borrowings

As at

30.06.2015

( RM000)

Current (Secured)

Bank overdraft

Term loans

Hire purchase payable

5,546

9,454

39

Total

15,039

Non-current (Secured)

Term loans

Hire purchase payable

Total

1,196

110

1,306

All borrowings were secured and denominated in Ringgit Malaysia.

B13.

Notes to Statements of Comprehensive Income

Current quarter

30.06.2015

30.06.2014

RM'000

RM'000

Profit before taxation for the period is arrived

at after charging /(crediting) the following:

interest expenses

Depreciation of property, plant and equipment

Bad debts written off

Property, plant and equipment written off

Gain on disposal of property, plant and equipment

Gain on disposal of subsidiary

(Gain)/loss on foreign currency exchange-realised

Gain from a bargain purchase

461

176

(16)

(7,050)

(29)

-

615

63

2,684

-

Cumulative quarter

30.06.2015

30.06.2014

RM'000

RM'000

2,426

1,495

197

(7,050)

(1,930)

2,085

1,570

2,684

1

(12)

-

Other than the above, the items listed under Appendix 9B Note 16 of the listing

Requirement of Bursa Malaysia Securities Berhad are not applicable.

11

B14.

Realised and Unrealised Earnings or Losses Disclosure

The (accumulated losses)/unappropriated profits as at 30 June 2015 and 30th June

2014 is analysed as follows:

30.06.2015

RM'000

Total (accumulated losses)/unappropriated

profits of the company and its subsidiaries:

- Realised loss

- Unrealised profit

Total group accumulated losses as per

consolidated financial statements

B15.

(10,743)

97

(10,646)

30.06.2014

RM'000

(26,103)

109

(25,994)

Earnings / (Loss) Per Share

a. Basic

Basic earnings/(loss) per share is calculated by dividing net profit/(loss) for the

financial period attributable to ordinary equity holders of the parent by the weighted

average number of ordinary shares in issue during the financial period.

Quarter Ended

30.06.2015

30.06.2014

RM'000

RM'000

Net (loss)/profit attributable

to equity holders of the Company

-from continuing operations

-from discontinued operation

Year to dated Ended

30.06.2015

30.06.2014

RM'000

RM'000

6,138

544

6,682

(2,631)

(3,001)

(5,632)

6,766

986

7,752

(2,939)

(4,334)

(7,273)

Number of ordinary shares

at the beginning of the period

-Effect of Right issue

-Effect of Special issue of share

('000)

40,115

1,273

110

('000)

40,115

1,056

-

('000)

40,115

1,273

110

('000)

40,115

1,056

-

Weighted average number of shares

in issue

41,498

41,171

41,498

41,171

Sen

Sen

Sen

Sen

Basic earnings/ (loss)per share

attributale to equity holders of

the Company

-from continuing operations

-from discontinued operation

14.79

1.31

16.10

(6.39)

(7.29)

(13.68)

16.30

2.38

18.68

(7.13)

(10.53)

(17.66)

('000)

41,498

('000)

41,171

('000)

41,498

('000)

41,171

16,650

58,148

16,650

57,821

16,650

58,148

16,650

57,821

Sen

11.64

1.70

13.33

Sen

(5.08)

(7.50)

(12.58)

b. Diluted

Weighted average number of shares in issue

Effect of Warrant

Adjusted weighted average number of ordinary

shares in issue and issurable

Diluted earning per share attributable

to equity holders of the Company :

-from continuing operations

-from discontinued operation

Sen

10.56

0.94

11.49

12

Sen

(4.55)

(5.19)

(9.74)

B16.

Authorised For Issue

The interim financial statements were authorised for issue by the Board of Directors

in accordance with a resolution of the Directors on 26 August 2015.

13

You might also like

- Q4FY2013 Interim ResultsDocument13 pagesQ4FY2013 Interim ResultsrickysuNo ratings yet

- APOLLO-Page 77 To ProxyForm (3MB)Document39 pagesAPOLLO-Page 77 To ProxyForm (3MB)luchono1No ratings yet

- Announces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Document4 pagesAnnounces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Third Quarter March 31 2014Document18 pagesThird Quarter March 31 2014major144No ratings yet

- Interim Condensed: Sanofi-Aventis Pakistan LimitedDocument13 pagesInterim Condensed: Sanofi-Aventis Pakistan LimitedawaisleoNo ratings yet

- SSI Group, Inc. Quarterly Report For June 30, 2015Document55 pagesSSI Group, Inc. Quarterly Report For June 30, 2015xnUdn4eNNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Pakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)Document8 pagesPakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)mohammadtalhaNo ratings yet

- FY11 - Investor PresentationDocument11 pagesFY11 - Investor Presentationcooladi$No ratings yet

- SSI Group, Inc 31 March 2015 17QDocument54 pagesSSI Group, Inc 31 March 2015 17QADxnUdn4eNNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- MEIK Unaudited Results For HY Ended 30 Sep 13Document1 pageMEIK Unaudited Results For HY Ended 30 Sep 13Business Daily ZimbabweNo ratings yet

- 2014-8-25 - Announcement of Interim ResultsDocument26 pages2014-8-25 - Announcement of Interim ResultsDan DurayNo ratings yet

- 18 Financial StatementsDocument35 pages18 Financial Statementswsahmed28No ratings yet

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Document4 pagesColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Aditya MishraNo ratings yet

- HCL Annual Report Analysis Final 2015Document16 pagesHCL Annual Report Analysis Final 2015mehakNo ratings yet

- Half Yearly Dec09-10 PDFDocument15 pagesHalf Yearly Dec09-10 PDFSalman S. ZiaNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Oldtown QRDocument26 pagesOldtown QRfieya91No ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- TSL Audited Results For FY Ended 31 Oct 13Document2 pagesTSL Audited Results For FY Ended 31 Oct 13Business Daily ZimbabweNo ratings yet

- 17Q Sept 2015 Final - SignedDocument55 pages17Q Sept 2015 Final - SignedxnUdn4eNNo ratings yet

- Drb-Hicom Berhad: Interim Financial Report For The Financial Period Ended 30 September 2015Document22 pagesDrb-Hicom Berhad: Interim Financial Report For The Financial Period Ended 30 September 2015cybermen35No ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Elpl 2009 10Document43 pagesElpl 2009 10kareem_nNo ratings yet

- KFA - Published Unaudited Results - Sep 30, 2011Document3 pagesKFA - Published Unaudited Results - Sep 30, 2011Chintan VyasNo ratings yet

- Magni-Tech Industries BerhadDocument9 pagesMagni-Tech Industries Berhadkhai_tajolNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document11 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Demonstra??es Financeiras em Padr?es InternacionaisDocument66 pagesDemonstra??es Financeiras em Padr?es InternacionaisFibriaRINo ratings yet

- 3Q15 Financial StatementsDocument43 pages3Q15 Financial StatementsFibriaRINo ratings yet

- Demonstra??es Financeiras em Padr?es InternacionaisDocument65 pagesDemonstra??es Financeiras em Padr?es InternacionaisFibriaRINo ratings yet

- 1Q15 Financial StatementsDocument42 pages1Q15 Financial StatementsFibriaRINo ratings yet

- KFA Published Results March 2011Document3 pagesKFA Published Results March 2011Abhay AgarwalNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- 2 PDocument238 pages2 Pbillyryan1100% (3)

- IDEAL RICE INDUSTRIES AccountsDocument89 pagesIDEAL RICE INDUSTRIES Accountsahmed.zjcNo ratings yet

- Quarterly Financial ResultsDocument22 pagesQuarterly Financial ResultsNabeel AftabNo ratings yet

- Demonstra??es Financeiras em Padr?es InternacionaisDocument66 pagesDemonstra??es Financeiras em Padr?es InternacionaisFibriaRINo ratings yet

- 2Q15 Financial StatementsDocument43 pages2Q15 Financial StatementsFibriaRINo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Bloomage 2010 Annual ReportDocument25 pagesBloomage 2010 Annual ReportHenry ThurmanNo ratings yet

- Financial StatementsDocument20 pagesFinancial Statementswilsonkoh1989No ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document16 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Aftab Automobiles Limited and Its SubsidiariesDocument4 pagesAftab Automobiles Limited and Its SubsidiariesNur Md Al HossainNo ratings yet

- Ifrs 8Document3 pagesIfrs 8Samantha IslamNo ratings yet

- Sebi MillionsDocument3 pagesSebi MillionsShubham TrivediNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Taj Textile Mills Limited: Quarterly Accounts September 30, 2006 (Un-Audited)Document8 pagesTaj Textile Mills Limited: Quarterly Accounts September 30, 2006 (Un-Audited)Muhammad Karim KhanNo ratings yet

- Apl 2013Document45 pagesApl 2013Wasif Pervaiz DarNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results Q1 August 2018Document40 pagesFinancial Results Q1 August 2018shakeelahmadjsrNo ratings yet

- IGB Corporation Berhad: Interim Financial Report For The Six Months Ended 30 June 2009Document14 pagesIGB Corporation Berhad: Interim Financial Report For The Six Months Ended 30 June 2009James WarrenNo ratings yet

- Company Accounting 9th Edition Solutions PDFDocument37 pagesCompany Accounting 9th Edition Solutions PDFatup12367% (9)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Abrupt FPSO Cancellation A Major Setback For Bumi Armada, Says Maybank IB - Business News - The Star OnlineDocument9 pagesAbrupt FPSO Cancellation A Major Setback For Bumi Armada, Says Maybank IB - Business News - The Star Onlinenickong53No ratings yet

- Interim Financial Result For 3rd Quarter Ended 31.01.2013Document23 pagesInterim Financial Result For 3rd Quarter Ended 31.01.2013nickong53No ratings yet

- AcquisiShares - Sinar MekarDocument3 pagesAcquisiShares - Sinar Mekarnickong53No ratings yet

- Sample Official ReceiptDocument1 pageSample Official Receiptnickong53No ratings yet

- Neelima A Kulkarni ResumeDocument3 pagesNeelima A Kulkarni ResumeAcademics LecturenotesNo ratings yet

- Teks Drama Malin KundangDocument8 pagesTeks Drama Malin KundangUhuy ManiaNo ratings yet

- CL RouterAndSwitches AE Kn1of3 AnswerDocument19 pagesCL RouterAndSwitches AE Kn1of3 Answereugene ngNo ratings yet

- IMC - BisleriDocument8 pagesIMC - BisleriVineetaNo ratings yet

- Mixing and Agitation 93851 - 10 ADocument19 pagesMixing and Agitation 93851 - 10 Aakarcz6731No ratings yet

- 01 - A Note On Introduction To E-Commerce - 9march2011Document12 pages01 - A Note On Introduction To E-Commerce - 9march2011engr_amirNo ratings yet

- Final Prmy Gr4 Math Ph1 HWSHDocument55 pagesFinal Prmy Gr4 Math Ph1 HWSHKarthik KumarNo ratings yet

- Standard nfx15-211Document2 pagesStandard nfx15-211Luis Enrique Cóndor PorrasNo ratings yet

- HAYAT - CLINIC BrandbookDocument32 pagesHAYAT - CLINIC BrandbookBlankPointNo ratings yet

- Audi R8 Advert Analysis by Masum Ahmed 10PDocument2 pagesAudi R8 Advert Analysis by Masum Ahmed 10PMasum95No ratings yet

- Suspend and Resume Calls: Exit PlugDocument4 pagesSuspend and Resume Calls: Exit PlugrajuNo ratings yet

- Amp DC, OaDocument4 pagesAmp DC, OaFantastic KiaNo ratings yet

- Sample Cross-Complaint For Indemnity For CaliforniaDocument4 pagesSample Cross-Complaint For Indemnity For CaliforniaStan Burman75% (8)

- ISO - 21.060.10 - Bolts, Screws, Studs (List of Codes)Document9 pagesISO - 21.060.10 - Bolts, Screws, Studs (List of Codes)duraisingh.me6602No ratings yet

- BIOBASE Vortex Mixer MX-S - MX-F User ManualDocument10 pagesBIOBASE Vortex Mixer MX-S - MX-F User Manualsoporte03No ratings yet

- PDF of Tally ShortcutsDocument6 pagesPDF of Tally ShortcutsSuraj Mehta100% (2)

- IPM GuidelinesDocument6 pagesIPM GuidelinesHittesh SolankiNo ratings yet

- Obara BogbeDocument36 pagesObara BogbeOjubona Aremu Omotiayebi Ifamoriyo0% (1)

- PDS (OTO360) Form PDFDocument2 pagesPDS (OTO360) Form PDFcikgutiNo ratings yet

- ATADU2002 DatasheetDocument3 pagesATADU2002 DatasheethindNo ratings yet

- III.A.1. University of Hawaii at Manoa Cancer Center Report and Business PlanDocument35 pagesIII.A.1. University of Hawaii at Manoa Cancer Center Report and Business Planurindo mars29No ratings yet

- Morse Potential CurveDocument9 pagesMorse Potential Curvejagabandhu_patraNo ratings yet

- ArcGIS Shapefile Files Types & ExtensionsDocument4 pagesArcGIS Shapefile Files Types & ExtensionsdanangNo ratings yet

- Power Control 3G CDMADocument18 pagesPower Control 3G CDMAmanproxNo ratings yet

- Britannia Volume 12 Issue 1981 (Doi 10.2307/526240) Michael P. Speidel - Princeps As A Title For 'Ad Hoc' CommandersDocument8 pagesBritannia Volume 12 Issue 1981 (Doi 10.2307/526240) Michael P. Speidel - Princeps As A Title For 'Ad Hoc' CommandersSteftyraNo ratings yet

- Ae - Centuries Before 1400 Are Listed As Browsable DirectoriesDocument3 pagesAe - Centuries Before 1400 Are Listed As Browsable DirectoriesPolNeimanNo ratings yet

- 200150, 200155 & 200157 Accelerometers: DescriptionDocument16 pages200150, 200155 & 200157 Accelerometers: DescriptionJOSE MARIA DANIEL CANALESNo ratings yet

- Villamaria JR Vs CADocument2 pagesVillamaria JR Vs CAClarissa SawaliNo ratings yet

- Distribution BoardDocument7 pagesDistribution BoardmuralichandrasekarNo ratings yet

- Understanding The Marshall AttackDocument6 pagesUnderstanding The Marshall Attacks.for.saad8176No ratings yet