Professional Documents

Culture Documents

CNX Nifty Weekly Report 28 Sep To 1 Oct

Uploaded by

zoidresearchOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CNX Nifty Weekly Report 28 Sep To 1 Oct

Uploaded by

zoidresearchCopyright:

Available Formats

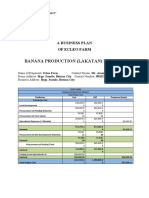

WEEKLY TECHNICAL REPORT

28 SEP TO 1 OCT 15

CNX NIFTY 7868.50 (-113.40)

(-1.42%)

Last Week Nifty opened with some

negative on Monday. On Tuesday

Nifty will gap up opened then it will

sharp down fall on same day closed

around the 7977. On Thursday

September

derivative

contracts

expiry,

share

indices

ended

marginally higher amid a volatile

trading session. On Friday market is

closed on of Eid. The nifty ended the

conclude week with a losing of (1.42%) or (-113.40) over the previous

weeks closing.

Formations

The 20 days EMA are placed at

7904.48

The 5 days EMA are placed at

7869.6

Future Outlook:

The Nifty daily chart is bullish; Nifty

is uptrend if is trading above 7920

our positional target is 8150. Nifty

selling pressure near 7760.Nifty

www.zoidresearch.com

Upside weekly Resistance is 80198170 level. Nifty weeks low 7723.25,

this level is strong support point. The

Nifty weekly support is 7721-7573

ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

28 SEP TO 1 OCT 15

Weekly Pivot Levels for Nifty 50 Stocks

Script Symbol

CNX NIFTY

Resistance2

8170

BAJAJ-AUTO

HEROMOTOCO

M&M

MARUTI

TATAMOTORS

2398.22

2478.63

1268.97

4736.15

346.60

ACC

AMBUJACEM

GRASIM

ULTRACEMCO

1427.02

215.63

3532.98

3034.07

LT

1605.18

ASIANPAINT

HINDUNILVR

ITC

864.42

809.60

333.98

BPCL

CAIRN

GAIL

NTPC

ONGC

POWERGRID

RELIANCE

TATAPOWER

913.97

158.12

313.25

131.58

380.83

141.43

906.88

68.05

AXISBANK

BANKBARODA

HDFCBANK

HDFC

ICICIBANK

IDFC

INDUSINDBK

KOTAKBANK

PNB

SBIN

YESBANK

552.85

202.17

1084.70

1253.78

287.13

147.70

969.77

690.82

146.82

255.22

795.87

www.zoidresearch.com

Resistance1

Pivot

8019

7871

AUTOMOBILE

2340.58

2275.37

2430.17

2401.38

1244.98

1209.02

4651.40

4519.25

325.00

313.30

CEMENT & CEMENT PRODUCTS

1385.03

1355.02

211.32

207.43

3482.97

3433.98

2922.58

2824.77

CONSTRUCTION

1533.82

1490.53

CONSUMER GOODS

835.38

810.37

795.65

785.95

328.27

317.63

ENERGY

897.43

875.77

154.13

147.12

304.00

293.65

126.82

122.93

304.17

265.13

133.42

128.98

872.12

853.43

66.55

64.20

FINANCIAL SERVICES

533.40

515.25

194.28

188.37

1068.05

1043.35

1217.82

1181.03

277.72

270.93

144.20

139.00

948.33

910.67

672.63

651.82

141.33

136.47

247.13

240.37

758.38

736.32

Support 1

7721

Support 2

7573

2217.73

2352.92

1185.03

4434.50

291.70

2152.52

2324.13

1149.07

4302.35

280.00

1313.03

203.12

3383.97

2713.28

1283.02

199.23

3334.98

2615.47

1419.17

1375.88

781.33

772.00

311.92

756.32

762.30

301.28

859.23

143.13

284.40

118.17

188.47

120.97

818.67

62.70

837.57

136.12

274.05

114.28

149.43

116.53

799.98

60.35

495.80

180.48

1026.70

1145.07

261.52

135.50

889.23

633.63

130.98

232.28

698.83

477.65

174.57

1002.00

1108.28

254.73

130.30

851.57

612.82

126.12

225.52

676.77

ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

28 SEP TO 1 OCT 15

BHEL

217.32

HCLTECH

INFY

TCS

TECHM

WIPRO

1002.15

1188.78

2653.47

600.62

619.45

ZEEL

417.52

COALINDIA

HINDALCO

NMDC

VEDL

TATASTEEL

353.47

81.40

108.65

105.73

234.78

CIPLA

DRREDDY

LUPIN

SUNPHARMA

663.10

4085.35

2115.62

922.40

BHARTIARTL

IDEA

368.28

150.65

INDUSTRIAL MANUFACTURING

207.73

200.42

IT

978.55

945.65

1164.67

1128.58

2616.93

2553.47

583.98

562.27

611.25

596.70

MEDIA & ENTERTAINMENT

406.03

392.02

METALS

335.93

325.97

76.40

73.80

101.70

97.95

100.67

94.78

224.97

219.48

PHARMA

653.10

643.30

4027.80

3942.40

2052.98

1940.17

907.15

897.70

TELECOM

350.62

341.33

144.95

141.80

190.83

183.52

922.05

1104.47

2516.93

545.63

588.50

889.15

1068.38

2453.47

523.92

573.95

380.53

366.52

308.43

68.80

91.00

89.72

209.67

298.47

66.20

87.25

83.83

204.18

633.30

3884.85

1877.53

882.45

623.50

3799.45

1764.72

873.00

323.67

136.10

314.38

132.95

Weekly Top gainers stocks

Script Symbol

LUPIN

CAIRN

MARUTI

INFY

GAIL

Previous Close

1898.85

143.50

4400.85

1104.45

287.25

Current Price

1990.35

150.15

4566.65

1140.55

294.75

% Change

4.82%

4.63%

3.77%

3.27%

2.61%

In Points

91.5

6.65

165.80

36.10

7.50

Current Price

303.40

318.40

332.95

720.90

837.35

% Change

-8.13%

-7.27%

-6.71%

-6.58%

-6.48%

In Points

-26.85

-24.95

-23.95

-50.75

-58.05

Weekly Top losers stocks

Script Symbol

TATAMOTORS

COALINDIA

BARTIAIRTL

YESBANK

RELIANCE

www.zoidresearch.com

Previous Close

330.25

343.35

356.90

771.65

895.40

ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

28 SEP TO 1 OCT 15

Weekly FIIS Statistics*

DATE

Buy Value

Sell Value

Net Value

24/SEP/2015

5760.19

5875.29

-115.10

23/SEP/2015

2987.47

4317.59

-1330.12

22/SEP/2015

3938.67

4990.91

-1052.24

21/SEP/2015

3569.39

3414.52

154.87

DATE

Buy Value

Sell Value

Net Value

24/SEP/2015

2624.14

2573.47

50.67

23/SEP/2015

2008.04

1116.68

891.36

22/SEP/2015

1910.71

1532.45

378.26

21/SEP/2015

1135.69

1031.61

104.08

Weekly DIIS Statistics*

MOST ACTIVE NIFTY CALLS & PUTS

EXPIRY DATE

TYPE

STRIKE PRICE

VOLUME

OPEN INTEREST

29/OCT/2015

CE

8200

172424

2661400

29/OCT/2015

CE

8000

169753

2508200

29/OCT/2015

CE

8100

145197

1913200

29/OCT/2015

PE

7800

156586

3310675

29/OCT/2015

PE

7500

149172

3203325

29/OCT/2015

PE

7700

108168

1995475

MOST ACTIVE BANK NIFTY CALLS & PUTS

EXPIRY DATE

TYPE

STRIKE PRICE

VOLUME

OPEN INTEREST

29/OCT/2015

CE

18000

17043

266950

29/OCT/2015

CE

17500

12481

231875

29/OCT/2015

CE

18500

8306

158750

29/OCT/2015

PE

17000

13274

248900

29/OCT/2015

PE

16000

7437

194950

29/OCT/2015

PE

16500

6482

210075

www.zoidresearch.com

ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

28 SEP TO 1 OCT 15

Weekly Recommendations:

DATE

SYMBOL

STRATEGY

ENTRY

TARGET

STATUS

26 SEP 15

COALINDIA

BUY ON DEEP

342-340

355-370

EXIT AT 320

12 SEP 15

SBIN

BUY ON DEEP

230-228

240-252

22 AUG 15

MARUTI

SELL ON RISE

4540-4550

4350-4150

8 AUG 15

PETRONET

BUY ON DEEP

185-183

195-205

1 AUG 15

WIPRO

BUY ON DEEP

570-565

595-625

18 JUL 15

CESC

BUY ON DEEP

585-580

610-635

11 JUL 15

COALINDIA

BUY ON DEEP

420-422

438-460

4 JUL 15

CANBK

BUY ON DEEP

286-285

300-315

27 JUN 15

BHEL

BUY ON DEEP

250

260-270

20 JUN 15

CIPLA

BUY ON DEEP

605-600

630-660

6 JUN 15

ADANIPORT

SELL ON RISE

312-315

300-285

30 MAY 15

BPCL

BUY ON DEEP

845

871-896

16 MAY 15

LUPIN

BUY ON DEEP

1680-1690

1740-1800

1ST TARGET

ACHIEVED

ALL TARGET

ACHIEVED

1ST TARGET

ACHIEVED

1ST TARGET

ACHIEVED

1ST TARGET

ACHIEVED

1ST TARGET

ACHIEVED

1ST TARGET

ACHIEVED

ALL TARGET

ACHIEVED

ALL TARGET

ACHIEVED

1ST TARGET

ACHIEVED

1ST TARGET

ACHIEVED

ALL TGT

ACHIEVED

* FII & DII trading activity on NSE, BSE, and MCXSX in Capital Market Segment (in Rs. Crores)

DISCLAIMER

Stock trading involves high risk and one can lose Substantial amount of money. The recommendations made herein do

not constitute an offer to sell or solicitation to buy any of the Securities mentioned. No representations can be made

that recommendations contained herein will be profitable or they will not result in losses. Readers using the

information contained herein are solely responsible for their actions. The information is obtained from sources deemed

to be reliable but is not guaranteed as to accuracy and completeness. The above recommendations are based on

technical analysis only. NOTE WE HAVE NO HOLDINGS IN ANY OF STOCKS RECOMMENDED ABOVE

Zoid Research

Office 101, Shagun Tower

A.B. Commercial Road,Indore

452001

Mobile : +91 9039073611

Email: info@zoidresearch.com

Website: www.zoidresearch.com

www.zoidresearch.com

ZOID RESEARCH TEAM

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Residual Income Model PowerpointDocument29 pagesResidual Income Model Powerpointqwertman3000No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Performance BondDocument3 pagesPerformance Bondllabarda100% (1)

- Understanding Natural Gas and LNG OptionsDocument248 pagesUnderstanding Natural Gas and LNG OptionsTivani MphiniNo ratings yet

- Quiz No. 3Document9 pagesQuiz No. 3Janwyne NgNo ratings yet

- Property ChecklistDocument30 pagesProperty ChecklistHeather Kinsaul FosterNo ratings yet

- Benefits Administration - 1Document34 pagesBenefits Administration - 1vivek_sharma13No ratings yet

- The Quarters Theory Chapter 1 BasicsDocument11 pagesThe Quarters Theory Chapter 1 BasicsKevin MwauraNo ratings yet

- Corporate Liquidation CaseDocument1 pageCorporate Liquidation CaseASGarcia24No ratings yet

- Equity Report 6 To 10 NovDocument6 pagesEquity Report 6 To 10 NovzoidresearchNo ratings yet

- Equity Weekly Report - Zoid ResearchDocument9 pagesEquity Weekly Report - Zoid ResearchzoidresearchNo ratings yet

- Equity Report 16 - 20 OctDocument6 pagesEquity Report 16 - 20 OctzoidresearchNo ratings yet

- Equity Weekly Report 19-23 NovDocument10 pagesEquity Weekly Report 19-23 NovzoidresearchNo ratings yet

- Nifty Technical Report (31july - 4aug)Document6 pagesNifty Technical Report (31july - 4aug)zoidresearchNo ratings yet

- Equity Report 5 Jun To 9 JunDocument6 pagesEquity Report 5 Jun To 9 JunzoidresearchNo ratings yet

- Equity Report 3 July To 7 JulyDocument6 pagesEquity Report 3 July To 7 JulyzoidresearchNo ratings yet

- Equity Report 10 July To 14 JulyDocument6 pagesEquity Report 10 July To 14 JulyzoidresearchNo ratings yet

- Equity Report 22 May To 26 MayDocument6 pagesEquity Report 22 May To 26 MayzoidresearchNo ratings yet

- Equity Report 21 Aug To 25 AugDocument6 pagesEquity Report 21 Aug To 25 AugzoidresearchNo ratings yet

- Equity Report 19 June To 23 JuneDocument6 pagesEquity Report 19 June To 23 JunezoidresearchNo ratings yet

- Equity Report 26 June To 30 JuneDocument6 pagesEquity Report 26 June To 30 JunezoidresearchNo ratings yet

- Equity Report 15 May To 19 MayDocument6 pagesEquity Report 15 May To 19 MayzoidresearchNo ratings yet

- Nifty Weekly Report 17 Apr To 21 AprDocument6 pagesNifty Weekly Report 17 Apr To 21 AprzoidresearchNo ratings yet

- Outlook On Equity Report 1 MAY To 5 MAYDocument6 pagesOutlook On Equity Report 1 MAY To 5 MAYzoidresearchNo ratings yet

- Equity Report 24 Apr To 28 AprDocument6 pagesEquity Report 24 Apr To 28 AprzoidresearchNo ratings yet

- Equity Technical Report 23 Jan To 27 JanDocument6 pagesEquity Technical Report 23 Jan To 27 JanzoidresearchNo ratings yet

- Equity Weekly Report 8 May To 12 MayDocument6 pagesEquity Weekly Report 8 May To 12 MayzoidresearchNo ratings yet

- Equity Technical Weekly ReportDocument6 pagesEquity Technical Weekly ReportzoidresearchNo ratings yet

- Equity Market Outlook (3-7 April)Document6 pagesEquity Market Outlook (3-7 April)zoidresearchNo ratings yet

- Equity Technical Report 10 Apr To 14 AprDocument6 pagesEquity Technical Report 10 Apr To 14 AprzoidresearchNo ratings yet

- Equity Technical Report 30 Jan To 3 FebDocument6 pagesEquity Technical Report 30 Jan To 3 FebzoidresearchNo ratings yet

- Equity Technical Report 2 Jan To 6 JanDocument6 pagesEquity Technical Report 2 Jan To 6 JanzoidresearchNo ratings yet

- Equity Weekly ReportDocument6 pagesEquity Weekly ReportzoidresearchNo ratings yet

- Equity Weekly Report 20 Feb To 24 FebDocument6 pagesEquity Weekly Report 20 Feb To 24 FebzoidresearchNo ratings yet

- Equity Report Outlook 6 Feb To 10 FebDocument6 pagesEquity Report Outlook 6 Feb To 10 FebzoidresearchNo ratings yet

- Equity Outlook 13 Feb To 17 FebDocument6 pagesEquity Outlook 13 Feb To 17 FebzoidresearchNo ratings yet

- Equity Report 12 Dec To 16 DecDocument6 pagesEquity Report 12 Dec To 16 DeczoidresearchNo ratings yet

- Equity Technical Report 28 Nov To 2 DecDocument6 pagesEquity Technical Report 28 Nov To 2 DeczoidresearchNo ratings yet

- Equity Technical Report 5 Dec To 9 DecDocument6 pagesEquity Technical Report 5 Dec To 9 DeczoidresearchNo ratings yet

- Executive Order 1035 Streamlines Gov't Land AcquisitionDocument5 pagesExecutive Order 1035 Streamlines Gov't Land Acquisitionahsiri22No ratings yet

- Assignment 1 - MaliniDocument5 pagesAssignment 1 - MaliniDarby BieNo ratings yet

- Banana Production (Lakatan) Project: A Business Plan of Ecleo FarmDocument20 pagesBanana Production (Lakatan) Project: A Business Plan of Ecleo Farmmarkgil1990No ratings yet

- Application Summary FormDocument2 pagesApplication Summary Formjqm printingNo ratings yet

- Tugas Kelompok 6 Bahasa Inggris Niaga Economic Started With GDocument10 pagesTugas Kelompok 6 Bahasa Inggris Niaga Economic Started With GrizkyNo ratings yet

- Abf303 BQ2Document4 pagesAbf303 BQ2Jay PatelNo ratings yet

- Sample Audit ReportsDocument3 pagesSample Audit Reportsvivek1119100% (1)

- CXC 20180206 PDFDocument16 pagesCXC 20180206 PDFJoshua BlackNo ratings yet

- Fund Flow StatementDocument16 pagesFund Flow StatementRavi RajputNo ratings yet

- Bajaj Allianz Guarantee Assure Plan SummaryDocument9 pagesBajaj Allianz Guarantee Assure Plan SummaryBhaskarNo ratings yet

- GJDocument58 pagesGJKishore ChakravarthyNo ratings yet

- Master of Business Administration: Narsee Monjee Institute of Management StudiesDocument5 pagesMaster of Business Administration: Narsee Monjee Institute of Management StudiesDivyanshu ShekharNo ratings yet

- Memo Model Netting ActDocument12 pagesMemo Model Netting ActChristine LiuNo ratings yet

- What Are The Features of The IstisnaDocument4 pagesWhat Are The Features of The IstisnaanassaleemNo ratings yet

- Ca Q&a Dec 2017Document101 pagesCa Q&a Dec 2017Bruce GomaNo ratings yet

- CAGR CalculatorDocument1 pageCAGR Calculatorsmallya100% (4)

- Nigerian Stock Exchange Performance On Economic GrowthDocument18 pagesNigerian Stock Exchange Performance On Economic GrowthsonyNo ratings yet

- Hablon Production Center Statement of Financial Performance For The Years Ended December 31Document41 pagesHablon Production Center Statement of Financial Performance For The Years Ended December 31angelica valenzuelaNo ratings yet

- MJ19 Sample AFM QPDocument12 pagesMJ19 Sample AFM QPNoor SohailNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument3 pages© The Institute of Chartered Accountants of IndiaDeepak KumarNo ratings yet

- Amazon Intern Job DescriptionsDocument15 pagesAmazon Intern Job Descriptionschirag_dceNo ratings yet

- Engineering Economic Analysis 11th Edition EbookDocument61 pagesEngineering Economic Analysis 11th Edition Ebookdebra.glisson665100% (48)