Professional Documents

Culture Documents

GPSC

Uploaded by

Pound KittiwangchaiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GPSC

Uploaded by

Pound KittiwangchaiCopyright:

Available Formats

Company Note | GPSC

29 September 2015

Global Power Synergy

Record earnings every year until 2020

CONSOLIDATED FINANCIAL SUMMARY

Year

Revenue (Bt, m)

Net profit (Bt, m)

Core profit (Bt, m)

Core profit growth (%)

Core EPS (Bt) - fully diluted

Core EPS growth (%)

PER (X)

PBV (X)

ROE (%)

Yield (%)

DPS (Bt)

Source: TISCO Research

2013

26,328

1,166

1,276

n.m.

0.85

n.m.

26.2

1.0

4.9

n.m.

n.m.

2014

23,755

1,581

1,589

24.5

1.06

24.5

21.0

1.0

6.3

0.4

0.10

2015F

24,651

1,794

1,835

15.5

1.22

15.5

18.2

0.9

5.0

3.0

0.66

2016F

24,093

2,175

2,175

18.5

1.45

18.5

15.4

0.9

5.9

3.6

0.80

2017F

28,048

2,698

2,698

24.1

1.80

24.1

12.4

0.9

7.0

4.4

0.99

2018F

29,959

3,681

3,681

36.4

2.46

36.4

9.1

0.8

9.2

6.1

1.35

Note: use current price for historical PER, PBV, yield

Bt33.00

Current Price (28/09/2015)

Bt22.30

Upside/Downside

48%

CG Rating

N/R

Sector

ENERG

Sector PER (x)

24.5x

SHARE SUMMARY

Issued shares:

1,498.3m

Par value:

Bt10.0

Market capitalization:

Bt33.4bn

Avg. Daily Turnover:

Bt235.8m

Foreign Limit/Actual (%)

49/0

Free Float:

24.9%

NVDR:

0.2%

Beta

0.3x

TISCOs forecast vs. consensus

TISCO

Consensus

% Diff.

2015F

EPS (Bt)

1.22

1.33

-8.1%

2016F

1.45

1.36

6.6%

PRICE / PRICE RELATIVE

Bt

30.0

28.0

26.0

24.0

22.0

20.0

Sep-15

Aug-15

Good entry level, re-iterate our BUY rating with TP of Bt33/sh

GPSC is trading on an attractive P/BV of 0.9x 2016F. We suspect the recent fall in

its share price is due to concerns that GPSCs growth is mostly back-loaded in

2018-20. Our revised numbers based on only secured capacity actually point to

decent profit growth of 19% in 2016 and 24% in 2017 to Bt2.7bn, reaching at least

Bt5.4bn in 2020. This implies EPS of Bt3.64, a PER of only 6.1x for 2020F. ROE on

track to increase to 12.5% in 2020F from current 5.0% in 2015F. We reiterate our

BUY rating for GPSC with a DCF-based SOTP target price of Bt33/sh.

(unchanged)

12 month Target Price

Jul-15

Secured capacity expansion to triple earnings; more projects in the pipeline

GPSCs secured projects equate to a total equity capacity increase of 46% to

1,971MW by 2020. This will result in profit jumping to Bt5.4bn in 2020F from

Bt1.6bn in 2014. GPSCs gross margin will widen significantly once its high-margin

IRPC-CP project comes fully online in 2018. We have included GPSC recent two

new projects since its IPO: 1) a new plant near its existing Rayong Central Utility

Plant (45MW) and 2) solar project in Japan (20.6MW). We estimate core profit

growth of 16% this year followed by 19% in 2016F (mainly NNEG in 2H) and 24%

in 2017F (IRPC-CP, BIC Phase 2, solar project and its new plant in Rayong).

BUY

Jun-15

Income from investments to boost earnings in mid-to-long term

We forecast income from GPSCs net-owned equity stakes in various power

projects to jump from Bt268m in 2014 (17% of profit) to Bt819m in 2017F (30% of

profit) and Bt4,063m in 2020F (74% of profit) when its two remaining high-margin

hydro-electric power projects come on-stream. Meanwhile net-owned equity

capacity is set to increase from 271MW in 2015 to 364MW in 2018F and 685MW

in 2020F. Projects currently in operation include Ratchaburi Power (IPP project),

TSR (solar projects) and BIC Phase 1 (SPP project). Note that NNEG (SPP project)

should come online in 2016F followed by BIC Phase 2 in 2017F, Nam Lik (hydroelectric) in 2018F and Xayaburi (hydro-electric) in 2020F.

Rating

May-15

New capacity to drive revenue growth from 2017

GPSC has three 100%-owned, operating assets: 1) Sriracha Power Plant (as IPP), 2)

Rayong Central Utility Plants (two Cogeneration plants and one utility plant) and

3) subsidiary CHPP (a VSPP). In addition it consolidates a 51% stake in IRPC-CP, a

SPP with two production units (phase 1 to run this month and the rest in 2H17F).

These projects should result in owned capacity increasing from 1,044MW in 2014

to 1,232MW in 2018. We forecast 4.0% revenue growth this year (helped by

strong demand from EGAT) and flat growth next year (on reduced ft rate),

followed by growth of 16.4% in 2017F as new capacity comes online.

Source: Bloomberg Finance LP

Performance (%)

GPSC

SET

Kanchan Khanijou

(ID:030871)

(66) 2633 6425

kanchan@tisco.co.th

-1m

-3m

-12m

(0.89)

(1.01)

(14.23)

(10.53)

0.00

(15.50)

Company Note | GPSC

I) New capacity to drive revenue growth from 2017

GPSCs own capacity to increase from 1,044MW in 2014 to 1,232MW in 2018F

GPSC has three 100%-owned operating assets 1) Sriracha Power Plant (47% of 1H15 revenue), 2)

Rayong Central Utility plant (52% of 1H15 revenue) and 3) a subsidiary CHPP (0.6% of 1H15

revenue). In terms of product types; electricity accounts for 74% of total revenue, steam 24% of

revenue and others 2%. The next main revenue driver will be its 51% stake in IRPC-CP; Phase 1 is

scheduled to run this month and the rest in 2H17. As this project generates a higher gross margin

than GPSCs existing power plants, it will lift the companys overall gross margin when the project

becomes fully operational.

We have included GPSCs two new projects since its IPO: 1) a new plant near its existing Rayong

Central Utility Plant (45MW) and 2) solar project in Japan (20.6MW). We also assume both

projects will come online in 2H17.

We forecast revenue to increase 3.8% this year (stronger than expected demand from EGAT in

1H15) before flattening out next year (on lower ft rate, in-line with lower gas costs). However, we

anticipate robust growth of 16.4% in 2017 and 7.0% in 2018F as the IRPC-CP project and its two

new projects come fully online in 2H17.

Figure 1. Revenue Breakdown (projects)

Figure 2. Revenue Breakdown (product types)

Others, 2%

Others, 1%

Rayong

central

utilitiy

plants,

52%

Source: TISCO Research, GPSC

Steam,

24%

Sriracha

power

plant, 47%

Electricity,

74%

Source: TISCO Research, GPSC

Below are details of GPSCs owned assets:

1) Sriracha Power Plant this is a power plant under EGATs Independent Power Producer (IPP)

scheme, with generating capacity of about 700MW of electricity and 80 cubic meters per hour of

industrial water. Based in Chonburi province, the plant sells all its electricity to EGAT under a

power purchase agreement with a 25-year term contract which expires in 2025. Revenue from

this plant grew 24% YoY in 1H15 to Bt6.2bn, accounting for 47% of total revenue.

2) Rayong Central Utility Plant this comprises of two cogeneration power plants which generate

and sell electricity, steam (at low cost) and industrial water to the PTT Group and other industrial

users and one utility plant. The plants also sell surplus electricity to EGAT on a non-firm basis.

Central Utility Plant 1: (CUP-1) Is located at the Hemraj Eastern Industrial estate (Map Ta Phut)

with approximate capacity of 226MW of electricity, 890 tons per hour of steam and 720 cubic

meters per hour of industrial water. The plant has an agreement to sell 124MW of electricity to

industrial users and a small power producer under a non-firm basis agreement for 40MW with

EGAT. It also sells to industrial customers in CUP-3 and recently signed an agreement to supply

electricity and steam for the second Phenol project starting early next year

2

29 September 2015

Company Note | GPSC

Central Utility Plant 2: (CUP-2) is located near RIL Industrial estate with approximate generating

capacity of 113MW of electricity, 170 tons per hour of steam and 510 cubic meters per hour of

industrial water. It has signed an agreement to sell 43MW to an industrial user and 60MW to

EGAT.

Central Utility Plant 3: (CUP-3). is located at the Hemraj Eastern Industrial estate (Map Ta Phut). It

generates 280 tons per hour of steam and 770 cubic meters per hour of industrial water. It has

reached an agreement with industrial users for 56MW which is supplied for CUP-1 (this plant

doesnt produce electricity).

3) Combined Heat and Power Production company (CHPP)- is a 100%-owned subsidiary of GPSC.

CHPP is a very small power producer (VSPP) with approximate generating capacity of 5MW of

electricity and 12,000 refrigeration tons of chilled water located in the Government Complex

selling 6.4MW to the MEA.

In addition GPSC holds a 51% stake in IRPC Clean Power:

4) IRPC Clean Power Company Limited (IRPC-CP) GPSC holds a 51% stake in this company, with

the remainder held by IRPC. IRPC-CP is a small power producer (SPP) with 2 production units with

total generating capacity of about 240MW and 300 tons per hour of steam. Located at IRPC

Industrial Zone, Rayong province, the company has a contract to sell 180MW to EGAT and the

remainder to IRPC. This project has 2 phases with Phase 1 of boiler capacity of 100ton/hs and gas

turbine capacity of 45MW to COD in September 2015 and the rest to COD in June 2017.

Figure 3. Pre-IPO GPSCs Owned Capacity Expansion Plan (MW)

1,200

1,166

1,166

1,166

2018F

2019F

2020F

1,117

1,100

1,044

1,052

2014

2015F

1,067

1,000

900

2016F

2017F

Source: TISCO Research, GPSC

Recently confirmed two new projects; with more in the pipeline:

1) Central Utility Plant 4 (CUP 4) - This project has obtained Environmental Impact Assessment

(EIA) approval for capacity up to 392MW and steam capacity of 900tph. GPSCs Board of directors

recently approved total project investment of Bt3.9bn for construction of a Cogeneration Power

Plant with first phase power capacity of 45MW and steam capacity of 70tph (construction begins

in 3Q15 and operations will start in 2017-2018). This plant is located in the Asia Industrial estate

(near its other plants) and will supply electricity and steam to nearby industrial customers, with an

agreement already signed for the second Phenol project. Our initial estimate of revenue

generation from this project is Bt1.7-2.0bn (adding 7.0% to our 2018 revenue forecast)

2) Solar power project in Japan This project is called Ichinoseki Power 1GK with GPSC holding a

99% stake. The project has capacity of 20.8MW and a tariff rate of yen 40 with COD expected in

2017 (we assumed in 2H). The project has already received relevant licenses including a Grid

Connection Agreement and the company has negotiated with banks to win financial support for

the project. Project financing for this project would be at a ratio of 80:20 with equity IRR at 14.0%.

3

29 September 2015

Company Note | GPSC

With more projects in the pipeline: GPSC plans to increase another 600-1000MW over the next 5

years which includes projects under and any potential M&A opportunities that may arise. GPSC

has already achieved 66MW (CUP-4 and solar project in Japan mentioned above). Other projects

under study and in the pipeline are: 1) Waste-to-Energy project in Rayong, 2)Thachang Biomass

project, 3) MOU signed with RATCH for a coal-fired power plant in Indonesia and Utilities plant in

Vietnam, 4)Thanlyin Gas-fired project with Ministry of Electric Power Myanmar (MOEP) (400MW),

5) Marid Coal-Fired project (1,800MW) with MOEP and 6) Ayeyarwady gas-fired project (500MW)

with MOEP. We havent factored in these potential projects into our pipeline.

Figure 4. Recently confirmed 2 new projects (66MW)

1,250

1,200

1,150

66

66

66

1,166

1,166

1,166

2018F

2019F

2020F

32

1,100

1,050

1,000

1,117

1,044

1,052

1,067

2014

2015F

2016F

950

2017F

Source: TISCO Research, GPSC

Figure 5. Details of GPSC - owned projects

Company-owned

Shareholding

(%)

Electricity

(MW)

Net

equity

capacity

(MW)

Steam

(ton/hr)

*

Demin

water

(m/hr)*

COD

80

2000

IPP power plant

Sriracha power plant

100%

700

700

Central Utility Plant 1: (CUP-1)

100%

226

226

890

720

2006

Central Utility Plant 2: (CUP-2)

100%

113

113

170

510

2008

Central Utility Plant 3: (CUP-3) utility plant

100%

280

770

2009

Cogeneration power plant

SPP power plant

IRPC Clean Power (IRPC-CP) Phase 1

51%

45

23

IRPC Clean Power (IRPC-CP) Phase 2

51%

195

99

300

2015

2017

Post IPO Expansion projects

Central Utility Plant 4-(CUP 4) Cogeneration

Solar Power project in Japan

Source: TISCO Research, GPSC

4

29 September 2015

100%

45

45

70

2017-2018

99%

20.8

20.6

2017-2018

Company Note | GPSC

II) Associates are key drivers of medium-term profit growth

Secured expansion net-equity capacity = Income from Bt268m in 2014 to Bt4,063m in 2020F

We forecast income from GPSCs net-owned equity stakes in various power projects to jump from

Bt268m in 2014 (17% of profit) to Bt819m in 2017 (30% of profit) and to Bt4,063m in 2020 (74%

of profit). A significant rise in associate income will especially be seen in 2018-20 when its last two

high-margin hydro-electric power projects come on stream. Net-owned equity capacity is set to

increase from 271MW in 2014 to 364MW in 2018 and 685MW in 2020. Brief details of

investments in different projects are below:

Figure 6. Net Equity Capacity Expansion (MW)

685

700

5,000

4,063

600

4,000

500

3,000

400

300

Figure 7. Associate Income to jump (Bt m)

271

271

290

324

364

364

2,000

200

1,000

100

268

2014

2015F 2016F 2017F 2018F 2019F 2020F

Source: TISCO Research, GPSC

2014

508

704

819

989

1,100

2015F 2016F 2017F 2018F 2019F 2020F

Source: TISCO Research, GPSC

Operating projects:

1) Ratchaburi Power (RPCL): GPSC has a 15% stake in this company. RPCL is an independent

power producer (IPP) with two production units with combined generating capacity of

1,400MW (GPSC net equity capacity is 210MW). Located in Ratchaburi province, it has a

power purchase agreement to sell to EGAT which will expire in 2033. We expect GPSC to

receive dividend income this year from RPCL in 3Q15 in the range of Bt250-300m.

2) Thai Solar Renewable (TSR): GPSC holds 40% in this company with the rest being held by Thai

Solar Energy (TSE), a listed company in the MAI market. TSE has 10 solar farm projects with a

total generating capacity of 80MW (GPSC net equity capacity is 32MW) which it sells to PEA

under a VSPP power purchase agreement. These projects are under the old tariff scheme rate

of Adder of Bt8/MW for the first 10 years; with equity IRR projected around +25%. All solar

farms started to run at full capacity this year.

3) Bangpa-in Cogeneration (BIC): GPSC holds a 25% stake in this small power producer (SPP)

which has approximate generating capacity of 117MW (GPSC net equity capacity is 29MW)

and 20tons/hr of steam. Located in the Banpa-in Industrial estate in Ayutthaya province, It

sells 90MW to EGAT and the rest to industrial users. Phase 2 is currently under construction

with another 117MW (GPSC net equity capacity is 29MW) scheduled to come online in 2017.

5

29 September 2015

Company Note | GPSC

Secured projects in pipeline scheduled to come on-stream in 2016-2020:

4) Navanakorn Electricity Generating (NNEG): GPSC holds a 30% stake in this company while

Ratchaburi Electricity Generating (RATCH), a listed utility company on the SET, owns 40%.

NNEG is a small power producer (SPP) with approximate capacity of 125MW of electricity

(GPSCs net equity capacity is 38MW) and 30 tons/hr of steam. Based in the Navanakorn

Industrial Promotion Zone in Pathumthani province it has a power purchase agreement to sell

90MW to EGAT. The company is expected to COD in June 2016. Investment in this project

totals Bt6.4bn with a project finance D/E ratio of 3:1.

5) Nam Lik Power (NL1PC): GPSC has a 40% stake in the company. It is registered and

established in Laos to develop the Nam Lik power plant project which is a run-of-river hydro

power plant project with approximate capacity of 65MW (GPSC net equity capacity is 29MW)

located to the north of Vientiane. So far only 15% of construction work has been completed

although the project is scheduled to sell electricity by end-2017. We have assumed the startup will be postponed to 2018 in our forecast. NL1PC will sell all electricity to EDL under a long

term power purchase agreement until the concession contract expires in about 27 years.

6) Natee Synergy (NSC): This is a fully-owned company of GPSC which invests 25% in XPCL

which develops hydro power plants. XPCL is registered and established in Laos and is building

the Xayaburi Hydro Power Plant project, a run-of-river hydro power plant project with

approximate generating capacity of 1,285MW (GPSCs net equity capacity is 321MW) located

on the Khong River. Construction started in 2012 and is 50% complete, with the project

scheduled to start selling electricity by 2019. XPCL will sell 1,220MW of electricity to EGAT

under a long term power purchase agreement and 60MW to EDL for a 29-year period from

the start of the operation which is expected to be around end-2019. Once this project starts,

GPSCs associate income will be boosted significantly (project gross margin is forecast to be

higher than GPSCs current gross margin).

Figure 8. Details of GPSCs investment companies

Combined cycle/Cogeneration

Ratchaburi Power (RPCL)

Bangpa-in Cogeneration (BIC)

Bangpa-in Cogeneration 2 (BIC2)

Nava Nakorn Electricity Generating (NNEG)

Solar Plant

Thai Solar Renewable (SSE1)

Hydro Electric Plant

Natee Synergy (XPCL) Xayaburi Project

Nam Lik 1 Power (NL1PC)

Source: TISCO Research, GPSC

6

29 September 2015

Shareholding (%)

Electricity

(MW)

Net equity

capacity

(MW)

Steam

(ton/hr)*

COD

15%

25%

25%

30%

1,400

117

117

125

210

29

29

38

29

29

30

2008

2013

2017

2016

40%

80

32

2013

25%

40%

1,285

65

321

26

2020

2017

Company Note | GPSC

III) On track for record earnings until 2020

Secured capacity expansion should lead to 3.4x jump in profit; more projects in pipeline

Overall, GPSCs net equity capacity will increase 46% to 1,917MW by 2020. This will result in profit

increasing 3.4x to Bt5.4bn in 2020F from Bt1.6bn in 2014. GPSCs gross margin will widen

significantly once its high-margin IRPC-CP project comes fully online in 2018 and associate income

will get a large boost once its two hydroelectric plants, especially Xayaburi, comes on-stream in

late 2019.

Estimated profit growth of 16% this year, followed by 19% in 2016F and 24% in 2017F

We estimate core profit growth of 16% this year driven by stronger than expected electricity

demand in 1H17, better gross margin and dividend income from RPCL. Associate income boost

from NNEG in 2H16F will help also support 19% growth in 2016F. For 2017, we anticipate

earnings growth of 24% driven by IRPC-CP Phase 2, BIC Phase 2 and the companys two new

projects (CUP-4 expansion and solar project in Japan). On the cost side we expect: 1) lower SG&A

in 2016-17 after exceptionally high SG&A this year mainly due to one-time IPO-related expenses,

and 2) lower interest costs (repayment to continue with funding for projects secured from IPO

funds), resulting in lower interest expenses in 2016-17.

We expect the companys profit to reach a record high of Bt5.4bn in 2020 (when its two hydroelectric dams in Laos come online).

Figure 9. Profit to jump every year until at least 2020

Bt, m

6,000

4,000

5,459

2,000

1,581

1,794

2,175

2014

2015F

2016F

3,681

4,000

2018F

2019F

2,698

0

2017F

2020F

Source: TISCO Research, GPSC

Current share price implies attractive dividend yield of 3.5% in 2016F and 4.4% in 2017F

According to company policy guidance, the dividend payout ratio was set at a minimum of 30% of

net profit. GPSCs payout ratio for 1H15 was 52% (in-line with its sector peers). We believe this

ratio will be maintained during 2H15 and in following years. We forecast full-year DPS of

Bt0.66/sh this year (paid 1H15 Bt0.35/sh) and Bt0.80/sh for 2016 and Bt1.0/sh for 2017. This is

based on a payout ratio of 55%. GPSCs net D/E currently stands at 0.05x and we expect it to

maintain this level for the next three years.

7

29 September 2015

Company Note | GPSC

IV) Attractive entry level; reiterate our BUY rating

After all secured projects come online, PER to decline to only 6.2x from current 16x 2015F

GPSCs share price surpassed its IPO price of Bt27 to reach a high of Bt28.25 on its third day of

trading but has fallen 20% since then. We suspect the decline is due to concerns that its profit

growth is mostly back-loaded in 2018-20. Our revised numbers based on only secured equity

capacity expansion plans actually point to decent profit growth of 19% in 2016F and 24% in 2017F

to Bt2.7bn. After its two high-margin hydro electric power plants come on-stream in 2019-20,

earnings will likely jump to a new record high of at least Bt5.4bn. This implies EPS will reach

Bt3.64, valuing the stock at a PER of only 6.2x for 2020F. This doesnt includes potential new

projects in the pipeline (GPSC has plans to secure an additional 1,000MW over the next 5 years).

Our DCF-based SOTP TP is Bt33/sh

We value GPSC using the discounted cash flow method due to its defensive business (power

demand is not volatile) and projects are mostly secured by long term contacts and with

government authorities. We value each power project individually to reflect the different finance

terms. We assume a cost of equity of 9.0% and no terminal value for all of its power plants. We

also incorporate GPSCs two recently confirmed projects (Central Utility Plant 4 (CUP 4) Phase 1 of

45 MW and its solar project in Japan of 20.6MW) in our earnings model.

Trading at attractive P/BV of 0.9x, ROE to jump to at least 12.5% by 2020F

Based on only its secured capacity expansion plans, ROE is set to increase to jump to the level of

peers and is on track to surge to 12.5% in 2020F from 5.0% in 2015F. We believe the P/BV gap

with peers will close as projects starts to come online. Another catalyst would be confirmation of

new projects that are currently in the pipeline or its Quick Win strategy of acquisition of

operating/under-construction assets.

Figure 10. DCF- based sum of-the-parts (SOTP) TP (Bt/sh)

Others, 2.2

TSR, 1.7

IRPCCP, 1.6

RPCL, 3.1

GPSC, 20.1

XPCL, 3.9

Source: TISCO Research, GPSC

Figure 11. Peers valuation

Ma r k et

Ca p (X )

NP (m ,Bt )

NP G (%)

E P S (Bt )

P E (X )

RO E (%)

P BV (x )

Bt , m

15 F

16 F

17 F

15 F

16 F

17 F

15 F

16 F

17 F

15 F

16 F

17 F

15 F

16 F

17 F

15 F

16 F

17 F

GLOW*

127,635

8,929

8,582

8,048

(2.3)

(3.9)

(6.2)

6.1

5.9

5.5

14.3

14.9

15.9

19.0 17.6

16.1

2.6

2.6

2.5

RATCH*

77,938

5,756

6,894

6,258

(8.3) 19.8

(9.2)

4.0

4.8

4.3

13.5

11.3

12.5

8.2 10.5

12.8

1.2

1.2

1.1

EGCO*

81,076

6,148

8,341

10,945 (19.8) 35.7

31.2

11.7

15.8

20.8

13.2

9.7

7.4

8.2 10.5

12.8

1.1

1.0

0.9

GPSC

33,980

1,835

2,175

2,698

15.5

18.5

24.1

1.2

1.5

1.8

18.8

15.8

12.8

5.0

5.9

7.0

1.0

0.9

0.9

CKP**

18,572

480

530

622

2.0

10.6

17.3

0.07

0.08

0.07

37.1

32.3

36.0

4.1

2.2

3.0

0.6

0.7

0.3

Note: * DB TISCO, ** Bloomberg consensus

Source: TISCO Research, GPSC

8

29 September 2015

Company Note | GPSC

V) Company background

Company description

GPSC was founded on 10 January 2013 through the amalgamation of PTT Utility Company (PTTUT)

and Independent Power (Thailand) Company Limited (IPT) to become PTT Groups power flagship.

Its core business is to generate and supply electricity, steam, and industrial water to customers

including electricity agencies (EGAT, PEA and MEA) and industrial users.

Key Risks

1) Production disruptions/unplanned shutdowns which could result in penalties (for IPPs) and lost

opportunities for non-EGAT sales

2) Contraction in power and steam demand from industrial customers

3) Lower than expected returns on investment due to construction delays/cost overruns

Figure 12. GPSCs portfolio of power plants

Source: TISCO Research, GPSC

9

29 September 2015

Company Note | GPSC

Figure 13. Company overview

Source: TISCO Research, GPSC

Figure 14. Capacity detail

Source: TISCO Research, GPSC

10

29 September 2015

Company Note | GPSC

CONSOLIDATED INCOME STATEMENT (Bt, m)

CONSOLIDATED QUARTERLY INCOME STATEMENT (Bt, m)

Year Ended December 31,

2013

2014

2015F

2016F

2017F

Revenue

26,328

23,755

24,651

24,093

28,048

Cost of goods sold

24,337

21,665

22,102

21,561

24,198

1,991

2,090

2,549

2,533

3,850

SG&A

289

410

736

600

670

Other income

189

135

114

138

Interest expense

618

470

439

Pre-tax profit

1,273

1,345

Corporate tax

27

1,269

Equity associates income

Minority interest

Gross profit

After-tax profit

Core Profit

2Q14

3Q14

4Q14

1Q15

2Q15

Revenue

7,287

5,628

5,905

6,451

6,609

Cost of goods sold

6,581

4,902

5,459

5,774

5,901

706

727

446

678

708

SG&A

80

130

110

137

193

157

Other income

39

27

26

22

36

393

394

Interest expense

119

113

110

103

100

1,487

1,678

2,943

Pre-tax profit

546

511

251

460

452

140

167

263

Corporate tax

54

(4)

(7)

20

33

1,318

1,348

1,511

2,679

After-tax profit

492

515

258

441

419

268

508

704

819

80

74

70

84

79

-20

-40

-800

(1)

(0)

24

1,276

1,589

1,835

2,175

2,698

Core Profit

573

588

328

524

522

Extra items

(48)

Extra items

(110)

(8)

-41

Net Profit

1,166

1,581

1,794

2,175

2,698

0.85

1.06

1.22

1.45

Core fully diluted EPS (Bt)

Net fully diluted EPS (Bt)

EBITDA

Gross profit

Equity associates income

Minority interest

(6)

(1)

Net Profit

574

582

327

531

474

1.80

Core fully diluted EPS (Bt)

0.38

0.39

0.22

0.35

0.35

Net fully diluted EPS (Bt)

0.38

0.39

0.22

0.35

0.32

EBITDA

960

857

622

824

815

0.78

1.05

1.20

1.45

1.80

2,907

2,858

3,312

3,486

4,779

CONSOLIDATED BALANCE SHEET (Bt, m)

CONSOLIDATED QUARTERLY BALANCE SHEET (Bt, m)

As of December 31,

Total current assets

2013

14,492

2014

8,145

2015F

2016F

2017F

19,416

15,955

15,666

Total current assets

Total fixed assets

28,853

34,787

37,422

Total assets

43,345

42,932

56,838

Total loans

2Q14

n.a.

3Q14

7,082

4Q14

8,145

1Q15

7,241

2Q15

17,467

40,186

42,287

Total fixed assets

n.a.

35,646

34,787

36,709

37,086

56,141

57,952

Total assets

n.a.

42,728

42,932

43,949

54,553

13,675

12,998

12,792

15,857

14,113

13,370

Total loans

n.a.

12,750

12,792

12,633

Other liabilities

5,985

4,123

4,298

4,326

4,866

Other liabilities

n.a.

3,287

4,123

4,764

4,421

Total liabilities

18,983

16,915

20,154

18,439

18,236

Total liabilities

n.a.

16,037

16,915

17,397

18,096

Paid-up capital

11,237

11,237

14,983

14,983

14,983

Paid-up capital

n.a.

11,237

11,237

11,237

14,983

9,297

10,655

11,462

12,441

13,655

Retained earnings

n.a.

12,137

10,655

11,186

11,145

434

733

753

793

1,593

Minority Interest

n.a.

946

733

736

844

23,927

25,285

35,930

36,909

38,123

Total equity

n.a.

25,745

25,285

25,816

35,613

Retained earnings

Minority Interest

Total equity

CONSOLIDATED KEY FINANCIAL RATIOS

CONSOLIDATED QUARTERLY KEY FINANCIAL RATIOS

Year Ended December 31,

Gross margin(%)

SGA to sales (%)

2013

7.6

2014

8.8

2015F

10.3

2016F

10.5

2017F

13.7

Gross margin(%)

SGA to sales (%)

1.1

1.7

3.0

2.5

2.4

11.0

12.0

13.4

14.5

17.0

Net profit margin(%)

4.4

6.7

7.3

9.0

9.6

ROE (%)

4.9

6.3

5.0

5.9

7.1

ROA (%)

2.7

3.7

3.2

3.9

Debt to equity (x)

0.8

0.7

0.6

Net Debt to equity (x)

0.2

0.4

0.03

Payout Ratio (%)

0.0

7.1

55.0

55.0

55.0

21.3

22.5

24.0

24.6

25.4

EBITDA margin(%)

BVPS (Bt)

2Q14

9.7

3Q14

12.9

4Q14

7.6

1Q15

10.5

2Q15

10.7

1.1

2.3

1.9

2.1

2.9

13.2

15.2

10.5

12.8

12.3

Net profit margin(%)

7.9

10.3

5.5

8.2

7.2

ROE (%)

n.a.

2.3

1.3

2.1

1.3

4.7

ROA (%)

n.a.

1.4

0.8

1.2

0.9

0.5

0.5

Debt to equity (x)

n.a.

0.6

0.7

0.7

0.5

0.07

0.08

Net Debt to equity (x)

n.a.

0.4

0.4

0.4

0.1

EBITDA margin(%)

CONSOLIDATED KEY ITEMS CASH FLOW STATEMENT (Bt, m)

Year Ended December 31,

Net Income

2013

1,166

2014

1,581

2015F

1,794

2016F

2,175

2017F

2,698

Depreciation

1,016

1,043

1,385

1,415

1,442

Change in working capital

(200)

803

32

(41)

(222)

Operating CF

2,519

4,603

4,445

4,762

5,893

Cash flow from investing

(6,356)

(7,143)

(10,041)

(4,036)

(3,111)

Cash flow from financing

10,227

(429)

10,929

(4,136)

(3,711)

6,390

(2,969)

5,332

(3,410)

(930)

Net change in cash

11

29 September 2015

Company Note | GPSC

TISCO Securities Company Limited

www.tiscosec.com

Bangkok

48/8 TISCO Tower 4th Floor, North Sathorn Road, Bangkok 10500, Thailand

Tel : (66) 2633 6999 Fax : (66) 2633 6490, (66) 2633 6660

Esplanade Branch

99 Esplanade Shopping Center, Room 202-2, 2nd Floor, Ratchadapisek Road, Din Daeng, Bangkok 10400

Tel : (66) 2641 3251, (66) 2641 3252 Fax : (66) 2641 3253

Chiang Mai

275/4, 2nd Floor, Chang Phuak Road, Chang Phuak, Muang District, Chiang Mai 50300

Tel. 0 5322 4722 Fax. 0 5322 4711

Nakhon Pathom

386, 388 Petchkasem Road, Prapatone, Muang District, Nakhon Pathom 73000

Tel: 0 3421 1812 Fax: 0 3425 1676

Nakhon Ratchasima

Tesco Lotus Korat, 719/5 Mittraphap Road, Naimuang, Muang District, Nakhon Ratchasima 30000

Tel: 0 4425 7752 Fax: 0 4425 3752

Udon Thani

227/21 2nd Floor, Udondussadee Road, Muang District, Udon Thani 41000

Tel: 0 4224 6888 Fax: 0 4224 5793

Score Range

Corporate Governance Report

of Thai Listed Companies 2014

90 - 100

80 - 89

70 - 79

60 - 69

50 - 59

< 50

Level

Description

5

4

3

2

1

n.a.

N/R

Excellent

Very Good

Good

Satisfactory

Pass

n.a.

Does not appear in the CGR report

Disclaimer

The disclosure of the survey result of the Thai Institute of Directors Association (IOD) regarding corporate governance is made pursuant to the policy of the Office of

the Securities and Exchange Commission. The survey of the IOD is based on the information of a company listed on the Stock Exchange of Thailand and the Market for

Alternative Investment disclosed to the public and able to be accessed by a general public investor. The result, therefore, is from the perspective of a third party. It is

not an evaluation of operation and is not based on inside information. (In order to recognize well performed companies, companies classified into the three highest

score groups (Good, Very Good, and Excellent) will be announced to the public).

The survey result is as of the date appearing in the Corporate Governance Report of Thai Listed Companies. As a result, the survey result may be changed after that

date. TISCO Securities Company Limited does not confirm nor certify the accuracy of such survey result.

12

The information, statements, forecasts and projections contained herein, including any expression of opinion, are based upon sources believed to be reliable but their accuracy completeness or

correctness are not guaranteed. Expressions of opinion herein were arrived at after due and careful consideration and they were based upon the best information then known to us, and in our

opinion are fair and reasonable in the circumstances prevailing at the time. Expressions of opinion contained herein are subject to change without notice. This document is not, and should not be

construed as, an offer or the solicitation of an offer to buy or sell any securities. TISCO and other companies in the TISCO Group and/or their officers, directors and employees may have positions

and may affect transactions in securities of companies mentioned herein and may also perform or seek to perform investment banking services for these companies. No person is authorized to

give any information or to make any representation not contained in this document and any information or representation not contained in this document must not be relied upon as having been

authorized by or on behalf of TISCO. This document is for private circulation only and is not for publication in the press or elsewhere. TISCO accepts no liability whatsoever for any direct or

consequential loss arising from any use of this document or its content. The use of any information, statements forecasts and projections contained herein shall be at the sole discretion and risk of

the user.

29 September 2015

You might also like

- ADB RateDocument1 pageADB RatePound KittiwangchaiNo ratings yet

- Thailand National Development PlanDocument171 pagesThailand National Development PlanPound KittiwangchaiNo ratings yet

- Public and Private Partnership of Highways in Korea: October 9, 2008Document18 pagesPublic and Private Partnership of Highways in Korea: October 9, 2008Pound KittiwangchaiNo ratings yet

- PPP Book 2011Document133 pagesPPP Book 2011Chico Mauni0% (1)

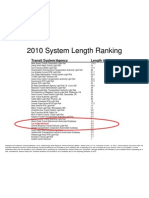

- System Length RankingDocument1 pageSystem Length RankingPound KittiwangchaiNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 1 API 653 Exam Mar 2015 MemoryDocument12 pages1 API 653 Exam Mar 2015 MemorymajidNo ratings yet

- EJC H2 Math P1 With Solution PDFDocument23 pagesEJC H2 Math P1 With Solution PDFKipp SohNo ratings yet

- SLU Missalette 2016 Capping (Not-Final)Document18 pagesSLU Missalette 2016 Capping (Not-Final)Teanu Jose Gabrillo TamayoNo ratings yet

- Literature Revisited: Understanding Key Concepts and Applying Analytical SkillsDocument31 pagesLiterature Revisited: Understanding Key Concepts and Applying Analytical SkillsMuhammad Furqan Aslam Awan100% (2)

- 2021.01.28 - Price Variation of Steel Items - SAIL Ex-Works Prices of Steel - RB-CivilDocument2 pages2021.01.28 - Price Variation of Steel Items - SAIL Ex-Works Prices of Steel - RB-CivilSaugata HalderNo ratings yet

- Calibration GuideDocument8 pagesCalibration Guideallwin.c4512iNo ratings yet

- Westford University College readies flagship campus with new programsDocument20 pagesWestford University College readies flagship campus with new programsSaju JanardhananNo ratings yet

- Vivaldi - Genuis of BaroqueDocument279 pagesVivaldi - Genuis of Baroqueilcanto100% (4)

- Brochure HorticultureDocument46 pagesBrochure HorticulturezulfiqaralimalikNo ratings yet

- Absolute Value - WikipediaDocument10 pagesAbsolute Value - WikipediaVenu GopalNo ratings yet

- 1 CAT O&M Manual G3500 Engine 0Document126 pages1 CAT O&M Manual G3500 Engine 0Hassan100% (1)

- Haier's Performance Management in Other CulturesDocument8 pagesHaier's Performance Management in Other CulturesSubhransu SahooNo ratings yet

- VANSINA, Jan. Art History in AfricaDocument250 pagesVANSINA, Jan. Art History in AfricaRaphaelTim100% (1)

- Topographic Map of Blooming GroveDocument1 pageTopographic Map of Blooming GroveHistoricalMapsNo ratings yet

- New Microwave Lab ManualDocument35 pagesNew Microwave Lab ManualRadhikaNo ratings yet

- Motor Electrico Bojin J4103 - B User ManualDocument6 pagesMotor Electrico Bojin J4103 - B User ManualJordan BonnettNo ratings yet

- Interview Question SalesforceDocument10 pagesInterview Question SalesforcesomNo ratings yet

- 3 - 6consctructing Probability Distributions CG A - 4 - 6 Lesson 2Document24 pages3 - 6consctructing Probability Distributions CG A - 4 - 6 Lesson 2CHARLYN JOY SUMALINOGNo ratings yet

- Perbandingan Penggunaan Refrigeran R22 Dengan R407 Pada Performa ACDocument15 pagesPerbandingan Penggunaan Refrigeran R22 Dengan R407 Pada Performa ACYuli RahmawatiNo ratings yet

- LAU Paleoart Workbook - 2023Document16 pagesLAU Paleoart Workbook - 2023samuelaguilar990No ratings yet

- BC Planning EvenDocument5 pagesBC Planning EvenRuth KeziaNo ratings yet

- Catalogue MinicenterDocument36 pagesCatalogue Minicentermohamed mahdiNo ratings yet

- Polymer Science: Thermal Transitions in PolymersDocument20 pagesPolymer Science: Thermal Transitions in Polymerstanveer054No ratings yet

- Solution Manual For Illustrated Guide To The National Electrical Code 7th Edition Charles R MillerDocument24 pagesSolution Manual For Illustrated Guide To The National Electrical Code 7th Edition Charles R MillerHenryJohnsonaswek97% (39)

- Balzac and the Little Chinese Seamstress: A Journey During the Cultural RevolutionDocument4 pagesBalzac and the Little Chinese Seamstress: A Journey During the Cultural RevolutionRogona 123No ratings yet

- Lorain Schools CEO Finalist Lloyd MartinDocument14 pagesLorain Schools CEO Finalist Lloyd MartinThe Morning JournalNo ratings yet

- Cognitive Clusters in SpecificDocument11 pagesCognitive Clusters in SpecificKarel GuevaraNo ratings yet

- Escalado / PLC - 1 (CPU 1214C AC/DC/Rly) / Program BlocksDocument2 pagesEscalado / PLC - 1 (CPU 1214C AC/DC/Rly) / Program BlocksSegundo Angel Vasquez HuamanNo ratings yet

- Padmavati Gora BadalDocument63 pagesPadmavati Gora BadalLalit MishraNo ratings yet

- Solwezi General Mental Health TeamDocument35 pagesSolwezi General Mental Health TeamHumphreyNo ratings yet