Professional Documents

Culture Documents

2000 June 2006 (Back)

Uploaded by

Rica Santos-vallesteroOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2000 June 2006 (Back)

Uploaded by

Rica Santos-vallesteroCopyright:

Available Formats

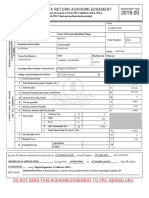

Who Shall File

This return shall be filed in triplicate by the following:

1.

In the case of constructive affixture of documentary stamps, by the person

making, signing, issuing, accepting, or transferring documents, instruments,

loan agreements and papers,

acceptances, assignments, sales and

conveyances of the obligation, right or property incident thereto wherever the

document is made, signed, issued, accepted or transferred when the obligation

or right arises from Philippine sources or the property is situated in the

Philippines at the same time such act is done or transaction had;

2.

by a metering machine user who imprints the documentary stamp tax due

on the taxable document; and

3.

by a revenue collection agent for remittance of sold loose documentary

stamps.

Whenever one party to the taxable document enjoys exemption from the tax herein

imposed, the other party thereto who is not exempt shall be the one directly liable for the tax.

When and Where to File

The return shall be filed within five (5) days after the close of the month when the

taxable document was made, signed, issued, accepted or transferred or when reloading a

metering machine becomes necessary or upon remittance by revenue collection agents of

collection from the sale of loose stamps.

The return shall be filed with the Authorized Agent Bank (AAB) within the territorial

jurisdiction of the Revenue District Office which has jurisdiction over the residence or place

of business of the taxpayer or where the collection agent is assigned. In places where there

are no AABs, the return shall be filed directly with the Revenue Collection Officer (RCO) or

duly Authorized City or Municipal Treasurer within the Revenue District Office which has

jurisdiction over the residence or place of business of the taxpayer or where the collection

agent is assigned.

When and Where to Pay

Upon filing the return, the total amount payable shall be paid to the AAB where the

return is filed. In places where there are no AABs, the tax shall be paid with the Revenue

Collection Officer or duly Authorized City or Municipal Treasurer who will issue a Revenue

Official Receipt (BIR Form No. 2524) therefor.

Where the return is filed with an AAB, taxpayer must accomplish and submit BIRprescribed deposit slip which the bank teller shall machine validate as evidence that the BIR

tax payment is deposited to the account of the Bureau of Treasury. The AAB receiving the tax

return/payment form shall also machine validate and stamp mark the word Received on the

return/payment form as proof of filing the return/payment form and payment of the tax by the

taxpayer. The machine validation shall reflect the date of payment, amount paid and

transactions code, the name of the bank, branch code, tellers code and tellers initial. Bank

debit advice/memo shall still be issued to taxpayers paying under the bank debit system.

For Electronic Filing and Payment System (EFPS) Taxpayer

The deadline for electronically filing and paying the taxes due thereon shall be in

accordance with the provisions of existing applicable revenue issuances.

Effect of Failure to Stamp Taxable Document

An instrument, document or paper which is required by law to be stamped

and which has been signed, issued, accepted or transferred without being duly stamped, shall

not be recorded, nor shall it or any copy thereof or any record of transfer of the same be

admitted or used in evidence in any court until the requisite stamp or stamps shall have been

affixed thereto and cancelled.

No notary public or other officer authorized to administer oaths shall add his jurat or

acknowledgment to any document subject to documentary stamp tax unless the proper

documentary stamps are affixed thereto and cancelled.

Penalties

There shall be imposed and collected as part of the tax:

1.

A surcharge of twenty five percent (25%) for each of the following violations:

a. Failure to file any return and pay the amount of tax or installment due on or

before the due date;

b. Unless otherwise authorized by the Commissioner, filing a return with a

person or office other than those with whom it is required to be filed;

c. Failure to pay the full or part of the amount of tax shown on the return, or the

full amount of tax due for which no return is required to be filed on or before

the due date;

d.

Failure to pay the deficiency tax within the time prescribed for its

payment in the notice of assessment.

2.

A surcharge of fifty percent (50%) of the tax or of the deficiency tax, in case any

payment has been made on the basis of such return before the discovery of the

falsity or fraud, for each of the following violations:

a. Willful neglect to file the return within the period prescribed by the Code or

by the rules and regulations; or

b. In case a false or fraudulent return is wilfully made.

3.

Interest at the rate of twenty percent (20%) per annum, or such higher rate as may

be prescribed by rules and regulations, on any unpaid amount of tax, from the

date prescribed for the payment until the amount is fully paid.

4.

Compromise penalty.

Attachments

1.

In case of constructive affixture of documentary stamps, photocopy of the document to

which the documentary stamp shall be affixed;

2.

For metering machine user, a schedule of the details of usage or consumption of

documentary stamps;

3.

Duly approved Tax Debit Memo, if applicable;

4.

Proof of exemption under special laws, if applicable.

Note: All background information must be properly filled up.

All returns filed by an accredited tax agent on behalf of a taxpayer shall bear the

following information as required in Revenue Regulation No. 15-99, as amended:

A.

For CPAs and others (individual practitioners and members of GPPs);

A.1 Taxpayer Identification Number (TIN); and

A.2 Certificate of Accreditation Number, Date of Issuance, and Date of Expiry

B.

For Members of the Philippine Bar (individual practitioners, members of GPPs;

B.1 Taxpayer Identification Number (TIN); and

B.2 Attorneys Roll Number or Accreditation Number, if any

In case of constructive affixture of documentary stamps, BIR Form 2000(in triplicate

copies) should be filed for every taxable document/transaction. Constructive affixture

means filing a tax return and paying the tax in accordance with the law.

The ATC on the face of the return shall be taken from the ATC Table at the back.

The amount of purchased documentary stamps for loading in a metering machine cannot

exceed the total consumption of documentary stamp since the last purchased date.

TIN = Taxpayer Identification Number.

ENCS

You might also like

- SEC. 202. Final Deed To PurchaserDocument14 pagesSEC. 202. Final Deed To PurchaserweygandtNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Tax Remedies Under The NIRCDocument7 pagesTax Remedies Under The NIRCmaeprincess100% (1)

- Tax DigestDocument6 pagesTax DigestJo-Al GealonNo ratings yet

- Catering Services AgreementDocument3 pagesCatering Services AgreementRica Santos-vallestero100% (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Income Taxation ModuleDocument52 pagesIncome Taxation ModulePercival CelestinoNo ratings yet

- Transmittal: Department of Justice National Prosecution Service Office of The City ProsecutorDocument1 pageTransmittal: Department of Justice National Prosecution Service Office of The City ProsecutorRica Santos-vallesteroNo ratings yet

- RR 12-1999Document21 pagesRR 12-1999anorith8867% (6)

- 2551QDocument3 pages2551QnelsonNo ratings yet

- RR 12-99 Full TextDocument5 pagesRR 12-99 Full TextErmawoo100% (2)

- Helvering V HorstDocument3 pagesHelvering V HorstKaren PascalNo ratings yet

- NDC v. CIRDocument2 pagesNDC v. CIRalexis_bea100% (1)

- Bir Form 2551qDocument6 pagesBir Form 2551qmaeshach100% (2)

- RR 12-99 Rules On Assessments PDFDocument19 pagesRR 12-99 Rules On Assessments PDFJeremeh PenarejoNo ratings yet

- 12 99Document32 pages12 99sui_generis_buddyNo ratings yet

- Revenue Regulations No. 12-99: September 6, 1999Document23 pagesRevenue Regulations No. 12-99: September 6, 1999Ricardo Jesus GutierrezNo ratings yet

- Revenue Regulations No 12-99Document3 pagesRevenue Regulations No 12-99Zoe Dela CruzNo ratings yet

- Bir Form Percentage TaxDocument3 pagesBir Form Percentage TaxEc MendozaNo ratings yet

- Business EconomicsDocument23 pagesBusiness Economicsdeepeshvc83% (6)

- Statutory Offenses and PenaltiesDocument11 pagesStatutory Offenses and PenaltiesDianna MontefalcoNo ratings yet

- Itr 2018-19 PDFDocument1 pageItr 2018-19 PDFMalik MuzafferNo ratings yet

- RR 12-99Document16 pagesRR 12-99doraemoanNo ratings yet

- The Collector of Internal Revenue vs. Suyoc Consolidated Mining Company, Et AlDocument3 pagesThe Collector of Internal Revenue vs. Suyoc Consolidated Mining Company, Et AlDaLe AparejadoNo ratings yet

- PenaltiesDocument2 pagesPenaltiesfatmaaleahNo ratings yet

- BIR Form No. 2551M Percentage Tax Return Guidelines and InstructionsDocument2 pagesBIR Form No. 2551M Percentage Tax Return Guidelines and InstructionsseanjharodNo ratings yet

- 0619-E Jan 2018 GuidelinesDocument1 page0619-E Jan 2018 GuidelinesFarida Wahab Mama-BasagNo ratings yet

- Guidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldDocument1 pageGuidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldMark Joseph BajaNo ratings yet

- 1601C GuidelinesDocument1 page1601C GuidelinesfatmaaleahNo ratings yet

- Guidelines and Instructions For BIR Form No. 2000 Monthly Documentary Stamp Tax Declaration/ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 2000 Monthly Documentary Stamp Tax Declaration/ReturnJoselito III CruzNo ratings yet

- 1601-EQ Guide January 2019 ENCS RevDocument1 page1601-EQ Guide January 2019 ENCS RevErika OrellanoNo ratings yet

- Guidelines and Instructions For BIR Form No. 1601-EQ Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document1 pageGuidelines and Instructions For BIR Form No. 1601-EQ Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded)Milds LadaoNo ratings yet

- Guidelines BIR Form No. 2000-OTDocument1 pageGuidelines BIR Form No. 2000-OTAnneNo ratings yet

- Compliance RequirementsDocument27 pagesCompliance Requirementsedz_1pieceNo ratings yet

- Bir Form No. 2551Q - Quarterly Percentage Tax Return Guidelines and Instructions Who Shall File Basis of TaxDocument2 pagesBir Form No. 2551Q - Quarterly Percentage Tax Return Guidelines and Instructions Who Shall File Basis of TaxkehlaniNo ratings yet

- 2551QDocument3 pages2551QJerry Bantilan JrNo ratings yet

- 2550Q Guidelines 2023 - FinalDocument1 page2550Q Guidelines 2023 - Finallorenzo ejeNo ratings yet

- 2551 MDocument2 pages2551 MAdrian AyrosoNo ratings yet

- 1601 C CompensationDocument2 pages1601 C Compensationjon_cpaNo ratings yet

- BIR Form 1601 c1Document2 pagesBIR Form 1601 c1Ver ArocenaNo ratings yet

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDocument1 pageBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNo ratings yet

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDocument1 pageBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNo ratings yet

- 1601C GuidelinesDocument1 page1601C GuidelinesAnonymous 1tTxK4No ratings yet

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDocument1 pageBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNo ratings yet

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDocument1 pageBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNo ratings yet

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDocument1 pageBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNo ratings yet

- 2551QDocument1 page2551QchelissamaerojasNo ratings yet

- Procedures For Filing of ESTATE TAXDocument2 pagesProcedures For Filing of ESTATE TAXJennylyn Biltz AlbanoNo ratings yet

- 2550Q InstructionsDocument1 page2550Q InstructionsMay RamosNo ratings yet

- 1702 Q Guide July 2008Document1 page1702 Q Guide July 2008fatmaaleahNo ratings yet

- BIR Form No. 2553Document2 pagesBIR Form No. 2553fatmaaleahNo ratings yet

- 1601e PDFDocument2 pages1601e PDFJanKhyrelFloresNo ratings yet

- Title I: Organization and Function of The BirDocument14 pagesTitle I: Organization and Function of The BirPJ HongNo ratings yet

- Description: 1) Who Are Required To File Documentary Stamp Tax Declaration Return?Document2 pagesDescription: 1) Who Are Required To File Documentary Stamp Tax Declaration Return?cristinatubleNo ratings yet

- Revenue Regulations No. 12-99: September 6, 1999Document16 pagesRevenue Regulations No. 12-99: September 6, 1999I.G. Mingo MulaNo ratings yet

- Tax 1.1Document13 pagesTax 1.1Mheryza De Castro PabustanNo ratings yet

- Guidelines and Instructions For BIR Form No. 1701Q Quarterly Income Tax Return For Individuals, Estates and TrustsDocument1 pageGuidelines and Instructions For BIR Form No. 1701Q Quarterly Income Tax Return For Individuals, Estates and TrustsAlyssa Hallasgo-Lopez AtabeloNo ratings yet

- 1601 CDocument2 pages1601 CChedrick Fabros SalguetNo ratings yet

- Monthly Percentage Tax ReturnDocument3 pagesMonthly Percentage Tax ReturnAu B ReyNo ratings yet

- Rev. Regs. 12-99Document21 pagesRev. Regs. 12-99Phoebe SpaurekNo ratings yet

- PROTESTING AN ASSESSMENT As Per Tax Code Sec. 228-231Document3 pagesPROTESTING AN ASSESSMENT As Per Tax Code Sec. 228-2312022107419No ratings yet

- Bir RR 12-99Document21 pagesBir RR 12-99Isaac Joshua AganonNo ratings yet

- Bir46 PDFDocument2 pagesBir46 PDFJulia SmithNo ratings yet

- RMO No. 14-2021 - DigestDocument3 pagesRMO No. 14-2021 - DigestMike Ferdinand SantosNo ratings yet

- BIR Form 0614-EVAP Payment Form Guidelines and Instructions: Who Shall Use This FormDocument1 pageBIR Form 0614-EVAP Payment Form Guidelines and Instructions: Who Shall Use This FormMhel GollenaNo ratings yet

- Return of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasDocument2 pagesReturn of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasAngela ArleneNo ratings yet

- RMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesDocument1 pageRMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesGodfrey Tejada100% (1)

- Tax Deficiency and Tax DeliquencyDocument4 pagesTax Deficiency and Tax DeliquencyJanelleNo ratings yet

- Remittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsDocument5 pagesRemittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsAngela ArleneNo ratings yet

- Not ApplicableDocument1 pageNot ApplicableRica Santos-vallesteroNo ratings yet

- Air Trnsportation Office vs. Spouses Ramos GR NO. 159402 FEBRUARY 23, 2011Document5 pagesAir Trnsportation Office vs. Spouses Ramos GR NO. 159402 FEBRUARY 23, 2011Rica Santos-vallesteroNo ratings yet

- It RelatedDocument1 pageIt RelatedRica Santos-vallesteroNo ratings yet

- As To Your First Query, in Our Opinion, The Absence of TheirDocument2 pagesAs To Your First Query, in Our Opinion, The Absence of TheirRica Santos-vallesteroNo ratings yet

- Crispin D. Baizas and Associates For Petitioners. Isidro T. Almeda For RespondentsDocument14 pagesCrispin D. Baizas and Associates For Petitioners. Isidro T. Almeda For RespondentsRica Santos-vallesteroNo ratings yet

- Bryan vs. Eastern & Australian SS (GR 9403, 4 November 1914) FactsDocument6 pagesBryan vs. Eastern & Australian SS (GR 9403, 4 November 1914) FactsRica Santos-vallesteroNo ratings yet

- Ethics 2Document61 pagesEthics 2Rica Santos-vallesteroNo ratings yet

- Ready ReckonerDocument72 pagesReady ReckonerSRINIVAS SEESALANo ratings yet

- Slides - SARSDocument191 pagesSlides - SARSCedric PoolNo ratings yet

- Issue 16 PDFDocument32 pagesIssue 16 PDFThe Indian NewsNo ratings yet

- The Platteville Journal Editorial Award Entry (Etc.)Document1 pageThe Platteville Journal Editorial Award Entry (Etc.)Steve PrestegardNo ratings yet

- Business Customer Information FormDocument3 pagesBusiness Customer Information Formpretty mangayNo ratings yet

- Practice Test 1 KeyDocument11 pagesPractice Test 1 KeyAshley Storey100% (1)

- POI Submission GuidelinesDocument4 pagesPOI Submission Guidelinesswapna vijayNo ratings yet

- E-Way Bill NO 000225Document1 pageE-Way Bill NO 000225Akshay TambeNo ratings yet

- RMC No 24-2019 Submission of Bir Form 2316Document2 pagesRMC No 24-2019 Submission of Bir Form 2316joelsy100100% (1)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Pragyakta SinghNo ratings yet

- BeaconDocument20 pagesBeaconCatawba SecurityNo ratings yet

- Macroeconomics: Tenth Edition, Global EditionDocument53 pagesMacroeconomics: Tenth Edition, Global EditionsubNo ratings yet

- Income From House PropertyDocument74 pagesIncome From House PropertyHarshit YNo ratings yet

- Tax InvoiceDocument1 pageTax Invoicesmarty sdNo ratings yet

- ECO401 Quiz 5 MCQ's500 SolvedDocument111 pagesECO401 Quiz 5 MCQ's500 Solvedhk dhamanNo ratings yet

- Present Scenario of Holding Tax Management of Local Government in Bangladesh - A Study On Union Parishad of Bogura DistrictDocument9 pagesPresent Scenario of Holding Tax Management of Local Government in Bangladesh - A Study On Union Parishad of Bogura DistrictMohiuddin Khan AL AminNo ratings yet

- Instruction To TenderersDocument4 pagesInstruction To TenderersPrinceCollinzeLockoNo ratings yet

- Deloitte Au Tax Insight Deconstructing Chevron Transfer Pricing Case 041115 PDFDocument8 pagesDeloitte Au Tax Insight Deconstructing Chevron Transfer Pricing Case 041115 PDFCA.Srikant Parthasarathy ParthasarathyNo ratings yet

- CFI Accounting FactsheetDocument1 pageCFI Accounting FactsheetPirvuNo ratings yet

- Part III PDFDocument53 pagesPart III PDFRandolph QuilingNo ratings yet

- ManojDocument1 pageManojAjit pratap singh BhadauriyaNo ratings yet

- 218880-2018-Revenue Office Tax Exemption Manual TESLite20221008-12-1h3k0fuDocument71 pages218880-2018-Revenue Office Tax Exemption Manual TESLite20221008-12-1h3k0fuLoren SanapoNo ratings yet

- B. Hilado vs. Collector of Internal Revenue, Et Al., G.R. No. L-9408, October 31, 1956Document2 pagesB. Hilado vs. Collector of Internal Revenue, Et Al., G.R. No. L-9408, October 31, 1956Rhenee Rose Reas SugboNo ratings yet