Professional Documents

Culture Documents

CIR Vs Sony Phil

Uploaded by

Jazem Ansama100%(3)100% found this document useful (3 votes)

507 views1 pageTax 2

Original Title

CIR vs Sony Phil

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTax 2

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(3)100% found this document useful (3 votes)

507 views1 pageCIR Vs Sony Phil

Uploaded by

Jazem AnsamaTax 2

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Jazem A.

Ansama

11186631

Commissioner of Internal Revenue vs. Sony Philippines. Inc.

G.R. No. 178697

November 17, 2010

Facts:

In 1998, the CIR issued Letter of Authority authorizing certain revenue officers to

examine Sonys books of accounts and other accounting records regarding revenue taxes for

the period 1997 and unverified prior years. In the following year, a preliminary assessment for

1997 deficiency taxes and penalties was issued by the CIR which Sony protested. Afterwards,

the CIR issued final assessment notices, the formal letter of demand and the details of

discrepancies. Then Sony filed a petition for review before the CTA. The CTA-First Division

ruled on the following: 1) disallowed the deficiency VAT assessment because the subsidized

advertising expense paid by Sony which was duly covered by a VAT invoice resulted in an input

VAT credit; 2) maintained the deficiency EWT assessment on Sonys motor vehicles and on

professional fees paid to general professional partnership; 3) disallowed the EWT assessment

on rental expense; 4) upheld the penalties for the late payment of VAT on royalties. In sum, the

CTA-First Division partly granted Sonys petition by cancelling the deficiency VAT assessment

but upheld a modified deficiency EWT assessment as well as the penalties. Because the CTAFirst Division denied its motion for reconsideration, CIR filed a petition for review with the CTAEB. However, the latter dismissed the petition. Hence, this petition was filed before the SC.

Issue:

Whether or not Sony Philippines is engaged in the sale of services to Sony International

Singapore (SIS), thus liable to pay VAT.

Held:

No. The deficiency VAT assessment should have been disallowed. CIRs argument that Sonys

advertising expense could not be considered as an input VAT credit because the same was

eventually reimbursed by Sony International Singapore (SIS) is erroneous.

Sonys deficiency VAT assessment stemmed from the CIRs disallowance of the input VAT

credits that should have been realized from the advertising expense of the latter. It is evident

under Sec. 110 of the 1997 Tax Code that an advertising expense duly covered by a VAT invoice

is a legitimate business expense. There is also no denying that Sony incurred advertising

expense. However, the Court does not agree that the same subsidy should be subject to the

10% VAT. The said subsidy termed by the CIR as reimbursement was not even exclusively

earmarked for Sonys advertising expense for it was but an assistance or aid in view of Sonys

dire or adverse economic conditions, and was only equivalent to the latters (Sonys)

advertising expenses.

There must be a sale, barter or exchange of goods or properties before any VAT may be levied.

Certainly, there was no such sale, barter or exchange in the subsidy given by SIS to Sony. It

was but a dole out by SIS and not in payment for goods or properties sold, bartered or

exchanged by Sony.

Sony did not render any service to SIS at all. The service rendered by the advertising

companies, paid for by Sony using SIS dole-out, were for Sony and not SIS. Therefore, Sony

Philippines is not liable to pay VAT because there was no sale of goods or services provided to

SIS.

You might also like

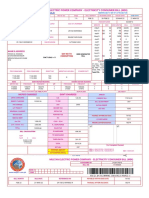

- EpaymentPrintCommonAction DoDocument1 pageEpaymentPrintCommonAction DoDHANU DANGINo ratings yet

- Sample Notes To Financial Statements For Single ProprietorDocument6 pagesSample Notes To Financial Statements For Single ProprietorLost Student100% (3)

- Contex Corp vs. CIRDocument3 pagesContex Corp vs. CIRKayelyn LatNo ratings yet

- CIR Vs Sony DigestDocument2 pagesCIR Vs Sony DigestPre Avanz83% (6)

- Bir Form 1904Document2 pagesBir Form 1904Kate Brzezinska50% (4)

- SIE ReviewerDocument5 pagesSIE ReviewerMina G.No ratings yet

- Sony Phils. vs. Cir DigestDocument3 pagesSony Phils. vs. Cir DigestClavel TuasonNo ratings yet

- NIRC CodalDocument67 pagesNIRC CodalJo-Al GealonNo ratings yet

- Bank of Philippine Islands Tax Collection CaseDocument1 pageBank of Philippine Islands Tax Collection CaseRaquel DoqueniaNo ratings yet

- Republic Vs AcebedoDocument2 pagesRepublic Vs AcebedoMaria Raisa Helga YsaacNo ratings yet

- 05 Aznar vs. CIRDocument2 pages05 Aznar vs. CIRAlec Ventura100% (1)

- Declaratory Relief On The Validity of BIR RMC No. 65-2012Document25 pagesDeclaratory Relief On The Validity of BIR RMC No. 65-2012CJNo ratings yet

- Taxation Law Mock BarDocument4 pagesTaxation Law Mock BarKrizzy GayleNo ratings yet

- CIR-v-PASCORDocument1 pageCIR-v-PASCORGyelamagne EstradaNo ratings yet

- CIR vs. Mindanao II GeothermalDocument3 pagesCIR vs. Mindanao II GeothermalMarife MinorNo ratings yet

- Winebrenner Vs CIRDocument1 pageWinebrenner Vs CIRRodney SantiagoNo ratings yet

- CIR vs Pascor Realty Tax EvasionDocument1 pageCIR vs Pascor Realty Tax EvasionMa Arnee LopezNo ratings yet

- Judy Santos Tax Case RulingDocument2 pagesJudy Santos Tax Case RulingQuoleteNo ratings yet

- Fishwealth Canning Corporation Vs CirDocument2 pagesFishwealth Canning Corporation Vs CirKateBarrionEspinosaNo ratings yet

- Revenue Memorandum Circular No. 50-2018: Quezon CityDocument18 pagesRevenue Memorandum Circular No. 50-2018: Quezon CityKyleZapanta100% (1)

- Philippine Supreme Court Upholds Validity of Revenue Regulation Denying Input Tax CreditsDocument1 pagePhilippine Supreme Court Upholds Validity of Revenue Regulation Denying Input Tax Creditsmark paul cortejosNo ratings yet

- TaxDocument7 pagesTaxArvi April NarzabalNo ratings yet

- Commissioner of Internal Revenue vs. Seagate Technology (Philippines)Document33 pagesCommissioner of Internal Revenue vs. Seagate Technology (Philippines)Giuliana FloresNo ratings yet

- CIR Vs United Salvage and Towage - Case DigestDocument2 pagesCIR Vs United Salvage and Towage - Case DigestKaren Mae ServanNo ratings yet

- CIR vs Liguigaz Philippines Corporation: CTA upholds WTC assessment despite void FDDADocument2 pagesCIR vs Liguigaz Philippines Corporation: CTA upholds WTC assessment despite void FDDAHenio PajaritoNo ratings yet

- Philam Asset Management, Inc V CirDocument2 pagesPhilam Asset Management, Inc V CirNeph MendozaNo ratings yet

- Bpi vs. Cir, GR No. 139736Document11 pagesBpi vs. Cir, GR No. 139736Ronz RoganNo ratings yet

- Cir v. MeralcoDocument2 pagesCir v. MeralcoKhaiye De Asis AggabaoNo ratings yet

- 9 TaxRev Ericcson v. City of PasigDocument12 pages9 TaxRev Ericcson v. City of PasigDexter MantosNo ratings yet

- CIR vs. Metro Star (TAX)Document3 pagesCIR vs. Metro Star (TAX)Teff QuibodNo ratings yet

- CIR vs Burroughs Tax Credit RulingDocument2 pagesCIR vs Burroughs Tax Credit RulingAngela Marie AlmalbisNo ratings yet

- Pagcor Vs BirDocument2 pagesPagcor Vs BirTonifranz SarenoNo ratings yet

- CIR v. Estate of Benigno Toda JR DIGESTDocument2 pagesCIR v. Estate of Benigno Toda JR DIGESTPia SottoNo ratings yet

- CTA upholds void EWT assessment for lack of factual basisDocument3 pagesCTA upholds void EWT assessment for lack of factual basisTheodore01760% (1)

- PRULIFE OF UK v. CIRDocument2 pagesPRULIFE OF UK v. CIREJ PajaroNo ratings yet

- UPSI-MI vs. CIRDocument2 pagesUPSI-MI vs. CIRAnalou Agustin VillezaNo ratings yet

- DIGEST - BPI Vs CIR 2005Document2 pagesDIGEST - BPI Vs CIR 2005Mocha BearNo ratings yet

- PAGCOR VAT Exemption UpheldDocument2 pagesPAGCOR VAT Exemption UpheldGem S. Alegado33% (3)

- 3 CIR V SEAGATEDocument15 pages3 CIR V SEAGATEjahzelcarpioNo ratings yet

- Philippine Bank of Communications vs CIR Prescriptive PeriodDocument2 pagesPhilippine Bank of Communications vs CIR Prescriptive PeriodCol. McCoyNo ratings yet

- CIR vs. Filinvest on Taxation of Property Exchange and AdvancesDocument3 pagesCIR vs. Filinvest on Taxation of Property Exchange and AdvancesLeica Jayme50% (2)

- CIR v. Fitness by DesignDocument4 pagesCIR v. Fitness by DesignJesi CarlosNo ratings yet

- Digested 13 18Document13 pagesDigested 13 18Tokie TokiNo ratings yet

- Silkair VS Cir, GR No 173594, Feb 6, 2008Document12 pagesSilkair VS Cir, GR No 173594, Feb 6, 2008KidMonkey2299No ratings yet

- Philippine Journalists, Inc. vs. CIRDocument3 pagesPhilippine Journalists, Inc. vs. CIRCourtney TirolNo ratings yet

- CIR Vs General Foods DigestDocument3 pagesCIR Vs General Foods DigestGil Aldrick FernandezNo ratings yet

- CIR v. Sony PhilippinesDocument1 pageCIR v. Sony PhilippinesMarcella Maria KaraanNo ratings yet

- Tax Assessment - X. CIR Vs Philippine Daily InquirerDocument3 pagesTax Assessment - X. CIR Vs Philippine Daily InquirerLouisse OcampoNo ratings yet

- Nazareno - LVM CONSTRUCTION CORPORATIONDocument3 pagesNazareno - LVM CONSTRUCTION CORPORATIONNoel Christopher G. BellezaNo ratings yet

- RCBC Vs CIR, GR No. 168498, April 24, 2007Document1 pageRCBC Vs CIR, GR No. 168498, April 24, 2007Vel June De LeonNo ratings yet

- 136 CIR vs. Vda de PrietoDocument2 pages136 CIR vs. Vda de PrietoMiw Cortes100% (1)

- Banks' 20% FWT Part of Gross Receipts for GRT CalculationDocument14 pagesBanks' 20% FWT Part of Gross Receipts for GRT Calculationrj_guzmanNo ratings yet

- Cir Vs Fitness by Design, Nc. GR NO. 215957 NOVEMEBER 9, 2016Document2 pagesCir Vs Fitness by Design, Nc. GR NO. 215957 NOVEMEBER 9, 2016Axel MendozaNo ratings yet

- CIR v. MIRANT PAGBILAO; G.R. No. 172129; 12 September 2008Document5 pagesCIR v. MIRANT PAGBILAO; G.R. No. 172129; 12 September 2008carolNo ratings yet

- Supreme Court Rules on Origination of Revenue BillsDocument180 pagesSupreme Court Rules on Origination of Revenue BillsJohnde MartinezNo ratings yet

- Cir V B.F. Goodrich Phil., Inc., Et Al GR No. 104171, February 24, 1999Document1 pageCir V B.F. Goodrich Phil., Inc., Et Al GR No. 104171, February 24, 1999Gela Bea BarriosNo ratings yet

- CIR Vs Fitness by Design - Case DigestDocument2 pagesCIR Vs Fitness by Design - Case DigestKaren Mae ServanNo ratings yet

- Cir V PNBDocument2 pagesCir V PNBAiz GutierrezNo ratings yet

- CIR Cannot Assess VAT Deficiency Without LOADocument2 pagesCIR Cannot Assess VAT Deficiency Without LOAHershey GabiNo ratings yet

- Cir vs. Meralco G.R. No. 181459, June 9, 2014Document1 pageCir vs. Meralco G.R. No. 181459, June 9, 2014Rusty NomadNo ratings yet

- RMC 75-2018 Prescribes The Mandatory Statutory Requirement and Function of A Letter of AuthorityDocument2 pagesRMC 75-2018 Prescribes The Mandatory Statutory Requirement and Function of A Letter of AuthorityMiming BudoyNo ratings yet

- CIR v. SONY PHILIPPINES, INC. - DigestDocument2 pagesCIR v. SONY PHILIPPINES, INC. - DigestMark Genesis RojasNo ratings yet

- Commissioner of Internal Revenue V. Sony Philippines. Inc. G.R. No. 178697, November 17, 2010 FactsDocument2 pagesCommissioner of Internal Revenue V. Sony Philippines. Inc. G.R. No. 178697, November 17, 2010 FactsBrent TorresNo ratings yet

- CIR Vs Sony PhilippinesDocument1 pageCIR Vs Sony PhilippinesLouie SalladorNo ratings yet

- People Vs VeraDocument2 pagesPeople Vs VeraVern Villarica Castillo100% (1)

- SC Rules Court Lacks Jurisdiction in Forcible Entry CaseDocument2 pagesSC Rules Court Lacks Jurisdiction in Forcible Entry CaseHector Mayel MacapagalNo ratings yet

- Insured Can Directly Sue Insurer for CompensationDocument2 pagesInsured Can Directly Sue Insurer for CompensationJazem AnsamaNo ratings yet

- Petition For ReplevinDocument1 pagePetition For ReplevinJazem AnsamaNo ratings yet

- 2016 Revised IRR Clean Format and Annexes 26 August 2016 PDFDocument149 pages2016 Revised IRR Clean Format and Annexes 26 August 2016 PDFRyan JD LimNo ratings yet

- Petition For ReplevinDocument1 pagePetition For ReplevinJazem AnsamaNo ratings yet

- Tousim Act of 2009, R.A. No. 9593Document126 pagesTousim Act of 2009, R.A. No. 9593PTIC London100% (2)

- National Federation of Labor V EismaDocument1 pageNational Federation of Labor V Eismadbigay100% (1)

- DO 183-17 (Changes in Section 2, Rule XI) Revised Rules On The Administration and Enforcement of Labor Laws Pursuant To Article 128 of The Labor Code, As RenumberedDocument24 pagesDO 183-17 (Changes in Section 2, Rule XI) Revised Rules On The Administration and Enforcement of Labor Laws Pursuant To Article 128 of The Labor Code, As RenumberedJeremiah Carlos100% (1)

- COA Circular No. 96-003Document6 pagesCOA Circular No. 96-003Dinnah Mae AlconeraNo ratings yet

- Petition For ReplevinDocument1 pagePetition For ReplevinJazem AnsamaNo ratings yet

- Insurance Dispute Over Earthquake CoverageDocument2 pagesInsurance Dispute Over Earthquake CoverageJazem AnsamaNo ratings yet

- Amaro v. SumanguitDocument2 pagesAmaro v. SumanguitJazem AnsamaNo ratings yet

- Central Bank of The Phils. v. CADocument4 pagesCentral Bank of The Phils. v. CAJazem AnsamaNo ratings yet

- CIR Vs CADocument1 pageCIR Vs CAJazem AnsamaNo ratings yet

- Carino V CapulongDocument2 pagesCarino V CapulongJazem Ansama50% (2)

- Yamane Vs BA Lepanto DIGESTDocument1 pageYamane Vs BA Lepanto DIGESTJazem Ansama100% (1)

- Sanctioning of Appointive OfficialsDocument2 pagesSanctioning of Appointive OfficialsJazem AnsamaNo ratings yet

- Lincoln Vs CA DDocument1 pageLincoln Vs CA DJazem AnsamaNo ratings yet

- PNB Vs Andrada DDocument2 pagesPNB Vs Andrada DJazem Ansama50% (2)

- Gercio v. Sun Life Assurance of CanadaDocument2 pagesGercio v. Sun Life Assurance of CanadaJazem AnsamaNo ratings yet

- Chattel Mortgage SyllabusDocument3 pagesChattel Mortgage SyllabusCes LoNo ratings yet

- RTC Decision on Writ of Amparo and Habeas Data OverturnedDocument2 pagesRTC Decision on Writ of Amparo and Habeas Data OverturnedJazem Ansama100% (1)

- Transportation Law SyllabusDocument6 pagesTransportation Law SyllabusCes LoNo ratings yet

- BP 68: The Corporation Code of The Philippines: Be It Enacted by The Batasang Pambansa in Session AssembledDocument21 pagesBP 68: The Corporation Code of The Philippines: Be It Enacted by The Batasang Pambansa in Session AssembledJazem AnsamaNo ratings yet

- Hipos Sr. Vs BayDocument2 pagesHipos Sr. Vs BayJazem Ansama100% (1)

- X. Provisional Remedies C. Receivership 4. Rivera V VargasDocument3 pagesX. Provisional Remedies C. Receivership 4. Rivera V VargasJazem AnsamaNo ratings yet

- Fajardo v. QuitaligDocument2 pagesFajardo v. QuitaligJazem AnsamaNo ratings yet

- Eternal Gardens Vs IAC R62 XXXDocument1 pageEternal Gardens Vs IAC R62 XXXJazem AnsamaNo ratings yet

- Fleet Status Report OdfjellDocument2 pagesFleet Status Report OdfjellAgungNo ratings yet

- Dispatch Export DocumentsDocument120 pagesDispatch Export DocumentsEdliraShehuNo ratings yet

- Tax Invoice: Duplicate 1 of 1 Export InvoiceDocument2 pagesTax Invoice: Duplicate 1 of 1 Export Invoiceamit0% (1)

- Intermediate Accounting III ReviewerDocument3 pagesIntermediate Accounting III ReviewerRenalyn PascuaNo ratings yet

- PPM223 Me-10299Document3 pagesPPM223 Me-10299Rob PortNo ratings yet

- Introduction To ExternalitiesDocument40 pagesIntroduction To ExternalitiesKhalidkhattak11100% (1)

- List of Sub-Object Code - 20190501Document140 pagesList of Sub-Object Code - 20190501Danny DabianoNo ratings yet

- Donors Tax Handout 3Document5 pagesDonors Tax Handout 3Xerez SingsonNo ratings yet

- Income Tax WHT Rates Card 2016-17Document8 pagesIncome Tax WHT Rates Card 2016-17Sami SattiNo ratings yet

- Corporate Hedging: What, Why and How?Document48 pagesCorporate Hedging: What, Why and How?postscriptNo ratings yet

- All NEW HL P1 Essays Micro Only Tweaked (RWE For Part B) Until NOV21Document9 pagesAll NEW HL P1 Essays Micro Only Tweaked (RWE For Part B) Until NOV21Alex sidiroNo ratings yet

- 2013-2019 Iloilo City, Comprehensive Development PlanDocument39 pages2013-2019 Iloilo City, Comprehensive Development PlanJawo Jimenez60% (5)

- Multan Electric Power Company - Electricity Consumer Bill (Mdi)Document1 pageMultan Electric Power Company - Electricity Consumer Bill (Mdi)Zohaib AhmadNo ratings yet

- Project Profile On The Establishment of Palm Beach Resort at BatticoloaDocument33 pagesProject Profile On The Establishment of Palm Beach Resort at BatticoloaCyril PathiranaNo ratings yet

- The Impact of Board Composition On Accounting Profitability of The Firm - A Study of Large Caps in Sweden Staement of The ProblemDocument3 pagesThe Impact of Board Composition On Accounting Profitability of The Firm - A Study of Large Caps in Sweden Staement of The ProblemYayoNo ratings yet

- Deutsche Bank Annual Review 2009 StrengthDocument436 pagesDeutsche Bank Annual Review 2009 StrengthCebotar AndreiNo ratings yet

- Bayag 1Document41 pagesBayag 1Jan Angelo MagnoNo ratings yet

- 2021 Tax Rates SwitzerlandDocument4 pages2021 Tax Rates SwitzerlandKamil JanasNo ratings yet

- Vat Summary Notes Business TaxationDocument34 pagesVat Summary Notes Business TaxationNinNo ratings yet

- Notes FMDocument42 pagesNotes FMSneha JayalNo ratings yet

- University of Cambridge International Examinations International General Certificate of Secondary Education Economics Paper 3 Multiple Choice May/June 2005 1 HourDocument12 pagesUniversity of Cambridge International Examinations International General Certificate of Secondary Education Economics Paper 3 Multiple Choice May/June 2005 1 HourShadyNo ratings yet

- Employee's Withholding Certificate 2020Document4 pagesEmployee's Withholding Certificate 2020CNBC.comNo ratings yet

- Student Support Material: Class XI Business StudiesDocument111 pagesStudent Support Material: Class XI Business StudiesPushpinder KumarNo ratings yet

- BLGF Opinion March 17 2011Document7 pagesBLGF Opinion March 17 2011mynet_peterNo ratings yet

- Requisition Form Requisition Form Requisition Form: Department of Health Department of Health Department of HealthDocument1 pageRequisition Form Requisition Form Requisition Form: Department of Health Department of Health Department of HealthsycNo ratings yet

- CPE520 - Site SelectionDocument3 pagesCPE520 - Site SelectionJaymacNo ratings yet