Professional Documents

Culture Documents

India Vs Major Emerging Economies

Uploaded by

Naveen PalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

India Vs Major Emerging Economies

Uploaded by

Naveen PalCopyright:

Available Formats

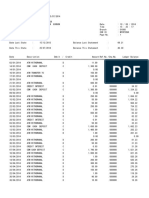

Health of Indias Economy vs major Emerging Economies

The Indian economy recorded 7% GDP growth in the first quarter of the financial year 2015-16. Economists are confused on whether to be excited about this

growth number (which has come amidst a gloomy global economic setting) or worry that domestic growth is decelerating from previous periods. Here are a few

factors that should help you decide.

The GDP number in perspective: Last quarters 7% GDP growth is below the 7.5% figure reported for the first three months of this calendar year, as well as the

7.3% recorded for the full financial year 2014-15. This suggests that economic growth in the country has slowed down, as opposed to gathering pace, as it was

expected to when the Modi government took over. However, it must be realized that today, the world economy is much different from the previous fiscal. The

green shoots of recovery that were emerging then, have been unable to survive for long. Also, the Modi government came in with a lot of internal house cleaning to

do; only some of which seems to be done yet. Despite this, last quarters growth has come in higher than 6.7% that was recorded in the same quarter last year. This

suggests that we have made some progress, but a lot remains to be done.

Better growth than other emerging markets: Despite a modest 7% figure, Indias growth rate stands above most of its emerging-market peers, namely

Russia, Brazil, Turkey and South Africa; and at par with China. While most of these economies seem to have recently entered a recession, India, which was never in

a recession, seems to be coming out of its domestic problems. The crash in global oil prices and the imposition of an economic embargo have left Russia in an

impoverished state. The countrys growth rate has become negative and the Rubble - its currency has fallen to parity with the Indian rupee. Brazils recession

deepened further last quarter, as the country experienced a contraction of 1.9%. Many economists believe that China too has entered an extended phase of

economic slowdown, following a major export boom. The country had to devalue its currency twice in August alone, and take desperate measures to support its

ailing infrastructure sector. Many of its cities have turned into ghost cities, as millions of new, up-market homes have no buyers. This has forced the government

to buy them at a fraction of the original value, and resell them for even cheaper, as low-cost houses for the poor. Former IMF economist Eshwar Prasad expects

Chinas growth to fall to 6.5%-7% from the double digit rates that the country has become used to. Indias economy, even for its challenges, seems much better

placed.

India in a sweet spot: Despite an average performance last quarter, India has many things going right for it. The wreckage caused by inflation now seems to be

over as we have now moved into disinflation. This means that the RBI can adopt a more pro-growth monetary policy by introducing another large interest rate cut.

Lower rates will enable people to spend more and companies to invest more. Growth will also be supported by the collapse of crude oil which, at below $50 a

barrel, is much lower than most economists year end estimate of $60-65 a barrel. Additionally, the commodity super-cycle is now over, which means that India

will be able to import things at a much lower cost than earlier in the decade, to support its growth. However, with the rupee falling to a two year low, this incentive

will be somewhat limited. Buoyed by these factors, foreign companies invested $ 9.5 billion in India, between April and June this year. This is an increase of 31.4%

over last year.

Key domestic concerns remain: Despite promising big, the NDA government has achieved little with regard to promoting Indias economic growth. The

present session of parliament was expected to be a landmark session as two critical bills- GST and Land Bill- were slated to pass in it. GST will rationalize indirect

taxation related to manufacturing, transportation and sale of goods and services, in India. It is widely touted as the final bit of legislation that would make FDI in

retail work in the country. The Land Bill will make acquiring land for industrial and infrastructural projects easier. It will enable work on many stuck projects to

restart, and facilitate many new projects to commence. It is unlikely that either bill would pass in the current session of the Parliament. A failure to get these bills

passed could have an adverse effect on private sector investments going forward. CRISIL expects investment in 22 large industries in the country to slip by 8% in

the 12 months ending March. A more committed push on the reforms front will inspire confidence in the private sector and enable it to invest more in the economy.

This is especially true when growth opportunities externally are limited.

You might also like

- Indias Economic WoesDocument3 pagesIndias Economic WoesresfreakNo ratings yet

- Slip-Sliding Away: India's EconomyDocument2 pagesSlip-Sliding Away: India's EconomyRamesh BishtNo ratings yet

- We Expect Liquidity To Be Tight Till December, at Least. - J P MorganDocument5 pagesWe Expect Liquidity To Be Tight Till December, at Least. - J P MorganAlpesh PatelNo ratings yet

- Indian EconomyDocument38 pagesIndian EconomyIQAC VMDCNo ratings yet

- Lecture by Dr. Raghuram Rajan, Governor, RBI On IndiaDocument2 pagesLecture by Dr. Raghuram Rajan, Governor, RBI On IndiaDeepak SharmaNo ratings yet

- Restoring High Growth: Guest ColumnDocument2 pagesRestoring High Growth: Guest Column47403768No ratings yet

- Economics IA MACRODocument7 pagesEconomics IA MACROAayush KapriNo ratings yet

- Click To Edit Master Subtitle StyleDocument14 pagesClick To Edit Master Subtitle StyleSneha SinghNo ratings yet

- The Case For India by Raghuram RajanDocument2 pagesThe Case For India by Raghuram Rajanmossad86No ratings yet

- Hallenges For The Indian Economy in 2017Document7 pagesHallenges For The Indian Economy in 2017Asrar SheikhNo ratings yet

- Managerial EconomicsDocument7 pagesManagerial EconomicsTanya Miriam SimonNo ratings yet

- Indian Economy - Challenges & Opportunities PDFDocument3 pagesIndian Economy - Challenges & Opportunities PDFDhiraj MeenaNo ratings yet

- GDP at 7.8% Doesn't Reflect Current Underlying Momentum of Indian EconomyDocument2 pagesGDP at 7.8% Doesn't Reflect Current Underlying Momentum of Indian EconomyManas RaiNo ratings yet

- Direction and Future of Inflation in India With Respect To ChinaDocument4 pagesDirection and Future of Inflation in India With Respect To ChinaAditya SinghNo ratings yet

- BREAKINGVIEWS-India in Depth: A Japanese-Style "Big Reset"Document2 pagesBREAKINGVIEWS-India in Depth: A Japanese-Style "Big Reset"Kunal DesaiNo ratings yet

- Macro Points From China Korea IndiaDocument6 pagesMacro Points From China Korea Indiaihavenoidea33No ratings yet

- IndiaDocument3 pagesIndiaAbhishek SinhaNo ratings yet

- India'S GDP vs. CitizensDocument3 pagesIndia'S GDP vs. Citizensarfana nizamNo ratings yet

- Ndia Is The 11th Largest Economy in The World by Nominal GDP and 4th Largest by Purchasing Power ParityDocument3 pagesNdia Is The 11th Largest Economy in The World by Nominal GDP and 4th Largest by Purchasing Power ParityShubhangi PanpatilNo ratings yet

- SPEX Issue 22Document10 pagesSPEX Issue 22SMU Political-Economics Exchange (SPEX)No ratings yet

- Project KMFDocument96 pagesProject KMFLabeem SamanthNo ratings yet

- Key Macro-Economic Challenges For India, at Present, Include: InflationDocument5 pagesKey Macro-Economic Challenges For India, at Present, Include: InflationAmita SinwarNo ratings yet

- Buy India Sell ChinaDocument9 pagesBuy India Sell ChinaRANG2812No ratings yet

- Indian EconomyDocument13 pagesIndian EconomyPraval SaiNo ratings yet

- Market Outlook VRK100 14062011Document3 pagesMarket Outlook VRK100 14062011RamaKrishna Vadlamudi, CFANo ratings yet

- Indian Economy - Nov 2019Document6 pagesIndian Economy - Nov 2019Rajeshree JadhavNo ratings yet

- Five Trillion Us Dollar Economy Target of IndiaDocument25 pagesFive Trillion Us Dollar Economy Target of Indiasrishti sharma.ayush1995No ratings yet

- Current Global Credit CrisisDocument1 pageCurrent Global Credit CrisisAbhinay KumarNo ratings yet

- 5 TN EconomyDocument4 pages5 TN EconomyPeyush NeneNo ratings yet

- Shashikant S KulkarniDocument13 pagesShashikant S KulkarniAmit ChoudhuryNo ratings yet

- Niveshak Niveshak: India Vision 2020Document24 pagesNiveshak Niveshak: India Vision 2020Niveshak - The InvestorNo ratings yet

- Course: Macro Economics Course Code: Bmt6111 SEMESTER: Tri Semester'2019-20Document9 pagesCourse: Macro Economics Course Code: Bmt6111 SEMESTER: Tri Semester'2019-20Gopinath KNo ratings yet

- India's Darkest Hour: RBI Should Also Look at Growth, Employment Generation: FMDocument2 pagesIndia's Darkest Hour: RBI Should Also Look at Growth, Employment Generation: FMPradeep RaghunathanNo ratings yet

- Indias Problem Is Export Not The RupeeDocument2 pagesIndias Problem Is Export Not The RupeeZiya ShaikhNo ratings yet

- Summer Internship Report On LenovoDocument74 pagesSummer Internship Report On Lenovoshimpi244197100% (1)

- Monthly Journal - Dec, 15 IssueDocument152 pagesMonthly Journal - Dec, 15 Issuemaddy0808No ratings yet

- Present Economic SlowdownDocument8 pagesPresent Economic SlowdownGopinath KNo ratings yet

- Present Indian Economy SlowdownDocument8 pagesPresent Indian Economy SlowdownGopinath KNo ratings yet

- Present Indian Economy SlowdownDocument8 pagesPresent Indian Economy SlowdownGopinath KNo ratings yet

- OwowDocument46 pagesOwowprasadsangamNo ratings yet

- Helping You Spot Opportunities: Investment Update - October, 2012Document56 pagesHelping You Spot Opportunities: Investment Update - October, 2012Carla TateNo ratings yet

- RBG Financial News LetterDocument2 pagesRBG Financial News Lettermarketing2871No ratings yet

- Top Ten Largest Trading Partners During 2006-07 Country Trade Volume (Rs. in Crores) Trade BalanceDocument6 pagesTop Ten Largest Trading Partners During 2006-07 Country Trade Volume (Rs. in Crores) Trade BalanceShru SharmaNo ratings yet

- Union Budget 2012-13Document24 pagesUnion Budget 2012-13hanuman3No ratings yet

- South Asia ReportDocument9 pagesSouth Asia ReporttoabhishekpalNo ratings yet

- Yes, India Can Become A 5 Trillion Dollar Economy by 2024Document8 pagesYes, India Can Become A 5 Trillion Dollar Economy by 2024Rayana Bhargav SaiNo ratings yet

- August 2019Document2 pagesAugust 2019Kiran MNo ratings yet

- Budget 2011Document2 pagesBudget 2011Tushar SharmaNo ratings yet

- Knowledge Session 1Document8 pagesKnowledge Session 1Rishi ChourasiaNo ratings yet

- Performance ApppraidDocument81 pagesPerformance ApppraidManisha LatiyanNo ratings yet

- LenovoDocument84 pagesLenovoasifanis100% (1)

- Business LineDocument23 pagesBusiness LineShraddha GhagNo ratings yet

- Crisil Ecoview: March 2010Document32 pagesCrisil Ecoview: March 2010Aparajita BasakNo ratings yet

- Fiscal Deficit InfoDocument12 pagesFiscal Deficit InfoSanket AiyaNo ratings yet

- EIC Project Report On Pharmaceutical IndustryDocument52 pagesEIC Project Report On Pharmaceutical IndustrykalpeshsNo ratings yet

- 2015: Outlook for Stocks, Bonds, Commodities, Currencies and Real EstateFrom Everand2015: Outlook for Stocks, Bonds, Commodities, Currencies and Real EstateNo ratings yet

- Operation and Supply Chain Management.Document9 pagesOperation and Supply Chain Management.Naveen PalNo ratings yet

- Ethical Issues in International BusinessesDocument13 pagesEthical Issues in International BusinessesNaveen Pal100% (1)

- Awt Controls and Layout ManagerDocument54 pagesAwt Controls and Layout ManagerNaveen PalNo ratings yet

- (WWW - Entrance-Exam - Net) - Oracle Sample Paper IVDocument6 pages(WWW - Entrance-Exam - Net) - Oracle Sample Paper IVvipin04No ratings yet

- Oracle Placement Sample Paper 5Document16 pagesOracle Placement Sample Paper 5Naveen PalNo ratings yet

- (WWW - Entrance-Exam - Net) - Oracle Placement Sample Paper 1Document16 pages(WWW - Entrance-Exam - Net) - Oracle Placement Sample Paper 1Pritesh PathakNo ratings yet

- Hockey Shivam PalDocument16 pagesHockey Shivam PalNaveen PalNo ratings yet

- Current Affairs 2011 GK MCQ On CurrentDocument22 pagesCurrent Affairs 2011 GK MCQ On CurrentNaveen PalNo ratings yet

- HandbookDocument194 pagesHandbookSofia AgonalNo ratings yet

- Acevac Catalogue VCD - R3Document6 pagesAcevac Catalogue VCD - R3Santhosh KumarNo ratings yet

- Lec # 26 NustDocument18 pagesLec # 26 NustFor CheggNo ratings yet

- ISP Flash Microcontroller Programmer Ver 3.0: M Asim KhanDocument4 pagesISP Flash Microcontroller Programmer Ver 3.0: M Asim KhanSrđan PavićNo ratings yet

- Drill String DesignDocument118 pagesDrill String DesignMohamed Ahmed AlyNo ratings yet

- Item Description RCVD Unit Price Gross Amt Disc % Ta Amount DeptDocument1 pageItem Description RCVD Unit Price Gross Amt Disc % Ta Amount DeptGustu LiranNo ratings yet

- COGELSA Food Industry Catalogue LDDocument9 pagesCOGELSA Food Industry Catalogue LDandriyanto.wisnuNo ratings yet

- EC2 406006 001 EFE 0121 - Controgen Generator Excitation System Description - Rev - ADocument29 pagesEC2 406006 001 EFE 0121 - Controgen Generator Excitation System Description - Rev - AAnonymous bSpP1m8j0n50% (2)

- VoLTE KPI Performance - E2EDocument20 pagesVoLTE KPI Performance - E2EAnway Mohanty100% (1)

- TT Class XII PDFDocument96 pagesTT Class XII PDFUday Beer100% (2)

- Design of Flyback Transformers and Filter Inductor by Lioyd H.dixon, Jr. Slup076Document11 pagesDesign of Flyback Transformers and Filter Inductor by Lioyd H.dixon, Jr. Slup076Burlacu AndreiNo ratings yet

- A Comparison of Pharmaceutical Promotional Tactics Between HK & ChinaDocument10 pagesA Comparison of Pharmaceutical Promotional Tactics Between HK & ChinaAlfred LeungNo ratings yet

- Alternator: From Wikipedia, The Free EncyclopediaDocument8 pagesAlternator: From Wikipedia, The Free EncyclopediaAsif Al FaisalNo ratings yet

- Copeland PresentationDocument26 pagesCopeland Presentationjai soniNo ratings yet

- Is.14785.2000 - Coast Down Test PDFDocument12 pagesIs.14785.2000 - Coast Down Test PDFVenkata NarayanaNo ratings yet

- White Button Mushroom Cultivation ManualDocument8 pagesWhite Button Mushroom Cultivation ManualKhurram Ismail100% (4)

- An Over View of Andhra Pradesh Water Sector Improvement Project (APWSIP)Document18 pagesAn Over View of Andhra Pradesh Water Sector Improvement Project (APWSIP)gurumurthy38No ratings yet

- Data Book: Automotive TechnicalDocument1 pageData Book: Automotive TechnicalDima DovgheiNo ratings yet

- PW Unit 8 PDFDocument4 pagesPW Unit 8 PDFDragana Antic50% (2)

- Notice For AsssingmentDocument21 pagesNotice For AsssingmentViraj HibareNo ratings yet

- Liga NG Mga Barangay: Resolution No. 30Document2 pagesLiga NG Mga Barangay: Resolution No. 30Rey PerezNo ratings yet

- IOSA Information BrochureDocument14 pagesIOSA Information BrochureHavva SahınNo ratings yet

- BMT6138 Advanced Selling and Negotiation Skills: Digital Assignment-1Document9 pagesBMT6138 Advanced Selling and Negotiation Skills: Digital Assignment-1Siva MohanNo ratings yet

- Class 11 Accountancy NCERT Textbook Chapter 4 Recording of Transactions-IIDocument66 pagesClass 11 Accountancy NCERT Textbook Chapter 4 Recording of Transactions-IIPathan KausarNo ratings yet

- The Concept of ElasticityDocument19 pagesThe Concept of ElasticityVienRiveraNo ratings yet

- CBC Building Wiring Installation NC IIDocument72 pagesCBC Building Wiring Installation NC IIFaysbuk KotoNo ratings yet

- Between:-Mr. Pedro Jose de Vasconcelos, of Address 14 CrombieDocument2 pagesBetween:-Mr. Pedro Jose de Vasconcelos, of Address 14 Crombiednd offiNo ratings yet

- SH210 5 SERVCE CD PDF Pages 1 33Document33 pagesSH210 5 SERVCE CD PDF Pages 1 33Em sulistio87% (23)

- Life Cycle Cost Analysis of Hvac System in Office ProjectsDocument3 pagesLife Cycle Cost Analysis of Hvac System in Office ProjectsVashuka GhritlahreNo ratings yet

- Bank Statement SampleDocument6 pagesBank Statement SampleRovern Keith Oro CuencaNo ratings yet