Professional Documents

Culture Documents

FIE402-2015 Syllabus v2

Uploaded by

NilsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FIE402-2015 Syllabus v2

Uploaded by

NilsCopyright:

Available Formats

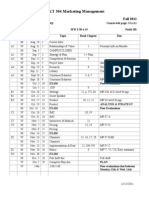

FIE 402N Corporate Finance, fall 2015 PRELIMINARY

Professor Thore Johnsen (C311)

Tue and Thu 10:15-12:00 in Jan Mossin

TA sessions are held by Jens Kvrner Srlie on indicated topics & exam problems; Terje Hansen Aud. 16.15 18.00

Readings:

Berk and DeMarzo (BD); Corporate Finance, 3rd edition. Course package (A) consisting of articles and case-materials

#

1

Tue

Date Topic

18/8 Introduction

Note

Readings

BD ch. 1-2

A.1-2

BD ch. 3-5, 7-8

A.3-4

2, 3 Thu

Tue

20/8 Capital budgeting

25/8

4, 5 Thu

Tue

27/8 Valuation of shares and firms

1/9

BD ch. 9

6, 7 Thu

Tue

3/9

8/9

BD ch. 10-13

BD ch. 18-19

Thu

Thu

Cost of capital

WACC from comparable companies

Valuation using options and forwards

10/9 Pricing of options and forward

contracts

10/9 TA session 1: Valuation

BD ch. 20-21

Practice problems

2: 8,10,13,20,22

Due date

12/9

7: 7,13,22

8: 10,19,23

12/9

9: 8,9,15,19,25,30

12/9

26/9

Marriott Corp.*

(8/9)

11: 48,50

12: 17-19, 22,25,27

18: 4,8,12,14

Bruce Honiball

(10/9)

20: 5,16,19,22

21: 12,26

26/9

Reeby Sport*(1/9)

(16.15 18.00)

Exam 2006 Q2, 2007 Q2

Fri

11/9 TA session 2: Cost of Capital (16.15 18.00)

Tue

15/9 Real options

BD ch. 22

A.5

10 Tue

22/9 Equity as an option

BD ch. 6.1-2,

6.4-5, 20.6

11 Thu

Capital structure and payout policy

24/9 The debt-equity choice: taxes vs.

bankruptcy costs

Case*/Mini-case

Exam 2003 Q1

BD ch. 14-16

A.6-7

Mr Thorndike

(22/9)

22: 7,12,15

26/9

8: 3,11

20: 28,30

26/9

14: 3,5,9,14,21

15: 6,7, 18,22

16: 9,12,17

10/10

12 Thu

1/10 Pecking order

13 Tue

6/10 Debt capacity

14 Thu

8/10 Dividend policy

15 Tue

13/10 Equity offerings

Thu 15/10 TA session 3: Options

Fri

16 Tue

BD ch. 24

A. 8-9

16: 29,33

24: 12

10/10

BD ch. 9.3, 17

A.10-11

9: 17

17: 2,6,9,16,22

24/10

BD ch. 23

A.12

23: 9,13,17

24/10

(16.15 18.00)

Exam 2008 Q4, 2006 Q3

16/10 TA session 4: Convertibles (16.15 18.00)

Special topics and course review

20/10 M&A

17 Thu 22/10 Valuation II

Fri

Crown*

(6/10)

Exam 2008 Q3, 2009 Q4

BD ch. 28

A.13

28: 4,9,14,18

24/10

BD ch. 29

A.14-15

23/10 TA session 5: equity offering / dividends

Exam 2004 Q3, 2010 Q5

GUEST LECTURES 26 29 Oct

Mon 26/10 16.15 - 18.00, Mossin: Anders Misund (NHH 98); Head of EQT Partners Norway

- Private Equity

Tue 27/10 10.15 12.00, Mossin:Peter Hermanrud (NHH 82), Head of Strategy, Swedbank Sec.

Valuation

16.15 - 18.00, Mossin: Are Andersen (NHH 93); Partner, ABG Sundal Collier

- Investment Banking

Thu 29/10 10.15 12.00 Mossin: Herleif Haavik (NHH 96), Head of Credit Trading, Nordea Markets - Credit markets

16.15 18.00 Mossin:McKinsey Norway

M&A

18 Tue

3/11 Course review I

Fall 2013 exam*

19 Thu

5/11 Course review II

Fall 2014 exam*

Man 16/11 FINAL EXAM

A star (*) indicates a case eligible for one course credit (vs. a mini-case, counting for course credit). Case write-ups are due before the start of class or, if indicated, the

date in parenthesis. Practice problems should be solved in MyFinanceLab, with at least 50% of the answers correct. Each home work set carries equal weight, i.e. if you

miss one practice problem set, you need 100% correct on the next practice problem set for an average of 50%. The last column shows the due date for the respective

practice problem set. See the course description for a detailed review of the course requirements. The course code in MyFinanceLab is XL21-I1YR-2020-3M02.

You might also like

- Business ConsultingDocument779 pagesBusiness ConsultingButunoi Bogdan-Adrian67% (3)

- Od 226180983725961000Document2 pagesOd 22618098372596100021Keshav C7ANo ratings yet

- Invoice Template Side TiltDocument1 pageInvoice Template Side TiltNAEEM MALIKNo ratings yet

- 07 IFRS 16 LeasesDocument45 pages07 IFRS 16 LeasesAung Zaw Htwe50% (2)

- Task Split Progress Milestone Project Summary External Tasks External Milestone Deadline Project: Gantt Chart Date: Mon 25/02/13Document1 pageTask Split Progress Milestone Project Summary External Tasks External Milestone Deadline Project: Gantt Chart Date: Mon 25/02/13Karl AttardNo ratings yet

- 3,4,5 - Training Pathway, Matriks NOSS & Core AbilityDocument27 pages3,4,5 - Training Pathway, Matriks NOSS & Core AbilityMohd Fariq IzmeerNo ratings yet

- Ready, Steady,: ForexDocument25 pagesReady, Steady,: ForexSrini VasanNo ratings yet

- Ch13 Case Novo IndustriesDocument11 pagesCh13 Case Novo IndustriesAlfaRahmatMaulana100% (4)

- IWC303 Principles of FinanceDocument2 pagesIWC303 Principles of FinanceToby ChungNo ratings yet

- 11F 304 Course ScheduleDocument1 page11F 304 Course ScheduleSchoolR29No ratings yet

- RaipurDocument2 pagesRaipurCSKKGUPTANo ratings yet

- Conduct Branch-I Programme: MBA (SEM) : Date Sheet/ Mar 2012Document1 pageConduct Branch-I Programme: MBA (SEM) : Date Sheet/ Mar 2012manveetSinghNo ratings yet

- MIEPP Exam Timetable WiSe 2016 - 17Document2 pagesMIEPP Exam Timetable WiSe 2016 - 17sdfNo ratings yet

- Exam Routine For Spring)Document1 pageExam Routine For Spring)nirjhor006No ratings yet

- Leactures ScheduleDocument2 pagesLeactures ScheduleSelin PusatNo ratings yet

- ACM M B02 - Financial ManagementDocument6 pagesACM M B02 - Financial ManagementRachit AgarwalNo ratings yet

- As LOL Timetable F12 DraftDocument1 pageAs LOL Timetable F12 DraftATee LeeNo ratings yet

- Session: Exam Date Day Sub - Code/Name: For Candidates Admitted in The Year 2009 & 2011Document5 pagesSession: Exam Date Day Sub - Code/Name: For Candidates Admitted in The Year 2009 & 2011vairampearl0No ratings yet

- FIN 502 Introduction To Financial Valuation: Lecturer: Carmen StefanescuDocument8 pagesFIN 502 Introduction To Financial Valuation: Lecturer: Carmen StefanescuWahaj AslamNo ratings yet

- General Instructions For Seating Arrangement The Name of The Examination Centre Is Printed On The Admission Card of The ExamineeDocument9 pagesGeneral Instructions For Seating Arrangement The Name of The Examination Centre Is Printed On The Admission Card of The ExamineeAmol IngleNo ratings yet

- Session: Exam Date Day Sub - Code/NameDocument4 pagesSession: Exam Date Day Sub - Code/NameGokul CoolNo ratings yet

- Allbba&bcomDocument12 pagesAllbba&bcomSanaNo ratings yet

- TimetableDocument2 pagesTimetableGiang_Tran_8895No ratings yet

- Engineering Economics: University of Sharjah Dept. of Civil and Env. EnggDocument24 pagesEngineering Economics: University of Sharjah Dept. of Civil and Env. EnggUyGrEdSQNo ratings yet

- MBA (Gen&PPM) T12 022Document4 pagesMBA (Gen&PPM) T12 022asdfghi123456No ratings yet

- MN-3012 Handbook - 2019-20Document17 pagesMN-3012 Handbook - 2019-20ikhsanmarbunNo ratings yet

- BSC (H) IBF I 23.03.11Document1 pageBSC (H) IBF I 23.03.11Ramchundar KarunaNo ratings yet

- FBE-6th Term SCH Post Mid TermDocument3 pagesFBE-6th Term SCH Post Mid TermAnika JindalNo ratings yet

- ADM 2350 N Syllabus Winter 2016Document10 pagesADM 2350 N Syllabus Winter 2016saadNo ratings yet

- Syllubus For Computer ApplicationDocument8 pagesSyllubus For Computer ApplicationsajeerNo ratings yet

- Session: Exam Date Day Sub - Code/Name: 1st SemesterDocument4 pagesSession: Exam Date Day Sub - Code/Name: 1st SemesterGnnaprakasan ArulNo ratings yet

- Study Schedule For June-2012 ExamDocument3 pagesStudy Schedule For June-2012 ExamḾỠḧṦịṊ ḨḀṝṌṓṈNo ratings yet

- Financial Markets 2020-21Document2 pagesFinancial Markets 2020-21Mayuresh GaikarNo ratings yet

- Study Schedule For December-2012 ExamDocument3 pagesStudy Schedule For December-2012 ExamRoha KhanNo ratings yet

- FIN 376 - International Finance - DuvicDocument9 pagesFIN 376 - International Finance - DuvicAakash GadaNo ratings yet

- Indicative Schedule Lectures Finance / Accounting in F4E 2016Document4 pagesIndicative Schedule Lectures Finance / Accounting in F4E 2016tuyulunyilNo ratings yet

- Subject Sr. No Semes Ter Progra M: MondayDocument3 pagesSubject Sr. No Semes Ter Progra M: MondayCoolNo ratings yet

- Business Plan Presentation Schedule (A) : Group Representat Ive Reg # Date TimeDocument3 pagesBusiness Plan Presentation Schedule (A) : Group Representat Ive Reg # Date TimeUmairIsmailNo ratings yet

- IAI Timetable May 2011Document1 pageIAI Timetable May 2011Akshay JoganiNo ratings yet

- Annamalai University: Distance Education / Open UniversityDocument12 pagesAnnamalai University: Distance Education / Open UniversitybhavyanshusinghNo ratings yet

- End Term - Term 1Document1 pageEnd Term - Term 1Irfan MemonNo ratings yet

- Final A Level Examination, Feb-March, 2022: Planning, Analysis and EvaluationDocument1 pageFinal A Level Examination, Feb-March, 2022: Planning, Analysis and EvaluationGaneshNo ratings yet

- Ca Ipc Both Group Students: Test Schedule: (You May Choose Any Other Subsequent Date Time)Document5 pagesCa Ipc Both Group Students: Test Schedule: (You May Choose Any Other Subsequent Date Time)Saurav KakkarNo ratings yet

- ECO104 CourseOutline Summer2023Document4 pagesECO104 CourseOutline Summer2023anika fairuz bushra vinesNo ratings yet

- UT Dallas Syllabus For Ba3341.002.09s Taught by Robert Bender (rcb013000)Document2 pagesUT Dallas Syllabus For Ba3341.002.09s Taught by Robert Bender (rcb013000)UT Dallas Provost's Technology GroupNo ratings yet

- Exam Schedule - Term 1 - 13.08.2020Document1 pageExam Schedule - Term 1 - 13.08.2020Souradipta ChowdhuryNo ratings yet

- CF III InvestmentManagemt PreReadDocument59 pagesCF III InvestmentManagemt PreReadibrahimtaherNo ratings yet

- Sem-III (2010-12) Revised Time Table From 27.10.11Document3 pagesSem-III (2010-12) Revised Time Table From 27.10.11Diwakar ChoudharyNo ratings yet

- Norges Bank Got A B-: Morning ReportDocument3 pagesNorges Bank Got A B-: Morning Reportnaudaslietas_lvNo ratings yet

- Trimester VI Time TableDocument2 pagesTrimester VI Time Tablerushabh3089No ratings yet

- Time Table 2016 1st SemesterDocument18 pagesTime Table 2016 1st SemesterMohamed AashimNo ratings yet

- Basic English For Business and Technology: Domestic Module B2 Tuesday 9:45-11:15 Room 0103 Susan O'ByrneDocument11 pagesBasic English For Business and Technology: Domestic Module B2 Tuesday 9:45-11:15 Room 0103 Susan O'ByrneАкимжан КаликовNo ratings yet

- Time Table For MassesDocument150 pagesTime Table For Massesaamna_shaikh01No ratings yet

- M.E TTDocument80 pagesM.E TTjcetmechanicalNo ratings yet

- Mba 2Document2 pagesMba 2hardikppNo ratings yet

- CV Resume Hans LeijströmDocument1 pageCV Resume Hans LeijströmHans LeijströmNo ratings yet

- M.Arch-Environmental Architecture BranchDocument43 pagesM.Arch-Environmental Architecture BranchMuthu LaxmiNo ratings yet

- 2.5 Intro TimetableDocument6 pages2.5 Intro TimetableVj McNo ratings yet

- Economics Welcome To Session 10 Capital Budgeting and Risk AnalysisDocument10 pagesEconomics Welcome To Session 10 Capital Budgeting and Risk Analysisprasanna_1986No ratings yet

- Mba 1Document2 pagesMba 1Kiran SoniNo ratings yet

- PlanDocument1 pagePlanŁukasz IrzyniecNo ratings yet

- Report Project Tracking TemplateDocument10 pagesReport Project Tracking TemplateDevi Gayatri DhanwadaNo ratings yet

- Kumaun University, NainitalDocument1 pageKumaun University, NainitalAnkit SagarNo ratings yet

- EPSRC Centre For Doctoral Training in Industrially Focused Mathematical Modelling 2015 - 2016Document1 pageEPSRC Centre For Doctoral Training in Industrially Focused Mathematical Modelling 2015 - 2016vtoaderNo ratings yet

- SYB Workbook (Final Draft)Document55 pagesSYB Workbook (Final Draft)JMDANo ratings yet

- Santa Clara County (CA) FY 2013 Recommended BudgetDocument720 pagesSanta Clara County (CA) FY 2013 Recommended Budgetwmartin46No ratings yet

- JE InFINeeti Nemani Sri Harsha 28KADocument2 pagesJE InFINeeti Nemani Sri Harsha 28KAMehulNo ratings yet

- KYC - W-Link - ISR-1 - Request Form For Registering Pan - Bank - KYCDocument2 pagesKYC - W-Link - ISR-1 - Request Form For Registering Pan - Bank - KYCJashan BelagurNo ratings yet

- Brand ExtensionDocument6 pagesBrand Extensionmukhtal8909No ratings yet

- Fabm2121 Week 11 19Document40 pagesFabm2121 Week 11 19Mikhaela CoronelNo ratings yet

- Instant Download Ebook PDF Financial Accounting 4th Edition by J David Spiceland PDF ScribdDocument23 pagesInstant Download Ebook PDF Financial Accounting 4th Edition by J David Spiceland PDF Scribdmarian.hillis984100% (38)

- Quiz - Chapter 3 - Bonds Payable & Other Concepts - 2021Document2 pagesQuiz - Chapter 3 - Bonds Payable & Other Concepts - 2021Martin ManuelNo ratings yet

- Optimal Capital Structure Is The Mix of Debt and Equity ThatDocument29 pagesOptimal Capital Structure Is The Mix of Debt and Equity ThatdevashneeNo ratings yet

- BP2313 Audit With Answers)Document44 pagesBP2313 Audit With Answers)hodgl1976100% (4)

- Nealon, Inc. Solutions (All Questions Answered + Step by Step)Document7 pagesNealon, Inc. Solutions (All Questions Answered + Step by Step)AndrewVazNo ratings yet

- Audit of PPEDocument2 pagesAudit of PPEChi VirayNo ratings yet

- Comparative Analysis of Index of 3 Industries (Publicly Listed Companies) With DSEX IndexDocument21 pagesComparative Analysis of Index of 3 Industries (Publicly Listed Companies) With DSEX IndexPlato KhisaNo ratings yet

- Hyundai Pricelist CSDDocument2 pagesHyundai Pricelist CSDNandish KumarNo ratings yet

- Chapter 5Document9 pagesChapter 5AMIR EFFENDINo ratings yet

- Fin 311 Chapter 02 HandoutDocument7 pagesFin 311 Chapter 02 HandouteinsteinspyNo ratings yet

- Iyana Melgar Enterprise Chart of Account Assets Liabilities Account Name Account Name Account Code Account CodeDocument9 pagesIyana Melgar Enterprise Chart of Account Assets Liabilities Account Name Account Name Account Code Account CodeJudy Silvestre BẹnóngNo ratings yet

- What Is A Sales BudgetDocument5 pagesWhat Is A Sales BudgetCyril Jean-BaptisteNo ratings yet

- Summary of Angelina Hernandez Defendant Estafa CaseDocument1 pageSummary of Angelina Hernandez Defendant Estafa CaseJay Mark Albis SantosNo ratings yet

- R.A. 9147 Wildlife Resources Conservation and Protection ActDocument17 pagesR.A. 9147 Wildlife Resources Conservation and Protection ActDennis S. SiyhianNo ratings yet

- Proyeksi INAF - Kelompok 3Document43 pagesProyeksi INAF - Kelompok 3Fairly 288No ratings yet

- Econ & Ss 2011Document187 pagesEcon & Ss 2011Amal ChinthakaNo ratings yet

- AB Capital ConcallDocument22 pagesAB Capital ConcallHarsimran SinghNo ratings yet

- Benzonan Vs CADocument9 pagesBenzonan Vs CAL100% (1)

- Sip Project Template Final RevisedDocument21 pagesSip Project Template Final RevisedMonnu montoNo ratings yet