Professional Documents

Culture Documents

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

B. S. Kedia & Co.

Chartered Accountants

Bikaner Building,

Building, 1st Floor, Room No. 8

8/1, Lal Bazar Street,

Street, Kolkata-700 001

Tel : 033-22

033-2248

-2248 3696,

3696, Mobile : 98310 85849

Email : bsk_1@rediffmail.com

Limited Review Report by Auditors

To

The Board of Directors

M/s. Prime Capital Market Limited

We have reviewed the accompanying statement of Un-Audited Financial Results of M/s. Prime

Capital Market Limited for the Quarter ended 30th September 2014 except for the disclosures

regarding Public Shareholding and Promoter and Promoter Group Shareholding which have

been traced from disclosures made by the management and have not been audited by us. This

statement is the responsibility of the Companys Management and has been approved by the

Board of Directors/ Committee of Board of Directors. Our responsibility is to issue a report on

these financial statements based on our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2400,

engagements to Review Financial Statements issued by the Institute of Chartered Accountants of

India. This standard requires that we plan and perform the review to obtain moderate assurance as

to whether the financial statements are free of material misstatement. A review is limited primarily

to inquiries of company personnel and an analytical procedure applied to financial data and thus

provides less assurance than an audit. We have not performed an audit and accordingly, we do not

express an audit opinion.

Based on our review conducted as above, nothing has come to our attention that causes us to

believe that the accompanying statement of unaudited financial results prepared in accordance

with applicable accounting standards1 and other recognized accounting practices and policies has

not disclosed the information required to be disclosed in terms of Clause 41 of the Listing

Agreement including the manner in which it is to be disclosed, or that it contains any material

misstatement.

For M/s. B. S. Kedia & Co.

Chartered Accountants

Firm Reg. No. : 317159E

Place : Kolkata

Date : November 14, 2014

Vikash Kedia

Partner

Membership Number 066852

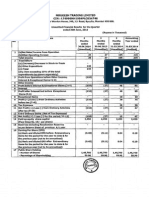

PRIME CAPITAL MARKET LIMITED

Regd. Office : Office No. 18A, BJB Nagar, Bhubaneswar 751014

Administrative Office: P-27 Princep Street, 3rd Floor, Kolkata 700072

CIN- L67120OR1994PLC003649, Email : primecapital.kolkata@gmail.com, Wesbite : www.primecapitalmarket.com

Rs. in Lacs

Statement of Unaudited Financial Results for the Quarter & Six months ended 30th September, 2014

Particulars

Sr.

No.

1 Income from Operations

a) Net Sales/Income from Operations

b) Other Operating Income

Total Income from Operations (Net)

2 Expenses

(a) Cost of Material Consumed

(b) Purchases of Stock-in-trade

3 Months

ended

30.09.2014

4

5

6

7

8

9

Un-Audited

Year to date

figures as on

31.03.2014

Audited

14.31

14.31

15.10

15.10

15.55

15.55

29.41

29.41

44.60

44.60

48.26

48.26

(d) Employees Benefit Expenses

(e) Depreciation & Amortization Expenses

(f) Other Expenses

Total Expenses

Profit/(Loss) from Operations before other Income, finance

cost and exceptional Expenses (1-2)

Other Income/(Loss)

1.18

1.93

3.11

1.17

2.17

3.34

1.20

1.58

2.78

2.35

4.10

6.45

2.37

3.73

6.10

4.62

7.84

12.46

11.20

-

11.76

-

12.77

-

22.96

-

38.50

-

35.80

-

Profit/(Loss) from ordinary activities before finance costs

and exceptional items (3+4)

Finance Costs

11.20

-

11.76

-

12.77

-

22.96

-

38.50

-

35.80

-

Profit/(Loss) from ordinary activities after finance cost but

before exceptional items (3+4)

Exceptional Items

11.20

-

11.76

-

12.77

-

22.96

-

38.50

-

35.80

0.08

11.20

-

11.76

-

12.77

-

22.96

-

38.50

-

35.72

12.65

11.20

11.20

-

11.76

11.76

-

12.77

12.77

-

22.96

22.96

-

38.50

38.50

-

23.07

23.07

-

11.20

1,000.01

11.76

1,000.01

12.77

1,000.01

22.96

1,000.01

38.50

1,000.01

23.07

1,000.01

Profit(+)/Loss(-) from ordinary activites before Tax (7-8)

10 Tax Expense

Net Profit (+)/Loss(-) from ordinary activites after tax (911 10)

Lac)

12 Extra Ordinary Items (Net of Tax Expense of Rs.

13 Net Profit (+)/Loss(-) for the period (11-12)

14 Share of Profit/(Loss) of Associates*

15 Minority Interest*

Net Profit (+)/Loss(-) after tax, minority interest and Share

16 of Profit / (Loss) of Associates (13-14-15)

17 Paid-up Equity Share Capital (Face Value of Rs. 10/- each)

Reserves excluding revaluation Reserves as per last Balance

18 Sheet

0.11

0.11

0.12

0.12

0.13

0.13

0.23

0.23

0.38

0.38

0.23

0.23

0.11

0.11

0.12

0.12

0.13

0.13

0.23

0.23

0.38

0.38

0.23

0.23

9,509,749

9,509,749

9,509,749

9,509,749

9,509,749

9,509,749

95.10

95.10

95.10

95.10

95.10

95.10

Earning Per Share (before extra-ordinary items) of Rs. 10/19 each (not annualized)

(i) a) Basic

b) Diluted

Earning Per Share (after extra-ordinary items) of Rs. 10/19 each (not annualized)

(ii) a) Basic

b) Diluted

A PARTICULARS OF SHAREHOLDING

Public Shareholding

- Number of Shares

- Percentage of Share Holding

18 Promoter and Promoter Group Shareholding

a) Pledged/Encumbered

- Number of Shares

- Percentage of Shares (as a % of the total Shareholding

of Promoter and Promoter Group

- Percentage of Shares (as a % of the total Share Capital

of the Company

b) None-Encumbered

- Number of Shares

- Percentage of Shares (as a % of the total Shareholding

of Promoter and Promoter Group

- Percentage of Shares (as a % of the total Share Capital

of the Company

B INVESTOR COMPLAINTS

Pending at the beginning of the Quarter

Received during the Quarter

Notes :

1.

2.

3.

4.

Corresponding

Corresponding

3 Months

Corresponding 6

6 Months

ended

Months ended

ended

30.09.2013

30.09.2014

30.09.2013

Un-Audited

(c) Changes in Inventories of Finished Goods, Work-inProgress and Stock-in-Trade

Preceding 3

Months ended

30.06.2014

283.32

490,351

100.00

490,351

100.00

490,351

100.00

490,351

100.00

490,351

100.00

490,351

100.00

4.90

4.90

4.90

4.90

4.90

4.90

Nil

Nil

Disposed during the Quarter

Remaining Unresolved at the end of Quarter

Nil

Nil

Segmental Report for the Quarter as per AS-17 is not applicable for the Quarter.

Above resultes were reviewed by Audit Committee taken on record in Board Meeting held on 14th November, 2014.

Provision for Taxation will be made at the end of the Year.

The Auditors of the Company have carried out "Limited Review" of the above financial Results.

Place : Kolkata

Date : 14th November, 2014.

For Prime Capital Market Limited

Sd/Sushil Kr. Purohit

Managing Director

PRIME CAPITAL MARKET LIMITED

Statement of Assets & Liabilities

Particulars

A

EQUITY & LIABILITIES

1 Shareholders' Fund

(a) Share Capital

(b) Reserves and Surplus

(c) Money Received against Share Warrants

Sub-Total - Share Holders Fund

2 Share Capital Money (Pending Allotment

3 Minority Interest*

4 Non Current Liabilities

(a) Long Term Borrowings

(b) Deferred Tax Liabilities (Net)

(c) Other Long Term Liabilities

(d) Long Term Provisions

Sub-Total - Long Term Liabilities

1,000.01

306.28

1,306.29

-

1,000.01

283.32

1,283.33

-

51.86

51.86

51.86

51.86

Sub-Total - Current Liabilities

12.73

520.37

533.10

192.17

555.49

12.65

760.31

TOTAL EQUITY & LIABILITIES

1,891.25

2,095.50

939.81

2.60

10.03

952.44

1,450.90

2.60

10.03

1,463.53

5 Current Liabilities

(a) Short Term Borrowings

(b) Trade Payables

(c) Other Current Liabilities

(d) Short Term Provisions

Rs. in Lacs

As At

30th Sept 2014

31st March 2014

Un-Audited

Audited

ASSETS

1 Non-Current Assets

(a) Fixed Assets

(b) Goodwill on Consolidation*

(c) Non-Current Investments

(d) Deferred Tax Assets (Net)

(e) Long Term Loans & Advances

(f) Other Non-Current Assets

Sub-Total - Non Current Assets

2 Current Assets

(a) Current Investments

(b) Inventories

(c) Trade Receivables

(d) Cash & Cash Equivalents

(e) Short Term Loans & Advances

(f) OtherCurrent Assets

Sub-Total - Current Assets

TOTAL - ASSETS

69.01

23.40

843.97

2.43

938.81

75.32

13.21

543.44

631.97

1,891.25

2,095.50

You might also like

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document10 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Document5 pagesAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Updates On Financial Result For Dec 31, 2015 (Company Update)Document4 pagesUpdates On Financial Result For Dec 31, 2015 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- National Securities Depository Limited 2. Central Depository Services (India) Limited 3. TSR Darashaw Consultants Private LimitedDocument35 pagesNational Securities Depository Limited 2. Central Depository Services (India) Limited 3. TSR Darashaw Consultants Private LimitedAnkita RanaNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document2 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Updates On Financial Results For June 30, 2015 (Result)Document7 pagesUpdates On Financial Results For June 30, 2015 (Result)Shyam SunderNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- 207.1 SyllabusDocument8 pages207.1 SyllabusCecilia PasanaNo ratings yet

- How To Make Resume For Digital Marketing Fresher JobsDocument1 pageHow To Make Resume For Digital Marketing Fresher Jobscandice flynnNo ratings yet

- Interprogetti Contract Portfolio.Document46 pagesInterprogetti Contract Portfolio.Raphael ArchNo ratings yet

- E-Commerce Vs Traditional CommerceDocument12 pagesE-Commerce Vs Traditional CommerceHari Shankar SinghNo ratings yet

- Mod - HRMDocument104 pagesMod - HRMEve FajardoNo ratings yet

- JJM StrategyDocument3 pagesJJM Strategyvkisho5845No ratings yet

- Sol. Man. - Chapter 3 - The Accounting EquationDocument9 pagesSol. Man. - Chapter 3 - The Accounting EquationAmie Jane Miranda100% (2)

- PWAL - Technical Proposal On AuditDocument63 pagesPWAL - Technical Proposal On AuditOlufemi MoyegunNo ratings yet

- 7 Steps For KK Activities On Railway Problem-17.09.2020Document35 pages7 Steps For KK Activities On Railway Problem-17.09.2020sohag shahNo ratings yet

- International Financial Reporting Standards An Introduction 2nd Edition Needles Solutions ManualDocument26 pagesInternational Financial Reporting Standards An Introduction 2nd Edition Needles Solutions ManualMichaelHughesafdmb100% (57)

- Eric Khrom of Khrom Capital 2012 Q3 LetterDocument5 pagesEric Khrom of Khrom Capital 2012 Q3 LetterallaboutvalueNo ratings yet

- D, Aveni, Richard, A, (1995) Coping With Hypercompetition Utilizing The New 7S S FrameworkDocument13 pagesD, Aveni, Richard, A, (1995) Coping With Hypercompetition Utilizing The New 7S S Frameworkeduardoaleman2015No ratings yet

- Adjusting EntriesDocument11 pagesAdjusting EntriesBenjaminJrMoronia100% (1)

- It Is Important To Understand The Difference Between Wages and SalariesDocument41 pagesIt Is Important To Understand The Difference Between Wages and SalariesBaban SandhuNo ratings yet

- (PAPER) Oskar Lange - The Role of Planning in Socialist Economy PDFDocument16 pages(PAPER) Oskar Lange - The Role of Planning in Socialist Economy PDFSyahriza RizaNo ratings yet

- E - Prospectus - 2014 PDFDocument28 pagesE - Prospectus - 2014 PDFArmy Institute of Management, Kolkata100% (1)

- Ethics of Organizational Gift GivingDocument7 pagesEthics of Organizational Gift GivingKyle SnyderNo ratings yet

- Abhishek Kumar: Jindal Poly Films LTDDocument3 pagesAbhishek Kumar: Jindal Poly Films LTDAarav AroraNo ratings yet

- Business Process ReengineeringDocument14 pagesBusiness Process ReengineeringFaisal AzizNo ratings yet

- Human Resource Policies in Colombia First Draft JonasDocument7 pagesHuman Resource Policies in Colombia First Draft JonasKabir RaiNo ratings yet

- ECON 3102 Intermediate Macroeconomics: Seungyoon JeongDocument23 pagesECON 3102 Intermediate Macroeconomics: Seungyoon Jeongag268No ratings yet

- What Is Process CostingDocument12 pagesWhat Is Process CostingPAUL TIMMYNo ratings yet

- 3.10 XMR Chart InvoicesDocument22 pages3.10 XMR Chart Invoicesاندر احمد اولدينNo ratings yet

- Kenneth Arrow EconDocument4 pagesKenneth Arrow EconRay Patrick BascoNo ratings yet

- Government BorrowingDocument19 pagesGovernment BorrowingMajid AliNo ratings yet

- Receiving and Inspection of Incoming Direct MaterialsDocument1 pageReceiving and Inspection of Incoming Direct MaterialssigmasundarNo ratings yet

- 020 2003 MercantDocument22 pages020 2003 MercantRamVasiNo ratings yet

- SAR FormatDocument13 pagesSAR FormatAbhimanyu YadavNo ratings yet

- IBS-Lesson Plan 2019-20Document5 pagesIBS-Lesson Plan 2019-20ankit chuggNo ratings yet

- P & V Demolition ToolsDocument100 pagesP & V Demolition ToolsMario Ordoñez100% (2)