Professional Documents

Culture Documents

PGAS

Uploaded by

chriscivil12Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PGAS

Uploaded by

chriscivil12Copyright:

Available Formats

Page 1 of 1

Quantitative Equity Report | Release Date: 17 September 2015 | Reporting Currency: USD | Trading Currency: IDR

Perusahaan Gas Negara (Persero) Tbk Class B PGAS

Last Close

Quantitative Fair Value Estimate

Market Cap (Bil)

Sector

Industry

2,790.00

4,005.48

65,325.9

f Utilities

Utilities - Regulated Gas

PT Perusahaan Gas Negara Persero Tbk is engaged in the

transportation and distribution of natural gas, connecting

Indonesia's natural gas supplies with customers across the

country.

Country of Domicile

IDN Indonesia

Price Versus Quantitative Fair Value

2011

2012

2013

2014

2015

2016

Sales/Share

Forecast Range

Forcasted Price

Dividend

Split

Quantitative Fair Value Estimate

7,450

Total Return

Quantitative Scores

5,960

Scores

Momentum:

Standard Deviation: 31.33

All Rel Sector Rel Country

Quantitative Moat

None

Valuation

Undervalued

Quantitative Uncertainty Very High

Financial Health

Moderate

65

98

71

50

46

98

58

47

4,470

77

93

73

53

2,980

2,150.00

52-Wk

6,225.00

2,025.00

5-Yr

6,450.00

1,490

PGAS

IDN

Undervalued

Fairly Valued

Overvalued

Valuation

Sector

Median

Country

Median

14.4

11.6

16.0

3.79

6.0

4.5

0.90

15.4

14.8

6.2

12.6

4.01

1.3

1.2

0.84

12.3

12.8

6.4

9.7

2.45

1.1

1.1

Current 5-Yr Avg

Sector

Median

Country

Median

10.1

3.2

1.1

13.3

5.1

931.9

Current 5-Yr Avg

Price/Quant Fair Value

Price/Earnings

Forward P/E

Price/Cash Flow

Price/Free Cash Flow

Dividend Yield %

Price/Book

Price/Sales

0.67

7.9

6.9

5.37

1.6

1.4

Profitability

Return on Equity %

Return on Assets %

Revenue/Employee (Mil)

22.1

10.2

1.4

39.7

19.6

1.5

Score

100

Quantitative Moat

80

60

40

20

0

2008

2009

2010

2011

2012

2013

2014

Financial Health

Current 5-Yr Avg

Distance to Default

Solvency Score

Assets/Equity

Long-Term Debt/Equity

2015

Sector

Median

Country

Median

0.6

633.8

2.7

0.8

0.5

561.3

2.1

0.3

0.6

2.2

0.7

2.0

0.5

1-Year

3-Year

5-Year

10-Year

13.6

5.2

-10.2

-11.5

11.2

-50.7

15.2

3.0

2.0

0.3

16.9

-6.7

12.3

3.8

1.4

82.5

17.3

-2.2

17.4

Growth Per Share

Revenue %

Operating Income %

Earnings %

Dividends %

Book Value %

Stock Total Return %

-24.7

-11.2

44.8

26.9

4.5

-11.6

38.8

42.0

-51.1

-49.9

4.89

12.7

4.0

3.01

15.1

4.8

4.53

9.8

3.0

3.51

14.5

3.5

5.37

7.9

1.4

Total Return %

+/ Market (Morningstar World

Index)

Dividend Yield %

Price/Earnings

Price/Revenue

Undervalued

Fairly Valued

Overvalued

Monthly Volume (Thousand Shares)

Liquidity: High

146,022

2010

2011

2012

2013

2014

TTM

2,168

13.4

2,160

-0.4

2,576

19.3

3,002

16.5

3,409

13.6

3,199

-6.2

Financials (Fiscal Year in Mil)

Revenue

% Change

991

21.7

709

853

-14.0

655

1,018

19.5

891

934

-8.3

861

982

5.2

723

801

-18.4

580

Operating Income

% Change

Net Income

-125

922

42.5

-76

842

39.0

-159

1,007

39.1

-317

512

17.0

-510

386

11.3

-703

-44

-1.4

Operating Cash Flow

Capital Spending

Free Cash Flow

% Sales

0.03

1.4

315.30

0.03

-4.1

327.41

0.04

47.9

341.29

0.04

0.0

311.61

0.03

-25.0

128.79

0.02

-20.2

-25.65

0.01

517.80

24,242

0.02

606.09

24,240

0.01

770.68

24,238

0.02

1,162.46

24,240

0.02

1,343.87

24,240

0.01

1,669.77

24,240

49.5

20.9

31.6

0.66

2.3

40.1

18.9

30.3

0.62

2.0

45.2

24.3

34.6

0.70

1.8

36.3

20.8

28.7

0.73

1.7

27.2

13.7

21.2

0.64

2.2

22.1

10.2

18.1

0.56

2.0

Profitability

Return on Equity %

Return on Assets %

Net Margin %

Asset Turnover

Financial Leverage

63.5

45.7

1,178

60.2

39.5

995

57.2

39.5

840

47.2

31.1

612

43.0

28.8

1,805

40.5

25.1

2,056

Gross Margin %

Operating Margin %

Long-Term Debt

1,521

1.2

1,749

1.2

2,197

1.5

2,545

1.7

2,767

1.2

2,837

1.0

Total Equity

Fixed Asset Turns

Quarterly Revenue & EPS

Revenue (Mil)

Mar

2015

696.4

2014

841.6

2013

731.1

2012

582.1

Earnings Per Share

2015

0.00

2014

0.01

2013

0.01

2012

0.01

EPS

% Change

Free Cash Flow/Share

Dividends/Share

Book Value/Share

Shares Outstanding (Mil)

Revenue Growth Year On Year %

Jun

719.5

862.0

760.6

598.8

Sep

809.9

709.3

646.8

Dec

895.0

800.5

748.7

Total

3,408.6

3,001.5

2,576.5

0.01

0.01

0.01

0.01

0.01

0.01

0.01

0.00

0.01

0.01

0.03

0.04

0.04

27.0

9.7

15.1

13.3

6.9

14.2

11.8

-17.3

2013

2014

2015 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information

contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution

is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

-16.5

2015

You might also like

- CPIDetailDocument7 pagesCPIDetailchriscivil12No ratings yet

- XLQ OnlyDocument45 pagesXLQ Onlychriscivil12No ratings yet

- RSStocksDocument28 pagesRSStockschriscivil12No ratings yet

- Scafolding Set PDFDocument2 pagesScafolding Set PDFchriscivil12No ratings yet

- Teknik Perencanaan Irigasi dan Rawa Dep. UNDIPDocument2 pagesTeknik Perencanaan Irigasi dan Rawa Dep. UNDIPchriscivil12No ratings yet

- Industry PerfDocument8 pagesIndustry Perfchriscivil12No ratings yet

- Revit Tutorial Segment 3Document20 pagesRevit Tutorial Segment 3Budega100% (10)

- Brosur HidrostalDocument2 pagesBrosur Hidrostalchriscivil12No ratings yet

- Sisi ProductionDocument1 pageSisi Productionchriscivil12No ratings yet

- PAMPAS Company Profile Since 2000Document6 pagesPAMPAS Company Profile Since 2000chriscivil12No ratings yet

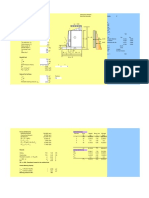

- DPT Kolam Retensi H 3.8m (No Water)Document6 pagesDPT Kolam Retensi H 3.8m (No Water)chriscivil12No ratings yet

- Best Tank Calculation SheetDocument88 pagesBest Tank Calculation Sheetchriscivil12No ratings yet

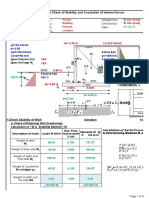

- Cantilever Sheet Pile Wall, SI Units (DeepEX 2015) PDFDocument13 pagesCantilever Sheet Pile Wall, SI Units (DeepEX 2015) PDFchriscivil12No ratings yet

- IndexDocument8 pagesIndexSengottu VelusamyNo ratings yet

- Cantilever Retaining WallDocument5 pagesCantilever Retaining Wallchriscivil12No ratings yet

- Watertreatmentplant 150602145903 Lva1 App6892Document172 pagesWatertreatmentplant 150602145903 Lva1 App6892chriscivil12100% (2)

- Perhitungan Valuasi FADocument2 pagesPerhitungan Valuasi FAchriscivil12No ratings yet

- Retaining Wall With Counterfort - Rev00 - 05-Apr-2014Document9 pagesRetaining Wall With Counterfort - Rev00 - 05-Apr-2014chriscivil12No ratings yet

- Media 111415 enDocument30 pagesMedia 111415 enchriscivil12No ratings yet

- Manual of SurvivingDocument1 pageManual of SurvivingKristi GonzalesNo ratings yet

- Restricted Commercial Framework AwardDocument3 pagesRestricted Commercial Framework Awardchriscivil12No ratings yet

- Sakaled Frameless Led 40wDocument1 pageSakaled Frameless Led 40wchriscivil12No ratings yet

- KCC Floor Coating GuideDocument16 pagesKCC Floor Coating Guidechriscivil12No ratings yet

- KCC FLOOR COATING (Catalogue) PDFDocument16 pagesKCC FLOOR COATING (Catalogue) PDFchriscivil12No ratings yet

- AISC Properties ViewerDocument3 pagesAISC Properties Viewerchriscivil12No ratings yet

- Award Report TemplateDocument3 pagesAward Report TemplatekulukundunguNo ratings yet

- Daftar Isian Alat IA LabDocument2 pagesDaftar Isian Alat IA Labchriscivil12No ratings yet

- TM 5 809 12 PDFDocument54 pagesTM 5 809 12 PDFchriscivil12No ratings yet

- PremierInsight 170116Document3 pagesPremierInsight 170116chriscivil12No ratings yet

- KCC Floor Coating (Catalogue)Document16 pagesKCC Floor Coating (Catalogue)chriscivil120% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Introduction to AccountingDocument17 pagesIntroduction to AccountingSiddeq HalimNo ratings yet

- Tasty BitesDocument41 pagesTasty Bitesrakeshmoney99No ratings yet

- Comparative Study of The Products of HDFC Standard Life Insurance Company and MetLife India Insurance CompanyDocument58 pagesComparative Study of The Products of HDFC Standard Life Insurance Company and MetLife India Insurance CompanyMayank Mahajan100% (2)

- Financial Accounting and Reporting Test BankDocument30 pagesFinancial Accounting and Reporting Test BankMiku Lendio78% (9)

- Zgjidhje Ushtrime InvaDocument6 pagesZgjidhje Ushtrime InvainvaNo ratings yet

- HistoryDocument21 pagesHistorynellafayericoNo ratings yet

- Memorandum and Articles of AssociationDocument4 pagesMemorandum and Articles of AssociationGarveet Modi75% (4)

- Quiz - iCPADocument33 pagesQuiz - iCPAGizelle TaguasNo ratings yet

- Universitas Klabat: Fakultas EkonomiDocument5 pagesUniversitas Klabat: Fakultas EkonomiIan SilaenNo ratings yet

- Chapter 3 - Shares & DividendsDocument2 pagesChapter 3 - Shares & DividendsRani muthuselvamNo ratings yet

- 2006 Hercules Annual ReportDocument124 pages2006 Hercules Annual ReportpkchanchanNo ratings yet

- BPR For Oil and Gas ConstructionDocument6 pagesBPR For Oil and Gas ConstructionMOORTHY.KENo ratings yet

- Bfin 2nd Quarter ExamDocument4 pagesBfin 2nd Quarter ExamDianne Ordiz100% (5)

- Bonds and Stock ValuationDocument82 pagesBonds and Stock ValuationAli Khan100% (2)

- Mock Exam QuestionsDocument11 pagesMock Exam QuestionsAlina TariqNo ratings yet

- Gulshan: Polyols LimitedDocument118 pagesGulshan: Polyols LimitedSureNo ratings yet

- UBS Market Internal Dynamic Model - Deep-Dive Models 101 102Document67 pagesUBS Market Internal Dynamic Model - Deep-Dive Models 101 102David YANGNo ratings yet

- Chapter-8 Summary of Findings, Conclusion and SuggestionsDocument28 pagesChapter-8 Summary of Findings, Conclusion and SuggestionsJCMMPROJECTNo ratings yet

- Mastek Monthly Recommendation Maintains Buy with Target Price IncreaseDocument10 pagesMastek Monthly Recommendation Maintains Buy with Target Price IncreaseynyyNo ratings yet

- Solution Manual For International Accounting 5th DoupnikDocument36 pagesSolution Manual For International Accounting 5th Doupnikcranny.pentoseeu9227100% (37)

- YouWiN! - Youth Enterprise With Innovation in Nigeria PDFDocument4 pagesYouWiN! - Youth Enterprise With Innovation in Nigeria PDFElias Idowu DurosinmiNo ratings yet

- Articles of Incorporation Stock CorpDocument3 pagesArticles of Incorporation Stock CorpJanlo Fevidal100% (1)

- United States Bankruptcy Court: Southern District of West VirginiaDocument54 pagesUnited States Bankruptcy Court: Southern District of West VirginiaWVGOP Research100% (1)

- DerivaGem Options Calculator SoftwareDocument10 pagesDerivaGem Options Calculator SoftwareNatalia TorresNo ratings yet

- Business Finance Curriculum MapDocument4 pagesBusiness Finance Curriculum MapCarla Fe BuanghudNo ratings yet

- Hugo Axsel González Hernández: AlumnoDocument4 pagesHugo Axsel González Hernández: AlumnoHugo Axsel GonzálezNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument15 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answerritz meshNo ratings yet

- 3032 Main ProjectDocument71 pages3032 Main Projectamanmukri1No ratings yet

- PLTS Rooftop Qualis - VC0-ReportDocument12 pagesPLTS Rooftop Qualis - VC0-ReportHarun Cahyo Utomo DanteNo ratings yet