Professional Documents

Culture Documents

PEMNA Govt Cash Management (Malaysia) - 1 PDF

Uploaded by

jhlim1294Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PEMNA Govt Cash Management (Malaysia) - 1 PDF

Uploaded by

jhlim1294Copyright:

Available Formats

Accountant General Department of Malaysia

Jabatan Akauntan Negara Malaysia

PEMNA HIGH-LEVEL CONFERENCE

Treasury COP:

Government Cash Management in Malaysia

Presented by:

Accountant General Department of Malaysia

InterContinental Seoul COEX Hotel

December 6 8, 2012

Seoul, Korea

Accountant General Department of Malaysia

Jabatan Akauntan Negara Malaysia

MALAYSIA

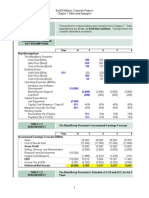

Federal Government Financial Position

Deficit/Surplus as %

of GDP;

Expenditure as %

of GDP

GDP growth (%)

60

Total Expenditure, Deficit/Surplus and GDP

50

40

30

20

10

0

-10 '71 '73 '75 '77 '79 '81 '83 '85 '87 '89 '91 '93 '95 '97 '99 '01 '03 '05 '07 '09 '11

-20

-30

-40

-50

-60

OE

DE

Deficit/Surplus

GDP

18

15

12

9

6

3

0

-3

-6

-9

-12

-15

-18

SOURCE: ECONOMICS AND INTERNATIONAL DIVISION,

MINISTRY OF FINANCE, MALAYSIA

POPULATION

2011

28.55 mil

AREA

MINISTRIES

GDP 2011

330,803 km2

24

RM881.1 b

GROWTH RATE

2011

5.1%

INFLATION RATE

2011

3.2%

Accountant General Department of Malaysia

Jabatan Akauntan Negara Malaysia

ACCOUNTING OFFICES IN MALAYSIA

About 50,000 government

users at 4,000 RCs will be

involved in this initiative

encompassing 25 Ministries,

177 Departments and 24 AGOs

Accountant General Department of Malaysia

Jabatan Akauntan Negara Malaysia

CASH MANAGEMENT

SPP Project

Monitoring

System

Bulk Payment

System

Procurement

System

Payment/ HR

Management

Revenue

System

Budget Preparation

Treasury System

(Budget Execution)

Payment & Receipt

Management

[MOF & EPU]

Budget

FISCAL REPORT

[MOF]

GFMAS

[AGO]

Investment (Surplus)

Cash Management Policy

[MOF]

Management of flows

Management of balances

Targeting a balance

Debt Management

Policy

[Accounting Government

Office & Central Bank]

[MOF & Central Bank]

Monetary Policy

[Central

Bank]

4

Accountant General Department of Malaysia

Jabatan Akauntan Negara Malaysia

GOVERNMENTS BANK ACCOUNTS

MONEY MARKET

OPERATION

CENTRAL MAIN

ACCOUNT

HEAD

OFFICE

CENTRAL

BANK OF

MALAYSIA

DIRECT PAYMENT :

CENTRAL

COLLECTION

ACCOUNT

CENTRAL

PAYMENT

ACCOUNT

LOAN

INVESTMENT

GRANT

DOMESTIC : LOAN

TRANSFER DEFICIT

TRANSFER SURPLUS

ACCOUNTING

OFFICE (36)

COMMERCIAL

BANK

COLLECTION

ACCOUNT

DIRECT

COLLECTION

DAILY

TRANSFER

AGENT/ACQUIRING

BANK

PAYMENT

ACCOUNT

DAILY

TRANSFER

INTERNET

BANKING

ONLINE

CHEQUE

E-PAYMENT

RESPONSIBILITY

CENTRE/ VENDORS

COLLECTION

PAYMENT

EFT ACCOUNT

ELECTRONIC

FUND TRANSFER

Accountant General Department of Malaysia

Jabatan Akauntan Negara Malaysia

GOVERNMENTS BANK ACCOUNTS [Collection from Central Agencies]

MONEY MARKET

OPERATION

HEAD

OFFICE

CENTRAL

BANK OF

MALAYSIA

COLLECTION

CENTRAL

AGENCIES

INLAND REVENUE

BOARD

CUSTOM DEPT.

CENTRAL MAIN

ACCOUNT

CENTRAL

COLLECTION

ACCOUNT

CENTRAL

PAYMENT

ACCOUNT

TRANSFER

TRANSFER

Revenue

(Tax Collection)

TRANSFER

(Dividend)

COLLECTION

ACCOUNT

GLC : PETRONAS

INLAND REVENUE

BOARD OF

MALAYSIA

ROYAL MALAYSIAN

CUSTOM DEPT

PETROLIAM NATIONAL

BERHAD

Accountant General Department of Malaysia

Jabatan Akauntan Negara Malaysia

Cash

Management

in Malaysia

Cash Flow Committee

MOF/AG

GFMAS (IFMS)

AG

TSA + Multiple Bank

AG

Efficient and

Effective Cash

Management

Investment

AG/CB

Debt Management

MOF

Fiscal Policy

MOF/EPU

Monetary Policy

CB

As of November, 2012

Headed by The Secretary General, The Federal Treasury of

Malaysia (MOF), Accountant General (AG), Economic

Division, Central Bank (CB), Budget Division, Loan Division,

Tax Division, Economic Planning Unit (EPU), Custom

Department & Inland Revenue Board Monitoring and

Decision Making on policy.

Government Financial and Management Accounting System

used in AOs and HO for financial planning, budget control

including payments, receipts, remuneration control,

unclaimed monies, government loans, loans and advance

payments, investments and preparation of the Public

Accounts.

Connecting all ministries to the AO by an on-line, real time

computer networks.

Commercial banks have a much greater geographical spread

and processing capability.

Idle cash balance; daily transfer of fund

E-Banking; Electronic Collection and payment (EFT)

Cash surplus placement is deposited at commercial bank by

AG and CB

To finance government deficit & DE

To borrow from Domestic sources as much as possible

To borrow from the cheapest sources

Empowering Ministries and agencies to be financially

accountable for revenue and expenditure

Ensure that cash ministrys actual expenditure is in

accordance with the budget provisions.

Centralized payment through AO

Manage the government cash flows in the financial market

To neutralize the impact on the domestic banking sector of

the government cash flow

Cash Flow Statement

Operating

Receipts

Taxation

Revenue

Non-taxation

Revenue

Miscellaneous

Receipts

Federal

Territories

Revenue

As of April 1, 2011

Accountant General Department of Malaysia

Jabatan Akauntan Negara Malaysia

Investing

Payments

Receipts

Wages, salaries

and employee

benefits

Proceeds from

disposals of

property, plant

and equipment

Purchase of

property, plant

and equipment

Proceeds from

sale of

investments

Loan extended

Receipts of loan

extended

Investments in

debt/equity

securities

Pension

payments

Payments made

to suppliers

Grants paid

Interest

received

Other payments

Dividends

received

Payments

Financing

Receipts

Payments

Proceeds from

borrowings

Repayment of

borrowings

Interest paid

Accountant General Department of Malaysia

Jabatan Akauntan Negara Malaysia

Debt Management

BORROWING POLICY:

To finance Government deficit on DE

To borrow from Domestic sources

To borrow from cheapest source

BUDGET

SOURCES OF BORROWING IN TERMS OR PRIORITY:

CASH FLOW COMMITTEE

1ST Priority : Domestic market :

MGS, TB, Government Investment Issues, Syndicated loan

Approval

by MOF

Cash Requirement & How to obtain it

2nd Priority: Foreign market:

Bond, World Bank, ADB, IDB, JICA , Other Government

FINANCE

DIVISION,MOF

Multilateral

Bilateral

LIMITS TO BORROWING:

Economic

Planning

Unit

External Loan Act 1963 Max RM35b

Treasury Bills (Local) Act 1964 Max RM10b

Government Funding Act 1983 & Loan (Local Act 1959

- Not more than 55% of GDP

Central Bank

Loan

Syndication

Govt Papers (TB, MGS,GII)

Market

Securitization

Auction Calendar

Close interaction between government debt and cash management units

Debt service charges not to exceed 15% of revenue

Federal Government external debt capped at 10% of GDP

Operating expenditure not to exceed revenues

The Relevant Laws

Financial Procedure Act 1957

Federal Constitution 1957

LAWS, RULES AND REGULATIONS

Domestic Loan

Acts

External Loan Acts

Legacy Acts

-Pension Act 1980

-Retirement Trust

Fund Act 2007

Housing Loan Act

1971

Development

Funds Act 1966

SYSTEM AND PROCESS

Accountant General Department of Malaysia

Jabatan Akauntan Negara Malaysia

Operating in a distributed environment with each of the

36 AOs/ SADs (25 AGOs and 11 SADs) running its ICT

operations.

The RCs will capture their transactions into eSPKB of the

respective AOs. The eSPKB data is then transferred to

GFMAS via Enterprise Application Integration (EAI) to

GFMAS database in each AGOs /SADs.

The GFMAS data in the AGOs/SADs is then consolidated to

the central database in the HO via SAP Application Link

Enabling (ALE).

The 36 AGOs/SADs are connected to the HO via JAN*NET

running on IPVPN WAN technology with bandwidth

varying from 256 Kbps to 1 Mbps and DSL lines as backup.

The RCs are connected to AOs via EG*Net.

Current System Architecture

Accountant General Department of Malaysia

Jabatan Akauntan Negara Malaysia

Distributed Processing and Disparate Systems

Interface between eSPKB, GFMAS and external system

Redundancy of data and work process (eSPKB running on java &

Oracle and GFMAS running on SAP & DB2)

High maintenance

Software and hardware license

Preventive and curative maintenance on the infrastructure

Duplication of work eg backup

Exorbitant cost for hot DRC

Difficulty in developing expertise

Inconsistency of data

RCs document status is not real time

Reconciliation of data

MOVING FORWARD

1GFMAS

a single integrated

centralized environment

SYSTEM AND PROCESS

SYSTEM DEVELOPMENT

STRATEGY

OPERATIONAL FRAMEWORK

Accountant General Department of Malaysia

Jabatan Akauntan Negara Malaysia

Moving Forward

Centralized treasury payment and revenue

collection systems

Centralized Systems (1GFMAS)

Efficient Payment Infrastructure

Electronic Fund Transfer (EFT)

Reduce cash holdings and idle

balances at AO Banks

Move to a Treasury Single

Accounts (TSA)

Enhance GL & SL functions

Single system for RCs & AOs functions

Cash and accrual basis of accounting

Financial statement by Ministry

Enhancing payment channel

Increasing reliance on EFT (99%)

Centralized treasury payment and revenue

collection system.

Further improve Treasury Cash Management

The costing data can be cascaded down to the

performance of individual departments responsible

for the respective activity in measuring the

effectiveness of the programs

Introduce performance measures

and cost monitoring systems :

Activity Based Costing (ABC)

Outcome Based Budgeting(OBB)

Accrual accounting is a key element in working for

outcomes framework under OBB Costing data

enables to quantitatively measure the operating

efficiency of Ministries and agencies in producing

the agreed outcomes

Accrual Accounting 2015

Better financial management through with the

complete view Assets & Liabilities comparable

with global development with wider stakeholders

interest in government finances

Accountant General Department of Malaysia

Jabatan Akauntan Negara Malaysia

THANK YOU

TERIMA KASIH

You might also like

- Accounting TheoryDocument45 pagesAccounting Theoryjhlim1294No ratings yet

- Accounting Theory and PracticesDocument46 pagesAccounting Theory and Practicesjhlim1294No ratings yet

- Accounting TheoryDocument269 pagesAccounting Theoryjhlim1294No ratings yet

- Roychowdhury JAE 2006Document36 pagesRoychowdhury JAE 2006Princess HaniNo ratings yet

- Public Accounts Committee of Malaysia-PAC Symposium - Melbourne 28th October 2014 - Present PDFDocument16 pagesPublic Accounts Committee of Malaysia-PAC Symposium - Melbourne 28th October 2014 - Present PDFjhlim1294No ratings yet

- Accountability Mechanism in LG - Kluvers 2010, IJBM PDFDocument8 pagesAccountability Mechanism in LG - Kluvers 2010, IJBM PDFjhlim1294No ratings yet

- Public Sector Accounting System and Governance - Sakarauchi (2007)Document4 pagesPublic Sector Accounting System and Governance - Sakarauchi (2007)jhlim1294No ratings yet

- Google (English Presentation)Document5 pagesGoogle (English Presentation)jhlim1294No ratings yet

- Compilation of MUET Speaking QuestionsDocument35 pagesCompilation of MUET Speaking Questionsgajeel19910% (1)

- Com Law AssignmentDocument32 pagesCom Law Assignmentjhlim1294No ratings yet

- CHPT 03 NotesDocument19 pagesCHPT 03 Notesjhlim1294No ratings yet

- CHPT 01 NotesDocument34 pagesCHPT 01 Notesjhlim1294No ratings yet

- CHPT 02 NotesDocument37 pagesCHPT 02 Notesjhlim1294No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Phuket Beach Hotel CaseDocument18 pagesPhuket Beach Hotel CaseDebashish Hota100% (1)

- Project Management PlanDocument38 pagesProject Management PlanEnghlab Eftekhari100% (2)

- Hemant Pandey WMP13017 Inexperience Case IssueDocument3 pagesHemant Pandey WMP13017 Inexperience Case IssueHemant PandeyNo ratings yet

- Mochamad Isnaeni: ExperienceDocument8 pagesMochamad Isnaeni: ExperienceGreen Sustain EnergyNo ratings yet

- Mishkin PPT Ch21Document24 pagesMishkin PPT Ch21Atul KirarNo ratings yet

- pc101 Document w09Document4 pagespc101 Document w09luis richard Vasquez ChavezNo ratings yet

- Media Planning Media Costs and Buying ProblemsDocument19 pagesMedia Planning Media Costs and Buying ProblemsBilal Munir100% (2)

- Creation vs. Capture: Evaluating The True Costs of Tax Increment FinancingDocument24 pagesCreation vs. Capture: Evaluating The True Costs of Tax Increment FinancingValerie F. LeonardNo ratings yet

- Chapter 7 Student File After 1st ClassDocument10 pagesChapter 7 Student File After 1st Classasflkhaf2No ratings yet

- CFA Level 1 Corporate Finance E Book - Part 1 PDFDocument23 pagesCFA Level 1 Corporate Finance E Book - Part 1 PDFZacharia Vincent67% (3)

- Capital BudgetingDocument71 pagesCapital BudgetingJun Guerzon PaneloNo ratings yet

- The Assessment of Budgetary PerformanceDocument44 pagesThe Assessment of Budgetary Performancepoo printNo ratings yet

- Recruitment - Nestle BDDocument7 pagesRecruitment - Nestle BDmirraihan37No ratings yet

- Barclays Global FX Quarterly Fed On Hold Eyes On GrowthDocument42 pagesBarclays Global FX Quarterly Fed On Hold Eyes On GrowthgneymanNo ratings yet

- 2016 Budget Guidelines PDFDocument136 pages2016 Budget Guidelines PDFNYAMEKYE ADOMAKONo ratings yet

- Raj FinalDocument58 pagesRaj Finalraj1415No ratings yet

- Budgeting Process and Pitching Ppt-Module-1,2Document52 pagesBudgeting Process and Pitching Ppt-Module-1,2Abhishek RainaNo ratings yet

- Capital Budgeting ProjectDocument69 pagesCapital Budgeting ProjectKeleti Santhosh50% (2)

- Capital Budgeting and Risk ManagementDocument12 pagesCapital Budgeting and Risk ManagementsabetaliNo ratings yet

- ACR107 Exercises 02.04.19Document102 pagesACR107 Exercises 02.04.19Patrick Kyle AgraviadorNo ratings yet

- CVPDocument20 pagesCVPDen Potxsz100% (1)

- ABILITY TO PAY THEORY (1) FiscalDocument12 pagesABILITY TO PAY THEORY (1) FiscalSubbuLakshmi SivakumarNo ratings yet

- Authorisation of Government ExpenditureDocument3 pagesAuthorisation of Government ExpenditureEsther AkpanNo ratings yet

- Composition of The Senate 15th Congress of The PhilippinesDocument22 pagesComposition of The Senate 15th Congress of The PhilippinesSarah Asher OcampoNo ratings yet

- PERB Case Ceres Unified School District Vs Ceres Unified Teachers' AssociationDocument15 pagesPERB Case Ceres Unified School District Vs Ceres Unified Teachers' AssociationThe Natomas BuzzNo ratings yet

- Sample Concert Event PortfolioDocument24 pagesSample Concert Event PortfolioLeila TaminaNo ratings yet

- Compass Spending PlanDocument12 pagesCompass Spending PlanAnakin AmeNo ratings yet

- Charity Drive ReportDocument19 pagesCharity Drive ReportWioraNassorNo ratings yet

- Colorado Senate Bill 09-174Document15 pagesColorado Senate Bill 09-174Derek BelohradNo ratings yet

- Management of Non-Profit Org.Document12 pagesManagement of Non-Profit Org.Ilinca MariaNo ratings yet