Professional Documents

Culture Documents

Financial Results & Limited Review For June 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review For June 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

tll

7f

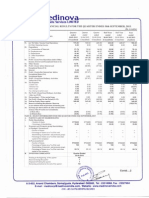

CANTAB!L RETAIL INDIA LIMITED

CIN : L74899DL1989PLC034995 web-site : www.cantabilinternational.com

Regd. Office: B-lO,Lawrence Road lndustrial Area, Delhi - 110035. Tel;91-11-27156381/82 Telefax : 91.'11-27156383

UNAUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED JUNE 30, 2015

(Rs. ln Lacs)

Quarter Ended

Particulars

S. No.

ia)

ib)

Other Operating lncome

Total

Expenditure

(a) Cost of materials consumed

(b)

Purchase of stock-in-trade

(c) Change in inventories of finished goods, work in progress and stockln

trade

(d) Employee benefits expense

(e) Depreciation and amortisation expense

(0 Job Work Charges

(g)

(h)

(i)

3,799.25

{5.23}

2,667.46

5.47

13,829.17

38.60

3,170.32

3,794.03

2,672.94

13.867.77

1,005.52

256.68

818.93

588.20

1,024.16

213.82

3,813.64

2,076.80

(10e.56)

187.441

(43e.50)

(1,069.09)

478.79

130.37

368.53

354.54

38.21

411.68

478.23

172.38

414.49

335.22

395.20

482.02

379.62

143.09

418.90

316.87

106.30

359.38

1,744.17

636.47

1,895.87

1,305.17

2,934.76

3,597.24

2,522.65

13,072.18

Rent

Discounts

Other Expenses

Total

ltems

795.59

196.79

150.29

0.78

4.20

4.20

(3+4)

236.35

200.99

154.49

109.42

118.90

124.07

494.94

126.93

82.09

30.42

317.56

2.67

(0.801

1.591

(60.231

257.34

Profit before finance cost and exceptional

Finance Cost

Profit after finance cost but before exceptiona! ltems(5-6)

Exceptional items

Profit (+)/ Loss (-) from Ordinary Activities before Tax (7+8)

10

fax Expenses

129.60

81.28

28.84

5.70

(8.751

(0.31

123.91

90.03

23.81

123.91

90.03

1.632.76

1.632.76

la) Current Tax

16.92

812.50

5.34

ib) Deferred Tax (Assets/Liability

Net Profit (+)/ Loss (-) from Ordinary Activities after Tax (9-10)

't1

931.94

1,737.23

235.56

Items (1-2)

Other lncome

31.03.2015

(Audited)

3,161.53

8.79

Profit from Operations before Other lncome, finance cost and exceptional

30.06.2014

(Unaudited)

31.03.2015

(Unaudited)

30.06.201s

(Unaudited)

Net Sales/lncome from Operations

Year Ended

t31.77)

289.11

xtraordinary ltems (net of tax)

12

13

Net Profit(+)/ Loss(-) for the period (11+121

14

Paid-up equity share capital (Face Value of Rs. 101)

15

Reserves excluding Revaluation Reserves as per balance sheet of previous

16

(i) Earnings Per Share (EPS)(before extraordinary items)(Face value o1

1.632.76

23.81

5,608.89

accountino vear

Rs.10/- each) (not annualised)

289.11

1.632.76

(a) Basic

(b)Diluted

0.76

0.76

0.55

0.55

0.15

0.15

1.77

1.77

0.76

0.76

0.55

0.15

0.15

1.77

1.77

(ii) Earnings Per Share (EPSXafter extraordinary items)(Face value of Rs.10,

each) (not annualised) :

(a)Basic

(b) Diluted

PART

ll : SELECT

0.5s

INFORMATION FOR THE QUARTER ENDED JUNE 30,2015

PARTICULARS OF SHAREHOLDING

1

Public Shareholding

- Number of shares

- Percentage of shareholding

al

Promoters and Promoter Group Shareholding '

Pledged/Encumbered

- Number of shares

- Percentage of shares (as a % of the total shareholding of Promoter and

Promoter qroup)

bl

Percentage of shares (as a% of the total Share Capital of the Company)

5,370,331

32.890/o

6,163,865

37.75%

5,370,331

29.32o/o

Nit

Nil

NiI

Nit

Nil

Nit

Ni!

Nit

Nil

Nil

Na!

Nit

11,539,605

10,957,277

10,163,743

10,957,277

'1000/o

100o/o

100%

100o/o

70.68%

67.11%

62.250/0

67.11Yo

32.89%

Non-encumbered

- Number of Shares

- Percentage of shares

(as a% of the total shareholding of Promoter and

Promoter qroup)

- Percentage of shares

(as a % of the total Share Capital of the Company)

PARTICULARS

B.

4,798,003

!NVESTORS COMPLAINTS

Pending at the beginning of the quarter

Received during the quarter

Disposed off during the quarter

Remaining unresolved at the end of the quafter

Quarter Ended 30.06.2015

NIL

NIL

NIL

NIL

?r

Notes:

'1

The above financial results have been reviewed by the Auditors, recommened by the Audit Committee, approvd and taksn on rcord by the Board

of Directors at their respective meeting held on 15th July 2015 .

2.

Company's revenue from Real Estat segmant is less than minimum level requird to be reported , tfirefor segment resulb are not given as per

Accounting Standard (AS) '17'Segment Reporting" prescribed by Companies (Accounting Standard) Rules 2006.

3.

Provision for current tax/minimum alternate tax (MAT) is not provided as there is unabosorbed depreication of prevoius years.

4.

The figures of the Previous periods (quarter/year) have been regrouped/rearranged/reclassified wherever considered necessary,

For Cantabil Retail

Jfc

Place: Delhi

-le1e.nr$is

(VUay

Chairman & Managing

DrN 01110877

4n

Y,

SURESH &ASSOCIATES

CHARTERED ACCOUNTANTS

3A, Bigjo's Tower, Netaji Subhash Place

Pitam Pura, Delhi-1 1 0034

Ph: 2735691 6, 2735691 7, 45058028 Fax: 2735691 8

Email: suresh_asociates@redifrnail.com,

SURESH K. GUPTA

B. Com..

FC.A

suresh_asociak{002@yahoo com I

SUN!L AGARWAL

NARENDRAARORA

ASHA TANEJA

AMIT KUMAR

B. Sc.. F.CA.

B. Sc., F.CA.

B.Com., F.C.A.

B.Com., A.C.A.

LIMITED REVIEW REPORT IN ACCORDANCE WITH TIM REOUREMENT OF CLAUSE 41 OF

LISTING AGREEMENT WITH STOCK EXCHANGE

To

THE BOARD OF DIRECTORS

CANTABIL RETAIL IIIDIA LIMITED

1.

We have reviewed the accompanying statement of unaudited financial results of Cantabil Retail India

Limited for the quarter ended 30tr'June 2015 being submitted by the company pursuant to clause 4l of the

Listing Agreements with the Stock Exchange, except for the disclosures regarding 'Public Shareholding,

altd 'Promoters and Promoters Group Shareholding' which have been traced from disclosures made by

the management and have not been audited by us. This statement is the responsibility of the Company,s

Management and has been approved by the Board of Directors

/ Committee of

Board of Directors. Our

responsibility is to issue a report on these financial statements based on our review.

2.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 24lO,,,Review

on lnterim Financial Information performed by the lndependent Auditor of the Entity", issued by the

Institute of Chartered Accountants of India. This Standard requires that we plan and perform the review to

obtain moderate assurance as to whether the financial statements are free of material misstatement.

3.

4'

A review is limited primarily to inquiries of a company personnel and analytical

procedures applied to

financial data and thus provided less assurance than an audit. We have not performed an audit and,

accordingly, we do not express an audit opinion.

Based on our review conducted as above, nothing has come to our attention that causes us

to believe that

the Statement has not been prepared in all material respects in accordance with the applicable

Accounting

Standards notified pursuant to the Companies (Accounting Standards) Rules,, 2006 as per

Section

of the Cornpanies Act, 1956 read with the General Circular

2tl(3C)

1512013 dated September 13,2013

of the

Ministry of Corporate Affairs in respectof Section 133 of the Companies Act, 2013 and other recognized

accounting practices and policies, and has not disclosed the information required to be disclosed

in terms

,trgAt\

qY ,r\,'

'

of Clause

4l

of the Listing Agreement including the manner in which it is to be disclosed, or that

contains any material misstatement.

For Suresh & Associates

Chartered Accountants

16N

(cA

nd

Partner

M.No. 08825

Date: 15.01 .2

Place: Delhi

rora)

#tr%,

You might also like

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Revised Financial Results For Sept 30, 2015 (Result)Document3 pagesRevised Financial Results For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document2 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2012 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Document5 pagesAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document10 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results 201920Document26 pagesFinancial Results 201920Ankush AgrawalNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Document4 pagesFinancial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document3 pagesAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Articles of Incorporation 2Document5 pagesArticles of Incorporation 2Marcos DmitriNo ratings yet

- A1 - The Canterville Ghost WorksheetsDocument8 pagesA1 - The Canterville Ghost WorksheetsТатьяна ЩукинаNo ratings yet

- Turb Mod NotesDocument32 pagesTurb Mod NotessamandondonNo ratings yet

- PHP Listado de EjemplosDocument137 pagesPHP Listado de Ejemploslee9120No ratings yet

- Sajid, Aditya (Food Prossing)Document29 pagesSajid, Aditya (Food Prossing)Asif SheikhNo ratings yet

- AquaSorb PlantDocument2 pagesAquaSorb Plantark6of7No ratings yet

- Adressverificationdocview Wss PDFDocument21 pagesAdressverificationdocview Wss PDFabreddy2003No ratings yet

- Movie ReviewDocument2 pagesMovie ReviewJohanna Gwenn Taganahan LomaadNo ratings yet

- 3 Pseudoscience and FinanceDocument11 pages3 Pseudoscience and Financemacarthur1980No ratings yet

- Vulnerabilidades: Security Intelligence CenterDocument2 pagesVulnerabilidades: Security Intelligence Centergusanito007No ratings yet

- DLL MIL Week 10-12Document2 pagesDLL MIL Week 10-12Juanits BugayNo ratings yet

- Injection Pump Test SpecificationsDocument3 pagesInjection Pump Test Specificationsadmin tigasaudaraNo ratings yet

- 12c. Theophile - de Divers ArtibusDocument427 pages12c. Theophile - de Divers Artibuserik7621No ratings yet

- TM201 - Session 1-2 Paper - Introduction To The Field of Technology Management - AFVeneracion - 201910816Document1 pageTM201 - Session 1-2 Paper - Introduction To The Field of Technology Management - AFVeneracion - 201910816Nicky Galang IINo ratings yet

- Practice Quiz 5 Module 3 Financial MarketsDocument5 pagesPractice Quiz 5 Module 3 Financial MarketsMuhire KevineNo ratings yet

- Ad&d - Poison Costs & Poison CraftDocument4 pagesAd&d - Poison Costs & Poison Craftweb moriccaNo ratings yet

- German Employment Visa Application: What Is A German Work Visa and Do I Need One?Document4 pagesGerman Employment Visa Application: What Is A German Work Visa and Do I Need One?FarbodNo ratings yet

- Aptitude For Civil ServicesDocument17 pagesAptitude For Civil Servicesnagarajuvcc123No ratings yet

- CV - Cover LetterDocument2 pagesCV - Cover LetterMoutagaNo ratings yet

- Corporate Plan 2018 2021Document94 pagesCorporate Plan 2018 2021Nkugwa Mark WilliamNo ratings yet

- Group Work, Vitruvius TriadDocument14 pagesGroup Work, Vitruvius TriadManil ShresthaNo ratings yet

- Review by Dr. Jim B. TuckerDocument5 pagesReview by Dr. Jim B. TuckerGumnamNo ratings yet

- Hybrid and Derivative Securities: Learning GoalsDocument2 pagesHybrid and Derivative Securities: Learning GoalsKristel SumabatNo ratings yet

- GiftsDocument189 pagesGiftsÜJessa Villaflor100% (2)

- Naresh Kadyan: Voice For Animals in Rajya Sabha - Abhishek KadyanDocument28 pagesNaresh Kadyan: Voice For Animals in Rajya Sabha - Abhishek KadyanNaresh KadyanNo ratings yet

- National Service Training Program 1Document13 pagesNational Service Training Program 1Charlene NaungayanNo ratings yet

- BCMSN30SG Vol.2 PDFDocument394 pagesBCMSN30SG Vol.2 PDFShemariyahNo ratings yet

- Medical Secretary: A. Duties and TasksDocument3 pagesMedical Secretary: A. Duties and TasksNoona PlaysNo ratings yet

- Blood Rage Solo Variant v1.0Document6 pagesBlood Rage Solo Variant v1.0Jon MartinezNo ratings yet

- English Holiday TaskDocument2 pagesEnglish Holiday Taskchandan2159No ratings yet