Professional Documents

Culture Documents

Daily Outlook 19th 3oct

Uploaded by

Seven Star FX LimitedCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Outlook 19th 3oct

Uploaded by

Seven Star FX LimitedCopyright:

Available Formats

Analyst (FX, Global Markets & OTC

Derivatives)

Monday, October 19, 2015

A MACRO COMMENTARY ON FX, GLOBAL INDICES, METALS & USA STOCKS

(+1) 316 413 3777

dhruv@sevenstarfx.com

About Seven Star FX Limited

Seven Star FX Limited, is authorised and regulated by the Internal Financial Service Commission (IFSC), Belize Central

America with Registration No: IFSC/60/211/TS/15 has a right to carry out whole range trading of FX & OTC products. Seven

Star FX is a leading online trading and investment specialist. Our trading platforms allow both professional traders who

earn money by receiving short-term profit, as well as managers of investment funds, who strive to increase the share of

overseas investment by using the advantages of foreign exchange trading. Seven Star FX Ltd serves both speculative and

strategic traders. For more than a decade we have served the needs of Banks, Brokers, Asset Managers, Wealth Managers,

Hedge Funds, Broker Dealers and other corporation for instant access to global financial markets.

Macro Commentary:

A Macro Economic Analysis on FX Majors, Energies, Metals, Global Indices & Stocks. The Insights May

Helps you to Trade & it May helps you to put trading orders with profits**

Monday, October 19, 2015

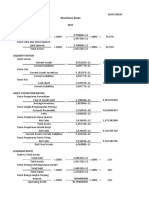

Pair

High

Low

GBP/USD

1.5480

1.1378

1.5425

1.1337

Bullish

119.60

0.7306

119.12

0.7237

Bullish

1.2901

0.6780

Bearish

NZD/USD

1.2945

0.6816

EUR/JPY

135.93

135.33

Bearish

USD/CHF

0.9520

183.82

Bullish

GBP/JPY

0.9549

184.73

EUR/GBP

0.7396

0.7369

Bearish

EUR/USD

USD/JPY

AUD/USD

USD/CAD

Trend Index

FX

Majors (40%)

Bearish

Bullish

US

Stocks (20%)

Precious

Metals (15%)

Bullish

Bullish

Energies

- (15%)

Global

Indices(10%)

Note** - The above Report is based on Personal Recommendation. Seven Star FX Ltd doesnt accept any liability or guarantee of such

recommendation

GMT (8.00 to 9.00) (H1 Chart)

Monday, October 19, 2015

day, October 12, 2015

On Friday, the currency pair is looking much more stronger from past week

there were major announcements earlier week (Core CPI and

unemployment), the #EUR/USD witnessed the bearish trend while today in

the intraday trading chart the currency pair has ranging between the

certain levels of 1.1358 and 1.1350 today, any kind of penetration in the

market from any of the below levels which will push the market further on

the consolidation level. Where breaking the 1.1374 Support level will

extend the bearish correction to reach 1.1347 levels initial, as in case

breaking the previous level.

Since, the Bearish scenario would be confirmed by the breaking the 1.1346

rate on the short-term, crossing this level would push market toward

1.1344 / 1.1334 respectively.

Bearish

Support Level:

S1- 1.1374

S2- 1.1359

Resistance

Level:

Todays Trend:

R1- 1.1349

R2- 1.1337

Weekly Trend:

Down-trend

Monday, October 19, 2015

Today in the early morning the market has started in slightly bearish

consolidation pattern; the market has again came into force. As the

currency pair is currently traded at 119.40

The Market today would pursue the bearish player to go long for this

moment of time if market consistently falls in the range of 119.35/119.45, as

they would expect a price correction trend toward 119.23. The price keeps

mostly fluctuating between the certain levels that represent the 119.59

support and 119.25 Resistance, and will lead the price to regain its main

bullish track that its main targets.

Bullish

Support Level:

S1- 119.59

S2- 119.37

Resistance

Level:

Todays Trend:

R1- 119.25

R2- 119.19

Weekly Trend:

Up-trend

Monday, October 19, 2015

Today the Currency pair GBP/USD certainly seem as though US Dollar $ fall

suggesting the good news for EURO sterling. The sharp bullish trend today

which has seen the outlook more predictive at the price level of 1.5480. The

overnight breach of the key reaction low at 1.5453 looks to be confirming

while the dollar has been decreasing for a while. The uptrend mark has now

been broken and a close around ($1.54) today would now confirm that a new

sequence of lower highs is being formed.

The intraday hourly chart shows all moving averages is moving in the bullish

trend, whilst the old support around 1.5481 is now being formed while the

resistance at 1.5455. Any rally now into the band $1.54/$1.55 looks to be a

slightly bullish opportunity.

Bullish

Support Level:

S1- 1.5481

S2- 1.5466

Resistance

Level:

Todays Trend:

R1- 1.5455

R2- 1.5448

Weekly Trend:

Up-Trend

Monday, October 19, 2015

Today, after rates cuts declared by RBA has slightly boosted the outlook

showing a bullish trend, (Even The US economy has shown a good numbers)

the correction shows A little real sign of any selling pressure, but however it

can be clearly observed as an important band of support once again forming

around the ($0.7280). While the sequence at $0.7290 that is again yet to be

broken. Back then there was arguably a trend lines set up, and while

following a bullish day this is again a possibility today. However, from our

Analysis perspective the suggestion on the intraday chart that today AUD,

however there is clearly an important band of support once again forming

around the $0.7290 level.). Back then there was arguably a trend lines &

three candlestick set up, following a strong bullish day this is again a

possibility today. .

Strong Trend lines showing bullish trend

Bullish

Support Level:

S1- 0.7290

S2- 0.7283

Resistance

Level:

Todays Trend:

R1- 0.7256

R2- 0.7267

Weekly Trend:

Up-trend

Monday, October 19, 2015

The currency Pair USD/CHF has rose to unexpected level. While the US$

again found support at the above mentioned level, rebounded or

dominated and moved sideways afterwards in the desired support level.

While currently it trades at 0.9557/0.9567,that is marginally much higher

for the week. The pair seems to move upwards shows a clear trend in the

short term. The market seems to be in right phase as from past couple of

days as it has garnered the bullish even today the market is strongly

Favouring the US economy

Hence even for today, Our Analyst Team predicts the bullish trend.

Best

to Trade for today

Bullish

Support Level:

S1- 0.9509

S2- 0.9500

Resistance

Level:

R1- 0.9483

R2- 0.9472

Todays Trend:

Weekly Trend:

Up-trend

Monday, October 19, 2015

Today, both the chart shows Bearish trend after a week of failure for this

currency, as USD/CAD closed slightly below the level of 1.2928 this weeks

highlight Canada economy doesnt shows any positive signs of progress or

improvement. Here is an outlook on the major market-movers and an

updated technical analysis for USD/CAD.

USD/CAD is falling today. Hourly resistance at 1.2985 has been broken.

Hourly support is given at 1.2914. Stronger support can be found at 1.2927.

While we remain (bullish) on the pair today as long as the technical

structure suggests a downward momentum

Bearish

Support Level:

S1- 1.2914

S-1.2927

Resistance

Level:

R1- 1.2895

R2- 1.2900

Todays Trend:

Weekly Trend:

Down-Trend

Monday, October 19, 2015

From the past week the signals might suggested that the outlook on WTI

has decreases but only to level bringing the optimistic news. But today it

has resulted in a general neutralising of the momentum indicators on both

daily and intraday charts. However, there is an argument now that there is

a down trend forming at $47.27 .This comes with a slight bearish Drift.

Perhaps this could begin to put pressure on the support levels, which the

intraday hourly chart shows to be initially at $47.00.

Support Level:

Resistance

Level:

Todays Trend:

Weekly Trend:

Down-Trend

Price Outlook:

Current Price

47.27

Change

-0.46

%Change

-0.97%

Next Contract

NOV 15

Source: Seven Star FX Research Center, Investing.com

NOV 1

Monday, October 19, 2015

In todays intraday session the price momentum has shown very slow but

however from past one hour the market movements is moving very slow,

The Gold prices slipped with a change of 0.13% against the US dollar and

today technical selling continued to weigh on the market. Today The

XAU/USD pair has slipped down to level of $1171.95, after a breach of some

key support levels triggered a huge selling trend. Gold price has drastically

come under renewed pressure in recent weeks, as market players seems to

be expecting bearish Trend.

From an intra-day perspective, Seven Star FX analysis believe the key levels

to pay attention will be 1172.40 and 1172.20, there is a significant amount

of support in the proximity of 1180 so it may remain intact before any main

event of the day.

We generally think that the support around 1172 today might have

successful break might drag gold prices towards the 1172- 1170

Slightly Bearish

Support Level:

Resistance

Level:

Todays Trend:

Weekly Trend:

Up-Trend

Monday, October 19, 2015

On Friday, The market has again jumped to a high level forming a new high

at 17,215 levels, which would push the trader to go for long position. While,

the US good numbers has made the impact on its index, while in that case

it will again rise to a level of 17.5k would be the target for that correction.

During this weekend the index has jumped to another higher level. The

Economic GDP has risen, unemployment rates have decreased, etc. all this

has contributed the positive level for US economy.

While the index has major high yesterday (raised to almost 74 points). Our

analyst and research team predicts the momentum will again having the

bullish trend touching the rate of 17.5K in the Month of Oct. From past

weeks the Analyst are quite bullish but only for a shorter version and it has

proved their theory right with this downfall.

Bullish

Support Level:

Resistance

Level:

Todays Trend:

Weekly Trend:

Up-Trend

Monday, October 19, 2015

Sr No.

Company

Trend

Market Cap:

1

2

Google Inc.

Apple Inc.

Up Trend

465.3 B

633.2 B

3

4

Amazon.com, Inc.

Facebook Inc.

Up Trend

Up Trend

267 B

274.8 B

Goldman Sachs group, Inc.

Up Trend

80.16 B

Down Trend

Monday, October 19, 2015

ECONOMIC SCENARIO

Current Assessment

4.3

1.8

2.1

2.5

3.4

3.8

3.5

3.9

5.2

6.1

Expectations

6.3

Business Climate

FX Spot (Currencies)

Energies & Spot Metals

Fixed Income

Global Markets(Indices)

Business Climate

5.2

6.3

3.8

4.3

Expectations

3.9

6.1

3.4

2.1

Current Assessment

3.5

2.5

1.8

Monday, October 19, 2015

Contact us

Address: No. 5, Cork Street,

Belize City, Belize,

Central America (C.A)

Email:

dhruv@sevenstarfx.com

This report is issued by Seven Star FX Limited, who is authorised and regulated by the Internal Financial Service Commission (IFSC) with Registration No: IFSC/60/211//TS/15. The

document is prepared and distributed for information and education purposes only. Seven Star FX is a congressionally authorized Forex broking organization of high repute. Its mission is to provide innovative

Forex programs and services that protect investors and ensure market integrity

It Does not Constitute any personal investment advice, nor it takes into consideration account the individual financial circumstances or objective of any of the clients who periodically receive it. All the

information and research provided by Seven Star FX Limited is intended to General use. It does not constitute a recommendation or offer to purchase or sale of any financial instrument in specific. All the

Suggestions or views within this report are solely and exclusively of the our analyst team which only reviews their Personal recommendation about any and all of the subject recommendation & are presented

to best of his knowledge. Any person relying to such report & undertaking the trading Decision does entirely at their own risk while Seven star FX ltd does not accept any such responsibilities

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange

you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not

invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Daily Technical Analysis Report 23/october/2015Document14 pagesDaily Technical Analysis Report 23/october/2015Seven Star FX LimitedNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Daily Technical Analysis Report 20/october/2015Document14 pagesDaily Technical Analysis Report 20/october/2015Seven Star FX LimitedNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Daily Technical Analysis Report: Market WatchDocument16 pagesDaily Technical Analysis Report: Market WatchSeven Star FX LimitedNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Daily Technical Analysis Report 22/october/2015Document14 pagesDaily Technical Analysis Report 22/october/2015Seven Star FX LimitedNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Daily Technical Analysis Report: Market WatchDocument16 pagesDaily Technical Analysis Report: Market WatchSeven Star FX Limited100% (2)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Daily Technical Analysis Report: Market WatchDocument16 pagesDaily Technical Analysis Report: Market WatchSeven Star FX LimitedNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Daily Technical Analysis Report: Market WatchDocument16 pagesDaily Technical Analysis Report: Market WatchSeven Star FX LimitedNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Daily Technical Analysis Report: Market WatchDocument16 pagesDaily Technical Analysis Report: Market WatchSeven Star FX LimitedNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Daily Technical Analysis Report: Market WatchDocument16 pagesDaily Technical Analysis Report: Market WatchSeven Star FX LimitedNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Daily Technical Analysis Report: Market WatchDocument16 pagesDaily Technical Analysis Report: Market WatchSeven Star FX LimitedNo ratings yet

- Daily Technical Analysis Report: Market WatchDocument16 pagesDaily Technical Analysis Report: Market WatchSeven Star FX LimitedNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Forex Daily Technical Analysis Report (March 28, 2014)Document16 pagesForex Daily Technical Analysis Report (March 28, 2014)Seven Star FX LimitedNo ratings yet

- Forex Daily Technical Analysis Report (March 27, 2014)Document18 pagesForex Daily Technical Analysis Report (March 27, 2014)Seven Star FX LimitedNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Forex Daily Technical Analysis Report (March 26, 2014)Document16 pagesForex Daily Technical Analysis Report (March 26, 2014)Seven Star FX LimitedNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Technical Analysis Report (March 25, 2014)Document16 pagesTechnical Analysis Report (March 25, 2014)Seven Star FX LimitedNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Andrew Lockwood: Trading Cheat SheetDocument20 pagesAndrew Lockwood: Trading Cheat SheetSeptiandi hendra SaputraNo ratings yet

- Financial Ratio AnalysisDocument4 pagesFinancial Ratio AnalysisFSLACCTNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Chapter 1-The Scope of Corporate Finance: Multiple ChoiceDocument7 pagesChapter 1-The Scope of Corporate Finance: Multiple ChoiceEuxine AlbisNo ratings yet

- The Abington Journal 04-06-2011Document28 pagesThe Abington Journal 04-06-2011The Times LeaderNo ratings yet

- Adidas Reebok Merger Case StudyDocument12 pagesAdidas Reebok Merger Case StudynehaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Halal Economy I Eeport PDFDocument112 pagesHalal Economy I Eeport PDFAbu EesaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Deloitte CN Consumer Global Pe Fashion N Luxury Survey 2019 en 190723 PDFDocument40 pagesDeloitte CN Consumer Global Pe Fashion N Luxury Survey 2019 en 190723 PDFPamelaNo ratings yet

- Caia Fundamentals Flyer 1-19 PDFDocument2 pagesCaia Fundamentals Flyer 1-19 PDFNasim AkhtarNo ratings yet

- UST Debt Policy SpreadsheetDocument9 pagesUST Debt Policy Spreadsheetjchodgson0% (2)

- Practical Accounting 2Document4 pagesPractical Accounting 2James Perater100% (2)

- The Analysis of The Statement of ShareholdersDocument14 pagesThe Analysis of The Statement of ShareholdersPankaj KhindriaNo ratings yet

- Sample Pro Forma Balance Sheet Templates Excel - InvoiceTempDocument6 pagesSample Pro Forma Balance Sheet Templates Excel - InvoiceTempPoly GallantNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- SMBU How To Find and Trade Stocks in Play PDFDocument17 pagesSMBU How To Find and Trade Stocks in Play PDFkabhijit04100% (3)

- Satyam Sam 23Document7 pagesSatyam Sam 23Punam GuptaNo ratings yet

- Ab PDFDocument5 pagesAb PDFIdrus FahrezaNo ratings yet

- ISC AccountsDocument20 pagesISC AccountsKris BubnaNo ratings yet

- Ibm 4Document19 pagesIbm 4aarthymbaNo ratings yet

- Curriculum Vitae Muhammad Wajid Raza: 1.contact InformationDocument4 pagesCurriculum Vitae Muhammad Wajid Raza: 1.contact InformationTanveer100% (1)

- Ehre Olbear: 2013 Ranking of Countries For Mining Investment: "Where Not To Invest"Document11 pagesEhre Olbear: 2013 Ranking of Countries For Mining Investment: "Where Not To Invest"Semuel Filex BaokNo ratings yet

- Chapter 8Document37 pagesChapter 8AparnaPriomNo ratings yet

- Business Finance II: Marriott Corporation: The Cost of CapitalDocument5 pagesBusiness Finance II: Marriott Corporation: The Cost of CapitalJunaid SaleemNo ratings yet

- Cipla Performance AnalysisDocument33 pagesCipla Performance Analysis9987303726No ratings yet

- Accounting Notes PDFDocument67 pagesAccounting Notes PDFEjazAhmadNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Gagan Deep Sharma Department of Management Studies BBSB Engineering College Fatehgarh Sahib, PunjabDocument29 pagesGagan Deep Sharma Department of Management Studies BBSB Engineering College Fatehgarh Sahib, PunjabAbdul Motaleb SaikiaNo ratings yet

- FNCE4030 Fall 2014 ch10 Handout PDFDocument22 pagesFNCE4030 Fall 2014 ch10 Handout PDFabdul mateenNo ratings yet

- UBS HandbookDocument152 pagesUBS HandbookcarecaNo ratings yet

- Case Study On Fraudulent Financial Reporting Evidence From MalaysiaDocument17 pagesCase Study On Fraudulent Financial Reporting Evidence From MalaysiaSamu BorgesNo ratings yet

- The Agility FactorDocument9 pagesThe Agility FactorVenkatesh PadmanabhanNo ratings yet

- Global Growth CompaniesDocument4 pagesGlobal Growth CompaniesVenkata Krishna Nalamothu100% (8)

- Quant Strategies in 2018Document5 pagesQuant Strategies in 2018coachbiznesuNo ratings yet