Professional Documents

Culture Documents

Mandate Process For PF and Pension Settlement

Uploaded by

Vikas KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mandate Process For PF and Pension Settlement

Uploaded by

Vikas KumarCopyright:

Available Formats

Note 1 Employee Opting for Transfer process may kindly

contact your New employer and fill form13 available them and

arrange send it to your respective SPOC for processing. For more

details on the same kindly write a mail to your respective SPOC

(Details of each location shared in Note-5).

Note 1 Below supporting documents to be sent along with

form19&10C(Withdrawals):

Two Photocopy of your PAN card.

Two Blank cancelled cheques along with signature for verifying Account holder

name (Employee name) and IFSC code number must be pre-printed on Cancelled

cheque, If not last Bank Statement to be submitted which contains Account

number, Account holder name, IFSC code and Branch Details as additional

document along with Cancelled cheque. Joint account will not be accepted.

Note 2 Below are the mandate points to be fallowed before

initiating the withdrawal process, kindly adhere for the same.

1.

Withdrawals request form19&10C to be submitted/sent to us only after 60Days from your Last working

day with HCLT if you are un-employed.

2. Please refer to Form19 (Instructions) and form10C (Instructions) attachment to seek help in filling the

applications.

3. Dont forget to sign in all the required places especially after affixing 1 Rupee revenue stamp.

4. Reason for leaving should be Personal/Left/resigned.

5. UAN number in mandated to be mentioned in respective form19&10C if employee resigned after

01/07/2014

6. Please make sure that Name of member, Father/Husband Name will be as per records.

7. Please make sure that DOL, DOJ, and PF/PENSION numbers mentioned will be as per records.

8. On receipt of withdrawal request settlements would take around 2Months and Incorrect/Insufficient details

with form will be Rejected and returned back to mentioned address.

9. Employee signature on cancelled cheque and PAN card copy should match with the signature on the form.

10. Pls note refer to Schedule IV, Part (A) of Income Tax Act, 1961 provides that if upon separation from

Company, if PF is withdrawn before completing 5 years of continuous service, then TDS at applicable rates

is to be recovered and deposited with IT authorities, which include statutory and voluntary contributions

made with member and company. We will provide Form-16 at end of present FY to claim the refund from

Income Tax Department in your IT returns if you are eligible.

11. If your Pensionable service is more than 10 years than additional documents to be submitted. I.e. Date of

birth proof of self and Nominee (Ex: passport copy/DOB certificate/secondary school certificate).

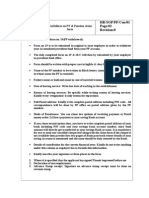

Note 3 Please send your Forms and document according to

Company Code by addressing to your respective SPOC :Company

SPOC Name

HCL Technologies Limited

(1000) Noida Region

HCL Global Pro.Ser. Ltd.

(1400) PAN India

HCL TECH LTD BPO

SERVICES (3000) PAN India

Amit Kumar Rohilla

(51336834)

HCL TECH LTD. IOMC

(2200) PAN India

HCL COMNET LIMITED

(2000) PAN India

HCL COMNET SYS & SERV

LTD (2100) PAN India

Dhruv Kumar

(51454999)

HCL Technologies Limited

(1000) Chennai,

Hyderabad and Mumbai

Region

Sathish Kumar

Theagarajan

(51369758)

HCL Technologies Limited

(1000) Bangalore Region

Padma Kumar

EMAIL ID

AmitRoh@hcl.com

dhruv-k@hcl.com

sathishkumart@hcl.com

PFhelpdesk.BLR@hcl.com

Communication Address

HCL Technologies Ltd,

PF Dept,

B-39, Sector-1, TowerA, 2nd Floor,

Noida-201301

HCL Technologies Ltd,

PF Dept,

B-39, Sector-1, TowerA, 2nd Floor,

Noida-201301

HCL Technologies Ltd,

PF Dept,

D12 & 12B 1st Floor,

Sidco Industrial Estate

Ambattur, Chennai600058

HCL Technologies Ltd,

PF Dept,

SJR Equinox, Sy no.

47/8, Dhodda Thogur

Village,

Begur Road Hobli, 1st

Phase, Electronic city,

Bangalore 560100.

You might also like

- Guidelines On F&F Settlement For Staff Who Have Resigned From RollsDocument5 pagesGuidelines On F&F Settlement For Staff Who Have Resigned From RollsSantosh Prasad0% (1)

- Employee Exit ChecklistDocument9 pagesEmployee Exit ChecklistNoel RozarioNo ratings yet

- Employee Communication On PF WithdrawalDocument1 pageEmployee Communication On PF WithdrawalchaitanyaNo ratings yet

- Guidelines UAN BasedDocument2 pagesGuidelines UAN BasedDhamu DharanNo ratings yet

- Employee Exit ChecklistDocument9 pagesEmployee Exit ChecklistRudraneel DasNo ratings yet

- Artifact 5a - Guidelines For Filling PF Withdrawal Form TCSDocument3 pagesArtifact 5a - Guidelines For Filling PF Withdrawal Form TCSAmy Brady100% (3)

- Obtain Director Identification Number (DIN) : WebsiteDocument2 pagesObtain Director Identification Number (DIN) : WebsitemitulNo ratings yet

- Artifact 3 - Instructions For Filling PF Withdrawal FormDocument1 pageArtifact 3 - Instructions For Filling PF Withdrawal FormSiva chowdaryNo ratings yet

- Certification of Employment for GajalaDocument2 pagesCertification of Employment for Gajalagajala jamirNo ratings yet

- Procedure PFDocument1 pageProcedure PFHemanth KumarNo ratings yet

- What Is Incorporation of A CompanyDocument4 pagesWhat Is Incorporation of A CompanyAnshika GuptaNo ratings yet

- PF Withdrawal ProcedureDocument4 pagesPF Withdrawal ProcedureZahida MariyamNo ratings yet

- Steps To Claim Dividend Shares IepfDocument4 pagesSteps To Claim Dividend Shares IepfBiswambhar GhoshNo ratings yet

- EMS Guidelines MailerDocument3 pagesEMS Guidelines Maileramit ranjanNo ratings yet

- PF Withdrawal PPT 1Document7 pagesPF Withdrawal PPT 1Kirankumar MNo ratings yet

- Mphasis PF Guidelines for Employees With PF Numbers Starting KN/16573 and KN/46330Document10 pagesMphasis PF Guidelines for Employees With PF Numbers Starting KN/16573 and KN/46330Binoy Xavier RajuNo ratings yet

- Superuser - 444209 - PF Withdrawal Procedure - Offline ProcessDocument3 pagesSuperuser - 444209 - PF Withdrawal Procedure - Offline ProcessPraveena DiamonraoNo ratings yet

- SOP PF Withdrawal Claim FormsDocument4 pagesSOP PF Withdrawal Claim FormsAastikUdeniaNo ratings yet

- Guidlines For Filling PF Withdrawal FormsDocument4 pagesGuidlines For Filling PF Withdrawal Formsr47693No ratings yet

- Annexure: User Id: Ctreferencenumber (For Eg: Ct20080154546) Password: Data-Of-Birth (Dd-Mm-Yy) (For Eg: 31-01-88)Document22 pagesAnnexure: User Id: Ctreferencenumber (For Eg: Ct20080154546) Password: Data-Of-Birth (Dd-Mm-Yy) (For Eg: 31-01-88)Abhishek BasuNo ratings yet

- Annexure: User Id: Ctreferencenumber (For Eg: Ct20080154546) Password: Data-Of-Birth (Dd-Mm-Yy) (For Eg: 31-01-88)Document22 pagesAnnexure: User Id: Ctreferencenumber (For Eg: Ct20080154546) Password: Data-Of-Birth (Dd-Mm-Yy) (For Eg: 31-01-88)Pandiyan MuruganNo ratings yet

- Taxpayer Registration Form TRF 01 For STRNNTNDocument8 pagesTaxpayer Registration Form TRF 01 For STRNNTNHammad Nazir MalikNo ratings yet

- Starting Business in India: 12 Step GuideDocument10 pagesStarting Business in India: 12 Step GuideWhats BuzzNo ratings yet

- By Teamlease in 2 To 3 Working Days From The Date of KYC UpdationDocument3 pagesBy Teamlease in 2 To 3 Working Days From The Date of KYC UpdationParvezNo ratings yet

- Contribution Rate Employee (12%)Document4 pagesContribution Rate Employee (12%)Kiran MettuNo ratings yet

- Guidelines For Filing PF Withdrawal Form - 2012Document3 pagesGuidelines For Filing PF Withdrawal Form - 2012princeforjesusNo ratings yet

- PF Withdrawal Form Process ChartDocument6 pagesPF Withdrawal Form Process ChartmynksharmaNo ratings yet

- The Joining Process Is Divided Into Seven Parts:: (Service Agreement & Affidavit/Notarized Undertaking)Document8 pagesThe Joining Process Is Divided Into Seven Parts:: (Service Agreement & Affidavit/Notarized Undertaking)ACOUSTIC GUITAR TRAININGNo ratings yet

- Joining Annex UreDocument5 pagesJoining Annex UreabhimaynuNo ratings yet

- Tcs AnnexureDocument16 pagesTcs Annexureswathinaidu143100% (4)

- Real Estate Marketing Agent Registration Form: Important InstructionsDocument7 pagesReal Estate Marketing Agent Registration Form: Important InstructionsAshok KumarNo ratings yet

- New EPF Withdrawal FormsDocument6 pagesNew EPF Withdrawal FormsnesanNo ratings yet

- Tax Deduction/Collection Account Number: Meaning of TANDocument8 pagesTax Deduction/Collection Account Number: Meaning of TANOnkar BandichhodeNo ratings yet

- Registering A Company in IndiaDocument8 pagesRegistering A Company in IndiaSomesh Rocku SomeshNo ratings yet

- General Guidelines For Filling Up The Nps Registration Form: Section Blank, Which Results in Rejection of The Form)Document1 pageGeneral Guidelines For Filling Up The Nps Registration Form: Section Blank, Which Results in Rejection of The Form)Best VideosNo ratings yet

- Project Report Cycle PartsDocument142 pagesProject Report Cycle PartsHIMANSHU RAWATNo ratings yet

- Relieving Certificate Experience 40Document2 pagesRelieving Certificate Experience 40Sushma SinghNo ratings yet

- TCS PDFDocument5 pagesTCS PDFEaster SCNo ratings yet

- WIth Drawl DoccumentsDocument1 pageWIth Drawl DoccumentsVivek Kumar SanuNo ratings yet

- 02 COR and Tax Filing PDFDocument4 pages02 COR and Tax Filing PDFMon Carla LagonNo ratings yet

- Online Process Flowfor PFWithdrawalDocument3 pagesOnline Process Flowfor PFWithdrawalWonton AkhilNo ratings yet

- Relieving Certificate ExperienceDocument2 pagesRelieving Certificate ExperienceParmNo ratings yet

- MVAT ACT, 2002: Who Needs To Register?Document14 pagesMVAT ACT, 2002: Who Needs To Register?CAJigarThakkarNo ratings yet

- Application For PAN Through Online Services: Tax Information NetworkDocument6 pagesApplication For PAN Through Online Services: Tax Information NetworkGaurav GuptaNo ratings yet

- Steps in Registering Sole ProprietorshipDocument5 pagesSteps in Registering Sole ProprietorshipMarjorie Treceñe AlconesNo ratings yet

- PAN Service ManualDocument19 pagesPAN Service ManualRavi SharmaNo ratings yet

- One Person Company Registration DocumentsDocument23 pagesOne Person Company Registration Documentsraajverma1000mNo ratings yet

- Procedure of Converting Partnership Firm Into A Private Limited CompanyDocument4 pagesProcedure of Converting Partnership Firm Into A Private Limited CompanylakshaymeenaNo ratings yet

- TCS Joinning AnnexureDocument23 pagesTCS Joinning AnnexureKajoree ChhatryNo ratings yet

- Company Make IncorporationDocument6 pagesCompany Make IncorporationGAURAVNo ratings yet

- GuideDocument5 pagesGuidejanclaudinefloresNo ratings yet

- Registration of CompanyDocument8 pagesRegistration of CompanySachin PatelNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Cisco Identity Services Engine, Release 1.1 Supported Windows AV/AS ProductsDocument17 pagesCisco Identity Services Engine, Release 1.1 Supported Windows AV/AS ProductsVikas KumarNo ratings yet

- July 2011 Master of Computer Application (MCA) - Semester 5 MC0081 - . (DOT) Net Technologies - 4 CreditsDocument8 pagesJuly 2011 Master of Computer Application (MCA) - Semester 5 MC0081 - . (DOT) Net Technologies - 4 CreditsVikas KumarNo ratings yet

- MC0083Document14 pagesMC0083Vikas KumarNo ratings yet

- VRRP StepDocument4 pagesVRRP StepVikas KumarNo ratings yet

- C Programming AssignmentDocument75 pagesC Programming AssignmentVikas KumarNo ratings yet

- Company RegistrationDocument2 pagesCompany RegistrationTsitsi AbigailNo ratings yet

- Tax Seatwork #3Document5 pagesTax Seatwork #3irish7erialcNo ratings yet

- Investment Patterns and Banking ProductsDocument21 pagesInvestment Patterns and Banking ProductsMelvin Mathew100% (1)

- Negotiable Instruments Bar Questions with Suggested AnswersDocument30 pagesNegotiable Instruments Bar Questions with Suggested AnswersEugene Albert Olarte Javillonar100% (1)

- Madsen PedersenDocument23 pagesMadsen PedersenWong XianyangNo ratings yet

- SWOT Analysis For A BankDocument2 pagesSWOT Analysis For A BankAndrew Hoth KangNo ratings yet

- Honeywell Question 1&2Document6 pagesHoneywell Question 1&2anon_909027967No ratings yet

- Cityneon Holidngs Limited 30-May-2016 SG CFDocument19 pagesCityneon Holidngs Limited 30-May-2016 SG CFTan Teck WeeNo ratings yet

- Treasury Regulations: For Departments, Constitutional Institutions and Public EntitiesDocument75 pagesTreasury Regulations: For Departments, Constitutional Institutions and Public EntitiesHoward CohenNo ratings yet

- AnnualReport2010 UKDocument152 pagesAnnualReport2010 UKsonystdNo ratings yet

- Chapter 5 - Modern Portfolio ConceptsDocument41 pagesChapter 5 - Modern Portfolio ConceptsShahriar HaqueNo ratings yet

- How The Market Really WorksDocument81 pagesHow The Market Really WorksSana Agarwal100% (11)

- JLL Zuidas Office Market Monitor 2014 Q4 DEFDocument16 pagesJLL Zuidas Office Market Monitor 2014 Q4 DEFvdmaraNo ratings yet

- Global Ambitions: How Mehraj Mattoo Is Building Commerzbank's Alternatives BusinessDocument4 pagesGlobal Ambitions: How Mehraj Mattoo Is Building Commerzbank's Alternatives BusinesshedgefundnewzNo ratings yet

- Chapter 2 HWDocument4 pagesChapter 2 HWFarah Nader GoodaNo ratings yet

- Chronocrator XL ManualDocument30 pagesChronocrator XL ManualDiego Ratti100% (2)

- SIRA1H11Document8 pagesSIRA1H11Inde Pendent LkNo ratings yet

- Service Portfolio ManagementDocument6 pagesService Portfolio ManagementAlexandru Dan GheorghiuNo ratings yet

- Au Small Finance BankDocument27 pagesAu Small Finance BankRuhi Rana100% (2)

- S - ALR - 87012284 - Financial Statements & Trial BalanceDocument9 pagesS - ALR - 87012284 - Financial Statements & Trial Balancessrinivas64No ratings yet

- Mrs. StoneDocument11 pagesMrs. StonespanischkindNo ratings yet

- Embracing Dynamism - The Next Phase in Kansas Economic Development PolicyDocument44 pagesEmbracing Dynamism - The Next Phase in Kansas Economic Development PolicyBob WeeksNo ratings yet

- Fdi and FiiDocument19 pagesFdi and FiiManju TripathiNo ratings yet

- Celebrity EndorsementDocument13 pagesCelebrity EndorsementMuhammad ZeshanNo ratings yet

- Websol Finanaical ReportDocument104 pagesWebsol Finanaical ReportmalleshjmNo ratings yet

- GAAPDocument3 pagesGAAPMarvi SolangiNo ratings yet

- Goat Farm BudgetingDocument9 pagesGoat Farm Budgetingqfarms100% (1)

- Ownership Incentive Culture: Case StudyDocument14 pagesOwnership Incentive Culture: Case StudyDavid Iskander100% (1)

- Merill Lynch Supernova Final UpdatedDocument16 pagesMerill Lynch Supernova Final UpdatedKnv Chinnarao100% (2)

- Underwriting Placements and The Art of Investor Relations Presentation by Sherilyn Foong Alliance Investment Bank Berhad MalaysiaDocument25 pagesUnderwriting Placements and The Art of Investor Relations Presentation by Sherilyn Foong Alliance Investment Bank Berhad MalaysiaPramod GosaviNo ratings yet