Professional Documents

Culture Documents

Irani Committee On Company Law

Uploaded by

Varun PaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Irani Committee On Company Law

Uploaded by

Varun PaiCopyright:

Available Formats

1

COMMENTS ON THE JJ IRANI COMMITTEE REPORT

ON COMPANY LAW (S L RAO)

It is a sign of our reforming times that the expert committee on

the new company law was chaired not by an economist,

politician or lawyer but by a distinguished professional

manager. Not being a lawyer and not being also knowledgeable

on the company law, my comments are made as a professional

manager who has over the years written and spoken on issues

of corporate governance and responsibility, helped also by the

many different types of Boards-in non profit organizations,

private and public listed companies operating in areas ranging

from banking to graphites.

1. Companies are subject to rules laid down by the Indian

Companies Act as well as by the rules laid down by SEBI

for companies that are listed on the stock exchanges

under listing agreements. It has been argued that SEBI

rules cannot be more stringent than under the Companies

Act. Since listed companies can be traded on the

exchanges, the scope of misuse and abuse of information

by those in the know at the expense of those who are not

is considerable. I cannot see why SEBI rules cannot be

stringent for listed companies as compared to others.

2. At the same time, as the Committee has observed, it is

necessary to make the Companies Act more simple,

enunciating principles, leaving it to regulatory and

supervisory bodies to set out the detailed rules. This also

seems to be the approach taken by the Irani Committee.

There should be no duplication of effort as has tended to

occur in recent years between the different regulatory

bodies.

3. On page 11 the Report makes the important point that

corporate governance goes far beyond access to capital

and that the capital markets regulator has to play a

central role in public access to capital..and must have the

necessary space to develop suitable frameworks...

4. In considering the scope of company law the report on

Page 14 draws a distinction between private and small

companies who use their personal or in-house finances

and others who access the public. The latter must be more

stringently regulated. I suggest that we must cast the net

more widely and make the law applicable to all corporate

organizations that access public money (from

government, banks, markets, other funding agencies) and

whose actions have impact on society and the

environment. However the requirements for the different

categories could vary in stringency. I would add to the

entities that must be so covered, not only public sector

undertakings but also departmental enterprises owned by

central and state governments and local bodies. I would

even go so far as to suggest that even non-profit trusts

and societies, apart from Section 25 companies should be

subject to the same rules for transparency and good

governance, though the report does not go so far as to

suggest that (Section 20).

5. I commend the Committee on asking for removing any

limits on companies having subsidiaries or their numbers.

However their performance must also be properly

disclosed and consolidated.

6. The report suggests a special regime for small companies.

I am a little hesitant about this because this caste system

of giving differential treatment to small enterprises has

encouraged many to remain small by adding more small

enterprises.

7. The Report mentions sick companies. Why do we not

imitate the Chapter 11 provisions of the American law

that give an opportunity for rehabilitation?

8. The Committee considered limiting the layers of

subsidiary investment companies as not feasible and

advocates a regime for preventing misuse of this

mechanism. It has no specifics for this purpose. This

matter is too serious to be left loose in this way. Perhaps

full disclosure subject to criminal liability for not doing so

might help.

9. In all this it does not attend to the distortions being

caused by the requirement to declare quarterly results;

the plight of shareholders in listed but untraded

companies that are closely held by the promoter. It

advocates video conferencing for Board meetings, a great

saving on time and cost. I suggest that at least two

meetings out of the mandatory four in the year should be

face-to-face. It also needs to address the questions of

clarity and length in annual reports as also give

permission to companies to send one report only to a

shareholder with multiple registrations. It will save costs

a great deal. Similarly a condensed version might be sent

but a full text be made available on the internet and in

selected, pre-announced, newspapers.

10.

I have numerous comments on the subject of Boards

of Dire4ctors covered in various sections in the report

from Page 36 onwards:

i)

I suggest that there should be a

minimum and a maximum to the

numbers on Boards for different

types and sizes of companies, if

the Board is not to become a

circus.

ii) 5.4 says there should be at least

one director resident in India. I

would rather have it that the

number of non-resident director

will not exceed a given

proportion. I do agree that

government permission to

appoint an overseas director or

even managing director at

iii)

iv)

whatever is a suitable

remuneration should not be

necessary.

On age limit for directors, as

someone who is in his 70th year,

perhaps I should comment the

proposal in 7.1 to subject those

over 70 to a special shareholder

resolution. The problem is that

one cannot expect everyone in this

category to be mentally capable of

making a contribution. I suggest

that a fitness test might be

prescribed.

On independent directors I am in

agreement with the definition but

believe that the concept still has

weaknesses. However

independent he may be, the

director owes his appointment to

the chief executive. The idea that

a nominations committee of the

Board might invite directors, and

select them when they are

executive directors, is something

that I would press for. However

independent they may be it might

be difficult for most not to rock

the boat since there are

substantial sitting fees and

commission. For this reasoon I

would place a limit on the service

period for independent directorssay 6 to 9 years. I would ask for a

rigorous self-evaluation process

conducted through a neutral third

party so that non-performers can

be sent away earlier. I have some

hesitations regarding the payment

of commissions to independent

directors since it adds a

temptation to fudge results.

v) I suggest further that the concept

of nominee directors is against all

principles of good governance.

They are appointed to look after

the interests of one group of

shareholders or lenders, not all of

them. If these lenders want to

keep an eye on the company they

have other methods for doing so.

vi) I also feel unlike the committee

that all subsidiary companies

must have one independent

director from the main Board to

keep an eye on the subsidiary.

vii) It is difficult to find competent

and truly independent directors.

How effective is the process also

depends on the genuine desire of

the promoter to keep them so. But

there is some safety in numbers

and for this reason I would like to

retain the provision of one-third if

the chairman is an outsider and

half if he is a promoter.

viii) I would make it compulsory for

independent rating of all

companies on corporate

governance and the report must

be published in the annual report

each year.

ix) I would apply this concept to all

corporate organizations including

charitable societies and trusts,

hospitals and educational

institutions so that we can impose

some transparency in all these

operations that impinge on the

public interest.

x) As far as number of directorships

is concerned I think the

committee is excessively generous

by capping it at 15 (12.1). The

work involved is arduous and

there is also Committee work to

be done. I do not think the

number should exceed 10.

xi) If it is argued that they are

difficult to find, I beg to differ.

Senior managers from other

companies can be appointed, as

can teachers in commerce,

economics, managements and

technology. So also professionals

in different subjects.

xii) I do not se the point of Section 32

that allows only those holding 1%

or over of the shares to nominate

directors and hikes the fee for

nominating directors at AGMs

from Rs 500 to Rs 10000.

Shareholders must feel free to

propose whom they wish. In any

case unless the big holders agree

with the nomination, no one will

be elected.

xiii) On Page 61 it is said that key

managerial personnel must be in

whole-time employment only in

one company at a time. I think

this should be qualified so that a

CFO or Head of HR can work

with subsidiaries or related

companies as well. Similarly

Managing Directors might also

serve on related companies with

full disclosure of all related party

transactions

11.

Good corporate governance is a function of the

intent of the promoters and the existence of strong

regulators well equipped with talented staff and penalties

that must include jail sentences for serious infringements,

with substantial financial for all others. Presently, the

different regulators (SEBI, RBI, Registrar of Companies,

Company Law Board), sometimes issue conflicting

Orders and certainly are inadequately staffed in the

necessary skills. They need to have adequate budgets and

pay the price to get the services of the best experts.

12.

Pages 118-119 says that shareholders should be

allowed to approve continuance of auditors for any period

of time. I do feel that there should be a limit. If continuity

is desired, the previous auditor might continue for one

term under the supervision of a new one. However there

must be a limit to the number of years for which the same

auditor can serve a company. The compulsory cost and

secretarial audit prescribed for some companies is a waste

of money and should be abolished.

In conclusion I am happy that the Irani committee has

applied its mind to the key issues. I believe that corporate

governance can be legislated for if companies are properly

inspected and regulated for the purpose. Violations should

not occur, though Audit committees, tough Regulators and

severe penalties can make it difficult. But the desire for

transparency must come from the top. Legislation can help

in detection and punishment. Institutions like independent

directors and audit committees can keep the company on the

straight and narrow path of transparency and good

behaviour. It is this combination of leadership, Board

oversight, external scrutiny and tough Regulation that will

keep most companies on good behaviour.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- AUB Secretary Certificate TemplateDocument3 pagesAUB Secretary Certificate TemplateSteve Barretto0% (1)

- Restaurant Social Media Marketing PlanDocument8 pagesRestaurant Social Media Marketing PlanFarah Al-ZabenNo ratings yet

- 1-Industry Overview (TDP-101) PDFDocument35 pages1-Industry Overview (TDP-101) PDFtonylyf100% (7)

- Sales Commission Quick Guide LS Retail NAV 6.3Document28 pagesSales Commission Quick Guide LS Retail NAV 6.3sangeeth_kNo ratings yet

- c2 PDFDocument37 pagesc2 PDFVarun PaiNo ratings yet

- Piercing Corporate VeilDocument8 pagesPiercing Corporate VeilVarun PaiNo ratings yet

- Liability of Independent Directors-In Light of MCA CircularDocument9 pagesLiability of Independent Directors-In Light of MCA CircularVarun PaiNo ratings yet

- Course Outline, Advanced Contracts, PG, 2016 - DR - RK Singh - Final - Jan-June, Sem 2Document24 pagesCourse Outline, Advanced Contracts, PG, 2016 - DR - RK Singh - Final - Jan-June, Sem 2Varun PaiNo ratings yet

- Article 12 Case AnalysisDocument4 pagesArticle 12 Case Analysisstikadar9163% (8)

- 19699ipcc Blec Law Vol1 Chapter2Document62 pages19699ipcc Blec Law Vol1 Chapter2Chaitu ChaituNo ratings yet

- Doctrine of NecessityDocument6 pagesDoctrine of NecessityVarun PaiNo ratings yet

- WLDoc 15-8-01 10 - 19 (PM)Document115 pagesWLDoc 15-8-01 10 - 19 (PM)Varun PaiNo ratings yet

- Pay rates for Miscellaneous Award 2010Document8 pagesPay rates for Miscellaneous Award 2010JoshNo ratings yet

- Fundamentals of Financial StatementsDocument13 pagesFundamentals of Financial StatementsJuvilyn Cariaga FelipeNo ratings yet

- Cba 2008-2009 PDFDocument10 pagesCba 2008-2009 PDFjeffdelacruzNo ratings yet

- New Iphone, Old AbusesDocument10 pagesNew Iphone, Old AbusesYi Yi Debby100% (2)

- Observation Commercial Banks PDFDocument52 pagesObservation Commercial Banks PDFyash_dalal123No ratings yet

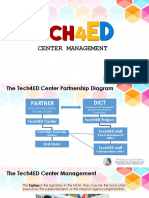

- BCMT Module 3 - Tech4ED Center ManagementDocument46 pagesBCMT Module 3 - Tech4ED Center ManagementCabaluay NHSNo ratings yet

- Maria Flordeliza L. Anastacio, Cpa Phd. Dbe: Vice President Centro Escolar University MalolosDocument31 pagesMaria Flordeliza L. Anastacio, Cpa Phd. Dbe: Vice President Centro Escolar University MalolosCris VillarNo ratings yet

- Career Objective For HR/Management/Public AdministrationDocument4 pagesCareer Objective For HR/Management/Public AdministrationSana ShahidNo ratings yet

- Enterprise Structure OverviewDocument5 pagesEnterprise Structure OverviewAnonymous 7CVuZbInUNo ratings yet

- Business Model and Sustainability AnalysisDocument11 pagesBusiness Model and Sustainability AnalysisAseem GargNo ratings yet

- Material Handling and ManagementDocument45 pagesMaterial Handling and ManagementGamme AbdataaNo ratings yet

- FABIZ I FA S2 Non Current Assets Part 4Document18 pagesFABIZ I FA S2 Non Current Assets Part 4Andreea Cristina DiaconuNo ratings yet

- Case Study HI ToursDocument6 pagesCase Study HI ToursRavi SusmithNo ratings yet

- Key Franchising PoliciesDocument10 pagesKey Franchising PoliciesBusiness Permit100% (1)

- Why Is Planning An Audit Important?Document5 pagesWhy Is Planning An Audit Important?panda 1No ratings yet

- AUC CHECK REFERENCE FORM - OriginalDocument2 pagesAUC CHECK REFERENCE FORM - OriginalteshomeNo ratings yet

- Group 2 - SPL Final PaperDocument28 pagesGroup 2 - SPL Final PaperJane GaliciaNo ratings yet

- Assign 2 Management AccountingDocument10 pagesAssign 2 Management AccountingRamin Mostamer ZiaNo ratings yet

- ISO 14001 2015 Checklist 13 August 2018Document1 pageISO 14001 2015 Checklist 13 August 2018Belajar K3LNo ratings yet

- Basic Banking Tools and VocabularyDocument1 pageBasic Banking Tools and Vocabularyperrine11No ratings yet

- TH 58Document345 pagesTH 58Taleb Boubacar RimNo ratings yet

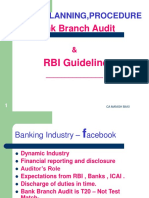

- RBI Bank Branch Audit Planning GuideDocument62 pagesRBI Bank Branch Audit Planning Guidebudi.hw748No ratings yet

- India's Leading Infrastructure Services CompanyDocument25 pagesIndia's Leading Infrastructure Services CompanyArdhendu ShekharNo ratings yet

- Project LeadershipDocument121 pagesProject LeadershipjimmydomingojrNo ratings yet

- BMST5103Document38 pagesBMST5103yusufNo ratings yet

- 14.17 Al MuqasatDocument5 pages14.17 Al Muqasatamelia stephanie100% (1)