Professional Documents

Culture Documents

Banking Assignment

Uploaded by

Ritika RitzOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Banking Assignment

Uploaded by

Ritika RitzCopyright:

Available Formats

1

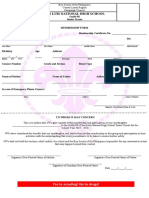

LEGAL PROTECTION FOR DISHONOR OF CHEQUES

(Assignment on Law Relating to Banking and Negotiable Instruments)

Submitted by:

ABHISHEK CHOUDHARY

Roll No. 2011SVII063

Regd. No. - 1141844003

Batch - 2011-2016

SOA NATIONAL INSTITUTE OF LAW

SIKSHA O ANUSANDHAN UNIVERSITY,

BHUBANESWAR

TABLE OF CONTENTS

Sl. No.

Contents

Page

Acknowledgement

ii

Preface

iii

Declaration

iv

Guide Certificate

Introduction

vi

Legislative Provisions

19

vii

Judicial analysis

20

viii

Conclusion

22

ix

Bibliography

23

ACKNOWLEDGEMENT

Apart from the efforts of me, the success of any Assigned work depends largely on

the encouragement and guidelines of many others. I take this opportunity to express my

gratitude to the people who have been instrumental in the successful completion of this

Assignment work.

I would like to show my greatest appreciation to Prof. (Dr) Jayadev Pati, Dean,

SNIL. I cant say thank you enough for his tremendous help and support. I feel motivated

and encouraged every time I attend his lectures. Without his encouragement and guidance

this assignment would not have materialized.

My special thanks to Mrs. (Dr.) Madhubrata Mohanty, the Faculty-in-charge; for

extending her support and guidance without whom the completion of this Assigned Work

would have been a more difficult task. She has taken pain to go through the assignment and

make necessary correction as and when needed.

Thanks and appreciation to the helpful people at SOA National Institute of Law, for

their support. I would also like to thank my friends without whom this assigned work would

have been a distant reality. I also extend my heartfelt thanks to my family and well wishers.

I hope that this research project will prove to be a breeding ground for the next

generation of students and will guide them in every possible way. My special thanks go to

the Almighty without whom anything is next to impossible.

ABHISHEK CHOUDHARY

5 years Integrated B Sc LLB (VIIth Semester)

Reg. No. 1141844003

SOA National Institute of Law (SNIL)

SOA University, Odisha, India

PREFACE

It gave me an immense pleasure to write a preface on my assigned work titled LEGAL

PROTECTION FOR DISHONOR OF CHEQUES

First chapter of this Assignment is completely based on introduction to the topic ie

dishonor of cheques, along with a little introduction to Negotiable Instruments.

In the second chapter various legislative provisions regarding the legal protection for

dishonor of cheques.

In the third chapter, after Statutory laws various judge made laws are discussed in chapter

three where various cases the related provisions are explained well.

Whereas the last chapter is concluded with suggestions and appraisals.

I have tried my best to explain the subject matter in a best possible way and had tried to

omit the errors, if found any, I request the student reading this research work, and the teacher

who are honoring me by using the same, to let me know those errors and omissions, so that I can

rectify the omissions in my next research work. Needless to say such suggestions will be

gratefully received and acknowledged!

ABHISHEK CHOUDHARY

5 years Integrated B Sc LLB (VIIth Semester)

Reg. No. 1141844003

SOA National Institute of Law (SNIL)

SOA University, Odisha, India

DECLARATION

I certify that the assignment on the topic LEGAL PROTECTION FOR

DISHONOR OF CHEQUES for the academic session 2014-15, has been prepared by me

under the guidance of Mrs. (Dr.) Madhubrata Mohanty, Faculty-in-charge, SNIL and I

declare that the same has not been submitted for evaluation elsewhere.

ABHISHEK CHOUDHARY

5 years Integrated B Sc LLB (VIIth Semester)

Reg. No. 1141844003

SOA National Institute of Law (SNIL)

SOA University, Odisha, India

GUIDE CERTIFICATE

This is to certify that Mr. Abhishek Choudhary of B.Sc. LLB course has

successfully completed his Law Relating to Banking and Negotiable Instruments

assignment on the topic LEGAL PROTECTION FOR DISHONOR OF CHEQUES as

provided by the institution for the session 2014-15.

FACULTY-IN-CHARGE

DEANS SIGNATURE

CHAPTER 1

INTRODUCTION

Advent of cheques in the market have given a new dimension to the commercial and

corporate world, its time when people have preferred to carry and execute a small piece of

paper called cheque than carrying the currency worth the value of cheque. Dealings in

cheques are vital and important not only for banking purposes but also for the commerce and

industry and the economy of the country. But pursuant to the rise in dealings with cheques,

the practice of giving cheques without any intention of honoring them has also risen. In case

a cheque is issued by a person in liquidation of his debt or liability, and same is dishonored,

then it not only creates a bad taste, but can also result in harassment and can cause damages

to the person to whom the cheque may have been issued.

Since business activities have increased, the attempt to commit crimes and indulge in

activities for making easy money have also increased. Thus besides civil law, an important

development both in internal and external trade is the growth of crimes and it has been found

that the banking transactions and banking business is every day being confronted with

criminal actions and this has led to an increase in the number of criminal cases relating to or

concerned with the banking transactions.

In India, cheques are governed by the Negotiable Instruments Act, 1881, which is largely

codification of the English Law on the subject. Before 1988 there was no effective legal

provision to restrain people from issuing cheques without having sufficient funds in their

account or any stringent provision to punish them in the event of such cheque not being

honored by their bankers and returned unpaid. Although, on dishonor of cheques there is a

civil liability accrued, however in reality the processes to seek civil justice becomes

notoriously dilatory and recover by way of a civil suit takes an inordinately long time. To

ensure prompt remedy against defaulters and to ensure credibility of the holders of the

negotiable instrument a criminal remedy of penalty was inserted in Negotiable Instruments

Act, 1881 in form of the Banking, Public Financial Institutions and Negotiable Instruments

Laws (Amendment) Act, 1988 which were further modified by the Negotiable Instruments

(Amendment and Miscellaneous Provisions) Act, 2002.

Of the ten sections comprising chapter XVII of the Act, section 138 creates statutory offence

in the matter of dishonor of cheques on the ground of insufficiency of funds in the account

maintained by a person with the banker. Section 138 of the Negotiable Instruments Act, 1881

is a penal provision wherein if a person draws a cheque on an account maintained by him

with a banker for payment of any amount of money to another person from out of that

account for the discharge, in whole or in part of any debtor other liability, is returned by the

bank unpaid, on the ground either because of the amount of money standing to the credit of

that account is insufficient to honor the cheque or that it exceeds the amount arranged to be

paid from that account by an agreement made with that bank, such person shall be deemed to

have committed an offence.

Section 138 of the Act can be said to be falling in the acts which are not criminal in real

sense, but are acts which in public interest are prohibited under the penalty or those where

although the proceeding may be in criminal form, they are in reality only a summary mode of

enforcing a civil right. Normally in criminal law existence of guilty intent is an essential

ingredient of a crime. However the Legislature can always create an offence of absolute

liability or strict liability where mens rea is not at all necessary.

DISHONOUR OF CHEQUES MEANING

Section 6 of the Negotiable Instruments Act, 1881 defines a cheque as "a bill of exchange

drawn on a specified banker and not expressed to be payable otherwise than on demand"."

Dishonor" means "to refuse or neglect to accept or pay when duly presented for payment of a

bill of exchange or a promissory note or draft on a banker 1 .

Blacks Law Dictionary2:

Defines the term "Dishonor" as "to refuse to accept or pay a draft or to pay a promissory note

when duly presented. An instrument is dishonored when a necessary or optional presentment

is duly made and due acceptance or payment is refused, or cannot be obtained within the

prescribed time, or in case of bank collections, the instrument is reasonably returned by the

midnight deadline;

Reference to the term 'dishonor' has been made in Section 91 and Section 92 of the

Negotiable Instruments Act, 1881.

Section 91 - Dishonor by non-acceptance "A bill of exchange is said to be dishonored by

non-acceptance when the drawee, or one of several drawee not being partners, makes default

in acceptance upon being duly required to accept the bill, or where presentment is excused

and the bill is not accepted.

Where the drawee is incompetent to contract, or the acceptance is qualified the bill may be

treated as dishonored".

Section 92- Dishonor by non-payment - "A promissory note, bill of exchange or cheque is

said to be dishonored by non-payment when the maker of the note, acceptor of the bill or

drawee of the cheque makes default in payment upon being duly required to pay the same.

Thus if on presentation the banker does not pay, then dishonor takes place and the holder

acquires at once the right of recourse against the drawer and the other parties on the cheque.

Dishonor of cheque has been considered as a criminal offence under Section 138 of the

Negotiable Instruments Act, 1881. According to Section 138 whenever any cheque for

discharge of any legally enforceable debt or other liability is dishonored by the bank for want

of funds and the payment is not made by the drawer despite a legal notice of demand, it shall

be deemed to be criminal offence.

DISHONOUR OF CHEQUE - INTERPRETATION OF SECTION 138

Section 138 of the Negotiable Instruments Act, 1881

1 Vide Whartons Law Lexicon, 1978 Ed. p. 335

2 Vide Rakesh Porwal v. Narayan Joglekar, 1993 Cr LJ 680 p. (688) (Bom).

10

Dishonor of cheques is considered as an offence under Section 138 of the Negotiable

Instruments Act, 1881. Section 138 deals with Dishonor of cheque for insufficiency of funds

in the accounts. The Section reads as follows:

"Where any cheque drawn by a person on an account maintained by him with a banker for

payment of any amount of money to another person from out of that account for the

discharge, in whole or in part, of any debt or other liability, is returned by the bank unpaid,

either because of the amount of money standing to the credit of that account is insufficient to

honor the cheque or that it exceeds the amount arranged to be paid from that account by an

agreement made with that bank, such person shall be deemed to have committed an offence

and shall without prejudice to any other provisions of this Act, be punished with

imprisonment for a term which may extend to two year, or with fine which may extend to

twice the amount of the cheque, or with both.

Provided that nothing contained in this section shall apply unless(a) The cheque has been presented to the bank within a period of six months from the date on

which it is drawn or within the period of its validity, whichever is earlier.

(b) The payee or the holder in due course of the cheque, as the case may be, makes a demand

for the payment of the said amount of money by giving a notice, in writing, to the drawer, of

the cheque, within thirty days of the receipt of information by him from the bank regarding

the return of the cheques as unpaid, and

(c) The drawer of such cheque fails to make the payment of the said amount of money to the

payee or, as the case may be, to the holder in due course of the cheque, within fifteen days of

the receipt of the said notice.

Object of Section 138:

The object of Section 138 is to make drawer of the cheque subject to penalty when the

cheque bounces on the ground of insufficient funds.

The plain reading of Section 138 of the Negotiable Instruments Act makes it clear that, the

words, "either because of the amount of money standing to the credit of that account is

insufficient to honor the cheque or that it exceeds the amount arranged to be paid from that

account" have been specifically used. It would, therefore, mean that only two

contingencies are contemplated and as such, the words-"either-or" has been used.

It is, therefore, clear that the cheque should be dishonored either for the insufficiency of the

amount or, because it exceeds the amount arranged to be paid from that account. No third

11

contingency or eventuality has been contemplated and the specific clear wording of Section

138 eliminates any third contingency than mentioned in the Section itself.

The cheques can be dishonored for many other reasons and there may be so many

eventualities in which the payee is denied payment by the bank, the reasons such as

mentioning the date incorrectly or some corrections not initialed or the difference in between

the amount mentioned in figures and words, are certain other contingencies in which the

cheques will be definitely dishonured and would be returned as unpaid however it is not in

respect of any of these contingencies that he dishonor of a chequesh as been made penal

under Section 138 of the said Act. In Om Prakash Maniyar v. Swati Bhide 3, the

submissions on behalf of the petitioners to the effect that the dishonor because of the closure

of the account should be held as penal, was not accepted by the court.

Section 138 was introduced with a laudable public policy behind it. It is intended to prevent

or curtail a mischief which is likely to affect financial transactions, and thereby trade and

business and ultimately, economy of the country.

Exclusion of Mens Rea4:

For committing an offence under Section 138 of the Act "mens rea" is not an essential

ingredient5.

Section 138 of the Negotiable Instruments Act, 1881, excludes mens rea by creating strict

liability and this is explicit from the words 'such person shall be deemed to have committed

an offence'. The returning of the cheque by the bank either because he amount of money

standing to the credit of the drawer of the cheque is insufficient or the amount covered by the

cheque is in the excess of the amount arranged to be paid from that account by an agreement

with the bank are the two necessary conditions creating strict liability.

3 1992 Mah LJ 302 at 304

4 Mens Rea, a guilty mind Although prima facie and as a general rule there must be a mind

at fault before there can be a crime, it isnot an inflexible rule, and a statute may relate to

such subject-matter and may be so framed as to make an act criminal, whether therehas

been any intention to break the law or otherwise to do wrong or not. There is a large body of

Municipal law at the present daywhich is so conceived Wills R. v. Tolson, (1889) 23 Q.B.D

173 (vide Whartons Law Lexicon 14th Ed., Fifth Imp., 1992).

5 Mahendra A.Dadia V. State of Maharashtra (2000) (1) Civil Court Cases 438 (Bom.)

12

PROCEEDINGS AGAINST DISHONOUR OF CHEQUE

Prior to the incorporation of chapter XVII in the Negotiable Instruments Act in 1988, to deter

and penalize the issue of worthless cheques, it was only under the provisions of the Indian

penal Code 1860 (IPC) that the drawer of a cheque could be criminally prosecuted if it could

be shown that he cheated someone by issuing the cheque. Even after the introduction of the

specific provisions in the Negotiable Instruments Act, a drawer can be prosecuted under IPC

for cheating, but he cannot be prosecuted and punished for the same offence under both the

enactments. Mens rea or dishonest intention must be established to prove cheating, but it is

not an essential element of an offence under section 138 of the Negotiable Instruments Act.

Criminal Proceeding Chapter XVII of the Negotiable Instruments Act

XVII inserted by the Banking, Public Financial Institutions and Negotiable Instruments Laws

(Amendment) Act, 1988 provides for penalties in case of dishonor of certain cheques for

insufficiency of funds in the accounts or for the reason that the amount exceeds the

arrangement made by the drawer. As per the penal provisions under the Act, the drawer,

committing an offence under Section 138, is liable to be punished with imprisonment for a

term which may extend to two years, or fine which may extend to twice the amount of the

cheque or both.

Summary Proceeding - Order 37 of the Code of Civil Procedure

When a cheque is dishonored, the holder or payee of the cheque can sue the drawer or

endorser for the recovery of amount along with interest. Besides a civil suit for recovery of

the amount, proceeding in a summary manner can be initiated under Order 37 of the Code of

Civil Procedure. The advantage of suing under chapter XXXVII of Civil Procedure Code is

that the defendant is not allowed in such cases to defend the suit without leave obtained from

Court and it is provided further that a decree passed under the said Order, may be executed

forthwith. If no such leave is applied for or granted, the allegations in the plaint shall be

deemed to be admitted, and the plaintiff is entitled to a decree for the principal sum and also

the interest as calculated under Section 9 and 80 of the Negotiable Instruments Act,

1881.Criminal prosecution under section 138 does not bar a civil action against the drawer

on the dishonored cheque.

13

LIABILITY FOR STOPPED PAYMENT

A stopped payment is usually requested if the cheque has been declared missing or lost. But

many a times the drawer, to escape his debt or liability has used it as an instrument of

deception. The 1988 amendment in Section 138 of Negotiable Instruments Act is also silent

about Stopped Payment.

The contract between the customer and the bank is defined as a debtor- creditor relationship.

This contract requires the bank to honor all valid and proper orders of the customer to pay

amounts from his account with the bank, for as long as funds remain available in the

customer's account. The customer's order, however, remains executory and can be rescinded

until the bank makes payment. One of the reasons on account of which the banker can refuse

to make the payment of a cheque is that the payment has been stopped by the drawer. Upon

receipt of a timely stop payment order, the bank ceases to have authority to pay the item.

A customer thus, has a right to give notice to his Bankers to stop payment of a cheque which

he has issued. Generally a written notice, signed by the drawer is sufficient to stop the

payment. A stopped payment is usually requested if the cheque has been declared missing or

lost.

In India, while there is as such no express provision relating to stop payment of cheques.

However there are various judgments regarding this aspect. Indian Courts have covered this

facet in Section 138 of Negotiable Instruments Act, which is related to dishonor of cheques.

The discussion relating to stop payment has assumed importance in view of the amendment

to the Negotiable Instruments law by the amendment in 1988. Prior to this amendment,

people issued cheques knowing well that the cheque is not going to be honored on

presentation, and they tried to create circumstances in which the bank would return the

cheque with such endorsements as "stopped payment", "refer to drawer" or "A/C closed".

These were some of the tricks used by the drawer to escape the penal liability, which was

attached to Section 138 of Negotiable Instruments Act.

14

DRAWERS LIABILITY FOR DISHONOUR OF CHEQUE

Section 30 of the Negotiable Instruments Act, 1881 reads as follows:

"the drawer of a bill of exchange or a cheque is bound, in case of dishonor by the drawee or

acceptor thereof, to compensate the holder, provided due notice of dishonor has been given

to, or received by, the drawer". Section 30 makes it imperative that the notice of dishonor

should of necessity be served on to the drawer of such cheque. It is clear that the drawer shall

be bound to compensate the payee or the holder, as the case may be, if only he has been

served with the notice of dishonor.

Section 138 of the Negotiable Instruments Act requires that the payee or the holder in due

course of the cheque to issue a notice in writing to the drawer making a demand for payment

of the cheque amount. Such notice must be given within 30 days of information from the

bank regarding the return of cheque as unpaid. The requirement of giving of notice is

mandatory. There is no mode prescribed under section 138 for serving the notice. It is

sufficient that the notice in writing is served on accused. Where no notice making demand

for payment was served upon the drawer as contemplated under clause (b) and clause (c) of

Section 138, which would mean that no demand has been made within the specified time

from the date of dishonor of cheque in question, conviction will not be sustainable. 6

Consequence of part payment by drawer after issue of notice

Section 138 clearly shows that in the event of the drawer of the cheque failing to make the

payment of the said amount of money, a prosecution can be maintained. The expression "said

amount of money" can only denote the amount for which the cheque is drawn and cannot

relate to a part of it. Even where part payment is made by the drawer after issue of statutory

notice, the prosecution cannot be quashed.7

Liability of drawer after deposit of entire amount during trial

As stated by the Supreme Court once the offence is committed, any payment made

subsequent thereto will not absolve the accused of the liability of criminal offence, though in

the matter of awarding of sentence, it may have some effect on the court trying the offence.

But by no stretch of imagination, a criminal proceeding could be quashed on account of

deposit of money in the court or that an order of quashing of criminal proceeding, which is

6 Adhikari (B) v. Ponraj 1996 Cri LJ 180 (Mad)

7 Ruby Leather Exports v. Venu (K) (1995) 82 Comp Cas 776 (Mad).

15

otherwise unsustainable in law, could be sustained because of the deposit of money in this

court. The deposit of money by the drawer, therefore, during the trial is of no consequence 8.

Death of Drawer

The criminal liability cannot be fastened to the heirs and the legal representatives of the

person who is said to have been guilty of the offence in question. The cheque presented for

realization by the complainant was returned on the ground of insufficient funds. The notice

sent was returned with postal endorsement 'party expired'. Wife and daughters of the drawer

of the cheque cannot be prosecuted for the offence under Section 138 of the Act for the

alleged failure of the drawer in meeting the liability to pay the amount covered by the cheque

which was dishonoured in response to the notice sent by the complainant 9

Drawer declared insolvent

The drawer cannot escape from the criminal liability by putting forward he plea that he is not

bound to discharge the liability mentioned in the complaint as he was already declared as an

insolvent, especially when there is section 139 permitting the court to presume that there is

an existing liability and the issuance of the cheque was made towards the discharge of the

said liability.

DRAWEES LIABILITY FOR DISHONOUR OF CHEQUE

Rightful Dishonor - when bank may refuse to honor

When there is the relationship of banker and customer between the parties, the banker is

under an obligation to pay cheques when a mandate to pay is received from the customer, or

when a cheque is issued. However, there may be a number of circumstances when the bank

has no other alternative but to return the cheque and in all such cases the bank is fully

justified in returning the cheque. These are the cases which may be termed as a countermand

from the customer which means an order to revoke the former instructions and annulling the

former mandate given by the customer to the bank to honor the cheques and it also means the

situations resulting from the closure of account by the customer, prohibitory 'garnishees'

orders having been received from the court or orders for payment having been received from

the court or orders for payment having been received under Section 226 (3) of the IncomeTax Act, 1961 and similarly it also means the situation when there is a restrained order from

the court, notice of death of the customer, lunacy of the customer, notice of loss of cheque or

forged signatures on the cheque.

8 Rajneesh Aggarwal v. Amit J. Bhalla 2001 Cri LJ 708 (SC)

9 Bhupinder Lima v. State (2000) 99 Comp Cas 424 (AP)

16

Wrongful dishonor of cheque Drawee/ banks liability to pay damages

In case all the conditions which are necessary for the payment of a cheque are present and

have been fulfilled then if the bank dishonors a cheque it will amount to a breach of contract

for which the banker is liable to pay damages. The liability of drawee of cheque in case of a

wrongful dishonor has been dealt with under Section 31 of the Negotiable Instruments Act,

1881. Section 31 states as follows:"the drawee of a cheque having sufficient funds of the

drawer in his hands properly applicable to the payment of such cheque must pay the cheque

when duly required so to do, and, in default of such payment, must compensate the drawer

for any loss or damage caused by such default".

Compensation for wrongful dishonor

Wrongful dishonor of a cheque exposes the drawee bank to statutory liability to the drawer to

compensate him for 'any loss or damage cause by such default'. The principle of awarding

compensation to the drawer of a cheque is reparation for the injury sustained or likely to be

sustained by reason of dishonor. In almost every case the drawer can recover substantial

damages against the drawee on the basis of injury to his credit, although he may not be able

to prove that he had suffered actual pecuniary loss through the dishonoring of the cheque 10

However, there appears to be a distinction between a trader and a non-trader in this respect,

while a trader is always entitled to substantial damages for dishonoring of his cheque, a nontrader will be entitled only to nominal damages in the absence of an allegation and proof of

substantial damages11,

The General rule followed by the courts in awarding damages is that damages area warded

for foreseeable and actual loss suffered and the quantum of damages is usually based on the

principle of restitutio in intgegram i.e. restoring the person to the position he would have

been in if he had not suffered a damage. But in case of trademans cheque the damages

awarded are inversely proportional to the amount on the cheque. Thus, smaller the amount of

the dishonored cheque, greater is the damages paid. The reason behind this rule is,

10 Sridhar v Tyrwitt, (101) A.W.N. 113; Rolin v. Steward (1854) 4 C.B. 595

11 Gibbons v. Westminster Bank (1939) 3 All E.r. 577

17

businessmans loss of reputation or status or goodwill is once again inversely proportional to

the amount of the cheque.

DISHONOUR OF CHEQUE - LIABILITY OF A COMPANY

Since a company is an artificial person it is incapable of committing any crime personally.

However, if certain crimes are committed by its officials in the name of the company then in

such circumstances a company is said to have committed these crimes. So far as the

punishment is concerned, its liability can be only in terms of fine. The company shall be

responsible for the acts of commissions and omissions of the persons working for the

company.

Section 141 (1) of the Negotiable Instruments Act, 1881 reads as follows:"If the person

committing an offence under section 138 is a company, every person who, at the time the

offence was committed, was in charge of, and was responsible to the company for the

conduct of the business of the company, as well as the company, shall be deemed to be guilty

of the offence and shall be liable to be proceeded against and proceeded against and punished

accordingly;

Provided that nothing contained in this sub-section shall render any person liable to

punishment if he proves that the offence was committed without his knowledge, or that he

had exercised all due diligence to prevent the commission of such offence".

Thus, Sub-section (1) of Section 141 (1) provides that if a person committing an offence

under the section is a company, every person who, at the time when the offence was

committed, was in charge of, and responsible to, the company for conduct of its business, as

well as the company shall be deemed to be guilty of the offence and shall be liable to be

proceeded against and punished accordingly. The offender in Section 138 is the drawer of the

cheque.

However, if the person provides that the offence was committed without his knowledge, or

that he had exercised all due diligence to prevent the commission of such offence, he shall

not be liable to punishment under this Section. Sub-section (2) further provides that where

any offence under this Act has been committed by a company and it is proved that the

offence has been committed with the consent or connivance of, or is attributable to, any

neglect on the part of, any director, Manager, secretary, or other office of the company, such

18

director, manager, secretary or other officer shall also be deemed to be guilty of that offence

and shall be liable to be proceeded against and punished accordingly.

LIABILITY FOR DISHONOR OF CHEQUES - A COMPARATIVE ANALYSIS OF

INDIAN LAWS AND FOREIGN LAWS:

Australian Laws:

As per Australian laws Section 70 of Cheques and Payment Orders Act 1986, in case of

dishonor of a cheque a person who is the drawer or an endorser, of such cheque, is liable on

the cheque whether or not the person is given notice by any person of the dishonor.

In India demand notice is mandatory. Sub-section (b) of Section 138 of the Negotiable

Instruments Act requires the payee or the holder in due course to issue a notice in writing to

the drawer of the cheque within 15 days of the receipt of the information by him from the

bank regarding the return of the cheque as unpaid.

This implies that unlike required in the Negotiable Instruments Act, 1881 there is no need for

the issue of demand notice to the drawer and the liability of the drawer or the endorser, as the

case may be, shall arise as soon as the cheque has been dishonored by the bank.

UK Laws:

Indian Laws and the UK Laws are very similar with respect to the provisions relating to the

dishonor of cheques and the liability arising there from. As required under the Negotiable

Instruments Act, 1881 for establishing the liability of the drawer for dishonor of cheque, the

holder must notify the drawer, of that fact of such dishonor of cheque. Similarly in UK Laws,

under Bills of Exchange Act, 1882, if a cheque is dishonored, the holder is required to notify

the fact of dishonor to the drawer.

New Zealand Laws:

Under the Bills of Exchange Act 1908 Section 42 requires that when a cheque is duly

presented for acceptance and is not accepted within the customary time, the person

presenting it must treat it as dishonored by non-acceptance. However, if he does not, the

holder will lose his right of recourse against the drawer and endorsers. Further, Section 48 of

the Bills of Exchange Act 1908 deals with notice of dishonor. The section states that if a

cheque has been dishonored by non-acceptance or by non- payment, notice of dishonor must

19

be given to the drawer and each endorser. However, any drawer or endorser to whom such

notice is not given shall be discharged from his liability.

CHAPTER 2

LEGISLATIVE PROVISIONS

STATUTORY PROVISIONS FOR LEGAL PROTECTION FOR DISHONOR OF

CHEQUES:

Chapter XVII Of penalties in case of dishonor of certain cheque for insufficiency of

funds in the accounts

Section 138- Dishonor of cheques for insufficiency, etc. of funds in the account.

Section 139- Presumption in favor of holder.

Section 140- Defence which may not be allowed in any prosecution under section 138.

Section 141- Offences by companies.

Section 142- Cognizance of offences

Section 143- Power of Court to try cases summarily.

Section 144- Mode of service of summons.

Section 145- Evidence on affidavit.

Section 146- Banks slip prima facie evidence of certain facts.

Section 147- Offences to be compoundable.

20

CHAPTER 3

JUDICIAL ANALYSIS

1. Abdul Samod v. Satya Narayan Mahavir12, High Court of Punjab and Haryana

thoroughly analyzed section 138 of the Act. Honble Mr. Justice A.P. Chowdhury

stated that there are five ingredients, which must be fulfilled. These are as follows:

1. The cheque is drawn on a bank for the discharge of a legally enforceable debt or

other liability.

2. The cheque has returned by the bank unpaid.

3. The cheque is returned unpaid because the amount available in that account is

insufficient for making the payment of the cheques.

4. The payee gives a notice to the drawer claiming the amount within 15 days of the

receipt of the information by the Bank and

5. The drawer fails to make payment within 15 days of the receipt of

notice.

2. New Central Hall v United Commercial Bank Ltd.13, the Madras High Court

held that where a banker having sufficient funds of a customer in his hands fails,

even by mistake to honor cheque issued by the customer, the customer has a right to

claim damages.

3. Jogendra Nath Chakrawarti v. New Bengal Bank Limited 14, it was held, where

the banker, being bound to honor his customers cheque, has failed to do so, he will

be liable in damages. If, special damage, naturally ensuing from the dishonor, is

proved, it will be properly taken into account in assessing the amount of the damages.

12 PLR 1990(2) 269

13 AIR 1959 Mad 153

14 AIR 1939 Cal. 63

21

4. Calcutta Sanitary Wares v. C. T. Jacob 15, where the Court was considering a

situation whereby the cheque was initially dishonored on the basis of a stop-payment

memo. The Court held that the object of the provision cannot be allowed to be

defeated by such ingenious action. The Court took the view that dishonor presupposes non-payment as the funds in question were not forthcoming and that in these

circumstances also, the failure to pay the amount within 15 days of the notice of

demand would still constitute an offence as any other view would defeat the specific

provisions of Section 138.

5. Sadanandan Bhadran v. Madhavan Sunil Kumar16, A cheque can be presented any

number of times during the period of its validity- Whether dishonor of the cheque on

each occasion of its presentation gives rise to a fresh cause of action within the

meaning of Sec. 142(b) of the act - Held No. - A competent court can take cognizance

of a written complaint of an offence u/s.138 if it is made within one month of the date

on which the cause of action arises under clause c of Sec.142 gives it is a restrictive

meaning - it is the failure to make payment within 15 days from date of receipt of

notice which will give rise to cause of action - Cause of action within meaning of Sec.

142 (c) arises and can arise only once - impediments which negate concept of

successive causes of actionHeld.: On each presentation of the cheque and its dishonour a fresh right and not

cause of action - accrues in his favour. He may, therefore, without taking pre-emptory

action in exercise of his right under clause (b) of Section 138, go on presenting the

cheque so as to enable him to exercise such right at any point of time during the

validity of the cheque. But, once he gives a notice under clause (b) of Sec. 138 he

forfeits such right for in case of failure of the drawer to pay the money within the

stipulated time he would be liable for the offence and the cause of action for filing the

complaint will arise. Needless to say, the period of one month for filing the complaint

will be reckoned from the day immediately following the day on which the period of

fifteen days from the date of the receipt of the notice by the drawer expires.

15 1991 (1) KLT 269

16 (1998 (4) SCALE SC

22

6. N.E.P.C Mecon Ltd. V. Magma Leasing Ltd., 17 the Supreme Court observed that the

object of bringing Section 138 on Statute appears to inculcate faith in the efficacy of

banking operations and credibility in transaction in business on negotiable instrument

and to promote the efficacy of the banking operation and to ensure credibility in

transacting business through cheques.

7. M/S Modi Cements Ltd v. K K Nandi,18 the Supreme Court while explaining the

object of Chapter XVII Of penalties in case of dishonor of certain cheque for

insufficiency of funds in the accounts, is to promote the efficacy of banking

operations and to ensure credibility in transacting business through cheques.

CHAPTER 4

CONCLUSION

The law relating to Negotiable instruments is the law of the commercial world which was

enacted to facilitate the activities in trade and commerce, making provision of giving sanctity

to the instrument of credit which would be deemed convertible into money and easily

passable from one person to another. In the absence of such instruments, the trade and

commerce activities were likely to be adversely affected as it was not practical for the trading

community to carry on with it the bulk of currency in force.

The main object of the Act is to legalize the system by which instruments contemplated by it

could pass from hand to hand by negotiation like any other goods.

Chapter XVII was inserted in the Act 1988 with a view to promote the efficacy of banking

operations and to ensure credibility in transacting business through cheques. However the

chapter is not comprehensive and lacks to cover the various aspects of the commercial

transactions especially in view of the emerging ways of payment through the Internet and

other electronic means. Section 138 also does not specifically cover the aspects such as

where the payment has been stopped by the drawer or where the account has been closed

prior to the endorsement of the cheque. These provisions no doubt have served their purpose

but they could be more elaborate in solving the dispute rather than merely relying on the

Court judgments.

17 AIR 1999 SC 1952

18 AIR 1998 SC 1057

23

Though insertion of the penal provisions have helped to curtail the issue of cheque

lightheartedly or in a playful manner or with a dishonest intention and the trading community

now feels more secured in receiving the payment through cheques. However there being no

provision for recovery of the amount covered under the dishonored cheque, in a case where

accused is convicted under section 138 and the accused has served the sentence but, unable

to deposit amount of fine, the only option left with the complainant is to file civil suit. The

provisions of the Act do not permit any other alternative method of realization of the amount

due to the complainant on the cheque being dishonored for the reasons of "insufficient fund"

in the drawers account.

However, the processes to seek civil justice is notoriously dilatory and recover by way of a

civil suit may take inordinately long time therefore if the Government of India could

establish a tribunal to deal with the dishonor of cheques and the liability arising there from, it

could make the process of recovery of damages faster for the aggrieved party.

BIBLIOGRAPHY

1. R N Chaudharys Banking laws

2. R.K Suri; Dishonour

Publishers,Hyderabad;

of

Cheques-

Prosecution

&

Penalties,

ALT

3. R. Swaroop, Cases on Dishonour of cheques (Under Section 138 to Section142 of

the Negotiable Instruments Act), Law Aid Publications, Madras;

4. Bhashyam & Adiga, The Negotiable Instruments Act, Bharat Law House, New

Delhi;

5. Law of Banking by S R Myneni

You might also like

- 3 Australia Government Economy WebquestDocument3 pages3 Australia Government Economy Webquestapi-289247247100% (1)

- App Development Guide For Samsung Smart TV (V1.20)Document100 pagesApp Development Guide For Samsung Smart TV (V1.20)PoiuxManNo ratings yet

- Elements Cards 8.5x11 2sided PDFDocument32 pagesElements Cards 8.5x11 2sided PDFJuan A. ConesaNo ratings yet

- FY23 Department of Energy Letter Supporting Significant, Targeted Increases For Innovation ActivitiesDocument4 pagesFY23 Department of Energy Letter Supporting Significant, Targeted Increases For Innovation ActivitiesThird WayNo ratings yet

- Cef Whitepaper Ver 1.0Document24 pagesCef Whitepaper Ver 1.0Wei Ping0% (1)

- Constitutional Provisions On TaxationDocument2 pagesConstitutional Provisions On TaxationPeter ArellanoNo ratings yet

- Zinc-Plating Copper and The Formation of Brass - 'Turning Copper Into Silver' and Gold''Document3 pagesZinc-Plating Copper and The Formation of Brass - 'Turning Copper Into Silver' and Gold''Phan TrangNo ratings yet

- The inherent hierarchy of moneyDocument21 pagesThe inherent hierarchy of moneyPokereeNo ratings yet

- Mathematical Sciences in 2025Document223 pagesMathematical Sciences in 2025Gerone Russel Jaca EugenioNo ratings yet

- Superhuman Op Tim Is at I On MapDocument2 pagesSuperhuman Op Tim Is at I On MapClaytonNo ratings yet

- Dynamic ProgrammingDocument45 pagesDynamic ProgrammingWasim JafarNo ratings yet

- Multiverse: Physical CosmologyDocument6 pagesMultiverse: Physical CosmologyMarinejetNo ratings yet

- The Gold StandardDocument12 pagesThe Gold StandardMary BeachNo ratings yet

- Ta'R I: TTT '? EowDocument5 pagesTa'R I: TTT '? Eow404 System ErrorNo ratings yet

- Law Commission Report No. 185 Part IIIA - Review of The Indian Evidence Act, 1872, 2003Document298 pagesLaw Commission Report No. 185 Part IIIA - Review of The Indian Evidence Act, 1872, 2003Latest Laws Team100% (1)

- Supreme Court Proceedure Hand BookDocument97 pagesSupreme Court Proceedure Hand BookAhmad MubashirNo ratings yet

- 18 Sha'Ban 1441 MC - Universal Affaidavit of Termination of All CORPORATE, Corporate, Corporate, Et Alia Contacts - Rescission of SignaturesDocument5 pages18 Sha'Ban 1441 MC - Universal Affaidavit of Termination of All CORPORATE, Corporate, Corporate, Et Alia Contacts - Rescission of Signaturesempress_jawhara_hilal_elNo ratings yet

- MetalsDocument10 pagesMetalsfergardeNo ratings yet

- Federal Theory WordDocument215 pagesFederal Theory Wordakalanka23No ratings yet

- Letters To A Law Student PDFDocument93 pagesLetters To A Law Student PDFAllyza SantosNo ratings yet

- Al Chemistry ManifestoDocument25 pagesAl Chemistry ManifestoEdmondNo ratings yet

- Circular Letter No. 2014-10Document2 pagesCircular Letter No. 2014-10Anob EhijNo ratings yet

- Exchange Rate DeterminationDocument12 pagesExchange Rate DeterminationxpshuvoNo ratings yet

- ODDY (1983) Assaying in AntiquityDocument8 pagesODDY (1983) Assaying in Antiquitypax_romana870No ratings yet

- Trade, Commerce and IntercourseDocument48 pagesTrade, Commerce and Intercourseadi_vijNo ratings yet

- BIDC Registration Form 2011 p1Document1 pageBIDC Registration Form 2011 p1andre_duvenhageNo ratings yet

- Precedent As A Source of Law and Its Historical DevelopmentDocument13 pagesPrecedent As A Source of Law and Its Historical DevelopmentSrijan Mehrotra50% (2)

- Muise Laughton Moors Impett 2018 Advanced Online PDFDocument22 pagesMuise Laughton Moors Impett 2018 Advanced Online PDFEddy WongNo ratings yet

- Presentation On Cheques: by Subrahmanya GSDocument12 pagesPresentation On Cheques: by Subrahmanya GSChaitra GsNo ratings yet

- AustraliaDocument34 pagesAustraliamanuel2801No ratings yet

- Land Grant Funding Testimony On January 11, 2021Document18 pagesLand Grant Funding Testimony On January 11, 2021FOX 17 NewsNo ratings yet

- Parliament and Administrative LawDocument71 pagesParliament and Administrative LawHtc MobNo ratings yet

- Meta1 Coin White Paper PDFDocument43 pagesMeta1 Coin White Paper PDFAlejandro Serrano NavarroNo ratings yet

- The Gold Standard 42 June 14Document10 pagesThe Gold Standard 42 June 14ulfheidner9103No ratings yet

- Essay On J.S. Mill's UtilitarianismDocument4 pagesEssay On J.S. Mill's UtilitarianismWill Harrison0% (1)

- Ancient Chinese History AgendaDocument82 pagesAncient Chinese History AgendaDaner BaxhijaNo ratings yet

- Theoretical Framework & VariablesDocument8 pagesTheoretical Framework & Variablessateeshmadala8767% (3)

- Weight - Standards For Greek CoinsDocument2 pagesWeight - Standards For Greek CoinsJon GressNo ratings yet

- Electronic Cheques and Truncated ChequesDocument4 pagesElectronic Cheques and Truncated ChequesBal Gopal SubudhiNo ratings yet

- Cca 1981, 1988-89Document113 pagesCca 1981, 1988-89Samples Ames PLLCNo ratings yet

- Format of The Letter Writing PDFDocument4 pagesFormat of The Letter Writing PDFssathishkumar88No ratings yet

- Commonwealth of Australia Constitution Act 1900 Uk PDFDocument2 pagesCommonwealth of Australia Constitution Act 1900 Uk PDFIlonaNo ratings yet

- Whitepaper Deep LearningDocument10 pagesWhitepaper Deep Learning超揚林No ratings yet

- Bank of America, NT & SA, Petitioner, vs. COURT OF Appeals, Inter-Resin Industrial Corporation, Francisco Trajano, John Doe and Jane DOE, RespondentsDocument29 pagesBank of America, NT & SA, Petitioner, vs. COURT OF Appeals, Inter-Resin Industrial Corporation, Francisco Trajano, John Doe and Jane DOE, Respondentseasa^belleNo ratings yet

- Australia InglishDocument31 pagesAustralia InglishElias Rodas PalominoNo ratings yet

- Wedding Checklist and Planning GuideDocument5 pagesWedding Checklist and Planning GuideDon Ero GonowonNo ratings yet

- Od S Genda: Where Do We Go From Here?Document8 pagesOd S Genda: Where Do We Go From Here?Bernard ConduahNo ratings yet

- Place and Virtual Place: The Use of Metaphor in Describing The Nature of The InternetDocument19 pagesPlace and Virtual Place: The Use of Metaphor in Describing The Nature of The InternetanthrotrekkerNo ratings yet

- Five Steps For CreditDocument2 pagesFive Steps For CreditjohnribarNo ratings yet

- Power Quality in India: A GlimpseDocument261 pagesPower Quality in India: A GlimpseRamesh Arjun TNo ratings yet

- Bankers' ObligationsDocument9 pagesBankers' ObligationsAnmoldeep DhillonNo ratings yet

- A Compilation of the Messages and Papers of the Presidents Volume 1, part 1: George WashingtonFrom EverandA Compilation of the Messages and Papers of the Presidents Volume 1, part 1: George WashingtonNo ratings yet

- Liability For Dishonor of Cheques - ProjectDocument53 pagesLiability For Dishonor of Cheques - Projectparullawyer89% (18)

- Liability of Dishonour of ChequeDocument26 pagesLiability of Dishonour of ChequeMithelesh DevarajNo ratings yet

- Liability for Dishonor of Cheques Act ExplainedDocument25 pagesLiability for Dishonor of Cheques Act ExplainedAbhijeet TalwarNo ratings yet

- Liability of Dishonour of ChequeDocument26 pagesLiability of Dishonour of ChequeRICHA SINGH0% (1)

- Research Methodology Aims and ObjectivesDocument8 pagesResearch Methodology Aims and ObjectivesMeenakshi Sakhare50% (2)

- Consequences of Wrongful Dishonour of ChequesDocument10 pagesConsequences of Wrongful Dishonour of ChequesDipsa PrasanthNo ratings yet

- India's judicial structure and highest courts outlinedDocument11 pagesIndia's judicial structure and highest courts outlinedRitika RitzNo ratings yet

- Judicial System ComparisonsDocument38 pagesJudicial System ComparisonsGauravChoudharyNo ratings yet

- Nuremberg TrialDocument8 pagesNuremberg TrialRitika RitzNo ratings yet

- Presentation On Rule of LawDocument18 pagesPresentation On Rule of LawRitika RitzNo ratings yet

- Synopsis On Competition IssuesDocument3 pagesSynopsis On Competition IssuesRitika RitzNo ratings yet

- On Labor LawsDocument10 pagesOn Labor LawsRitika RitzNo ratings yet

- Moot 1Document19 pagesMoot 1Ritika RitzNo ratings yet

- Uniform Civil CodeDocument5 pagesUniform Civil CodeRitika RitzNo ratings yet

- Case Study On Competition LawDocument8 pagesCase Study On Competition LawRitika RitzNo ratings yet

- Is Company A CitizenDocument11 pagesIs Company A CitizenRitika Ritz0% (1)

- Notes ch8Document36 pagesNotes ch8Ritika RitzNo ratings yet

- Analytical Study of Laws Relating To Sexual Offences in IndiaDocument74 pagesAnalytical Study of Laws Relating To Sexual Offences in IndiaRitika Ritz100% (1)

- The Intellectual Property and Antitrust Review - The Law ReviewsDocument11 pagesThe Intellectual Property and Antitrust Review - The Law ReviewsMannat KalraNo ratings yet

- Arguments For The Ban LajjaDocument3 pagesArguments For The Ban Lajjapizzabythebay kNo ratings yet

- COMELEC Ruling on Disqualification Petition OverturnedDocument2 pagesCOMELEC Ruling on Disqualification Petition OverturnedApril Joy Omboy100% (1)

- PP vs. GILBERT MALLARI y TAYAG (Penned by J. Corona)Document3 pagesPP vs. GILBERT MALLARI y TAYAG (Penned by J. Corona)Jan LorenzoNo ratings yet

- People vs. Berk PDFDocument12 pagesPeople vs. Berk PDFElvin BauiNo ratings yet

- Boy Scouts Membership FormDocument1 pageBoy Scouts Membership FormSofronioMTarucJr.No ratings yet

- Transcript of Testimony For Foreclosure CaseDocument4 pagesTranscript of Testimony For Foreclosure CaseNye LavalleNo ratings yet

- Irr Eo180Document23 pagesIrr Eo180nascel3432No ratings yet

- Custody of ChildDocument3 pagesCustody of ChildKrish BhatiaNo ratings yet

- Refusing To Work Hand OutDocument1 pageRefusing To Work Hand OutshreyanshuNo ratings yet

- Ergonomic Systems Vs EnajeDocument1 pageErgonomic Systems Vs EnajeRobertNo ratings yet

- LIC of India vs Rawal: Life insurance claim denial overturnedDocument4 pagesLIC of India vs Rawal: Life insurance claim denial overturnedbellaryradhikaNo ratings yet

- Merchant & SonsDocument13 pagesMerchant & SonsAjay SinghNo ratings yet

- Brunda's Designers Contract & AgreementDocument3 pagesBrunda's Designers Contract & AgreementhanumanthgowdaNo ratings yet

- Best-Supranational Institutions and Regional Integration PDFDocument45 pagesBest-Supranational Institutions and Regional Integration PDFDaniela SerbanicaNo ratings yet

- Amerifa Construction Company, A.S.B.C.A. (2017)Document2 pagesAmerifa Construction Company, A.S.B.C.A. (2017)Scribd Government DocsNo ratings yet

- Module 1Document27 pagesModule 1shaamimahmedNo ratings yet

- Estrada Vs DestierroDocument31 pagesEstrada Vs DestierroCatie Tan ChingNo ratings yet

- Delhi Rent Control ActDocument58 pagesDelhi Rent Control ActKumail fatimaNo ratings yet

- CDR RentalDocument6 pagesCDR RentalElvynDanielArnaudParedesNo ratings yet

- Victoriano vs. Elizalde Rope Workers' Union PDFDocument42 pagesVictoriano vs. Elizalde Rope Workers' Union PDFAdelyn Joy SalvadorNo ratings yet

- Course Syllabus - Law 117 - Legal TheoryDocument6 pagesCourse Syllabus - Law 117 - Legal TheorytemporiariNo ratings yet

- Rivera v. Villanueva SC Rules Angelina Not Heir to Gonzales EstateDocument2 pagesRivera v. Villanueva SC Rules Angelina Not Heir to Gonzales EstateMaria Clarissa BalbasNo ratings yet

- Earl v. Winne - Libel, Slander, Malicious ProsecutionDocument31 pagesEarl v. Winne - Libel, Slander, Malicious ProsecutiongoldilucksNo ratings yet

- Contract Law - Essential ElementsDocument25 pagesContract Law - Essential ElementsZveen LeeNo ratings yet

- The Railway Carriage & Wagon Workshop Established by East Indian Railway Company at Howrah and Shifted To The Liluah at Present Place in The YearDocument39 pagesThe Railway Carriage & Wagon Workshop Established by East Indian Railway Company at Howrah and Shifted To The Liluah at Present Place in The YearSourav NandiNo ratings yet

- Sources of Authority: Law, Religion, Culture and EthicsDocument18 pagesSources of Authority: Law, Religion, Culture and EthicsLorelene RomeroNo ratings yet

- G.R. No. L-23988, January 2, 1968: CIR V.villaDocument2 pagesG.R. No. L-23988, January 2, 1968: CIR V.villaReyna RemultaNo ratings yet

- People vs. CusiDocument1 pagePeople vs. CusiRuth LumibaoNo ratings yet

- Affidavit (Discrepancy) - DomDocument3 pagesAffidavit (Discrepancy) - DomGhrace Segundo CocalNo ratings yet