Professional Documents

Culture Documents

PXP: Financial Results From Jan-Sept

Uploaded by

BusinessWorldOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PXP: Financial Results From Jan-Sept

Uploaded by

BusinessWorldCopyright:

Available Formats

October 28, 2015

PHILIPPINE STOCK EXCHANGE, INC.

Tower Exchange Plaza

Ayala Triangle, Ayala Avenue

Makati City

Attention: MS. JANET A. ENCARNACION

Head - Disclosure Department

Gentlemen:

We submit herewith a copy of Philex Petroleum Corporations press release on the Companys Financial

and Operating Highlights for the Nine Months ended 30th September 2015.

Very truly yours,

(SIGNED)

MARK H. RILLES

Finance Controller

October 28, 2015

PRESS RELEASE

FINANCIAL RESULTS

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2015

Philex Petroleum Corporation (Philex Petroleum or the Company) incurred a consolidated net

loss of P118.1 million for the nine-month period ended September 30, 2015, compared to a net loss

of P376.9 million during the same period last year. Net loss attributable to equity holders of the

Parent Company amounted to P65.9 million compared to a net loss of P188.8 million during the

same period last year. The net loss primarily resulted from lower petroleum revenues contributed

by its subsidiary, Forum Energy Plc (Forum), due to a drop in crude oil prices and a lower

production from Service Contract 14C1 Galoc. Net loss decreased year-on-year due to a charge in

impairment to Pitkins SC6a - Octon during the same period last year.

During a Special Shareholders Meeting held on August 11, 2015, the Pledge of Philex Petroleums

shareholdings in subsidiaries to Philex Mining Corporation was approved by shareholders,

representing at least 2/3 of the outstanding shares of the Company.

On August 11, 2015 Philex Petroleum confirmed that the Philippine Department of Energy (DOE)

has granted a Force Majeure on Service Contract 75 ("SC75"). Under the terms of the force majeure,

all exploration work at SC75 shall be immediately suspended effective from the end of its first subphase (SP-1) on 27 December 2015 until the date the DOE notifies the Company to resume

petroleum-related activities. As a result, the second sub-phase (SP-2) of SC75 has been put on

hold until further notice. The terms of SP-2 and all subsequent sub-phases will be extended by the

term of the force majeure.

The Company will continue its efforts to reduce operating expenditures through the rationalization

of the Companys business structure and asset portfolio particularly in the current low oil-price

environment.

-2-

About Philex Petroleum Corporation

Philex Petroleum Corporation is an upstream oil and gas company incorporated in the Philippines whose

shares are listed on the Philippine Stock Exchange. The Company directly and indirectly owns oil and gas

exploration and production assets located in the Philippines, and indirectly owns exploration assets

located in Peru.

For further information, please contact:

Mark H. Rilles

Finance Controller

Philex Petroleum Corporation

Telephone: (632) 631 1381

Email: mhrilles@philexpetroleum.com.ph

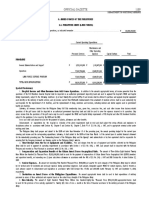

PHILEX PETROLEUM CORPORATION AND SUBSIDIARIES

UNAUDITED CONSOLIDATED BALANCE SHEETS

(Amounts in Thousands)

ASSETS

Current Assets

Cash and cash equivalents

Accounts receivable - net

Inventories - net

Other current assets -net

Total Current Assets

SEPTEMBER 30, 2015

(UNAUDITED)

DECEMBER 31, 2014

(AUDITED)

P 537,373

74,420

11,894

28,486

652,173

P 1,908,365

91,787

18,550

42,634

2,061,336

332,398

1,238,583

4,979,186

22,580

25,593

6,598,340

P 7,250,513

316,430

1,238,583

4,831,363

22,302

27,157

6,435,835

P 8,497,171

LIABILITIES AND EQUITY

Current Liabilities

Accounts payable and accrued liabilities

Advances from related parties

Income tax payable

Total Current Liabilities

P 17,901

2,931,676

2,949,577

P 64,077

3,421,836

653

3,486,566

Noncurrent Liabilities

Deferred income tax liabilities - net

Other liabilities

Total Noncurrent Liabilities

Total Liabilities

1,112,029

206,317

1,318,346

4,267,923

1,111,937

225,977

1,337,914

4,824,480

Noncurrent Assets

Property, Plant and Equipment - net

Goodwill

Deferred oil and gas exploration costs - net

Deferred income tax assets

Other noncurrent assets

Total Noncurrent Assets

TOTAL ASSETS

Equity

Capital Stock - P1 par value

Equity reserves

Deficit

Cumulative translation adjustment on foreign subsidiaries

Non-controlling Interests

Total equity

TOTAL LIABILITIES AND EQUITY

1,700,000

120,145

(1,215,986)

(10,911)

593,248

2,389,343

2,982,591

P 7,250,514

1,700,000

48,970

(1,145,665)

(57,018)

546,287

3,126,404

3,672,691

P 8,497,171

PHILEX PETROLEUM CORPORATION

AND SUBSIDIARIES

UNAUDITED CONSOLIDATED

CONDENSED INTERIM

FINANCIAL STATEMENTS

September 30, 2015

PHILEX PETROLEUM CORPORATION AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF INCOME

(Amounts in Thousands, except Earnings or Loss Per Share)

Nine-Month Period Ended September 30

2015

2014

REVENUE

Petroleum

Coal

105,509

105,509

COSTS AND EXPENSES

Petroleum production costs

Cost of coal sales

General and administrative expenses

Mine product royalties

OTHER INCOME (CHARGES)

Provision for impairment of assets

Interest income - net

Foreign exchange gains - net

Others - net

LOSS BEFORE TAX

PROVISION FOR INCOME TAX (BENEFIT FROM)

Current

Deferred

NET LOSS

Net Loss Attributable to:

Equity holders of the Parent Company

Non-controlling interests

272,331

3,197

275,528

73,217

187,846

261,063

122,240

3,197

210,444

606

336,487

5,492

25,465

6,425

37,382

(118,172)

(319,852)

4,644

1,259

311

(313,638)

(374,597)

(36)

(36)

(P

(P

(P

BASIC/DILUTED LOSS PER SHARE

(P

134

2,139

2,273

118,136)

(P

65,884)

(52,252)

118,136)

(P

0.0388)

376,870)

188,806)

(188,064)

( P 376,870)

(P

0.1111)

PHILEX PETROLEUM CORPORATION AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF INCOME

(Amounts in Thousands, except Earnings Per Share)

3rd Quarter Ended September 30,

2015

REVENUE

Petroleum

Coal

COSTS AND EXPENSES

Petroleum producion costs

General and administrative expenses

Cost of coal sales

Mine product royalties

OTHER INCOME (CHARGES)

Provision for impairment of assets - net

Interest income - net

Foreign exchange gains (losses)

Gain on reversal of impairment loss

Others

LOSS BEFORE INCOME TAX

PROVISION FOR (BENEFIT FROM) INCOME TAX

Current

Deferred

2014

22,057 P

22,057

77,286

19,093

62,705

81,798

34,682

51,670

77,286

86,352

3,688

23,786

(337,974)

1,120

4,717

123

27,597

6

(332,131)

(32,144)

(341,197)

(1)

(150)

(4,891)

(5,041)

(1)

NET LOSS

Net income attributable to:

Equity holders of the Parent Company

Non-controlling interests

`

BASIC/DILUTED EARNINGS PER SHARE

(P

32,143)

(P

17,182)

(14,961)

( P 32,143)

(P

(P

(P

0.0101)

336,156)

176,926)

(159,230)

( P 336,156)

(P

0.1977)

You might also like

- 12 Elements of Firearms TrainingDocument6 pages12 Elements of Firearms TraininglildigitNo ratings yet

- A. Questions: Conversation Activities - TravelDocument11 pagesA. Questions: Conversation Activities - TravelkicsirekaNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- b0700sv F PDFDocument188 pagesb0700sv F PDFabdel taibNo ratings yet

- Galactic Federations, Councils Secret Space Programs (Michael Salla) (Z-Library)Document289 pagesGalactic Federations, Councils Secret Space Programs (Michael Salla) (Z-Library)Junior VeigaNo ratings yet

- Malaysia PSCDocument19 pagesMalaysia PSCRedzuan Ngah100% (1)

- Netscape ProformaDocument6 pagesNetscape ProformabobscribdNo ratings yet

- 17.-GCRO Top250 PG March2019Document214 pages17.-GCRO Top250 PG March2019Mikee Baliguat Tan100% (1)

- Business Combi - AcquisitionDocument6 pagesBusiness Combi - Acquisitionnaser20% (5)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Making Fertilizer Using Ipil Ipil LeavesDocument10 pagesMaking Fertilizer Using Ipil Ipil LeavesRaine TalionNo ratings yet

- Provisional Restorations in Fixed ProsthodonticsDocument4 pagesProvisional Restorations in Fixed ProsthodonticsPhoebe David100% (1)

- Half Yearly Dec09-10 PDFDocument15 pagesHalf Yearly Dec09-10 PDFSalman S. ZiaNo ratings yet

- Xls178 Xls EngDocument7 pagesXls178 Xls EngprincetonymesNo ratings yet

- Global Petroleum Tax GuideDocument14 pagesGlobal Petroleum Tax Guidemuki10No ratings yet

- Small and Medium Thesis Edit Final 123Document9 pagesSmall and Medium Thesis Edit Final 123Allyssa MospaNo ratings yet

- Oil and Gas Sector: PPL Profitability Expected To Grow by 15.5% in HFY14Document2 pagesOil and Gas Sector: PPL Profitability Expected To Grow by 15.5% in HFY14jibranqqNo ratings yet

- Pre-Finals ExaminationDocument2 pagesPre-Finals ExaminationShane KimNo ratings yet

- Revised Financial Results For Sept 30, 2015 (Result)Document6 pagesRevised Financial Results For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- APC Ch11sol.2011Document6 pagesAPC Ch11sol.2011Reymilyn Sanchez100% (2)

- Annual Report 2008Document249 pagesAnnual Report 2008PiaggiogroupNo ratings yet

- Horizon Oil (HZN) Advises Half-Year Profit After Tax of Us$8.5 MillionDocument28 pagesHorizon Oil (HZN) Advises Half-Year Profit After Tax of Us$8.5 Millionapi-127423253No ratings yet

- PXP SEC+17Q+report+Q2+2019Document29 pagesPXP SEC+17Q+report+Q2+2019BERNA RIVERANo ratings yet

- Interim Report Interim ReportDocument34 pagesInterim Report Interim ReportMohammed AbdoNo ratings yet

- Easycall Communications: Q2/H1 Financial StatementDocument44 pagesEasycall Communications: Q2/H1 Financial StatementBusinessWorldNo ratings yet

- FY11 - Investor PresentationDocument11 pagesFY11 - Investor Presentationcooladi$No ratings yet

- Financial Management - FSADocument6 pagesFinancial Management - FSAAbby EsculturaNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- AIIT CH 12 Oil and Gas CoDocument17 pagesAIIT CH 12 Oil and Gas CoOdvut SwapnoNo ratings yet

- Memo To All SAs & ATLs On The Audit Observations oDocument14 pagesMemo To All SAs & ATLs On The Audit Observations onikiboigeniusNo ratings yet

- Updates On Financial Result For Dec 31, 2015 (Company Update)Document4 pagesUpdates On Financial Result For Dec 31, 2015 (Company Update)Shyam SunderNo ratings yet

- San Miguel CorporationDocument505 pagesSan Miguel Corporationcedrick calalangNo ratings yet

- SCI Sample ProblemDocument1 pageSCI Sample ProblemLee TeukNo ratings yet

- Dipifr 2005 Dec QDocument8 pagesDipifr 2005 Dec QAndrew WongNo ratings yet

- IT Return IT1 WithAnnexure 23454434Document3 pagesIT Return IT1 WithAnnexure 23454434khurramacaaNo ratings yet

- The Sixth Sense: UMW Oil & GasDocument7 pagesThe Sixth Sense: UMW Oil & GasEricNgNo ratings yet

- Interim Condensed: Sanofi-Aventis Pakistan LimitedDocument13 pagesInterim Condensed: Sanofi-Aventis Pakistan LimitedawaisleoNo ratings yet

- Oil and Gas Sector: POL Is Due To Announce EPS of PKR30.03 and DPS of PKR25 in HFY14Document2 pagesOil and Gas Sector: POL Is Due To Announce EPS of PKR30.03 and DPS of PKR25 in HFY14jibranqqNo ratings yet

- Financial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Rio Tinto Delivers First Half Underlying Earnings of 2.9 BillionDocument58 pagesRio Tinto Delivers First Half Underlying Earnings of 2.9 BillionBisto MasiloNo ratings yet

- Chapter 14Document25 pagesChapter 14Clarize R. Mabiog100% (1)

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Q3 2013 Report AWDR FinalDocument11 pagesQ3 2013 Report AWDR FinalgjangNo ratings yet

- QantasDocument37 pagesQantasHunter David100% (1)

- Advanced Financial Accounting & Reporting AnswerDocument13 pagesAdvanced Financial Accounting & Reporting AnswerMyat Zar GyiNo ratings yet

- Advanced Accounting Part II Quiz 13 Intercompany Profits Long QuizDocument14 pagesAdvanced Accounting Part II Quiz 13 Intercompany Profits Long QuizRarajNo ratings yet

- Ppe ApDocument5 pagesPpe ApGrace A. Manalo0% (1)

- Financial and Legal Notes: Price/Earnings RatiosDocument7 pagesFinancial and Legal Notes: Price/Earnings RatiosMohd Syazwan Abdul RaufNo ratings yet

- Updates On Financial Results For Sept 30, 2015 (Result)Document4 pagesUpdates On Financial Results For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- United Industries Company: Annual Review 2008Document31 pagesUnited Industries Company: Annual Review 2008Abdulla AbdulmajeedNo ratings yet

- Paramount Resources Pitch - FINALDocument18 pagesParamount Resources Pitch - FINALJonathanChangNo ratings yet

- Assignment Percentage TaxDocument6 pagesAssignment Percentage TaxChristel OrugaNo ratings yet

- Anglo Ventures Corporation Executive Summary 2020Document3 pagesAnglo Ventures Corporation Executive Summary 2020Don Michaelangelo BesabellaNo ratings yet

- APQ3FY12Document19 pagesAPQ3FY12Abhigupta24No ratings yet

- Tax Alert (Jurisprudence)Document6 pagesTax Alert (Jurisprudence)Cherilyn NgoNo ratings yet

- Taxation of OilDocument81 pagesTaxation of OilPrince McGershonNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Official Gazette 1189 J 3, 2022: G. Armed Forces of The Philippines G.1. Philippine Army (Land Forces)Document20 pagesOfficial Gazette 1189 J 3, 2022: G. Armed Forces of The Philippines G.1. Philippine Army (Land Forces)Christine Joy CobiaranNo ratings yet

- Indonesian PSCDocument20 pagesIndonesian PSCpoetoetNo ratings yet

- BP Annual Report and Form 20FDocument272 pagesBP Annual Report and Form 20FsingpamNo ratings yet

- Personal Assignment of AcaDocument2 pagesPersonal Assignment of AcaSiyuan ChenNo ratings yet

- Consolidated Statements of IncomeDocument2 pagesConsolidated Statements of IncomePenguinNo ratings yet

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Petroleum Bulk Stations & Terminals Revenues World Summary: Market Values & Financials by CountryFrom EverandPetroleum Bulk Stations & Terminals Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 00capítulo - The Routledge Handbook of Henri Lefebvre, The City and Urban SocietyDocument12 pages00capítulo - The Routledge Handbook of Henri Lefebvre, The City and Urban SocietyJeronimoNo ratings yet

- André Bakker Modeling Flow Fields in Stirred TanksDocument40 pagesAndré Bakker Modeling Flow Fields in Stirred TanksKhalida BekrentchirNo ratings yet

- Questions-1D and 2D Flow: Depth To WaterDocument4 pagesQuestions-1D and 2D Flow: Depth To WaterJoseph ChangNo ratings yet

- Selulitis Orbita Pada Laki-Laki Usia 64 Tahun: Laporan KasusDocument8 pagesSelulitis Orbita Pada Laki-Laki Usia 64 Tahun: Laporan KasusLuh Dita YuliandinaNo ratings yet

- Constructing 30deg AngleDocument4 pagesConstructing 30deg AngleArthur ChewNo ratings yet

- 14 Parabola Formula Sheets QuizrrDocument9 pages14 Parabola Formula Sheets QuizrrChandanNo ratings yet

- CO Q1 TLE EPAS 7 8 Module 4 Preparing Technical DrawingsDocument47 pagesCO Q1 TLE EPAS 7 8 Module 4 Preparing Technical DrawingsNicky John Doroca Dela MercedNo ratings yet

- Wanderer Above The Sea of FogDocument5 pagesWanderer Above The Sea of FogMaria Angelika BughaoNo ratings yet

- Apexification Using Different Approaches - Case Series Report With A Brief Literature ReviewDocument12 pagesApexification Using Different Approaches - Case Series Report With A Brief Literature ReviewIJAR JOURNALNo ratings yet

- Animal Cells PDFDocument4 pagesAnimal Cells PDFFalah HabibNo ratings yet

- CE-401CE 2.0 Network Diagrams 2015Document83 pagesCE-401CE 2.0 Network Diagrams 2015Shubham BansalNo ratings yet

- CERN Courier - Digital EditionDocument33 pagesCERN Courier - Digital EditionFeriferi FerencNo ratings yet

- Problem Set Solution QT I I 17 DecDocument22 pagesProblem Set Solution QT I I 17 DecPradnya Nikam bj21158No ratings yet

- G30 Developer MSDS ABDocument6 pagesG30 Developer MSDS ABramadhanNo ratings yet

- GNM SyllabusDocument4 pagesGNM SyllabusVinay SinghNo ratings yet

- Fortified Rice FssaiDocument8 pagesFortified Rice FssaisaikumarNo ratings yet

- April262019 Airline Economic Analysis 2018-2019vfwebDocument62 pagesApril262019 Airline Economic Analysis 2018-2019vfwebapi-548139140No ratings yet

- Balance Diet and NutritionDocument9 pagesBalance Diet and NutritionEuniceNo ratings yet

- Lesson Plan 3Document3 pagesLesson Plan 3api-547884261No ratings yet

- Naskah Drama Beauty and The BeastDocument39 pagesNaskah Drama Beauty and The BeastAyu Rose75% (4)

- Detailed Lesson Plan in Science Grade 10Document9 pagesDetailed Lesson Plan in Science Grade 10christian josh magtarayoNo ratings yet

- HP Virtual Connect Flex-10 and Nexus VPC (Virtual Portchannel) ConfigurationDocument13 pagesHP Virtual Connect Flex-10 and Nexus VPC (Virtual Portchannel) ConfigurationTuan Anh NguyenNo ratings yet

- Introducing RS: A New 3D Program For Geotechnical AnalysisDocument4 pagesIntroducing RS: A New 3D Program For Geotechnical AnalysisAriel BustamanteNo ratings yet

- What Is Kpag?: Table of ContentsDocument2 pagesWhat Is Kpag?: Table of Contentsangelito bernalNo ratings yet