Professional Documents

Culture Documents

Technical Trading Strategy

Uploaded by

Tommy LohOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Technical Trading Strategy

Uploaded by

Tommy LohCopyright:

Available Formats

Technical Trading Strategy

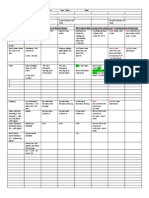

Trading Hr

SGX : 9am - 5pm

US: 930pm 430am

1-hr after market open

US, SGX, Index

SG-1 pip above yesterday's high

Look for hammer with high vol

US ~ 5 pip (0.05)

Look for reversal at support line

SGX/US~ < 2% from EP

1 pip below bullish reversal candle

at least 1.4 x ATR below EP

1 pip below bearish reversal candle

At least 1.4 X ATR above EP

Highest point of recent resistance

(1) Discipline

EP , SL and PT

US RRR > 1.8

SG RRR > 2

More than 6 mths from last 50D MA vs 150D MA crossover

Bullish reversal (Trading)

E.P (reversal)

EP validity

Stop Loss criteria (long)

Stop Loss criteria (short)

Profit Target Setting

Profit taking strategy (1)

Trading Plan

Risk-Reward-Ratio

Filter Criteria Scanned Stock

Pattern to align

Validity of signal

Max allowable Days to TP

Uptrend in Price Action & Market Index

3 days from scan

Need to adjust data daily for 3 days

Time Stop < 7 weeks

Release stock just before 7 weeks

(2) Intra day

EP & SL

Profit taking strategy (2)

Trading Plan

RRR

RRR US< 1.8 or SG <1.5

EP

SG/HK-1 bid ytd high (0.01)

US ~ 5 bids (0.05)

Individual appetite but exit before market close

Profit Target point

Profit taking strategy (3)

EP

SL

Trialing Stop setting

Profit Target (Trailing Stop)

(3) Immediate Trailing Stop

SG -1 pip ytd high (0.01)

US ~ 5 pip (0.05)

Long: 1 pip below bullish reversal

Short : 1 pip above the bearish reversal

Long : Use ytd LOW and set 1 pip below

Short : Use ytd HIGH and set 1 pip above

ytd low.

Long: When One pip below ytd LOW is

Short : when One pip above ytd HIGH is

broken

broken

Speculation Strategy

Speculation/Accumulation

EP (speculation)

HK /SG - 1 bid ytd high

EP validity

HKSE< 7% from EP

Training Plan

Only EP and SL ..NO TP

Taking Profit Target

1.

2.

SG /HK Bullish Accumulation

Filter criteria from scanner

data (apply 7 days search)

* also must do bearish

accumulation

1st profit taking at 7% from EP

2nd profit taking 1hr before market close

Do not need to consider trend

Need high vol for Flag pole, more than

8pips on pole is preferred

Flag volume must be less than 30% of

flag pole

Daily adjust EP & SL till breakout as

long RRR~1.4

Look for strong flag pole (white) w

black candle

Higher Probability for reversal,

with preceding high vol to trigger

breakout

Any px gap up that form the flag

pole, negate that stock

Negate stock with high vol formed

after flag pole

Money and Risk Management

No of stock/trade

Risk Mgmt

Profit Taking

Basic Rules

3 trades/wk (not inclusive intra day)

4:1 ratio (every 4 long or 4 short must

have 1 opposing trade for hedging

purpose)

Not more than 3% of trading capital per

trade

Scale the trade size according to

market trend ( eg. $500 down to $250 )

1) stick to predetermined profit target plan (u need to wait for PT, but remember u are

subjected to the risk of any overnight bearish news in the US market which may cause

this to hit SL)

2) use trailing stop loss strategy upon entry price. (until the candle break previous day

low, u will hold. your profit is when candle break previous day low) 70% profit

3) using intraday profit taking strategy which works for them. (upon entry price hit,

enter and close your position before market close)

Buy

Sell

Growth Stock (6 mths holding)

When bullish reversal signal present

Look for uptrend cross over

Must be based on technical analysis

When 50MA cross over 150MA

You might also like

- 1 Minute Scalping StrategyDocument6 pages1 Minute Scalping Strategyayub khanNo ratings yet

- Stop Losses Are For Sissies PDFDocument11 pagesStop Losses Are For Sissies PDFXRM0909No ratings yet

- Trading SystemDocument2 pagesTrading SystemMayank Meher100% (1)

- Fo 48151255 PDFDocument17 pagesFo 48151255 PDFsnehachandan91No ratings yet

- The Scavenger Hunt NieDocument47 pagesThe Scavenger Hunt NieSubathara PindayaNo ratings yet

- Last Hour TradingDocument3 pagesLast Hour TradingSenorNo ratings yet

- 10 Forex Sins and Trader TypesDocument6 pages10 Forex Sins and Trader TypesnauliNo ratings yet

- 01 - Stop Loss - How To Set It Properly So You Don't Get Stopped Out UnneccesarilyDocument7 pages01 - Stop Loss - How To Set It Properly So You Don't Get Stopped Out UnneccesarilyWAHYU SUMANJAYANo ratings yet

- SlidesDocument77 pagesSlidesSuneel HoodaNo ratings yet

- Day 1 Session 1Document72 pagesDay 1 Session 1msamala09No ratings yet

- Maximum Profit Targets: Trader Makes $18 BillionDocument4 pagesMaximum Profit Targets: Trader Makes $18 BillionIan Moncrieffe100% (2)

- Make Profitable Trading Strategy Using MACD Histogram PDFDocument12 pagesMake Profitable Trading Strategy Using MACD Histogram PDFElizabeth John RajNo ratings yet

- Jay Cluster MethodologyDocument17 pagesJay Cluster MethodologylowtarhkNo ratings yet

- Session 21 - Action Plan For Daily Income Trader (Template)Document4 pagesSession 21 - Action Plan For Daily Income Trader (Template)Sri Chowdary0% (1)

- Forex Virtuoso PDFDocument19 pagesForex Virtuoso PDFHARISH_IJTNo ratings yet

- Deposit USD: Entry Equity LotDocument11 pagesDeposit USD: Entry Equity LotDaisy TaylorNo ratings yet

- GBPJPY Daily Trend MethodDocument3 pagesGBPJPY Daily Trend MethodghcardenasNo ratings yet

- Scalp Trading MethodsDocument4 pagesScalp Trading Methodsakshay12489No ratings yet

- Stefx85: Joined May 2015 Status: Member 894 Posts Online NowDocument2 pagesStefx85: Joined May 2015 Status: Member 894 Posts Online NowTrading BrothersNo ratings yet

- Forex Profit Heaper ManualDocument12 pagesForex Profit Heaper Manualluisk94No ratings yet

- $5 To $100k in 100 Days Game Plan Daily Target 20 Pips/200 Points DailyDocument3 pages$5 To $100k in 100 Days Game Plan Daily Target 20 Pips/200 Points DailyAkhmadjon MukhsinovNo ratings yet

- PIVOTDocument5 pagesPIVOTLori Ondrick100% (1)

- Firststrike 1 PDFDocument8 pagesFirststrike 1 PDFgrigoreceliluminatNo ratings yet

- Power Pin Reversal Stochastic Forex Trading StrategyDocument7 pagesPower Pin Reversal Stochastic Forex Trading StrategyjoseluisvazquezNo ratings yet

- Trade ScoreDocument30 pagesTrade Scoresangram1705100% (1)

- LFB London Open Trade PlanDocument3 pagesLFB London Open Trade PlanmdufauNo ratings yet

- Daily Day Trading PlanDocument10 pagesDaily Day Trading PlanlowtarhkNo ratings yet

- Trading MethodDocument3 pagesTrading MethodkanannnNo ratings yet

- Schaff Trend Cycle Indicator - Forex Indicators GuideDocument3 pagesSchaff Trend Cycle Indicator - Forex Indicators Guideenghoss77100% (1)

- Forex StrategyDocument42 pagesForex StrategyfuraitoNo ratings yet

- The Skinny On Forex TradingDocument113 pagesThe Skinny On Forex TradingnobleconsultantsNo ratings yet

- Expectancy: What Is Expectancy in A Nutshell?Document3 pagesExpectancy: What Is Expectancy in A Nutshell?rafa manggala100% (1)

- Andrew Lockwood: Trading Cheat SheetDocument20 pagesAndrew Lockwood: Trading Cheat SheetSeptiandi hendra SaputraNo ratings yet

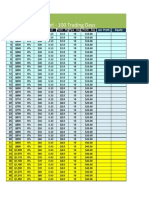

- Trading Plan & Target - 100 Trading Days: Hari Equity Risk RiskDocument3 pagesTrading Plan & Target - 100 Trading Days: Hari Equity Risk RiskYoe GieNo ratings yet

- 15 Ways To Trade Moving Averages by Mrtq13 - StockBangladesh ExcellenceDocument2 pages15 Ways To Trade Moving Averages by Mrtq13 - StockBangladesh ExcellencePratik ChhedaNo ratings yet

- Amazing Market SetupDocument9 pagesAmazing Market SetupongkeNo ratings yet

- Mini Position SizeDocument4 pagesMini Position SizeAbbey EzedonmwenNo ratings yet

- The 30-Minute Breakout StrategyDocument15 pagesThe 30-Minute Breakout StrategyMohd Yazel Md SabiaiNo ratings yet

- Laththur Arasu Trading Company: Nifty Option Day Trading Plan Nifty TrendDocument1 pageLaththur Arasu Trading Company: Nifty Option Day Trading Plan Nifty Trend9952090083No ratings yet

- Lindencourt Daily Forex SystemDocument19 pagesLindencourt Daily Forex Systemjodaw100% (1)

- For Ex Cheat SheetDocument61 pagesFor Ex Cheat SheetLeon DavisNo ratings yet

- Fibonacci The Most Powerful Indicator: Technical Analysis ToolsDocument5 pagesFibonacci The Most Powerful Indicator: Technical Analysis ToolsIan Moncrieffe100% (3)

- Trading FTBs - A Teen TraderDocument7 pagesTrading FTBs - A Teen TraderMANOJ KUMAR100% (1)

- ForeignDocument5 pagesForeignkumar_eeeNo ratings yet

- Financial GoalDocument7 pagesFinancial GoalStoxmasterNo ratings yet

- NasdaqDocument4 pagesNasdaqhoneygroupNo ratings yet

- Getting An Edge Chris Capre 2 ND SkiesDocument5 pagesGetting An Edge Chris Capre 2 ND SkiesZakariya ThoubaNo ratings yet

- 10Keys2SuccessfulTrading Press PDFDocument22 pages10Keys2SuccessfulTrading Press PDFJoshua Appart100% (1)

- Trade Plan StrategiesDocument5 pagesTrade Plan StrategiespithagorasNo ratings yet

- Support Gap Up: Bullish ConfirmationDocument6 pagesSupport Gap Up: Bullish ConfirmationScott LuNo ratings yet

- From WoodiesDocument12 pagesFrom WoodiesalexandremorenoasuarNo ratings yet

- The 8and8 Method E-BookDocument17 pagesThe 8and8 Method E-Bookrsousa1No ratings yet

- Security Analysis and Portfolio ManagementDocument36 pagesSecurity Analysis and Portfolio Managementthe_randomistNo ratings yet

- Strategy Mobile Trading - Envelopes With RSI (Instructions)Document6 pagesStrategy Mobile Trading - Envelopes With RSI (Instructions)uncle hammerNo ratings yet

- Report Big Three StrategyDocument18 pagesReport Big Three StrategyCladel100% (1)

- The Empowered Forex Trader: Strategies to Transform Pains into GainsFrom EverandThe Empowered Forex Trader: Strategies to Transform Pains into GainsNo ratings yet

- Angel InvesterDocument17 pagesAngel InvesterPrasoonNo ratings yet

- Application For Electrical Contractor License Category BDocument3 pagesApplication For Electrical Contractor License Category BFaisalNo ratings yet

- Research Proposal PDFDocument21 pagesResearch Proposal PDFRamraj Ronil SharmaNo ratings yet

- Persistent SebiDocument315 pagesPersistent Sebirahul_viswanathan_1No ratings yet

- Advanced Accounting 7e Hoyle - Chapter 6Document13 pagesAdvanced Accounting 7e Hoyle - Chapter 6Leni RosiyaniNo ratings yet

- Summary Hybrid Financing (18!11!2021)Document5 pagesSummary Hybrid Financing (18!11!2021)Shafa ENo ratings yet

- Damodaran Corp Fin Quiz 1Document37 pagesDamodaran Corp Fin Quiz 1praveen_bpgc100% (1)

- Wegelin & Co - Investment Commentary 272 - Too Big Not To FailDocument8 pagesWegelin & Co - Investment Commentary 272 - Too Big Not To FailthecynicaleconomistNo ratings yet

- Lateritic Ore Capability ProfileDocument4 pagesLateritic Ore Capability Profileفردوس سليمانNo ratings yet

- Bse, Nse, Ise, Otcei, NSDLDocument17 pagesBse, Nse, Ise, Otcei, NSDLoureducation.in100% (4)

- Harvard Case Study Toy WorldDocument19 pagesHarvard Case Study Toy WorldHomework Ping100% (1)

- The SIX SENSE (Karvy Demat Scam)Document12 pagesThe SIX SENSE (Karvy Demat Scam)Pranav TaleNo ratings yet

- Legal & Regulatory Aspects of BankingDocument31 pagesLegal & Regulatory Aspects of BankingKrishna HmNo ratings yet

- Role & Functions of Financial ManagerDocument19 pagesRole & Functions of Financial Managersumi0% (1)

- Grohe Hurun IndiaDocument26 pagesGrohe Hurun IndiaAvinash TiwariNo ratings yet

- Quant Technical QuestionsDocument14 pagesQuant Technical QuestionsJingyi GuoNo ratings yet

- The Most Dangerous Organization in America ExposedDocument37 pagesThe Most Dangerous Organization in America ExposedDomenico Bevilacqua100% (1)

- UcpbDocument3 pagesUcpbPaul Jeffrey PeñaflorNo ratings yet

- Form ISR 1Document2 pagesForm ISR 1RavishankarNo ratings yet

- Case Study - Fifa PDFDocument38 pagesCase Study - Fifa PDFEranda Prasad KulasingheNo ratings yet

- Septian Pajrin Mukti - InvestmentDocument2 pagesSeptian Pajrin Mukti - InvestmentSeptian Pajrin MuktiNo ratings yet

- Investment in Equity - MCDocument5 pagesInvestment in Equity - MCLeisleiRago100% (1)

- Short-Term Loan Remittance Form (STLRF)Document2 pagesShort-Term Loan Remittance Form (STLRF)maricorNo ratings yet

- Guide9 EngDocument37 pagesGuide9 EngDiana Bluesea100% (1)

- Rbi ActDocument44 pagesRbi Actaneesh arvindhanNo ratings yet

- Carter Manufacturing: Do We Really Have Income?Document33 pagesCarter Manufacturing: Do We Really Have Income?zulqarnain016134No ratings yet

- Strategy Index 10 UpdateDocument1 pageStrategy Index 10 UpdateChanuka PrabhashNo ratings yet

- Damodaran ValuationDocument99 pagesDamodaran Valuationmarklen100% (1)

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsNo ratings yet

- How Costly Is Investors' Compliance With Sharia?: Sam Hakim and Manochehr RashidianDocument14 pagesHow Costly Is Investors' Compliance With Sharia?: Sam Hakim and Manochehr RashidiandorcasxNo ratings yet