Professional Documents

Culture Documents

Should I Save or Invest

Uploaded by

Anonymous KpVxNXsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Should I Save or Invest

Uploaded by

Anonymous KpVxNXsCopyright:

Available Formats

7/9/2015

ShouldIsaveorinvest?MoneyAdviceService

Should I save or invest?

If youre not sure whether you should save or invest, the answer is probably both. It all depends on your goals and

your financial situation. This guide covers the basics to help you plan out your finances for short term savings and

long term investment.

Whats the difference between saving and investing?

Who should save?

Are you ready to invest?

A look at some goals save or invest?

Set your savings goals

Whats the difference between saving and investing?

Saving is putting money aside bit by bit, to make a lump sum. You usually save for a particular goal, like having the

money for a holiday, a deposit on a house, or any emergencies that might crop up. Often saving is taken to mean

putting your money into cash products, like bank and building society deposit accounts, and thats how we define

saving in this guide.

Investing is taking some of your money and with the aim of making it grow, by buying things that might increase in

value, like stocks, property or shares in a fund.

Who should save?

Everybody ought to have a certain amount of cash savings to hand. The rule of thumb is to have three months

https://www.moneyadviceservice.org.uk/en/articles/shouldisaveorinvest

1/9

7/9/2015

ShouldIsaveorinvest?MoneyAdviceService

essential outgoings (things like rent and food) in an instant access savings account. This is called an emergency fund.

The only time you shouldnt save or invest is if there are other, more important things you need to do with your money.

This includes:

Getting your debts under control

Making sure your family could cope financially if you died

Decide whether to save or pay off debts(https://www.moneyadviceservice.org.uk/en/articles/should-i-save-or-pay-off-debt)

Do you need life insurance?(https://www.moneyadviceservice.org.uk/en/articles/do-you-need-life-insurance)

Once you have your emergency fund, you should keep on saving. A good goal is to be putting aside at least 10% of

your earnings each month (or as you can afford it if your earnings are variable).

Aim for 5% to begin with and build it up. You can save up for anything you want, for example to pay for a wedding or to

have enough money to invest in something specific.

Its important to set savings goals so you know what youre aiming for more on how to do this later.

Get money saving tips straight to your inbox

Join 100,000+ subscribers to get our free newsletter packed with tips and advice.

https://www.moneyadviceservice.org.uk/en/articles/shouldisaveorinvest

2/9

7/9/2015

ShouldIsaveorinvest?MoneyAdviceService

Enter your email address

Sign up now

Privacy promise: We will never share your data or spam you.

Are you ready to invest?

As with savings, you need to know your goals to decide if you should invest. Specifically, you need to know which of

your goals are short-term, and which are long-term.

Short-term goals are things you plan to do within the next five years

Medium-term goals are things you plan to do within the next 5-10 years

Longer-term goals are ones where youre wont need the money for ten years or more

For your short-term goals, the rule is to save into cash deposits. The stock market may go up or down in the short term

and if you invest for less than five years you might well make a loss.

For longer-term goals, its often best to invest because inflation can seriously affect the value of cash savings over the

medium and long term. The stock market tends to do better than cash over time. The longer you can leave your

money, the more chance you have of making a profit.

For the medium term, cash deposits may sometimes be the best answer, but it depends on how much inflation risk you

are willing to take, and whether you need a certain sum on a certain date.

You can adjust the level of risks you take when you invest by spreading your money across different types of

investments called diversifying the risks.

https://www.moneyadviceservice.org.uk/en/articles/shouldisaveorinvest

3/9

7/9/2015

ShouldIsaveorinvest?MoneyAdviceService

If youre approaching or over 30, you should have at least one long-term goal retirement. Money you put aside for

retirement should usually go into investments. Most people invest in a pension, but other investments can be suitable

too.

Read our guide Diversifying the smart way to save and invest

(https://www.moneyadviceservice.org.uk/en/articles/diversifying-the-smart-way-to-save-and-invest)

A look at some goals save or invest?

Goal

Situation and timescale

Save or

invest?

Buy a new car

Your old car is ready to give up the ghost you need a new one within a year.

Save

Put down a deposit on a

house

Youd like to move in to your own home by the time you start a family maybe in

three years.

Save

Pay for your childs

wedding

Your child is still very young probably at least 15 years away from getting

married.

Your child is older a couple of years away from getting married.

Invest

Youve just turned 30, and youd like to retire when youre about 65 35 years in

the future.

Invest

Have a comfortable

retirement

Save

Set your savings goals

As you can see, you probably have quite a few financial goals. Theyll all have different timescales, which means you

want to do a bit of saving and a bit of investing. Thats why its important to make a plan.

https://www.moneyadviceservice.org.uk/en/articles/shouldisaveorinvest

4/9

7/9/2015

ShouldIsaveorinvest?MoneyAdviceService

If your finances are fairly simple, take a look at this guide to see how to set your goals:

How to set a savings goal(https://www.moneyadviceservice.org.uk/en/articles/how-to-set-a-savings-goal)

If you have complex finances, with various assets and liabilities, you probably need to do a bit of thinking about you

current situation before you set your goals. You should gather the facts together by doing a money fact find.

Complete a money fact find(https://www.moneyadviceservice.org.uk/en/articles/complete-a-money-fact-find)

Rule of thumb

If youll use the money in under five years, save.

If youll use the money more than ten years in the future, invest.

If youll use the money in between five and ten years, then consider your attitude to different risks, your investment

goal and financial situation. In this situation, it may be suitable that you do a bit of both saving and investing.

Previous

How to set a savings goal

(https://www.moneyadviceservice.org.uk/en/articles/how-to-seta-savings-goal)

Relatedguides

Mostread

https://www.moneyadviceservice.org.uk/en/articles/shouldisaveorinvest

5/9

7/9/2015

ShouldIsaveorinvest?MoneyAdviceService

Fromourblog

More in 'How to save money'

Why it pays to save regularly(https://www.moneyadviceservice.org.uk/en/articles/why-it-pays-to-save-regularly)

Action plan Build an emergency savings fund

(https://www.moneyadviceservice.org.uk/en/action_plans/build-an-emergency-savings-fund)

Budget planner(https://www.moneyadviceservice.org.uk/en/tools/budget-planner)

Money Health Check(https://www.moneyadviceservice.org.uk/en/tools/health-check)

Savings calculator(https://www.moneyadviceservice.org.uk/en/tools/savings-calculator)

Quick cash finder(https://www.moneyadviceservice.org.uk/en/tools/money-stretcher)

View all (https://www.moneyadviceservice.org.uk/en/categories/how-to-save-money)

Report a technical issue with this page(https://www.moneyadviceservice.org.uk/en/feedback/new)

Back to top

Debt and borrowing(https://www.moneyadviceservice.org.uk/en/categories/debt-and-borrowing)

Budgeting and managing money(https://www.moneyadviceservice.org.uk/en/categories/budgeting-and-managing-money)

Saving and investing(https://www.moneyadviceservice.org.uk/en/categories/saving-and-investing)

How to save money(https://www.moneyadviceservice.org.uk/en/categories/how-to-save-money)

https://www.moneyadviceservice.org.uk/en/articles/shouldisaveorinvest

6/9

7/9/2015

ShouldIsaveorinvest?MoneyAdviceService

Types of savings(https://www.moneyadviceservice.org.uk/en/categories/savings-types)

How to invest money(https://www.moneyadviceservice.org.uk/en/categories/how-to-invest-money)

Types of investment(https://www.moneyadviceservice.org.uk/en/categories/investment-types)

Pensions and retirement(https://www.moneyadviceservice.org.uk/en/categories/pensions-and-retirement)

Work and redundancy(https://www.moneyadviceservice.org.uk/en/categories/work-and-redundancy)

Benefits(https://www.moneyadviceservice.org.uk/en/categories/benefits)

Births, deaths and family(https://www.moneyadviceservice.org.uk/en/categories/births-deaths-and-family)

Insurance(https://www.moneyadviceservice.org.uk/en/categories/insurance)

Homes and mortgages(https://www.moneyadviceservice.org.uk/en/categories/homes-and-mortgages)

Care and disability(https://www.moneyadviceservice.org.uk/en/categories/care-and-disability)

Cars and travel(https://www.moneyadviceservice.org.uk/en/categories/cars-and-travel)

https://www.moneyadviceservice.org.uk/en/articles/shouldisaveorinvest

7/9

7/9/2015

ShouldIsaveorinvest?MoneyAdviceService

Web chat

Web chat is available from 8amto8pm.

Offline

Monday to Friday, 8amto8pm

Saturday, 9amto1pm

Sunday and Bank Holidays, closed

Call us

Give us a call for free and impartial money advice.

0300 500 5000 *

Monday to Friday, 8am to 8pm

Saturday, 9am to 1pm

Sunday and Bank Holidays, closed

* Calls cost the same as a normal call, if your calls are free, it's included.

https://www.moneyadviceservice.org.uk/en/articles/shouldisaveorinvest

8/9

7/9/2015

ShouldIsaveorinvest?MoneyAdviceService

Follow us

Get up-to-date money advice from Twitter, Facebook and YouTube.

(https://twitter.com/YourMoneyAdvice)

(https://www.facebook.com/MoneyAdviceService?ref=mas)

(https://www.youtube.com/user/MoneyAdviceService)

For more ways to get in touch, go to our contact us(https://www.moneyadviceservice.org.uk/en/corporate/contact-us) page.

https://www.moneyadviceservice.org.uk/en/articles/shouldisaveorinvest

9/9

You might also like

- Starting A Financial PlanDocument4 pagesStarting A Financial PlanElishaNo ratings yet

- Finance Life Cycle Stages GuideDocument9 pagesFinance Life Cycle Stages Guidemamudul hasan100% (1)

- Topic 10 Achieving Entrepreneurs Personal Financial DreamsDocument31 pagesTopic 10 Achieving Entrepreneurs Personal Financial DreamsTalk 2meNo ratings yet

- Wealth CreationDocument28 pagesWealth CreationMike RobertsonNo ratings yet

- Setting and Targeting Investment GoalsDocument3 pagesSetting and Targeting Investment GoalsChris RhodesNo ratings yet

- Investing For Beginners Book: Investing Basics and Investing 101From EverandInvesting For Beginners Book: Investing Basics and Investing 101No ratings yet

- How to Manage Expenses and Start SavingDocument3 pagesHow to Manage Expenses and Start Savingkulambira sessionNo ratings yet

- Module 15 16 Investing FundamentalsDocument6 pagesModule 15 16 Investing FundamentalsDonna Mae FernandezNo ratings yet

- How to Invest Your Money WiselyDocument8 pagesHow to Invest Your Money WiselyAnna Lina LimosNo ratings yet

- Essentials of A More Secure Retirement: Get Started Keep It Going Invest Wisely Retire WellDocument5 pagesEssentials of A More Secure Retirement: Get Started Keep It Going Invest Wisely Retire WellFakhar QureshiNo ratings yet

- Road Map For Investing SuccessDocument44 pagesRoad Map For Investing Successnguyentech100% (1)

- Unit 1Document6 pagesUnit 1malarastogi611No ratings yet

- Senior High School: Business FinanceDocument12 pagesSenior High School: Business Financesheilame nudaloNo ratings yet

- CFP EbookDocument81 pagesCFP EbookNikhil parabNo ratings yet

- Investment Fundamentals GuideDocument36 pagesInvestment Fundamentals GuideHimanshu JauhariNo ratings yet

- Financially Fit PersonDocument8 pagesFinancially Fit PersonMoises Von Rosauro De Gracia100% (1)

- Pivotal Planning Winter Addition NewsletterDocument7 pagesPivotal Planning Winter Addition NewsletterAnthony WrightNo ratings yet

- 5 Critical Financial Planning Tips for 20-SomethingsDocument2 pages5 Critical Financial Planning Tips for 20-Somethingsjojo laygoNo ratings yet

- Personal FinanceDocument24 pagesPersonal FinanceKirosTeklehaimanotNo ratings yet

- Chapter 6Document7 pagesChapter 6Erika GueseNo ratings yet

- Pivotal Planning Winter Addition NewsletterDocument7 pagesPivotal Planning Winter Addition NewsletterAnthony WrightNo ratings yet

- Overview of Financial Plan: Lesson 1: FIN101Document17 pagesOverview of Financial Plan: Lesson 1: FIN101Antonette HugoNo ratings yet

- Govt. new law college Indore financial goalsDocument18 pagesGovt. new law college Indore financial goalssumit panchalNo ratings yet

- Lecture 3 Goals of Financial PlanningDocument3 pagesLecture 3 Goals of Financial PlanningsestiliocharlesoremNo ratings yet

- Financial LiteracyDocument49 pagesFinancial Literacy025wilmelNo ratings yet

- Acceptable and Unacceptable AssetDocument3 pagesAcceptable and Unacceptable AssetDenicelle BucoyNo ratings yet

- The Money PlannerDocument4 pagesThe Money PlannerAbdullah AfzalNo ratings yet

- InvestmentDocument106 pagesInvestmentSujal BedekarNo ratings yet

- Establishing Investment Goals and Factors to ConsiderDocument35 pagesEstablishing Investment Goals and Factors to Consider陈皮乌鸡No ratings yet

- How to Make Money in the Stock Market: Investing for BeginnersFrom EverandHow to Make Money in the Stock Market: Investing for BeginnersNo ratings yet

- Investing Made Simple: Strategies for Building a Profitable Investment Portfolio through Real Estate, Stocks, Options Trading, Index Funds, Bonds, REITs, Bitcoin, and Beyond.From EverandInvesting Made Simple: Strategies for Building a Profitable Investment Portfolio through Real Estate, Stocks, Options Trading, Index Funds, Bonds, REITs, Bitcoin, and Beyond.Rating: 5 out of 5 stars5/5 (54)

- Basic Financial Literacy CourseDocument30 pagesBasic Financial Literacy Coursejazzy mallari100% (1)

- Money Saving Strategies: Laura Connerly, PH.D., Assistant Professor - Family and Consumer EconomicsDocument5 pagesMoney Saving Strategies: Laura Connerly, PH.D., Assistant Professor - Family and Consumer EconomicsAhmedinNo ratings yet

- Saving For The Long TermDocument2 pagesSaving For The Long TermSamson Temitope OgunnusiNo ratings yet

- Entrepreneurs - Co Investing GuideDocument25 pagesEntrepreneurs - Co Investing GuideMandy745No ratings yet

- PFP Bba V Unit 4 NotesDocument15 pagesPFP Bba V Unit 4 NotesRaghuNo ratings yet

- How To Build A Mutual Fund Portfolio: The Debt-Equity RatioDocument10 pagesHow To Build A Mutual Fund Portfolio: The Debt-Equity Ratioparry5000No ratings yet

- HL Investing in 30s GuideDocument12 pagesHL Investing in 30s GuidedamilolaNo ratings yet

- How To Get Rich From NothingDocument5 pagesHow To Get Rich From NothingMark Last TrillaNo ratings yet

- CSE K Reading-Morton Niederjohn Thomas-Building WealthDocument17 pagesCSE K Reading-Morton Niederjohn Thomas-Building Wealthgraphicman1060No ratings yet

- How To Get Rich: 8 Tips For Building Wealth: E. NapoletanoDocument9 pagesHow To Get Rich: 8 Tips For Building Wealth: E. NapoletanoʟǟʊʀɛɛֆɛNo ratings yet

- Fidelity's: Top TipsDocument24 pagesFidelity's: Top Tipsmandar LawandeNo ratings yet

- Financial Planning: I Need A Plan?Document6 pagesFinancial Planning: I Need A Plan?Karim Boupalmier100% (1)

- Business Finance f2f LessonDocument49 pagesBusiness Finance f2f LessonLuzy AshooriyanNo ratings yet

- Investment Fundamentals Guide PDFDocument36 pagesInvestment Fundamentals Guide PDFShashank Gaurav100% (1)

- Money doesn't grow on trees: How to take control of your personal financesFrom EverandMoney doesn't grow on trees: How to take control of your personal financesNo ratings yet

- Importance of Financial Planning in achieving goalsDocument43 pagesImportance of Financial Planning in achieving goalsManasi KalgutkarNo ratings yet

- Top Tips For Choosing InvestmentsDocument6 pagesTop Tips For Choosing InvestmentsBey Bi NingNo ratings yet

- WealthCreation Financial PlanningDocument36 pagesWealthCreation Financial PlanningcoerenciaceNo ratings yet

- Financial Planning in Sweet SixtiesDocument7 pagesFinancial Planning in Sweet SixtiesS GaneshNo ratings yet

- Chapter 1: IntroductionDocument20 pagesChapter 1: IntroductionAlyn CheongNo ratings yet

- Achieve Financial GoalsDocument3 pagesAchieve Financial GoalsManu ThakurNo ratings yet

- Investing - The Beginner's Guide to Investing: The Foundation of Knowledge That All Rich Investors HaveFrom EverandInvesting - The Beginner's Guide to Investing: The Foundation of Knowledge That All Rich Investors HaveRating: 4 out of 5 stars4/5 (2)

- Welingkar LeafletDocument8 pagesWelingkar LeafletAnonymous KpVxNXsNo ratings yet

- PVRV SizingDocument233 pagesPVRV Sizingkarthick100% (1)

- Difference Between ANSI & API PumpsDocument2 pagesDifference Between ANSI & API PumpsAnonymous KpVxNXs100% (3)

- Kern Method Heat ExchangerDocument30 pagesKern Method Heat ExchangerCS100% (3)

- Nature's Slow But Thorough GrindingDocument1 pageNature's Slow But Thorough GrindingAnonymous KpVxNXsNo ratings yet

- RTJ FlangeDocument1 pageRTJ FlangeAnonymous KpVxNXsNo ratings yet

- MAT Score Card PDFDocument1 pageMAT Score Card PDFAnonymous KpVxNXsNo ratings yet

- Mechanical 2009Document27 pagesMechanical 2009Anonymous KpVxNXsNo ratings yet

- ASME Impact Test RequirementDocument6 pagesASME Impact Test RequirementJ.SIVIRANo ratings yet

- ASG - CrackedGasCompressors - FinalDocument5 pagesASG - CrackedGasCompressors - FinalAnonymous KpVxNXsNo ratings yet

- Weight of SA 516 GR 60 Base Plate PDFDocument2 pagesWeight of SA 516 GR 60 Base Plate PDFAnonymous KpVxNXsNo ratings yet

- Sizing Shell and Tube Heat ExchangerDocument17 pagesSizing Shell and Tube Heat ExchangerCallum Biggs100% (3)

- Filter CalculationsDocument5 pagesFilter CalculationsAnonymous KpVxNXsNo ratings yet

- ASME Impact Test RequirementDocument6 pagesASME Impact Test RequirementJ.SIVIRANo ratings yet

- Valve Seat Material GuideDocument1 pageValve Seat Material GuideAndresNo ratings yet

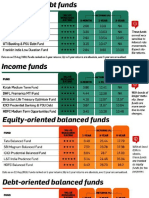

- Mutual Fund OverviewDocument10 pagesMutual Fund OverviewAnonymous KpVxNXsNo ratings yet

- Amazon Code PDFDocument1 pageAmazon Code PDFAnonymous KpVxNXsNo ratings yet

- Rectification Needed Navamsa Lagna Rahu NakshatraDocument1 pageRectification Needed Navamsa Lagna Rahu NakshatraAnonymous KpVxNXsNo ratings yet

- Yamini Tentative TobDocument1 pageYamini Tentative TobAnonymous KpVxNXsNo ratings yet

- Nakshatra RevatiDocument5 pagesNakshatra RevatiAstroSunilNo ratings yet

- BPHS Santhanam Vol 2Document552 pagesBPHS Santhanam Vol 2Marius Macuc90% (10)

- The Graha or The Planets in The ShastrasDocument48 pagesThe Graha or The Planets in The ShastrasAnthony Writer100% (4)

- Air Cooled Heat Exchanger - ChE GuideDocument5 pagesAir Cooled Heat Exchanger - ChE GuideAnonymous KpVxNXsNo ratings yet

- Djokovic Murray HoroscopesDocument1 pageDjokovic Murray HoroscopesAnonymous KpVxNXsNo ratings yet

- How To Determine The Number of Shell PassesDocument5 pagesHow To Determine The Number of Shell PassesAnonymous KpVxNXsNo ratings yet

- All Mutual Funds - PerformanceDocument3 pagesAll Mutual Funds - PerformanceAnonymous KpVxNXsNo ratings yet

- Sandia Lab New Heat ExchangerDocument48 pagesSandia Lab New Heat ExchangerKoza43No ratings yet

- Top Performing Indian Mutual Funds Over Different Time PeriodsDocument6 pagesTop Performing Indian Mutual Funds Over Different Time PeriodsAnonymous KpVxNXsNo ratings yet

- How To Choose Mutual FundsDocument18 pagesHow To Choose Mutual FundsAnonymous KpVxNXsNo ratings yet

- MFDocument3 pagesMFAnonymous KpVxNXsNo ratings yet

- Pangea Mortgage Capital Closes $8.5 Million LoanDocument3 pagesPangea Mortgage Capital Closes $8.5 Million LoanPR.comNo ratings yet

- ABM - Specialized Subject: Fundamentals of Accountancy, Business and Management 1Document14 pagesABM - Specialized Subject: Fundamentals of Accountancy, Business and Management 1Jupiter Whiteside100% (6)

- Reliance Retail Limited: Sr. No. Item Name Hsn/Sac Qty Price/Unit Discount ValueDocument3 pagesReliance Retail Limited: Sr. No. Item Name Hsn/Sac Qty Price/Unit Discount ValuemukeshNo ratings yet

- RBS Shareholder Fraud AllegationsDocument326 pagesRBS Shareholder Fraud AllegationsFailure of Royal Bank of Scotland (RBS) Risk ManagementNo ratings yet

- Ax2009 Enus Finii 08Document24 pagesAx2009 Enus Finii 08Timer AngelNo ratings yet

- Impact of Merger On Financial Performance of Nepalese Commercial BankDocument4 pagesImpact of Merger On Financial Performance of Nepalese Commercial BankShrestha Photo studioNo ratings yet

- Department of Education Region III Schools Division of Zambales Municipality of Sta. CruzDocument5 pagesDepartment of Education Region III Schools Division of Zambales Municipality of Sta. CruzNhatz Gallosa MarticioNo ratings yet

- PT INDOFOOD CBP SUKSES MAKMUR TBK DAN ENTITAS ANAKNYADocument3 pagesPT INDOFOOD CBP SUKSES MAKMUR TBK DAN ENTITAS ANAKNYARama fauziNo ratings yet

- HJR 192.original 1933 06 05Document4 pagesHJR 192.original 1933 06 05WeberSteve90% (79)

- PA 242.2 Problem Set 2Document2 pagesPA 242.2 Problem Set 2Laurence Niña X. OrtizNo ratings yet

- Project Financial AnalysisDocument79 pagesProject Financial AnalysisAngel CastilloNo ratings yet

- RFBT 04 03 Law On Obligation For Discussion Part TwoDocument15 pagesRFBT 04 03 Law On Obligation For Discussion Part TwoStephanieNo ratings yet

- Ge Capital Mar19-09 PresentationDocument88 pagesGe Capital Mar19-09 PresentationCarneades100% (2)

- Tax - AssignmentDocument29 pagesTax - Assignmentjai_thakker7659No ratings yet

- 06 ReceivableDocument104 pages06 Receivablefordan Zodorovic100% (4)

- Partnership Agreement Investment BreakdownDocument13 pagesPartnership Agreement Investment BreakdownSlamet S89% (9)

- Forex Earthquake: by Raoul WayneDocument21 pagesForex Earthquake: by Raoul WayneDavid100% (1)

- MamaearthDocument9 pagesMamaearthAmar Singh100% (1)

- Megaworld Corporation: Liabilities and Equity 2010 2009 2008Document9 pagesMegaworld Corporation: Liabilities and Equity 2010 2009 2008Owdray CiaNo ratings yet

- Accounting for Income TaxesDocument18 pagesAccounting for Income TaxesAndrea Marie CalmaNo ratings yet

- Cindy MYOB 2Document1 pageCindy MYOB 2SMK NusantaraNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Ritesh GhoshNo ratings yet

- TallyDocument109 pagesTallyRamya RamamurthyNo ratings yet

- Marty Interview 4Document16 pagesMarty Interview 4Health NobelNo ratings yet

- CPA Review School Philippines Capital AssetsDocument8 pagesCPA Review School Philippines Capital AssetsJuan Miguel UngsodNo ratings yet

- Investor Prospectus QuinateDocument9 pagesInvestor Prospectus QuinateRichard WestermannNo ratings yet

- Analysis of Option Combination Strategies: February 2018Document11 pagesAnalysis of Option Combination Strategies: February 2018Shubham NamdevNo ratings yet

- Soal Dan JWBN Siklus DGGDocument17 pagesSoal Dan JWBN Siklus DGGGhina Risty RihhadatulaisyNo ratings yet

- A Project Report On Bharti-AXA Life Insurance Co.Document66 pagesA Project Report On Bharti-AXA Life Insurance Co.sushobhanbirtia85% (20)

- (P3,300,000.00), Philippine Currency, Payable As FollowsDocument3 pages(P3,300,000.00), Philippine Currency, Payable As FollowsMPat EBarr0% (1)