Professional Documents

Culture Documents

Yield Pledge Checking: Account Opening & Usage

Uploaded by

shenzo_Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Yield Pledge Checking: Account Opening & Usage

Uploaded by

shenzo_Copyright:

Available Formats

YIELD PLEDGE CHECKING

SUMMARY OF BASIC TERMS*

Minimum deposit required to

open account

ACCOUNT

OPENING &

USAGE

Monthly account fee

Requirements to waive monthly fee

Interest rate

ATM fees

$1,500

$0

N/A

Variable

This is a tiered, variable rate account. Interest rate, annual percentage

yield (APY), and tiers may change. Interest will accrue on the average

daily balance. Visit us online for a complete listing of current rates.

$0

EverBank does not charge its clients ATM fees at EverBank or other

financial institution ATMs.

Other financial institutions may charge our clients a fee for using

their ATM.

We will automatically reimburse our clients for other financial

institution ATM fees on U.S. ATM transactions during any month that

the average daily balance for the account is at least $5,000.

Non-Sufficient Funds (NSF) fee

$30

This fee applies to all overdrafts, except those created by Visa

Debit Card or ATM card. This fee is limited to 2 per day per account.

Returned deposited item fee

$10

$0

Per declined item deposited into your account.

$30

Per item to stop payment for up to 6 months.

Stop payment fee

OVERDRAFT

OPTIONS

Option A

Option B:

Overdraft

Service

Account closing fee

$0

Online bill pay monthly fee

$0

No overdraft service

$0

If you choose not to opt in to any kind of overdraft service, Visa Debit

Card and ATM card transactions that would cause an overdraft will be

declined at no cost to you. Any checks written by you that exceed your

available account balance would be subject to the NSF fee listed above.

Overdraft transfer fee

$0

Per overdraft covered by transfer from linked account or line of credit.

Variable

Based on the Prime Rate plus a margin of 5.9%. Visit us online for a

complete listing of current rates.

Overdraft line of credit

interest rate

ACH/EFT transaction out,

with our assistance

OTHER

COMMON

FEES

Cashiers check

$0

$10

Online/mobile check deposit

$0

Replacement Visa Debit Card

$5

Uncollected item fee

Wire funds into EverBank

(domestic or foreign)

$30

$0

Wire funds out of EverBank (domestic)

$25

Wire funds out of EverBank (foreign)

$35

Important disclosures on reverse.

For New York or Vermont residents.

Additional fees may be charged by other financial institutions.

Continued on reverse

YIELD PLEDGE CHECKING

CONTINUED

PROCESSING

POLICIES

Posting Order

The order in which withdrawals and

deposits are processed

Cash transactions are generally posted at the time of transaction. Most other

transactions are posted to your account during our nightly processing each

Business Day.

1. Cash transactions: Cash withdrawals at a Financial Center, wire transfers and

bank check purchases. Withdrawals in this category are paid intraday at the

time of the transaction.

2. ATM and Debit Card transactions: Withdrawals or transfers conducted with your

ATM or Visa Debit Card are paid during end of day processing and are posted by

date received.

3. Bill pay and other financial center transactions: Bill Pay transactions, transfers

requested at Financial Centers, checks deposited by others that have EverBank

accounts at Financial Centers. Withdrawals in this category are paid during end

of day processing and are paid from highest-to-lowest dollar amount.

4. All other transactions: All other checks and all other automatic payments

(ACH transactions) are paid during end of day processing and are posted from

highest-to-lowest dollar amount.

Funds Availability Policy

When funds deposited to your

account are available

1. Direct deposit, wire transfers and cash: When you set up Direct Deposit,

wire funds into your EverBank account or deposit cash in person to one of

our employees, your funds are made available on the same Business Day

that they are received. When we receive your deposit will depend on the

cut-off times described in our Funds Availability Disclosure.

2. Checks and certain money orders: The first $5,000 from a deposit of checks

and certain money orders on any one day will be available on the first Business

Day after the day of your deposit. The remaining funds will be available on the

fourth Business Day after the day of your deposit. These rules will not apply to

deposits made at an ATM.

3. Extended holds: Funds you deposit by check may be delayed for a longer

period. Visit us online for more details.

4. Special rules for new accounts: If you are a new client, special rules will apply

during the first 30 days that your account is open. Visit us online for more details.

DISPUTE

RESOLUTION

If you have a dispute with EverBank and we are not able to resolve the dispute informally, you agree that the dispute will

be resolved through an arbitration process further detailed in the Arbitration Of Disputes section of your Personal Account

Terms, Disclosures and Agreements Booklet.

* This summary describes only certain key features and fees, and is not a description of all terms and fees related to this account. For a complete

description, visit us online to view the Personal Account Terms, Disclosures and Agreements Booklet.

15MCM0013.17 ~ M419 ~ 02/15

2015 EverBank. All rights reserved.

You might also like

- Asad Bank StatementDocument6 pagesAsad Bank Statementapi-344873207100% (2)

- Day To Day Banking Companion Booklet - Scotiabank PDFDocument74 pagesDay To Day Banking Companion Booklet - Scotiabank PDFNhân MaximusNo ratings yet

- Unlimited Cash Back Bank AccountDocument49 pagesUnlimited Cash Back Bank AccountalanNo ratings yet

- Rewards Plus Gold Card Summary and Minimum Payment DueDocument14 pagesRewards Plus Gold Card Summary and Minimum Payment Dueksj5368100% (2)

- New Balance CR$800.00 Minimum Payment Due $0.00 Payment Not RequiredDocument6 pagesNew Balance CR$800.00 Minimum Payment Due $0.00 Payment Not RequiredKevin Diaz100% (1)

- Credit Card Agreement For Consumer Cards in Capital One N.ADocument8 pagesCredit Card Agreement For Consumer Cards in Capital One N.AChisom ChidiNo ratings yet

- Archetypal Astrology and Transpersonal Psychology (Richard Tarnas and Stan Grof)Document20 pagesArchetypal Astrology and Transpersonal Psychology (Richard Tarnas and Stan Grof)vesterose100% (2)

- Earth & Life Science Q1 Module 2 - DESIREE VICTORINODocument22 pagesEarth & Life Science Q1 Module 2 - DESIREE VICTORINOJoshua A. Arabejo50% (4)

- School Communication Flow ChartsDocument7 pagesSchool Communication Flow ChartsSarah Jane Lagura ReleNo ratings yet

- Bac Core Checking EnusDocument2 pagesBac Core Checking Enusapi-285070305No ratings yet

- 3584 CS MyAccess ALL 8 2013Document2 pages3584 CS MyAccess ALL 8 2013rasheed-aliNo ratings yet

- Manage Your Attain Checking AccountDocument2 pagesManage Your Attain Checking AccountieatpinktacozNo ratings yet

- BofA CoreChecking en ADADocument2 pagesBofA CoreChecking en ADAFrank TilemanNo ratings yet

- No Monthly Fees or Minimums for Asterisk-Free Checking AccountDocument3 pagesNo Monthly Fees or Minimums for Asterisk-Free Checking AccountMarcells Danyel JordanNo ratings yet

- PT CAP BasicBankingDocument3 pagesPT CAP BasicBankingRayan PaulNo ratings yet

- Thomas 05.31.23Document32 pagesThomas 05.31.23Deuntae ThomasNo ratings yet

- Chase Sample GuideDocument3 pagesChase Sample Guideapi-310599226No ratings yet

- Nfcu Secured Credit Card Application - 800nDocument2 pagesNfcu Secured Credit Card Application - 800nKako The 66th ChannelNo ratings yet

- Kfs Current AccountsDocument10 pagesKfs Current Accountsritika sainiNo ratings yet

- Overview of Regular Savings Key Policies and Fees: Bank of America Clarity StatementDocument2 pagesOverview of Regular Savings Key Policies and Fees: Bank of America Clarity StatementJacob DaleNo ratings yet

- A Guide To Your Common Checking Account Fees: How Deposits and Withdrawals Are ProcessedDocument4 pagesA Guide To Your Common Checking Account Fees: How Deposits and Withdrawals Are ProcessedBradley KirtsNo ratings yet

- Netspend All-Access Account: Monthly UsageDocument2 pagesNetspend All-Access Account: Monthly UsageSam BojanglesNo ratings yet

- Green Dot Bank AccountDocument46 pagesGreen Dot Bank AccountSupersix KuntaNo ratings yet

- Easy Checking SnapshotDocument2 pagesEasy Checking SnapshotsupportNo ratings yet

- HRSA Fee Changes 2014 en PDFDocument1 pageHRSA Fee Changes 2014 en PDFBratuSBRNo ratings yet

- Understanding Bank of America Interest Checking: An Overview of Key Policies and FeesDocument2 pagesUnderstanding Bank of America Interest Checking: An Overview of Key Policies and FeesGheorghiu GheorgheNo ratings yet

- Boa CardDocument5 pagesBoa Cardapi-285069637100% (1)

- Personal Banking General Fees ChargesDocument20 pagesPersonal Banking General Fees ChargesmikeNo ratings yet

- HCBC CC InfoDocument5 pagesHCBC CC Infooninx26No ratings yet

- Terms Basic Checking PDFDocument2 pagesTerms Basic Checking PDFMilton DavidsonNo ratings yet

- International Student Account Key FactsDocument4 pagesInternational Student Account Key FactsWenyuQuakNo ratings yet

- Most Important Terms & ConditionsDocument93 pagesMost Important Terms & Conditionslancy_dsuzaNo ratings yet

- GO2BANK DEPOSIT ACCOUNT AGREEMENTDocument40 pagesGO2BANK DEPOSIT ACCOUNT AGREEMENTHank MacsNo ratings yet

- All Fees Amount Details: Fee ScheduleDocument17 pagesAll Fees Amount Details: Fee ScheduleLuke EvansNo ratings yet

- Key-Facts-Statement-Signature-Priority-Account UBLDocument4 pagesKey-Facts-Statement-Signature-Priority-Account UBLMuhammadDanialNo ratings yet

- Summary of Rates and FeesDocument2 pagesSummary of Rates and Fees7fr8cr5wt2No ratings yet

- Credit CardsDocument5 pagesCredit CardsCemitoXNo ratings yet

- Salem Five Direct Consumer Banking Fee ScheduleDocument2 pagesSalem Five Direct Consumer Banking Fee ScheduleshoppingonlyNo ratings yet

- Personal Banking Terms and Conditions Banking Charges: 1 October 2020Document36 pagesPersonal Banking Terms and Conditions Banking Charges: 1 October 2020Andrew ChristianNo ratings yet

- Advanced Cash Prepaid Card Terms and ConditionsDocument15 pagesAdvanced Cash Prepaid Card Terms and ConditionsMarioNo ratings yet

- So A 900920160610Document1 pageSo A 900920160610Francisco Oringo Sr ESNo ratings yet

- Standard Checking Summary PDFDocument2 pagesStandard Checking Summary PDFBobby BakerNo ratings yet

- Screenshot 2023-11-26 at 12.01.23 AMDocument73 pagesScreenshot 2023-11-26 at 12.01.23 AMqt5tggw8k8No ratings yet

- StatementDocument9 pagesStatementEduard-Dumitru HogasNo ratings yet

- TC Sky1 062Document4 pagesTC Sky1 062jeffreygrimm8No ratings yet

- Neo Money Account Disclosure Statement, Rate & Fee Schedule ENDocument8 pagesNeo Money Account Disclosure Statement, Rate & Fee Schedule ENVijay SarvagunananthanNo ratings yet

- 120121023web Version Fees and Charges FinalDocument17 pages120121023web Version Fees and Charges Finalhelloooo5No ratings yet

- PAY YOUR CREDIT CARD BILL ON TIMEDocument75 pagesPAY YOUR CREDIT CARD BILL ON TIMEjamin2020No ratings yet

- ATM and Debit Card Overdraft Coverage Confirmation NoDocument2 pagesATM and Debit Card Overdraft Coverage Confirmation NoSucreNo ratings yet

- Loan - Documents - SignedDocument25 pagesLoan - Documents - SignedJimmie WhiteNo ratings yet

- 2014sep11 2014oct10Document3 pages2014sep11 2014oct10Karen JoyNo ratings yet

- 32-Day Account RulesDocument3 pages32-Day Account RulesAyo ChoncoNo ratings yet

- En Fair Fees ScheduleDocument3 pagesEn Fair Fees ScheduleHassan AliNo ratings yet

- CC DCBDocument7 pagesCC DCBHugo DivalNo ratings yet

- 730462222Document20 pages730462222Tank ZillaNo ratings yet

- Disclosure 26339 en-USDocument5 pagesDisclosure 26339 en-USjeremyallan6969No ratings yet

- Rates Fees and Charges PCA and JCADocument3 pagesRates Fees and Charges PCA and JCAcryptoarbitrager001No ratings yet

- Overdraft NoticeDocument1 pageOverdraft Noticeleinbergerwife1No ratings yet

- Credit Card Statement DisclosureDocument1 pageCredit Card Statement DisclosureShahnaz NawazNo ratings yet

- P0543778 NatWest Changes To Your Account TermsDocument4 pagesP0543778 NatWest Changes To Your Account Termsderek49cleanerNo ratings yet

- Fetch PDFDocument3 pagesFetch PDFcute babyNo ratings yet

- All You Need to Know About Payday LoansFrom EverandAll You Need to Know About Payday LoansRating: 5 out of 5 stars5/5 (1)

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountFrom EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountRating: 2 out of 5 stars2/5 (1)

- Ultramax Dimming: Bi-Level Dimming & Load Shed 0-10V Dimming Instant Start BallastsDocument2 pagesUltramax Dimming: Bi-Level Dimming & Load Shed 0-10V Dimming Instant Start Ballastsshenzo_No ratings yet

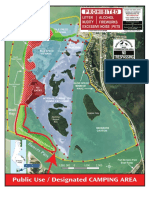

- Public Use / Designated CAMPING AREADocument1 pagePublic Use / Designated CAMPING AREAshenzo_No ratings yet

- Nagarjuna and Quantum Physics: Eastern and Western ThoughtDocument3 pagesNagarjuna and Quantum Physics: Eastern and Western Thoughtshenzo_100% (1)

- 2014 Camera Comparison Chart v11Document2 pages2014 Camera Comparison Chart v11John Alexander Saavedra ZapataNo ratings yet

- Account DisclosuresDocument1 pageAccount Disclosuresshenzo_No ratings yet

- User'S Guide Guía Del Usuario: Safety PrecautionsDocument0 pagesUser'S Guide Guía Del Usuario: Safety PrecautionsDiego Andrés MartínezNo ratings yet

- Khenpo Namdrol BiographyDocument1 pageKhenpo Namdrol Biographyshenzo_No ratings yet

- Tax Guide To Small BusinessesDocument53 pagesTax Guide To Small Businessesshenzo_No ratings yet

- NYCneuromodulation v14Document4 pagesNYCneuromodulation v14shenzo_No ratings yet

- Angles of The Horoscope1Document9 pagesAngles of The Horoscope1shenzo_100% (2)

- Bus To Callao SalvajeDocument3 pagesBus To Callao Salvajeshenzo_No ratings yet

- Steven Soderbergh's Media DietDocument8 pagesSteven Soderbergh's Media DietBryan CastañedaNo ratings yet

- Booming 3Document4 pagesBooming 3shenzo_No ratings yet

- Nagarjuna and Quantum Physics: Eastern and Western ThoughtDocument3 pagesNagarjuna and Quantum Physics: Eastern and Western Thoughtshenzo_100% (1)

- A Great VillainDocument7 pagesA Great Villainshenzo_No ratings yet

- New TextDocument1 pageNew Textshenzo_No ratings yet

- On Children: Kahlil GibranDocument2 pagesOn Children: Kahlil Gibranshenzo_No ratings yet

- New TextDocument1 pageNew Textshenzo_No ratings yet

- Apple ProRes White Paper July 2009Document22 pagesApple ProRes White Paper July 2009shenzo_No ratings yet

- Dwnload Full Fundamentals of Human Neuropsychology 7th Edition Kolb Test Bank PDFDocument12 pagesDwnload Full Fundamentals of Human Neuropsychology 7th Edition Kolb Test Bank PDFprindivillemaloriefx100% (12)

- The Rescue FindingsDocument8 pagesThe Rescue FindingsBini Tugma Bini Tugma100% (1)

- The Emergence of India's Pharmaceutical IndustryDocument41 pagesThe Emergence of India's Pharmaceutical Industryvivekgupta2jNo ratings yet

- Journal Entry DiscussionDocument8 pagesJournal Entry DiscussionAyesha Eunice SalvaleonNo ratings yet

- Assessment: Bipolar DisorderDocument2 pagesAssessment: Bipolar DisorderMirjana StevanovicNo ratings yet

- Impact of Agile On IT and BusinessDocument6 pagesImpact of Agile On IT and BusinessPurva RaneNo ratings yet

- Lauritzen 1964Document10 pagesLauritzen 1964Priyanka GandhiNo ratings yet

- All Over AgainDocument583 pagesAll Over AgainJamie Kris MendozaNo ratings yet

- Volatility Clustering, Leverage Effects and Risk-Return Trade-Off in The Nigerian Stock MarketDocument14 pagesVolatility Clustering, Leverage Effects and Risk-Return Trade-Off in The Nigerian Stock MarketrehanbtariqNo ratings yet

- The Conflict With Slavery and Others, Complete, Volume VII, The Works of Whittier: The Conflict With Slavery, Politicsand Reform, The Inner Life and Criticism by Whittier, John Greenleaf, 1807-1892Document180 pagesThe Conflict With Slavery and Others, Complete, Volume VII, The Works of Whittier: The Conflict With Slavery, Politicsand Reform, The Inner Life and Criticism by Whittier, John Greenleaf, 1807-1892Gutenberg.org100% (1)

- Affect of CRM-SCM Integration in Retail IndustryDocument8 pagesAffect of CRM-SCM Integration in Retail IndustryRajeev ChinnappaNo ratings yet

- Hbet1103 Introduction To General LinguisticsDocument11 pagesHbet1103 Introduction To General LinguisticsNasidah NasahaNo ratings yet

- The Ten Commandments For Network MarketersDocument3 pagesThe Ten Commandments For Network MarketersJustin Lloyd Narciso PachecoNo ratings yet

- Evoe Spring Spa Targeting Climbers with Affordable WellnessDocument7 pagesEvoe Spring Spa Targeting Climbers with Affordable WellnessKenny AlphaNo ratings yet

- HDFC Bank's Organizational Profile and BackgroundDocument72 pagesHDFC Bank's Organizational Profile and Backgroundrohitkh28No ratings yet

- Promotion From Associate Professor To ProfessorDocument21 pagesPromotion From Associate Professor To ProfessorKamal KishoreNo ratings yet

- Essay Sustainable Development GoalsDocument6 pagesEssay Sustainable Development GoalsBima Dwi Nur Aziz100% (1)

- Course Title: Cost Accounting Course Code:441 BBA Program Lecture-3Document20 pagesCourse Title: Cost Accounting Course Code:441 BBA Program Lecture-3Tanvir Ahmed ChowdhuryNo ratings yet

- Cultural Briefing: Doing Business in Oman and the UAEDocument2 pagesCultural Briefing: Doing Business in Oman and the UAEAYA707No ratings yet

- Dislocating The Sign: Toward A Translocal Feminist Politics of TranslationDocument8 pagesDislocating The Sign: Toward A Translocal Feminist Politics of TranslationArlene RicoldiNo ratings yet

- The Experience of God Being Consciousness BlissDocument376 pagesThe Experience of God Being Consciousness BlissVivian Hyppolito100% (6)

- Junior Instructor (Computer Operator & Programming Assistant) - Kerala PSC Blog - PSC Exam Questions and AnswersDocument13 pagesJunior Instructor (Computer Operator & Programming Assistant) - Kerala PSC Blog - PSC Exam Questions and AnswersDrAjay Singh100% (1)

- Doña PerfectaDocument317 pagesDoña PerfectadracbullNo ratings yet

- Short EssayDocument3 pagesShort EssayBlue PuppyNo ratings yet

- Clique Pen's Marketing StrategyDocument10 pagesClique Pen's Marketing StrategySAMBIT HALDER PGP 2018-20 BatchNo ratings yet

- 13 Years of Unremitting Tracking of Chinese Scientists To Find The Source of SARS Virus - NewsDocument14 pages13 Years of Unremitting Tracking of Chinese Scientists To Find The Source of SARS Virus - NewsWillSmathNo ratings yet

- Annex-4-JDVP Certificate of Learners MasteryDocument1 pageAnnex-4-JDVP Certificate of Learners MasteryZINA ARRDEE ALCANTARANo ratings yet

- Nurses Assigned in Covid-19 Isolation Facilities. in This ConnectionDocument4 pagesNurses Assigned in Covid-19 Isolation Facilities. in This ConnectionDan HizonNo ratings yet