Professional Documents

Culture Documents

11 Sep - Joint Seminar

Uploaded by

choihwlorraineCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

11 Sep - Joint Seminar

Uploaded by

choihwlorraineCopyright:

Available Formats

Supporting organisation

Host

Seminars on Tax Planning in an

Increasingly Transparent World and

Rethinking Independent NonExecutive Directorships

Supporting organisation

CPD point(s):

The Law Society of

Hong Kong

The HKICPA

The HKICS

: 4 CPD points;

(2 points per session)

: TBC

: TBC

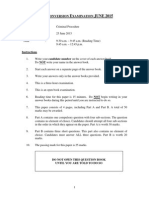

Friday, 11 September 2015

Topic

Time

Presenters

Session 1

Tax Planning in an Increasingly

Transparent World

10:00 a.m. 12:00 noon

Session 2

Rethinking Independent

Non-Executive Directorships

2:00 p.m. 4:00 p.m.

Mr. Scott D. Michel

Adjunct Professor of Law,

Graduate Program in Taxation,

University of Miami and Member of

Caplin & Drysdale, United States

Professor C. K. Low,

CUHK Business School,

The Chinese University of Hong Kong

Mr. H. David Rosenbloom

Director of the International Tax Program,

New York University and Member of Caplin

& Drysdale, United States

Venue

: Joint Professional Centre, Unit 1, G/F, The Centre,

99 Queens Road Central, Hong Kong

Level

: Intermediate

Language

: English

Fee

: For members of the Law Society, HKICPA or HKICS

HK$450 for the full-day seminar or HK$250 per session

For non-members

HK$810 for the full-day seminar or HK$450 per session

In association with:

Sponsors:

About the course

Session 1 - Tax Planning in an Increasingly Transparent World

The tax planners watchword that a taxpayer needs only pay the minimum taxes required by law is under increasing

pressure with the mutation of the very nature of tax planning. Persons with a professional interest in taxation and

entrusted with the task of providing advice need to be sensitized to this constantly shifting ground. Beginning in the last

decade, tax authorities worldwide have begun to push the outer bounds of anti-abuse doctrines, even bringing criminal

charges against tax planners thought to have crossed the line into conspiratorial conduct aimed at unlawfully reducing a

taxpayers liability. Now, the combination of ethical, political and even moral considerations, the news media, the

possibility of leakers and whistleblowers, and even a heightened sense of patriotism have put increasing pressure on the

tax planning trade. This seminar will discuss how tax planners can perform their jobs appropriately in this increasingly

pressurized environment.

Session 2 - Rethinking Independent Non-Executive Directorships

Academic studies are at best ambiguous in terms of the contributions that independent non-executive directors (INEDs)

make towards the performance of the companies on which board they serve and indeed of the quality of their monitoring of

executive management. With this in mind, can one unequivocally say that the INED is truly independent and would be

able to represent the interests of all the shareholders of the company? This seminar sets out a framework for rethinking

the appointment and the role of INEDs within an environment which is dominated by controlling shareholders.

About the presenters

Session 1 - Tax Planning in an Increasingly Transparent World

Scott D. Michel is a Member of Caplin & Drysdale, Chartered and has been with the firm since 1981. He is on the firms

Board of Directors and served as the firms President from 2007 to 2015. Mr. Michel advises clients on a wide range of tax

compliance issues, including criminal tax investigations, sensitive civil audits, and voluntary disclosures. Currently he

represents numerous clients worldwide in such matters arising from the IRS and Justice Departments recent crackdown

on unreported foreign assets and accounts, including a number of Swiss banks participating in the Department of Justice

Swiss Bank Program announced in 2013. Mr. Michel speaks and writes frequently on tax enforcement issues, and has

made presentations throughout the U.S., and in Seoul, Singapore, Hong Kong, Vienna, Zurich, Geneva, Mumbai, and

Kuwait City to multiple law firms, bankers, and tax and financial advisors. He is also the co-chair of the American Bar

Association Section of Taxation's Annual Conference on International Tax Enforcement, and has also appeared at other

programs held by the American Bar Association, The Tax Executives Institute (U.S. and foreign branches), and the

Virginia, New York University, Tennessee, and North Carolina Tax Institutes. Mr. Michel is also an Adjunct Professor of Law

at the University of Miami School of Law Graduate Program in Taxation. He served as a Council Director for the American

Bar Associations Section of Taxation and previously chaired the Tax Section's Committees on Civil and Criminal Tax

Penalties and on Standards of Tax Practice. Mr. Michel graduated from Northwestern University in 1977 with highest

distinction and in 1980 from the University of Virginia School of Law as a member of the Order of Coif. From 1980 to

1981, he served as clerk to the Honorable Joyce Hens Green, U.S. District Court for the District of Columbia.

H. David Rosenbloom is the Director of the International Tax Program at New York University School of Law and a

member of Caplin & Drysdale, Chartered, a law firm he rejoined in 1981 after serving as International Tax Counsel and

Director, Office of International Tax Affairs, in the U.S. Treasury Department from 1978 to 1981. Born in 1941,

Mr. Rosenbloom graduated from Princeton University summa cum laude in 1962 and, after a year as a Fulbright Scholar at

the University of Florence in Florence, Italy, attended Harvard Law School. He graduated magna cum laude in 1966 and

was President of Volume 79 of the Harvard Law Review. Mr. Rosenbloom served as assistant to Ambassador Arthur

Goldberg at the U.S. Mission to the United Nations and then as clerk to U.S. Supreme Court Justice Abe Fortas. A

frequent speaker and author on tax subjects, Mr. Rosenbloom has taught international taxation and related subjects at

Stanford, Columbia, the University of Pennsylvania, Harvard, and New York University Law Schools, and at educational

institutions in Taipei, Mexico City, Milan, Bergamo, Sydney, Mainz, Heidelberg, Rio de Janeiro, Pretoria, Melbourne,

Vienna, Lisbon, Leiden, and Neuchtel. He has also served as Tax Policy Advisor for the U.S. Treasury, the OECD, AID,

and the World Bank in Eastern Europe, the Former Soviet Union, Senegal, Malawi, and South Africa. In recent years he

has served as an expert witness on international tax matters in the United States, New Zealand, Canada, Australia, the

Netherlands, and Norway.

Session 2 - Rethinking Independent Non-Executive Directorships

Professor C K Low is an Associate Professor in Corporate Law at CUHK Business School with research interests in

issues pertaining to corporate governance and the regulatory framework of capital markets. His research, which has

published in journals in Australasia, Europe and the United States of America, is supported by private sector grants from

Ernst & Young, Noble Group, Sino Group and Tricor Group. An Advocate and Solicitor of the High Court of Malaya, CK is a

member of the Process Review Panel of the Financial Reporting Council and the Securities and Futures Appeals Tribunal

in Hong Kong. He was a member of the Listing Committee of the Stock Exchange of Hong Kong from May 2006 to July

2010 and served on the board of directors of the Asian Institute of Finance in Malaysia for three years through April 2012.

Supporting organization

Host

Supporting organisation

Seminars on

Session 1 - Tax Planning in an Increasingly Transparent World and

Session 2 - Rethinking Independent Non-Executive Directorships

11 September 2015

Enrolment Slip

To :

Kong

The Law Society of Hong Kong, 3rd Floor, Wing On House, 71 Des Voeux Road Central, Hong

(Attention: Ms. Goldie Ng - Tel: 2846 0585)

Name: Mr./Ms.

(full name)

I would like to enrol in

Full Day Seminar (HK$450 for members / HK$810 for non-members); or

Session 1 from 10:00 a.m. to 12:00 noon (HK$250 for members / HK$450 for non-members); or

Session 2 from 2:00 p.m. to 4:00 p.m. (HK$250 for members / HK$450 for non-members)

(please tick as appropriate)

I am a:

Law Society Member

Solicitor No :

(if applicable)

Year of admission:

(if applicable)

Trainee :

First /

Second year (if applicable)

HKICPA Member (membership number :

HKICS Member (membership number :

Non-member

(please specify your occupation :

(please tick as appropriate)

)

)

)

Do you wish to claim CPD points for your attendance?

CPD points required from The Law Society of Hong Kong

CPD points required from the HKICPA

CPD points required from the HKICS

(please tick as appropriate)

Company/Firm:

Fax:

Address:

E-mail:

Tel:

I enclose a cheque made payable to The Law Society of Hong Kong for $ in payment for

the above course.

I have read and accepted the Enrolment Conditions as stated below.

Signature:

Date:

Enrolment Conditions:

1.

Enrolments will be accepted on a first-come-first-served basis.

2.

The CPD Attendance Policy will apply to the Law Societys members. Bad Weather Policy will apply to all participants. Please enquire for further

details.

3.

The Law Society of Hong Kong reserves the right to alter the contents, speakers(s) or otherwise of this course, or cancel this course.

4.

Places cannot be reserved by facsimile. Registrations will only be accepted upon full payment of the course fee and receipt of the enrolment slip.

5.

Course fees shall under no circumstances be refunded. If you cannot attend a booked course, you may transfer your booking to a replacement

delegate provided that the Law Society is notified in writing at least one clear day in advance of the scheduled course date.

You might also like

- 14 Oct - New Probate Checklist (Version 7)Document2 pages14 Oct - New Probate Checklist (Version 7)choihwlorraineNo ratings yet

- Case Brief TemplateDocument3 pagesCase Brief TemplatechoihwlorraineNo ratings yet

- t1 EnglishDocument7 pagest1 EnglishchoihwlorraineNo ratings yet

- t8 EnglishDocument4 pagest8 EnglishchoihwlorraineNo ratings yet

- OIL Comp Chart Without Cost (ENG) - 201506Document1 pageOIL Comp Chart Without Cost (ENG) - 201506choihwlorraineNo ratings yet

- Form EPA Attorney AuthorityDocument11 pagesForm EPA Attorney AuthoritychoihwlorraineNo ratings yet

- Forml2 1Document2 pagesForml2 1choihwlorraineNo ratings yet

- 8 Oct - Family Law - Jurisdictional and Financial Implications v.3 (24.7.15)Document2 pages8 Oct - Family Law - Jurisdictional and Financial Implications v.3 (24.7.15)choihwlorraineNo ratings yet

- Rconditionals eDocument25 pagesRconditionals echoihwlorraineNo ratings yet

- T5a EnglishDocument4 pagesT5a EnglishchoihwlorraineNo ratings yet

- OIL Comp Chart Without Cost (ENG) - 201506Document1 pageOIL Comp Chart Without Cost (ENG) - 201506choihwlorraineNo ratings yet

- Forml2 1Document2 pagesForml2 1choihwlorraineNo ratings yet

- SubindexDocument34 pagesSubindexchoihwlorraineNo ratings yet

- OIL Comp Chart W - Cost (ENG) - 201506Document1 pageOIL Comp Chart W - Cost (ENG) - 201506choihwlorraineNo ratings yet

- Access To Legal Service1Document4 pagesAccess To Legal Service1choihwlorraineNo ratings yet

- HK Constitutional Law Jun 2015Document2 pagesHK Constitutional Law Jun 2015choihwlorraineNo ratings yet

- HK Legal System Jun 2014Document2 pagesHK Legal System Jun 2014choihwlorraineNo ratings yet

- 2015-09-22 CLS PSM M1 Assignment Questions SOULDocument2 pages2015-09-22 CLS PSM M1 Assignment Questions SOULchoihwlorraineNo ratings yet

- Offer and Acceptance Case Law SummaryDocument4 pagesOffer and Acceptance Case Law SummarychoihwlorraineNo ratings yet

- Business Association Types and GovernanceDocument3 pagesBusiness Association Types and GovernancechoihwlorraineNo ratings yet

- Law of Contract For Resolving Construction DisputesDocument38 pagesLaw of Contract For Resolving Construction DisputeschoihwlorraineNo ratings yet

- Understanding Land Law PDFDocument255 pagesUnderstanding Land Law PDFchoihwlorraine100% (2)

- Doctrine (Rules) of PrecedentDocument9 pagesDoctrine (Rules) of PrecedentchoihwlorraineNo ratings yet

- Criminal Procedure Jan 14Document3 pagesCriminal Procedure Jan 14choihwlorraineNo ratings yet

- Criminal Procedure Jun 15Document4 pagesCriminal Procedure Jun 15choihwlorraineNo ratings yet

- Judicial Vs ObiterDocument5 pagesJudicial Vs ObiterGem SNo ratings yet

- HK Constitutional Law Jun 2015Document2 pagesHK Constitutional Law Jun 2015choihwlorraineNo ratings yet

- RHC Appendix A PDFDocument53 pagesRHC Appendix A PDFchoihwlorraineNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Funa Vs AgraDocument2 pagesFuna Vs AgraKeziah HuelarNo ratings yet

- Viva EthicsDocument5 pagesViva EthicsNUR SYAZWANI IZZATI SALEHUDDINNo ratings yet

- The Legal Profession in Malaysia ArtDocument58 pagesThe Legal Profession in Malaysia ArtNaqbila & CoNo ratings yet

- Complaint Process Against LawyersDocument34 pagesComplaint Process Against LawyersNur Ayuni RahimNo ratings yet

- NSW UCPR Form 20 Notice of MotionDocument4 pagesNSW UCPR Form 20 Notice of MotionRobertGChristieNo ratings yet

- f18b905b-a77e-4f19-901d-a62a0a250e2eDocument38 pagesf18b905b-a77e-4f19-901d-a62a0a250e2eRabia BegumNo ratings yet

- Republic of The Philippines, Local Civil Registrar of Cauayan, PetitionersDocument4 pagesRepublic of The Philippines, Local Civil Registrar of Cauayan, PetitionersLeogen Tomulto100% (1)

- Digests LegEthDocument17 pagesDigests LegEthJapsalm Lyann AstudilloNo ratings yet

- Title D (3) and E (1) Readmission and MCLEDocument5 pagesTitle D (3) and E (1) Readmission and MCLEKat RANo ratings yet

- Andrew Hilary Caldecott QCDocument10 pagesAndrew Hilary Caldecott QCmerNo ratings yet

- Bussines Law - Keenan & RichesDocument231 pagesBussines Law - Keenan & RichesFrancisco80% (5)

- Lucena Grand Central TerminalDocument48 pagesLucena Grand Central TerminalLizzette Dela PenaNo ratings yet

- Bolkiah Vs KPMGDocument15 pagesBolkiah Vs KPMGNurul AinNo ratings yet

- Legal Ethics - Midterms Transcript (Atty. Rellin)Document10 pagesLegal Ethics - Midterms Transcript (Atty. Rellin)Katelene Alianza100% (1)

- Majlis Peguam Malaysia V Norsiah BT AliDocument21 pagesMajlis Peguam Malaysia V Norsiah BT AliNUR SYUHADA FADILAHNo ratings yet

- Legal Ethics Digest 1st CaseDocument15 pagesLegal Ethics Digest 1st CaseCarlo John C. RuelanNo ratings yet

- GR 208383 2016 PDFDocument11 pagesGR 208383 2016 PDFKrisandra Ann MalaluanNo ratings yet

- Unit 8 Professional MisconductDocument47 pagesUnit 8 Professional MisconductJanice Mayers-BrathwaiteNo ratings yet

- Liles V Terry and Wife.Document6 pagesLiles V Terry and Wife.Nicole YauNo ratings yet

- Lantoria v. Atty. Bunyi, AC 1769, 1992Document7 pagesLantoria v. Atty. Bunyi, AC 1769, 1992Jerald Oliver MacabayaNo ratings yet

- EXAMPLE of Law ResumesDocument8 pagesEXAMPLE of Law ResumesRoberts SamNo ratings yet

- He's Just A StereotypeDocument36 pagesHe's Just A StereotypeRabia BegumNo ratings yet

- 2 Unjieng V PosadasDocument1 page2 Unjieng V PosadasSalma GurarNo ratings yet

- CASE Stakeholder KuldipDocument8 pagesCASE Stakeholder KuldipIqram Meon100% (1)

- Upreme !court: Corazon Kang Ignacio, A.C. No. 9426Document10 pagesUpreme !court: Corazon Kang Ignacio, A.C. No. 9426Dianne AquinoNo ratings yet

- 2009 Hkcfa 11Document27 pages2009 Hkcfa 11Anthony BradyNo ratings yet

- Notary Practice Manual CANADADocument508 pagesNotary Practice Manual CANADAgoldilucksNo ratings yet

- The Conduct of An Advocate and SolicitorDocument13 pagesThe Conduct of An Advocate and SolicitorZafry TahirNo ratings yet

- Modern Legal DraftingDocument274 pagesModern Legal DraftingVishal Jain100% (12)

- Transforming Legal AidDocument162 pagesTransforming Legal AidTom KentNo ratings yet