Professional Documents

Culture Documents

Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

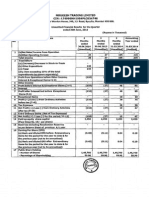

UNISYS SOFTWARES & HOLDING INDUSTRIES LIMITED

Regd. Office : 75C, Park Street, Basement, Kolkata- 700016

CIN - L51909WB1992PLC056742, Email : unisys.softwares@gmail.com, Wesbite : www.unisyssoftware.com

Statement of Standalone Unaudited Financial Results for the Quarter & Six months ended 30th September, 2015

Rs. in Lacs

Corresponding

Corresponding

3 Months

3 Months

6 Months

Preceding 3

6 Months

Year to date

Months ended

ended

ended

ended

ended

figures as on

30.09.2015 30.06.2015 30.09.2014 30.09.2015 30.09.2014 31.03.2015

Un-Audited

Un-Audited

Audited

Particulars

Sr.

No.

1

Income from Operations

a) Net Sales/Income from Operations

b) Other Operating Income

12,355.88

80.00

Total Income from Operations (Net)

Expenses

(a) Cost of Material Consumed

(b) Purchases of Stock-in-trade

(c) Changes in Inventories of Finished Goods, Work-inProgress and Stock-in-Trade

(d) Employees Benefit Expenses

(e) Depreciation & Amortization Expenses

(f) Other Expenses

3

Total Expenses

Profit/(Loss) from Operations before other Income, finance

cost and exceptional Expenses (1-2)

4

5

Other Income/(Loss)

6

7

Finance Costs

8

9

Exceptional Items

Profit/(Loss) from ordinary activities before finance costs

and exceptional items (3+4)

Profit/(Loss) from ordinary activities after finance cost but

before exceptional items (3+4)

Profit(+)/Loss(-) from ordinary activities before Tax (7-8)

11

12 Extra Ordinary Items (Net of Tax Expense of Rs.

13

14 Share of Profit/(Loss) of Associates*

15 Minority Interest*

Net Profit (+)/Loss(-) for the period (11-12)

Lac)

Net Profit (+)/Loss(-) after tax, minority interest and Share

of Profit / (Loss) of Associates (13-14-15)

16

17 Paid-up Equity Share Capital (Face Value of Rs. 10/- each)

Reserves excluding revaluation Reserves as per last Balance

18 Sheet

1,332.69

99.75

20,207.83

165.00

15,520.73

145.00

47,314.58

330.69

12,435.88

7,936.95

1,432.44

20,372.83

15,665.73

47,645.27

12,180.05

7,871.89

1,327.56

20,051.94

15,482.79

47,317.81

138.00

4.70

7.52

6.40

4.60

7.52

5.48

4.80

11.28

6.32

138.00

9.30

15.04

11.88

9.55

22.56

11.87

18.69

45.11

35.02

12,336.67

7,889.49

1,349.96

20,226.16

15,526.77

47,416.63

99.21

47.46

82.48

146.67

138.96

228.64

99.21

47.46

82.48

146.67

138.96

228.64

33.75

33.75

57.60

67.50

57.60

158.40

65.46

13.71

24.88

79.17

81.36

70.24

65.46

13.71

24.88

79.17

81.36

70.24

32.95

65.46

65.46

-

13.71

13.71

-

24.88

24.88

-

79.17

79.17

-

81.36

81.36

-

37.29

37.29

-

10 Tax Expenses

Net Profit (+)/Loss(-) from ordinary activities after tax (910)

7,851.95

85.00

65.46

13.71

24.88

79.17

81.36

37.29

2,300.02

2,300.02

2,300.02

2,300.02

2,300.02

2,300.02

19

(i) a) Basic

b) Diluted

0.28

0.28

0.06

0.06

0.11

0.11

0.34

0.34

0.35

0.35

0.16

0.16

19

(ii) a) Basic

b) Diluted

0.28

0.28

0.06

0.06

0.11

0.11

0.34

0.34

0.35

0.35

0.16

0.16

17,440,800

17,440,800

17,440,800

17,440,800

17,440,800

17,440,800

75.83

75.83

75.83

75.83

75.83

75.83

50,000

50,000

50,000

50,000

50,000

50,000

0.90

0.90

0.89

0.90

0.90

0.90

0.22

0.22

0.22

0.22

0.22

0.22

5,509,400

100.00

5,509,400

100.00

5,559,400

100.00

5,509,400

100.00

5,509,400

100.00

5,509,400

100.00

23.95

23.95

24.17

23.95

23.95

23.95

Earning Per Share (before extra-ordinary items) of Rs. 10/each (not annualized)

Earning Per Share (after extra-ordinary items) of Rs. 10/each (not annualized)

A PARTICULARS OF SHAREHOLDING

Public Shareholding

- Number of Shares

- Percentage of Share Holding

18 Promoter and Promoter Group Shareholding

a) Pledged/Encumbered

- Number of Shares

- Percentage of Shares (as a % of the total Shareholding

of Promoter and Promoter Group

- Percentage of Shares (as a % of the total Share Capital

of the Company

b) None-Encumbered

- Number of Shares

- Percentage of Shares (as a % of the total Shareholding

of Promoter and Promoter Group

- Percentage of Shares (as a % of the total Share Capital

of the Company

3,609.22

B INVESTOR COMPLAINTS

Pending at the beginning of the Quarter

Received during the Quarter

Nil

Nil

Disposed during the Quarter

Remaining Unresolved at the end of Quarter

Nil

Nil

UNISYS SOFTWARES & HOLDING INDUSTRIES LIMITED

Un-Audited Segment Results for the Quarter & 6 months ended 30th September, 2015

Rs. in Lacs

Sr.

No. Particulars

1 Segment Revenue

a) Sale of Software & Hardware / Mobile

b) Investment Activities

c) Other Income

Total Income from Operations

2 Segment Profit/(Loss) before Interest & Tax

a) Sale of Software & Hardware / Mobile

b) Investment Activities

c) Other Unallocable Activities

Profit before Tax

3 Capital Employed

a) Software & Hardware / Mobile

b) Investment Activities

c) Other Unallocable Activities

Total

Notes :

3 Months

Preceding 3 Preceding 3

Months ended Months ended

ended

30.09.2015 30.06.2015 30.09.2014

Un-Audited

12,355.88

80.00

-

7,851.95

85.00

-

1,332.69

99.75

-

Corresponding Corresponding

6 Months

6 Months

Year to date

ended

ended

figures as on

30.09.2015 30.09.2014 31.03.2015

Un-Audited

Audited

20,207.83

165.00

-

15,520.73

145.00

-

47,314.58

313.38

-

12,435.88

7,936.95

1,432.44

20,372.83

15,665.73

47,627.96

7.00

58.46

-

3.00

10.71

-

0.03

24.85

-

10.00

69.17

-

25.83

55.53

-

14.09

56.15

-

65.46

13.71

24.88

79.17

81.36

70.24

7,104.00

30,209.00

75.20

5,281.00

33,514.00

82.72

6,388.82

31,087.34

79.79

7,104.00

30,209.00

75.20

6,388.82

31,087.34

79.79

5,794.74

30,886.11

90.24

37,388.20

38,877.72

37,555.95

37,388.20

37,555.95

36,771.09

1. Segmental Report as per AS-17, issued by Institute of Chartered Accountants of India is applicable for the Quarter.

2. Above results were reviewed by Audit Committee taken on record in Board Meeting held on 9th November, 2015.

3. The Auditors of the Company have carried out "Limited Review" of the above financial Results.

4. Figures of Previous Year/Period have been re-arranged/re-casted wherever necessary.

For Unisys Softwares & Holding Industries Ltd.

Place : Kolkata

Date : 9th November, 2015.

Sd/-

Jagdish Prasad Purohit

Managing Director

UNISYS SOFTWARES & HOLDING INDUSTRIES LTD

Statement of Assets & Liabilities

Particulars

A EQUITY & LIABILITIES

1 Shareholders' Fund

(a) Share Capital

(b) Reserves and Surplus

(c) Money Received against Share Warrants

Sub-Total - Share Holders Fund

2 Share Capital Money (Pending Allotment

3 Minority Interest*

4

Non Current Liabilities

(a) Long Term Borrowings

(b) Deferred Tax Liabilities (Net)

(c) Other Long Term Liabilities

(d) Long Term Provisions

Sub-Total - Long Term Liabilities

5 Current Liabilities

(a) Short Term Borrowings

(b) Trade Payables

(c) Other Current Liabilities

(d) Short Term Provisions

Sub-Total - Current Liabilities

TOTAL EQUITY & LIABILITIES

B ASSETS

1 Non-Current Assets

(a) Fixed Assets

(b) Goodwill on Consolidation*

(c) Non-Current Investments

(d) Deferred Tax Assets (Net)

(e) Long Term Loans & Advances

(f) Other Non-Current Assets

Sub-Total - Non Current Assets

Current Assets

(a) Current Investments

(b) Inventories

(c) Trade Receivables

(d) Cash & Cash Equivalents

(e) Short Term Loans & Advances

(f) Other Current Assets

Sub-Total - Current Assets

TOTAL - ASSETS

Rs. in Lacs

As At

30th Sept 2015 31st March 2015

Un-Audited

Audited

2,300.02

3,688.39

2,300.02

3,609.22

5,988.41

5,909.24

1,642.66

30,180.47

1,267.97

32.98

1,575.16

28,694.69

572.69

32.95

33,124.08

39,112.49

30,875.49

36,784.73

75.20

13.64

90.24

13.64

88.84

103.88

24,308.00

7,104.30

61.76

7,549.59

-

23,925.02

5,794.75

20.14

6,940.94

-

39,023.65

39,112.49

36,680.85

36,784.73

B. S. Kedia & Co.

Chartered Accountants

Limited Review Report by Auditors

To

The Board of Directors

M/s. Unisys Softwares & Holding Industries Limited

75C, Park Street

Kolkata-700 016

We have reviewed the accompanying statement of Un-Audited Financial Results of M/s. Unisys

Softwares & Holding Industries Limited for the Quarter ended 30th September 2015 except

for the disclosures regarding Public Shareholding and Promoter and Promoter Group

Shareholding which have been traced from disclosures made by the management and have not

been audited by us. This statement is the responsibility of the Companys Management and has

been approved by the Board of Directors/ Committee of Board of Directors. Our responsibility is

to issue a report on these financial statements based on our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2400,

engagements to Review Financial Statements issued by the Institute of Chartered Accountants of

India. This standard requires that we plan and perform the review to obtain moderate assurance as

to whether the financial statements are free of material misstatement. A review is limited primarily

to inquiries of company personnel and an analytical procedure applied to financial data and thus

provides less assurance than an audit. We have not performed an audit and accordingly, we do not

express an audit opinion.

Based on our review conducted as above, nothing has come to our attention that causes us to

believe that the accompanying statement of unaudited financial results prepared in accordance

with applicable accounting standards 1 and other recognized accounting practices and policies has

not disclosed the information required to be disclosed in terms of Clause 41 of the Listing

Agreement including the manner in which it is to be disclosed, or that it contains any material

misstatement.

For M/s. B. S. Kedia & Co.

Chartered Accountants

Firm Reg. No. : 317159E

Place : Kolkata

Date : November 9, 2015

Vikash Kedia

Partner

Membership Number 066852

You might also like

- Success StoriesDocument255 pagesSuccess Storiesflaquitoquerio125100% (10)

- FIN322 Week4 TutorialDocument4 pagesFIN322 Week4 Tutorialchi_nguyen_100No ratings yet

- Lou Simpson GEICO LettersDocument24 pagesLou Simpson GEICO LettersDaniel TanNo ratings yet

- Financial Ratio AnalysisDocument15 pagesFinancial Ratio Analysissnigdha songa100% (1)

- Moelis Valuation AnalysisDocument27 pagesMoelis Valuation AnalysispriyanshuNo ratings yet

- Newspaper Headlines VocabularyDocument7 pagesNewspaper Headlines VocabularyJM RamirezNo ratings yet

- New Commercial Company Law in Uae PDFDocument7 pagesNew Commercial Company Law in Uae PDFAli AdnanNo ratings yet

- Collins TCPA Fee ContestDocument229 pagesCollins TCPA Fee ContestDaniel FisherNo ratings yet

- Raaaa A A AaaaaaaaaaaaaaaaaaaaaaaaaaDocument140 pagesRaaaa A A Aaaaaaaaaaaaaaaaaaaaaaaaaajay4nothingNo ratings yet

- CML Vs SMLDocument9 pagesCML Vs SMLJoanna JacksonNo ratings yet

- APCF Research Grant Starch Final Report 2017 October 2017Document177 pagesAPCF Research Grant Starch Final Report 2017 October 2017kyaq001No ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- Bonds Payable Multiple Choice QuestionsDocument9 pagesBonds Payable Multiple Choice QuestionsAl-Sinbad Bercasio100% (2)

- How To Calculate ERP ROIDocument13 pagesHow To Calculate ERP ROImnazihNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Jaihind Synthetics Limited: S BusDocument4 pagesJaihind Synthetics Limited: S BusShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Consolidated Financial StatementsDocument28 pagesConsolidated Financial Statementsswissbank333No ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document2 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- ABSL Annual Report 2014-15 HighlightsDocument20 pagesABSL Annual Report 2014-15 HighlightsjunkyNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document2 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Document3 pagesFinancial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Aug 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Aug 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Financial Inclusion Growth in India: A Study With Reference To Pradhan Mantri Jan-Dhan Yojana (PMJDY)Document16 pagesFinancial Inclusion Growth in India: A Study With Reference To Pradhan Mantri Jan-Dhan Yojana (PMJDY)Muhammed Shafi. M.KNo ratings yet

- Cw2-Individual-Amended VersionDocument5 pagesCw2-Individual-Amended VersiontswNo ratings yet

- Case Study Presentation-Consumer BehaviourDocument26 pagesCase Study Presentation-Consumer BehaviourPravakar KumarNo ratings yet

- Treasury BondsDocument5 pagesTreasury BondsDivya Raja ManickamNo ratings yet

- Advanced Accounting: Stock Investments - Investor Accounting and ReportingDocument30 pagesAdvanced Accounting: Stock Investments - Investor Accounting and ReportingNafilah Rahma100% (1)

- DrewDocument2 pagesDrewmusunna galibNo ratings yet

- Excel Chapter 15 StudentDocument8 pagesExcel Chapter 15 StudentsagarsbhNo ratings yet

- Hue Cosmetics BPDocument26 pagesHue Cosmetics BPDennis ZaldivarNo ratings yet

- Equity Pick-Up Module & Customized Intercompany Matching: Fusion 11.1.1.2, HFM & ReportsDocument20 pagesEquity Pick-Up Module & Customized Intercompany Matching: Fusion 11.1.1.2, HFM & Reportssagiinfo1No ratings yet

- Macroeconomics Jargons: University of Caloocan CityDocument16 pagesMacroeconomics Jargons: University of Caloocan CityMyriz AlvarezNo ratings yet

- E08 00 gb2008Document330 pagesE08 00 gb2008usa_mercNo ratings yet

- WhiteMonk HEG Equity Research ReportDocument15 pagesWhiteMonk HEG Equity Research ReportgirishamrNo ratings yet

- CCL Products India Standalone Balance SheetDocument2 pagesCCL Products India Standalone Balance SheetSaurabh RajNo ratings yet

- Types of InterestDocument4 pagesTypes of InterestUmar SheikhNo ratings yet

- Working Capital Goodfrey PhilipsDocument81 pagesWorking Capital Goodfrey PhilipslovleshrubyNo ratings yet

- Price Level AccountingDocument14 pagesPrice Level AccountingNadia StephensNo ratings yet

- Cash Management: © 2009 The Mcgraw-Hill Companies, Inc., All Rights ReservedDocument32 pagesCash Management: © 2009 The Mcgraw-Hill Companies, Inc., All Rights ReservedHiep Nguyen TuanNo ratings yet