Professional Documents

Culture Documents

Valuing Cashflows

Uploaded by

AbelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Valuing Cashflows

Uploaded by

AbelCopyright:

Available Formats

ANUx Introduction to Actuarial Science

Lesson 1

Valuing Cash Flows

Time Value of Money

Actuarial work typically involves the investigation of some sort of financial process over a period of

time. This is certainly the case for the Life Insurance example we discussed in the Prologue and that

will be considered throughout the course.

Whenever we want to think about a financial process over a period of time, it is essential that we

consider the time value of money. Whilst entire introductory university courses are based on the

concept of the time value of money, in this Lesson were just going to present the key elements that

will be relevant to this course.

Interest

The concept of interest is a foundation of the capitalist structure that most Western economic

markets are based on. Essentially it simplifies down to the fact that if Party X (who may be an

individual or an institution) loans money to Party Y (who may also be an individual or an institution),

then Party Y will make a payment to Party X for the service provided by Party X. This payment is

usually expressed as a percentage of the amount loaned, with this percentage being known as the

interest rate.

A numerical example will make this clearer:

Party X makes a loan of $100 to Party Y

At some point in time in the future Party Y pays the $100 loan back to Party X

In addition to repaying $100, Party Y also pays interest at a rate of 5% on the loan, which

results in an interest payment of 5% x $100 = $5

The total amount repaid by Party Y is therefore $100 + $5 = $105

In summary, Party Y has borrowed $100 from Party X, but has repaid Party X an amount of $105 at

some time in the future.

If we let the interest rate be i , and the initial amount borrowed by Party Y be P , then we can see

that the amount repaid by Party Y is equal to P Pi P(1 i) or $100 x 1.05 = $105. The cash

flows from Party Ys perspective are:

Borrows from Party X

Repays Party X

$100

P

-$105

- P(1 i)

Adam Butt

Version 1 (2015)

Page 1

ANUx Introduction to Actuarial Science Lesson 1 Valuing Cash Flows

Accumulated Value

The example above was mostly expressed from Party Ys perspective. If we want to think of this

from Party Xs perspective, we would say that Party X has invested P , which has become an

accumulated value of P(1 i) . The cash flows from Party Xs perspective are:

Loans to / Invests in

Party Y

Accumulated Value

-$100

-P

$105

P(1 i)

Interest Rates and Time Horizons

The previous example did not specify a time horizon for the investment made by Party X. Of course

most investments will be made over a certain period of time, and hence the time period that the

interest rate applies to will need to be defined.

Expanding upon the previous example, lets imagine that Party X made the $100 investment for a 1

year period, and that the interest rate was 5% per year (per year is usually called per annum). Since

the period of the investment is the same as the period over which the interest rate applies (1 year),

the accumulated value of the $100 investment is still $105 as it was previously.

But what if the investment made by Party X was over a 7 year period instead of a 1 year period? We

know that the accumulated value after the first 1 year period that the interest rate applies for is

$100 x 1.05.

If this amount is reinvested after 1 year (i.e. P $100 1.05 ), then the accumulated value

after 2 years is equal to [$100 x 1.05] x 1.05 = $100 x 1.052.

Similarly, if this amount is reinvested after 2 years, then the accumulated value after 3 years

is equal to [$100 x 1.052] x 1.05 = $100 x 1.053.

It follows, therefore, that the accumulated value after 7 years is equal to $100 x 1.057 =

$140.71.

In more general terms, we could say that if Party X invests P for a period of n years at an interest

rate of i per annum, then the accumulated value, A , at the end of the n years would be:

P(1

i)n

Initial Investment

Accumulated Value

Adam Butt

Version 1 (2015)

A

Page 2

P(1

i)n

ANUx Introduction to Actuarial Science Lesson 1 Valuing Cash Flows

This form of interest calculation is known as effective compound interest other ways of calculating

interest such as simple interest and nominal compound interest will not be considered in this course.

In addition, to simplify matters all time periods considered in this course will be expressed in years

(i.e. per annum).

Practice Question 1.1

An individual invests $10,000 at an interest rate of 2% per annum. Calculate the accumulated value

after 10 years.

Assessment Question 1.1

A life insurer receives $500,000 in premiums and invests them at an interest rate of 3.5% per annum.

Calculate the accumulated value after 2 years.

Present Value

Lets now imagine a situation where a party knows they need to achieve a particular accumulated

value at some time in the future. For example, an insurer might be expecting to have to make a

claim payment to a policyholder at some time in future. Given that we know from the above

analysis that interest affects the value of money over time, how much does the insurer need to set

aside today in order to have enough to make the claim payment in future?

Well start with a simple numerical example that is similar to what we have looked at previously.

Party X now wishes to ensure they have $100 in 7 years from today. If the interest rate is 5% per

annum, how much does Party X need to set aside today?

Essentially what we are saying here is that the accumulated value, A , needs to be $100 in 7 years

from now. Lets place this information on the same timeline we have looked at previously:

Initial Investment

Accumulated Value

P(1

i)n

$100

What we now want to do is solve the above equation for P , given that we already know the values

of A , n and i :

P (1

i )n

$100

P (1.05)

$100

$100

P

$100(1.05)

1.057

Adam Butt

Version 1 (2015)

$71.07

Page 3

ANUx Introduction to Actuarial Science Lesson 1 Valuing Cash Flows

We can hence say that Party X needs to set aside $71.07 today to ensure they will have $100 in 7

years from now. This amount is said to be the present value of $100 in 7 years from now.

In more general terms, we could say that if Party X requires an amount A in n years from today,

and the interest rate is i per annum, then the present value, P , today would be:

A(1

i)

where v

(1

Av n

i)

Note that this is simply a rearrangement of the accumulated value equation above; the notation

v

(1

i)

is standard actuarial notation used in present value calculations. The process of

multiplying a cash flow by some power of v is often described as discounting the cash flow.

Practice Question 1.2

Calculate the present value, at an interest rate of 6% per annum, of a cash flow of $20,000 due in 25

years.

Assessment Question 1.2

An individual is required to make a payment of $1,500 in 3 years from today. Calculate the amount

that must be set aside today in order to have sufficient money to make the repayment. Use an

interest rate of 5.5% per annum.

Adam Butt

Version 1 (2015)

Page 4

ANUx Introduction to Actuarial Science Lesson 1 Valuing Cash Flows

Multiple Payments

The techniques for valuing multiple payments are similar to the techniques for valuing single

payments described above.

Accumulated Value

We will use the Life Insurance example described in the Prologue to demonstrate this. The table is

reproduced below:

Year

0

1

2

3

4

5

Premium Received

535,824

Interest Received

21,433

20,870

18,805

17,184

13,704

Claims Paid

35,498

72,512

59,334

104,177

89,265

Actual Reserves

535,824

521,759

470,117

429,588

342,595

267,034

First we should note that the Interest Received is simply 4% of the Actual Reserves at the previous

year, e.g. 20,870 = 521,759 x 0.04. This represents an interest rate of 4% per annum. The Actual

Reserves are the accumulated value of the insurers cash flows at that point in time. In addition to

interest, there are hence only two cash flows that affect the accumulated value; the Premium

Received (which is a positive cash flow for the insurer) and the Claims Paid (which is a negative cash

flow for the insurer).

Well now recreate the Actual Reserves using the techniques described above. We will do it in two

ways, first by accumulating multiple cash flows and then iteratively.

Accumulating multiple cash flows

We now want to recreate the Actual Reserve of 267,034 at Year 5 by accumulating multiple cash

flows until Year 5. This is done as follows:

Year

Premium Received

Claims Paid

535,824

35,498

72,512

59,334

104,177

89,265

Adam Butt

Version 1 (2015)

Page 5

Note

A positive cash flow accumulated at 4%

p.a. for 5 years from Year 0 to Year 5

A negative cash flow accumulated at 4%

p.a. for 4 years from Year 1 to Year 5

A negative cash flow accumulated at 4%

p.a. for 3 years from Year 2 to Year 5

A negative cash flow accumulated at 4%

p.a. for 2 years from Year 3 to Year 5

A negative cash flow accumulated at 4%

p.a. for 1 years from Year 4 to Year 5

A negative cash flow that occurs at the

same time as the accumulated value

ANUx Introduction to Actuarial Science Lesson 1 Valuing Cash Flows

We can hence calculate the Actual Reserve at Year 5 as follows:

535, 824(1.04)5

59, 334(1.04)2

267, 034

35, 498(1.04)4

104,177(1.04)1

72, 512(1.04)3

89, 265

Iteratively

An iterative approach builds the accumulated value year-by-year by incorporating all of the cash

flows up until that date.

At Year 0 the Actual Reserves are simply equal to the premium received at Year 0.

At Year 1 the Actual Reserves must incorporate interest on the Actual Reserves at Year 0, in

addition to allowing for the negative claim cash flow that occurs at Year 1. Since the Actual

Reserves at Year 0 must be accumulated for 1 year until Year 1, we can calculate the Actual

Reserves at Year 1 as follows:

A

35, 498

521, 759

At Year 2 the Actual Reserves must incorporate interest on the Actual Reserves at Year 1, in

addition to allowing for the negative claim cash flow that occurs at Year 2. We can hence

calculate the Actual Reserves at Year 2 as follows:

A

535, 824(1.04)1

521, 759(1.04)1

72, 512

470,117

This process can be repeated until Year 5.

The iterative approach is particularly useful when looking at a life insurers Actual Reserves, as it

allows the Actual Reserves to be investigated at each year, rather than at a single time period. This

approach is typically implemented in a computer spreadsheet tool, which we will look at in Lesson 2.

Practice Question 1.3

Recalculate the Actual Reserves of the insurer in the previous example at Year 5 using an interest

rate of 6% per annum.

Assessment Question 1.3

An individual invests an amount of $5,000 in a bank account today, knowing that they will need to

withdraw $1,000 in 1 year, $500 in 2 years and $2,000 in 3 years. If the interest rate on the amount

invested is 2.5% per annum, calculate the amount of money in the bank account immediately after

the $2,000 withdrawal in 3 years from today.

Adam Butt

Version 1 (2015)

Page 6

ANUx Introduction to Actuarial Science Lesson 1 Valuing Cash Flows

Extension Question 1.1

Show that, mathematically, the two approaches described above for calculating the accumulated

value of the insurers cash flows give equivalent results.

Present Value

Present value calculations for multiple cash flows are typically not done iteratively, as we are

generally only interested in a present value today, unlike an accumulated value where we may wish

to investigate accumulated values over a number of years. Hence the first approach described

above is used; in this instance the present values of the individual cash flows are added together.

Practice Question 1.4

Calculate the present value at Year 0 of the claims paid by the insurer in the example above, using

the same interest rate of 4% per annum.

Assessment Question 1.4

Calculate the total present value today of the following cash flows:

$300 due in 2 years from today

$1,000 due in 5 years from today

$200 due in 15 years from today

Use an interest rate of 12% per annum.

Extension Question 1.2

Given the present value of the claims calculated in Practice Question 1.4, determine a mathematical

relationship between the present values of the cash flows of the insurer and the Actual Reserves at

Year 5 of the insurer. Are you able to easily calculate the Actual Reserves at Year 5 given that you

already have the present value of the claims paid at Year 0, and you also have the premium received

at Year 0?

Adam Butt

Version 1 (2015)

Page 7

ANUx Introduction to Actuarial Science Lesson 1 Valuing Cash Flows

Multiple Regular Payments

A special type of example involving multiple payments is when the multiple payments are all

identical and evenly spaced. Consider the following example, where payments of 1 are made at year

1, 2, 3,...,n :

an

Year

sn

Amount

n-1

These types of payments are known by actuaries as an annuity certain and there are special

formulae that can be used to calculate the accumulated value at Year n , sn , and the present value

at Year 0, an , of these series of payments:

sn

an

(1

i)n

i

vn

Note that, as per the solution to Extension Question 1.2 above, the sn and an formulae can be

related by discounting the sn back n years:

sn v n

(1

i)n

i

vn

(1

i)n v n

i

vn

(1

i)n (1

i)

i

vn

vn

1

i

an

If the annuity payments are not equal to 1 (which of course they usually wont be!), then then

annuity value is simply equal to the annuity formula multiplied by the value of the payments. For

example, the present value at Year 0, of a series of payments (an annuity) of $100 at Year 1,2,3,,15,

at an interest rate of 3% per annum, is calculated as follows:

100an

Adam Butt

Version 1 (2015)

100

vn

1

i

100

1.03

0.03

15

$1,193.79

Page 8

ANUx Introduction to Actuarial Science Lesson 1 Valuing Cash Flows

Finally, as we did in Extension Question 1.2, we need to note that if we have the value of a series of

payments at a particular time, then we can use the techniques of taking accumulated and present

values to calculate the value at any time. Using the $100 annuity example again, lets say we wanted

to calculate the present value of the annuity at Year -3. Since we have the present value of the

annuity at Year 0, we can simply discount this value for a further 3 years. The present value at Year

-3 is hence:

1,193.79v 3

1,193.79(1.03)

$1, 092.49

Similarly, if we wanted the accumulated value of the annuity at Year 20, we can simply accumulate

the present value at Year 0 for 20 years. The accumulated value at Year 20 is hence:

1,193.79(1.03)20

$2,156.12

The reason this works was covered in the solution to Extension Question 1.2 to some extent,

although you wont need to worry about understanding this explanation throughout the rest of the

course.

Practice Question 1.5

Calculate the present value at Year 0, and the accumulated value at Year 30, of an annuity of

$25,000 paid at Year 1,2,3,,30. Use an interest rate of 4.5% per annum.

Assessment Question 1.5

An individual invests $2,000 every year for 40 years. Calculate the accumulated value of this

investment, at an interest rate of 7% per annum, at the time of the last $2,000 investment.

Assessment Question 1.6 (Hard)

Calculate the total present value today of the following cash flows:

$50 due in 1 year from today

$100 due in 2 years from today

$200 due yearly at 3,4,5,6,7,,20 years from today

Use an interest rate of 8% per annum.

Adam Butt

Version 1 (2015)

Page 9

ANUx Introduction to Actuarial Science Lesson 1 Valuing Cash Flows

Extension Question 1.3

Using the techniques of summing geometric series, show that the sn formula is correct by summing

the accumulated values of the individual cash flows.

Adam Butt

Version 1 (2015)

Page 10

ANUx Introduction to Actuarial Science Lesson 1 Valuing Cash Flows

Summary of the Lesson 1 Material

Accumulated Value in n years from today, A , of an investment today, P , at an interest

rate of i per annum:

A

P(1

i)n

Present Value today, P , of an amount due in n years from today, A , at an interest rate of

i per annum:

P

A(1

i)

where v

(1

Av n

i)

The accumulated/present values of multiple cash flows can be calculated by summing the

accumulated/present values of the individual cash flows together.

Alternatively for accumulated values, an iterative approach may be used, as it allows the

accumulated value to be investigated at each year.

Accumulated Value in n years from today, sn , of a series of payments of 1 in 1, 2, 3,...,n

years from today, at an interest rate of i per annum:

sn

i)n

i

(1

Present Value today, an , of a series of payments of 1 in 1, 2, 3,...,n years from today, at an

interest rate of i per annum:

an

Adam Butt

Version 1 (2015)

vn

1

i

Page 11

You might also like

- Syed Babar Ali School of Science and EngineeringDocument106 pagesSyed Babar Ali School of Science and EngineeringZeeshan KhanNo ratings yet

- Time Value of Money-PowerpointDocument83 pagesTime Value of Money-Powerpointhaljordan313No ratings yet

- Economics For EngineersDocument11 pagesEconomics For EngineersUdop CharlesNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Nilai Waktu Uang Bhs InggrisDocument7 pagesNilai Waktu Uang Bhs InggrisALBERT KURNIAWANNo ratings yet

- An MBA in a Book: Everything You Need to Know to Master Business - In One Book!From EverandAn MBA in a Book: Everything You Need to Know to Master Business - In One Book!No ratings yet

- FM I CH IiiDocument8 pagesFM I CH IiiDùķe HPNo ratings yet

- Time Value of MoneyDocument38 pagesTime Value of MoneydadplatinumNo ratings yet

- Chapter One - Time Value of Money-1-29 Part OneDocument29 pagesChapter One - Time Value of Money-1-29 Part OnesamicoNo ratings yet

- Group 6.time Value of Money and Risk and Return - FinMan FacilitationDocument95 pagesGroup 6.time Value of Money and Risk and Return - FinMan FacilitationNaia SNo ratings yet

- Fin Man Unit 5Document5 pagesFin Man Unit 5Jenelle Lee ColeNo ratings yet

- FM TheoryDocument55 pagesFM TheoryDAHIWALE SANJIVNo ratings yet

- Chapter 02Document4 pagesChapter 02Gautam DNo ratings yet

- Financial Management Time Value of Money Lecture 2 3 and 4Document12 pagesFinancial Management Time Value of Money Lecture 2 3 and 4Kratika Pandey SharmaNo ratings yet

- DivD 4731 DikshaJain Assignment1Document9 pagesDivD 4731 DikshaJain Assignment1Diksha JainNo ratings yet

- Managerial Finance chp5Document13 pagesManagerial Finance chp5Linda Mohammad FarajNo ratings yet

- Chapter 4Document69 pagesChapter 4xffbdgngfNo ratings yet

- ManagmentDocument91 pagesManagmentHaile GetachewNo ratings yet

- FM Chapter 5Document65 pagesFM Chapter 5Nagiib Haibe Ibrahim Awale 6107No ratings yet

- TVM Stocks and BondsDocument40 pagesTVM Stocks and Bondseshkhan100% (1)

- M T R E: Oney-Ime Elationship and QuivalenceDocument53 pagesM T R E: Oney-Ime Elationship and QuivalenceKIM JINHWANNo ratings yet

- Concept of Value and Return Question and AnswerDocument4 pagesConcept of Value and Return Question and Answervinesh1515No ratings yet

- TVM - Stocks and BondsDocument42 pagesTVM - Stocks and BondsSafi SheikhNo ratings yet

- PEB4102 Chapter 4 - UpdatedDocument79 pagesPEB4102 Chapter 4 - UpdatedLimNo ratings yet

- Econ 313 Handout Time Value of MoneyDocument63 pagesEcon 313 Handout Time Value of MoneyKyle RagasNo ratings yet

- Time Value of MoneyDocument78 pagesTime Value of Moneyneha_baid_167% (3)

- Chapter 4 - Time Value of MoneyDocument46 pagesChapter 4 - Time Value of MoneyAubrey AlvarezNo ratings yet

- Time Value of MoneyDocument60 pagesTime Value of MoneyZain AbbasNo ratings yet

- The Time Value of MoneyDocument29 pagesThe Time Value of MoneysonalbharatiNo ratings yet

- FM Unit 4 Lecture Notes - Time Value of MoneyDocument4 pagesFM Unit 4 Lecture Notes - Time Value of MoneyDebbie DebzNo ratings yet

- Financial Mathematics Lecture Notes Fina PDFDocument71 pagesFinancial Mathematics Lecture Notes Fina PDFTram HoNo ratings yet

- Time Value of Money Notes Loan ArmotisationDocument12 pagesTime Value of Money Notes Loan ArmotisationVimbai ChituraNo ratings yet

- M T R E: Oney-Ime Elationship and QuivalenceDocument30 pagesM T R E: Oney-Ime Elationship and QuivalenceClifford BacsarzaNo ratings yet

- The Time Value of Money: Money NOW Is Worth More Than Money LATER!Document37 pagesThe Time Value of Money: Money NOW Is Worth More Than Money LATER!Meghashyam AddepalliNo ratings yet

- Business Finance Module 5Document10 pagesBusiness Finance Module 5CESTINA, KIM LIANNE, B.No ratings yet

- Time Value of MoneyDocument18 pagesTime Value of MoneyJunaid SubhaniNo ratings yet

- Foundations of Engineering EconomyDocument50 pagesFoundations of Engineering EconomyOrangeNo ratings yet

- Ceng - 24: Engineering Economy: Interest Is The Manifestation of The Time Value of MoneyDocument7 pagesCeng - 24: Engineering Economy: Interest Is The Manifestation of The Time Value of MoneyJayvee ColiaoNo ratings yet

- Actmath Lecture NotesDocument320 pagesActmath Lecture NotesNuwan ScofieldNo ratings yet

- Lecture Notes On Actuarial Mathematics Jerry Alan VeehDocument320 pagesLecture Notes On Actuarial Mathematics Jerry Alan VeehRochana RamanayakaNo ratings yet

- Simple Annuity DueDocument3 pagesSimple Annuity Duefamous boy357No ratings yet

- Bfin 2 NDDocument33 pagesBfin 2 NDjasmine fayNo ratings yet

- TMVTBDocument17 pagesTMVTBShantam RajanNo ratings yet

- Financial Management Time Value of Money Lecture 2,3 and 4Document12 pagesFinancial Management Time Value of Money Lecture 2,3 and 4Rameez Ramzan Ali67% (3)

- Middle East Technical University Civil Engineering DepartmentDocument33 pagesMiddle East Technical University Civil Engineering DepartmentCenk BudayanNo ratings yet

- 304A Financial Management and Decision MakingDocument67 pages304A Financial Management and Decision MakingSam SamNo ratings yet

- Personal Financial ManagementDocument39 pagesPersonal Financial ManagementNors PataytayNo ratings yet

- Engineering Economy: Chapter 3: The Time Value of MoneyDocument32 pagesEngineering Economy: Chapter 3: The Time Value of MoneyAhmad Medlej100% (1)

- Financial Mathematicg CT 1Document320 pagesFinancial Mathematicg CT 1janekhanNo ratings yet

- Time Value of MoneyDocument19 pagesTime Value of Moneyjohnnyboy30003223No ratings yet

- Finman Modules Chapter 5Document9 pagesFinman Modules Chapter 5Angel ColarteNo ratings yet

- Lecture Engineering Economic AnalysisDocument64 pagesLecture Engineering Economic Analysisvon11No ratings yet

- Lecture 5-9 Chapter 4aDocument30 pagesLecture 5-9 Chapter 4aAli AlluwaimiNo ratings yet

- PEB4102 Chapter 4Document61 pagesPEB4102 Chapter 4LimNo ratings yet

- Calculating Present and Future Value of AnnuitiesDocument4 pagesCalculating Present and Future Value of Annuitiesbernardo delos santosNo ratings yet

- Present Value 1Document7 pagesPresent Value 1shotejNo ratings yet

- Mathematics 2 Assignment: Note 1: The Following Website May HelpDocument2 pagesMathematics 2 Assignment: Note 1: The Following Website May HelpAbelNo ratings yet

- Chapters 8 and 9: Capital Budgeting: Ppts To Accompany Fundamentals of Corporate Finance 6E by Ross Et AlDocument42 pagesChapters 8 and 9: Capital Budgeting: Ppts To Accompany Fundamentals of Corporate Finance 6E by Ross Et AlAbel100% (1)

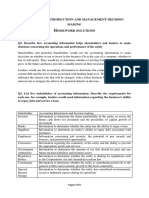

- Module 1 - Introduction and Management Decision Making - Homework SolutionsDocument4 pagesModule 1 - Introduction and Management Decision Making - Homework SolutionsAbelNo ratings yet

- Module 6 - Accounting Cycle 1 - Recording Business Transactions and Accounting For Service Entities - Part BDocument29 pagesModule 6 - Accounting Cycle 1 - Recording Business Transactions and Accounting For Service Entities - Part BAbelNo ratings yet

- Module 4 - Business SustainabilityDocument16 pagesModule 4 - Business SustainabilityAbelNo ratings yet

- Financial Accounting (F3/FFA) September 2015 (For CBE Exams From 23 September 2015) To August 2016Document14 pagesFinancial Accounting (F3/FFA) September 2015 (For CBE Exams From 23 September 2015) To August 2016AbelNo ratings yet

- Exam FileDocument14 pagesExam FileAbelNo ratings yet

- HmiscDocument397 pagesHmiscAbelNo ratings yet

- Review Women With Moustaches and Men Without Beards - Gender and Sexual Anxieties of Iranian Modernity PDFDocument3 pagesReview Women With Moustaches and Men Without Beards - Gender and Sexual Anxieties of Iranian Modernity PDFBilal SalaamNo ratings yet

- Maruti FinalDocument23 pagesMaruti FinalYash MangeNo ratings yet

- SpeechGeek H.I.-larious Volume 3Document9 pagesSpeechGeek H.I.-larious Volume 3SpeechGeekNo ratings yet

- Oleg Losev NegativeDocument2 pagesOleg Losev NegativeRyan LizardoNo ratings yet

- Prayer For Protection PDFDocument3 pagesPrayer For Protection PDFtim100% (1)

- Research InstrumentsDocument28 pagesResearch InstrumentsAnjeneatte Amarille AlforqueNo ratings yet

- Harmonica IntroDocument5 pagesHarmonica Introapi-26593142100% (1)

- Caribbean Career Opportunity - Cayman Island Water Authority - Plant Operator Cayman Brac Plant Operator (Overseas)Document1 pageCaribbean Career Opportunity - Cayman Island Water Authority - Plant Operator Cayman Brac Plant Operator (Overseas)Cawasa St-LuciaNo ratings yet

- SCI Annual Report 2017Document32 pagesSCI Annual Report 2017The Seamen's Church Institute100% (2)

- Airline and Airport Master - OdsDocument333 pagesAirline and Airport Master - OdsGiri KumarNo ratings yet

- Ajol File Journals - 404 - Articles - 66996 - Submission - Proof - 66996 4813 136433 1 10 20110608Document12 pagesAjol File Journals - 404 - Articles - 66996 - Submission - Proof - 66996 4813 136433 1 10 20110608Lovely Joy Hatamosa Verdon-DielNo ratings yet

- Jackson R. Lanning: Profile StatementDocument1 pageJackson R. Lanning: Profile StatementJacksonLanningNo ratings yet

- 17 Samss 518Document20 pages17 Samss 518Mohamed H. ShedidNo ratings yet

- Spot Welding Function R30iB Manual Del OperarioDocument130 pagesSpot Welding Function R30iB Manual Del Operariopedro100% (2)

- 3500 Ha027988 7Document384 pages3500 Ha027988 7Gigi ZitoNo ratings yet

- The Exchange Student (Dedicated To Rotary International)Document163 pagesThe Exchange Student (Dedicated To Rotary International)Nikita100% (1)

- Examples of Consonant BlendsDocument5 pagesExamples of Consonant BlendsNim Abd MNo ratings yet

- 5CT PDVSA em - 18!00!05 EnglishDocument27 pages5CT PDVSA em - 18!00!05 EnglishJuan Gutierrez100% (1)

- Data Mining With Apriori AlgorithmDocument12 pagesData Mining With Apriori AlgorithmMAYANK JAINNo ratings yet

- Fin 320 - Individual AssignmentDocument14 pagesFin 320 - Individual AssignmentAnis Umaira Mohd LutpiNo ratings yet

- Assembling Your Antenna SystemDocument27 pagesAssembling Your Antenna SystemKam MusNo ratings yet

- Basic Definition of Manufacturing SystemDocument18 pagesBasic Definition of Manufacturing SystemRavenjoy ArcegaNo ratings yet

- Sample Barista Offer LetterDocument2 pagesSample Barista Offer LetterMohammed Albalushi100% (2)

- Coca-Cola BeverageDocument17 pagesCoca-Cola BeverageMahmood SadiqNo ratings yet

- Shib Mandir, PO-Kadamtala Dist-Darjeeling WB - 734011 JC 18, 3RD Floor, Sector - III Salt Lake City, Kolkata 700098Document7 pagesShib Mandir, PO-Kadamtala Dist-Darjeeling WB - 734011 JC 18, 3RD Floor, Sector - III Salt Lake City, Kolkata 700098Rohit DhanukaNo ratings yet

- Sri Anjaneya Cotton Mills LimitedDocument63 pagesSri Anjaneya Cotton Mills LimitedPrashanth PB50% (2)

- Four Quartets: T.S. EliotDocument32 pagesFour Quartets: T.S. Eliotschwarzgerat00000100% (1)

- Barclays Personal Savings AccountsDocument10 pagesBarclays Personal Savings AccountsTHNo ratings yet

- Colony Earth - Part X: The Myriad WorldsDocument7 pagesColony Earth - Part X: The Myriad WorldsV. Susan FergusonNo ratings yet

- Appendix h6 Diffuser Design InvestigationDocument51 pagesAppendix h6 Diffuser Design InvestigationVeena NageshNo ratings yet