Professional Documents

Culture Documents

IIBF Vision May 2015

Uploaded by

rksp99999Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IIBF Vision May 2015

Uploaded by

rksp99999Copyright:

Available Formats

A Monthly Newsletter of Indian Institute of Banking & Finance

(Rs. 40/- per annum)

(ISO 9001 : 2008 CERTIFIED)

Committed to

professional excellence

Volume No. : 7

Issue No. : 10

May 2015

No. of Pages - 8

Bi-Monthly Monetary Policy Statement : 7th April, 2015

The policy

repo rate under the Liquidity Adjustment

Facility (LAF) remains unchanged at 7.5%.

The Cash Reserve Ratio (CRR) of scheduled banks

remains unchanged at 4.0% of Net Demand and Time

Liability (NDTL).

To provide liquidity under overnight repos at 0.25%

of bank-wise NDTL at the LAF repo rate and liquidity

under 7-day and 14-day term repos of up to 0.75% of

NDTL of the banking system through auctions.

To continue with daily variable rate repos and reverse

repos to smooth liquidity.

The reverse repo rate under the LAF remains unchanged

at 6.5%, and the Marginal Standing Facility (MSF) rate

and the Bank Rate at 8.5%.

UCBs eye NextGen tag with credit cards

By allowing Urban Co-operative Banks (UCBs) to issue

credit cards, RBI has allowed new avenue to traditional

banks to emerge as NextGen banks. In the Monetary

Policy announcement, Dr. Raghuram Rajan, Governor,

RBI said in order to enlarge the scope and business

of UCBs, the Financially Sound and Well-Managed

(FSWM) scheduled UCBs, which are CBS-enabled and

having minimum net worth of `100 crore, will now be

allowed to issue credit cards. Similarly, with a view to

providing greater freedom to state co-operative banks to

expand their business and to provide technology-enabled

services to their customers, it has been decided to permit

State Co-operative Banks satisfying certain eligibility

criteria to set up off-site ATMs / mobile ATMs without

obtaining prior approval from the Reserve Bank of India.

Parliament passes Payments and Settlement Bill

The Parliament has passed a Bill that seeks to address the

problem of insolvency in the payment and settlement

system by increasing transparency and stability and

the

n of

ssio develop d

i

m

n

o

The

is "t

ied a

tute ly qualif and

i

t

s

n

I

onal ankers ls

essi

b

prof petent essiona ess

c

com ce prof

a pro

finan through aining,

cy /

n, tr

arily

prim educatio onsultan ing

of

on, c continu nt

inati

d

e

exam elling an evelopm

s

d

n

l

u

a

o

c

"

on

essi ograms.

prof

pr

Bi-Mon

thly Mo

netary

Policy S

Top Sto

tateme

ries ......

nt ......1

............

............

Bankin

g Policie

............

.......1

s ..........

Bankin

............

g Deve

............

lopmen

..

....2

ts ........

Regula

............

tor's Sp

..........3

eak / N

ew App

Insuran

ointmen

ce / Fo

t ......4

rex ......

............

Produc

............

ts & All

.........5

iances

............

Basel II

............

I-Capita

..........5

l Regula

Financia

tions ....

l Basics

............

.....6

............

Glossa

............

ry / Insti

............

tute's T

..

...6

raining

News fr

Activitie

om the

s ......7

Institute

Market

............

Roundu

............

p ..........

......7

............

............

......8

"The information / news items contained in this publication have appeared in various external sources / media for public use

or consumption and are now meant only for members and subscribers. The views expressed and / or events narrated /

stated in the said information / news items are as perceived by the respective sources. IIBF neither holds nor assumes any

responsibility for the correctness or adequacy or otherwise of the news items / events or any information whatsoever."

Top Stories - Banking Policies

bringing India's banking payment system in sync with

international practices. The amendment seeks to protect

funds collected from the customers by the payment

system providers. It also seeks to extend the Act to cover

trade repository and legal entity identifier issuer.

by borrowers, the asset classification, and consequent

provisioning, depends upon the realisable value of

security. On a review, RBI has decided to prescribe a

uniform provisioning norm in respect of all cases of

fraud. The entire amount due to the bank (irrespective

of the quantum of security held against such assets),

or for which the bank is liable (including in case of

deposit accounts), is to be provided for over a period not

exceeding four quarters commencing with the quarter in

which the fraud has been detected. However, where there

has been delay, beyond the prescribed period, in reporting

the fraud to Reserve Bank, the entire provisioning is

required to be made at once. In addition, Reserve Bank

of India may also initiate appropriate supervisory action

where there has been a delay by the bank in reporting

a fraud, or provisioning there against.

RBI tightens rules for export credit to repay rupee loans

RBI has tightened the rules for granting long-term

export advances to curb the practice of using trade

finance to retire old rupee loans. The facility for longterm export advances was primarily being utilized for

refinancing rupee loans of borrowers, instead of using

it to execute long-term supply contracts for export of

goods. In order to ensure that long term export advances

are used for the intended purpose, RBI advised that

while eligible Indian companies may continue to avail

of the facilities available to them under the guidelines,

any repayment / refinancing of rupee loans with foreign

currency borrowings / export advances, where permitted,

will be subject to certain conditions : If the foreign

currency borrowings / export advances, are obtained from

lenders who are not part of the Indian banking system

(Indian banking system would include all banks in

India and overseas branch / subsidiary / joint venture of

Indian banks) without any support from the Indian

banking system in the form of Guarantees / Standby

Letters of Credit / Letters of Comfort etc., the same may

be utilised to refinance / repay loans availed from the

Indian banking system. If obtained from lenders who

are part of Indian banking system (where permitted);

or with support (where permitted) from the Indian

banking system in the form of Guarantees / Standby

Letters of Credit / Letters of Comfort, etc.; then,

in addition to any applicable guidelines issued under

the Foreign Exchange Management Act, 1999 (42 of

1999), the refinance shall be treated as 'restructuring',

if the above borrowings / export advances are extended

to a borrower who is under financial difficulty and

involve concessions that the bank would otherwise not

consider.

Banking Policies

RBI liberalises norms for taking position in exchangetraded currency derivatives

Foreign Portfolio Investors can take position - both long

(bought) as well as short (sold) - in foreign currency up to

USD 10 million or equivalent per exchange . As a measure

of further liberalisation, it has now been decided to increase

the limit (long as well as short) for FPIs in USD-INR pair

upto USD 15 million per exchange. In addition, FPIs shall

be allowed to take long (bought) as well as short (sold)

positions in EUR-INR, GBP-INR and JPY-INR pairs, all

put together, upto USD 5 million equivalent per exchange.

These limits shall be monitored by the exchanges and

breaches, if any, may be reported. For the convenience of

monitoring, exchanges may prescribe fixed limits for the

contracts in currencies other than USD such that these

limits are within the equivalent of USD 5 million.

Banks get further flexibility in debt recast if promoter

changes

RBI has given banks additional time for classifying a

restructured asset as non-performing by extending the Date

of Commencement of Commercial Operations (DCCO)

by up to two years for projects whose ownership changes.

The DCCO might get further extension of two years

(more) for infrastructure projects stuck due to court cases.

An extension of one year is granted beyond the two year

period quoted above, when the project is delayed due to

reasons beyond the control of the promoters (other than

court cases). For project loans to the non-infrastructure

sector, other than commercial real estate exposures, DCCO

could be extended by one more year. If the implementation

of the project has been stalled primarily due to inadequacies

of the existing promoters and if a change in ownership takes

place before the DCCO, an extension of two years is now

allowed in addition to the extension of DCCO permitted

under existing regulations.

Provisioning pertaining to fraud accounts

In regard to Prudential Norms on Income Recognition,

Asset Classification and Provisioning pertaining to

Advances, in terms of which, in accounts where there

are potential threats for recovery on account of erosion

in the value of security or non availability of security

and existence of other factors such as frauds committed

IIBF VISION

May 2015

Banking Policies - Banking Developments

term deposits of `1 crore and above. Banks will have

the discretion to offer differential interest rates based on

whether the term deposits are with or without-prematurewithdrawal-facility, subject to certain conditions. Under

new guidelines all term deposits of individuals (held singly

or jointly) of `15 lakh and below should, necessarily, have

premature withdrawal facility, for others, banks can offer

deposits without the option of premature withdrawal as

well. However, banks that offer such term deposits should

ensure that at the customer interface point the customers

are, in fact, given the option to choose between term

deposits either with or without premature withdrawal

facility. Banks should also disclose in advance the schedule

of interest rates payable on deposits. The banks should have

a Board approved policy with regard to interest rates on

deposits including deposits with differential rates of interest

and ensure that the interest rates offered are reasonable,

consistent, transparent and available for supervisory review /

scrutiny as and when required.

RBI issues guidelines for identification of Wilful Defaulters

RBI said that the evidence of wilful default on the part

of the borrowing company and its promoter / wholetime director at the relevant time should be examined

by a Committee headed by an Executive Director and

consisting of two other senior officers of the rank of GM /

DGM. If the Committee concludes that an event of wilful

default has occurred, it shall issue a Show Cause Notice

to the concerned borrower and the promoter / wholetime director and call for their submissions and after

considering their submissions issue an order recording

the fact of wilful default and the reasons for the same.

An opportunity should be given to the borrower and the

promoter / whole-time director for a personal hearing

if the Committee feels such an opportunity is necessary.

All other rules of wilful defaulters declaration and

intervention will remain the same. RBI also said that a

non-whole time director should not be considered as a

defaulter unless it is conclusively established that he was

aware of the fact of default by the borrower by virtue of

any proceedings recorded in the Minutes of the Board

or a Committee of the Board and has not recorded his

objection to the same in the Minutes, or, the default had

taken place with his consent or connivance.

RBI raises borrowing limit of NBFC-MFI clients

RBI has allowed Non Banking Financial CompanyMicrofinance Institutions (NBFC-MFIs) to increase the

cap on the borrowing limit of their clients by `50,000 to

`1 lakh. In order to widen the scope, it has been decided

that loan disbursed by an NBFC-MFI to a borrower with a

rural household annual income not exceeding `1,00,000

or urban and semi-urban household income not exceeding

`1,60,000 would be eligible to be defined as a qualifying

asset. NBFCs-MFI while disbursing loans were required

to ensure that the total indebtedness of the borrower does

not exceed `50,000. In partial modification of the above,

the limit of total indebtedness of the borrower has been

increased to `1,00,000. Education and medical expenses

will be excluded while arriving at the total indebtedness of

a borrower. As per the earlier notification, loan amount

should not exceed `35,000 in the first cycle and `50,000

in subsequent cycles. In light of the revision to the limit on

total indebtedness, it has been decided to revise the limit

on disbursal of loans. Henceforth, the loan amount should

not exceed `60,000 in the first cycle and `1,00,000 in

subsequent cycles.

Banking units in IFSC must have capital of at least $20

million

RBI has mandated capital of at least $20 million for

setting up banking units in the International Financial

Services Centre (IFSC) near Gandhinagar, Gujarat. Both

Indian banks and Foreign banks in India have to adhere

to this requirement. Banks seeking to set up units within

special financial zones could only transact in currencies

other than the rupee. All prudential norms applicable to

overseas branches of Indian banks would apply to IFSC

Banking Units (IBUs). Specifically, these units would be

required to follow the 90 days' payment delinquency

norm for income recognition, asset classification and

provisioning as applicable to Indian banks. The IBUs

would be required to adopt liquidity and interest rate risk

management policies prescribed by Reserve Bank in

respect of overseas branches of Indian banks and function

within the overall risk management and ALM framework

of the bank subject to monitoring by the board at

prescribed intervals. Each bank will be allowed to set up

only a single unit in IFSC. The liabilities of the banking

unit would be exempt from the Cash Reserve Ratio (CRR)

and Statutory Liquidity Ratio (SLR) requirements.

Banks Can Now Offer Differential Rates to Fixed

Deposit Holders

Banks are now allowed to offer differential rates of interest

on term deposits on the basis of tenor for deposits less

than `1 crore and on the basis of quantum and tenor on

IIBF VISION

Banking Developments

At 9.75%, non-food credit grows lowest in a decade on

slowdown

Banks' non-food credit grew at the lowest pace in a decade

in FY 2014-15 as a slow-down in the economy crimped

3

May 2015

Banking Developments - Regulator's Speak... - New Appointments

fresh loan demand from corporate and a sharp fall in

bond yields drove companies to take recourse to the bond

market. As on March 20,2015 non-food credit rose 9.75%

to an outstanding `64.70 lakh crore. Loan off-take to

manufacturing companies plummeted to 6% in February

2015, the lowest since RBI began decimating it in 2007.

With project loan sanctions hardly growing and the pipe

dry for many banks, the only boost to loan growth came

from the retail segment.

RBI scraps ceiling on buyer's credit for project exports

In order to push project exports, RBI has scrapped the

limit on banks to extend buyer's credit. RBI has withdrawn

the earlier ceiling of $20 million for buyer's credit extended

to foreign buyers for export of goods on deferred payment

terms and turn-key projects from India. The step has been

taken to further liberalizing the procedures for export of

goods and services. Memorandum of instructions on

project and service exports has been revised accordingly.

Banks turn to BCs to make Jan Dhan accounts operational

As of February, 2015, about 13.68 crore accounts were

opened by PSBs, RRBs and Private Sector banks under the

Pradhan Mantri Jan Dhan Yojana (PMJDY). However,

out of these, about 8.60 crore accounts have zero balance

and the Indian Banks' Association (IBA) is now working

on making them operational. IBA has suggested that

Banking Correspondents (BCs)be imparted the necessary

training to help operationalize and make these accounts

viable. There are 2.5 lakh BCs providing banking services

especially in the unbanked and under-banked areas of

the country. The IBA, banks, NABARD and the Indian

Institute of Banking and Finance (IIBF) have drawn up a

road-map to familiarise BCs with banking products and

financial services like micro insurance, micro pensions,

etc. to make them available to the target group. The course

content will be prepared by IIBF and will include PMJDY.

IIBF is also ready to roll out a two-day Trainers' Training

Programme across state capitals. BCs will be certified after

successfully completing this training in which they will

be familiarized with technology and basic knowledge of

products. The BCs, though well-versed with technologies

like handling Point of Sales (PoS) devices, micro ATMs

and biometric devices, are seen lacking in the knowledge

of basic banking products and services. Hence, they need

to be given the appropriate training.

Easier KYC for sole owner companies to open Co-op

bank A/cs

Relaxing KYC norms, RBI has allowed sole proprietor firms

to open accounts in urban, state and central co-operative

banks by submitting a single proof of their business (instead

IIBF VISION

of two documents as were required earlier), if it is not

possible for them to submit two documents. However, the

banks would have to undertake contact point verification,

collect such information as would be required to establish

the existence of such firm, confirm, clarify and satisfy

themselves that the business activity has been verified from

the address of the proprietary concern.

RBI fixes ceiling on MSS balance

Reserve Bank of India, in accordance with the provisions

of the Memorandum of Understanding (MoU) on the

Market Stabilisation Scheme (MSS) with Government of

India, the ceiling for the outstanding balance under the

MSS for the fiscal year 2015-16 has been fixed at `50,000

crore. This ceiling will be reviewed when the outstanding

balance reaches the threshold limit of `35,000 crore. The

current MSS outstanding balance is nil.

Regulator's Speak...

Need for more options to trade in currencies

Mr. G. Padmanabhan, Executive Director, RBI has

proposed more options instruments to trade in currencies

and shifting more of other currency debt into rupee debt.

He opines There is a need to appropriately incentivize

the move away from foreign currency debts to rupee debts

even as the position of overall indebtedness is prudentially

managed. We propose to pursue this matter further in a

calibrated manner.

Differentiated banking is key to financial inclusion

Mr. R. Gandhi, Deputy Governor, RBI while delivering

the 10th Sri Narayanan Memorial Lecture at Sastra

University Campus in Tamil Nadu said that there are

diverse opportunities in the banking and financial

landscape reflecting significant macro-economic growth

potential in India and differentiated licensing could

enable unlocking potential of these opportunities as it

encourages niche banking by facilitating specialisation

thereby reducing potential non-optimal use of resources.

Issues of conflict of interest when a bank performs

multiple functions would not arise, where differentiated

licenses are issued. He added that core competency could

be better harnessed leading to enhanced productivity

in terms of reduced intermediation cost, better price

discovery and improved allocative efficiency.

New Appointments

Name

Designation / Organisation

Mr. G. Sreeram

Managing Director & CEO of Dhanlaxmi Bank

May 2015

Insurance - Forex - Products & Alliance

Foreign Exchange Reserves

As on 24th April 2015

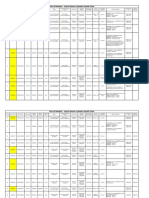

Item

`Bn.

Insurance

Motor third party premiums for FY 2015-16

From 1st April 2015, the Insurance Regulatory and

Development Authority of India (IRDAI) has hiked

the vehicle insurance premiums depending on the type

of vehicle owned. However, Insurers are not permitted

to cancel the current insurance policies and issue fresh

policies to effect new premium rates. The schedule of

premium rates shall be prominently displayed on the

Notice Board of every underwriting office of the insurers

where it can be viewed by the public.

Insurance FDI cap increased to 49%

The extant FDI policy for the insurance sector has

been reviewed and further liberalized. On 1st April 2015,

Reserve Bank of India (RBI) has notified the

government's decision to raise Foreign Direct Investment

(FDI) limit in the insurance sector to 49%, subject

to revised conditions. Also, a new activity viz. Other

Insurance Intermediaries appointed under the provisions

of Insurance Regulatory and Development Authority

Act, 1999 (41 of 1999) has been included within the

definition of 'Insurance'.

US $ Mn.

Total Reserves

21,810.2

344,605.6

(a) Foreign Currency Assets

20,277.0

320,264.0

(b) Gold

1,191.6

19,038.0

(c) SDRs

259.3

4,005.4

(d) Reserve Position in the IMF

82.3

1,298.2

Source : Reserve Bank of India (RBI)

Products

& Alliances

Organisation

Organisation

Purpose

tied up with

SIDBI

World Bank

To make available debt assistance

to Start-ups (MSME) through

innovative financing models and

to meet the gaps in the Start-up

ecosystem.

SIDBI

World Bank

To support the GoIs efforts to

transform the Energy Efficiency

(EE) market in India by promoting

increased level of EE investments.

Forex

YES Bank

Paytm

To provide an easier way for its

users to add cash in their Paytm

Benchmark Rates for FCNR (B) Deposits

applicable for the month of May 2015

wallet by online transferring their

money through their bank account

LIBOR / SWAP for FCNR (B) Deposits

at many banks across India.

LIBOR

SWAPS

Bandhan

Life Insurance

To mandatorily cover the women

1 year

2 years

3 years

4 years

5 years

Financial

Corporation of

borrowers as well as their

USD

0.46600

0.82500

1.13300

1.38100

1.57900

Services Pvt.

India (LIC)

spouses while granting the loan.

GBP

0.68940

0.9947

1.2140

1.3878

1.5268

Ltd. (BFSPL)

ICICI Bank

Tech

To enable customers with the

Mahindra

help of Tap-n-pay card to make

Currency

EUR

0.06900

0.085

0.150

0.210

0.286

JPY

0.15630

0.164

0.179

0.214

0.263

CAD

1.02000

1.074

1.180

1.303

1.438

AUD

2.10400

2.123

2.212

2.430

2.550

CHF

-0.68000

-0.590

-0.490

-0.360

-0.230

DKK

0.05800

0.1420

0.2410

0.3460

over-the-counter payments

without using cash.

ICICI Bank

0.4670

NZD

3.56750

3.500

3.560

3.608

3.670

SEK

-0.16700

-0.060

0.101

0.267

0.442

SGD

1.09000

1.330

1.570

1.785

1.960

HKD

0.53000

0.830

1.130

1.360

1.520

MYR

3.62000

3.610

3.650

3.720

3.780

Bangalore

To offer debit and credit card

Metro Rail

benefits to commuters through

Corporation

ICICI Bank Unifare Bangalore

Metro card.

Union Bank

Star Union

To offer SUDs Life Reverse

of India

Dai-Ichi

Mortgage loan enabled annuity plan

to its potential customers among

the home owing senior citizens.

Source : www.fedai.org.in

IIBF VISION

May 2015

Basel III - Financial Basics

7. There are no circumstances under which the

distributions are obligatory. Non-payment is therefore

not an event of default.

8. Distributions are paid only after all legal and

contractual obligations have been met and payments

on more senior capital instruments have been made.

This means that there are no preferential distributions,

including in respect of other elements classified as the

highest quality issued capital.

9. It is the paid up capital that takes the first and

proportionately greatest share of any losses as

they occur. Within the highest quality capital,

each instrument absorbs losses on a going concern

basis proportionately and pari passu with all the

others.

10.The paid up amount is classified as equity capital (i.e.

not recognised as a liability) for determining balance

sheet insolvency.

11.The paid up amount is classified as equity under the

relevant accounting standards.

12.It is directly issued and paid up and the bank cannot

directly or indirectly have funded the purchase of the

instrument. Banks should also not extend loans against

their own shares.

13.The paid up amount is neither secured nor covered

by a guarantee of the issuer or related entity nor subject

to any other arrangement that legally or economically

enhances the seniority of the claim.

14.Paid up capital is only issued with the approval of the

owners of the issuing bank, either given directly by the

owners or, if permitted by applicable law, given by the

Board of Directors or by other persons duly authorised

by the owners.

15.Paid up capital is clearly and separately disclosed in the

bank's balance sheet.

(Source : Reserve Bank of India)

Basel III - Capital Regulations (Continued...)

In continuation of the discussion on BASEL III

Capital Regulations, we enumerate the following

information :

Criteria for Classification as Common Shares (Paid-up

Equity Capital) for Regulatory Purposes - Indian Banks

1. All common shares should ideally be the voting shares.

However, in rare cases, where banks need to issue nonvoting common shares as part of Common Equity Tier

1 capital, they must be identical to voting common

shares of the issuing bank in all respects except the

absence of voting rights. Limit on voting rights will be

applicable based on the provisions of respective statutes

governing individual banks {i.e. Banking Companies

(Acquisition and Transfer of Undertakings) Act, 1970 /

1980 in case of nationalized banks; SBI Act, 1955

in case of State Bank of India; State Bank of India

(Subsidiary Banks) Act, 1959 in case of associate banks

of State Bank of India; Banking Regulation Act, 1949

in case of Private Sector Banks, etc.}

2. Represents the most subordinated claim in liquidation

of the bank.

3. Entitled to a claim on the residual assets which is

proportional to its share of paid up capital, after

all senior claims have been repaid in liquidation

(i.e. has an unlimited and variable claim, not a fixed

or capped claim).

4. Principal is perpetual and never repaid outside of

liquidation (except discretionary repurchases / buy

backs or other means of effectively reducing capital

in a discretionary manner that is allowable under

relevant law as well as guidelines, if any, issued by RBI

in the matter).

5. The bank does nothing to create an expectation

at issuance that the instrument will be bought

back, redeemed or cancelled nor do the statutory

or contractual terms provide any feature which might

give rise to such an expectation.

6. Distributions are paid out of distributable items.

The level of distributions is not in any way tied or

linked to the amount paid up at issuance and is

not subject to a contractual cap (except to the

extent that a bank is unable to pay distributions

that exceed the level of distributable items). As

regards 'distributable items', it is clarified that the

dividend on common shares will be paid out of current

year's profit only.

IIBF VISION

Financial Basics

BASEL Committee on Banking Supervision

The BASEL Committee is a committee of bank

supervisors consisting of members from each of the G10

countries. The Committee is a forum for discussion on the

handling of specific supervisory problems. It co-ordinates

the sharing of supervisory responsibilities among national

authorities in respect of banks' foreign establishments

with the aim of ensuring effective supervision of banks'

activities worldwide.

May 2015

Glossary - Institute's Training - News from the Institute

Cut-off Date of Guidelines / Important Developments

for Examinations

In respect of the exams to be conducted by the Institute

during May / June of a calendar year, instructions /

guidelines issued by the regulator(s) and important

developments in banking and finance up to 31st December

of the previous year will only be considered for the

purpose of inclusion in the question papers.

In respect of the exams to be conducted by the Institute

during November / December of a calendar year,

instructions / guidelines issued by the regulator(s) and

important developments in banking and finance up to

30th June of that year will only be considered for the

purpose of inclusion in the question papers.

Launch of Updated Syllabus from May / June 2015

examination

The syllabi for the JAIIB and Diploma in Banking &

Finance (DB&F) examinations have been updated due

to changes that have happened in the banking and finance

space. The updated syllabus for JAIIB and Diploma

in Banking & Finance (DB&F) examinations will be

applicable for candidates appearing from the May / June

2015 examination onwards. The updated courseware

(study material) in Hindi & English is available in the

market. For details visit www.iibf.org.in.

Code of conduct for blended courses

The Institute has started issuing a code of conduct to all

the successful candidates completing the blended courses

and they are encouraged to adhere to the same. For details

visit www.iibf.org.in.

Additional Reading Material for Institute's examination

The Institute has put on its web site additional reading

material, for various examinations, culled out from the

Master Circulars of RBI and other sources. These are

important from examination view point. For details visit

www.iibf.org.in.

Green Initiative

Members are requested to update their e-mail address

with the Institute and send their consent to receive the

Annual Report via e-mail in future.

CAIIB Linked MBA

IGNOU has announced the enrolment for the next

batch of MBA (Banking & Finance) course. For details

visit www.iibf.org.in.

Continuing Professional Development (CPD)

CPD programme is open to current members of the

Institute, regardless of previous qualification. Members

who have not yet registered are requested to register for

CPD programme now. For details visit www.iibf.org.in.

Glossary

Standby Letters of Credit

A guarantee of payment issued by a bank on behalf of a

client that is used as "payment of last resort" should the

client fail to fulfill a contractual commitment with a third

party. Standby letters of credit are created as a sign of good

faith in business transactions, and are proof of a buyer's

credit quality and repayment abilities. The bank issuing

the SLOC will perform brief underwriting duties to ensure

the credit quality of the party seeking the letter of credit,

then send notification to the bank of the party requesting

the letter of credit (typically a seller or creditor). A standby

letter of credit will typically be in force for about one year,

allowing for enough time for payment to be made through

standard contractual guidelines. Standby letters of credit

are often used in international trade transactions, such as

the purchase of goods from another country.

Institute's Training Activities

Training Programme Schedule for the month of May 2015

No. Name of the programme

Date

Location

1. Post examination

training for Certified

Credit Officers

5th to 9th May, 2015

4th to 8th May, 2015

5th to 9th May, 2015

Mumbai

Kolkata

Trivandrum

2. Post examination training

for Certified Banking

Compliance Officers

25th to 29th May, 2015 Mumbai

25th to 29th May, 2015 Chennai

25th to 29th May, 2015 Delhi

3. Post examination training

for Certified Treasury

Dealer Course

22nd to 24th May, 2015 Mumbai

4. Post examination training

for Certified Bank Trainer

Programme

25th to 29th May 2015

NIBM,

Pune

News From the Institute

Certificate examination for BCs / BFs (PMJDY)

The Institute has recently launched a Certificate

Examination for BCs / BFs under the Pradhan Mantri

Jan Dhan Yojana (PMJDY) scheme. The Institute

has also published a book titled Inclusive Banking

thro' Business Correspondent - A tool for PMJDY.

(For details visit www.iibf.org.in)

Call for Conference Papers

The Institute would be organizing the APABI International

Banking Conference 2015 on the theme New Paradigms

in Banking. Papers on any topic related to the theme of the

conference are invited. For details visit www.iibf.org.in.

IIBF VISION

May 2015

News from the Institute - Market Roundup

Posted at Mumbai Patrika Channel Sorting Office, Mumbai

WPP Licence No. : MR / Tech / WPP - 62 / N E / 2013 - 15

Licence to post without prepayment.

/ 1998

Sending of hard copies of IIBF Vision document

The Institute is forwarding the monthly IIBF Vision

by e-mails to all the members who had registered

their e-mail ids with the Institute. Members who have

not registered their e-mail ids are requested to register

the same with the Institute on or before 30th September,

2015. The Institute is going to discontinue sending

the hard copies of the IIBF vision with effect from

October-2015 to all members. The members are

requested to note that only the soft copies of IIBF

Vision will be sent by e-mail in the future.

100.00

90.00

80.00

70.00

60.00

USD

EURO

100 Jap Yen

30/04/15

29/04/15

27/04/15

24/04/15

21/04/15

15/04/15

09/04/15

06/04/15

50.00

Market Roundup

POUND STERLING

Source : Reserve Bank of India (RBI)

Weighted Average Call Rates

% p.a.

29500

BSE Sensex

29000

28500

28000

27500

27000

Source : CCIL Newsletter, April 2015

30/04/15

28/04/15

27/04/15

24/04/15

22/04/15

21/04/15

17/04/15

13/04/15

10/04/15

07/04/15

01/04/15

26000

30/04/15

28/04/15

25/04/15

23/04/15

22/04/15

20/04/15

16/04/15

11/04/15

10/04/15

26500

04/04/15

% p.a.

7.80

7.60

7.40

7.20

7.00

6.80

6.60

6.40

6.20

6.00

-1

RBI Reference Rates

110.00

07/04/15

Registered with Registrar of Newspapers under RNI No. : 69228

Postal Registration No. : MH / MR / North East / 295 / 2013 - 15

Published on 25th of every month.

Posting Date : 25th to 30th of every month.

Source : Bombay Stock Exchange (BSE)

Printed by Dr. J. N. Misra, published by Dr. J. N. Misra on behalf of

Indian Institute of Banking & Finance, and printed at Quality Printers (I),

6-B, Mohatta Bhavan, 3rd Floor, Dr. E. Moses Road, Worli, Mumbai - 400 018

and published from Indian Institute of Banking & Finance, Kohinoor City,

Commercial-II, Tower-I, 2nd Floor, Kirol Road, Kurla (W), Mumbai - 400 070.

Editor : Dr. J. N. Misra.

INDIAN INSTITUTE OF BANKING & FINANCE

Kohinoor City, Commercial-II, Tower-I, 2nd Floor, Kirol Road, Kurla (W),

Mumbai - 400 070.

Tel. : 91-22-2503 9604 / 9746 / 9907

Fax : 91-22-2503 7332

Telegram : INSTIEXAM

E-mail : iibgen@iibf.org.in

Website : www.iibf.org.in

IIBF VISION

May 2015

You might also like

- IIBF Vision July 2015Document8 pagesIIBF Vision July 2015rksp99999No ratings yet

- North Country AutoDocument4 pagesNorth Country Autorksp99999No ratings yet

- 5125IIBF Vision Sep 2015Document8 pages5125IIBF Vision Sep 2015Satya NarayanaNo ratings yet

- IIBF Vision August 2015Document8 pagesIIBF Vision August 2015rksp99999No ratings yet

- New Jersey InsuranceDocument2 pagesNew Jersey Insurancerksp9999950% (2)

- Project On JapeeDocument136 pagesProject On Japee8004067882No ratings yet

- 4163IIBF Vision March 2015Document8 pages4163IIBF Vision March 2015Madhumita PandeyNo ratings yet

- XyzDocument8 pagesXyzyahooshuvajoyNo ratings yet

- IIBF Vision April 2015Document8 pagesIIBF Vision April 2015rksp99999No ratings yet

- Arthneeti Finance Newsletter March 2013Document26 pagesArthneeti Finance Newsletter March 2013rksp99999No ratings yet

- Financial Modelling of Interest Rate Hedging: Free TutorialDocument2 pagesFinancial Modelling of Interest Rate Hedging: Free Tutorialrksp99999No ratings yet

- Medoc Co.Document2 pagesMedoc Co.rksp99999No ratings yet

- Monthly Current Affairs Capsule - AugustDocument19 pagesMonthly Current Affairs Capsule - AugustROHITNo ratings yet

- Gilt Fund QuestionnaireDocument4 pagesGilt Fund Questionnairerksp99999No ratings yet

- Mobile BankingDocument4 pagesMobile BankingRobin HoodxiiNo ratings yet

- MCQs On General Awareness (March 2013)Document4 pagesMCQs On General Awareness (March 2013)rksp99999No ratings yet

- Important Techniques To Precis WritingDocument10 pagesImportant Techniques To Precis Writingrksp99999No ratings yet

- Westport Electric CorporationDocument3 pagesWestport Electric CorporationPraful PatilNo ratings yet

- Tips For Reading ComprehensionDocument6 pagesTips For Reading Comprehensionrksp99999No ratings yet

- How To Write PrecisDocument10 pagesHow To Write Precisrksp99999No ratings yet

- Southwest AirlinesDocument2 pagesSouthwest Airlinesrksp999990% (1)

- International Business Paper Oct 2009Document16 pagesInternational Business Paper Oct 2009rksp99999No ratings yet

- Approach To Precis WritingDocument10 pagesApproach To Precis Writingrksp99999No ratings yet

- IB Paper - November 2010Document20 pagesIB Paper - November 2010rksp99999No ratings yet

- Question Paper DS 5729 Oct 2009 Revised SylabusDocument10 pagesQuestion Paper DS 5729 Oct 2009 Revised Sylabusrksp99999No ratings yet

- International Business Paper Oct 2009Document16 pagesInternational Business Paper Oct 2009rksp99999No ratings yet

- IB - Nov 2011Document19 pagesIB - Nov 2011rksp99999No ratings yet

- Theories of International Trade and InvestmentDocument3 pagesTheories of International Trade and Investmentrksp99999No ratings yet

- International Business Paper Oct 2009Document16 pagesInternational Business Paper Oct 2009rksp99999No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Trading As A BusinessDocument169 pagesTrading As A Businesspetefader100% (1)

- 1.each of The Solids Shown in The Diagram Has The Same MassDocument12 pages1.each of The Solids Shown in The Diagram Has The Same MassrehanNo ratings yet

- Casting Procedures and Defects GuideDocument91 pagesCasting Procedures and Defects GuideJitender Reddy0% (1)

- Liebert PSP: Quick-Start Guide - 500VA/650VA, 230VDocument2 pagesLiebert PSP: Quick-Start Guide - 500VA/650VA, 230VsinoNo ratings yet

- Honda Wave Parts Manual enDocument61 pagesHonda Wave Parts Manual enMurat Kaykun86% (94)

- Passenger E-Ticket: Booking DetailsDocument1 pagePassenger E-Ticket: Booking Detailsvarun.agarwalNo ratings yet

- Rohit Patil Black BookDocument19 pagesRohit Patil Black BookNaresh KhutikarNo ratings yet

- Artist Biography: Igor Stravinsky Was One of Music's Truly Epochal Innovators No Other Composer of TheDocument2 pagesArtist Biography: Igor Stravinsky Was One of Music's Truly Epochal Innovators No Other Composer of TheUy YuiNo ratings yet

- The Impact of School Facilities On The Learning EnvironmentDocument174 pagesThe Impact of School Facilities On The Learning EnvironmentEnrry Sebastian71% (31)

- Case StudyDocument2 pagesCase StudyBunga Larangan73% (11)

- FINAL A-ENHANCED MODULES TO IMPROVE LEARNERS - EditedDocument22 pagesFINAL A-ENHANCED MODULES TO IMPROVE LEARNERS - EditedMary Cielo PadilloNo ratings yet

- Data Sheet: Experiment 5: Factors Affecting Reaction RateDocument4 pagesData Sheet: Experiment 5: Factors Affecting Reaction Ratesmuyet lêNo ratings yet

- Katie Tiller ResumeDocument4 pagesKatie Tiller Resumeapi-439032471No ratings yet

- Three-D Failure Criteria Based on Hoek-BrownDocument5 pagesThree-D Failure Criteria Based on Hoek-BrownLuis Alonso SANo ratings yet

- IDocument2 pagesIsometoiajeNo ratings yet

- GLF550 Normal ChecklistDocument5 pagesGLF550 Normal ChecklistPetar RadovićNo ratings yet

- CAS-GEC04 Module11 Food-SecurityDocument6 pagesCAS-GEC04 Module11 Food-SecurityPermalino Borja Rose AnneNo ratings yet

- SEO-Optimized Title for Python Code Output QuestionsDocument2 pagesSEO-Optimized Title for Python Code Output QuestionsTaru GoelNo ratings yet

- TWP10Document100 pagesTWP10ed9481No ratings yet

- 8.1 Interaction Diagrams: Interaction Diagrams Are Used To Model The Dynamic Aspects of A Software SystemDocument13 pages8.1 Interaction Diagrams: Interaction Diagrams Are Used To Model The Dynamic Aspects of A Software SystemSatish JadhaoNo ratings yet

- Level 3 Repair PBA Parts LayoutDocument32 pagesLevel 3 Repair PBA Parts LayoutabivecueNo ratings yet

- Unit 1 TQM NotesDocument26 pagesUnit 1 TQM NotesHarishNo ratings yet

- ConductorsDocument4 pagesConductorsJohn Carlo BautistaNo ratings yet

- Main Research PaperDocument11 pagesMain Research PaperBharat DedhiaNo ratings yet

- John Hay People's Alternative Coalition Vs Lim - 119775 - October 24, 2003 - JDocument12 pagesJohn Hay People's Alternative Coalition Vs Lim - 119775 - October 24, 2003 - JFrances Ann TevesNo ratings yet

- CMC Ready ReckonerxlsxDocument3 pagesCMC Ready ReckonerxlsxShalaniNo ratings yet

- JurnalDocument9 pagesJurnalClarisa Noveria Erika PutriNo ratings yet

- Attributes and DialogsDocument29 pagesAttributes and DialogsErdenegombo MunkhbaatarNo ratings yet

- AZ-900T00 Microsoft Azure Fundamentals-01Document21 pagesAZ-900T00 Microsoft Azure Fundamentals-01MgminLukaLayNo ratings yet

- Innovation Through Passion: Waterjet Cutting SystemsDocument7 pagesInnovation Through Passion: Waterjet Cutting SystemsRomly MechNo ratings yet