Professional Documents

Culture Documents

Chapter 2 Pelaporan Keuangan

Uploaded by

Yessie Marwah Fauziah0 ratings0% found this document useful (0 votes)

13 views5 pagesChapter 2 pelaporan keuangan

Original Title

Chapter 2 pelaporan keuangan

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentChapter 2 pelaporan keuangan

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views5 pagesChapter 2 Pelaporan Keuangan

Uploaded by

Yessie Marwah FauziahChapter 2 pelaporan keuangan

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

Chapter 2

BASIC MANAGEMENT

ACCOUNTING CONCEPT

THE MEANING and USES of COST

Cost of product, service, customer, and other item

- sangat penting?

- penentuan / perhitungan: sangat penting

system akuntansi biaya

Cost?

- The amount of cash or equivalent cash

- Dikorbankan untuk barang atau jasa

- Yg diharapkan

Bentuk pengorbanan (ekonomi)

- Berkurangnya kas, atau

- Berkurangnya asset lain, atau

- Bertambahnya hutang

Accumulating and Assigning Costs

- Accumulating costs

o Pengukuran dalam Rp

o pencatatan

- Assigning costs

Costs Objects (objek biaya)

Assigning Costs to Costs Objects

- Direct costs: dapat ditelusuri ke obyek biaya

tertentu

- Indirect costs:

o Allocation a reasonable and convenient

method.

Other Categories of cost

- Variable costs:

o Per unit: tetap

o Total:

- Fixed costs (pada range kapasitas tertentu)

o Per unit:

o Total: tetap

Opportunity costs (biaya peluang atau

kesempatan)

Relevant cost vs irrelevant cost

- Relevant costs -> bentuk

o Incremental costs

o Decremental cost

o Avoidable cost

o Future costs (tidak selalu relevant)

o Opportunity costs

- Irrelevan costs

o Sunk cost (selalu tidak relevant)

o Unavoidable cost

PRODUCT and SERVICE COSTS

- Products

- manufacturing organization

- Services

Service organization

Perbedaan produk dan jasa

Providing Cost Information

- Type informasi

- Pengukuran informasi

- Kapan

- Untuk siapa (fungsi, tingkat manajemen, tugas/

kepentingan

Kegiatan produksi vs kegiatan non produksi

- Kegiatan produksi biaya

produksiinventoriable

- Kegiatan non-produksi biaya periode LR

Biaya produksi vs biaya non produksi

Determining Product Cost

- Direct material

- Direct labor

- Manufacturing overhead

- Total product costs

- Per unit product costs

Prime (production) costs

- Direct material

- Direct labor

Conversion costs

- Direct labor

- Manufacturing overhead

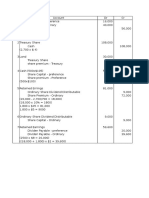

Cornerstone 2.1: Calculating Product Costs in Total

and Per unit

Cornerstone 2.2: Calculating Prime Costs and

Conversion Cost in Total and Per unit

The Impact of Product versus Period Costs on the

Financial Statement

PREPARING INCOME STATEMENT

Cost of Goods Manufactured

Cornerstone 2.3: Calculating the Direct Material

Used in Production

BBB= sediaan BB awal + Pembelian Sediaan BB

akhir

Cornerstone 2.4: Calculating Cost of Goods

Manufactured

CGM = Sediaan BDP awal + Biaya Produksi

Sediaan BDP akhir

Cost of Goods Sold

Cornerstone 2.5: Calculating Cost of Goods Sold

CGS = Sediaan PJ awal + CGM Sediaan PJ akhir

Income Statement: Manufacturing Firm

Cornerstone 2.6: Preparing an Income Statement

for a Manufacturing Firm

Cornerstone 2.7: Calculating the Percentage of

Sales Revenue for Each Line on the Income

Statement

% laba kotor (Gross Profit margin) = (Penjualan

HPP)/(penjualan

Income Statement: Service Firm

Cornerstone 2.8: : Preparing an Income Statement

for a Service Organization

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Zurich ResumeDocument7 pagesZurich ResumeYessie Marwah FauziahNo ratings yet

- Kelompok 7. TESCODocument2 pagesKelompok 7. TESCOYessie Marwah FauziahNo ratings yet

- Discovering Customer Needs Through ResearchDocument10 pagesDiscovering Customer Needs Through ResearchYessie Marwah FauziahNo ratings yet

- Using Strategy and Planning To Measure, Monitor and Report PerformanceDocument5 pagesUsing Strategy and Planning To Measure, Monitor and Report PerformanceYessie Marwah FauziahNo ratings yet

- Zurich ResumeDocument7 pagesZurich ResumeYessie Marwah FauziahNo ratings yet

- 3Document2 pages3Yessie Marwah FauziahNo ratings yet

- E15 18Document1 pageE15 18Yessie Marwah FauziahNo ratings yet

- 1.2 The Traditions of State AuditDocument5 pages1.2 The Traditions of State AuditYessie Marwah FauziahNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CCVF BrochureDocument35 pagesCCVF BrochurekamalchakilamNo ratings yet

- Laurence Connors - Bollinger Bands Trading Strategies That WorkDocument32 pagesLaurence Connors - Bollinger Bands Trading Strategies That Work3dvg 10% (1)

- AFAR - Corp L, JA, HBODocument6 pagesAFAR - Corp L, JA, HBOJoanna Rose DeciarNo ratings yet

- Real Estate BP SampleDocument26 pagesReal Estate BP SamplePro Business Plans90% (10)

- A Study On Portfolio: Construction Using Sharpe'S Single Index ModelDocument8 pagesA Study On Portfolio: Construction Using Sharpe'S Single Index ModelBhavani KarakunNo ratings yet

- Hyper-Urbanization in IndonesiaDocument48 pagesHyper-Urbanization in Indonesiawt_alkatiriNo ratings yet

- All Slides - Delhi Algo Traders ConferenceDocument129 pagesAll Slides - Delhi Algo Traders ConferencenithyaprasathNo ratings yet

- Monetary and Credit Policy of RBIDocument9 pagesMonetary and Credit Policy of RBIHONEYNo ratings yet

- Financial ManagementDocument24 pagesFinancial ManagementozalmistryNo ratings yet

- ECN204 Mid 2013WDocument17 pagesECN204 Mid 2013WexamkillerNo ratings yet

- Business Finance Revision Kit As at 25 April 2006Document239 pagesBusiness Finance Revision Kit As at 25 April 2006dnlkaba88% (16)

- Entrepreneurship Toolkit - Baker Library - Harvard Business SchoolDocument4 pagesEntrepreneurship Toolkit - Baker Library - Harvard Business SchoolcmkkaranNo ratings yet

- SEBI Issue CapitalDocument243 pagesSEBI Issue CapitalHansaraj ParidaNo ratings yet

- Chapter 4 (James C.Van Horne)Document63 pagesChapter 4 (James C.Van Horne)Maaz SheikhNo ratings yet

- Corpolaw Outline 2 DigestDocument24 pagesCorpolaw Outline 2 DigestAlexPamintuanAbitanNo ratings yet

- From Cigar Butts To Super ModelsDocument4 pagesFrom Cigar Butts To Super Modelstomwillems6496No ratings yet

- AR2011Document144 pagesAR2011Seharum MyoriNo ratings yet

- Ar 2017 DildDocument225 pagesAr 2017 DildDEYLA VIOLANo ratings yet

- Dirty Deals: How Wall Street's Predatory Deals Hurt Taxpayers and What We Can Do About ItDocument18 pagesDirty Deals: How Wall Street's Predatory Deals Hurt Taxpayers and What We Can Do About ItRoosevelt InstituteNo ratings yet

- CCFDocument19 pagesCCFDeepak JainNo ratings yet

- Sidharth Summer ReportDocument80 pagesSidharth Summer ReportipmmeerutNo ratings yet

- Test Bank For Investments 11th Edition Alan Marcus Zvi Bodie Alex KaneDocument9 pagesTest Bank For Investments 11th Edition Alan Marcus Zvi Bodie Alex Kanerestatevinery.nt5ykp100% (38)

- 01 - Title - SoudhgangaDocument330 pages01 - Title - SoudhgangaVinod BCNo ratings yet

- Overconfidence and Investment Decisions in Nepalese Stock MarketDocument10 pagesOverconfidence and Investment Decisions in Nepalese Stock MarketMgc RyustailbNo ratings yet

- Finlatics Investment Banking Experience Program Project 4: - Nischal SinghalDocument4 pagesFinlatics Investment Banking Experience Program Project 4: - Nischal SinghalNischal Singhal ce18b045No ratings yet

- Fitch Affs Grupo ElektraDocument2 pagesFitch Affs Grupo ElektraSonia VasquezNo ratings yet

- Axis BankDocument44 pagesAxis Bank2kd TermanitoNo ratings yet

- QuestionnairesDocument2 pagesQuestionnairesSandeep MadivalNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 15, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 15, 2012)Manila Standard TodayNo ratings yet

- Annexure III A-One Pager Profile - Prakesh - AttavarDocument2 pagesAnnexure III A-One Pager Profile - Prakesh - AttavarPrakesh AttavarNo ratings yet