Professional Documents

Culture Documents

Tax2 - Real Property Tax Reviewer

Uploaded by

cardeguzman100%(1)100% found this document useful (1 vote)

1K views5 pagestax2 reviewer

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenttax2 reviewer

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

1K views5 pagesTax2 - Real Property Tax Reviewer

Uploaded by

cardeguzmantax2 reviewer

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

RTDG - ausl real property tax reviewer

REAL PROPERTY TAXATION

Q: What are real property taxes?

These are direct taxes imposed on the privilege to use real

property such as land, building, machinery and other

improvements unless specifically exempted.

Q: What are considered real properties?

Article 415 of the Civil Code, the following are immovable

property.

Q: Define machinery.

Machinery embraces machines, equipment, mechanical

contrivances, instruments, appliances or apparatus which

may or may not be attached, permanently or temporarily, to

the real property. It includes the physical facilities for

production, the installations and appurtenant service

facilities, those which are mobile, self-powered or selfpropelled, and those not permanently attached to the real

property which are actually, directly, and exclusively used

to meet the needs of the particular industry, business or

activity and which by their very nature and purpose are

designed for, or necessary to its manufacturing, mining,

logging, commercial, industrial or agricultural purposes.

(Sec. 199 (o), LGC)

Q: What types of machinery are subject and not

subject to RPT?

(1) Machinery that is permanently attached to land and

buildings is subject to the real property tax, even

though this is actually, directly, and exclusively used

for religious, charitable or educational purposes.

(2) Machinery that is not permanently attached to real

estate is:

(i) subject to RPT if it is an essential and

principal element of an industry, work or activity

without which such industry, work or activity,

cannot function;

(ii) not subject to RPT if it is not an essential and

principal element of an industry, work or activity.

(3) Machinery of non-stock, non-profit educational

institutions used actually, directly, and exclusively for

educational purposes is not subject to real property tax.

Q: Define improvement.

Improvement is a valuable addition to the property or an

amelioration in its condition amounting to more than a

repair or replacement of parts. (Sec. 199 (m), LGC)

Q: What are the requisites for taxability of an

improvement?

(1) It must enhance the value of the property

(2) It must be separately assessable

(3) It can be treated independently from the main property

Q: Are equipment/machineries in cement or wooden

platform and which were never used as industrial

equipments to produce finished products for sale nor

to repair machineries offered to the general public for

business or commercial purposes considered as realty

subject to RPT?

Page 1

NO. In Mindanao Bus Co. v. City Assessor & Treasurer

[Sept. 29, 1962], the Supreme Court held that for

equipment to be real property, they must be essential and

principal elements. In addition, the machinery should be

essential to carry on business in a building or piece of land

and this is not the case here since it was proven that the

equipment was not essential because it it used only for

repairs which could actually be done elsewhere.

Q: Are the gas station equipment and machinery

(tanks, pumps, etc) permanently affixed by Caltex to its

gas station and pavement, albeit on leased land,

considered real property subject to RPT even if lessor

does not become the owner of the said assets?

YES. Because they are essential to the business of

taxpayer. In Caltex v. CBAA [May 31, 1982], the Supreme

Court ruled that the said equipment and machinery, as

appurtenances to the gas station building or shed owned

by Caltex and which fixtures are necessary to the operation

of the gas station for without them the gas station would be

useless and which have been attached or affixed

permanently to the gas station site are taxable

improvements and machinery.

Q: MERALCO installed two oil storage tanks on a lot in

Batangas which it leased from Caltex. They are used

for storing fuel oil for MERALCOs power plants. Are

the oil storage tanks real property for purposes of

RPT?

YES. In Meralco v. CBAA [May 31, 1982], the Supreme

Court held that while the two storage tanks are not

embedded in the land, they are to be considered

improvements on the land enhancing its utility and

rendering it useful to the oil industry. The two tanks have

been installed with some degree of permanence as

receptacles for the considerable quantities oil needed by

MERALCO for its operations.

Q: Enumerate the fundamental principles that shall

guide real property taxation.

(1) Real property shall be appraised at its current and fair

market value.

(2) Real property shall be classified for assessment

purposes on the basis of its actual use.

(3) Real property shall be assessed on the basis of a

uniform classification within each LGU.

(4) The appraisal, assessment, levy and collection of real

property tax shall not be let to any private person.

(5) The appraisal and assessment of real property shall

be equitable. (Sec. 198, LGC)

Q: Do all types of LGUs have the power to impose real

property taxes?

NO. Only provinces and cities as well as municipalities

within Metro Manila may impose RPTs. (Sec. 232, LGC)

Municipalities outside Metro Manila and barangays cannot

impose RPT.

RTDG - ausl real property tax reviewer

Q: What are the rates of levy for purposes of RPT?

A province or city or municipality within Metro Manila shall

fix a uniform rate of basic property tax applicable to their

respective localities:

(1) Province, at the rate not exceeding 1% of the

assessed value

(2) City or Municipality within Metro Manila, at the rate not

exceeding 2% of the assessed value (Sec. 233, LGC)

Q: What are the special levies under the LGC?

(1) Additional Levy for the Special Education Fund

(SEF) - 1% on the assessed value of real property in

addition to the basic RPT. (Sec. 235, LGC)

(2) Special Levy on Idle Lands - idle lands shall be

taxed at a rate not exceeding 5% of the assessed

value in addition to the basic RPT. (Sec. 236, LGC)

(3) Special Levy by LGUs for lands benefited by

public works (special assessment) - the special levy

shall not exceed 60% of the actual cost of such project

and improvements, including the costs of acquiring

land and other real property. (Sec. 240, LGC)

Q: When may idle lands be exempted from tax?

(1) force majeure

(2) civil disturbance

(3) natural calamity

(4) any cause which physically or legally prevents the

owner of the property or person having legal interest

therein from improving, utilising, or cultivating the

same (Sec. 238, LGC)

Q: What are the conditions for the validity of a tax

ordinance imposing special levy for public works?

(1) the ordinance shall describe the nature, extent and

location of the project, state the estimated cost, and

specify the metes and bounds by monuments and

lines (Sec. 241, LGC)

(2) it must state the number of annual installments, not

less than 5 yrs nor more than 10 yrs (Sec. 241, LGC)

(3) notice to the owners and public hearing (Sec. 242,

LGC)

Q: What are the properties exempt from RPT?

(a) Real property owned by the Republic or any of its

political subdivisions (except when beneficial use has

been granted to a taxable person)

(b) Charitable institutions, churches, parsonages or

convents appurtenant thereto, mosques, non-profit or

religious cemeteries and all lands, buildings or

improvements actually, directly, and exclusively used

for religious, charitable or educational purposes

(c) All machineries and equipment actually, directly and

exclusively used by local water districts and GOCCs

engaged in supply and distribution of water and/or

generation and transmission of electric power

(d) All real property owned by duly registered cooperatives

(e) Machinery and equipment used for pollution control and

environmental protection (includes infrastructure). (Sec.

234, LGC)

Page 2

Sec. 234(a), LGC

Q: Is the Metro Manila International Airport Authority

(MIAA) a GOCC which will now be considered liable for

RPT under the LGC?

NO. In Metro Manila International Airport Authority v.

CA [July 20, 2006], the Supreme Court, in resolving the

issue on whether the lands and buildings owned by the

MIAA were subject to real property tax, ruled in the

negative. The Supreme Court opined that since MIAA is not

a GOCC but instead as government instrumentality vested

with corporate powers or a government corporate entity. As

such, it is exempt from RPT.

However, in Mactan Cebu International Airport Authority

v. Marcos [Sept. 11, 1996], the Supreme Court ruled that

MCIAA is a GOCC and since the last paragraph of Section

234 of the LGC unequivocally withdrew the exemptions

from payment of RPT granted to natural or juridical

including GOCCs, MCIAA is now liable for RPT.

Q: Is the Philippine Fisheries Development Authority

(PFDA) a GOCC and, hence, now liable for RPT?

NO. In Philippine Fisheries Development Authority v.

CA [July 31, 2007], the Supreme Court ruled that the

PFDA is not a GOCC but an instrumentality of the national

government which is generally exempt from payment of

RPT. However, said exemption does not apply to the

portions of the properties which the PFDA leased to private

entities.

Q: Is the GSIS liable for RPT?

NO. As held in GSIS v. City Treasurer of the City of

Manila [December 23, 2009], GSIS is an instrumentality of

the government and, as such, is not a taxable juridical

person for purposes of RPT.

Q: Is the Light Rail Transit Authority (LRTA) a GOCC,

and, as such, liable for RPT?

YES. Although not expressly stating that LRTA is a GOCC,

the Supreme Court in Light Rail Transit Authority v.

CBAA [Oct. 12, 2000], stated that the LRTA is clothed with

corporate status and corporate powers in the furtherance of

its proprietary objectives. It operates much like any private

corporation engaged in the mass transport industry. AS

such, it is liable for RPT.

Sec. 234(b), LGC

Q: The Philippine Lung Center leased portions of its

real property out for commercial purposes. Are these

exempt from RPT?

NO. In Lung Center of the Philippines v. Quezon City

[433 SCRA 119], the Supreme Court held that the hospital

was not exempt from real property tax on the portions of its

property not actually, directly, and exclusively used for

charitable purposes. Thus, those leased out for commercial

purposes are subject to RPT. Those used by the hospital

even if used for paying patients remain exempt from RPT.

Q: ABC Association is a non-stock, non-profit

organization owned by XYZ Hospital in Cebu City. XYZ

likewise owns the XYZ Medical Arts Center. The City

RTDG - ausl real property tax reviewer

Assessor assessed the XYZ Medical Arts Center

Building with the assessment level of 35% for

commercial buildings (instead of the 10% special

assessment imposed on XYZ hospital and its

buildings). Was the medical arts center built to house

its doctors a separate commercial building?

NO. The Supreme Court in City Assessor of Cebu City v.

Association of Benevola De Cebu Inc. [June 8, 2007],

classified the medical arts center building as special for

the following reasons: (1) the medical arts center was an

integral part of the hospital; (2) the medical arts center

facility was incidental to and reasonably necessary for the

operations of the hospital; and (3) charging rentals for the

offices used by its accredited physicians was a practical

necessity and could not be equated to a commercial

venture.

Sec. 234(c), LGC

Q: What are the requisites to claim exemption from

RPT for machineries and equipment used by LWDs and

GOCCs?

(1) the machineries and equipment are actually, directly,

and exclusively used by the LWDs and GOCCs

(2) the LWDs and GOCCs claiming exemption must be

engaged in the supply and distribution of water and/or

generation and transmission of electric power

Q: FELS entered into a lease contract with NAPOCOR

over two engine power barges at Balayan Bay

Batangas. The lease contract stipulated that

NAPOCOR shall be responsible for all taxes (including

RPT on the barges), fees and charges that FELS and

its employees and construction permit and

environmental fees. FELS was assessed for RPT and

LBAA upheld the assessment stating that while the

barges may be classified as personal property, they

are considered real property for RPT purposes

because they are installed at a specific location with a

character if permanency. Are the power barges subject

to RPT?

YES. The Supreme Court in FELS Energy v. Province of

Batangas [Feb. 16, 2007], held that the power barges are

subject to RPT on the following reasons: (1) Article 415(9)

of the CC provides that docks and structures which,

though floating, are intended by their nature and object to

remain at a fixed place on a river, lake or coast. Barges fall

under this provision. (2) FELS cannot claim exemption

given that the requirement is that to be exempt the

machineries and equipment must be actually, directly and

exclusively used by GOCCs engaged in the generation of

power. Since the agreement between FELS and

NAPOCOR is that FELS will own and operate the barges

and not NAPOCOR.

Q: How is real property appraised?

All real property, whether taxable or exempt, shall be

appraised at the current and FMV prevailing in the locality

where the property is situated. (Sec. 201, LGC)

Page 3

Q: What is the purpose of a tax declaration?

A tax declaration only enables the assessor to identify the

property for purposes of determining the assessment

levels. It does not bind the assessor when he makes the

assessment. (Sec 202-204, LGC)

Q: Are tax declarations conclusive evidence of

ownership?

As a rule, tax declarations are not conclusive evidence of

ownership. However, tax receipts and tax declarations

become strong evidence of ownership acquired by

prescription when accompanied by proof of actual

possession of the property.

Q: Who prepares the schedule of FMVs?

The provincial, city and the municipal assessors of the

municipalities within Metro Manila prepares the schedule of

the FMV for the different classes of real property situated in

their respective LGUs for enactment by ordinance of the

Sanggunian concerned. (Sec. 212, LGC)

Q: What are the classes of real property for

assessment purposes?

(1) Residential

(2) Agricultural

(3) Commercial

(4) Industrial

(5) Mineral

(6) Timberland or Special

(Sec. 215, LGC)

Q: What are the special classes of real property under

the LGC?

All lands, building, and other improvements actually,

directly and exclusively:

(1) used for hospitals, cultural or scientific purposes

(2) owned and used by local water districts

(3) owned and used by GOCCs rendering essential public

services in

(i) supply and distribution of water;

(ii) generation and transmission of electric

power. (Sec. 216, LGC)

Q: What is the basis for assessment?

Real property shall be classified, valued, and assessed on

the basis of its actual use regardless of where located,

whoever owns it, and whoever uses it. (Sec. 217, LGC)

Q: Define assessment.

Assessment is the act or process of determining the value

of a property or proportion thereof subject to tax, including

the discovery, listing, classification, and appraisal of

properties.

Q: Define assessment level.

It is the percentage applied to the FMV of the real property

to determine the taxable value of the property.

Q: Define assessed value.

It is the FMV of the real property multiplied by the

assessment level.

RTDG - ausl real property tax reviewer

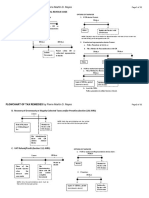

Q: What is the procedure in computing real property

tax?

Market Value x Assessment Level (%)

= Assessed Value

Assessed Value x Tax Rate (%)

= Real Property Tax Payable

Q: What is the rule on assessment of RPT?

General Rule: The assessment must be made within 5

years from the date they become due.

Exception: If there is fraud or intent to evade taxes,

assessment may be made within 10 years from discovery

of fraud or intent to evade. (Sec. 270, LGC)

Page 4

In Testate Estate of Concordia Lim v. City of Manila

[Feb. 21, 1990], the Supreme Court held that unpaid real

estate taxes attaches to the property and is chargeable

against the taxable person who had actual or beneficial use

and possession of it, regardless of whether or not he is the

owner.

Q: When is there levy on real property?

After the expiration of the time required to pay the tax

levied, the real property subject to tax may be levied upon.

(Sec. 258, LGC)

The remedies of distraint or levy may be repeated if

necessary until the full amount due including all expenses

is collected. (Sec. 265, LGC)

PROCEDURE FOR LEVY ON REAL PROPERTY

Q: What is the rule on collection of RPT?

Collection of RPT must be made within 5 years from

assessment.

Q: In what instances is the running of the prescriptive

period be suspended?

(1) Treasurer is legally prevented from assessing/

collecting

(2) Taxpayer requests for reinvestigation and executes

waiver

(3) Taxpayer is out of the country or cannot be located

Q: In what instances can there be a condonation or

reduction of RPT?

(1) general failure of crops

(2) substantial decrease in the price of agricultural or agribased products

(3) calamity

(Sec. 276, LGC) condonation is done by the Sanggunian

concerned by ordinance and upon recommendation of the

Local Disaster Coordinating Council

(4) when public interest so requires

(Sec. 277, LGC) only the President may exercise this

power

REMEDIES AVAILABLE TO THE LGU

Q: What are the remedies available to the LGU for the

collection of RPT? (Sec. 256, LGC)

(1) Administrative action thru levy of real property

(i) Distraint of personal property

(ii) Lien on property subject to tax

(iii) Levy on real property tax

(2) Judicial action

Note: The remedies are concurrent and simultaneous

Q: What is the Local Governments Lien?

The basic RPT constitutes as a lien on the property subject

to tax, superior to all liens, charges or encumbrances in

favor of any person, irrespective of the owner or possessor

thereof, enforceable by administrative or judicial action and

may only be extinguished by payment of the tax and

related interests and expenses. (Sec. 257, LGC)

(1) Tax constitutes a lien on the property superior to all

liens and may only be extinguished upon payment of

the tax and charges (Sec. 257, LGC)

(2) Time for payment of real property taxes expires (Sec.

258, LGC)

(3) Warrant of Levy issued by the Local Treasurer (LT),

which has the force of legal execution in the LGU

concerned (Sec. 258, LGC)

(4) Warrant is mailed to or served upon the delinquent

owner (Sec. 258, LGC)

(5) Written notice of the levy and the warrant is mailed/

served upon the assessor and the Registrar of Deeds

of the LGU (sec. 258, LGC)

(6) 30 days from service of warrant, LT shall advertise

sale of the property by:

(i) posting notice at the main entrance of LGU hall/

building and in a conspicuous place in the barangay where

the property is located and

(ii) by publication once a week for 2 weeks (RPT)

(Sec. 260, LGC)

Note: In cases of levy for unpaid local taxes publication

once a week for 3 weeks

(7) Before the date of sale, the owner may stay the

proceedings by paying the delinquent tax, interest and the

expenses of sale

(8) Sale is held:

(i) at the main entrance of the LGU building, or

(ii) on the property to be sold, or

(iii) at any other place specified in the notice

Note: The next steps in the procedure will vary depending

on whether there is a bidder or not.

(i) for local taxes, the LGU may purchase levied

property for 2 reasons (1) there is no bidder or (2) the

highest bid is insufficient to cover the taxes and other

charges.

(ii) for RPT, the LGU may purchase for only 1

reason - there is no bidder.

Q: What is the redemption period for tax delinquent

properties sold at public auction?

RTDG - ausl real property tax reviewer

Under the LGC, the redemption period is within 1 year from

the date of sale. (Sec. 261, LGC)

Q: Civil action for collection of real property tax.

The civil action for collection of real property tax shall be

filed by the local treasurer in any court of competent

jurisdiction within 5 or 10 years wherein real property taxes

may be collected. (Sec. 266, LGC)

Page 5

YES. Sec. 252, LGC provides no protest shall be

entertained unless the taxpayer first pays the tax.

Q: When is payment under protest not required?

Prior payment under protest is applicable only if the issue

is anchored on the correctness, reasonableness, or

excessiveness of assessment, hence, considered a

question of fact.

REMEDIES AVAILABLE TO THE TAXPAYERS

If the taxpayer is questioning the validity of the tax

ordinance, the taxpayer may either question the legality of

a tax ordinance before the DOJ Secretary under Sec. 187

of the LGC or question the constitutionality of the

ordinance before the Regular Courts.

In this case,

payment under protest is not required.

If the taxpayer is questioning the correctness,

reasonableness or excessiveness of the assessment,

the taxpayer will resort to administrative remedies. In this

case, payment under protest is required.

Q: Who may contest the assessment of real property?

In order for a taxpayer to have legal standing to contest an

assessment to the LBAA, he must be a person having legal

interest in the property. (Sec. 226, LGC)

PROCESS IN CONTESTING A REAL PROPERTY TAX

ASSESSMENT (Sec. 226 & 229, LGC)

(1) Pay the tax under protest and annotation of paid

under protest in receipt

(2) File written protest with local treasurer within 30 days

from payment of the tax

(3) Treasurer to decide within 60 days from receipt of the

protest

(4) From treasurers decision or inaction, appeal to the

LBAA within 60 days

(5) LBAA to decide within 120 days

(6) Appeal LBAA decision to CBAA within 30 days from

receipt of adverse decision

(7) CBAA appealable to CTA en banc within 30 days from

receipt of the adverse decision of the CBAA

(8) Appeal to SC within 15 days from receipt of adverse

decision of CTA

Note: In (4), if the treasurers decision is in favor of the

taxpayer, he may now apply for a tax refund or tax credit.

Q: What is the effect of an appeal on assessment?

An appeal on assessments of real property shall, in no

case, suspend the collection of the corresponding realty

taxes on the property involved as assessed by the

provincial or city assessor, without prejudice to subsequent

adjustment depending upon the final outcome of the

appeal. (Sec. 231, LGC)

PAYMENT UNDER PROTEST (Sec. 252, LGC)

Q: Is payment a pre-requisite to protest an assessment

for RPT?

Prior payment under protest is not required when the

taxpayer is questioning the very authority and power of

the assessor to impose the assessment and of the

treasurer to collect the tax as opposed to questioning the

increase/decrease in the tax to be paid.

Q: Can the taxpayer file a case directly to the RTC if it

claims that it was questioning the authority of the

treasurer to assess and not only the amount of the

assessment?

NO. In Olivares v. Joey Marquez [Sept. 22, 2004], it was

found that the taxpayer raised issues on prescription,

double taxation, and tax exemption. In such case, the

correctness of the assessment must be dealt with and the

treasurer has initial jurisdiction and his decision is

appealable to the LBAA. Payment under protest is

required.

Q: The Province of Quezon assessed Mirant for unpaid

real property taxes. NAPOCOR, which entered a BOT

with Mirant, protested the assessment before the

LBAA, claiming the entitlement to tax exemption under

Sec. 234 of the LGC. The RPT assessed were not paid

prior to the protest. LBAA dismissed NAPOCORs

petition for failure to make a payment under protest. Is

NAPOCOR required to make a payment under protest?

YES. By claiming an exemption from realty taxation,

NAPOCOR is simply raising the question of the

correctness of the assessment. A such RPT must be paid

prior to the making of the protest. On the other hand, if the

taxpayer is questioning the authority of the local assessor

to assess RPT, it is not necessary to pay the RPT prior to

the protest. A claim for tax exemption, whether full or

partial, does not question the authority of the local

assessor to assess RPT as held in NAPOCOR v. Province

of Quezon [January 25, 2010].

REFUND OR CREDIT OF RPT (Sec. 253, LGC)

Q: What is the rule on refunds of RPT?

The taxpayer must file the written claim within 2 years from

the date of payment of tax or from the date when the

taxpayer is entitled to reduction or adjustment.

The provincial treasurer has 60 days to decide the claim for

tax refund or credit.

Q: What is the remedy available if the claim for tax

refund or credit is denied?

Follow steps 4 to 8 in the procedure in contesting a RPT

assessment.

You might also like

- Real Property Tax Guide for LGUsDocument20 pagesReal Property Tax Guide for LGUsTubal Clemencio0% (1)

- Real Property Tax ReviewerDocument5 pagesReal Property Tax ReviewerAtty. Rheneir MoraNo ratings yet

- Tax2 - Local Taxation ReviewerDocument4 pagesTax2 - Local Taxation Reviewercardeguzman89% (9)

- Philippine Transfer Taxes and Value Added Tax-2011Document54 pagesPhilippine Transfer Taxes and Value Added Tax-2011Chris Rivero100% (2)

- Tax Review Q and A Quiz 1 and 2 FinalsDocument19 pagesTax Review Q and A Quiz 1 and 2 FinalsAngel Xavier CalejaNo ratings yet

- Donor's Tax Guide for Business OwnersDocument6 pagesDonor's Tax Guide for Business OwnersMaryrose SumulongNo ratings yet

- Taxation Law 2 Reviewer (Long)Document44 pagesTaxation Law 2 Reviewer (Long)Gertz Mayam-o Pugong100% (21)

- Tax Remedies ReviewerDocument9 pagesTax Remedies ReviewerheirarchyNo ratings yet

- RR 4-86Document2 pagesRR 4-86Mico Maagma CarpioNo ratings yet

- Final Tax ExamDocument10 pagesFinal Tax ExamGerald RojasNo ratings yet

- Donor's Tax and Foreign Tax Credit (Presentation Slides)Document5 pagesDonor's Tax and Foreign Tax Credit (Presentation Slides)Kez100% (1)

- Taxation - 7 Tax Remedies Under LGCDocument3 pagesTaxation - 7 Tax Remedies Under LGCcmv mendozaNo ratings yet

- Local Government TaxationDocument7 pagesLocal Government TaxationCeresjudicataNo ratings yet

- Taxation - 8 Tax Remedies Under NIRCDocument34 pagesTaxation - 8 Tax Remedies Under NIRCcmv mendoza100% (3)

- Revenue Regulations No. 10-2012 overviewDocument18 pagesRevenue Regulations No. 10-2012 overviewFrancis Puno100% (2)

- Estate Taxation Guide for Northern CPA ReviewDocument18 pagesEstate Taxation Guide for Northern CPA ReviewJane Oblena100% (1)

- Estate Tax: "Gross Estate and Gifts"Document9 pagesEstate Tax: "Gross Estate and Gifts"Tricia Sandoval100% (1)

- Business Tax Final Exam QuestionsDocument7 pagesBusiness Tax Final Exam QuestionsKeira TanNo ratings yet

- 1.1 MC - Exercises On Estate Tax (PRTC)Document8 pages1.1 MC - Exercises On Estate Tax (PRTC)marco poloNo ratings yet

- Tax Administration Powers and RemediesDocument16 pagesTax Administration Powers and Remediescristiepearl100% (6)

- Donor's Tax A) Basic Principles, Concept and DefinitionDocument4 pagesDonor's Tax A) Basic Principles, Concept and DefinitionAnonymous YNTVcDNo ratings yet

- Tax2 - 3rdExamLG Tax OnlyDocument46 pagesTax2 - 3rdExamLG Tax OnlyMark Joseph M. Virgilio100% (2)

- LTOM BOOK 1 CHAPTER 2 QUALIFICATIONSDocument2 pagesLTOM BOOK 1 CHAPTER 2 QUALIFICATIONSMarivic EspiaNo ratings yet

- OM No. 2018-04-03Document2 pagesOM No. 2018-04-03Christian Albert HerreraNo ratings yet

- TAX-902 (Gross Income - Exclusions)Document5 pagesTAX-902 (Gross Income - Exclusions)Ciarie Salgado100% (1)

- Tax Flowchart Remedies (Tokie)Document9 pagesTax Flowchart Remedies (Tokie)Tokie TokiNo ratings yet

- Tax Alert BIR Ruling 142-2011Document3 pagesTax Alert BIR Ruling 142-2011Ia Bolos0% (1)

- Section 85. Gross Estate. - The Value of The Gross Estate of TheDocument6 pagesSection 85. Gross Estate. - The Value of The Gross Estate of TheCharles RiveraNo ratings yet

- Estate tax problemsDocument2 pagesEstate tax problemsClaricel JoyNo ratings yet

- Estate TaxDocument13 pagesEstate Taxfly awayNo ratings yet

- Ra 8424 - NircDocument123 pagesRa 8424 - NircJOHAYNIENo ratings yet

- Estate Tax GuideDocument31 pagesEstate Tax GuideMary Joy DenostaNo ratings yet

- Final Tax and Creditable Withholding TaxesDocument3 pagesFinal Tax and Creditable Withholding Taxesarrianemartinez100% (4)

- MidtermDocument13 pagesMidtermAlexandra Nicole IsaacNo ratings yet

- Real Property Tax PDFDocument8 pagesReal Property Tax PDFMark Rainer Yongis LozaresNo ratings yet

- Multiple choice questions on negotiable instruments, contracts, corporations and partnershipsDocument11 pagesMultiple choice questions on negotiable instruments, contracts, corporations and partnershipsJinx Cyrus RodilloNo ratings yet

- Capital Gains Tax Exemption for Principal Home SalesDocument10 pagesCapital Gains Tax Exemption for Principal Home SalesmatinikkiNo ratings yet

- New Central Bank ActDocument20 pagesNew Central Bank Actcpl123No ratings yet

- Order of Intestate SuccessionDocument3 pagesOrder of Intestate Successiondiyesa100% (2)

- Section 11-16Document6 pagesSection 11-16Jane Gonzales100% (1)

- Estate Tax and Some Exempt TransfersDocument3 pagesEstate Tax and Some Exempt TransfersfcnrrsNo ratings yet

- PM Reyes Notes On Taxation 2 - Local Taxation (Working Draft)Document9 pagesPM Reyes Notes On Taxation 2 - Local Taxation (Working Draft)dodong123No ratings yet

- Law On AccretionDocument41 pagesLaw On AccretionKerwin Leonida100% (2)

- Donor S Tax QuizDocument5 pagesDonor S Tax QuizDerick John Palapag100% (1)

- Chapter 03 Gross EstateDocument16 pagesChapter 03 Gross EstateNikki Bucatcat0% (1)

- Procedure in Computing Vanishing DeductionDocument5 pagesProcedure in Computing Vanishing DeductionDon Tiansay100% (5)

- Calculating Gross Estate for Estate TaxDocument11 pagesCalculating Gross Estate for Estate TaxBiboy GSNo ratings yet

- Vat Exempt SalesDocument4 pagesVat Exempt SalesEmma Mariz GarciaNo ratings yet

- Outline FRIADocument30 pagesOutline FRIAhellojdey100% (1)

- Tax2 Local Taxation Reviewer PDFDocument4 pagesTax2 Local Taxation Reviewer PDFaeron_camaraoNo ratings yet

- Taxation Theory and ConceptsDocument18 pagesTaxation Theory and ConceptsDARLENENo ratings yet

- Flowchart of Tax Remedies I. Remedies UnDocument12 pagesFlowchart of Tax Remedies I. Remedies UnKevin Ken Sison Ganchero100% (2)

- Cagayan Sugar Mill Assessment UpheldDocument2 pagesCagayan Sugar Mill Assessment UpheldPhylian Corazon W. Oras0% (1)

- Special Proceedings ReviewerDocument11 pagesSpecial Proceedings Reviewerabogada1226No ratings yet

- Chattel Mortgage-Ppt - RFBT 3Document22 pagesChattel Mortgage-Ppt - RFBT 316 Dela Cerna, RonaldNo ratings yet

- Tax2 - Ch1-5 Estate Taxes ReviewerDocument8 pagesTax2 - Ch1-5 Estate Taxes ReviewerMaia Castañeda100% (15)

- Real Propert Y: TaxationDocument41 pagesReal Propert Y: TaxationFreeza Masculino FabrigasNo ratings yet

- Local TaxationDocument9 pagesLocal TaxationSNLTNo ratings yet

- Real Property Taxation UpdatedDocument39 pagesReal Property Taxation UpdatedEmille LlorenteNo ratings yet

- Book 5Document211 pagesBook 5Angelynne N. NieveraNo ratings yet

- Land Titling PDFDocument51 pagesLand Titling PDFcardeguzmanNo ratings yet

- Film analysis of A Few Good MenDocument2 pagesFilm analysis of A Few Good Mencardeguzman50% (2)

- Ladia Corpo Lecture Part 4 (June 8)Document8 pagesLadia Corpo Lecture Part 4 (June 8)Khaiye De Asis AggabaoNo ratings yet

- GPS Tracking An Invasion of PrivacyDocument11 pagesGPS Tracking An Invasion of PrivacycardeguzmanNo ratings yet

- Full Legres CasesDocument58 pagesFull Legres Casescardeguzman100% (1)

- Partnership and Agency Digests For Atty. CochingyanDocument28 pagesPartnership and Agency Digests For Atty. CochingyanEman Santos100% (3)

- Jurisdiction in Civil CasesDocument8 pagesJurisdiction in Civil CasesChester Pryze Ibardolaza TabuenaNo ratings yet

- Ladia Corpo Lecture 1 (June 9)Document9 pagesLadia Corpo Lecture 1 (June 9)Ruel Benjamin BernaldezNo ratings yet

- Dratw Philippines 2011 PDFDocument59 pagesDratw Philippines 2011 PDFcashielle arellanoNo ratings yet

- Anti-Illegal Drugs Special Operations Task Force ManualDocument97 pagesAnti-Illegal Drugs Special Operations Task Force ManualAntonov FerrowitzkiNo ratings yet

- Criminal Case Evidence SummaryDocument3 pagesCriminal Case Evidence Summarycardeguzman80% (5)

- Appellate's BriefDocument32 pagesAppellate's BriefcardeguzmanNo ratings yet

- Civ 2 CaseDocument40 pagesCiv 2 CasecardeguzmanNo ratings yet

- Waiver of RightsDocument1 pageWaiver of RightscardeguzmanNo ratings yet

- Armed Conflict and DisplacementDocument34 pagesArmed Conflict and DisplacementcardeguzmanNo ratings yet

- Responsibility of non-state actors for protecting internally displaced personsDocument2 pagesResponsibility of non-state actors for protecting internally displaced personscardeguzmanNo ratings yet

- Civ Pro Mid Term Exam - Flattened-1Document10 pagesCiv Pro Mid Term Exam - Flattened-1cardeguzmanNo ratings yet

- Film Analysis Guilty by SuspicionDocument2 pagesFilm Analysis Guilty by SuspicioncardeguzmanNo ratings yet

- Special Proceeding Reviewer (Regalado)Document36 pagesSpecial Proceeding Reviewer (Regalado)Faith Laperal91% (11)

- Land Titling Guide for the PhilippinesDocument48 pagesLand Titling Guide for the PhilippinescardeguzmanNo ratings yet

- EthicsDocument2 pagesEthicscardeguzmanNo ratings yet

- Appellate TableDocument2 pagesAppellate TablecardeguzmanNo ratings yet

- EthicsDocument2 pagesEthicscardeguzmanNo ratings yet

- LTD Outline Land TitlingDocument51 pagesLTD Outline Land TitlingClaire Roxas100% (2)

- Arellano Outline Land ClassificationDocument6 pagesArellano Outline Land ClassificationZan BillonesNo ratings yet

- Cases in Land RegistrationDocument3 pagesCases in Land RegistrationcardeguzmanNo ratings yet

- Land DispositionDocument27 pagesLand Dispositioncardeguzman100% (1)

- Estate, donor, VAT, excise tax reviewerDocument3 pagesEstate, donor, VAT, excise tax reviewercardeguzmanNo ratings yet

- Aban Tax 1 Reviewer PDFDocument67 pagesAban Tax 1 Reviewer PDFcardeguzmanNo ratings yet

- Recommended Budget 2011Document375 pagesRecommended Budget 2011clilly8037No ratings yet

- Q2FY20 Presentation Inox Leisure PDFDocument37 pagesQ2FY20 Presentation Inox Leisure PDFshailesh1978k0% (1)

- Alex G Baraona BIO For Salvador Holdings International CorporationDocument7 pagesAlex G Baraona BIO For Salvador Holdings International CorporationAlexGBaraonaNo ratings yet

- HSBC DraftDocument1 pageHSBC Draftpavel25bNo ratings yet

- Understanding key concepts of provisions, bonds payable, operating leases and finance leasesDocument20 pagesUnderstanding key concepts of provisions, bonds payable, operating leases and finance leasesRheu ReyesNo ratings yet

- Soal Kuis Minggu 11Document7 pagesSoal Kuis Minggu 11Natasya ZahraNo ratings yet

- National Moot Pool Problem 2020Document8 pagesNational Moot Pool Problem 2020gaurav singhNo ratings yet

- Gemco v. Royal Bank of Canada, 61 F.3d 94, 1st Cir. (1995)Document10 pagesGemco v. Royal Bank of Canada, 61 F.3d 94, 1st Cir. (1995)Scribd Government DocsNo ratings yet

- Filipinas Marble vs. IACDocument2 pagesFilipinas Marble vs. IACPia Janine ContrerasNo ratings yet

- FINANCE (Allowances) DEPARTMENT Secretariat, Chennai-600 009. Letter No.1074/FS/Fin. (Allowances) /2020, Dated:05-06-2020Document2 pagesFINANCE (Allowances) DEPARTMENT Secretariat, Chennai-600 009. Letter No.1074/FS/Fin. (Allowances) /2020, Dated:05-06-2020kmtharan.mca@gmail.comNo ratings yet

- Apollo Hospitals Enterprise Limited NSEI APOLLOHOSP Financials Balance SheetDocument3 pagesApollo Hospitals Enterprise Limited NSEI APOLLOHOSP Financials Balance Sheetakumar4uNo ratings yet

- Radio Corp v. Roa CaseDocument8 pagesRadio Corp v. Roa CaseJet GarciaNo ratings yet

- Dr. Sandeep Malu Associate Professor SVIM, IndoreDocument14 pagesDr. Sandeep Malu Associate Professor SVIM, Indorechaterji_aNo ratings yet

- CFA Level 1 Quantitative Analysis E Book - Part 1Document26 pagesCFA Level 1 Quantitative Analysis E Book - Part 1Zacharia VincentNo ratings yet

- ISA FormDocument2 pagesISA FormAkram SayeedNo ratings yet

- Working Capital MGMT Practice Manual PDFDocument75 pagesWorking Capital MGMT Practice Manual PDFPankaj PandeyNo ratings yet

- Aa21 Afa (Eng)Document11 pagesAa21 Afa (Eng)FarrukhsgNo ratings yet

- Winding Up and A Brief Discussion On How A Co Averts LiquidationDocument20 pagesWinding Up and A Brief Discussion On How A Co Averts LiquidationDebina MitraNo ratings yet

- SBI Life eShield protects families affordablyDocument6 pagesSBI Life eShield protects families affordablyAnkit VyasNo ratings yet

- 2Q - STEM - GenMath - LEC 07 - Simple Annuities PDFDocument12 pages2Q - STEM - GenMath - LEC 07 - Simple Annuities PDFKim Cinderell PestijoNo ratings yet

- CV. Linggarjati Cash Receipt Journal March 2010Document64 pagesCV. Linggarjati Cash Receipt Journal March 2010Verro CasparoNo ratings yet

- Bills of ExchangeDocument31 pagesBills of ExchangeViransh Coaching ClassesNo ratings yet

- Sa105 NotesDocument14 pagesSa105 Notesmarijana_jovanovikNo ratings yet

- Financial Analysis of Unilever PakistanDocument7 pagesFinancial Analysis of Unilever Pakistanzainab malikNo ratings yet

- DIGEST-5. Bank of America v. American Realty Corp.Document3 pagesDIGEST-5. Bank of America v. American Realty Corp.Karl EstavillaNo ratings yet

- Assessable Spouse Election FormDocument1 pageAssessable Spouse Election FormpetermhanleyNo ratings yet

- Emicro Product InfoDocument5 pagesEmicro Product InfoAmar AliNo ratings yet

- Understand Joint and Solidary ObligationsDocument85 pagesUnderstand Joint and Solidary Obligationslena cpaNo ratings yet

- On Comparative Analysis of Financial Statement of Pepsi Co & Coca Cola.Document7 pagesOn Comparative Analysis of Financial Statement of Pepsi Co & Coca Cola.Saikat BhattacharjeeNo ratings yet

- 2006 Hbos Ra PDFDocument196 pages2006 Hbos Ra PDFsaxobobNo ratings yet