Professional Documents

Culture Documents

Soal Asis 3 - Jordy - AJP

Uploaded by

Jordy TangCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Soal Asis 3 - Jordy - AJP

Uploaded by

Jordy TangCopyright:

Available Formats

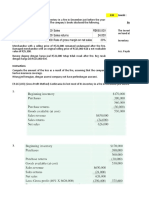

Asistensi Pengantar Akuntansi 1

SOAL 2

Pertemuan 3 Adjusting Entries

Neosho River Resort opened for business on June 1 with eight air-conditioned units. Its trial balance before

adjustment on August 31 is as follows.

Asisten: Jordy

SOAL 1

Tony Masasi started his own consulting firm, Masasi Company, on June 1, 2010. The trial balance at June

30 is shown below

In addition to those accounts listed on the trial balance, the chart of accounts for Masasi Company also

contains the following accounts and account numbers: No. 158 Accumulated DepreciationOffice

Equipment, No. 212 Salaries Payable, No. 244 Utilities Payable, No. 631 Supplies Expense, No. 711

Depreciation Expense, No. 722 Insurance Expense, and No. 732 Utilities Expense.

Other data:

In addition to those accounts listed on the trial balance, the chart of accounts for Neosho River Resort also

contains the following accounts and account numbers: No. 112 Accounts Receivable, No. 144 Accumulated

DepreciationCottages, No. 150 Accumulated DepreciationFurniture, No. 212 Salaries Payable,No. 230

Interest Payable,No. 620 Depreciation ExpenseCottages,No. 621 Depreciation ExpenseFurniture, No.

631 Supplies Expense, No. 718 Interest Expense, and No. 722 Insurance Expense.

Other data:

1. Supplies on hand at June 30 are $600.

1. Insurance expires at the rate of $400 per month.

2. A utility bill for $150 has not been recorded and will not be paid until next month.

2. A count on August 31 shows $600 of supplies on hand.

3. The insurance policy is for a year.

3. Annual depreciation is $6,000 on cottages and $2,400 on furniture.

4. $2,500 of unearned service revenue has been earned at the end of the month.

4. Unearned rent revenue of $4,100 was earned prior to August 31.

5. Salaries of $2,000 are accrued at June 30.

6. The office equipment has a 5-year life with no salvage value. It is being depreciated at $250 per month

for 60 months.

7. Invoices representing $1,000 of services performed during the month have not been recorded as of June

30.

Instructions

5. Salaries of $400 were unpaid at August 31.

6. Rentals of $1,000 were due from tenants at August 31. (Use Accounts Receivable.)

7. The mortgage interest rate is 9% per year. (The mortgage was taken out on August 1.)

Instructions

(a) Journalize the adjusting entries on August 31 for the 3-month period June 1August 31.

(a) Prepare the adjusting entries for the month of June. Use J3 as the page number for your journal.

(b) Post the adjusting entries to the ledger accounts. Enter the totals from the trial balance as beginning

account balances and place a check mark in the posting reference column.

(b) Post the adjusting entries to the ledger accounts. Enter the totals from the trial balance as beginning

account balances and place a check mark in the posting reference column.

(c) Prepare an adjusted trial balance at Aug 31, 2010.

(c) Prepare an adjusted trial balance at June 30, 2010.

Asis3AJPJordy

Asis3AJPJordy

You might also like

- Prepare adjusting entries for deferrals and accrualsDocument15 pagesPrepare adjusting entries for deferrals and accrualsKirammin Bararrah100% (1)

- Tutorial Laporan Arus KasDocument17 pagesTutorial Laporan Arus KasRatna DwiNo ratings yet

- Tugas AkbiDocument44 pagesTugas AkbiLafidan Rizata FebiolaNo ratings yet

- Preliminary computations and consolidation of Piero SAADocument3 pagesPreliminary computations and consolidation of Piero SAAMuhammad SyukurNo ratings yet

- Latihan 3Document3 pagesLatihan 3Radit Ramdan NopriantoNo ratings yet

- 6.PR Spoilage Good Proses CostingDocument2 pages6.PR Spoilage Good Proses CostingSembilan 19No ratings yet

- SOAL LATIHAN MATERI FINAL TESTDocument24 pagesSOAL LATIHAN MATERI FINAL TESTCarissaNo ratings yet

- Pembahasan Ch 11 Intangible Assets LatihanDocument3 pagesPembahasan Ch 11 Intangible Assets LatihanWira DinataNo ratings yet

- Bank Reconciliation and Adjusting Entries for Aglife GeneticsDocument9 pagesBank Reconciliation and Adjusting Entries for Aglife GeneticsDetha Prasetio KumaraNo ratings yet

- Assume The FollowingDocument3 pagesAssume The FollowingElliot RichardNo ratings yet

- Assignment 2Document4 pagesAssignment 2Sultan LimitNo ratings yet

- Chapter 2-Bonds Payable Students RevDocument45 pagesChapter 2-Bonds Payable Students RevPriscillia SakuraNo ratings yet

- The Statement of Financial Position of Stancia Sa at DecemberDocument1 pageThe Statement of Financial Position of Stancia Sa at DecemberCharlotte100% (1)

- Packard Company Has The Following Opening Account Balances in ItDocument1 pagePackard Company Has The Following Opening Account Balances in ItM Bilal SaleemNo ratings yet

- FIX ASSET&INTANGIBLE ASSET Kel. 1 AKM 1 PDFDocument6 pagesFIX ASSET&INTANGIBLE ASSET Kel. 1 AKM 1 PDFAdindaNo ratings yet

- P7-11 (Income Effects of Receivables Transactions) Sandburg Company Requires Additional Cash For ItsDocument3 pagesP7-11 (Income Effects of Receivables Transactions) Sandburg Company Requires Additional Cash For ItsDella Putri Reba UtamyNo ratings yet

- Comprehensive Problems Solution Answer Key Mid TermDocument5 pagesComprehensive Problems Solution Answer Key Mid TermGabriel Aaron DionneNo ratings yet

- 645873Document3 pages645873mohitgaba19No ratings yet

- Adjusting Allowance for Doubtful AccountsDocument2 pagesAdjusting Allowance for Doubtful AccountsWisanggeni RatuNo ratings yet

- LATIH SOAL M3 3 Laporan Laba Rugi Dan Hal Lain Yg BerkaitanDocument2 pagesLATIH SOAL M3 3 Laporan Laba Rugi Dan Hal Lain Yg BerkaitanBlue FinderNo ratings yet

- حل الكتابDocument12 pagesحل الكتابايهاب غزالةNo ratings yet

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnDocument6 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnSkarlz ZyNo ratings yet

- HW 7Document2 pagesHW 7Mishalm96No ratings yet

- Contoh Dan Soal Cash FlowDocument9 pagesContoh Dan Soal Cash FlowAltaf HauzanNo ratings yet

- Belinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To TheDocument1 pageBelinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To ThebelindaNo ratings yet

- Body EmailDocument2 pagesBody Emailferry firmannaNo ratings yet

- Tugas CH 8 Dan 9Document13 pagesTugas CH 8 Dan 9muhammad alfariziNo ratings yet

- Consolidated Financial Statement Practice 3-2Document2 pagesConsolidated Financial Statement Practice 3-2Winnie TanNo ratings yet

- Akuntansi Biaya - Tugas E4-23Document3 pagesAkuntansi Biaya - Tugas E4-23Rizkya Ajrin ArtameviaNo ratings yet

- Assignment Week 4 Hal 205Document1 pageAssignment Week 4 Hal 205Pinarasrayan HaqueNo ratings yet

- ACY4001 Individual Assignment 2 SolutionsDocument7 pagesACY4001 Individual Assignment 2 SolutionsMorris LoNo ratings yet

- Tugas Mandiri Lab. Ak. Meng 1 - PersediaanDocument9 pagesTugas Mandiri Lab. Ak. Meng 1 - PersediaanZachra MeirizaNo ratings yet

- The Respective Normal Account Balances of Sales RevenueDocument12 pagesThe Respective Normal Account Balances of Sales RevenueRBNo ratings yet

- E21 16Document2 pagesE21 16Warmthx0% (1)

- Condensed Income Statement, Periodic Inventory MethodDocument2 pagesCondensed Income Statement, Periodic Inventory MethodAsma HatamNo ratings yet

- Lecture 8 - Exercises - QuestionDocument3 pagesLecture 8 - Exercises - QuestionIsyraf Hatim Mohd TamizamNo ratings yet

- Accounting Problem 5 5ADocument8 pagesAccounting Problem 5 5AParbon Acharjee100% (1)

- Pert 11 Tugas Dividend and Retained Earnings PDFDocument1 pagePert 11 Tugas Dividend and Retained Earnings PDFAini NS100% (1)

- Homework1 E3 10Document4 pagesHomework1 E3 10Jade NguyenNo ratings yet

- 3 Cash - Assignment PDFDocument6 pages3 Cash - Assignment PDFCatherine RiveraNo ratings yet

- Chapter 15 Amended With AnswersDocument6 pagesChapter 15 Amended With AnswersIbn FaridNo ratings yet

- ACCT550 Homework Week 1Document6 pagesACCT550 Homework Week 1Natasha DeclanNo ratings yet

- Pandora Acquires Sophocles CompanyDocument4 pagesPandora Acquires Sophocles CompanyAstria Arha DillaNo ratings yet

- Accounting 1Document11 pagesAccounting 1Audie yanthiNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- P5 4Document3 pagesP5 4Monica HutagaolNo ratings yet

- Page 204 Post ClosingDocument7 pagesPage 204 Post ClosingPaulina MayganiaNo ratings yet

- Specimen For Qiuz & Assignment .........................................Document3 pagesSpecimen For Qiuz & Assignment .........................................Umair AmirNo ratings yet

- 6-GL and FR CycleDocument6 pages6-GL and FR Cyclehangbg2k3No ratings yet

- Logan Industries asset acquisition and building constructionDocument1 pageLogan Industries asset acquisition and building constructionseptember manisNo ratings yet

- Ganang Surya Hananta Swara 1901572691 Tugas Personal Ke-4 Minggu 8Document22 pagesGanang Surya Hananta Swara 1901572691 Tugas Personal Ke-4 Minggu 8Vira JilmiNo ratings yet

- MODULE 6 English For Communication IDocument26 pagesMODULE 6 English For Communication IAngga ServiamNo ratings yet

- Tugas Sesi 7Document5 pagesTugas Sesi 7mutmainnahNo ratings yet

- Contoh Soal Laporan Arus KasDocument2 pagesContoh Soal Laporan Arus KasGabriel HarrisNo ratings yet

- Audit of Other Income Statement ComponentsDocument7 pagesAudit of Other Income Statement ComponentsIbratama Sukses PratamaNo ratings yet

- Latihan 7 PAK MaksiDocument3 pagesLatihan 7 PAK MaksiDwi HandariniNo ratings yet

- MK 2102-BAE2020 - Aje - ReDocument2 pagesMK 2102-BAE2020 - Aje - ReAngela ThrisanandaNo ratings yet

- FA3PDocument4 pagesFA3PdainokaiNo ratings yet

- Neosho River Resort Opened For Business On June 1 With PDFDocument1 pageNeosho River Resort Opened For Business On June 1 With PDFAnbu jaromiaNo ratings yet

- Soal Pert 6 - Merchandising Business - JordyDocument1 pageSoal Pert 6 - Merchandising Business - JordyJordy Tang100% (1)

- Soal Asistensi Pa 1 - JordyDocument1 pageSoal Asistensi Pa 1 - JordyJordy TangNo ratings yet

- Jawaban Asis 2 - JordyDocument3 pagesJawaban Asis 2 - JordyJordy TangNo ratings yet

- Accounting Errors and Dentist Business TransactionsDocument1 pageAccounting Errors and Dentist Business TransactionsJordy TangNo ratings yet

- Soal Asistensi Master BudgetDocument4 pagesSoal Asistensi Master BudgetJordy Tang100% (1)

- Soal Asistensi Pa 1 - JordyDocument1 pageSoal Asistensi Pa 1 - JordyJordy TangNo ratings yet

- Financial Management Tutorial QuizDocument1 pageFinancial Management Tutorial QuizJordy TangNo ratings yet

- Asistensi Akuntansi Keuangan 2 - Basic& Diluted EPSDocument2 pagesAsistensi Akuntansi Keuangan 2 - Basic& Diluted EPSJordy TangNo ratings yet

- Chap 4 ReviewDocument60 pagesChap 4 ReviewDezi Brown100% (1)

- Abubakar v. Auditor GeneralDocument1 pageAbubakar v. Auditor GeneralsectionbcoeNo ratings yet

- Admin Law Cases I (Digests)Document5 pagesAdmin Law Cases I (Digests)Glyza Kaye Zorilla PatiagNo ratings yet

- Industrial Visit 2011Document5 pagesIndustrial Visit 2011magimaryNo ratings yet

- Santos Vs ManarangDocument10 pagesSantos Vs ManarangJan Jason Guerrero LumanagNo ratings yet

- ERP Report on Miscellaneous Billing for National Aviation CompanyDocument59 pagesERP Report on Miscellaneous Billing for National Aviation CompanyAnil Chaudhari0% (1)

- Application for Bonded TitleDocument4 pagesApplication for Bonded TitleRod ShaughnessyNo ratings yet

- Caselet Solution 3Document2 pagesCaselet Solution 3Dhara RathwaNo ratings yet

- Education LoanDocument82 pagesEducation LoanJCMMPROJECTNo ratings yet

- Integrated Realty Corporation Vs PNBDocument2 pagesIntegrated Realty Corporation Vs PNBcmv mendozaNo ratings yet

- Stanbic Bank: Mid Year Gauge The Kenyan Shilling Begins To Reflect Weak FundamentalsDocument9 pagesStanbic Bank: Mid Year Gauge The Kenyan Shilling Begins To Reflect Weak FundamentalsAreeb AhmadNo ratings yet

- Eureka Wow - Money-And-Financial-MarketsDocument208 pagesEureka Wow - Money-And-Financial-MarketsParul RajNo ratings yet

- Dairy Farming Success StoryDocument3 pagesDairy Farming Success StoryAman Roze BishnoiNo ratings yet

- LutonIncSolution 1527006077044Document2 pagesLutonIncSolution 1527006077044Nilesh DhatavkarNo ratings yet

- Chapter 1 IADocument43 pagesChapter 1 IAEloisaNo ratings yet

- Philippine Expenditure PatternDocument10 pagesPhilippine Expenditure PatternRara Alonzo100% (2)

- International Bond Market: Chapter ObjectiveDocument16 pagesInternational Bond Market: Chapter ObjectiveSam Sep A SixtyoneNo ratings yet

- Financial Aid Reflection Lesson 14Document2 pagesFinancial Aid Reflection Lesson 14api-287801256No ratings yet

- Saran Blackbook FinalDocument78 pagesSaran Blackbook FinalVishnuNadar100% (3)

- Hire Purchase FULL N FINALDocument12 pagesHire Purchase FULL N FINALAmyt KadamNo ratings yet

- ASNPO at a Glance OverviewDocument21 pagesASNPO at a Glance OverviewRemi AboNo ratings yet

- The UCC and The Assignment ProcessDocument5 pagesThe UCC and The Assignment ProcessJohnGarzaNo ratings yet

- Fornilda VsDocument2 pagesFornilda VsMark Aaron Delos ReyesNo ratings yet

- Grade 9 Top Accounting Exam AnalysisDocument3 pagesGrade 9 Top Accounting Exam AnalysisStars2323100% (3)

- Handling of Accounts of Deceased DepositorsDocument24 pagesHandling of Accounts of Deceased DepositorsUmair Khan NiaziNo ratings yet

- Debt Piles Add To RiskDocument8 pagesDebt Piles Add To RiskYOONNo ratings yet

- Military Ranks and Insignia at A GlanceDocument8 pagesMilitary Ranks and Insignia at A GlanceBill R WilsbergNo ratings yet

- Sample Business Proposal - Impact of Microfinance in KenyaDocument61 pagesSample Business Proposal - Impact of Microfinance in KenyaKennedy Nyabwala100% (15)

- Multiple-Choice Problems on Business TaxationDocument6 pagesMultiple-Choice Problems on Business TaxationKatKat Olarte0% (1)

- LiborDocument4 pagesLiborDaisy AggarwalNo ratings yet