Professional Documents

Culture Documents

Inquiry: Investment Banking Career Profile

Uploaded by

Wyatt ShelyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inquiry: Investment Banking Career Profile

Uploaded by

Wyatt ShelyCopyright:

Available Formats

INQUIRY: Investment Banking Career

Career Profile

Prospect for Success Paper # 2

Submitted to

Ms. Amy Riter

Director Undergraduate Special Programs

Belk College of Business

UNC Charlotte

Submitted by

S. Wyatt Shely

BUSN 1101-H01

November 23, 2015

Inquiry PFS Paper # 2

Inquiry: Investment Banking

Inquiry: Investment Banking Career Profile

Investment banking is one of the most competitive careers to pursue. Much of the world

has dramatized this lucrative and prosperous career, often misleading the public about the

immense amount of work it requires to excel in the investment banking industry. Yes, the

potential rewards of being in the financial industry, particularly investment banking, can be

incredibly attractive. Nevertheless, many people do not realize how much work is needed to

climb up the hypothetical investment banking ladder.

According to University Alliance (n.d.), working as an investment banker encompasses

an array of different duties including consulting with clients ... conducting research, maintaining

data in spreadsheets and creating reports ... and making recommendations (Investment Banker

Job Duties, para. 3). The purpose of an investment banker revolves around meeting the needs of

other businesses. Whether businesses need help with financing, or companies are interested in

becoming acquired or purchasing or merging with another firm, an investment banker will

advise and structure the complicated information needed to complete the deals (University

Alliance, n.d.). Due to the large amount of capital that is needed in deals involving investment

banks, it is critical that one take the responsibility of analyzing and interpreting data with a keen

sense to detail. As mentioned earlier, investment bankers will have to collect and prepare data

that is important for conducting various deals such as an Initial Public Offering (IPO), or a

merger. Considering the amount of responsibilities that come with a career in investment

banking, one must be able to manage stress well.

A young career starting in investment banking is infamous for the large amount of hours.

One should be willing to work long hours that go well beyond the normal 40 hours a week

(Russell, n.d.). In fact, many investment bankers put in about 100 hours. According to a former

Inquiry: Investment Banking

investment banker, Julia La Roche (2013), all of these hours do not include intense mental and

physical strength, but it still means being in the office for 100 hours. An early career in

investment banking calls for many hours in office, but as you climb the ladder and take on more

responsibility, you will travel and be in front of clients more often.

Advancing ones position in an investment bank is fairly straightforward. The major

differences between positions is the qualifications and training required. The first job one may

get right out of an undergraduate program is an analyst position. This is the position that has the

most hours in the office, and one will be spending the majority of the time creating pitch books,

or PowerPoint presentations, and doing analytical work (Investment Banker Career Paths,

n.d.). In order to become an analyst, one should have some kind of business degree. It is also

helpful to obtain an internship at an investment bank prior to graduating. Many investment

banks hire from their internship programs.

Becoming an associate is the next level in an investment bank. There are two separate

ways people become associates. One is straight out of an MBA program, and the other is from a

promotion as an analyst. As one can see, an MBA is not required for the associate level, but it is

admired. Put simply, an associates job is to manage their analysts. This includes assigning them

work to be completed, as well as revising their work. It depends on for which bank one is

working, but usually associates are promoted to Vice President after three years (Investment

Banker Career Paths, n.d.). Obviously, as one progresses through the levels of investment

banking, the responsibilities increase.

Vice Presidents at investment banks manage the two levels below them, associates and

analysts. According to a former Goldman Sachs banker, Michel, Vice Presidents also help to

manage clients on a daily basis (as cited in Butcher, 2004). Similar to the advancement of an

Inquiry: Investment Banking

associate, many Vice Presidents earn their position after serving at the associate level for three

years. The top and most prestigious level of an investment bank is Managing Director. This role

requires one to not only have expert knowledge of the financial markets, but to also build and

foster relationships with current and future clients (Butcher, 2004). Making ones way to the top

of an investment bank will take a significant amount of experience in the industry.

Although investment bankers work an extensive amount of hours, they are compensated

quite nicely. In fact, they have some of the most attractive earnings in the financial industry. At

the lowest position, an analyst, one can expect to earn from $70,000 to $350,000 depending on

the number of years worked for the bank. Associates earn $150,000 to $500,000, also depending

on how many years of experience. Vice Presidents earn $350,000 to an astounding 1.5 million

dollars. And finally, Managing Directors earn anywhere from half a million dollars to twenty

million dollars. These are rough estimates of compensation that rely on the amount of deals

taken on by investment banks, as well as the overall size of the banks (Investment Banking

Salary & Compensation, n.d.). Encouragingly, the U.S. Bureau of Labor Statistics has predicted

an eleven percent growth of jobs in the investment banking industry (University Alliance, n.d.).

This rise is due to a large retiring population of baby boomers in the coming years. Being

proactive and securing an internship with an investment bank while pursuing ones

undergraduate degree is an advantageous strategy to secure a spot in this industry.

Inquiry: Investment Banking

5

References

Butcher, S. (2014, October 29). Banks' weird hiearchies: What analysts, associates, VPs, MDs do

really. Retrieved November 25, 2015, from http://news.efinancialcareers.com/usen/167611/banks-weird-hierarchies-analysts-associates-vps-mds-really/

Investment Banker Career Paths. (n.d.). Retrieved November 25, 2015, from

https://www.wallstreetprep.com/knowledge/investment-banking-careers/

Investment Banking Salary & Compensation, Average Bonus in Banking. (n.d.). Retrieved

November 25, 2015, from http://www.wallstreetoasis.com/salary/investment-bankingcompensation

Russell, A. (n.d.). The Job Description of an Investment Banking Analyst. Retrieved November

25, 2015, from http://work.chron.com/job-description-investment-banking-analyst17910.html

Roche, J. (2013, April 16). A Former Banker Explains How Wall Streeters Work 100 Hours A

Week and Keep Their Social Lives. Retrieved November 25, 2015, from

http://www.businessinsider.com/how-bankers-work-100-hours-per-week-2013-4

University Alliance. Investment Banker Career and Salary Profile. (n.d.). Retrieved November

25, 2015, from http://www.floridatechonline.com/resources/accountingfinance/investment-banker-career-and-salary-profile/

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Ideal CitizenDocument5 pagesThe Ideal CitizenWyatt ShelyNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- World Cup GlobalizationDocument9 pagesWorld Cup GlobalizationWyatt ShelyNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Microtheme 5Document2 pagesMicrotheme 5Wyatt ShelyNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Wyatt Shely: Will Be GreatDocument2 pagesWyatt Shely: Will Be GreatWyatt ShelyNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Microtheme 1Document2 pagesMicrotheme 1Wyatt ShelyNo ratings yet

- How I Used Feedback 1Document4 pagesHow I Used Feedback 1Wyatt ShelyNo ratings yet

- How I Used Feedback 2Document1 pageHow I Used Feedback 2Wyatt ShelyNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- First Discussion Board PostDocument5 pagesFirst Discussion Board PostWyatt ShelyNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Commitment To Success - BUSN 1101Document5 pagesCommitment To Success - BUSN 1101Wyatt ShelyNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Linear Space-State Control Systems Solutions ManualDocument141 pagesLinear Space-State Control Systems Solutions ManualOrlando Aguilar100% (4)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Statistical MethodsDocument4 pagesStatistical MethodsYra Louisse Taroma100% (1)

- Toward A Design Theory of Problem SolvingDocument24 pagesToward A Design Theory of Problem SolvingThiago GonzagaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- D8.1M 2007PV PDFDocument5 pagesD8.1M 2007PV PDFkhadtarpNo ratings yet

- Belbis Vs PeopleDocument1 pageBelbis Vs Peoplekatherine magbanuaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Form No. 10-I: Certificate of Prescribed Authority For The Purposes of Section 80DDBDocument1 pageForm No. 10-I: Certificate of Prescribed Authority For The Purposes of Section 80DDBIam KarthikeyanNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Strategic Risk ManagementDocument46 pagesStrategic Risk ManagementNuman Rox100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Genpact - Job Description - One Data and AI - B Tech Circuit and MCA (3) 2Document4 pagesGenpact - Job Description - One Data and AI - B Tech Circuit and MCA (3) 2SHIVANSH SRIVASTAVA (RA2011053010013)No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

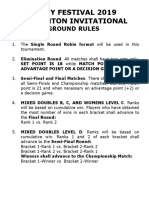

- Ground Rules 2019Document3 pagesGround Rules 2019Jeremiah Miko LepasanaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Lets Install Cisco ISEDocument8 pagesLets Install Cisco ISESimon GarciaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Tan vs. Macapagal, 43 SCRADocument6 pagesTan vs. Macapagal, 43 SCRANikkaDoriaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Zimbabwe Mag Court Rules Commentary Si 11 of 2019Document6 pagesZimbabwe Mag Court Rules Commentary Si 11 of 2019Vusi BhebheNo ratings yet

- Stockholm KammarbrassDocument20 pagesStockholm KammarbrassManuel CoitoNo ratings yet

- Complete Admin Law OutlineDocument135 pagesComplete Admin Law Outlinemarlena100% (1)

- WaiverDocument1 pageWaiverWilliam GrundyNo ratings yet

- 800 Pharsal Verb Thong DungDocument34 pages800 Pharsal Verb Thong DungNguyễn Thu Huyền100% (2)

- Modern DrmaDocument7 pagesModern DrmaSHOAIBNo ratings yet

- Arctic Beacon Forbidden Library - Winkler-The - Thousand - Year - Conspiracy PDFDocument196 pagesArctic Beacon Forbidden Library - Winkler-The - Thousand - Year - Conspiracy PDFJames JohnsonNo ratings yet

- Dan 440 Dace Art Lesson PlanDocument4 pagesDan 440 Dace Art Lesson Planapi-298381373No ratings yet

- August Strindberg's ''A Dream Play'', inDocument11 pagesAugust Strindberg's ''A Dream Play'', inİlker NicholasNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Hero Cash Cash Lyrics - Google SearchDocument1 pageHero Cash Cash Lyrics - Google Searchalya mazeneeNo ratings yet

- India: SupplyDocument6 pagesIndia: SupplyHarish NathanNo ratings yet

- Isolated Flyback Switching Regulator W - 9V OutputDocument16 pagesIsolated Flyback Switching Regulator W - 9V OutputCasey DialNo ratings yet

- SPQRDocument8 pagesSPQRCamilo PeraltaNo ratings yet

- DELA CRUZ - LAC 1 - 002 - Individual Learning Monitoring Plan - Bugtongnapulo INHSDocument2 pagesDELA CRUZ - LAC 1 - 002 - Individual Learning Monitoring Plan - Bugtongnapulo INHSGilbert Dela CruzNo ratings yet

- Pediatric Autonomic DisorderDocument15 pagesPediatric Autonomic DisorderaimanNo ratings yet

- Bersin PredictionsDocument55 pagesBersin PredictionsRahila Ismail Narejo100% (2)

- Peter Lehr Militant Buddhism The Rise of Religious Violence in Sri Lanka Myanmar and Thailand Springer International PDFDocument305 pagesPeter Lehr Militant Buddhism The Rise of Religious Violence in Sri Lanka Myanmar and Thailand Springer International PDFIloviaaya RegitaNo ratings yet

- Comfrey Materia Medica HerbsDocument17 pagesComfrey Materia Medica HerbsAlejandra Guerrero100% (1)

- Traps - 2008 12 30Document15 pagesTraps - 2008 12 30smoothkat5No ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)