Professional Documents

Culture Documents

Name of The Contributors of Economics

Uploaded by

Marius VillanuevaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Name of The Contributors of Economics

Uploaded by

Marius VillanuevaCopyright:

Available Formats

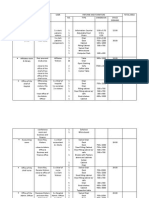

Name of the Contributors of Economics

From the father of Economic History who developed theories to explain why capitalist economies

have fluctuations and crises - to the greatest economic thinker of the 20th century

1. ADAM SMITH (1723-1790)

A key figure of the Scottish Enlightenment, Smith is the giant on whose

shoulders subsequent economists have stood. He is best known

for The Wealth Of Nations, his 1776 landmark book on economics,

published at the dawn of the Industrial Revolution - and was even

consulted on economic matters by Pitt The Elder, the Whig politician

and Prime Minister. His arguments for free trade, market competition

and the morality of private enterprise remain as fresh and influential

as when written over 200 years ago. That said, Smith - who studied

and later taught at Glasgow University - saw only a limited role for

government and was hostile to economic nationalism. However, his

arguments have at times been misinterpreted by free marketeers in recent decades. The fact is that

he did not believe in 'laissezfaire' (an earlier French doctrine opposing any government intervention

in economic matters) - he saw government's sole job as to establish law and justice, and provide for

the nation's education and basic infrastructure.

2. DAVID RICARDO (1772-1823)

British political economist - the third of 17 children from a Sephardic Jewish

family of Portuguese origin - Ricardo was a huge influence on 19th-century

economics. After making a fortune as a stockbroker, he became fascinated

by economics - and wrote the influential The Principles Of Political Economy

And Taxation (1817). In it, he dealt with questions of distribution (worker

and landlord rewards, etc) and the link with the value of production: in

particular, the idea of economic 'rent', where rewards are greater than the

cost of production. This foreshadowed today's debate about 'fair' pay and

rewards. Crucially, he developed Adam Smith's thinking on free trade, and

his work helped the Anti-Corn Law League win the battle over the Corn Laws

(protective duties on corn, designed to protect the landed gentry, which were repealed in 1846) which

established Britain as a free-trading nation.

3. FUKUZAWA YUKICHI (1834-1901)

An author, entrepreneur and political theorist, Yukichi's ideas made a lasting

impact on Japan following the 1868 Meiji Revolution, which saw the

restoration of imperial rule in Japan and set in train its economic

modernisation. Widely regarded as one of Japan's founding fathers, Yukichi

tried to understand how modern systems and organisations worked and

how 'civilisation', including business enterprise and new technology, could

be transplanted to Japan to create economic development. He was an

educator rather than an economist but wrote many books that influenced a

generation of Japanese to embrace a rational and scientific approach to

economic, and wider, policy. If it hadn't been for Yukichi, I suspect the

modernisation and industrialisation of Japan, and subsequently the rest of

east Asia, would have probably been longer in coming.

4. KARL MARX

OK, Marx might now be remembered as a revolutionary advocate of

communism - he co-wrote The Communist Manifesto - but he was a leading

19th-century economist in the 'classical' tradition. Indeed, in many ways he

is the father of Economic History, having developed explanations for the

evolution of the economic structure from feudalism to capitalism. The

German philosopher, sociologist and economist, who spent much of his life

in London (and is buried in Highgate Cemetery), developed theories to

explain why capitalist economies - which he opposed - have fluctuations and

crises. However, despite his belief in capitalism's self-destructive tendencies,

much of his economic thinking stands up to scrutiny. Had it not been for The

Communist Manifesto, I think Western commentators would recognise more readily today his role in

advancing economic thinking.

5. AMARTYA SEN (1933-)

Among the most important events of my lifetime has been the economic

emergence through rapid growth of major developing countries - most

notably China and India, but also Korea, Brazil and Mexico among others. A

variety of fine economists have contributed to understanding growth and

development in the late 20th century: among them Sen, the Indian Nobel

Laureate (he was awarded the 1998 Nobel Prize in Economic Sciences). One

of the Bengal-born economist's key contributions was a book on famine

whose essential point was that it originates in a shortage of income rather

than food. More recently he has sought to inject an ethical dimension into

economic thinking. It's interesting to note that not only are nations like India

now making their mark economically, so are their economists.

6. JOHN MAYNARD KEYNES (1883-1946)

The greatest economic thinker of the 20th century, Keynes (a Liberal incidentally) challenged

fundamentally the idea that market economies will automatically adjust to create full employment.

After working at the Treasury during World War I, he was its chief representative at the post-war Paris

peace conference, but resigned in protest at the harshness of the planned reparations. In the Twenties

he developed radical plans for dealing with unemployment through deficit financing and state

intervention. His insistence on the central role that uncertainty plays in

economic decisions foreshadows much of the current interest in

behavioural economics. While his basic economic framework - in which

short-term economic growth (and employment) depends on 'aggregate

demand' (consumption, investment and net exports) is built into many of

our forecasting models today. Later on, he participated in the Bretton

Woods conference (which looked at how to establish a post-war monetary

system that would avoid further economic crises) that led to the creation

of the International Monetary Fund and the World Bank. Admittedly, he

went out of fashion in recent decades when inflation was a bigger worry

than unemployment. However, the present crisis has led to something of a revival in Keynesian

thinking, and his insights into how international imbalances should be tackled remain highly relevant.

7. MILTON FRIEDMAN (1912-2006)

Wrongly described as the antithesis and an opponent of Keynes, Friedman is

associated essentially with two big ideas which have inspired the Chicago

School of Economics. One is an uncompromising restatement and

development of Adam Smith's views on the merits of free markets. He made

the case for floating exchange rates (as Britain has had since Black

Wednesday in 1992) - but the translation of this idea into a belief in 'efficient'

financial markets has been severely tested (perhaps to destruction) in the

recent financial crisis. His other major contribution, the quantity theory of

money - given its first clear statement by the great Scottish thinker David

Hume - linking money supply to inflation, was embraced in the Eighties by

Mrs Thatcher's government with mixed results. It has, however, moved back

to centre stage in the current crisis as central banks have fought recession (and the risks of deflation)

by means of aggressive monetary policy: minimal interest rates and expanding money supply via

quantitative easing.

8. JOSEPH SCHUMPETER (1883-1950)

The Austrian-American economist and political scientist is responsible for

the idea of capitalism as a (positive) source of 'creative destruction'.

Technology and capitalism together drive change and growth - but

traditional freemarket thinking would worry about monopolies (albeit

temporary) such as Microsoft's software platforms, which are based on

intellectual property protection of an innovation. However, Schumpeter,

who moved to the USA in 1932, saw the process as benign. He believed that

such 'monopoly rents' encouraged innovation and investment, which are

essential to growth. Modern capitalism - often based on competition

between innovative giant companies - is somewhat closer to the Schumpeter

model than Adam Smith's. Incidentally, Schumpeter's followers are a part of

the so-called Austrian School, which is highly critical of the orthodox (Keynesian and Friedmanite)

attempt to fight the current crisis through reflationary fiscal and monetary policy. They believe banks,

governments and individuals have no alternative but to learn from their mistakes, not be rescued from

them.

9. DANIEL KAHNEMAN (1934-)

Daniel Kahneman, an Israeli-American psychologist - not an

economist - did much of the pioneering work in the fascinating field

of 'behavioural economics'

Perhaps the most radical change in direction in economics in recent

decades has been the emergence of 'behavioural economics'. And

Kahneman, an Israeli-American psychologist - not an economist did much of the pioneering work in this fascinating field. Traditional

economics, from Smith and Ricardo to Marx, Keynes and Friedman,

has been based on general theories which treat it as a branch of natural science. But people are not

like atoms, or plants, or rats in mazes. They learn and adapt (or we hope they do), invalidating models

based on past behaviour. However, people also hang on to irrational habits and seemingly perverse

ways of evaluating choices, confounding those economists who premise their models on 'rational

economic man'. Some economists have retaliated by applying economic rationality to explain noneconomic problems such as crime and punishment, prostitution and marriage patterns.

10. HYMAN MINSKY(1919-1996)

The Western world has been painfully reminded over the past three years of the way capitalist

economies - especially their banks - can be caught in speculative financial bubbles which burst with

disastrous effects.

The South Sea Bubble (which saw shares in an 18th-century British company soar before crashing) was

an early example of such an event. The philosopher John Stuart Mill wrote about cycles leading to

bank collapses and ensuing 'credit crunches' in the 19th century - and Minsky was the best analyst of

the problem in recent times.

Sometimes described as a post-Keynesian economist (because he supports some government

intervention), the American described with uncanny accuracy the seven stages of a boom and bust

cycle which we have now seen enacted in our own country.

The Coalition Government is now seeking to manage the consequences and to stop another Minsky

cycle developing.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Theories of Economic DevelopmentDocument77 pagesTheories of Economic Developmentdigvijay909100% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- AP Macroeconomics Practice Exam 2012Document8 pagesAP Macroeconomics Practice Exam 2012KatieNo ratings yet

- Keynesian TheoryDocument98 pagesKeynesian TheorysamrulezzzNo ratings yet

- (Rethinking Globalizations 30) Barry K. Gills - Patrick Manning-Andre Gunder Frank and Global Development - Visions, Remembrances and Explorations-Routledge (2011) PDFDocument313 pages(Rethinking Globalizations 30) Barry K. Gills - Patrick Manning-Andre Gunder Frank and Global Development - Visions, Remembrances and Explorations-Routledge (2011) PDFCozme Fulanito100% (1)

- History of Philippine MoneyDocument5 pagesHistory of Philippine MoneyMarius Villanueva100% (2)

- History of Philippine MoneyDocument5 pagesHistory of Philippine MoneyMarius Villanueva100% (2)

- Heather Whiteside - Capitalist Political Economy - Thinkers and Theories-Routledge (2020)Document173 pagesHeather Whiteside - Capitalist Political Economy - Thinkers and Theories-Routledge (2020)Can ArmutcuNo ratings yet

- Macroeconomics 4th Edition Krugman Solutions Manual DownloadDocument7 pagesMacroeconomics 4th Edition Krugman Solutions Manual DownloadRex Webster100% (25)

- Embedding Neoliberalism: The Evolution of A Hegemonic Paradigm (By Philip Cerny, From The Journal of International Trade and Diplomacy 2 (1), Spring 2008: 1-46)Document46 pagesEmbedding Neoliberalism: The Evolution of A Hegemonic Paradigm (By Philip Cerny, From The Journal of International Trade and Diplomacy 2 (1), Spring 2008: 1-46)skasnerNo ratings yet

- AirportDocument8 pagesAirportShiela CedronNo ratings yet

- AirportDocument8 pagesAirportShiela CedronNo ratings yet

- Ang Ladlad LGBT Party V Comelec DigestDocument2 pagesAng Ladlad LGBT Party V Comelec DigestAmado Peter Garbanzos80% (5)

- Mark S. Mizruchi - The Fracturing of The American Corporate Elite-Harvard University Press (2013) PDFDocument380 pagesMark S. Mizruchi - The Fracturing of The American Corporate Elite-Harvard University Press (2013) PDFMoulay BarmakNo ratings yet

- Ventilation and Its ImportanceDocument41 pagesVentilation and Its Importancejoy abraham100% (1)

- Hansen 1951Document5 pagesHansen 1951Vishnu GirishNo ratings yet

- (SPEECH) A Short Speech On Global WarmingDocument1 page(SPEECH) A Short Speech On Global WarmingMarius Villanueva100% (1)

- Keynes, The Post Keynesians and The Curious Case of Endogenous MoneyDocument25 pagesKeynes, The Post Keynesians and The Curious Case of Endogenous MoneySebastian MartinezNo ratings yet

- Perali, Scandizzo - The New Generation of Computable GeneralDocument343 pagesPerali, Scandizzo - The New Generation of Computable GeneralEstudiante bernardo david romero torresNo ratings yet

- Brgy. SindalanDocument7 pagesBrgy. SindalanMarius VillanuevaNo ratings yet

- Space ProgDocument16 pagesSpace ProgMarius VillanuevaNo ratings yet

- ArchitectureDocument353 pagesArchitectureMarius Villanueva100% (2)

- Accessibility Law Bp344Document3 pagesAccessibility Law Bp344NicoCastilloNo ratings yet

- Overview of PHil TourismDocument38 pagesOverview of PHil TourismMarius VillanuevaNo ratings yet

- Space ProgDocument5 pagesSpace ProgMarius VillanuevaNo ratings yet

- Animal Farm by George OrwellDocument1 pageAnimal Farm by George OrwellMarius VillanuevaNo ratings yet

- Philippine ArchitectureDocument18 pagesPhilippine ArchitectureMarius VillanuevaNo ratings yet

- Hum Course OutlineDocument5 pagesHum Course OutlineMarius VillanuevaNo ratings yet

- Sample Letter of Recommendation RevisedDocument1 pageSample Letter of Recommendation RevisedMarius VillanuevaNo ratings yet

- 2015 Trends in ArchitectureDocument12 pages2015 Trends in ArchitectureMarius VillanuevaNo ratings yet

- Draft Chapter2Document5 pagesDraft Chapter2Marius VillanuevaNo ratings yet

- Airport Research FinalDocument17 pagesAirport Research FinalMarius VillanuevaNo ratings yet

- Development of Successful Resort Design With Vernacular Style in Langkawi MalaysiaDocument12 pagesDevelopment of Successful Resort Design With Vernacular Style in Langkawi MalaysiaJulie NilayNo ratings yet

- Users Mindoro's CultureDocument9 pagesUsers Mindoro's CultureMarius VillanuevaNo ratings yet

- Definition of TermsDocument3 pagesDefinition of TermsMarius VillanuevaNo ratings yet

- Case Study Na VerticalDocument5 pagesCase Study Na VerticalMarius VillanuevaNo ratings yet

- ArchitectureDocument12 pagesArchitectureMarius VillanuevaNo ratings yet

- Media and Prosocial BehaviorDocument6 pagesMedia and Prosocial BehaviorMarius VillanuevaNo ratings yet

- Charlie Chaplin SpeechDocument2 pagesCharlie Chaplin SpeechMarius VillanuevaNo ratings yet

- Charlie Chaplin SpeechDocument2 pagesCharlie Chaplin SpeechMarius VillanuevaNo ratings yet

- ArchitectureDocument12 pagesArchitectureMarius VillanuevaNo ratings yet

- Keynesian is-LM Model (Print)Document3 pagesKeynesian is-LM Model (Print)Jose Jestin GeorgeNo ratings yet

- MCDocument127 pagesMCMadiha AshrafNo ratings yet

- Household and Firm Behavior in The Macroeconomy: A Further LookDocument64 pagesHousehold and Firm Behavior in The Macroeconomy: A Further Lookhasan jabrNo ratings yet

- The Titile of The Proposal Is DETERMINANTS ofDocument24 pagesThe Titile of The Proposal Is DETERMINANTS ofABEBAW BISETNo ratings yet

- Syllabus For Agribusiness Management (COQP01)Document80 pagesSyllabus For Agribusiness Management (COQP01)Sachin PalNo ratings yet

- Frenkel1976 PDFDocument26 pagesFrenkel1976 PDFCésar Manuel Trejo LuceroNo ratings yet

- Ba in EconomicsDocument6 pagesBa in EconomicsShravani SalunkheNo ratings yet

- Chapter 10 QuestionsDocument2 pagesChapter 10 QuestionsFreeBooksandMaterialNo ratings yet

- Birla Institute of Technology and Science, Pilani Pilani Campus Instruction DivisionDocument2 pagesBirla Institute of Technology and Science, Pilani Pilani Campus Instruction DivisionAstitva AgnihotriNo ratings yet

- Group 1Document27 pagesGroup 1ChristianNo ratings yet

- Mankiw Skeptics Guide To Modern Monetary Theory PDFDocument9 pagesMankiw Skeptics Guide To Modern Monetary Theory PDFFiel Aldous EvidenteNo ratings yet

- 10.chapter 1 (Introduction To Investments) PDFDocument41 pages10.chapter 1 (Introduction To Investments) PDFEswari Devi100% (1)

- Macro Economics 1Document9 pagesMacro Economics 1Deepak SinghNo ratings yet

- Manuscript Research 1Document20 pagesManuscript Research 1Kaye Jay EnriquezNo ratings yet

- Abel Macro8c TIF Ch01-2Document14 pagesAbel Macro8c TIF Ch01-2Mr.TNo ratings yet

- AP Macro Classical vs. KeynesianDocument15 pagesAP Macro Classical vs. KeynesianShawn OlsenNo ratings yet

- Street Vendors, Modernity and Postmoder-Nity: Conflict and Compromise in The Global EconomyDocument23 pagesStreet Vendors, Modernity and Postmoder-Nity: Conflict and Compromise in The Global EconomyAbo El-SafaweeetNo ratings yet

- Schools of Economic ThoughtDocument5 pagesSchools of Economic ThoughtTrang NguyenNo ratings yet

- The Globalization of World Economics: Lesson 02Document7 pagesThe Globalization of World Economics: Lesson 02Rheamie FuyonanNo ratings yet