Professional Documents

Culture Documents

Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

Regd.

Offics: Ncw No. 4, Old

No. 47. N,owrcji

Rd, Chdpcr, Chcmi - 600031

CINr 13699lTN1991P1@21888

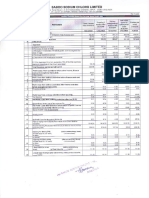

Rs.in Lqkhs

Unauditcd Fimrriol R.sult,

for thr guortcr qdcd 3frt Dcccnbcr ZOl4

Comepoding Y"or lo dotc

pfcvious

3 nonths

sI.

Porticulorc

l.lo

andcd

31.t2.2011

frotn opc.o?ions

(o) Nlet soles/incone frcril oprotions

3 nonths

crdcd

30.09.2014

cndcd in thc

Ycor ?o dotc

fi$rc for thc

Prcvious

pr.avious yaor

yeor crdcd

31.03.2014

pravious ycor

endcd

cndcd

31.12.20r3

(/n-At ditcd)

31.1e.2014

31.12-20r3

(A'rdit d)

785.27

0.63

746.16

632.t6

o.25

2,276.64

2.20

1,679.49

3.20

2,968.?9

t.28

785.90

747.4

632.1t

Expcrscs

(o) 6ost of rnoteriqb consuned

(b) Chongas in ihventories of finished goods, work-inond stock-in-trod

2.Z7E.U

1,682.6E

2.976.12

52t.52

615.47

525.13

1,697.34

1,289.87

?,ut.to

65.25

36.76

(37.44)

(c) Employee benefits ?xpense

(36.46)

22.24

111.45

18.05

18.06

35,01

50.78

33.43

23.77

64.07

(e.36)

t02.46

53.9?

001.20)

(d) Deprcciotion ond orortizction expeEe

(e) Other expenses

37.38

t57.39

184_O7

325.21

676.59

694.26

6@.94

2,U2.16

,,620.97

2.853.58

109.3r

53.18

22.4E

236.38

61.72

t22.85

109.31

53.18

86.02

45.47

?2.48

47.88

236.38

197.57

61.72

167.42

224.76

23.29

7.71

(25.4t)

38.81

(105.71)

4.59

(10r.90

2.45

tE-70

5.26

Totol inconc from opcrfotiorc (n

Total apcnscs

Ptofit(Loss)

op.r.otio6 bcforc ofhcr

fina'lcc costs ond cxccptioral itcns (l-2)

fTom

fiom ordimrl activities before finance cosfs

exceptionol items (3 i 4)

costs

from ordimry octivities ofter fimnce

but before exccpfioml itens (5 - 6)

itens

fon

odinory octivitiG bp,tcrl. tax O

r8)

Tox expense

Plfit(l,oss)

(9

fronr ordinor?

54.04

8.12

117.76

7070

lrrconp.

tncoma

8.41

(25.41)

0.59

ocfiviflc aftcr

t0)

t2 lPoid-up e$rity sharv cdpitol

1: lReserw excluding Revoluafion Reser\s

14

per shorc Bosic & Dilutcd

lEornings

30..t0

122.E5

o.92

r.t9

(106.63)

(r03.r01

(r06.63)

(103.rq

1.32

tE.70

4.67

(25.4r)

609.60

o09.60

609.60

29.08

ouy.oo

609.60

609.60

(431.60)

0.31

o.o77

I PARTICIJtARS oF SHAREHoLDII\Ia

15

fignsc for. thc

Eps cnd Shcrcholding dct<

(Mt of excise

duty)

(b) Other operofing income

l(

3 nonths

ac"pt

(o.417.

0.48

(1.75)

0.6e)

Public shorcholding

- Nrmber of shares

- Percentoge of shorcholding

3941078

64.65%

3942078

2t54922

2t53922

35.35%

35.33%

64.67%

Prumoters ond Pnomotcr 6rcup Shoreholding

(o) PledpdlEngrmbered

- Nmbcr of shorcs

- Perccntog of sharcs (os o

shoreholding

3942078

64.6n"

3941078

3942078

64.67/,

394?078

64.65"/,

2153922

2154922

2153922

2t53922

35.33%

35.35%

35.33%

35.33%

100.00%

100.00%

100.00%

100.00%l

64.677"

of the total

of promoter

ond pnormter group)

- Percentoge of sharcs (os o % of the totcl shone

copitol of the company)

(b) tlon - enctrnberred

- l.lmbcr of shor.es

- Pcroentdgp of shares (os o

of th. totol

Promoter ond prsnroter group)

- Percentoge of shsr.s (os o % of the totoishore

shorreholding

of the

:apitol of the conpory)

100.00%

Poriicrrlor:s

INVESTOR COflPL/TNTS

padiry qt the bcginnhg of tha qmrter

Eciwd durirE ihc gurtq

Nil

dispsed off during th guarier

Nil

ramaining unresolraed ot the end

100.00%l

!mtg

91.t2.2011

of the quorter

Nit

Nil

The obove finoncial results were subjected

to "Lirnited review" by the sfotutory Auditors

of the compony, hove been reviewedby the Audit

committee oi its meeting ond tdken on record by

the Boord of Directors ot its meeting held on

l3th Februory 2015.

The compory bei ng engoged in monufocture

of pocking nroteriols hos single segment inierms

of

Accounting stondord (AS) 17 .segment Reporting"

Previous yeor's figures hove been rearranged/regrouped

wherever necessory.

Depreciotion hos been chorged os per the Schedule

Xrv of the componies Act, tg56. Thc effect of

chonge brought out in Schedule rr of the

Conponies Act 2013 is being ossessed by the

irlonogement bosed on technicol evoluotions

and odjusiments if ony orising out of this

exercise would be

corried out in th last guorter' The fronsitionol

odjusments if ony orising out of this exercise

will be odjusted in the Reserves ond surprus ond

such will noi offect the results for the obove period,,.

os

Deferred ta></current tox odjustments sholl be ncde

ot the end of the yeor.

I:ffiJrT

comploint wcs pending either at the beginning

or of the end of the Quorter. Further no inv?stor,s

comploint hos been received during

.RAlH,.ilfiTGENA

NA6I'*9

DINECTOR

M. Srinivasan & Associates

Chartered Accountants

LIMITED REVIEW REPORT

We have reviewed the accompanying statement of unaudited financial results of

Stanpacks (lndia) Ltd for the quarter and nine months ended 31't Dec 2014 except for

the disclosures regarding 'Public Shareholding' and Promoter and Promoter Group

Shareholding which have been traced from disclosures made by the management and

have not been audited by us. This statement is the responsibility of the Company's

Ma.nagement and has been approved by the Board of Directors at the meeting held on

13th Feb 2015. Our responsibility is to issue a report on these financial stltements

based on our review.

We conducted our review in accordance with the Standard on Review Engagement

(SRE) 2400, engagements to Review Financial Statements issued by the lnstitute of

Chartered Accountants of lndia. This standard requires that we plan and perform the

review to obtain moderate assurance as to whether the financial statements are free of

material misstatement. A review is limited primarily to inquiries of the company

personnel and analytical procedures applied to financial data and thus provides less

assurance than an audit. We have not performed an audit and accordingly, we do not

express an audit opinion.

Based on our review conducted as above, nothing has come to our attention that causes

us to believe that the accompanying statement of unaudited Quarterly financial results

prepared in accordance with applicable accounting standards and other recognized

accounting practices and policies has not disclosed the information required to be

disclosed in terms of Clause 4't of the Listing Agreement including the manner in which it

is to be disclosed, or that it contains any material misstatement.

For M. Srinivasan & Associates,

Chartered Accountants

Date itz.oz.zols

Place: Chennai

[UiSrinivasan

Partner

M.No,022959

ffi

W#ry

#5,

Tal' (+Q1-AA\ )Rrn

B Wing, Parsn Manere, 9th Floo6 442, Annasalai, Chennai - 600 006.

,2Al lR?

Fev' /rO1-/tr.l tQ)fit2,AA o-mqil rdminG\maqnt

You might also like

- Auditing Theory CabreraDocument23 pagesAuditing Theory CabreraGem Alcos Nicdao100% (2)

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document10 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For March 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Result)Document5 pagesFinancial Results & Limited Review For June 30, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Company Update)Document6 pagesFinancial Results & Limited Review Report For June 30, 2015 (Company Update)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- COA PresentationDocument155 pagesCOA PresentationRonnie Balleras Pagal100% (1)

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document7 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document2 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- National Code: To Inform Yau of and CondudedDocument12 pagesNational Code: To Inform Yau of and CondudedKhush GosraniNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- COA Presentation - RRSADocument155 pagesCOA Presentation - RRSAKristina Dacayo-Garcia100% (1)

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document12 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document9 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Requirements in Renewing Business PermitDocument1 pageRequirements in Renewing Business PermitCharina Marie CaduaNo ratings yet

- Performing Substatntive TestsDocument18 pagesPerforming Substatntive TestsAlex OngNo ratings yet

- Ust Global Welfare Foundation Guidelines For Ussociates in IndiaDocument10 pagesUst Global Welfare Foundation Guidelines For Ussociates in IndiaZenk itNo ratings yet

- Finance Accounts Assistant Question PaperDocument16 pagesFinance Accounts Assistant Question Paperakshaypranu5No ratings yet

- Long Form Audit ReportDocument34 pagesLong Form Audit ReportAshish SaxenaNo ratings yet

- Laporan Tahunan PT Nusa Raya Cipta TBK Tahun 2019Document249 pagesLaporan Tahunan PT Nusa Raya Cipta TBK Tahun 2019Fitriani WulandariNo ratings yet

- Loi / Icpo Buyer Profile CIS Ncnd/Imfpa: Proc E DU RE C I F, A SWP: + + + + + +Document2 pagesLoi / Icpo Buyer Profile CIS Ncnd/Imfpa: Proc E DU RE C I F, A SWP: + + + + + +Yrvis100% (1)

- Quizbowl M7&M8Document54 pagesQuizbowl M7&M8Ann Christine C. ChuaNo ratings yet

- Netrika Corporate Forensic Investigation Deck DTD 28th April, 2023Document41 pagesNetrika Corporate Forensic Investigation Deck DTD 28th April, 2023Himanshu BishtNo ratings yet

- GDEX Annual Report 2009 - 2nd PartDocument88 pagesGDEX Annual Report 2009 - 2nd PartElaine YeapNo ratings yet

- Notes Securities Regulation-1Document84 pagesNotes Securities Regulation-1Gregory QuentinNo ratings yet

- ACC LESSON 1 Balance SheetDocument38 pagesACC LESSON 1 Balance SheetRojane L. AlcantaraNo ratings yet

- TN Comptroller's FY2017 Audit of Grundy CountyDocument208 pagesTN Comptroller's FY2017 Audit of Grundy CountyDan LehrNo ratings yet

- Aicpa Special Committee On Assurance ServicesDocument16 pagesAicpa Special Committee On Assurance ServicesJoel Christian MascariñaNo ratings yet

- 3ATDocument3 pages3ATPaula Mae Dacanay0% (1)

- Emerging Issues - HR Policies of NK MindaDocument5 pagesEmerging Issues - HR Policies of NK MindaAyushmaan BaroowaNo ratings yet

- Laws Accounts PracticeDocument459 pagesLaws Accounts PracticeVarun Sahani0% (1)

- COSO ERM Exec Summary Draft Post Exposure Version PDFDocument16 pagesCOSO ERM Exec Summary Draft Post Exposure Version PDFMauricio MenjivarNo ratings yet

- A Qualitative and Quantitative Analysis of Public Health Expenditure in India: 2005-06 To 2014-15Document70 pagesA Qualitative and Quantitative Analysis of Public Health Expenditure in India: 2005-06 To 2014-15sonali mishraNo ratings yet

- Handout - Concept and Situs of IncomeDocument27 pagesHandout - Concept and Situs of Incomesosexyme123No ratings yet

- Financial ManagementDocument98 pagesFinancial Managementkcmiyyappan2701No ratings yet

- Auditors Certificate On Return of Deposits DPT 3Document4 pagesAuditors Certificate On Return of Deposits DPT 3Arundeep RanjanNo ratings yet

- Joint Venture Accounting (JVA) : SAP AG 2002Document38 pagesJoint Venture Accounting (JVA) : SAP AG 2002Himanshu OswalNo ratings yet

- CHP 14 NotesDocument22 pagesCHP 14 NotesDhruvit DadNo ratings yet

- Statement of The ProblemDocument3 pagesStatement of The ProblemCyangenNo ratings yet

- Accounting IA Sample Unit 1Document23 pagesAccounting IA Sample Unit 1CandiceNo ratings yet

- Module 4 - Government AccountingDocument14 pagesModule 4 - Government AccountingJoanna TiuzenNo ratings yet

- Unit 03 The Financial Statement AuditDocument31 pagesUnit 03 The Financial Statement AuditYeobo DarlingNo ratings yet

- Gadang - Annual Report 2018 PDFDocument284 pagesGadang - Annual Report 2018 PDFMohd FazlanNo ratings yet