Professional Documents

Culture Documents

Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

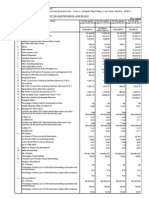

CEEJAY FINANCE LIMITED

Regd Office : C. J. House Motapore, NADIAD - 387001

Corporate Office : 9th floor, Abhijeet II, Mithakhali six Road

Ellisbridge, AHMEDABAD - 380006

UNAUDITED FINANCIAL RESULTS (PROVISIONAL)

FOR THE QUARTER ENDED 30th JUNE 2015

PARTICULARS

QUARTER ENDED

PART- I

1. Income From Operation ( Net )

TOTAL INCOME FROM OPERATION (net)

2. Expenses

(A) Employee Benefits Expenses

(B) Bad Debts/Hypo. Loans written off / ( Recovered )

(C) Provision for Doubtful / Non performing assets (net)

(D) Marketing Expenses

(E) Brokerage

(F) Depreciation

(G) Other Expenses

TOTAL EXPENSES

3. Profit from operations before Other Income, Finance

Costs and Exceptional Items (1-2)

4. Other Income

5. Profit before Finance Costs and Exceptional Items (3+4)

6. Finance Costs

7. Profit after Finance Costs but before Exceptional Items (5-6)

8. Exceptional Items

9. PROFIT BEFORE TAX (7-8)

10.Tax Expenses

11. PROFIT AFTER TAX (9-10)

12. Extraordinary Items

13. PROFIT FOR THE PERIOD(11-12)

14. Paid up Equity Share Capital (Face value Rs 10 each)

15. Reserves excluding Revaluation Reserve

16. Basic and Diluted E.P.S.

PART-II

A. PARTICULARS OF SHAREHOLDING

1. Public Shareholding

- Number of shares

- Percentage of shareholding

2. Promoters and Promoter Group shareholding

a) Pledged/Encumbered

- Number of shares

- Percentage of shareholding ( as a% of total of Promoter

and promoter group)

- Percentage of shareholding ( as a% of total of Share Capital)

b) Non-encumbered

- Number of shares

- Percentage of shareholding ( as a% of total of Promoter

and promoter group)

- Percentage of shareholding ( as a% of total of Share Capital)

B. INVESTOR COMPLAINTS

In Lacs)

PREVIOUS

YEAR ENDED

31.03.15

(AUDITED)

30.06.2015

(UNAUDITED)

31.03.2015

(UNAUDITED)

30.06.2014

(UNAUDITED)

287.43

287.43

319.19

319.19

268.07

268.07

31.43

(6.07)

19.49

13.42

7.87

3.72

26.27

96.13

191.30

38.24

51.65

(40.96)

13.79

9.28

2.97

42.22

117.19

202.00

26.34

(10.60)

19.80

8.71

4.99

3.46

26.48

79.18

188.89

0.07

191.37

53.94

137.43

137.43

45.37

92.06

92.06

345.00

1.35

203.35

59.70

143.65

143.65

46.52

97.13

97.13

345.00

0.33

189.22

53.60

135.62

135.62

43.93

91.69

91.69

345.00

2.67

2.82

2.66

2.67

776.54

225.37

551.17

551.17

178.53

372.64

372.64

345.00

2,322.22

10.80

14,44,981

41.88

14,44,981

41.88

14,44,981

41.88

14,44,981

41.88

Nil

N.A.

Nil

N.A.

Nil

N.A.

Nil

N.A.

N.A.

N.A.

N.A.

N.A.

20,05,019

100.00

20,05,019

100.00

20,05,019

100.00

20,05,019

100.00

58.12

58.12

58.12

58.12

1,157.63

1,157.63

136.64

21.47

0.04

49.19

30.55

14.77

131.10

383.76

773.87

There was one complaint from an investor during the Quarter. No investor complaint is pending at the Quarter-end

NOTES:1. The above results were taken on record by the Board of Directors at the meeting held on 31.07.2015.

2. The auditors of the Company have carried out ' Limited Review' of the above results.

3. The previous year's and previous period's figures have been regrouped, wherever necessary.

4. The figures of quarter ended 31st March, 2015 are the balancing figures between audited figures in respect of full financial

year and the unaudited published year to date figures up to the third quarter of the financial year 2014-15.

5. As the Company is operating in one broad segment of Financial Services,no separate segmental results have been given.

PLACE : NADIAD

DATE : 31.07.2015

DEEPAK PATEL

MANAGING DIRECTOR

You might also like

- Financial Results & Limited Review Report For June 30, 2015 (Result)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document11 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- MSSL Unaudited Financial Results For The Quarter Nine Months Ended 31dec 2012Document4 pagesMSSL Unaudited Financial Results For The Quarter Nine Months Ended 31dec 2012kpatil.kp3750No ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For The Quarter Ended 30 June 2012Document2 pagesFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNo ratings yet

- MSSL Results Quarter Ended 31st December 2011Document4 pagesMSSL Results Quarter Ended 31st December 2011kpatil.kp3750No ratings yet

- Name of The Insurer: Life Insurance Corporation of India Registration No. 512 Date of Registration With IRDAI: 01.01.2001Document1 pageName of The Insurer: Life Insurance Corporation of India Registration No. 512 Date of Registration With IRDAI: 01.01.2001nigam34No ratings yet

- Financial Results & Limited Review For June 30, 2015 (Company Update)Document7 pagesFinancial Results & Limited Review For June 30, 2015 (Company Update)Shyam SunderNo ratings yet

- Financial Results For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Sebi Million Q3 1213 PDFDocument2 pagesSebi Million Q3 1213 PDFGino SunnyNo ratings yet

- Reliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003Document3 pagesReliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003ak47ichiNo ratings yet

- Sebi MillionsDocument2 pagesSebi MillionsNitish GargNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Document4 pagesAnnounces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- HDFC Life and IciciDocument5 pagesHDFC Life and IciciSubhashNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Balance Sheet: Titan Industries LimitedDocument4 pagesBalance Sheet: Titan Industries LimitedShalini ShreyaNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Balance SheetDocument2 pagesBalance Sheetgagandeepdb2No ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document16 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Pdfnews PDFDocument5 pagesPdfnews PDFMurthy KarumuriNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For December 31, 2015 (Result)Document1 pageFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- 2009-10 Annual ResultsDocument1 page2009-10 Annual ResultsAshish KadianNo ratings yet

- Axis Bank: Regd. Office: Trishul', 3 Floor, Opp. Samartheshwar Temple, Law Garden, Ellisbridge, Ahmedabad - 380 006Document3 pagesAxis Bank: Regd. Office: Trishul', 3 Floor, Opp. Samartheshwar Temple, Law Garden, Ellisbridge, Ahmedabad - 380 006alayprajapatiNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Document3 pagesAnnounces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- State Bank of India: Unaudited Financial Results For The Period Ended 30Th June 2008Document1 pageState Bank of India: Unaudited Financial Results For The Period Ended 30Th June 2008Rajat PaniNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet