Professional Documents

Culture Documents

Trade Credit in Inr Denomination

Uploaded by

ibmrCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trade Credit in Inr Denomination

Uploaded by

ibmrCopyright:

Available Formats

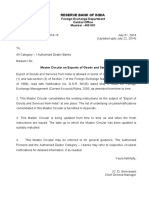

RESERVE BANK OF INDIA

Mumbai - 400 001

RBI/2015-16/ 175

A.P. (DIR Series) Circular No.13

September 10, 2015

To,

All Authorised Dealer Category I Banks

Madam/ Sir

Trade Credit Policy - Rupee (INR) Denominated trade credit

Attention of Authorized Dealer Category - I (AD Category - I) banks is invited

to Schedule III to the Foreign Exchange Management (Borrowing or Lending

in Foreign Exchange) Regulations, 2000 notified vide Notification No. FEMA

3/2000-RB dated May 03, 2000 read with Regulation 6(3) of the said

Regulations regarding raising of trade credit (buyers' credit / suppliers' credit)

from overseas supplier, bank and financial institution for import of capital and

non-capital goods into India.

2. With a view to providing greater flexibility for structuring of trade credit

arrangements, it has been decided that the resident importer can raise trade

credit in Rupees (INR) within the following framework after entering into a loan

agreement with the overseas lender:

i.

Trade credit can be raised for import of all items (except gold)

permissible under the extant Foreign Trade Policy

ii.

Trade credit period for import of non-capital goods can be upto one

year from the date of shipment or upto the operating cycle

whichever is lower

iii.

Trade credit period for import of capital goods can be upto five

years from the date of shipment

iv.

No roll-over / extension can be permitted by the AD Category - I

bank beyond the permissible period

v.

AD Category - I banks can permit trade credit upto USD 20 mn

equivalent per import transaction

vi.

AD Category - I banks are permitted to give guarantee, Letter of

Undertaking or Letter of Comfort in respect of trade credit for a

maximum period of three years from the date of shipment

vii.

The all-in-cost of such Rupee (INR) denominated trade credit

should be commensurate with prevailing market conditions

viii.

All other guidelines for trade credit will be applicable for such Rupee

(INR) denominated trade credits

3. Overseas lenders of Rupee (INR) denominated trade credits will be eligible

to hedge their exposure in Rupees through permitted derivative products in

the on-shore market with an AD Category - I bank in India. Necessary

guidelines for hedging will be issued separately.

4. AD Category I banks may bring the contents of this Circular to the notice

of their constituents and customers.

5. The directions contained in this circular have been issued under Section

10(4) and 11(1) of the Foreign Exchange Management Act, 1999 (42 of 1999)

and are without prejudice to permissions / approvals required, if any, under

any other law.

Yours faithfully

(B. P. Kanungo)

Principal Chief General Manager

You might also like

- TRADE NOODLES - Trade Credit NotificationDocument2 pagesTRADE NOODLES - Trade Credit NotificationHemant PantNo ratings yet

- RBI Notfn Jan-Jun 2019 - Intnl TFDocument22 pagesRBI Notfn Jan-Jun 2019 - Intnl TFArjun PatilNo ratings yet

- INR Trade Credit NotificationDocument2 pagesINR Trade Credit NotificationAlok PathakNo ratings yet

- Circular RbiDocument20 pagesCircular RbiVenugopal HonavanapalliNo ratings yet

- Master Circular ImportsDocument19 pagesMaster Circular ImportsPrasad NayakNo ratings yet

- RBI Master Circular On Import PaymentsDocument22 pagesRBI Master Circular On Import PaymentsInter NetNo ratings yet

- International Trade Settlement in Indian RupeesDocument4 pagesInternational Trade Settlement in Indian Rupeesdipak kambleNo ratings yet

- B.3. Import Licenses: Notification No - FEMA14/2000-RBDocument13 pagesB.3. Import Licenses: Notification No - FEMA14/2000-RBvmandowara_1No ratings yet

- 3.20200707 - Updates - CAIIB BFMDocument23 pages3.20200707 - Updates - CAIIB BFMSATISHNo ratings yet

- Foreign Exchange Management Act 1999, StratifiedDocument33 pagesForeign Exchange Management Act 1999, Stratifiedrohan.explorerNo ratings yet

- RBI Regulations on Foreign Currency AccountsDocument11 pagesRBI Regulations on Foreign Currency AccountsAnushka AgarwalNo ratings yet

- RBI Circular On EPBG April 6 2015Document4 pagesRBI Circular On EPBG April 6 2015Sachin JainNo ratings yet

- MD ImportsDocument14 pagesMD Importsshaunak goswamiNo ratings yet

- Master Direction Risk ManagementDocument94 pagesMaster Direction Risk ManagementRajeev CHATTERJEENo ratings yet

- RBI FX MASTERDocument94 pagesRBI FX MASTERmd1586No ratings yet

- ImportDocument19 pagesImportSunayana GuptaNo ratings yet

- RBI expands commodity hedging permissionsDocument5 pagesRBI expands commodity hedging permissionsDanish ShaikhNo ratings yet

- Fema 1Document10 pagesFema 1Amit SinghNo ratings yet

- Foreign Exchange Management (Borrowing and Lending) Regulations, 2018 - Taxguru - inDocument11 pagesForeign Exchange Management (Borrowing and Lending) Regulations, 2018 - Taxguru - inVinod RahejaNo ratings yet

- RBI PolicyDocument157 pagesRBI Policyanilmourya5No ratings yet

- RBI/2008-09/122 A.P. (DIR Series) Circular No. 05 August 06, 2008Document8 pagesRBI/2008-09/122 A.P. (DIR Series) Circular No. 05 August 06, 2008aNo ratings yet

- RBI DocDocument36 pagesRBI DocPritesh RoyNo ratings yet

- ECONOMIC LAWS: IMPORT PAYMENTS AND LIBERALIZED REMITTANCE SCHEMEDocument6 pagesECONOMIC LAWS: IMPORT PAYMENTS AND LIBERALIZED REMITTANCE SCHEMEGAURAV PRAJAPATINo ratings yet

- RBI Master Circular on Risk Management and Inter-Bank DealingsDocument95 pagesRBI Master Circular on Risk Management and Inter-Bank DealingsBathina Srinivasa RaoNo ratings yet

- TCS On Forex TransactionsDocument33 pagesTCS On Forex TransactionsArun Kumar ViswanadhulaNo ratings yet

- External Commercial BorrowingDocument14 pagesExternal Commercial BorrowingKK SinghNo ratings yet

- Fedai Rules LatestDocument25 pagesFedai Rules LatestVIJAYASEKARANNo ratings yet

- (FAQ On ODI Updated Till 28.02.2019, RBI Website) Direct Investments Outside IndiaDocument16 pages(FAQ On ODI Updated Till 28.02.2019, RBI Website) Direct Investments Outside IndiaUditanshu MisraNo ratings yet

- Sources of Foreign Financing or Foreign Currency Finance For Indian CompaniesDocument3 pagesSources of Foreign Financing or Foreign Currency Finance For Indian Companiesarshad391No ratings yet

- Certificates of Deposit Issued in India Guideline by RBIDocument9 pagesCertificates of Deposit Issued in India Guideline by RBIJhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

- FAQs On RMIBD - Hedging of Foreign Exchange Risk DTD July 14 2020Document7 pagesFAQs On RMIBD - Hedging of Foreign Exchange Risk DTD July 14 2020Anup SharmaNo ratings yet

- Reserve Bank of India Foreign Exchange Department Central Office Mumbai - 400 001Document9 pagesReserve Bank of India Foreign Exchange Department Central Office Mumbai - 400 001Amrita PatroNo ratings yet

- Securities and Exchange Board of IndiaDocument7 pagesSecurities and Exchange Board of IndiaShyam SunderNo ratings yet

- RBI Master Circualr On Import of GoodsDocument44 pagesRBI Master Circualr On Import of GoodstigerkillerNo ratings yet

- Securities and Exchange Board of IndiaDocument6 pagesSecurities and Exchange Board of IndiaShyam SunderNo ratings yet

- RBI FAQ of FDI in IndiaDocument53 pagesRBI FAQ of FDI in Indiaaironderon1No ratings yet

- Reserve Bank of India Financial Markets Regulation Department Central Office Mumbai - 400 001Document94 pagesReserve Bank of India Financial Markets Regulation Department Central Office Mumbai - 400 001kaustubh_dec17No ratings yet

- Foreign Exchange Management (Exports of Goods and Services) RegulationsDocument37 pagesForeign Exchange Management (Exports of Goods and Services) RegulationsSawan SharmaNo ratings yet

- RBI - Master - Direction - Import of Goods and ServicesDocument33 pagesRBI - Master - Direction - Import of Goods and ServicesShin ShanNo ratings yet

- RBI PledgeDocument2 pagesRBI PledgerohitadasNo ratings yet

- RBI Circular On Export Finance - 1Document21 pagesRBI Circular On Export Finance - 1Anonymous l0MTRDGu3MNo ratings yet

- ODI May2011Document4 pagesODI May2011Parul ShahNo ratings yet

- RBI-Buyback of FCCBDocument4 pagesRBI-Buyback of FCCBprateek.karaNo ratings yet

- C.1. Advance Remittance C.1.1. Advance Remittance For Import of GoodsDocument4 pagesC.1. Advance Remittance C.1.1. Advance Remittance For Import of GoodsRaja GopalakrishnanNo ratings yet

- FEMA RegulationsDocument38 pagesFEMA RegulationsRamakrishnan AnantapadmanabhanNo ratings yet

- RBI Master Circular on Exports of Goods and ServicesDocument40 pagesRBI Master Circular on Exports of Goods and ServicesAbhinav SharmaNo ratings yet

- RBI Notifications March 2019Document7 pagesRBI Notifications March 2019Manish KumarNo ratings yet

- 220ecb and Trade Credits1Document10 pages220ecb and Trade Credits1Mohd ParvezNo ratings yet

- RBI updates guidelines for participation in currency derivatives marketsDocument4 pagesRBI updates guidelines for participation in currency derivatives marketsPraveer MoreyNo ratings yet

- Guidelines On Foreign Exchange Derivatives and Overseas Hedging of CommodityDocument47 pagesGuidelines On Foreign Exchange Derivatives and Overseas Hedging of CommodityAmit VarmaNo ratings yet

- All The Primary Dealers (PDS) in Government Securities MarketDocument3 pagesAll The Primary Dealers (PDS) in Government Securities MarketPrasad NayakNo ratings yet

- Foreign Exchange Dealers' Association of India: General Guidelines/InstructionsDocument18 pagesForeign Exchange Dealers' Association of India: General Guidelines/InstructionsSUVANKAR NANDINo ratings yet

- Updates SMAIT June 2016Document11 pagesUpdates SMAIT June 2016Harsh SharmaNo ratings yet

- RBI Guidelines on UCB Participation in IRF MarketsDocument12 pagesRBI Guidelines on UCB Participation in IRF MarketsMusahib ChaudhariNo ratings yet

- Startup Series 7 - Exchange Control Provisions For StartupsDocument12 pagesStartup Series 7 - Exchange Control Provisions For StartupsRavi PatelNo ratings yet

- Guidelines for Commercial Paper IssuanceDocument10 pagesGuidelines for Commercial Paper IssuanceShreya AgarwalNo ratings yet

- Foreign Exchange Dealers' Association of India: General Guidelines/InstructionsDocument18 pagesForeign Exchange Dealers' Association of India: General Guidelines/InstructionssannnNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- ASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesFrom EverandASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesNo ratings yet

- A Practical Approach to the Study of Indian Capital MarketsFrom EverandA Practical Approach to the Study of Indian Capital MarketsNo ratings yet

- International MarketingDocument2 pagesInternational MarketingibmrNo ratings yet

- Orm SMMDocument60 pagesOrm SMMibmr100% (1)

- Tourist Visa Document Checklist: More Details Can Be Found at UDI's WebpagesDocument3 pagesTourist Visa Document Checklist: More Details Can Be Found at UDI's WebpagesibmrNo ratings yet

- Confirmatory Order in The Matter of Kailash Auto Finance LimitedDocument43 pagesConfirmatory Order in The Matter of Kailash Auto Finance LimitedibmrNo ratings yet

- Chapter 14Document24 pagesChapter 14ibmrNo ratings yet

- All Currency Notes AcceptedDocument1 pageAll Currency Notes AcceptedibmrNo ratings yet

- Publication Papper@Loco PilotDocument3 pagesPublication Papper@Loco PilotibmrNo ratings yet

- Scan of DocumentDocument1 pageScan of DocumentibmrNo ratings yet

- FAQs For FORM ADocument2 pagesFAQs For FORM AibmrNo ratings yet

- Fast - N - Fresh MFDocument11 pagesFast - N - Fresh MFibmrNo ratings yet

- 2009 Sol Z TableDocument2 pages2009 Sol Z TableFauzi AzzamahsyariNo ratings yet

- Ragumoorthy Nehrumoorthy Presentation ByDocument21 pagesRagumoorthy Nehrumoorthy Presentation ByibmrNo ratings yet

- France Visa Application for Business Travel in DelhiDocument10 pagesFrance Visa Application for Business Travel in DelhiibmrNo ratings yet

- Lecture 7 CrosstabsDocument20 pagesLecture 7 CrosstabsibmrNo ratings yet

- Lecture 10Document65 pagesLecture 10ibmrNo ratings yet

- Indian Higher Education: Shifting The ParadigmDocument12 pagesIndian Higher Education: Shifting The ParadigmibmrNo ratings yet

- SFM Module 3 Chapter 12Document52 pagesSFM Module 3 Chapter 12ibmrNo ratings yet

- Derivatives Basics: By: Ajay Mishra JSSGIW Faculty of Management, BhopalDocument19 pagesDerivatives Basics: By: Ajay Mishra JSSGIW Faculty of Management, BhopalibmrNo ratings yet

- Market ResearchDocument44 pagesMarket ResearchibmrNo ratings yet

- Forward Contracts Regulation Act 1952Document41 pagesForward Contracts Regulation Act 1952ibmrNo ratings yet

- Master Circular On External Commercial Borrowings and Trade CreditsDocument45 pagesMaster Circular On External Commercial Borrowings and Trade CreditsShriram NarakasseryNo ratings yet

- Master Circular On External Commercial Borrowings and Trade CreditsDocument45 pagesMaster Circular On External Commercial Borrowings and Trade CreditsShriram NarakasseryNo ratings yet

- World New CommDocument1 pageWorld New CommibmrNo ratings yet

- Reforms and Integration in Commodity Markets: NICR WorkshopDocument13 pagesReforms and Integration in Commodity Markets: NICR WorkshopibmrNo ratings yet

- Comm WorldDocument1 pageComm WorldibmrNo ratings yet

- Comm WorldDocument1 pageComm WorldibmrNo ratings yet

- Comm WorldDocument1 pageComm WorldibmrNo ratings yet

- World of CommDocument1 pageWorld of CommibmrNo ratings yet

- Fmi - Commodity MarketDocument30 pagesFmi - Commodity MarketektapatelbmsNo ratings yet

- 02 Components of Financial PlanDocument23 pages02 Components of Financial PlanGrantt ChristianNo ratings yet

- The Rich Cheat and Become Richer Discover How We Let The Rich Thrive and How We Can Stop Them by Fixing CapitalismDocument251 pagesThe Rich Cheat and Become Richer Discover How We Let The Rich Thrive and How We Can Stop Them by Fixing Capitalismcharles yerkesNo ratings yet

- Connectors and Linkers b1Document1 pageConnectors and Linkers b1Anonymous 0NhiHAD100% (1)

- Non Self-Executing Provisions in The ConstitutionDocument9 pagesNon Self-Executing Provisions in The Constitutiontequila0443No ratings yet

- Ex Parte, Sheonarayan Harlal MaheshwariDocument6 pagesEx Parte, Sheonarayan Harlal MaheshwariNAKSHATRA GUJRATINo ratings yet

- Anchor Savings Bank Vs FurigayDocument1 pageAnchor Savings Bank Vs FurigayDannR.Reyes100% (1)

- Law BookDocument279 pagesLaw BookKalapala ShaliniNo ratings yet

- Corporations' Assets in Estate CaseDocument10 pagesCorporations' Assets in Estate CaseDara CompuestoNo ratings yet

- Blacks and The Seminole War PDFDocument25 pagesBlacks and The Seminole War PDFcommshackNo ratings yet

- Spamming Tutorial: What What What What Is IS IS Is Spamming Spamming Spamming SpammingDocument20 pagesSpamming Tutorial: What What What What Is IS IS Is Spamming Spamming Spamming Spammingfaithscott100% (3)

- Dharma Global EthicsDocument100 pagesDharma Global Ethicsparag100% (1)

- DepED Sports Meet Entry FormDocument1 pageDepED Sports Meet Entry FormMarz TabaculdeNo ratings yet

- PreludeinEmajorPartita 3 by Rick GrahamDocument12 pagesPreludeinEmajorPartita 3 by Rick GrahamXavier Lara D100% (3)

- Philippine Standards and Practice Statements (Final) PDFDocument4 pagesPhilippine Standards and Practice Statements (Final) PDFMica R.No ratings yet

- NEC4 and FIDIC Compared - LexologyDocument7 pagesNEC4 and FIDIC Compared - LexologyVicente CabreraNo ratings yet

- Cross-Compiling Arm NN For The Raspberry Pi and TensorFlowDocument16 pagesCross-Compiling Arm NN For The Raspberry Pi and TensorFlowSair Puello RuizNo ratings yet

- Brown v. YambaoDocument2 pagesBrown v. YambaoBenjie CajandigNo ratings yet

- Exercises On Value Added TaxDocument20 pagesExercises On Value Added TaxIan Jamero100% (2)

- P7 Questions R. KIT 4Document95 pagesP7 Questions R. KIT 4Haider MalikNo ratings yet

- MMDA Bel Air Case DigestDocument2 pagesMMDA Bel Air Case DigestJohn Soliven100% (3)

- Hotel Sales Company Volume Guaranteed Rate LetterDocument5 pagesHotel Sales Company Volume Guaranteed Rate LetterSimon EllyNo ratings yet

- Synopsis/ Key Facts:: TAAR V. LAWAN (G.R. No. 190922. October 11, 2017)Document16 pagesSynopsis/ Key Facts:: TAAR V. LAWAN (G.R. No. 190922. October 11, 2017)Ahmed GakuseiNo ratings yet

- Big Data SecurityDocument4 pagesBig Data SecurityIbrahim MezouarNo ratings yet

- United States Court of Appeals, Sixth CircuitDocument9 pagesUnited States Court of Appeals, Sixth CircuitScribd Government DocsNo ratings yet

- Recurring Inspection Process in SAP QM - SAP BlogsDocument16 pagesRecurring Inspection Process in SAP QM - SAP BlogsManish GuptaNo ratings yet

- 20465D ENU TrainerHandbook PDFDocument290 pages20465D ENU TrainerHandbook PDFbapham thuNo ratings yet

- Sample Vaping Warning LetterDocument3 pagesSample Vaping Warning LetterStephen LoiaconiNo ratings yet

- Adopt A School MOA TemplateDocument5 pagesAdopt A School MOA TemplateLakanPH96% (26)

- Allegro PCB Editor Training Manual 1Document534 pagesAllegro PCB Editor Training Manual 1Văn Lin100% (1)

- Entrepreneurship Reviewer FinalsDocument7 pagesEntrepreneurship Reviewer FinalsEricka Joy HermanoNo ratings yet