Professional Documents

Culture Documents

Importing To India: Process and Requisites

Uploaded by

SandyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Importing To India: Process and Requisites

Uploaded by

SandyCopyright:

Available Formats

Importing to India: Process and Requisites

Here are the steps required to carry out the procedure of import to India:

1.Obtaining import license and quota: Download the application form available for IEC

application form (Importer Exporter Code). Attach the required documents (Applicant PAN

card, photograph, bank certificate), furnish the additional company documents including list

of partners/directors, memorandum, articles of association, company's letterhead if the

application is sought for partnership of private limited company. Also, the bank fee receipt for

obtaining license, certificate from a Chartered Accountant denoting the total import value,

income tax verification certificate- are to be furnished along with the above mentioned

documents. Procedure for online application through step by step procedure is in detail

discussed in this article- All that you need to know about IEC code and how to obtain

it. Quota certificate from the concerned authority has t be kept ready which indicates the

upper cap to the quantity of imports.

2.Obtaining foreign exchange: Required foreign exchange is to be applied before the

execution of the import order. The importer needs to apply to the Exchange Control

Department (EDC) of RBI. The request needs to be forwarded through the importer's bank.

Upon validation, the EDC releases the essential foreign exchange.

3.Placing an order: Placing order can be either direct or through canalisation for specified

products like metals and minerals need channelisation through government agency like

MMTC. In the case of canalisation, the importer needs to place the order with the facilitating

agency and the agency will place the order for the importer.

4.Dispatching Letter of Credit: Once the importer receives the confirmation from the

exporter about the products ordered for, the importer needs to give a request letter to his

bank to issue a Letter of Credit (LC) in favouring the exporter. This is a payment confirmation

for the seller meaning that his payment is confirmed by the importer's bank upon the receipt

of documents regarding receipt of imports.

5.Appointing C and F Agents: Clearing and forwarding agents are required to be appointed

by the importer to ensure the hassle-free clearance of imports from customs department.

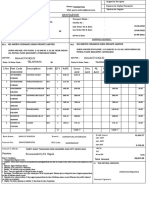

6.Receipt of Shipment advice: Bill of Exchange, a copy of Bill of Lading, Certificate of

Origin, consular invoice, packing list reaches the importer's bank from the exporter's bank.

(Other documents that may include- Signed invoice, Packing list, Bill of lading or delivery

order/air waybill, GATT declaration form, Importer/CHA declaration, Import license wherever

necessary, Letter of credit/bank draft, Insurance document, Industrial license, if required Test

report in case of chemicals, Adhoc exemption order, DEEC Book/DEPB in original,

Catalogue where applicable, technical write up, literature in case of machineries etc). The

importer needs to collect the documents after payment if he has not paid while dispatching

the Letter of Credit.

7.Bill of Entry: Bill of Entry is as important in import as the shipping bill is, during every

export. The document is the proof that the specified goods have entered the country in the

mentioned quantities with specified quality parameters fulfilled. The customs office gives Bill

of Entry in triplicate. Each copy carries different color to be distinguished easily. A copy each

is retained by customs department, port trust and given to the importer.

8.Delivery Order: The delivery order is given by the shipping company to the clearing

agents after the payment of freight is settled, if any.

9.Clearing of goods: The clearing agent obtains port trust receipt after settling the dock/port

trust dues. Then, the clearing agent approaches the Customs House to present the copy of

Port Trust receipt and two copies of Bill of Entry. He then receives a copy of Bill of Entry to be

given to the importer and also, the Customs House endorses the Trust receipt and gives it

back to the agent. The goods are stored in bonded warehouses if the duty is not paid.

Otherwise, they are released to be taken inside the country, post which, the Clearance and

Forwarding agents receive the payment from the importer.

10.Follow-up: The importer needs to inform the exporter about the receipt of goods and their

condition of import. This completes the import procedure.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Implementing Purchase CardsDocument46 pagesImplementing Purchase CardsIan Makgill100% (1)

- Complaint Filed 8-10-2016 PDFDocument131 pagesComplaint Filed 8-10-2016 PDFal_crespoNo ratings yet

- Redington Printer RCDocument19 pagesRedington Printer RCFarooque PeerzadaNo ratings yet

- Purchasing Rebate Processing (2R7 - SA) : Test Script SAP S/4HANA - 02-09-19Document52 pagesPurchasing Rebate Processing (2R7 - SA) : Test Script SAP S/4HANA - 02-09-19noor ahmedNo ratings yet

- Snooker GymDocument11 pagesSnooker GymtopguitarNo ratings yet

- Trust ReceiptsDocument26 pagesTrust ReceiptsA.T.Comia100% (1)

- Invoice: Worldlink Communications Ltd. Jawalakhel, Lalitpur Tel: 4217100,9801523050 Fax: 977-1-5529403Document1 pageInvoice: Worldlink Communications Ltd. Jawalakhel, Lalitpur Tel: 4217100,9801523050 Fax: 977-1-5529403Bhuwan BhattNo ratings yet

- Parts QuoteDocument1 pageParts QuoteV.Sampath RaoNo ratings yet

- Role of Commercial Banks in International TradeDocument89 pagesRole of Commercial Banks in International TradeHarshit Kh.No ratings yet

- 2011 Registration FormDocument1 page2011 Registration Formtfairlady80No ratings yet

- Oracle Apps Financial Interview Questions Answers GuideDocument7 pagesOracle Apps Financial Interview Questions Answers GuideJohn StephensNo ratings yet

- Oss BSSDocument105 pagesOss BSSsamymityNo ratings yet

- Tax Refunds and Credits: Nature and BasisDocument3 pagesTax Refunds and Credits: Nature and BasisJoshua Erik MadriaNo ratings yet

- Merchanting TradesimplifiedDocument3 pagesMerchanting TradesimplifiedRadhey Prince Ray ChoudharyNo ratings yet

- Dispute MGMT Config GuideDocument64 pagesDispute MGMT Config Guidervmvenkat92% (25)

- BJK S4hana2023 BPD en deDocument19 pagesBJK S4hana2023 BPD en deabdeltifNo ratings yet

- Configuration T Codes in SAP MMDocument18 pagesConfiguration T Codes in SAP MMbeema1977No ratings yet

- FI Billing ComparisionDocument6 pagesFI Billing Comparisionssram1010No ratings yet

- (Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountDocument1 page(Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountVivek RajputNo ratings yet

- RDocument2 pagesRrishabhNo ratings yet

- Procedure For Clearance of Export GoodsDocument11 pagesProcedure For Clearance of Export GoodssahuanNo ratings yet

- Intermediate Course Study Material: TaxationDocument27 pagesIntermediate Course Study Material: TaxationBharath WajNo ratings yet

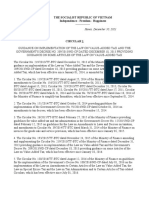

- 21 VBHN-BTC 512873Document78 pages21 VBHN-BTC 512873LET LEARN ABCNo ratings yet

- British Gas Example BillDocument2 pagesBritish Gas Example BillYoutube Master13% (8)

- Sto Intra Process 1Document26 pagesSto Intra Process 1Amit GuptaNo ratings yet

- GeM Bidding 2292023Document4 pagesGeM Bidding 2292023Vijay RauljiNo ratings yet

- CoupaDocument91 pagesCoupaSingh Anish K.No ratings yet

- ECOM Unit 4Document28 pagesECOM Unit 4kunchala_veniNo ratings yet

- GST Advance Receipt Voucher PDFDocument4 pagesGST Advance Receipt Voucher PDFmanukleoNo ratings yet

- Accounting Information System As A Means of Enhancing Financial Management of Transport CompanyDocument110 pagesAccounting Information System As A Means of Enhancing Financial Management of Transport Companyachiever usangaNo ratings yet