Professional Documents

Culture Documents

Get Rid of Your Debt, Start The New Year Fresh!: Inside This Issue

Uploaded by

Jenee ThomasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Get Rid of Your Debt, Start The New Year Fresh!: Inside This Issue

Uploaded by

Jenee ThomasCopyright:

Available Formats

2221 S Webster Ave

Green Bay, WI 54301

(920)432-4353 Fax (920)432-1301

www.wismedcu.org

www.wismedcu.org

Winter 2016

MoneyMatters

Get rid of your debt, start the new year fresh!

Inside This Issue

-Debt Consolidation Loans

-Remote Deposit Tips

-52 Week Money Savings Challenge!

Do you have what it takes?

-1099 and 1098 Tax Forms

-How often should you shop for Auto

and Homeowners Insurance?

-Win $25.00

Money can be tight when you have a lot

of monthly payments to make.

A debt consolidation loan can give you

one low monthly payment saving you

time and money you can use for

Vacation Savings Home Improvement A New Vehicle

IMPORTANT

Remote deposit checks must be done as

follows to avoid delays or rejected items:

Sign the check (your signature)

& Write: Remote Deposit Only

Make sure when you take a picture of the

check that you do it on a solid color background

with a contrasting color.

The check has to be within the guidelines

given on your screen.

Your deposit will go through a short approval process

before it shows up in your account . Make sure you see the

deposit in your account before using the funds.

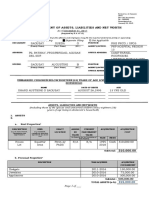

Week Deposit Extra Balance W

$1

18

$18

35

$35

$2

19

$19

36

$36

$3

20

$20

37

$37

$4

21

$21

38

$38

$5

22

$22

39

$39

$6

23

$23

40

$40

$7

24

$24

41

$41

$8

25

$25

42

$42

$9

26

$26

43

$43

10

$10

27

$27

44

$44

11

$11

28

$28

45

$45

12

$12

29

$29

46

$46

13

$13

30

$30

47

$47

14

$14

31

$31

48

$48

15

$15

32

$32

49

$49

16

$16

33

$33

50

$50

17

$17

34

$34

51

$51

52

$52

Do you have what it takes to do the

52 Week Money Savings Challenge?!

Join us starting in January 2016

You can do it on your own or set up your personalized

savings account today and watch your progress throughout the year. Use

the savings chart to the left to keep track of your balance.

You can also print one off of our website or our Facebook page.

Every quarter we will send out tips and tricks, and see some things the staff

and other members have to say about their progress.

Share the fun with your children too by using the

52 Week Youth Money Savings Challenge worksheet.

A great way to teach them the value of savings!

By the end of the challenge you should have $1,378.00, and the

youth challenge should have $300.00.

* for the youth and children saving chart, please see our website or call the Credit Union

Win $25.00! Every quarterly newsletter we want to give you an opportunity to WIN $25.00.

All you have to do is read your newsletter. There will be a

birth date hidden one time within the pages. If that date is your birth date, you have until the end of the month to come into Wisconsin Medical Credit Union to

claim your $25.00. It will be hidden in text and or images with 2 digit month 2 digit day , and a 2 digit year EX: xxxxxx

Federally Insured by NCUA

Tax Information Forms Mailed 1st week in January.

If you do not receive a tax form, all of the tax information you need for filing is on your December 2015

statement or on your home banking account.

If you have a home loan or equity loan with Wisconsin Medical Credit Union and you paid $600.00 or more in interest for the year 2015 you

will be mailed a 1098 tax form.

If you have earned $10.00 or more in interest from Wisconsin Medical Credit Union for the year 2015 you will be mailed a 1099 tax form.

-When doing your taxes and claiming interest paid or earned we recommend that you always check with your financial/tax advisor. -

Important Information Regarding Your Auto and Homeowners Insurance

Shopping for car insurance can seem like a hassle, but you may have heard that it can save you money on your car insurance premiums, too. It is easy to get an insurance policy in place and just not think about it again until you need to file a claim. Yet shopping for insurance periodically really can save you money, and it may not be quite as stressful and time consuming to do as you might think.

How Often to Shop for Coverage

Some experts recommend that you shop for new auto coverage every six or twelve months. There are many factors that car insurance companies use to calculate your rate, and these factors do change fairly regularly. Understanding these factors can help

you to better understand why you should shop for new coverage every six or twelve months. Some of these factors include:

Your Driving History

Crime Rates

The Location of Your Home

The State of the Economy

Your Vehicle

Your Driving History

Factors like if youve had an accident, a speeding ticket, and more do affect your premium. You may have added one of these

events onto your driving record in the last few months, and your current rate may reflect a rate change that is less forgiving of

such events than another policy may be Even if your last accident or ticket occurred a few years ago, keep in mind that each insurance company calculates their rates differently 070663. So that added time that has elapsed may be enough to trigger a lower

rate through another company.

Crime Rates

Crime rates and statistics are constantly being updated, and this includes vehicle-related crimes. The last time you shopped for

rates, there could have been a string of car thefts or vandalism crimes that took place that affected your rates.

The Location of Your Home

Insurance companies use the location of your home for a few different reasons in calculating your rate. Crime, as noted above is

one of them. However, other location-related factors such as the average age of residents in your area and the level of traffic in

your area are taken into account. If you have moved, these factors will definitely change. Even if you have not moved, people do

get older, people move in and out of the area to affect the average age of residents, and traffic patterns change, too.

The State of the Economy

The insurance industry is a business that does take into account factors like supply and demand, inflation, and other economic

factors when calculating rates. The state of the economy is constantly changing, and this can spur rate changes in an insurance

company.

Your Vehicle

Your insurance rates will change if you buy a new car. However, even if your car is the same one youve been driving for a few

years, your rates may need to be adjusted. Factors that affect your car insurance rates include the value and repair costs of your

car. As your model ages, these factors do tend to decrease. Yet if you have been locked into a rate for the past few years under

the same policy, you may not be taking advantage of this fact.

Faster and Easier Rate Shopping

Understanding the factors that affect insurance rates changing often can help you to realize that you may get a better rate by

shopping around for new coverage today. However, the thought of calling around from insurance company to insurance company

can be intimidating, and actually making so many calls can be time-consuming. A better way to shop for rates is to use a price

comparison website. This is an online tool that allows you to enter your personal and vehicle information into a single form, and

you will receive several quotes back as a result. The forms are available to use around the clock, and they take only a few

minutes to use. With how fast and easy it is to get new insurance quotes today combined with the possibility that you could save

money on your premium, it does make sense to take a few minutes today and get a few quotes for coverage. Your insurance

premium is a regular expense in your budget, and so trimming it down today equates to regular savings for months to come. Be

sure to set a reminder for yourself to shop for new coverage again in a few months, too. Simply mark it on a calendar or set an

auto reminder to complete this easy task in your phone or computer.

Copyright 2015 All Rights Reserved Car Insurance Comparison www.carinsurancecomparison.com

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Aptitude QuestionsDocument109 pagesAptitude QuestionsRam KeserwaniNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Blank Assured Shorthold Tenancy AgreementDocument15 pagesBlank Assured Shorthold Tenancy AgreementNatasha Hammick100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Citizens CharterDocument35 pagesCitizens ChartermanojNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Crump - The Phenomenon of Money (1981)Document258 pagesCrump - The Phenomenon of Money (1981)Anonymous OOeTGKMAdD100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Summary Economics of Money Banking and Financial Markets Frederic S Mishkin PDFDocument143 pagesSummary Economics of Money Banking and Financial Markets Frederic S Mishkin PDFJohn StephensNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Chapter 2 Governance and ManagementDocument32 pagesChapter 2 Governance and Managementlmmh100% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Darshan Gandhi - Sem 6 - Roll No-052 - Sec-C - CORPORATE LAWDocument19 pagesDarshan Gandhi - Sem 6 - Roll No-052 - Sec-C - CORPORATE LAWSounak VermaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- BIR Ruling on Tax Implications of Bank's Decrease in Capital Stock and Transfer of Assets to Parent CompanyDocument11 pagesBIR Ruling on Tax Implications of Bank's Decrease in Capital Stock and Transfer of Assets to Parent CompanyRB BalanayNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Philippine Economic Zone Authority (PEZA)Document7 pagesPhilippine Economic Zone Authority (PEZA)LeaNo ratings yet

- History of BankingDocument6 pagesHistory of Bankinglianna marieNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Apply for Hotel CreditDocument3 pagesApply for Hotel CreditIkaLianiManurungNo ratings yet

- Digests Nego Jason ArtecheDocument133 pagesDigests Nego Jason ArtecheMatt LedesmaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- SC rules investments by sugar company in related firms valid without stockholder approvalDocument3 pagesSC rules investments by sugar company in related firms valid without stockholder approvalrgtan3No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Capital Structure Analysis of Hero Honda, For The Year 2005 To 2010Document8 pagesCapital Structure Analysis of Hero Honda, For The Year 2005 To 2010shrutiNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Philippine Planning Journal Article Reviews Government Role in Housing SectorDocument70 pagesPhilippine Planning Journal Article Reviews Government Role in Housing SectorJica DiazNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- ADM 2350 N Syllabus Winter 2016Document10 pagesADM 2350 N Syllabus Winter 2016saadNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- DHS N-400 Document ChecklistDocument2 pagesDHS N-400 Document ChecklistVuQuocAnNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Roger Price - The French Second Republic-A Social History-B. T. Batsford (1972) PDFDocument197 pagesRoger Price - The French Second Republic-A Social History-B. T. Batsford (1972) PDFMarcos CeiaNo ratings yet

- Guide Lines For Enlistment As Collection Recovery or / and Repossession Agencies On Pakistan Banks Association (PBA)Document28 pagesGuide Lines For Enlistment As Collection Recovery or / and Repossession Agencies On Pakistan Banks Association (PBA)asifsahuNo ratings yet

- Unit - 4: Amalgamation and ReconstructionDocument54 pagesUnit - 4: Amalgamation and ReconstructionAzad AboobackerNo ratings yet

- Project Report - PNBDocument81 pagesProject Report - PNBabirwadhwa6027100% (1)

- Role of Central Bank With Special Reference To The Nepal Rastra BankDocument2 pagesRole of Central Bank With Special Reference To The Nepal Rastra BankShambhav Lama100% (1)

- CFLA's Opposition To The CFPB Preliminary InjunctionDocument30 pagesCFLA's Opposition To The CFPB Preliminary InjunctionAndrew Lehman100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Revised SWORN Statement of Assets, Liabilities and Net WorthDocument10 pagesRevised SWORN Statement of Assets, Liabilities and Net WorthJeanrichel Quillo LlenaresNo ratings yet

- Analysis of Altman "ZDocument3 pagesAnalysis of Altman "ZShruthi JumkaNo ratings yet

- Mama's Meatball Restaurant Slo Official Contest Rules & Sign UpDocument4 pagesMama's Meatball Restaurant Slo Official Contest Rules & Sign UpPhuong LeNo ratings yet

- Supreme Court Rules Ramos Must Pay Balance Despite DemandsDocument6 pagesSupreme Court Rules Ramos Must Pay Balance Despite DemandsfebwinNo ratings yet

- AcctgDocument1 pageAcctgCherry Rago - AlajidNo ratings yet

- 2009-04-09 130229 Case 12-4Document5 pages2009-04-09 130229 Case 12-4NadhilaNo ratings yet

- 2019 Caribbean Hospitality Financing Survey FinalDocument12 pages2019 Caribbean Hospitality Financing Survey FinalBernewsAdminNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)