Professional Documents

Culture Documents

Topic 6 Pricing and Credit Strategies

Uploaded by

HesanRajaraniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Topic 6 Pricing and Credit Strategies

Uploaded by

HesanRajaraniCopyright:

Available Formats

STUDY GUIDE

Topic 6:

BMSB5103

Small Business Management

Pricing and Credit Strategies

Learning Outcomes

By the end of this topic, you should be able to:

1.

Discuss the role of cost and demand factors in setting a price;

2.

Apply break-even analysis and markup pricing;

3.

Identify specific pricing strategies;

4.

Explain the benefits of credit, factors that affect credit extension, and types

of credit; and

5.

Describe the activities involved in managing credit.

Topic Overview

Pricing and credit strategies are essential to small business. Setting a price is not

an easy task. Setting a high price may not bring a sufficient sale volume to a

small business, while setting a low price may lead to a high sale volume but not

enough profit. Thus, price and credit directly influence the relationship between a

small business and its customers, as well as directly affecting both revenue and

sale of the small business. Customers do not like a high price or a price increase,

so much so restrictive credit policies. As a value must be placed on a product

and service by a producer or provider before it can be sold, undoubtedly pricing

strategies are a critical issue in small business. It is always common that a seller

provides credit to buyers or customer to make the exchange happen. An

agreement between buyer and seller that payment for a product or service will be

paid at some later date is known as credit. Giving too many credits to customers

may loosen the cash flow and reduce the capacity of a small business to expand.

Not providing a single credit facility may result in less revenue as customers may

not like the products or services. Similar to pricing, credit represents another

critical issue for small businesses.

47

STUDY GUIDE

BMSB5103

Small Business Management

Focus Areas and Assigned Readings

Focus Areas

Assigned Readings

6.1 Define what is price and credit

Discuss the role of cost and demand

factors in setting a price.

Moore et al. (2010), Chapter 16, p 419

Extra Readings:

Scarborough (2012), Chapter 11, p 361.

6.2 Setting a Price

Apply break-even

markup pricing.

analysis

and

6.3 Applying a Pricing System

Identify specific pricing strategies.

Moore et al. (2010), Chapter 16, pp 419420

Extra Readings:

Scarborough (2012), Chapter 11, pp 362365.

Moore et al. (2010), Chapter 16, pp 420423

Extra Readings:

Scarborough (2012), Chapter 11, pp 365370.

6.4 Selecting a Pricing Strategy

Explain the benefits of credit, factors

that affect credit extension and types

of credit.

Moore et al. (2010), Chapter 16, pp 423426

Extra Readings:

Scarborough (2012), Chapter 11, pp 370382.

6.5 Offering Credit

Describe the Credit Process.

Moore et al. (2010), Chapter 16, pp 426428

Extra Readings:

Scarborough (2012), Chapter 11, pp 382383-384.

6.6 Managing the Credit process

6.6.1 Evaluation of Credit Applicants

6.6.2 Sources of Credit Information

6.6.3 Aging of Accounts Receivable

6.6.4 Billing

and

Collection

Procedures

6.6.5 Credit Regulation

6.6.6 Pricing and credit decisions

Moore et al. (2010), Chapter 16, pp 426432

Extra Readings:

Scarborough (2012), Chapter 11, pp 382384.

Moore et al. (2010), Chapter 16, pp 432-436

Extra Readings:

Scarborough (2012), Chapter 11, pp 382386.

48

STUDY GUIDE

BMSB5103

Small Business Management

Other Sources

1. Small Business School video; company

website: Glidden Point Oysters http://www.oysterfarm.com

2. A.G.A Correa & Son

http://www.agacorrea.com/aga/cgi

bin/aga.pl

3. Hardy Boat Cruises

http://www.hardyboat.com.

Maine Gold http://www.mainegold.com

4. Gulf of Maine Visionary Awards

http://www.gulfofmaine.org/mediaroom/

documents/2006Visionaryawards.pdf

Content Summary

6.1

Setting a Price

Cost Determination for Pricing

(a)

Cost of goods offered for sale

(b)

Selling cost

(c)

Overhead cost applicable to the given product

How Customer Demand Affects Pricing

Cost analysis can identify a level below which a price should not be

set under normal circumstances, but does not show how much the

final price might exceed that minimum figure and still be acceptable

to customers

Elasticity of Demand

(a)

Customer demand for a product is often sensitive to the price

level

(b)

Inelastic demand for a product means a lower total revenue

when the price is raised

(c)

Pricing and a firms competitive advantage

(d)

When customers perceive the product/service as an important

solution to their unsatisfied needs, they are likely to demand

more

49

STUDY GUIDE

6.2

BMSB5103

Small Business Management

(e)

If competing firms offer identical products and services, then the

services offered by the companies generally differ

(f)

Prestige pricing is setting a high price to convey an image of

high quality or uniqueness

Applying a Pricing System

Break-Even Analysis

(a)

Examining cost and revenue relationships

(b)

First phase of break-even analysis is to determine the sales

volume level at which the product, at an assumed price, will

generate enough revenue to start earning a profit

(c)

Contribution margin difference between the unit selling price and

the unit variable costs and expenses

(d)

Unrealistic to assume that quantity sold can increase continually

(e)

Incorporates sales forecasts

(f)

Indirect impact of price on the quantity that can be sold

complicates pricing decisions

Markup Pricing

(a)

Applying a percentage to a products cost to obtain its selling

price

(b)

Manageable pricing system that allows quick pricing of many

products

(c)

Must cover operating expenses, subsequent price reductions

(i.e. such things as markdowns and employee discounts) and

desired profit

50

STUDY GUIDE

6.3

BMSB5103

Small Business Management

Selecting a Pricing Strategy

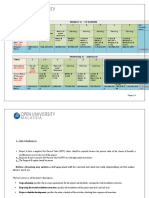

Figure 6.1: Pricing strategies

Penetration Pricing

(a)

Prices a product or service at less than its normal, long-range

market price to gain more rapid market acceptance or to

increase existing market share

(b)

Strategy can sometimes discourage new competitors from

entering the market niche

Skimming Pricing

(a)

Sets prices for products/services at high levels for a limited

period before reducing prices to lower, more competitive levels

(b)

Assumes certain customers will pay the higher price due to

perception of the product as a prestige item

Follow-the-Leader Pricing

(a)

Uses a particular competitor as a model in setting a price for a

product/service

51

STUDY GUIDE

(b)

x

x

x

6.4

BMSB5103

Small Business Management

Price differential options may not work with different size

competitors

Variable Pricing

(a)

Offers price concessions to certain customers

(b)

Dynamic (personalised) pricing strategy charges more than the

standard price after gauging a customers financial means and

desire for the product

Price Lining

(a)

Establishes distinct price categories

(b)

Amount of inventory stocked at different quality levels depends

on the income levels and buying desires of a stores customers

Pricing at What the Market Will Bear

Uses when the seller has little or no competition

Final Notes on Pricing Strategies

(a)

Local, state, and federal laws may affect setting prices (Sherman

Antitrust Act prohibits price fixing)

(b)

Sometimes a line of products may have items which compete

with each other in which case the effects of a single product

must be considered when setting prices

(c)

Adjusting a price to meet changing marketing conditions

(d)

Can be costly to the seller and confusing to buyers

(e)

Alternative may be a system of discounting design to reflect a

variety of needs

(f)

Pricing errors can be corrected

Offering Credit

Explain the benefits of credit, factors that affect credit extension and types

of credit.

x

Benefits of Credit

(a)

Provides small firms with working capital, often allowing marginal

businesses to continue operations

(b)

Retail Customers (borrowers)

(i)

Ability to satisfy immediate needs and pay for them later

(ii)

Better records of purchases on credit billing statements

(iii)

Better service and greater convenience when exchanging

purchased items

52

STUDY GUIDE

BMSB5103

(iv)

(c)

Small Business Management

Establishment of a credit history

Suppliers

(i)

Facilitate increased sales volume

(ii)

Suppliers earn money on unpaid balances

(iii)

Closer association with customers because of implied trust

(iv)

Easier selling through telephone, mail-order systems and

the Internet

(v)

Smoother sales peaks and valleys, since purchasing power

is always available

(vi)

Easy access to a tool with which to stay competitive

Factors That Affect Selling on Credit

(a)

Credit sales should increase profits but this is not a risk-free

practice

(b)

May shift or share credit risk by accepting credit cards

(c)

Cost of accepting credit cards includes fraud protection,

chargebacks

(d)

Variety of reasons why small businesses may decide not to sell

on credit including the type of business, credit policies of

competitors, customers income levels and the availability of

working capital

Type of Business

(a)

Retailers of durable goods typically grant credit more freely than

those that sell perishables or primarily serve local customers

(b)

Big ticket items often must be sold on an instalment basis

Types of Credit

(a)

Consumer credit including open charge accounts, instalment

accounts, revolving charge accounts

(b)

Credit cards including bank credit cards, entertainment credit

cards. retailer credit cards

(c)

Trade Credit (depends on product sold and circumstances of the

buyer and the seller)

53

STUDY GUIDE

BMSB5103

Small Business Management

Managing the Credit Process

(a)

Describe the credit process.

(b)

Evaluation of Credit Applicants with Four Credit Questions

(i)

Can the buyer pay as promised?

(ii)

Will the buyer pay?

(iii)

If so, when will the buyer pay?

(iv)

If not, can the buyer be forced to pay?

The traditional five Cs of credit (character, capital, capacity,

conditions, collateral) are relevant.

x

x

x

Sources of Credit Information

(a)

Customers previous credit history

(b)

Trade credit agencies collect credit information on businesses

(c)

Credit bureaus summarise a number of firms credit experiences

with particular individuals

Aging of Accounts Receivable

Aging schedule (see Exhibit 16-6 Hypothetical Aging Schedule for

Accounts Receivable)

Billing and Collection Procedures

(a)

Timely notification of customers indicating the status of their

accounts is the most effective method of keeping credit accounts

current

(b)

Overdue credit accounts time sellers working capital

(c)

Effective weapon in collecting past-due accounts is reminding

debtors that their credit standing may be impaired

(d)

Bad-debt ratio is the ratio of bad debts to credit sales

Credit Regulation

(a)

Variety of federal and state laws that vary from state to state

(b)

Federal legislation includes: The Fair Credit Billing; The Fair

Credit Reporting Act; The Equal Credit Opportunity Act; The Fair

Debt Collection Practices Act

Pricing and credit decisions have a direct impact on a firms financial health.

54

STUDY GUIDE

BMSB5103

Small Business Management

Study Questions

1.

How does the concept of elasticity of demand relate to prestige pricing?

Give an example.

2.

What is the difference between penetration pricing strategy and skimming

pricing strategy? Under what circumstances would each be used?

3.

What are the major benefits of credit to buyers? What are its major benefits

to sellers?

4.

What is the major purpose of aging accounts receivable? At what point in

credit management should this activity be performed? Why?

5.

Based on this case study, answer the questions that follow.

SUPPLIES TEMPORARY OFFICE HELP

Mat Junid is the 35-year-old owner of a highly competitive small

business that supplies temporary office help. Like most businesspeople,

he is always looking for ways to increase profit. However, the nature of

his competition makes it very difficult to raise prices for the temps

services, while reducing their wages makes recruiting difficult. Mat Junid

has, nevertheless, found an area bad debts in which improvement

should increase profits. A friend and business consultant met Mat Junid

to advise him on credit management policies. Mat Junid was pleased to

get his friends advice, as bad debts were costing him about two percent

of sales. Currently, Mat Junid has no system for managing credit.

Adapted from Moore et al. (2010)

(a)

What advice would you give Mat Junid regarding the screening of new

credit customers?

(b)

What action should Mat Junid take to encourage current credit

customers to pay their debts? Be specific.

(c)

Mat Junid has considered eliminating credit sales. What are the

possible consequences of this decision?

55

You might also like

- Rajnandini PricingDocument4 pagesRajnandini PricingRAJNANDINI PUJARINo ratings yet

- Customer Portfolio Management StrategiesDocument49 pagesCustomer Portfolio Management StrategiesSahil MathurNo ratings yet

- Chapter 5 CPMDocument25 pagesChapter 5 CPMSahil MathurNo ratings yet

- Clearing The Roadblocks To Better B2B PricingDocument12 pagesClearing The Roadblocks To Better B2B PricingTarek HusseinNo ratings yet

- Strategic Management Page 81Document4 pagesStrategic Management Page 81deddymujiantoNo ratings yet

- Unit 18 Pricing of Bank Products and Services: ObjectivesDocument17 pagesUnit 18 Pricing of Bank Products and Services: Objectivesrishabh_arora@live.comNo ratings yet

- BM AnswersDocument7 pagesBM Answersviki vigneshNo ratings yet

- Chapter 10 - Pricing and Credit Strategies: "The Price Is What You Pay The Value Is What You Receive." AnonymousDocument15 pagesChapter 10 - Pricing and Credit Strategies: "The Price Is What You Pay The Value Is What You Receive." AnonymousMutya Neri Cruz100% (1)

- Chapter 10 Entrepreneurship by Zubair A Khan.Document21 pagesChapter 10 Entrepreneurship by Zubair A Khan.Zubair A Khan100% (1)

- Daily Wear: Business Management and StrategyDocument7 pagesDaily Wear: Business Management and StrategyMuhammad ArslanNo ratings yet

- SM4Document8 pagesSM4Tú Anh NguyễnNo ratings yet

- Pricing DecisionsDocument3 pagesPricing DecisionsNilufar RustamNo ratings yet

- B2B CommodityDocument3 pagesB2B CommodityAman ChopraNo ratings yet

- Module 4 - B2BDocument15 pagesModule 4 - B2Bsaritasinha0207No ratings yet

- OM Case Presentation - Group9Document12 pagesOM Case Presentation - Group9ptgoel100% (1)

- Chapter 5:-Creating Customer Value, Satisfaction, and LoyaltyDocument10 pagesChapter 5:-Creating Customer Value, Satisfaction, and Loyaltyapi-3753113100% (4)

- PRICING DECISIONS AND COST MANAGEMENTDocument3 pagesPRICING DECISIONS AND COST MANAGEMENTVagabondXikoNo ratings yet

- Chapter 14 - Pricing Strategy For Business MarketsDocument25 pagesChapter 14 - Pricing Strategy For Business Marketsdewimachfud100% (1)

- CH 6 Cost IIDocument3 pagesCH 6 Cost IIfirewNo ratings yet

- Lean Pricing StartupsDocument31 pagesLean Pricing StartupsJuan PC100% (2)

- Stratman Case Study 1Document10 pagesStratman Case Study 1Angelica MangaliliNo ratings yet

- Pricing Policies Presentation on Industrial MarketingDocument18 pagesPricing Policies Presentation on Industrial MarketingggeettNo ratings yet

- PRICING CH SixDocument31 pagesPRICING CH SixBelay AdamuNo ratings yet

- Introduction To Pricing PrinciplesDocument4 pagesIntroduction To Pricing PrinciplesthekaustuvNo ratings yet

- Soal Uas E-Commerce 116Document7 pagesSoal Uas E-Commerce 116Azkaluthfan RudianaNo ratings yet

- Customer Relationship Management: Concepts and TechnologiesDocument49 pagesCustomer Relationship Management: Concepts and TechnologiesDr. Usman Yousaf100% (1)

- Price or Relationship: Securenow'S DilemmaDocument4 pagesPrice or Relationship: Securenow'S DilemmaYash sardaNo ratings yet

- Marketing: Gyaan Kosh Term 1Document16 pagesMarketing: Gyaan Kosh Term 1Avi JainNo ratings yet

- 3.analysis of Case Study 3.1 Introduction of Market PositioningDocument2 pages3.analysis of Case Study 3.1 Introduction of Market PositioningYamunah JaiNo ratings yet

- Chapter 13 Quiz: The Following Data Apply To Questions 6 and 7Document41 pagesChapter 13 Quiz: The Following Data Apply To Questions 6 and 7Dellya PutriNo ratings yet

- Paper 2Document10 pagesPaper 2saiNo ratings yet

- Chapter 15 Designing Pricing Strategies and ProgramsDocument19 pagesChapter 15 Designing Pricing Strategies and ProgramsMandy00011123322No ratings yet

- Initiating Price IncreasesDocument5 pagesInitiating Price IncreasesDurgaChaitanyaPrasadKondapalliNo ratings yet

- Building and Defending Competitive Advantages - Lesson 5Document6 pagesBuilding and Defending Competitive Advantages - Lesson 5api-3738338100% (1)

- Price STRDocument3 pagesPrice STRleyna maryNo ratings yet

- 1) - How Do Consumers Process and Evaluate Prices?Document4 pages1) - How Do Consumers Process and Evaluate Prices?Nasir HussainNo ratings yet

- Marketing ManagementDocument11 pagesMarketing Managementdeekshapatel.7665No ratings yet

- Chapter 2.1Document40 pagesChapter 2.1Linh ChiNo ratings yet

- Ajmal - 1550 - 4118 - 1 - Pricing Strategy For Industrial Markets - Lecture # 14Document44 pagesAjmal - 1550 - 4118 - 1 - Pricing Strategy For Industrial Markets - Lecture # 14Raiana TabithaNo ratings yet

- The Art of Banking Wars: How Savings Rate Changes Impact CompetitionDocument3 pagesThe Art of Banking Wars: How Savings Rate Changes Impact CompetitionRaja DebnathNo ratings yet

- Pricing DecisionsDocument24 pagesPricing DecisionsFatma HusseinNo ratings yet

- (Written Report) Chap 5Document25 pages(Written Report) Chap 5Nicole Anne GatilaoNo ratings yet

- Pricing Complexities in Financial ServicesDocument17 pagesPricing Complexities in Financial ServicesshahneelahmedNo ratings yet

- GROUP TASK - Week 4 - Stratbis 12 Sep 2016Document3 pagesGROUP TASK - Week 4 - Stratbis 12 Sep 2016ArifNo ratings yet

- BDHR - Bab 12Document40 pagesBDHR - Bab 12NataliaNo ratings yet

- Pricing Strategy - AssignmentDocument19 pagesPricing Strategy - AssignmentHitesh PatniNo ratings yet

- Bain Brief Clearing The Roadblocks To Better b2b Pricing PDFDocument12 pagesBain Brief Clearing The Roadblocks To Better b2b Pricing PDFRishabh VijayNo ratings yet

- Faculty of Business / Faculty of Management (Fob / Fom) : PBU0035 Introduction To Business Plan Foundation in ManagementDocument6 pagesFaculty of Business / Faculty of Management (Fob / Fom) : PBU0035 Introduction To Business Plan Foundation in ManagementLIM YU HANGNo ratings yet

- 11 - Chapter 4Document32 pages11 - Chapter 4gs randhawaNo ratings yet

- Relationship-Based Pricing:: Build A Sound Foundation For New Paradigm SuccessDocument9 pagesRelationship-Based Pricing:: Build A Sound Foundation For New Paradigm SuccessdellibabukNo ratings yet

- Understanding pricing strategies and conceptsDocument3 pagesUnderstanding pricing strategies and conceptsAriysha SHAHEENNo ratings yet

- Bains Limit Pricing Theory Determinants Factors LimitationsDocument4 pagesBains Limit Pricing Theory Determinants Factors LimitationsExport ImbdNo ratings yet

- Pricing Policy OptimizationDocument30 pagesPricing Policy OptimizationSakshi ShahNo ratings yet

- Pricing of Bank Products and ServicesDocument20 pagesPricing of Bank Products and ServicesRishabh JainNo ratings yet

- Business Level Strategy: Ijaz AhmedDocument51 pagesBusiness Level Strategy: Ijaz AhmedNaeem Ul HassanNo ratings yet

- CMA CH 4 - Cost Analysis and Pricing Decisons March 2019-1Document30 pagesCMA CH 4 - Cost Analysis and Pricing Decisons March 2019-1Henok FikaduNo ratings yet

- Langfield-Smith7e IRM Ch20Document38 pagesLangfield-Smith7e IRM Ch20Sophia Duong100% (5)

- Proposals & Competitive Tendering Part 1: Strategy & Positioning to Win (Second Edition)From EverandProposals & Competitive Tendering Part 1: Strategy & Positioning to Win (Second Edition)No ratings yet

- Competitive Pricing: Strategies for Staying Ahead in a Crowded MarketFrom EverandCompetitive Pricing: Strategies for Staying Ahead in a Crowded MarketNo ratings yet

- Template 3 Risk and Mitigation Table Part 2 Appendix BDocument9 pagesTemplate 3 Risk and Mitigation Table Part 2 Appendix BHesanRajaraniNo ratings yet

- 2 Maize Milling Business Plan SampleDocument22 pages2 Maize Milling Business Plan SamplechowNo ratings yet

- Task 2 (A) (Answers) : Project A - TV StationDocument3 pagesTask 2 (A) (Answers) : Project A - TV StationHesanRajaraniNo ratings yet

- Declaration of Conformity467Document1 pageDeclaration of Conformity467HesanRajaraniNo ratings yet

- Open and Closed FractureDocument22 pagesOpen and Closed FractureHesanRajaraniNo ratings yet

- OperatorsDocument10 pagesOperatorsHesanRajaraniNo ratings yet

- 29149Document1 page29149HesanRajaraniNo ratings yet

- PST SLE Declaration PDFDocument10 pagesPST SLE Declaration PDFHesanRajaraniNo ratings yet

- Noble Denton Guidelines For LoadoutsDocument36 pagesNoble Denton Guidelines For LoadoutsBoyNo ratings yet

- DLT Climbing Jack Operating SequenceDocument21 pagesDLT Climbing Jack Operating SequenceBoyNo ratings yet

- RCR Presentation RevisedDocument30 pagesRCR Presentation RevisedHesanRajaraniNo ratings yet

- Quotation - Timun - 3000 Polybags GantungDocument1 pageQuotation - Timun - 3000 Polybags GantungHesanRajaraniNo ratings yet

- 29149Document1 page29149HesanRajaraniNo ratings yet

- 2015 CIMA Professional Qualification SyllabusDocument51 pages2015 CIMA Professional Qualification SyllabusvictorpasauNo ratings yet

- Chemicals UsageDocument1 pageChemicals UsageHesanRajaraniNo ratings yet

- Shifting Route Sec 2 To Sec 1Document1 pageShifting Route Sec 2 To Sec 1HesanRajaraniNo ratings yet

- Req T QuotationDocument5 pagesReq T QuotationHesanRajaraniNo ratings yet

- Business Law RajDocument10 pagesBusiness Law RajHesanRajaraniNo ratings yet

- NAAM QuotationDocument2 pagesNAAM QuotationHesanRajaraniNo ratings yet

- Introduction Using Analysis Tools For TESCODocument16 pagesIntroduction Using Analysis Tools For TESCOSiew PhingNo ratings yet

- HarryDocument2 pagesHarryHesanRajaraniNo ratings yet

- What Is Critical WritingDocument4 pagesWhat Is Critical Writingnicholaz53No ratings yet

- Soil Training Manual Text PDFDocument30 pagesSoil Training Manual Text PDFHesanRajaraniNo ratings yet

- Critique Research PaperDocument13 pagesCritique Research PaperMadhusudan BistaNo ratings yet

- Project Bukit PelandukDocument9 pagesProject Bukit PelandukHesanRajaraniNo ratings yet

- Ns Vitamin e - Repair Cream Brochure 2015Document4 pagesNs Vitamin e - Repair Cream Brochure 2015BoyNo ratings yet

- Job Desc - Operations ManagerDocument1 pageJob Desc - Operations ManagerHesanRajaraniNo ratings yet

- Small Business Strategic EdgeDocument8 pagesSmall Business Strategic EdgeHesanRajaraniNo ratings yet

- 314 944 1 PBDocument16 pages314 944 1 PBHesanRajaraniNo ratings yet