Professional Documents

Culture Documents

Pakistan's Growing Economy and 4.24% GDP Rise in FY2015

Uploaded by

Munir HalimzaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pakistan's Growing Economy and 4.24% GDP Rise in FY2015

Uploaded by

Munir HalimzaiCopyright:

Available Formats

Economy of pakistan

GDP Growth rate = 4.24% as compare of 2.7 % of previous.

Agriculture sector accounts for 20.88 % of GDP, 43.5 % of employment..

o Growth rate of Agriculture= 2.9% (2.9% in prev year),

o Important crops contains 25.6 % of agri value and 64.5 % in overall crops

o Other crops contain 11.11 % agri value and contribute 2.3% of GDP

o Cotton ginning has 2.9% share in agriculture and .6% in GDP

o livestock share 56.3 % in agriculture, 11.8% to GDP, grew at 4.12%

o Forestry shares 2.0% in agriculture, growth rate 3.15%

o Fisheries share 2.1% in agriculture, growth rate 5.75%

Industry sector accounts for 20.30 % of GDP

o Industrial growth rate= 3.6 % (4.5% in last year),

o Four sub sectors: Mining & quarriying, manufacturing, Energy generation &

distribution, construction

o Manufacturing contributes 13.3% to GDP, employees 14.2% of labor

o manufacturing growth 5.5%

LSM (Large scale manufacturing), 10.68 % to GDP, 11 % of industry and

80 % of manufacturing

LSM growth rate : 2.5%

SME/SSM growth rate 8.2%, 1.7 % to GDP, 13 % to manufacturin

o Construction contributes 2.4 % to GDP, 12% share to Industry, employees 7.33%

of labor force, growth rate 7%

o Mining & quarrying 2.9% in GDP, 14.4% to Industry, growth rate 1.6%

o Power Generation and Distribution contributes 1.7% tp GDP, 8.2% in industry

and grew at 1.9%

Services sector accounts for 58.82% and growth rate 4.95 %

o Six sub sectors: Transport, Storage & Communication, Wholesale & Retail Trade,

Finance & Insurance, Housing, General Govt./Defense Services/Public

Administration, Private Services/Social Services

o Wholesale and retail trade grew at 3.38%

o Transport, Storage and Communication grew at 4.21%, employees 5.44 % of

labor force

o Housing Services grew at 4%

o Other Private services grew at 5.94%

o Finances and Insurance grew at 6.2% against 5.8 last year

o General Govt. services grew at 9.4% 9increase in pay & pension, low default rate)

Total investment to GDP improved at 15.1% as compared to 13.9% last year

o Fixed investment to GDP 13.52%

o Private investment 9.66% of GDP

o Public investment gre at 25.56%

o KSE 100 index witnessed highest in history

o Market capitalization $ 71.8 billion

o FDI inflows : grew at 10.2 % and reached at $ 2057.3 million

o Savings improved to 14.5% ------Rs. 4140 billion

o Remittances reached at $ 14969.66 million, growth of 16.06 %

o Gross fixed Capital Formation (GFCF) Rs. 3702 billion 10.3 % increase

o Commodity Producing Sector accounts for 41.2 % of GDP, growth rate 3.24%

o Declining oil prices led to shortfall in FBR collection by Rs. 205 billion

Fiscal Development

o Fiscal Deficit: 3.8 % (July-March 2014-15)

o Fiscal /Budget Deficit 5% of GDP (FY 2014-15

o Trade deficit: 0.7%

o Foreign Ex. reserves(of country): $ 17.739 billion, +ve change of 25%

o Total Revenue grew by 8.3% and reached Rs. 2682.6 billion

o Total tax collection Rs. 2063.2 billion, growth rate of 15.5 %

o FBR collected Rs. 1972.4 billion with a growth rate of 13% (GST on Petroleum

27%, 2% withholding tax on non filers)

o Total Expenditure Rs. 3731.6 billion against Rs. 3446.2 billion

o Current Expenditure grew by 10.1% and reached Rs. 3199.1 billion

o Dev expenditure and net lending grew by 6.9% and reached Rs. 594 bill

o PSDP grew by 27.1% and reached Rs. 499.4 billion

o Decline in current subsidies from Rs. 201.8 billion to Rs. 185.9 billion

Money and Credit

o SBP Discount Rate in monetary policy = 7%

o Broad money M2 witnessed increase of 7.33% and stood at Rs. 730.5 bill

o Net Foreign Assets (NFA) grew and stood at Rs. 220.1 billion

o NDA of banking sector grew by 5.45% and stood at Rs. 510.5 billion

o Govt. borrowing for budgetary support Rs. 601.1 billion against 240.2 pre

o Credit to Private sector grew by 4.3%

o Decline in NPL ratio to 12.3%

o Capital Adequacy ratio (CAR) of banking 17.4%

o Pak Rupee recorded a depreciation of 3.1 %

Capital Market:

o 27 % return for investors (31 % return in terms of US $)

o Gained 6870 points till 32131 level

o Auto sector top performer with market capital increase by 133 %

o Domestic Sukuk : Rs. 26 billion

o International Sukuk : $ 1 billion

o TFCs : Rs. 6 billion

o Mutual Fund Industry stood at Rs. 510.920 increase of 14%

o Portfolio of National Saving (NSS) Rs. 2938920.21 million constituting 25 %

share of overall domestic debt of GOP.

Education

o Literacy Rate 58 % as compared to 60 % last year

o LR in urban and rural areas 74% and 49 % respectively

o LR for men and women 81 % and 66% respectively

o Province wise LR for Punjab 61%, Sindh 56%, KPK 53%, Balochistan 43%

o Increase in enrollment by 2.4% reached 42.1 million

Health

o Expenditure on health 0.4 % of GDP Rs. 114.2 billion

o Calories intake per day per person increased from 2484 to 2490 0.24 % increase

o Medical Facility ratio: 1073 persons / doctor, 12447 persons / dentist, one hospital

bed for 1593 persons

o 1142 hospitals, 5499 dispensaries, 5438 BHU, 669 RHCs, 118041 beds in

hospitals.

o 175223 doctors, 15106 dentists, 90276 nurses in the country

Population & Employment

o Estimated population 191.71 milion, growth rate 1.92 %, 6th populous country

o Unemployment rate : 6%

o Total labor force 60.09 million, 56.52 are employeed

o 49 % of overseas Pakistanis are in middle east, 28.2% in Europe, 16 % in USA,

o Manpower export increased to 0.752 million

o Per Capita Income: $1512

Transport and Communication

o NHA highways, expressways, motorways of about 12313 km, portfolio of 72

projects costing Rs.1342 billion

o Pakistan Railway

o Revival of PIA, losses reduced from 44.3 bill to Rs. 32 billion

o Ports and shipping earned Rs 11.424 billion

o Karachi Port Trust 11.5 km long, 12 meters deep, turning basin of 600 meters

provides upto 75000 metric tons deadweight and handled 31.133 mill tons of

cargo

o Total volume of Port Qasim 15.189 mill tons

o Gawadar Port future centerpiece alongwith china

Energy

o Last year govt retired circular debt of Rs 480 billion, now again circular amounts

Rs. 250 billions including current payments

o Turkmanistan-Afghanistan, Pakistan-India (TAPI) pipeline ($10-12) will be

materialized till 2017 will provide 1.3 billion cubic feet gas to Pakistan

o Jamshoro Power project will be complete in 2018 with 1300 MW.

o Enhancement of distribution network and upgradation of 284 grid stations with

investment of $ 167.2 miilion

o Dasu Hydro Power I on Indus River through IDA credit of $ 588.4 million will

add 2160 MW.

o Different MoU signed with china on energy projects of coal, wind, sola, and

hydro project by 2017 adding 10400 MW

o Neelum Jehlum Hydropower to be completed in 2016

Telecom: Total Subscribers 134 million

Allocation of 4.5% of GDP to social safety Nets through BISP, PPAF, RSPNs, Pakistan

Bait-ul-Mal

Foreign Exchange reserves(of SBP): $ 12.550 billion as on 8th May

Public Debt 61.8% of GDP Rs. 16936 billion, increase of 940 billion from prev

Public Debt servicing Rs. 1139 billion 44.5 % of total revenues

EDL stock $ 62.6 billion out of which external public debt $ 49.1 billion

Three main drivers of economic growth are consumption, investment and export

Inflation: 4.8 %, Food and Non Food Inflation 3.6% and 5.7 % respectively

Import Volume: $34.086 billion decline of 1.61%

Export Volume: $20.176 billion - 3% decline

External Account posted a surplus of $2.12 billion

Current Account deficit: $ 1.364 billion (.06% of GDP), 53.5 % less than prev

Tax to GDP ratio= 8.7% (min average in world is 15%)

If Poverty line= $2 per day then 60.19% Population fall below poverty line in Pakistan.

In china 29.7%, India 68.7% and Bangladesh 76.5% of population is below poverty line.

Financial Account balance: $2.836 billion

Sale of EURO Bonds: $ 2 billion

Issuance of Sukuk bonds in international market: $ 1 billion

Budget 2015-16

Total Outlay : Rs.4451.3 billion 3.5 % higher than previous,

Estimated gross revenue receipts are Rs.4,313 billion , 9.1 % higher

o Estimated net revenue receipts Rs 2,463.4 billion with 3.6 % increase,

o Est. provincial share in federal taxes Rs 1,849.4 billion 17.4 % higher,

o Estimated net capital receipts Rs 606.3 billion with decline of 12.2 %,

o Estimated external receipts Rs 751.5 billion 12.1 % higher.

Estimated expenditure Rs 4,089 billion, 4.8 % higher

o Current expenditure is Rs 3,128 billion (78.2%)

Defense Budget Rs.780 Billion, 11 % higher

o Development Budget is Rs 700 billion, 29 % higher

Size of PSDP Rs 1,513.7 billion

Target Budget deficit 4.3 % - that is Rs. 1625 billion

Taxation

o Capital gain Tax 15 % and 12.5 % for securities held for 1 year and 2 years

respectively and 7.5 % for holding securities for 2-4 years

o For commission agents/non filers increased to 3 % against 2 %

o Adjustable Advance income tax on banking instruments 0.3 % (Cheques)

o Income tax for banking companies income @ 35%

o For dividend income 12.5%, for non filers 17.5%, for mutual funds 10 %

o Adjustable adnace income tax @ 0.1% for each transaction at PMEX

o Adjustable advance income tax of 7.5 % at electricity bills amounting to Rs.

75000/o A tax @ 10 % for not distributing dividend

o An additional withholding tax of 10 % for renting machinery, equipment,

scientific instruments alongwith already final tax of 15 %

o Additional one time tax of 3 % on banking companies and 4 % for others having

income above Rs. 500 million for rehabilitation of TDPs

o Proposed income tax of 32 % for companies instead of 35 % earlier in lieu of 1%

reduction strategy annually.

o Tax credit for enlistment is increased to 20 % against 15% earlier

o Tax credit for new investment limit is proposed to increase to 1.5 million

against Rs. 1 million earlier

o Reduction in Withholding Tax On Token Tax by 20-25% for tax filers

o Reduction in Withholding Tax On Transfer of Vehicles by 75 % for tax filers

and one third for non filers

o Reduced income tax of 25% for small company and propsed limit enhancement to

Rs. 50 million

o Reduction in income tax to 2% for salaried persons with income 4 5 lac, and 7%

for non salaried persons having income between 4-5 Lac

o FED on cigarettes increased from 58 % to 63%, 0.75% on each filter rod

o Rates of further tax enhanced from 1 % to 2%

o Sales tax on Mobile phones increased from 150, 250 and 500 rupees to 300, 500

& 1000 rupees respectively

o FED on aerated water increased from 9% to 12 %

Reduction in maximum tariff slab from 25 % to 20% and reduction in number of slabs

from 6 to 5

Powers of FBR to issue exemptions are withdrawn and subjected to circulars through

parliament

Construction

o Markup on housing credit be deductable to income upto 50 % of taxable income

or Rs. 1 million

o Sales tax on bricks and crushed stones is exempted for 3 years.

o Custom duty on import of construction machinery is reduced from 30% to 20%

o Tax/mport duty exemption for solar panels

Agriculture

o Income Tax holiday of 3 years for agri supply chain if set upto 2016

o Tax exemption for halal food manufacturers for four years if set upto 2016

o Reduction of sales tax from 17 to 7%, withholding tax to 0%, and import duty to 2

% o n import or local supply of agril machinery

o Income Tax reduction for rice mills to minimum level

o Interest free loansof Rs. 1.1 million for solar tubewells against deposit of Rs.

100000

Estimated bank borrowing Rs 282.9 billion

NFC Composition: Punjab 51.74%, Sindh 24.55%, KPK 14.62 %, Baluchistan 9.09 %

Expenditure on General Public Services is 70.3 % of current expenditure

Income tax holiday for all manufacturing units set up in KPK upto 2018

7.5% adhoc relief allowance on running basic pay, merging of previous adhoc relief

allowances to basic pay, medical allowance increased to 25 %. 7.5% increase in pension

Minimum wage rate.Rs 13000

You might also like

- Research Paper Presented To The Senior High School University of Santo Tomas Manila, PhilippinesDocument42 pagesResearch Paper Presented To The Senior High School University of Santo Tomas Manila, PhilippinesHitomi Claudette GozunNo ratings yet

- BudgetDocument3 pagesBudgetkawalkaurNo ratings yet

- Budget 2015-16: Net Revenue ReceiptDocument7 pagesBudget 2015-16: Net Revenue ReceiptDani RajaNo ratings yet

- Budget 1Document30 pagesBudget 1Karishma SarodeNo ratings yet

- Economy FY22Document2 pagesEconomy FY22sumeraNo ratings yet

- Click Here For Pakistan Budget 2011-12 DetailsDocument6 pagesClick Here For Pakistan Budget 2011-12 DetailsSaim AhamdNo ratings yet

- Sop-G 8 PresentsDocument24 pagesSop-G 8 PresentsHimesh V NairNo ratings yet

- Economicoutlook 201314 HighlightsDocument5 pagesEconomicoutlook 201314 Highlightsrohit_pathak_8No ratings yet

- Budget Highlights - 2011-12Document3 pagesBudget Highlights - 2011-12Raman KapoorNo ratings yet

- Analysis of 2010-11 Federal Budget of PakistanDocument19 pagesAnalysis of 2010-11 Federal Budget of PakistanMaaz Aslam KhanNo ratings yet

- India's Economic Growth Projected at 8.2% for 2011-12Document5 pagesIndia's Economic Growth Projected at 8.2% for 2011-12Ishaan GoelNo ratings yet

- Budget 2023 SummaryDocument2 pagesBudget 2023 SummarySidhartha Marketing CompanyNo ratings yet

- Economic SurveyDocument11 pagesEconomic SurveycfzbscjdghNo ratings yet

- PTI Economic PolicyDocument47 pagesPTI Economic PolicyPTI Official100% (9)

- Trade Policy Review Report by Pakistan: Orld Rade RganizationDocument13 pagesTrade Policy Review Report by Pakistan: Orld Rade Rganizationthewizards_nomanNo ratings yet

- Economic Survey Pakistan Economic Survey 2015-16Document17 pagesEconomic Survey Pakistan Economic Survey 2015-16Nasir HasanNo ratings yet

- Tanzaniabudget2015 2016summaryDocument8 pagesTanzaniabudget2015 2016summaryAnonymous FnM14a0No ratings yet

- The Following Are Some of The Key Highlights On Union Budget 2010-2011Document2 pagesThe Following Are Some of The Key Highlights On Union Budget 2010-2011ajithtv3No ratings yet

- Budget Analysis 2011-12 (RR)Document10 pagesBudget Analysis 2011-12 (RR)Gandharav BajajNo ratings yet

- Punjab National Bank: CMP: INR760 TP: INR964 Buy Asset Quality Deteriorates Asset-Liability Well-MatchedDocument14 pagesPunjab National Bank: CMP: INR760 TP: INR964 Buy Asset Quality Deteriorates Asset-Liability Well-MatchedDavid ThambuNo ratings yet

- Budget 2012 13 HighlightsDocument66 pagesBudget 2012 13 HighlightsvickyvikashsinhaNo ratings yet

- Pakistan Economic Survey 2014-15: Economic Adviser's Wing, Finance Division, Government of Pakistan, IslamabadDocument18 pagesPakistan Economic Survey 2014-15: Economic Adviser's Wing, Finance Division, Government of Pakistan, IslamabadAhmed Ali KhanNo ratings yet

- EnglishDocument6 pagesEnglishbajebhootNo ratings yet

- Summary of Economic Survey 2019 Vol - II: State of The Economy in 2018-19: A Macro ViewDocument5 pagesSummary of Economic Survey 2019 Vol - II: State of The Economy in 2018-19: A Macro Viewkabu209No ratings yet

- Pakistan's GDP Growth, Investments, Exports and ImportsDocument4 pagesPakistan's GDP Growth, Investments, Exports and ImportsHadi Hassan Wardak100% (1)

- Pakistan Economic Survey 2011-12 PDFDocument286 pagesPakistan Economic Survey 2011-12 PDFAli RazaNo ratings yet

- KunduDocument10 pagesKunduzaid.samawiNo ratings yet

- Uganda Economic Snapshot H2, 2017: Trade & Investment SWOT Strengths WeaknessesDocument4 pagesUganda Economic Snapshot H2, 2017: Trade & Investment SWOT Strengths Weaknesses842janxNo ratings yet

- Salient Points of Budget 2010-2011Document3 pagesSalient Points of Budget 2010-2011mudassar2933No ratings yet

- BH 1Document10 pagesBH 1api-247991222No ratings yet

- Development Economics PPT PakDocument36 pagesDevelopment Economics PPT Pakminnie908No ratings yet

- Bangladesh Quarterly Economic Update: September 2014From EverandBangladesh Quarterly Economic Update: September 2014No ratings yet

- Lbs August 213Document123 pagesLbs August 213adoekitiNo ratings yet

- Budget 2020-21 and RealityDocument3 pagesBudget 2020-21 and RealityMohammad AlauddinNo ratings yet

- Fiscal PolicyDocument43 pagesFiscal PolicyIrfan JNo ratings yet

- Eco Letter - June 10, 2011Document2 pagesEco Letter - June 10, 2011Junaid AhmedNo ratings yet

- Economic Survey of Pakistan: Executive SummaryDocument12 pagesEconomic Survey of Pakistan: Executive SummaryBadr Bin BilalNo ratings yet

- Comsats Institute of Information Technology: "Working of Multinational Companies in Pakistan"Document15 pagesComsats Institute of Information Technology: "Working of Multinational Companies in Pakistan"Farhan Badar SiddiquiNo ratings yet

- BUDGET Analysis 2010Document11 pagesBUDGET Analysis 2010Emran HossainNo ratings yet

- Budget 2013Document5 pagesBudget 2013@nshu_theachieverNo ratings yet

- Nri News Bulletin May 18 AdvDocument11 pagesNri News Bulletin May 18 AdvJames MurrayNo ratings yet

- Interim Budget 2014 15Document12 pagesInterim Budget 2014 15Pratik KitlekarNo ratings yet

- Cpfga 15645 BHDocument3 pagesCpfga 15645 BHShanthan ChippaNo ratings yet

- Report On MoroccoDocument10 pagesReport On Moroccoaimajunaid06No ratings yet

- President Marcos SONA PDFDocument29 pagesPresident Marcos SONA PDFTheSummitExpressNo ratings yet

- Macroeconomic Performance of Bangladesh Based On The 7th 5 Year PlanDocument3 pagesMacroeconomic Performance of Bangladesh Based On The 7th 5 Year PlanSakib SadmanNo ratings yet

- Unio Nbu Dget - 12H Ighli GhtsDocument32 pagesUnio Nbu Dget - 12H Ighli GhtsMayur BulchandaniNo ratings yet

- CPD Analysis of Bangladesh National Budget FY2014Document89 pagesCPD Analysis of Bangladesh National Budget FY2014hossainmzNo ratings yet

- Budget 2012 Highlights SummaryDocument11 pagesBudget 2012 Highlights SummaryMilan MeeraNo ratings yet

- Highlight of Economy 2009-10-2Document18 pagesHighlight of Economy 2009-10-2Mateen SajidNo ratings yet

- 2 Ibp EcoLetter January 13, 2012Document2 pages2 Ibp EcoLetter January 13, 2012Chinkoz SagaNo ratings yet

- Fact Sheet CSS 2024Document8 pagesFact Sheet CSS 2024Asifa JamilNo ratings yet

- State of The Nation AddressDocument23 pagesState of The Nation AddressChelsie SantosNo ratings yet

- Budget AuroDocument38 pagesBudget AuroSrihari PatelNo ratings yet

- Tanzania - African Economic OutlookDocument14 pagesTanzania - African Economic OutlookVivekanandhan SindhamaniNo ratings yet

- President Yoweri Museveni New Year Address 2019Document14 pagesPresident Yoweri Museveni New Year Address 2019The Independent MagazineNo ratings yet

- Free State Budget Speech 2021Document40 pagesFree State Budget Speech 2021Brandon BothaNo ratings yet

- A Macroeconomic Analysis of BangladeshDocument35 pagesA Macroeconomic Analysis of Bangladeshnazmul_85No ratings yet

- Budget 2010-2011Document20 pagesBudget 2010-2011Simi SolunkeNo ratings yet

- Philippines: Energy Sector Assessment, Strategy, and Road MapFrom EverandPhilippines: Energy Sector Assessment, Strategy, and Road MapNo ratings yet

- Finance in Africa: Navigating the financial landscape in turbulent timesFrom EverandFinance in Africa: Navigating the financial landscape in turbulent timesNo ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word DocumentMunir HalimzaiNo ratings yet

- And Other Planets, Including Thehydrologic Cycle, Water Resources and Environmental Watershed SustainabilityDocument5 pagesAnd Other Planets, Including Thehydrologic Cycle, Water Resources and Environmental Watershed SustainabilityMunir HalimzaiNo ratings yet

- Presentaion of ProblemsDocument3 pagesPresentaion of ProblemsMunir HalimzaiNo ratings yet

- Lecture - 13engineering CurvesDocument50 pagesLecture - 13engineering CurvesMunir HalimzaiNo ratings yet

- RemoveDocument1 pageRemoveAnderson AlvesNo ratings yet

- B Tech-2010Document152 pagesB Tech-2010Gina RobinsonNo ratings yet

- Projection of LinesDocument44 pagesProjection of Linesxblueknight100% (5)

- Right of Minoroties in IslamDocument4 pagesRight of Minoroties in IslamcuamiNo ratings yet

- Concrete Technology Notes 4Document7 pagesConcrete Technology Notes 4Munir HalimzaiNo ratings yet

- 1.1 IntroductionDocument9 pages1.1 IntroductionGregory SimmonNo ratings yet

- Manufacture and testing of cementDocument10 pagesManufacture and testing of cementMunir HalimzaiNo ratings yet

- Pakistan Economic SurveyDocument18 pagesPakistan Economic SurveyNabi BakhshNo ratings yet

- Structure 2 2Document46 pagesStructure 2 2Munir HalimzaiNo ratings yet

- Wuthering HeightsDocument192 pagesWuthering HeightsViorica TalambutaNo ratings yet

- Islam and The WestDocument20 pagesIslam and The Westsnj313No ratings yet

- Democracy According To Traditional Islamic SourcesDocument15 pagesDemocracy According To Traditional Islamic SourcesMunir HalimzaiNo ratings yet

- How To Attempt Compulsory SubjectsDocument3 pagesHow To Attempt Compulsory SubjectsMunir HalimzaiNo ratings yet

- Qudratullah ShahabDocument7 pagesQudratullah ShahabMunir HalimzaiNo ratings yet

- An Introduction To GIS and GPS TechnologyDocument27 pagesAn Introduction To GIS and GPS TechnologyMunir HalimzaiNo ratings yet

- PC Assignment PPMDocument5 pagesPC Assignment PPMMunir HalimzaiNo ratings yet

- How To Attempt Compulsory SubjectsDocument3 pagesHow To Attempt Compulsory SubjectsMunir HalimzaiNo ratings yet

- Penmetsa Venkata Subba Raju: MobileDocument2 pagesPenmetsa Venkata Subba Raju: MobilePushpa Latha MNo ratings yet

- MaaDocument2 pagesMaaSiva SankariNo ratings yet

- DLG Chapter 4 (Combined)Document14 pagesDLG Chapter 4 (Combined)Puth RathanaNo ratings yet

- ECE 202 Notes Study Economics Yr1 Prt2Document106 pagesECE 202 Notes Study Economics Yr1 Prt2gavin henning100% (1)

- Euroland Foods SA PDFDocument12 pagesEuroland Foods SA PDFPutu Aditya Pratama0% (1)

- Subsidy Vs Voucher in EducationDocument4 pagesSubsidy Vs Voucher in Educationikutmilis0% (1)

- Investment Center and Transfer PricingDocument10 pagesInvestment Center and Transfer Pricingrakib_0011No ratings yet

- Charmagne E. Eclavea: Manuel S. Enverga University Foundation Inc. (MSEUF) Bachelor of Science in Public AdministrationDocument2 pagesCharmagne E. Eclavea: Manuel S. Enverga University Foundation Inc. (MSEUF) Bachelor of Science in Public AdministrationPrances PelobelloNo ratings yet

- Longer-Run Decisions: Capital Budgeting: Changes From Eleventh EditionDocument19 pagesLonger-Run Decisions: Capital Budgeting: Changes From Eleventh EditionAlka NarayanNo ratings yet

- A26 Ipsas - 17Document40 pagesA26 Ipsas - 17Marius SteffyNo ratings yet

- Budget Analysis ReportDocument7 pagesBudget Analysis ReportRahul KumarNo ratings yet

- Management Accounting Report BudgetDocument42 pagesManagement Accounting Report BudgetBilly Maravillas Dela CruzNo ratings yet

- Jay Kusler-ResumeDocument4 pagesJay Kusler-Resumeapi-403638887No ratings yet

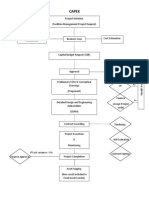

- CAPEXDocument1 pageCAPEXAmal KaNo ratings yet

- Performance Management - at The Federal Level of Government in AustriaDocument6 pagesPerformance Management - at The Federal Level of Government in AustriadorinciNo ratings yet

- Soal - 5 Flexible BudgetDocument4 pagesSoal - 5 Flexible BudgetMiranti SoebagioNo ratings yet

- T-SAP BaselineDocument21 pagesT-SAP BaselineLý BằngNo ratings yet

- Notes To The Financial StatementsDocument19 pagesNotes To The Financial StatementsRegina AurelliaNo ratings yet

- Case 4 LPDocument3 pagesCase 4 LPapi-192241020No ratings yet

- (2019) MM5007 Financial ManagementDocument19 pages(2019) MM5007 Financial ManagementYoungky J.P. ValantinoNo ratings yet

- Create Your Zero-Based Budget Template or SpreadsheetDocument4 pagesCreate Your Zero-Based Budget Template or SpreadsheetNabila ArifannisaNo ratings yet

- Financial Planning and Analysis: The Master BudgetDocument57 pagesFinancial Planning and Analysis: The Master BudgetBig D100% (2)

- CAG 2009/10 Report FindingsDocument8 pagesCAG 2009/10 Report FindingsSubiNo ratings yet

- Soal Ujian AM PDFDocument148 pagesSoal Ujian AM PDFtyasardyra100% (2)

- Performing Arts BusinessDocument4 pagesPerforming Arts BusinessFreya RowlandsNo ratings yet

- Pakistan's Impressive 5.1% GDP Growth in 2002-03Document267 pagesPakistan's Impressive 5.1% GDP Growth in 2002-03Farooq ArbyNo ratings yet

- Ial Wec12 01 Oct19Document32 pagesIal Wec12 01 Oct19non100% (1)

- Free Trade Benefits and DrawbacksDocument21 pagesFree Trade Benefits and Drawbacksrajan2778No ratings yet