Professional Documents

Culture Documents

Introduction To Auditing: D. An Audit Has A Benefit Only To The Owners

Uploaded by

Christine Mae ManliguezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction To Auditing: D. An Audit Has A Benefit Only To The Owners

Uploaded by

Christine Mae ManliguezCopyright:

Available Formats

NAME:__________________________________ Yr.

& Course: __________ Date:__________ Score: __________

Introduction to Auditing

Select the best answer for each of the following questions.

1. Which of the following best describes the objective of an audit of financial statements?

a. To express an opinion whether the financial statements are prepared in accordance with prescribed criteria.

b. To express an assurance as to the future viability of the entity whose financial statements are being audited.

c. To express an assurance about the managements efficiency or effectiveness in conducting the operations of

entity.

d. To express an opinion whether the financial statements are prepared, in all material respect, in

accordance with an identified financial reporting framework.

2. Certain fundamental beliefs called "postulates" underlie auditing theory. Which of the following is not a postulate of

auditing?

a. No long-term conflict exists between the auditor and the management of the enterprise under audit.

b. Economic assertions can be verified.

c. The auditor acts exclusively as an auditor.

d. An audit has a benefit only to the owners.

3. The overall objectives of the auditor in conducting an audit of financial statements are:

I. To obtain reasonable assurance about whether the financial statements as a whole are free from

material misstatement, whether caused by fraud or error.

II. To report on the financial statements.

III. To obtain conclusive rather than persuasive evidence

IV. To detect all misstatements, whether due to fraud or error

a. I and II only

b. II and IV only

c. I, II, and III only

d. I, II, III and IV

4. Which of the following is explicitly included in the Auditors responsibility section of the auditor's report?

a. Reason for modification of opinion.

b. Philippine Financial Reporting Standards.

c. Philippines Standards on Auditing.

d. Division of responsibility with another audit.

5. Identify the following as financial audit (FA), compliance audit (CA), and operational audit (OA).

1) A supervisor is not carrying out his assigned responsibilities.

2) A company's tax return does not conform to income tax laws and regulations.

3) A municipality's financial statements correctly show actual cash receipts and disbursements.

4) A company's receiving department is inefficient.

a.

b.

CA, CA, FA, OA

OA, CA, CA, OA

c. OA, CA, FA, OA

d. CA, CA, FA, CA

6. A review of any part of an organizations procedures and methods for the purpose of evaluating efficiency and

effectiveness is classified as a (n)________.

a. Audit of financial statements

c. Operational audit

b. Compliance audit

d. Production audit

7. The best description of the auditors responsibility with respect to audited financial statement is:

a. The auditor's responsibility on fair presentation of financial statements is limited only up to the date of the audit

report.

b. The auditor is responsible for detecting misstatements on the financial statements.

c. The responsibility over the financial statements rests with the management.

d. The auditor's responsibility is limited to the expression of opinion on the financial statements

8. Which of the following best describes what is meant by the term PSA?

a. Rules acknowledged by the accounting profession because of their universal application.

b. Pronouncements issued by the Auditing Standards Board.

c. Measures of the quality of the auditor's performance.

d. Procedures to be used to gather evidence to support financial statements.

9. In relation to auditing, which of the following is a correct phrase?

a. Auditing communicates results to management.

b. Auditing involves obtaining evidence regarding action and events.

c. Auditing evaluates assertions regarding evidence.

d. Auditing subjectively obtains and evaluates evidence.

10. Philippine Standards on Auditing require auditors to assess the risk of material misstatements due to fraud

a. For first-time audits.

b. Sufficient to find any frauds which may exist.

c. For every audit.

d. Whenever it would be appropriate.

11. The independent auditor lends credibility to clients financial statements by

a. Stating in the auditors management letter that the examination was made in

accordance with generally

accepted auditing standards.

b. Maintaining a clear-cut distinction between managements representations and the

auditors representation

c. Attaching an auditors opinion to the clients financial statements

d. Testifying under oath about clients financial statements

e.

12. Which of the following best describes the reason why an independent auditor reports on financial

statements?

a. A management fraud may exist and is more likely to be detected by independent

auditors.

b. Different interests may exist between the company preparing the statements and the

persons using the statements.

c. A misstatement of account balances may exist and is generally corrected as the result of the

independent auditor's work.

d. Poorly designed internal control may exist.

13

.

The independent audit is important to readers of financial statements because it

a. Determines the future stewardship of the management of the company whose financial

statements are audited

b. Measures and communicates financial and business data included in financial

statements

c. Involves the objective audit of and reporting on management-prepared

statements

d. Reports on the accuracy of all information in the financial statements

14. An independent audit aids in the communication of economic data because the audit

A)

Confirms the exact accuracy of managements financial representations.

B)

Lends credibility to the financial statements.

C)

Guarantees that financial data are fairly presented.

D)

Assures the readers of financial statements that any fraudulent activity has been corrected.

15. In auditing accounting data, the concern is with

a. Determining whether recorded information properly reflects the economic events that

occurred during the accounting period.

b. Determining if fraud has occurred.

c. Determining if taxable income has been calculated correctly.

d. Analyzing the financial information to be sure that it complies with government

requirements.

The overall objectives of the auditor in conducting an audit of financial statements are:

I. To obtain reasonable assurance about whether the financial statements as a whole are free from

material misstatement, whether caused by fraud or error.

II. To report on the financial statements.

III. To obtain conclusive rather than persuasive evidence

IV. To detect all misstatements, whether due to fraud or error

a. I and II only

b. II and IV only

c. I, II, and III only

d. I, II, III and IV

18. An audit designed to detect violation of laws and regulations would be referred to as

a. financial statement audit

c. a performance audit

b. Compliance audit

d. operational audit

The overall objectives of the auditor in conducting an audit of financial statements are:

I. To obtain reasonable assurance about whether the financial statements as a whole are free from

material misstatement, whether caused by fraud or error.

II. To report on the financial statements.

III. To obtain conclusive rather than persuasive evidence

IV. To detect all misstatements, whether due to fraud or error

a. I and II only

b. II and IV only

c. I, II, and III only

d. I, II, III and IV

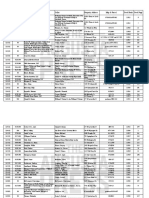

You might also like

- Option and Purchase Agreement - AuthcheckdamDocument6 pagesOption and Purchase Agreement - AuthcheckdamSterlingNo ratings yet

- The Historical Development of AuditingDocument7 pagesThe Historical Development of AuditingChristine Mae ManliguezNo ratings yet

- MCQ - Intro To AuditDocument13 pagesMCQ - Intro To Auditemc2_mcv74% (27)

- Indiana Life Cliff Notes NEWDocument35 pagesIndiana Life Cliff Notes NEWDenise CampbellNo ratings yet

- Aud Module 1-5Document23 pagesAud Module 1-5yaanvinaNo ratings yet

- Auditing Theory MCQs by Salosagcol With AnswersDocument31 pagesAuditing Theory MCQs by Salosagcol With AnswersYeovil Pansacala79% (62)

- Auditing TheoryDocument10 pagesAuditing TheoryAnna Mae SanchezNo ratings yet

- Dissertation On Artificial IntelligenceDocument55 pagesDissertation On Artificial IntelligenceByron SequeiraNo ratings yet

- Chapter 1-QuizDocument27 pagesChapter 1-QuizJpzelle100% (1)

- Banking Ombudsman Compaint FormDocument2 pagesBanking Ombudsman Compaint FormNeelakanta KallaNo ratings yet

- Chapter 1 SalosagcolDocument20 pagesChapter 1 SalosagcolgingerootNo ratings yet

- DocDocument13 pagesDocMequen Chille QuemadoNo ratings yet

- President Uhuru Kenyatta's Speech During The Launch of The Rapid Results Initiative (RRI) at KICCDocument5 pagesPresident Uhuru Kenyatta's Speech During The Launch of The Rapid Results Initiative (RRI) at KICCState House Kenya0% (1)

- Air and Space LawDocument52 pagesAir and Space LawBharath SimhaReddyNaidu100% (1)

- Case Digest SET 2Document7 pagesCase Digest SET 2Ma Gabriellen Quijada-TabuñagNo ratings yet

- At 92 Cpar PW PDFDocument12 pagesAt 92 Cpar PW PDFglcpaNo ratings yet

- Auditing Theory Mcqs by Salosagcol With AnswersDocument50 pagesAuditing Theory Mcqs by Salosagcol With AnswersAnthony Koko CarlobosNo ratings yet

- Chapter 1 - Solution Manual CabreraDocument2 pagesChapter 1 - Solution Manual CabreraClarize R. Mabiog67% (12)

- Chapter 1 - Audit: An OverviewDocument78 pagesChapter 1 - Audit: An OverviewMarnelli CatalanNo ratings yet

- CHAPTER 2 Introduction To AuditingDocument15 pagesCHAPTER 2 Introduction To AuditingChristine Mae ManliguezNo ratings yet

- Auditing Theory SalosagcolDocument4 pagesAuditing Theory SalosagcolYuki CrossNo ratings yet

- Auditing Theory Auditing ConceptsDocument15 pagesAuditing Theory Auditing ConceptsEllah MaeNo ratings yet

- People vs. de GranoDocument2 pagesPeople vs. de GranoMarcial Gerald Suarez IIINo ratings yet

- Auditing Theory Mcqs by Salosagcol With AnswersDocument31 pagesAuditing Theory Mcqs by Salosagcol With AnswersLeonard Cañamo100% (1)

- Chapter 1 Salosagcol PDF FreeDocument20 pagesChapter 1 Salosagcol PDF Freeforentertainment purposesNo ratings yet

- Audit Theo FPB With Answer KeysDocument6 pagesAudit Theo FPB With Answer KeysPj Manez100% (1)

- AT PrelimDocument32 pagesAT Prelimfer maNo ratings yet

- 3.0 Case Study 1:: 1.1 ChronologyDocument35 pages3.0 Case Study 1:: 1.1 Chronologyluqman syakirNo ratings yet

- Administrative Law: Doctrine of Primary JurisdictionDocument11 pagesAdministrative Law: Doctrine of Primary Jurisdictionwilfred poliquit alfecheNo ratings yet

- Prelim and Midterm CompilationDocument61 pagesPrelim and Midterm CompilationJOLLYBEL ROBLESNo ratings yet

- Assignment 1 in Auditing TheoryDocument6 pagesAssignment 1 in Auditing TheoryfgfsgsrgrgNo ratings yet

- Global ServicesDocument15 pagesGlobal Servicesparth_upadhyay_1No ratings yet

- Benefits Summary PhilippinesDocument2 pagesBenefits Summary PhilippinesRose GeeNo ratings yet

- Auditing Theory Mcqs by Salosagcol With AnswersDocument31 pagesAuditing Theory Mcqs by Salosagcol With AnswersCharilyn RemigioNo ratings yet

- Chapter 01 - Management Consultancy by CabreraDocument2 pagesChapter 01 - Management Consultancy by Cabrerarogienelr75% (8)

- T10 Government AccountingDocument10 pagesT10 Government AccountingAiya LumbanNo ratings yet

- 4-9 (Formilleza Up To Deloso)Document4 pages4-9 (Formilleza Up To Deloso)nchlrysNo ratings yet

- 118 Telengtan Brothers & Sons, Inc. v. Court of AppealsDocument4 pages118 Telengtan Brothers & Sons, Inc. v. Court of AppealsRem Serrano100% (1)

- Auditing Theory - 1Document9 pagesAuditing Theory - 1Kageyama HinataNo ratings yet

- Audit Assessment True or False and MCQ - CompressDocument8 pagesAudit Assessment True or False and MCQ - CompressHazel BawasantaNo ratings yet

- Far Eastern University - Manila: Open Using Adobe Reader and PCDocument5 pagesFar Eastern University - Manila: Open Using Adobe Reader and PCKristine TiuNo ratings yet

- 111年會考 審計學題庫Document15 pages111年會考 審計學題庫張巧薇No ratings yet

- At 01 - Introduction To Assurance and Related Services (Incl. Intro To Audit) - QuizzerDocument6 pagesAt 01 - Introduction To Assurance and Related Services (Incl. Intro To Audit) - QuizzerRei-Anne Rea100% (1)

- At 93 PWDocument16 pagesAt 93 PWPrinces Joy De GuzmanNo ratings yet

- Audit Overview & Professional StandardsDocument6 pagesAudit Overview & Professional Standardsjaypee.bignoNo ratings yet

- Far Eastern University - Manila: Open Using Adobe Reader and PCDocument5 pagesFar Eastern University - Manila: Open Using Adobe Reader and PCKristine TiuNo ratings yet

- Louwers - Auditing and Assurance Services 4eDocument74 pagesLouwers - Auditing and Assurance Services 4eChristian Ray DetranNo ratings yet

- MCQ Comprehensive ActivityDocument13 pagesMCQ Comprehensive ActivityMicaela MarimlaNo ratings yet

- Audit TheoDocument6 pagesAudit TheoVillapando GemaNo ratings yet

- Audit Principles QuizDocument9 pagesAudit Principles QuizCindy BitongNo ratings yet

- AT 2nd Monthly AssessmentDocument8 pagesAT 2nd Monthly AssessmentCiena Mae AsasNo ratings yet

- Quiz in Audit Overview Name: Section DIRECTION: Write The CAPITAL LETTER of Your Best Answer On The Space Provided Before Each NumberDocument4 pagesQuiz in Audit Overview Name: Section DIRECTION: Write The CAPITAL LETTER of Your Best Answer On The Space Provided Before Each NumberExequielCamisaCrusperoNo ratings yet

- Chapter 1 QuestionsDocument7 pagesChapter 1 QuestionsAyame MalinaoNo ratings yet

- Chapter 1Document27 pagesChapter 1julita08No ratings yet

- DocxDocument30 pagesDocxrandomlungs121223No ratings yet

- Aud-90 PWDocument17 pagesAud-90 PWElaine Joyce GarciaNo ratings yet

- ACCTG 9 - Audit in GeneralDocument6 pagesACCTG 9 - Audit in GeneralRed YuNo ratings yet

- Acctg QuizDocument15 pagesAcctg QuizMadi KomoaNo ratings yet

- Short Quiz 1Document11 pagesShort Quiz 1AMNo ratings yet

- AUDITTHEODocument13 pagesAUDITTHEOAlisonNo ratings yet

- PrE1 QUIZ #1Document5 pagesPrE1 QUIZ #1Abegail Kaye BiadoNo ratings yet

- Auditing Theory-1 Weekend Exercise NAME: - PROFESSOR: - (Acctg12 Prof)Document3 pagesAuditing Theory-1 Weekend Exercise NAME: - PROFESSOR: - (Acctg12 Prof)ezraelydanNo ratings yet

- Auditing Theory Testbank 6Document111 pagesAuditing Theory Testbank 6Debbie Grace Latiban LinazaNo ratings yet

- Auditing Theory: Quiz 2Document4 pagesAuditing Theory: Quiz 2KIM RAGANo ratings yet

- Audthe02 Activity 1Document4 pagesAudthe02 Activity 1Christian Arnel Jumpay LopezNo ratings yet

- QuestionsDocument2 pagesQuestionsKristel Keith NievaNo ratings yet

- Chap 00146Document74 pagesChap 00146tmxdkidNo ratings yet

- Aut QDocument3 pagesAut QdreianyanmaraNo ratings yet

- Audtg421 Week1-3 ULOa-b RationalizationDocument23 pagesAudtg421 Week1-3 ULOa-b RationalizationJohn Rich GamasNo ratings yet

- Introduction To Assurance and Non Assurance - MULTIPLE CHOICES QUESTIONSDocument8 pagesIntroduction To Assurance and Non Assurance - MULTIPLE CHOICES QUESTIONSReynan E. BolisayNo ratings yet

- Seatwork#1Document14 pagesSeatwork#1Tricia Mae FernandezNo ratings yet

- Lebanese Association of Certified Public Accountants - Audit February Exam 2020 Extra SessionDocument8 pagesLebanese Association of Certified Public Accountants - Audit February Exam 2020 Extra Sessionjifri syamNo ratings yet

- Activity 1 Week 1 Audit TheoryDocument2 pagesActivity 1 Week 1 Audit TheoryGONZALES, MICA ANGEL A.No ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18From EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18No ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19From EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19No ratings yet

- Common Greek and Latin RootsDocument1 pageCommon Greek and Latin RootsChristine Mae ManliguezNo ratings yet

- Lived ExperiencesDocument8 pagesLived ExperiencesChristine Mae ManliguezNo ratings yet

- Principles, Payouts Only at RetirementDocument8 pagesPrinciples, Payouts Only at RetirementChristine Mae ManliguezNo ratings yet

- Lived ExperiencesDocument9 pagesLived ExperiencesChristine Mae ManliguezNo ratings yet

- CHAPTER 1. Development of Internal AuditingDocument3 pagesCHAPTER 1. Development of Internal AuditingChristine Mae Manliguez100% (1)

- American Expat Social Security Planning Retirement AbroadDocument6 pagesAmerican Expat Social Security Planning Retirement AbroadChristine Mae ManliguezNo ratings yet

- The Need For Auditor Independence: Why Independent Auditing Is Necessary? Importance of Auditor IndependenceDocument2 pagesThe Need For Auditor Independence: Why Independent Auditing Is Necessary? Importance of Auditor IndependenceChristine Mae ManliguezNo ratings yet

- The Changing Role of Audit Uae PerspectiveDocument8 pagesThe Changing Role of Audit Uae PerspectiveChristine Mae ManliguezNo ratings yet

- The Notion of AccountabilityDocument1 pageThe Notion of AccountabilityChristine Mae ManliguezNo ratings yet

- Comparison Among The Different Types of Audit: Financial Audit Compliance Audit Operational AuditDocument2 pagesComparison Among The Different Types of Audit: Financial Audit Compliance Audit Operational AuditChristine Mae ManliguezNo ratings yet

- Five Organizations: Selected Proposals Re-Envisioning Retirement SecurityDocument4 pagesFive Organizations: Selected Proposals Re-Envisioning Retirement SecurityChristine Mae ManliguezNo ratings yet

- Cynthia Vela PDFDocument7 pagesCynthia Vela PDFRecordTrac - City of OaklandNo ratings yet

- History Final PaperDocument17 pagesHistory Final Paperapi-320308976No ratings yet

- Memo - Coal Inspection As of 09-22-2015Document2 pagesMemo - Coal Inspection As of 09-22-2015Raffy PangilinanNo ratings yet

- RIIHAN306A Carry Out Lifting Using Multiple Cranes: Release: 1Document11 pagesRIIHAN306A Carry Out Lifting Using Multiple Cranes: Release: 1Gia Minh Tieu TuNo ratings yet

- Title: Document/Drawing Approval/Comment Transmittal: Comments On 132kV Cable Termination Frame DrawingDocument2 pagesTitle: Document/Drawing Approval/Comment Transmittal: Comments On 132kV Cable Termination Frame DrawingPritom AhmedNo ratings yet

- United States Court of Appeals: For The First CircuitDocument22 pagesUnited States Court of Appeals: For The First CircuitScribd Government DocsNo ratings yet

- Mann v. Southern Health Partners Services Et Al (INMATE1) - Document No. 3Document4 pagesMann v. Southern Health Partners Services Et Al (INMATE1) - Document No. 3Justia.comNo ratings yet

- Gun ControlDocument7 pagesGun Controlapi-309774071No ratings yet

- Loc019 EngDocument3 pagesLoc019 Engloulouche165No ratings yet

- Percentage Distribution of CICL by Sex: Age No. Percent 10 11 12 13 14 15 16 17 18 TotalDocument8 pagesPercentage Distribution of CICL by Sex: Age No. Percent 10 11 12 13 14 15 16 17 18 TotalShefferd BernalesNo ratings yet

- BS en 10246-10-2000Document20 pagesBS en 10246-10-2000Jithu KareemNo ratings yet

- Model Customs Collectorate, Wazirabad Road, Sambrial, SialkotDocument5 pagesModel Customs Collectorate, Wazirabad Road, Sambrial, SialkotFaraz AliNo ratings yet

- LW-204 Professional Ethics and Bar Bench Relation and Accountancy For Lawyers PDFDocument2 pagesLW-204 Professional Ethics and Bar Bench Relation and Accountancy For Lawyers PDFRubab ShaikhNo ratings yet

- Julius Maddox 8-Week-Bench-Program PDF Weight TrainingDocument1 pageJulius Maddox 8-Week-Bench-Program PDF Weight TrainingentrtainmentvNo ratings yet

- Eticket Receipt: Cauinian/Leslie Ann Mrs (Adt)Document3 pagesEticket Receipt: Cauinian/Leslie Ann Mrs (Adt)Jiro MalinaoNo ratings yet

- Legal Ethics Duty To Clients CasesDocument66 pagesLegal Ethics Duty To Clients CasesJongAtmosferaNo ratings yet

- CCPT3 10doneDocument2 pagesCCPT3 10doneaugustapressNo ratings yet

- Agot V RiveraDocument3 pagesAgot V RiveraJohn CjNo ratings yet